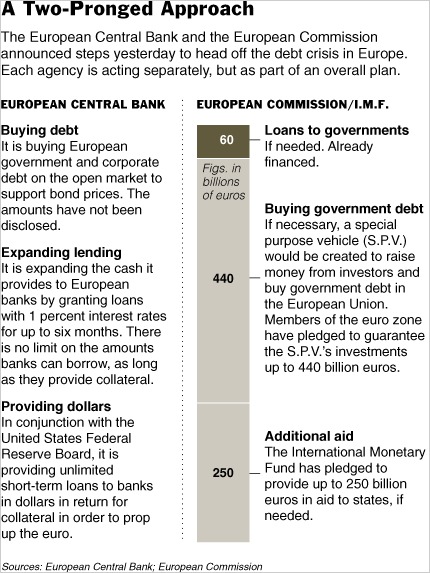

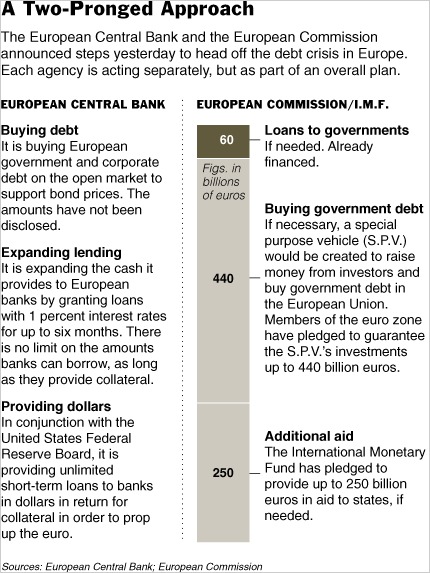

There’s plenty of coverage of the bailout package [0] [1], but here’s the graphic depiction (from NYT):

Graphic from Thomas and Ewing, NYT, May 11, 2010; link here.

There’s plenty of coverage of the bailout package [0] [1], but here’s the graphic depiction (from NYT):

Graphic from Thomas and Ewing, NYT, May 11, 2010; link here.

Menzie,

All this should theoretically allow sovereign borrowers to roll over their debt interest payments for the 2-3 years to come. A question remains unanswered however… If the cost of funds in the bond markets becomes prohibitive, what rate will the Euro Area SPV request to buy these countries’ bonds? Presumably, a rate lower than the market rate, but still a penalty rate that is higher than the SPV’s own cost of funds. However, there is no guarantee that the penalty rate charged on the bonds bought by the SPV will be compatible with a structural reduction in borrowing countries’ deficits and debts. This could still be just kicking the can down the road for 2-3 years, unless there is at the same time an avenue for avoiding a recessionary spiral in these countries. Left by itself, this financial operation is doomed to fail in the longer run unless a way can be found to ensure decent (nominal) GDP growth. So, trashing domestic demand can’t be the answer. Hence, as I see it, debt restructuring remains unavoidable.

Another interesting feature of the “plan” is that the ECB has now accepted to buy sovereign bonds on the secondary market (the Governing Council still has to decide on how much). This is crucial for “bailing out” euro area banks, who hold these sovereign bonds. But, the SPV could potentially also sell its sovereign bonds to the ECB, getting rid of its risks and leaving the ECB with a pile of worthless assets and negative equity… Willem Buiter has written a few interesting things on the subject of Central Banks going broke…

Nice little graphic. Menzie, any thoughts on the ECB’s intent to sterilize new lending, and how effective that will be versus QE?

As David Rosenberg said in his newsletter today, “It is a sad deflationary reality when a trillion dollars can only buy you 400 points on the Dow. What can the European politicos do for an encore? ”

My reaction:

Announcement #1, from the EU ministers, offers a dramatically large shock and awe rescue plan.

Hats off gentlemen, sheer genius.

Announcement #2, from the ECB, says they’ll help too but it’ll only be liquidity operations, and will be completely sterilized.

Hats back on gentlemen, monumental idiocy.

“Stimulate it, yeah, yeah, don’t monetarily deflate it.”

Bob “Central Banker” Marley

Mark,

Big Spender.

Did anyone notice that the EU only has $60B?

Last I looked, the IMF didn’t have $250B either.

It took only 19 years from the date of the Maestrich treaty, for its content to be “ripe” before even to be green!

Legislators and associates think well (covenants on public debts, fiscal and primary were in place) execution was poor. The usual pitfall of many contracts!

A civilization is not one economy but several different economies ( Fernand Braudel).His perspective was on evolution, when Europe perspective is actual.

Ecownbrowser posts and comments have covered the pivotal years of institutional shred when in execution.The linearity lays in the instant gratification of the financial markets and the EC members states, where green mailing have been rewarded and the means provided trough excessive money supply, leverages and “fausse monaie”.

All or almost said, so far the ECB balance sheet is certainly not faring worse than others,the trend is worrying,the quantities of expedients without any intelligible programs of exit strategies are disturbing and require explanations.

For a comparative statement of Public budget, balances and gross debts and CB balance sheets pleas see:

http://www.ecb.int/press/key/date/2010/html/sp100415_1.en.html (then press slides in annex)

PS Agree with Patrick concern, SPVs are good vehicles for waist disposal.

MikeF,

Re the ECB’s role, it looks like it is standing firmly behind its “enhanced credit support” strategy. This means that it will continue to attempt to separate its decisions on monetary policy (ensuring price stability) and its role of credit support (lender of last resort). It announced that it will help out markets, and banks holding risky sovereigns, but that it will not increase the monetary base. So, its unlimited lending operations (now once again with full allotment) and its “credit easing” operations (buying sovereign bonds on the secondary market) will be sterilised, probably through higher marginal reserve requirements.

PPCM,

Re SPVs and “waste disposal”, the nice thing about the Euro Area’s new SPV is that it will allow governments to guarantee the SPV’s borrowing while allowing governments to keep these contingent liabilities completely off their deficit and debt statements. These guarantees would have to come onto the books as higher deficits and debt only if and when they are called, i.e. if and when a sovereign borrower defaults on the bonds held by the SPV and the SPV has insufficient funds to meet the interest payments on its own bonds. The appearance that the guarantors of the SPV manage to keep deficits and debt under control is the sine qua non condition for the SPV being able to borrow on more favourable terms than the troubled sovereign states. Once again, a lot of smoke and mirrors…

Patrick VB

Thanks I thought that balance sheet dressing exercise, could require as well a little effort on the waist size but it seems waste prevails!

source The angry investor 15/12/2009

“A more than $30 billion pool of corporate loans managed by Barclays (BCS Quote) has slipped by virtually unnoticed, but merits close scrutiny as it sheds light on central bank lending standards loosened by regulators’ fight against the global economic downturn.

The transaction, dubbed Newfoundland and rated triple-A by Moody’s Investors Service looks to be the largest collateralized loan obligation ever issued, by a large margin. Most CLOs are in the $300 million range and anything over $1 billion is considered la The transaction, dubbed Newfoundland and rated triple-A by Moody’s Investors Service looks to be the largest collateralized loan obligation ever issued, by a large margin. Most CLOs are in the $300 million range and anything over $1 billion is considered large, according to Bill May, an analyst at Moodys

Who’s the lender of last resort here? In TARP an external entity to the problem, the U.S. government, bought the bad debts of the banks until the market returned and a fair value for the assets was determined. A crash of sovereign EU state debt would not be solved by this plan, because it is the EU states themselves who are pledging to back the “investors” of these additional 440 billion in debt offerings. Sure Germany and France can keep the thing spinning for a while, but they all share a currency so the downward spiraling self fulfilling prophecy will then begin… Investors sell the bonds they hold because unknown risks in certain states remain too uncontrollable and the prices are falling… As bond prices fall, ratings decrease, currencies become devalued due to a necessity to print more euros, and on and on it goes.

Some will claim that the IMF is the lender of last resort. However, in the current plan, the IMF is commiting 250 billion USD worth of their Special Drawing Rights units (SDRs), which conveniently equates to the ENTIRE current lending capacity of the IMF. So what happens if developing Asian countries with similar issues catch the Aegean virus and need the IMF for what it was designed to do? Well sports fans, that’s when the proverbial sink would have come in handy…

Check out our analysis of the issue, where we call into question the ability of the IMF to combat a EU wide crisis, using some simple math and common sense @ http://www.diamondslice.com/2010/02/tarp-2-0-will-the-e-u-let-one-of-its-own-die/

Menzie,

Am I correct to assume that this does not include any assistance the FED might be giving?

Hi RicardoZ,

The rescue package that Menzie shows from the NYT is composed funds or guarantees from the Euro area, from the EU member states and credit from the ECB. The US FedRes is only intervening in that it is re-activating swap lines with other central banks (ECB, FED, Swiss CB, UK CB).

Thanks Patrick.