This week we received more evidence confirming that the U.S. economy has returned to positive, but still disappointing, growth.

|

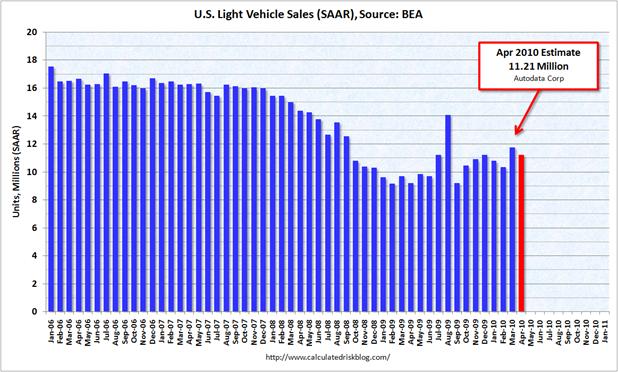

Seasonally unadjusted U.S. light vehicle sales in April were up 20% from the previous year, but down 8% from March and down 26% from April 2007. So we’ve bounced off the bottom but are still less than halfway back up to where we were. Here are the seasonally adjusted estimates:

|

The Chicago Fed’s national activity index edged back up for March, but still can’t break into positive territory.

|

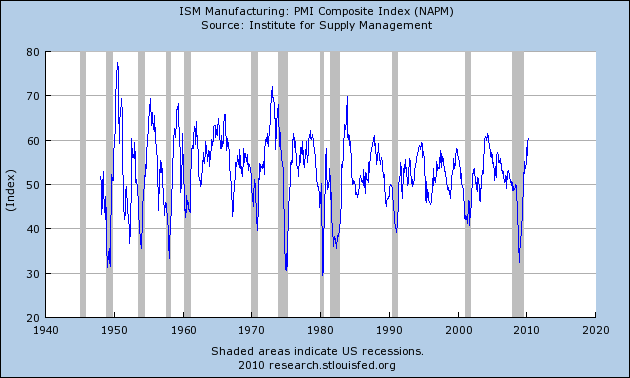

The Institute for Supply Management PMI manufacturing index is looking very good, rising to 60.4 for April, the highest it’s been in almost six years. A value above 50 means that managers reporting improvements outnumbered those reporting declines.

|

All of which confirms the impression from earlier data– U.S. growth has resumed, but we still have a long way to go.

Could we say the ISM-PMI is looking a little toppy based on a comparison with tops in the last 25 years? It doesn’t seem possible that this is as good as it usually gets for manufacturing. What am I missing?

tj: The ISM-PMI is not an index of the level of manufacturing, it’s just accurately telling us that things are getting better than they were for a majority of establishments.

In a rambling lecture recently at Heritage (available at their website)Robert Mundell argued that the time lag between money supply change and real world impact is no longer 18 months but 18 minutes! If true, the implications seem pretty dramatic. I wonder if you agree; and, if so, what are the ramifications for the Fed’s exit strategy

Qingdao: I personally would not agree with such a statement. In fact, I think the monetary aggregates today have an even fuzzier relationship with economic activity than they did before September 2008.

Ok, the recovery is sluggish.

After so much monetary and fiscal stimuli, exactly why is it sluggish?

Manfred – Debt Deflation. It is still out there.

Qingdao,

Yes, Mundell’s lecture was very enlightening. I believe that Mundell was saying the impact of a money supply change on the economy is 18 minutes. Those who use government statistics and indicators don’t see it until 18 months later so for them there is an 18 month lag. Of course by then we are into a totally different dynamic.

Manfred: Sluggish is better than negative growth or a nasty implosion. Recoveries from financial crises are invariably slow and sluggish. The investment of GDP is always the most volatile. Nothing crushes the Animal Spirits of capitalism like a financial crisis. I can’t think of any compelling reasons why the US economy would be different.

In this case, the patient could have died on the operating table but didn’t.

4-Week Moving Average of Continued Claims (Insured Unemployment)

http://research.stlouisfed.org/fred2/series/CC4WSA?cid=10

Strange correlation at a high level of PPI and lower employment level.

http://research.stlouisfed.org/fred2/series/PPIACO?cid=31

Investments are lagging, speculation is paid first and assets prices are unduly kept high.

The fixed gross capital formation is still much below trend

http://research.stlouisfed.org/economy/intl/8countries.pdf

Adam, GNP,

Ok, debt deflation, crushing of animal spirits. I guess those could be reasons.

And, GNP, I do agree, sluggish is better than negative, sure; but, still, it could be better.

How about policy uncertainty [on energy policy, for instance; or not knowing the actual impact of health care reform] and taxation? Do they have anything to do with a slow recovery?

looks like an U-shaped recovery to my layman’s eyes

Manfred,

The patient didn’t die because we threw him on life support. Let’s wait and see what happens when its withdrawn.

JDH: The issue of monetary policy lags is an important one. Do you have any post-2008 studies to recommend on the subject?

So, would ‘recovery’ mean going back to our old habits, with miles driven per capita back on its steady rise? If Americans can’t think of anything better to do with their income, then perhaps it should be taxed away and spent on research or even more highly subsidized medical care. Or they could be encouraged to seek more leisure, a-la European habits, rather than to work longer hours to consume more goods. The current price system does not require people to pay for the full social cost of their consumption.

Manfred,

Any policy grid-lock is unlikely to help restore consumer and investor confidence. In the case of health care reform, I would argue that warts and all President Obama scored a major political victory. His stature increased domestically and internationally. We saw some of that strength in action as he deliberately and openly snubbed the Israeli prime minister over settlements.

Over the longer term, it will matter how quickly and decisively the USA gets its fiscal house in order. Steep tax increases on dirty fuels would be most helpful in terms of restoring confidence and helping the economy move forward. A speedy withdrawl from Iraq and Afghanistan will reduce costs as well as facilitate the return of global confidence in American leadership.

We have entered a new are of rapid technological creative destruction.

Hence, permanently high unemployment rate, coupled with permanently high productivity gains, will be the new normal.

The versatile will thrive. The inflexible will suffer.

GNP – I have to argue the opposite on your second point. Not to turn this overly political, but a withdrawal from Iraq and Afghanistan, without clearly establishing a politically viable society in both concerns, would fundamentally destabilize both countries and surrounding neighbors (Iran) to the point that the complications would largely be felt by the major players in the region. Most of these major political players are also major fuel suppliers for the rest of the world (keeping in mind that China, Japan, the EU, and Korea all import more oil on a per capita basis than the U.S.). While certainly a popular idea in a lot of corners,U.S. withdrawal would fundamentally be destabilizing for a lot of the world – our economy included.

As far as ‘steep taxes on dirty fuels’ – I don’t see what connection additional taxation as this point has to encouraging a productive economy (thereby increasing the tax base). While fuels certainly can be an effective platform for taxation, higher fuel costs generally dampen productivity and constrict the economy (and narrow the tax base).

JDH, a while back you posted some comments and models on the tendency for GDP to “snap back” to trend after a recession. I would love to see an update to those based on current data. It looks to me there there was no snap back to trend, but that we have permanently lost wealth

Flashman: Few argue in favour of hasty withdrawl from either Iraq or Afghanistan. But I think you are being uncompletely unrealistic if you think the USA can achieve “politically stable societies” before exiting without having wrung up more unacceptably high costs. Do not take NATO for granted. NATO is worth saving!

The USA has plenty of room to move on related dossiers, in particular Israel and the occupied part of the former Palestinian mandate. It is up to Americans if they want to continue US$3 to US$4 billion in aid, mostly military to Israel. It is up to Americans as to whether American continues to be a friendly launching pad for the colonization of lands seized in the 1967 colonial war of conquest.

As for the fiscal situation, to quote enviro-activists: “the long-term is now”. The USA must signal a credible commitment to getting its fiscal house in order or per capita wealth levels will continue down. High taxes on dirty fossil fuels can be announced and scheduled in over several years.

I would argue that unexpected energy price shocks push the US economy into recession. Expected permanent energy price changes should not materially slow US growth. This is the only tax increase that would unambigiously make America richer by credibly signalling to global oil markets a commitment to conserving energy and increasing efficiency which should lead to lower prices and by actually further reducing volumes off oil imports.

I think what we are seeing is a poor job by the govt to be stimulative. With the $1T spent on “stimulus”, we will see that the multiplier effect was much lass than 1. This does not include the money poured into fannie and freddie to prop up the housing market. Transfer payments do not lead to job creation, tax receipts, etc. We should be well over 7% growth right now if the govt stimulus was spent correctly.