For the last year and a half my assessment has been that the near-term pressures on the U.S. economy were deflationary, while long-term fundamentals involve significant inflation risks. It’s time for a look at the data that have come in over the last 6 months, and time to say that I still see things exactly the same way.

The short-run deflationary forces come from the substantial underemployment of potentially productive labor and capital. I noted in January that, given the high unemployment rate at the time, a traditional Phillips Curve would predict deflation in the CPI over 2010-2011. Six months into the year, that’s about how things have unfolded so far. The Bureau of Labor Statistics reported on Thursday that the seasonally adjusted consumer price index for May was at exactly the same value it had been in December.

|

I often hear the idea expressed that all the money that the Federal Reserve has created through its various responses to to the financial crisis has to produce inflation. With the exception of the assets the Fed acquired through the AIG deal, which aren’t going anywhere, most of the other special facilities the Fed implemented in the fall of 2008 have been wound down, replaced with long-term holdings of mortgage-backed securities and agency debt.

|

Although the Fed’s balance sheet remains expanded, the potential currency that these operations created still remains parked as excess reserves held by banks or the Treasury. It hasn’t shown up as currency in circulation, and I don’t see a reason to expect it to soon. The nation’s money supply, as measured by seasonally adjusted M1, is only up 1% since December.

|

The source of my concern about long-run inflation comes not from the expansion of the Fed’s balance sheet, but instead from worries about the ability of the U.S. government to fund its fiscal expenditures and debt-servicing obligations as we get another 5 or 10 years down the current path. Just as many analysts have had trouble seeing how Greece can reasonably be expected over the near term to move to primary surpluses sufficient to meet its growing debt servicing costs, I have similar problems squaring the numbers for the U.S. looking a little farther ahead.

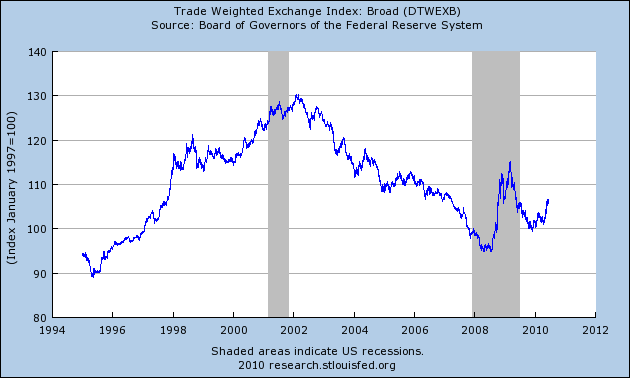

The way that I would envision these pressures translating into inflation would be a flight from the dollar by international lenders, leading to depreciation of the exchange rate, increase in the dollar price of traded goods, and possible sharp challenges for rolling over U.S. Treasury debt. We’ve of course been seeing the exact opposite of this over the last few months, as worries in Europe and elsewhere have resulted in a flight to the dollar and the perceived safety of U.S. Treasuries. That appreciation of the dollar has been one factor keeping U.S. inflation down. So any inflation scare is clearly not an incipient development, but instead something we’d possibly face farther down the road.

|

Some reversal of that recent trend and resumption of dollar depreciation would in fact be quite welcome at the moment. But a loss of world confidence in the ability of Washington to honor its debts would not. I continue to believe that it is quite important for the U.S. to communicate its seriousness about bringing the long-run fiscal challenges under control. I should emphasize that, in saying this, I am definitely not among those calling for current budget cuts– that would only aggravate our immediate employment challenges. But I do think now would be an excellent time for fiscal reforms that make the long-run math look substantially more responsible. Examples include raising the eligibiity age for Social Security and Medicare, increasing the Medicare copay, budget reform to bring earmarks under control, a plan to ease the government out of responsibiity for implicitly or explicitly guaranteeing U.S. mortgage debt, and reforms at the state and local government level to bring their long-run pension liabilities under control.

America needs leaders willing to talk honestly about our long-run fiscal challenges and what needs to be done to address them.

I can dream, can’t I?

Why do long term inflationists never mention our military expenditures? Medicare and SS pay for themselves now while it is the Military that is deficit financed.

Professor,

When you mentioned:

“Although the Fed’s balance sheet remains expanded, the potential currency that these operations created still remains parked as excess reserves held by banks or the Treasury. It hasn’t shown up as currency in circulation, and I don’t see a reason to expect it to soon.”

Why would banks want to exchange their excess reserves for paper currency? This would amount to exchanging assets (excess reserves) that earn 0.25% for assets (paper currency) that earn 0%! On top of it, storage of paper currency in this amount would be an issue, so the net interest would probably be negatives on paper currency holding. Exchanging excess reserves for paper currency does not make any sense for a private bank irrespective of the economic context.

Also, with respect to the “fiscal challenge”, the US government can never run out of US dollars, just like the UK will never run out of UK pounds (and Japan will never run out of Japanese Yen and so on). Greece could however run out of Euros, just like Argentina ran out of US dollars when it was on a US dollar peg in the 90s. There was an attempt by economists to put the UK in the same basket as PIGS countries not so long ago. Those economists has been silenced by the market: UK is currently borrowing for 10 years at 3.5% (the US is at 3.2%). And Japan is borrowing for 30 years at 2.2%.

Funny how economists have been singing the praise of the market all those years, and now when these same economists are looking at US and UK bonds yields, they call the market short-sighted, irrational, and stupid.

The US, because it has its own floating currency, will never face a liquidity or a solvency crisis. As for the inflation scarce, please show me the data indicating that inflation is coming big time. The biggest threat for the US is deflation force. Just as deflation has been the threat to the Japanese economy for the last 20 years.

Full disclosure: I live in Canada. When the Canadian dollar hit parity with the US dollar, I switched all my savings in US dollars. I am also currently long US treasuries.

A sudden flight from U.S. debt, accompanied by rising interest rates and depreciation, could be inflationary, as in the scenario outlined. On the other hand, depending on how domestic political forces were aligned at the time, could it not equally well trigger a disorderly rush to austerity, with deflationary consequences? Either way, It is right to start worrying about the medium- and long-term budget picture now, even when a case can still be made for continuing short-term stimulus a bit longer.

So long as you assume the future is going to look like the past, the future is going to look like the past.

Because low levels of inflation are not a transitory phenomenon, the path of federal spending is going to be lower than the CBO currently assumes. As the Treasury market begins to price in the continued low inflation, the interest costs of servicing our existing debt will drop.

On the revenue side, even absent an increase in taxes Federal revenue from corporate and personal income taxes should rebound strongly as cyclical unemployment drops. We will not return to the revenue levels of the bubble years but even a rebound of half the fall from those levels would substantially improve our budget picture.

Well said.

The Dirty Fed’s money printing has not created CPI inflation yet because we are still in a depression. You can’t make somebody go out and buy flat screen TVs if he doesn’t know where his next paycheck is coming from.

Money printing can create asset inflation much more readily than it can cause wage or CPI inflation, and it already has. The stock market has rallied enormously from last year’s lows, housing prices are still at ridiculous price/rent and price/income ratios, and gold is hitting new all-time highs. Yet the Dirty Fed can’t create wage inflation with U-6 running near 20%.

Are they going to have to devalue the dollar to the point where manufacturing wages become competitive with Mexico and China? I’m sure they’d love to, but the other countries won’t let them get that far ahead in the game of competitive devaluation.

Welcome to Zimbabwe Planet.

As long as we have chronic unemployment/underemployment, the inflationary pressures will remain in check.

The U.S. government can “stimulate” only so long until the political backlash makes that impossible.

While certain commodities may be experiencing price inflation, it is more likely that the aggregate numbers are reflecting a continued value deflation. One might also call it a correction of several decades of illusory wealth creation.

As long as the U.S. population growth is primarily dependent on poorly-educated, low-skilled, unemployable groups… and the U.S. government exacerbates the problems with economy-killing programs… you can count on a continuing malaise.

“Examples include raising the eligibiity age for Social Security and Medicare, increasing the Medicare copay, budget reform to bring earmarks under control, a plan to ease the government out of responsibiity for implicitly or explicitly guaranteeing U.S. mortgage debt, and reforms at the state and local government level to bring their long-run pension liabilities under control.”

but never, never, never raise taxes – the horror!

JDH:

Inflation expectations over the first half of 2010 have been declining as seen here. Do you find this as troubling as I do?

“The way that I would envision these pressures translating into inflation would be a flight from the dollar by international lenders, leading to depreciation of the exchange rate”

The Yen and the Euro are going to implode in the next decade-lots of Euro base debt and Yen base savings that will swap it’s way into the dollar. Principle preservation will be all that matters as the unsustainable post WWII Bretton Woods falters.

JDH: Pretty much agree. The danger is that we may be moving from a period of disinflation to a period of actual deflation. Where I disagree is with raising the retirement age for Social Security. I don’t think we’re there yet. The Trust Fund reports just don’t support the claim that SS is in any serious trouble. The worst case scenario is that with no change benefits 40 years out will still be 125% of current benefits. And raising the retirement age may have perverse effects because if people believe that SS benefits are going to be effectively cut, then rational actors will save more today and treat their homes as ATM machines even more than they are doing already. Not exactly what we want right now. Of course, I suppose it’s possible that raising the retirement age might induce people to spend more today because they will have a shorter retirement period. I suppose that’s possible if retirement ages actually get pushed out, but the fact of the matter is that biology is a bigger factor in a person’s retirement age than is government policy. Not everyone has a comfy desk job. But I completely agree that other programs (especially Medicare) need to be rationalized. And while I would agree that it’s time to lay out a credible plan for how we’re going to unwind the fiscal mess, academics economists really need to drive home the point that we need to do first things first. This means Hyde Park economists should baptize themselves in saltwater and forever renounce real business cycle theory as relevant when the economy is suffering from weak aggregate demand. Plans to cut the deficit should always be conditional on getting the economy back on its feet first. Trying to fix the longer run structural problem too soon will only guarantee that we stay stuck in recession and that the debt-to-GDP ratio gets even worse than it otherwise would be. It will be hard enough to fix the fiscal mess even with a healthy economy; it will be a hopeless task if we try and do it with an anemic recovery.

Bruce Hall: the U.S. government exacerbates the problems with economy-killing programs.

Total nonsense. There are four major components to aggregate demand: C, I, G and NX. Business is sitting on the sidelines, so don’t count on “I”. Europe is self-destructing and China is propping up its currency, so don’t count on “NX”. The consumer is tapped out and trying to fix personal balance sheets, so don’t count on “C”. That leaves us with lots of savings and no demand. Government spending is the only thing keeping this economy afloat right now.

Examples include raising the eligibility age for Social Security and Medicare, increasing the Medicare copay, budget reform to bring earmarks under control, a plan to ease the government out of responsibility for implicitly or explicitly guaranteeing U.S. mortgage debt, and reforms at the state and local government level to bring their long-run pension liabilities under control

You sound like Greenspan, who first helped to destroy the US economy and now pitches for austerity.

What about making Social Security and Medicare payable on all income professor ?

…China is propping up its currency,

Oops. Meant to say China is propping up its exports. Obviously they are holding down their currency.

The argument that business is not ready to do business or consumers are tapped out doesn’t quite ring true. There is, however, a large psychological barrier being erected by government spending and a spiraling, well-publicized debt that leads both consumers and business to be very cautious about committing funds when tax increases are most certainly going to be an increasing burden.

“We’ll hang on to what we have because we’ll have less income and more expenses in the coming years.”

“… a loss of world confidence in the ability of Washington to honor its debts …”

Worried about Vogons? The Yellowstone Caldera? A meteor strike?

Short of the world ending, it’s utterly impossible for US not to honour it’s debts; default is forbidden by the constitution.

Lower spending, higher taxes, and higher interest rates are all plausible. Default is not.

Patrick: Yes, the debt will be repaid in nominal dollars. That’s my point.

And suddenly it dawned on me, JDH = JDH, the guy whose blog I’ve been following = the guy whose book I’ve been reading. Looks like some of these time series could use an augmented Dickey-Fuller test!

Patrick,

There are all sorts of things forbidden by the Constitution that happen anyway. See especially the First, Second, Fourth, Fifth, and Tenth Amendments.

I tend to agree that the U.S. will print its way out rather than default, but it’s not a certainty. Either way, buying a 30-year government obligation around 4% is for suckers.

Can you put Japan from 1990 – present in the context of your argument that debt levels correlate to future inflation? Is Japan going to experience inflation any minute now after 15 years of budget deficits? Is Japan still not far enough down the debt accumulation path to raise inflation expectations?

I have trouble believing any macroeconomic forecast that makes predictions inconsistent with the most extreme historical cases: the Great Depression, Japan’s lost decade, and Wiemar Germany.

“Some reversal of that recent trend and resumption of dollar depreciation would in fact be quite welcome at the moment. But a loss of world confidence in the ability of Washington to honor its debts would not.”

I’m not convinced that such a loss of confidence — at least to any degree that I can imagine happening during the next few years — would be a bad thing. Of course, even if it happens, we won’t know whether it’s a bad thing, because we won’t know what would have happened otherwise. Quite possibly, if confidence in the US government’s creditworthiness continues, the scenario we will see is much like what we have seen in Japan over the past 20 years. And even that is not a worst-case scenario: an ongoing 1930’s style depression, but lasting longer than a decade (without WWII to cut it short), is within my ability to imagine.

On the other side, set against that a “disaster” that would have a very large silver lining: a sudden drop in the dollar would, over a few years, result in a dramatic improvement in US net exports, which (along with an exit from dollar-denominated domestic assets into of real, more productive assets) would likely be enough to put an end to the mini-depression that we are now experiencing. My guess is that markets would be foolish enough not to anticipate the large increases in revenue that would result, so that the US fiscal situation would suddenly appear to be improving dramatically, and the crisis would be self-limiting. (Of course, the US fiscal situation — defined in terms of cyclically adjusted deficits — wouldn’t actually be improving, and the long-run problem would remain, but it would still be far enough in the uncertain future to be ignored by financial markets.)

Also (continuing from my previous comment), confidence in Washington’s ability to honor its debts is not a binary variable. An increase in confidence at this point in time could have detrimental short-run effects, as it would tend to strengthen the dollar even more (and increase the preference for nominal over real assets). For one who, like me, is concerned that the short run may turn out not to be very short, this is a significant concern.

I don’t buy the mechanics invoked to call for long-term inflation pressures. Even if it finally works as you suggest, I believe that it would be much wiser to worry about how can the US reduce it’s dependence on oil consumptiom rather than worrying about oil-driven inflation.

The only way I see this story hanging together is if Congress is totally reckless over the long run (say 10 years) and the US experiences a lost decade (which seems frighteningly plausible). Between cutting the insane levels of military spending, really containing health care costs, and introducing a modest VAT there is TONS of fiscal maneuvering room.

http://hallofrecord.blogspot.com/2010/06/too-much-debt.html

That’s why we have nothing to worry about.

“Examples include raising the eligibiity age for Social Security and Medicare, increasing the Medicare copay, budget reform to bring earmarks under control, a plan to ease the government out of responsibiity for implicitly or explicitly guaranteeing U.S. mortgage debt, and reforms at the state and local government level to bring their long-run pension liabilities under control.”

All good ideas, except it’s too late for the mortgage debt – taxpayers are locked into some huge losses and there is no way to sucker private investors into taking back some of the losses that they were allowed to transfer to taxpayers.

Yeah, about time people get the “FED printing” nonsense out of there head. Everything they did to “print” was destroyed. Hence, nothing was printed. It all went down a “black hole”……….as intended to buy time.

Just a brainsmash on people to think that meant the banks were “functioning”. The truth is, they are still insolvent as ever. At some point people will have to call the banks out again and see through the headfake and really put the FED on the spot.

The main focus of “core” of the problem is the trade inbalances(when isn’t it). It it why we need to stop following dead economists for our problems. We can’t publicly cover private debt liquidation forever with public deficits to the country drowns in debt. At the same time, a liquidation won’t work because it would take the inbalances to a whole new level as all exporting and internal growth are destroyed by a hyper-evaluated currency, exporting our deflation/spiral to “BRIC” and giving them want they want, a complete importing domination of America and labor control.

Time to look at alternatives.

Right on! Good analysis and good recommendations. I would add to the recommendations a set of Federal policies (not subsidies) aimed at igniting large new (or newly revived) competitive business investments to spur economic growth, for example, commercial international space launch to replace the stalled government domestic programs, revived nuclear power generation, and solar power installations. We should stop government investments in mature industries, like banks and auto companies, and invest in new growth businesses and oil replacement businesses.

Bruce Hall: “well-publicized debt that leads both consumers and business to be very cautious about committing funds when tax increases are most certainly going to be an increasing burden.”

Huh? I have a feeling that I’m not the only who finds your comment bizarre. Sounds like Ersatz economics gone amok. Look at JDH’s chart. No sign of inflation on the near or medium term horizon. Just not there. The risk today is deflation and that’s what’s causing people to sit on the sidelines. Idle capital can earn a postive return and consumers are better off deferring purchases until tomorrow because prices will be lower. That’s a vicious cycle.

Yes, taxes will have to go up, but I’d rather pay a higher tax rate when the economy is healthy than a lower tax rate saddled to a weak economy. The structural gap is somewhere in the neighborhood of around 4 percent of GDP. That’s a lot, but it’s not an impossible gap to close. And the primary structural deficit (i.e., deficit less interest costs) is less than that, and it’s the primary deficit that we need to worry about over the long run. As long as that component of public debt is under control…or rather, as long as bondholders believe it is under control, then we should be able to manage things. Yes, it will take some courage, but that’s just another argument for voting against Tea Party wingnuts. As though we needed yet another reason not to vote for them.

“Examples include raising the eligibiity age for Social Security and Medicare, increasing the Medicare copay”

With all due respect, Professor, wouldn’t this hurt the lower segment of the population? And if so, why are them the ones that have to be punished for someone else’s irresponsible behaviour -referring to those who have been drawing and continue to draw a very fat paycheck-?

At Varones… wage inflation hasn’t ocurred yet not because of high U6 but because of lack of unions across the board. Otherwise, an argentine- type of quarterly wage adjustment of 30% (by unions and collective bargain agreements) would have had those flat screen TVs flying from the shelves last week.

Examples include raising the eligibiity age for Social Security and Medicare, increasing the Medicare copay, budget reform to bring earmarks under control,

A litany of silliness. There is no serious problem with Social Security, and the worst case scenario can be remedied with extremely modest payroll tax increases on wages that will be much higher than they are today. Medicare is a problem because it buys health care in the private markets, but hey, “death panels.” As long as we assume a 64 year old has somewhere to buy affordable health insurance in the private market, our problems magically go away.

And earmarks, which account for half a percent of the federal budget? Really?

Meanwhile, the deficit peacocks are hard at work cutting unemployment, protecting low tax rates for hedge fund managers, and working to slash the estate tax for multimillionaires.

Agree with W.C. Varones just because inflation is not there currently does not mean that there is not the potential. If anything the potential is massive, barring regulators suggesting that tier one capital ratios should be at 20-25% M3 will start flowing again (a figure the FED successfully managed to disregard in 2006). The problem with US monetary policy is that it is Bernanke’s legacy (and thus he is loathe to modify his thesis), fine run QE as a backstop for the economy but certainly don’t run loose monetary policy (QE is just debt monetisation, ask the Weimar Republic how that went). Rates at 2% immediately please. Also RMB appreciates 0.43% yesterday, any guesses what is in the inflation basket?

Why is it possible for people to write about the budget deficit and not even mention the Wars and the Defense budget. I don’t get it.

In 2007 the US would have had a budget surplus IF the growth in defense spending had been held to the rate of inflation from 2000 to 2007.

I’m in full agreement with Dr. H., though I think the timeline is debatable-

Parking $1Trillion of bogus mortgage securities at the FED does not make the bad debt magically disappear. Professions and skilled labor billing at 2006 rates does not make clients magically appear. Consumer purchases and retail volume are sure to decline when credit is tight, fuel prices are high and rising, all levels of local government are in debt, are cutting expenditures, and are adding taxes to raise revenue…. Sure looks to me like margins and prices have to drop, ’cause it’s a buyers market.

Face up to it… the banksters will get what they paid for: A Federal Government and a FRB that will allow them plenty of time to try to unload their worthless paper in a deflationary environment that protects their dollar-denominated assets. In the longer run, this losing strategy will inevitably result in hyper-inflation, since it relies on continual expansion of central government debt to support fictitious asset values.

When the Renmimbi, the Euro, the YEN, or the Loony look more stable and liquid than the Dollar… LOOK OUT BELOW!!!

2slugbaits:

“No sign of inflation on the near or medium term horizon. Just not there. The risk today is deflation and that’s what’s causing people to sit on the sidelines.”

Agree with the first part. Also agree with possibility of the second part, but that is somewhat unlikely unless there is a generalize collapse of the economy. More than likely is future inflation based on an increasingly weak dollar. Money that sits on the sideline in the form of dollars becomes far less valuable.

Of course, just in case you are right, I’ll keep a few hundred K in cash for the coming slew of bargains.

Jim, you and I have already had this debate, and neither your nor my position has changed. I do think you should acknowledge that creation of excess reserves is creation of liquid money and thus inflationary, albeit not nearly as inflationary as the conversion of excess reserves into currency, as that typically creates an amount of central bank money several times larger than the amount of reserves converted.

The fact that the inflationary power of the creation of excess reserves has not translated into CPI is explained by (1) the powerful deflationary forces of recession, which on their own would have resulted in substantial and ongoing negative CPI since 2008, and (2) the fact that liquidity since 2008 has been channeled into investments that generate relatively few jobs/dollar.

While it’s true that the existing excess reserves won’t unleash massive inflation unless they are converted into currency, that’s no reason to be sanguine about them. At some point, when financial or policy conditions change, banks will have motive to convert those reserves into currency, and thus expand the supply of commercial bank money, potentially by up to 100%. There is no guarantee or even any strong reason to assume that the Fed will responsibly drain the reserves in good time. There will certainly be powerful lobbies against withdrawing the reserves. There is also a serious risk that a double dip recession will convince the Fed to further increase excess reserves.

ZIRP? No, by definition the interest rate “floor” is the remuneration rate. The FED is “pushing on a string” with its new policy tool – IORs.

What the FED has fostered is a contractionary policy with the use of a penalty rate.

The floor on the FFR (or the interest rate on excess & required reserves), now @ .25%, has created dis-intermediation among the non-banks (an outflow of funds), and has reduced money velocity, in the thrifts, as well as the CB system.

IORs have caused massive portfolio shifts in the earning assets among the commercial banks ($1,047,858T in new excess reserves).

These portfolio shifts have induced system-wide bank credit contraction (the remuneration rate on IORs will have exceeded all 4-week, 3-month & 6-month Treasury bills for 2 years as of this Nov 5th). Back then, the target FFR was @ 1% (on 11/05/08).

The consolidate condition statement doesn’t balance. The factors supplying reserves don’t equal the factors absorbing reserves.

Professional economists have no excuse for misinterpreting the savings investment process. They are paid to understand and interpret what is happening in the whole economy at any one time.

For the commercial banking system, this requires constructing a balance sheet for the System, an income and expense statement for the System, and a simultaneous analysis of the flow of funds in the entire economy.

From a System standpoint, interbank demand deposits represent savings that have a velocity of zero. As long as these savings are impounded within the commercial banking system, they are lost to investment or to any type of expenditure.

From a system standpoint, excess reserves are not a source of loan-funds for the banking system as a whole. CBs do not loan out excess reserves. They always create new deposits when lending & investing.

The money supply can never be managed by any attempt to control the cost of credit (whether the FFR & IORs)…the liquidity preference curve is a false doctrine & the Taylor Rule is a ficticious “sign post” (see Alfred Marshall’s “money paradox”).

Nominal GDP will cascade in the 4th qtr (down in every month – Oct, Nov, & Dec), without extra (upwards of the linear path), stimulus.

Inflation or deflation doesn’t matter. We have s flow/ distribution problem. More money exacerbates

existing inefficiencies whether or not there is inflation.

But I do think now would be an excellent time for fiscal reforms that make the long-run math look substantially more responsible. Examples include raising the eligibiity age for Social Security and Medicare, increasing the Medicare copay, budget reform to bring earmarks under control, a plan to ease the government out of responsibiity for implicitly or explicitly guaranteeing U.S. mortgage debt, and reforms at the state and local government level to bring their long-run pension liabilities under control.

How about eliminated ALL government programs started after 1960?

Truly, is there any good the government has done since 1960, despite how much more tax revenue they consume relative to then?

The great thing about economics is that there are convincing arguments for proposals that vary by 180.

http://money.cnn.com/2010/06/25/news/economy/stimulus_spending_cuts.fortune/index.htm?section=money_latest&utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+rss/money_latest+(Latest+News)&utm_content=Google+Feedfetcher

http://www.huffingtonpost.com/robert-reich/the-truth-about-jobs-that_b_307642.html

That doesn’t mean both sides are correct.