Four Acronyms in a Very Depressing Play

Truly we are in a strange world where legislative extension of unemployment insurance payments, which is highly effective at maintaining aggregate demand, is stalled, while giving tax cuts to households with income in excess of $250K (a.k.a. the Todd Henderson households) moves forward despite having very little impact on employment and aggregate demand. In other words, on benefit-cost grounds we would want to do exactly the reverse. Given the sheer incoherence of some of the arguments being propounded, it might be useful to recap some findings.

Jobs and Benefit-Cost Calculations (BCA)

Here’s CBO’s assessment (first discussed in this January post).

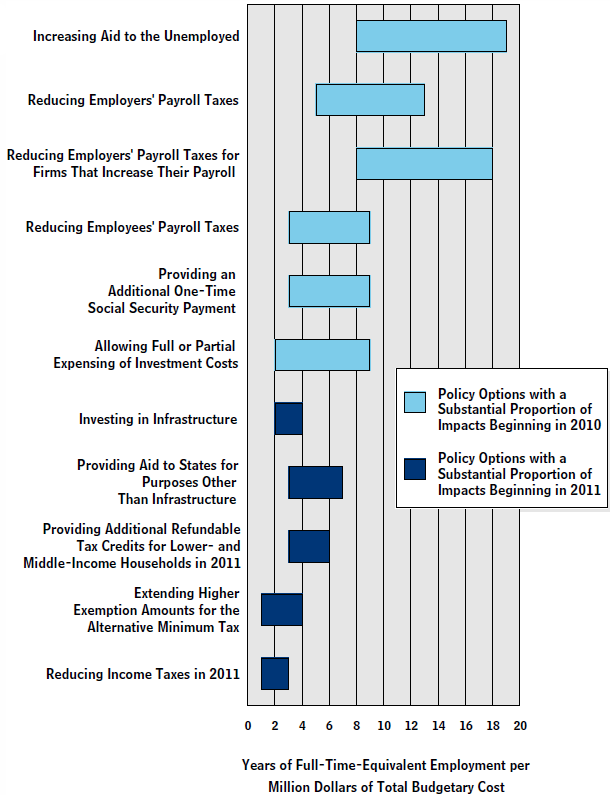

Figure 2 from CBO Director D. Elmendorf, Policies for Increasing Economic Growth and Employment in the Short Term February 23, 2010.

Note that in terms of years of full time equivalent employment per million dollars of total budgetary cost, aid to unemployment (including unemployment insurance) rates extremely high, between 8 to 19. In contrast, extending EGTRRA/JGTRRA combined with AMT patch for one year would have an effect of between 1 and 3.

The Administration earlier on pushed for an extension only for households below $250K income per year ($200K for single filers). The CBO observes:

One variant on this option is to defer most of the tax increases in EGTRRA and JGTRRA for one year but allow the rate increases for the top brackets to go into effect. That approach would cost less than would deferring all of the scheduled tax increases, and it would be more cost-effective because the higher-income households that would be excluded would probably save a larger fraction of their increase in after-tax income. However, the difference relative to the option analyzed here would be small, because much of the remaining tax reduction would still go to higher-income taxpayers. [Emphasis added — mdc]

One can wonder what happens if the EGTRRA/JGTRRA extension is permanent. Then the impact in 2010-11 is higher, but the impact averaged over several years is lower.

In other words, when advocates in favor of a permanent extension of EGTRRA/JGTRRA at all levels also assert that “jobs” should be number one priority, they are embarking upon a logical inconsistency, at least insofar as the economics literature is concerned. Of course, as some have observed, that is no impediment to incoherence.

Impact on GDP

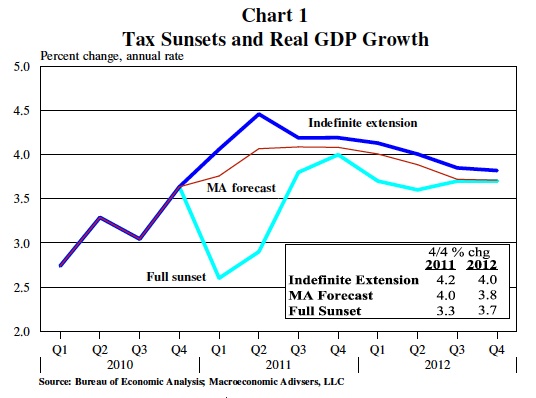

Back in August, Macroeconomic Advisers assessed the impact on GDP of a partial permanent versus full permanent extension of EGTRRA/JGTRRA. Full extension has only minimal additional impact on GDP relative to partial extension.

Source: Macroeconomic Advisers (August 2010).

Clearly, the increment to GDP growth from allowing the over $250K households to keep their tax cuts is minimal (the difference between the blue line and the brown line, where the brown line incorporates the indefinite extension for households with incomes below $250K).

I know there is a meme out there that asserts that allowing the tax rate on those households to revert to pre-2001 levels would reduce labor supply and destory the entrepreneurial forces of the economy; according to this argument, there was little entrepreneurship before 2001. For a slightly technical assessment of the first count, see this post. For a quantitative assessment of the impact on entrepreneurship, see this article; a non-quantitative view, here.

Impact on the Budget

At the same time, full extension is pretty expensive, in terms of its impact on the budget deficit, particularly in the out years.

Figure 1: Deficit as a share of GDP, actual (black), under CBO baseline (red), under President’s tax proposals for EGTRRA/JGTRRA and modification of AMT (blue) and extension of EGTRRA and JGTRRA and indexing AMT for inflation (green), by fiscal years. Shaded area is projected. Source: CBO, Budget and Economic Outlook: An Update (August 2010); CBO, An Analysis of the President’s Budgetary Proposals for Fiscal Year 2011 (March 2010), CBO Historical Statistics, and author’s calculations.

In other words, full extension EGTRRA/JGTRRA puts the Nation on a faster path toward large budget deficits (after all, to my knowledge no one advocating full extension has simultaneously advocated finding offsetting cuts in spending or tax increases elsewhere to finance extension, in a manner comparable to the demands for spending cuts to finance UI extension).

Pie in the Sky

In an ideal world, we would let all of EGTRRA/JGTRRA lapse, and use other measures (those with higher benefit cost ratios in Figure 2) to sustain employment growth. But this is a world, apparently, where a strategic arms reduction treaty and tax cuts are linked [1], and where inflation fears mount even as actual inflation dives. So in this world, given a choice between indefinite and full extension versus letting ’em lapse, the latter looks best (among two bad alternatives).

Finally, lest we forget, just a reminder (from Ezra Klein) of who gains from a full extension of EGTRRA/JGTRRA, relative to the President’s proposal for a limited extension.

Figure from E. Klein, “The Bush tax plan vs. the Obama tax plan in one chart,” WaPo, Aug. 17, 2010.

Other commentary on the tax cut extension issue: [Economist Mom] [Economists View] [Econbrowser]

“….giving tax cuts to households earning in excess of $250K…” Not raising taxes is a tax cut? And some of those “households” are subchapter S corporations who actually invest in real assets and employ people.

In an ideal world, we would understand unemployment benefits are a waste of resources (but not money). The resource wasted is labor. Instead of giving the unemployed money to do nothing, give them a public sector job to do something productive. Of course some say govt jobs are low productive, but low is better then no production. As for the money, the govt creates money when it spends. Think of it as QE without the bond traders. In other words, the Treasury makes a payment and the Fed credits a reserve account for the funds. There is no financial constaint to this operation. Notice that taxing or bond sales are not a requirement for this operation. In an Ideal world, economist and politicians would understand monetary operations (well, the MMT gang get it).

There is no lack of aggregate demand. Everyone always wants much more than they have. There is lack of supply. If there were more supply, then prices would be lower and poor people could consume more.

Consider an unemployed person who wants to buy a car. He has the demand, but the price of the car is out of his reach. All that is missing in an entrepreneur to invest in a car factory and hire this guy. This guy how has a paycheck, cars are produced (and are now cheaper due to higher supply), so he buys one.

How did stealing from the entrepreneur to give a handout to the unemployed guy increase demand?

As a reminder, the last President to raise taxes in a bad economy was noted Democrat Ronald Wilson Reagan who signed the largest tax increase in US history in 1982 even as unemployment was rising and GDP was actually declining. President Reagan was assisted in this by a Congress controlled in both houses by the GOP.*

One can argue that times have changed – and we can see that the GOP has certainly changed – but one can’t point to the 80’s and the Reagan era as a paragon of growth and tax policies while ignoring this.

I’m pointing this out because no matter how many economic arguments are made it always boils down to myths and political distortions.

*The GOP lost control of the House after an election cycle but kept control of the Senate.

Ah, you’re making a liberal (fiscally conservative) argument today. If I understand correctly, you’re saying that current deadlock is creating a suboptimal outcome for aggregate GDP and deficit levels that are too high.

And why does this occur? Because we have three ideologies in Congress and because these three ideologies allow agents to dominate principals. Right? Or wrong?

If right, how do we fix the problem? Jim wants us to reason together. I’m skeptical.

But you might allow that we would want the politicians–as individuals–incentivized to maximize GDP growth subject to fiscal sustainability. So would you then support an incentive structure like the one below, where the bonus of Congressman would be paid out over a period of time (say four years) with clawbacks:

bonus = 0.25% * (Percent GDP growth – Federal budget deficit, as percent of GDP + 1%) * ($/percent of GDP) / 535

Thus, if growth and the deficit were both 3% of GDP, then a member of Congress would receive of bonus of about $2 million, paid out over four years and subject to clawbacks (ie, recessions).

This would apply to all members of Congress, not just the party in power. Do you think that might help them figure out a way to optimize tax and spend policies?

And remember, this has many impacts. First and foremost, it creates a client for you. Are members of Congress clamoring for optimal, sustainable economic policy? No, just the opposite, they’re resisting it as much as possible. If they have a stake in sustainable prosperity, they’ll turn to economists to help them create it.

Second, an incentive structure creates credibility to the opposition. If the Democrats want more investment in education, for example, then I’ll know they are speaking with their own money. I’ll know that they either think it’s really important, or they think it’s really good for the economy. As a fiscal conservative, I’ll be more inclined to give them the benefit of the doubt. They gain credibility, and with it (paradoxically) freedom of action, because the opposition believes it has an implicit voice at the table.

Third, such a program means no one is rooting for the government–and by extension, the country, to fail. Today, that’s just not true–which is very different from, say, the corporate environment. Right now, Republicans benefit if the Obama administration–and with it, the country–fails. That’s just nuts.

Fourth, it will draw different people into politics. A decent middle to upper level business manager has to take a pay cut to go into Congress. That’s ridiculous. Obama wants to make government ‘cool’ again. Well, this is how you do it.

Fifth, for weak countries like Hungary, a bonus program would have a huge impact on corruption. Basically, corruption benefits the ruling clique, primarily, say, 30-50 people in Hungary (the ones controlling infrastructure projects and state-owned companies, for example). The backbenchers in parliament get scraps. If they had a bonus scheme, suddenly you’d see backbenchers stiffen up and demand that policies meet their bonus objectives. As such, this scheme would devolve power and constrain corruption that fails to promote economic growth.

So, perhaps we’ve arrived at a point where economists like you and Jim can agree that democracies appear to have a specific form of governance failure, that is, a deficit bias. If so, you need to decide why this occurs and how to fix it. You know my opinion.

Steve Kopits,

What is fiscal sustainability in a fiat money system with floating exchange rates? I understand there are limits under a gold (fixed) standard. But what are you talking about? Can a soveriegn country that issues its own floating rate currency go bankrupt or insolvent? Please explain your meaning of fiscal sustainability. Thanks

gene laber: I suggest you consult this JCT document about how many subchapter S firms would be affected. And just because they employ people, should we give them a break? “For example, in 2005, 12,862 S corporations and 6,658 partnerships had receipts of more than $50 million.” I guess we should lavish breaks on the Chicago Tribune (a subchapter S corporation)?

Hiya markg [tryin to find you like this]

In an ideal [and simplistic?] world, we would understand unemployment benefits are a waste of resources (but not money). The resource wasted is labor. [seems a tad harsh …or maybe just hasty. Could be this “gift” sustains the unemployed so they are able to respond to that need for labor next week when the strawberries need pickin, yes?] Instead of giving [investing in that foreseeable need for labor] the unemployed money to do nothing, give them a public sector job to do something productive. [an intentional slur on the public sector?] Of course some say govt jobs are low productive, but low is better then no production. [the soft slur continues, so I need to join you to add that managers’ performance is not only self-regulated, but self-assessed and self-rewarded …above and beyond measures of productivity, yes?] As for the money, [that parenthetical reference at the top…not real lives or one of the derivatives, labor] the govt creates money when it spends. [It’s only money. Izzatit? Anso fuggedabout any consequences this may have on succeeding generations (ok, workers) to pay for this magical creation?]

Menzie wrote:

Truly we are in a strange world where legislative extension of unemployment insurance payments, which is highly effective at maintaining aggregate demand, is stalled, while giving tax cuts to households with income in excess of $250K (a.k.a. the Todd Henderson households) moves forward despite having very little impact on employment and aggregate demand.

Menzie, you never cease to amuse me.

On the extension of the government paying to extend unemployment you are very consistent. Rather than suggesting that we use money already appropriated but not spent, you support a mercantilist increased appropriation to spend even more. (I have ceased to call this a Keynesian technique because actually Keynes suggested the government save during good times to have resources to distribute during bad times. This is not Keynesian but mercantilist where you want to distribute all the time.) It is more important to get more money into the system than to increase the production of goods. There is nothing quite as tasty as a good old casserole of $100 bills.

On the issue of the tax reductions scheduled to expire at the end of the year, I heard President Obama in a news report just this morning when commenting on the Bush tax reductions state that “no one wants the middle class to experience a tax increase.” So for President Obama if the Bush tax reductions expire on the middle class that will be a tax increase. But for you if the tax reductions expire on the “rich” it is a tax cut.

You are really a hoot!!

gene laber: Apparently you are unfamiliar with how S-corps work. S-corps are pass-through entities that do not pay taxes. The owner of an S-corp is taxed only on the money they don’t spend on investment in the company. The best way for an S-corp owner to avoid taxes is to spend it on growing their company — they can reduce their taxes to zero. Contrary to your belief, higher tax rates encourage more investment in S-corps, not less. Lower tax rates encourage an S-corp owner to withdraw money from their company and not spend it on investment.

Ricardo: Let me assure you, you provide me endless entertainment as well. In your DickF incarnation, you stated:

That’s hysterical (in so many ways)!

Rather sophomoric off-topic assault on Ricardo, Menzie. Are we to read that you have no better counter?

I wish I had time to review CBO’s assumptions. On its face, it seems to me that transfers to states for non-infrastructure would help employment more than extending unemployment benefits. The great bulk of state spending is for services, which are very labor intensive, and there is no adverse incentive effect as with extended unemployment benefits.

The problems with implementing a tax break for firms that increase employment are legion, and the great bulk of such a tax break is bound to go to firms for employment expansions that would have occurred anyway.

The difference found between cutting the employer or employee portion of the payroll taxes looks dangerously like someone made the old mistake of assuming that who actually writes the check to the government matters for the incidence of a tax.

Anonymous (10:39AM) a.k.a. Dr. D: I do wonder why you even bother to read my posts, given your statement “Menzie long ago gave up proper research and truth, prefering [sic] istead [sic] to engage in raw political spinning with pseudo-technical justification: it’s so sad, really.”

But if it’s any comfort to you, here’s my reasoning why I laughed and laughed at Ricardo‘s post: what he characterizes as “mercantilism” is what mainstream macro would characterize as standard aggregate demand/aggregate supply. Ricardo also likes to redefine variables to fit into his arguments; witness his recent redefinition of inflation to not be a rise in the price level. Perhaps you agree. If so, let me be the first to thank you, too, for giving me a chuckle.

Menzie,

I think Ricardo makes a valid critque of your position. On the one hand, you want to raise taxes to reduce the deficit. On the other, you don’t want cut spending to pay for extending unemployment benefits.

As I understand it, fiscal conservatives in Congress will go along with extending unemployment benefits if progressives will agree to cut spending somewhere else. I thought President Obama was in favor of a pay as you go system.

Net/Net the large stimulative effect from the benefits extension will more than offset the drag associated with the spending offset.

tj: I’m not averse to PAYGO. So, if we were to reduce some tax expenditures in order to pay for extended UI, I say go for it — although I’m pretty sure the Republicans will not go along with it.

But let’s flip things over and ask why not ask for the tax cut extension to be fully paid for. I haven’t heard either you, Anonymous/Dr. D, or Ricardo, suggest that option, which is consistent with your position.

If you offset the UI spending with a cut elsewhere it wouldn’t be stimulative. Sure, there may (on paper in some economist’s office) be an arbitrage of sorts where the UI spending has more, say, velocity, then what is cut; but seems it would be minimal.

If giving money to unemployed is so stimulative, then why not argue to give them double, triple the benefits? How does it make sense that it is stimulative to pay folks not to work? Now, it may make sense as social policy, and doing right by people that have temporarily fallen on hard times. But, that is an argument that the cost is worth the benefit.

I’m sure there are models, and I am but a layperson. But, when something doesn’t seem logical (like the models during the housing boom that didn’t allow one to plug in a negative decline in housing prices) then it seems mere dogma.

Ricardo What I find amusing are your rather offbeat definitions of rather standard terms. In your world inflation is not about rising price levels. And I’m afraid you have completely misunderstood what economists mean by “mercantilist” policies. As best I can tell, you seem to equate “mercantilist” policies with redistributionist approaches. Wrong. “Mercantilism” refers to the 18th century belief that the goal of economic policy ought to be the accumulation of gold and silver, and that governments should try and export goods in order to build up species reserves.

Menzie: Thanks for the link to the quant paper on the relationship between tax policies and measures of entrepreneurship. Their finding that only the top corporate tax rate provided a common cointegrating vector across the other endogenous variables is hard to explain intuitively. They found that certain policies were statistically significant, but the coefficients were economically trivial. Interesting. But I still wonder about that corporate tax rate providing a common error correction term. Using Rudy Dornbusch’s argument about corporate tax rates, as long as interest on loans is fully deductible and as long as we ignore inflation and depreciation allowances, the changes in the tax rate should not affect decisions regarding the physical amount of capital investment. For example, suppose there is zero corporate tax rate and interest is 10%. The desired capital stock would be set to a level such that the marginal product of capital is 10%. Now suppose that there is a corporate tax rate of 25%, but interest is deductible. The capital stock now yields an after tax marginal product of 7.5%; but if the firm deducts 25% of its interest payments from taxes, then the after tax cost of capital will also be 7.5%. In other words, no change in the physical amount of capital stock because the after tax MP of capital equals the after tax cost of capital. As Dornbusch puts it, “…the corporate income tax has no effect on the desired capital stock. The ambiguities areise when the special tax treatment of depreciation, of inflation, and of investment financing other than through borrowing is taken into account.” So this tells me that the authors of the study might have misspecified their model…maybe they should have used depreciation or ratios of debt/equity financing. So instead of looking at the prime interest rate, maybe they should have used a weighted average of equity and debt yields.

Taking money from people who earned it & giving money to those who didn’t [& haven’t worked in 100 weeks]…there’s a formula for economic prosperity.

Ryan_Stambaugh: I am also just a layperson and it seems perfectly obvious to me why paying people unemployment would stimulate an economy in recession. The problem today isn’t a stiff aggregate supply curve in which we keep bumping up against production constraints. If that were the case, then indeed, paying people unemployment insurance would be a huge mistake. But today’s problem is weak aggregate demand. Basically those who have money are sitting on it rather than spending it. Running deficits (or even taxing high incomes) and giving it to the unemployed is a pretty effective way to move money out from under the mattress and into the economy. Those who deny that unemployment insurance is stimulative end up doing so by denying the reality of an aggregate demand curve. In their world economics is only about one curve, the supply curve.

BTW, even in good times there is a case for having limited unemployment insurance. You don’t want to have people accept a lower paying job too quickly because that reduces society’s productive potential over the long run. It’s a good idea to give people some limited search time so that they don’t just accept the next job that comes along. Picking any job might have the ring of sound moral fiber and good family values, but it makes for disastrous economic policy. OTOH, you don’t want to make the unemployment benefits too generous either…but keep in mind that here I’m talking about unemployment during normal times. In today’s world we shouldn’t worry about unemployment discouraging work efforts.

Menzie,

We are talking about a permanent tax increase here. You seem to want to paint it as something else. There is no reason to find a spending offset for a tax increase.

2slugbaits:

I’m not opposed to UI, as it has obvious social benefits. Just a tad leery of models, where $1 of spending gets $1.50 output, so, voila!, spend $x and GDP grows $1.5x.

Also, I don’t know about Aggregate Demand. You say people are putting money under their mattress, so to speak. That means there is a demand for cash. You want to shift demand to something else (which may be laudable, no doubt) say cars, or houses. But, that’s a shift in demand, no? Not an increase in AD.

So, the underlying issue is what is causing the large demand for cash/liquidity, and the sticky nature not allowing cash to clear the market.

Bryce: Perhaps you aren’t aware of this, but unemployment insurance is paid by all workers. It’s part of the wage bill. As a matter of econ 101 a portion of workers’ wages go towards the payment of insurance premia that insures against the risk of future unemployment. That’s why it’s called unemployment “insurance.”

Yeah, slug, but it is only intended to last for a reasonable 26 weeks. This will be paid for with borrowed money.

I’m not opposed to the concept of unemployment insurance. But extending it toward 2 years is questionable on many grounds: The increase in unemployment insurance creates addtional wedge between the cost of an employee & what he receives. Also, the wolf-at-the-door creates an incentive for a worker to be willing to re-locate geographically, widen the scope of jobs he would except, & in other subtle ways be a more concerted job seeker.

There are studies documenting these effects.

Slugbait: You’re CLEARLY unaware that unemployment insurance is paid by EMPLOYERS, not workers. As a matter of basic business administration, a portion of business revenue and/or working capital must be handed over to the federal and/or state unemployment insurance programs that cover the employees.

In most states, the premiums that employers pay into this system are (partially) determined based on claims history: a history of laying off workers will result in (greatly) increased premiums. This, combined with extended unemployment benefits and an uncertain economic outlook is presently imposing a very large drag on hiring.

Menzie: I’m impressed with your obsessive sleuthing! (Well, not really.) Glad to know I hit a nerve, but thanks for the more substantive followup, though you’re still criticizing Ricardo for merely adopting some of your favored approaches.

I made sure to put my alias in the box to save your sleuthing time for some real work, or whatever it is you do.

Dr D You’re clearly unaware of the distinction between the impact of a tax and the incidence of a tax. Given any plausible relationship between the elasticities of labor demand and labor supply, virtually all of the incidence of unemployment insurance is paid by workers. The cost of unemployment insurance is part of the wage bill. The fact that the employer bears the impact of the tax might be interesting to accountants, but is irrelevant as an economic issue.

Joseph: You claim that S Corps are taxed only on the money they don’t spend on investment. Are you saying that all cap X is expensed? If you are, it is you who should learn more about S Corps.

Slugbait: You said, “As a matter of econ 101 a portion of workers’ wages go towards the payment of insurance premia that insures against the risk of future unemployment.” This is factually incorrect in both an operational and an economics-analytical sense. UI is effected via a tax on employers, a maximally senior claim on the employing entity.

You can argue that in a macro large-scale steady-state sense that your “plausible elasticities” require that this tax is effectively paid via lower wages, and I would even partially agree with that from a macro relationship perspective. (Partially in that labor is priced competitively between companies, yet the UI tax is determined partially by the historic behavior of all employers and partially (substantially!) by each employers’ history: that is, an employer with a larger UI tax as a result of a history of layoffs cannot pass the increased tax on to workers in the form of lower wages.)

However, this discussion is effectively a partial-derivative discussion, in that we are not at all in a steady-state condition, and the mechanics of the UI tax are having a very real impact on hiring. Note that as this tax is determined by an employer’s historic behavior, employers – many of which have recently laid off workers, increasing their UI premiums – are being very conservative in hiring to avoid future layoffs (which would further increase their UI premiums). This is currently a very important route by which an uncertain economic outlook is feeding back into labor demand.

Here’s an anecdote that will perhaps help you understand the real world a little better: a short time ago, I spent some time in northern Maine, in a town that is a key forestry products gateway town. At Mark’s Garage (name changed), there was a large number of people waiting for their vehicles to be worked on: consumer automobiles, as well as industrial trucks and logging equipment. Mark and his two techs were fully booked for the next several days. A customer came in with an urgent problem, and exhasperatedly asked Mark why he didn’t hire back at least one of the techs he laid off the prior year; Mark answered that his UI premiums had skyrocketed after the layoffs, and if he had to layoff the re-hire next year, the resulting UI premuim increase would effectively put him out of business. He offered to bring back one of his former employees on temp hours, which he felt more sustainable, but the former employees all rejected the offer, prefering their UI payout and spare time (which they undoubtedly use to perform some amount of unreported work). Mark even offered a much sweeter deal to his former employees: use a service bay as a contractor, and just give Mark a minor cut of the revenue, but no takers!

Perhaps in a fantasy Econ101 world, Mark is making an error in his business management, but I see this very same behavior repeated in businesses from the very small (like Mark’s) to the very large (Fortune 500 clients). Note that the consequences of this to the economy are very severe; in the case of Mark and the forestry town, the forestry operators have idled equipment and thus idled workers and reduced output, even though they have demand. (Demand which may be unfilled, or may be filled by another Maine locale, or perhaps Canada.)

The simple fact is that the mechanics of the UI tax has a very real consequence in that it makes layoffs sticky on the downside, and extending UI payouts increases this stickiness, a situation which today is posing a very real, and very substantial drag on hiring. It is extremely unfortunate if people with a basic grasp of economics can’t understand this!

(As a side note, I will remark that I have long thought it very unfortunate that we have three disciplines – economics, finance, and business administration – which while being completely intertwined at an operational real-world level, seem to have their own independent ivory towers at an educational level. Very unfortunate, and I will go so far as to say that I believe this is/was a significant factor in our current economic situation.)

Dr D Suggest you go back and reread your anecdote. You just made the guess why the incidence of the UI tax is paid by workers. Honestly, I don’t think you understand the difference between the impact of a tax and the incidence of the tax. And the fact that you seem to think the distinction has to do with “macro” just reinforces my belief that you really don’t have a clue.

Dr.D: Cute little made up anecdote that makes no sense when you look at the real facts, even in the ivory tower world.

You claimed that UI taxes would put him out of business. You can look up the numbers yourself. The cost of UI per employee in Maine ranges from a minimum of $50 to a maximum of $650 with an average of $190 per year. Now assuming you didn’t just make up your little story, then the garage owner is just blowing smoke if he claims that a few hundred dollars a year in expenses are going to put him out of business, considering the typical garage bills at the rate of $80 to $100 per hour.

Dr. D

Maine, per Paycheck’s website, has a maximum rate of 7.19% on the first $12,000 of wages. That comes to $862.80 per employee.

Dr. D: Surely you know in this digital age, nobody (or more specifically, nobody’s computer) is truly anonymous. No sleuthing necessary, using this software. On the other hand, we don’t know anything about you (as a person), unless you tell us something specific.

Why saying “UI extensions good” and “tax cuts bad” is consistent:

Multiplier. 100 dollars to someone who doesn’t spend every penny they have will result in some portion of that 100 dollars going to savings. We don’t need savings. We have excess private sector savings (see trillions of dollars in cash holdings by corporate America). 100 dollars to someone who spends every penny they have just to eat and continue to have a car results in increased demand. UI extensions put money in the hands of people who run negative equity month over month. Tax cuts put money in the hands of people who are making enough money at their job to be in the top tax bracket. The government has a choice of where that 100 dollars will go, and it needs to pick UI benefits.

And can we cool it with the deficits stuff? Fiat money people. Government can print all it wants up until the hyperinflation point set by the FOREX markets. And the bond markets have said loud and clear (see 3% T bill rate) that the USGOV can run deficits as much as it wants.

Joeseph: Your hourly rate for [Mark’s] Garage is high by a substantial multiplier, and Ryan while your UI tax amount is correct, the amount is substantial for a low-margin business in difficult times in the Maine economy. Note that the Maine 2010 UI rate (which you are quoting) is up by 75% on average over the 2009 rate, though the top rate is only up by some 33%.

Which brings me to address Slugbait, who persists in demonstrating his naieve view of the real world….

Consider an employer who is currently at a level of staffing and demand where they have no need to add staff; with the coming increase in UI tax, they can not pass this on to their workers (too expensive to even try), and they likely can not pass it on to their customers. So the employer pays the increase, no matter how you look at it. Over a long period of time, yes this will translate into lower demand for workers resulting in the workers effectively paying for their UI, but that shift will take a very long time: the immediate impact is the UI tax is a very real cost coming out of the employer equity holders’ pockets.

But further consider the anecdote (which is very real, BTW): the situation described is one of market failure caused by UI: there is no price that workers can ask which will result in [Mark] hiring one or more back on. It’s not a matter of the workers price being crammed down; they are simply stopped out by the very mechanics of the program. And [Mark] has to pick up the full cost of the increase in UI tax on his existing employees. And given the continued draw on the UI fund, it is entirely likely to assume that the increases in UI will continue over the next several years. But beyond the cost of the UI tax, the market failure caused by the UI program means that [Mark] has idled capital equipment and unmet demand: a very expensive situation to be in.

Lastly, I will point out: if you believe that UI is fully paid for by workers, then you should be all for replacing state & federal UI programs with mandated worker purchase of a private UI plan. (ObamaCare could be such an excellent precedent for all sorts of things!) The private plans could be backstopped by the Treasury, and the direct payment would reduce or even eliminate all of the policy complications and cost frictions; seems to me you and workers everywhere should be all for this. I know employers would be…. (Which of course tells you something.)

This discussion reminds me very much of a hypothetical discussion with a physicist regarding running for weight loss: the physicist would say that if you start and end at the same point you have done no work, a completely true but utterly useless statement in the context.

Dr. D: Your story simply makes no sense. Your original claim was that unemployment insurance was going to drive the garage owner out of business. It turns out that the rate increase is only a few hundred dollars per year, at worst.

This is typical of discussions with conservatives. First they decide on the policy outcome they want (generally lower taxes) then they invent out of thin air some bogus justification for it.