The Republican members on the FCIC released a Financial Crisis Primer that has been debunked by a number of observers (since so many of the old canards were hauled out, this was easily accomplished). [0] [1] But the refusal to allow the phrase “Wall Street” in the final commission report [2] impelled me to quantify the attempts by Wall Street to influence financial legislation in the years leading up to the financial crisis.

Here are PAC contributions from the finance, insurance, and real estate (FIRE) sectors, to Democrats and Republicans, by election cycle, over the period in which the housing market bubble was developing.

Figure 1: Political Action Committee (PAC) contributions from finance, insurance and real estate sectors during 2002, 2004, and 2006 election cycles. Red portion, to Republicans; blue portion to Democrats. Source: Opensecrets.

Now, it might be wrong to aggregate FIRE (which includes for instance accountants). So I’ll just examine the time series for banks:

Figure 2: Political Action Committee (PAC) contributions from commercial banks during 2002, 2004, and 2006 election cycles. Red portion, to Republicans; blue portion to Democrats. Source: Opensecrets.

Both parties were recipients, with a particularly decided tilt to Republicans (65.6% over election cycles 2002-06), but I guess the issue is touchier for the Republicans on the Financial Crisis Inquiry Commission than for the Democrats.

In any case, this is what Atif Mian, Amir Sufi and Francesco Trebbi conclude:

But the story is more complex than just subprime lenders buying government support for subprime lending. Beginning in 2002, mortgage industry campaign contributions increasingly targeted US representatives from districts with a large fraction of subprime borrowers. To measure constituent interest we use zip code level data on consumer credit. Combining this with electoral data, we then compare this with campaign contributions, lobbying expenditure, and eventually congressional voting data.

During the expansion years, we find that both mortgage industry campaign contributions and the share of subprime borrowers in a congressional district increasingly predicted congressional voting behaviour on housing-related legislation. In 1997 and 1998, the fraction of subprime borrowers in a representative’s district significantly predicts the representative’s votes on only 30% of roll calls. By 2003 the fraction increases to 70%.

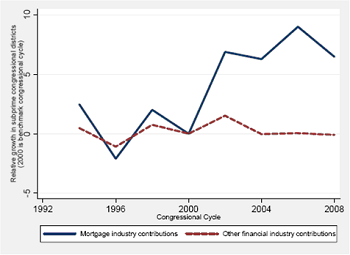

As the solid line in Figure 2 shows, beginning with the 107th Congress in 2002, there is a sharp relative increase in mortgage campaign contributions to high subprime share districts, while there is no such pattern for non-mortgage contributions. Our results suggest that a one standard deviation increase in the subprime share as of 1998 — before the expansion — leads to a relative increase in the growth rate of mortgage industry campaign contributions of 81%.

For my money, the financial sector (a.k.a. “Wall Street”) had a role in the episode we have come to call the financial crisis. And continues to have a role in hindering measures to address the root causes of the crisis.

I’ve been thinking about this issue as I’ve been copy-editing Lost Decades: The Making of America’s Debt Crisis and

the Long Recovery (W.W. Norton, Sept. 2011), co-authored with Jeffry Frieden. In the manuscript (which we completed back in November), we observed that passage of the financial reform bill (Dodd-Frank) was only the first step in preventing a replay of the financial crisis of 2008. Adequate funding of the regulators, a problem before the crisis, will be even harder to obtain, as certain groups work hard to defund financial regulation. [3] [4] The dire conditions of the states’ finances will also hinder effective regulation [5].

Perhaps it won’t be that long before I hear that familiar rallying cry “self-regulation, now and forever”. If the opponents of financial regulation have their way, I fear we will be seeing a replay of 2008 in the not too far off future.

Returning to an explanation for the genesis of the “Financial Crisis Primer”, Figure 3, which depicts bank-related PAC contributions in the 2010 election cycle tells it all.

Figure 3: Political Action Committee (PAC) contributions from commercial banks during 2010 election cycle. Red portion, to Republicans; blue portion to Democrats. Source: Opensecrets.

(For those who have forgotten the escapades of the deregulatory 2000’s, see here and here.)

Menzie,

You’re biases are getting in the way of better thinking once again. First of all, showing that commercial banks contributed a larger portion to republican than democrats does not mean that commercial banks have or will influence republican votes. We need to see evidence that those republicans would have voted any differently without the contributions.

Secondly, for someone who is arguing that “Wall Street” is trying to buy its way into the regulatory discussion, I wonder why you chose to graph the contributions made by commercial banks and not securities and investment firms? To me the later seem more representative of Wall Street than commercial banks. And interestingly, securities and investment firms have contributed more to democrats (55%) than republicans (45%). Using your logic, am I to conclude that democrats are the lap dog of Wall Street this election cycle?

Wall Street is a tourist attraction on Manhattan.

Jeff: I agree that the appropriate test would be to examine behavior against the counterfactual (thank goodness for somebody who believes in analyzing using counterfactuals!) — so, I provided a link and quote to a more systematic analysis — perhaps Mian et al. would take issue with my conclusions.

I confess to have not having enough time to do a systematic analysis of voting behavior. If you are interested in systematic analysis, see the trade and farm policy chapters of this book, or this article for farm policy.

Regarding contributions, I agree securities and investment contributions are important. The 2010 cycle is interesting in that it is somewhat anomalous; over the 2002, 2004, and 2006 cycles, the Republican shares are 59%, 60%, 58% respectively.

In any case, your point highlights the interesting fact that despite the contributions, the Democratic commissioners did not want to remove all references of Wall Street. This points to something of an empirical puzzle if one hews to the pure capture approach. That’s why Peter Navarro and I forwarded the capture and ideology approach (first proposed by Joe Kalt) in our article.

By the way, on the Casey Mulligan/demand piece, you never responded to my query about what I’d said, and how you re-interpreted my clear statement in the first paragraph of the post. Do we now have agreement on what I did and did not state?

the FCIC’s Financial Crisis Primer fails to mention foreign inflows. Nor is there any mention of excess liquidity in the system.

Eventually, as the process of technocrats serving their plutocrats concludes, it seems that a ‘few-bad-apples’ excuse will prevail. Whether those rotten apples are blue or red, that seems to be a fairly close contest.

This ‘closeness’ though says more about our circumstances, especially considering how distorted the analysis has become, than whether one party may be slightly more guilty than what the other party might be.

I’ve always thought that wall street was simply copying the business model that Fan and Fred created -> borrow short -> buy long term crappy mortgages -> securitize -> insure -> sell at a premium to their borrowing rate -> rinse and repeat with as many mortgages as you can get your hands on. I think Barney Fwank has admitted he made a mistake with Fan and Fred.

Nevertheless, I agree with Menzie that wall street certainly deserves some of the blame.

Our political system is broke. We all have a vote, but the average individual does not have the ability to influence election outcomes, and legislation the way special interests do.

Whether you like the U.S. constitution or not, you have to admit that this is not what the framers intended. Way too much power at the top.

Its been seriously disturbing to see how some former economists have traded their credibility for a paycheck. Hotz-Eakin is the best example of this. Once upon a time he had some great papers on fiscal policy. But now, he’s just a hack that Fox News, Larry Kudlow, or Republican politicians can tap for easy support of their disproven approach to fiscal matters. If ever there was a reason for a license to call yourself an economist, he is one of them. But it goes much farther than just him; there are several noted financial economists/macro people who are more than willing to blame Fannie, Freddie, and the CRA than the actual causes. And with their support, we’ll only enhance the chances and the severity of another financial crisis in our lifetime.

All guilty

There is commun legal practice, a universal rejection of pleas sustained by the defendant or plaintiff own turpitude.The languages, the legal cases,their precedents are available.

“Nul ne peut se prévaloir de ses propres turpitudes”

“Nemo tenetur jurare in suam turpitudinem’.

“No one is bound to testify to his own turpitude.”

Turpitude:

“In its legal sense, everything done contrary to justice, honesty, modesty, or good morals. An action showing gross depravity.

Cases of turpitude in the contemplated universe:

Rating agencies (SP,Moodys,Fitch….)

(Please see Federal Bank of Boston,ratings changes June 99 June 07, P14,15,16,17,18)

http://www.bos.frb.org/economic/smr/smr2007/smr0807.pdf

Banks and brokers and universal banks.P19 of the same report is:

Witnessing the financial industry risk assessment.The financial industry had gone “through powerful innovation in its range of products supply” A Greenspan:

Leverage equity funds 1/3 with 1$ capital and 2$ loans.Investors would capture the ever lasting ascension of the equities markets wall of worries and the dividends attached (self perpetuating prophecy).Investors had to be locked in for a tenor of 3 years.

Interest swaps (governments,municipalities.One chart was enough to demonstrate the ever lasting capital gain,when exhibiting the ever declining long term yield (The manufacturing an ever lasting declining long term yield is available in its process please see the OCC derivatives report.Please see Econbrowser post “Portfolio Crowding Out, Illustrated”to name just one of them)

The subprime derivatives in names and primary functions.

Econbrowser post and comments “Richard Clarida’s retrospective on the financial crisis” is providing for a brief outlines of the institutional and private sector, an endeavor in making the world and the financial world a better place.

Let us save the effects of sleeves,guilty they all are and not only wall street.

Ne pouvant faire que ce qui est juste fût fort, on a fait que ce qui est fort fût juste » Pascal

“Unable to make strong what is just, one will make what is strong just”

Menzie,

It’s interesting that you omitted 2008 from your post.

It makes me think you’re more interested in pushing a partisan point than engaging in honest academic inquiry.

Wall Street typically gives more money to the party in power (as do other lobbies).

I haven’t looked at the data, but I strongly suspect that showing 2008 would mar the Republican Wall Street image you’re trying to create, and I’d say the 2010 money split was anticipating the foreseeable GOP victory.

I’m not defending the GOP or the banks here. Washington is thoroughly corrupt, and Wall Street owns Congress, Treasury, and the Fed. But can we have a little intellectual honesty in the discussion?

Hide the decline.

P.S. The Dodd-Frank financial reform bill was an utter farce that left the Too Big To Fail banks even bigger than they were before the crisis. It solved absolutely nothing and left Wall Street as rapacious and risky as ever.

The Dodd-Frank fake financial reform bill was passed while both houses of Congress had large Democratic majorities.

You’ve made the prime case for an incentive system for politicians.

You’re arguing that there are significant principal-agent problems in Congressional decision-making which, in effect, liberates the agent (the politician) to act as principal. Instead of acting on behalf of the voters, the politicians used PAC money to get re-elected.

So, as a practical problem, how do you remedy this? Your implicit solution appears to suggest a socially conservative ideology, ie, that politicians should ‘do their duty’, that is, act as agents for their constituents (or is it their country, and is that short-term or long-term?). Your view is absolutely standard for economists, who are stuck on the whole public service ethic. To be profit-driven is to be grubby. You want to deny the invisible hand in politics, and yet your whole case supports it!

So, for the principals (voters) to gain control over the agents (politicians), there must be a single objective function with a clear and material incentive structure for achieving desired objectives. This is the key to good governance around the world. When economists are prepared to accept this notion, billions of people will have hope, where there is none today.

What a huge disappointment and waste of electrons. Menzie has an opportunity to actually rip the Republicans to shreads by actually analyzing their report and instead he chooses to play the guilt-by-association game of looking at campaign donations. How lame!!

What about addressing the questions?

Why was there a housing bubble?

Republican response: Demand for homes declined, and demand for mortgage investments followed. The U.S. government stepped in, but it was too little, too late. The bubble had burst.

My response: Give me a break! The goverment stepped in too little too late?!! The crisis happened because the stupid Bush administration encouraged it and then made it worse when the bottom fell out. Today we are not dealing with the 2008 crisis but with the stupid moves by government to “fix” the 2008 crisis and the government is still making it worse.

How did the U.S. government contribute to declining lending standards?

Republican response: The government has always supported homeownership.

My response: Why? Why should the government be taking resources away from productive workers and subsidizing home builders? And this did not start yesterday. This has been going on for decades. What gives the government, Democrats or Republicans, the right to pick winners and losers?

How did important financial firms become exposed to the mortgage market?

Republican response: The primary role that financial firms played in mortgage lending was that of financial intermediary, providing a link between those who wished to invest in mortgages and those who wanted to take out a mortgage to buy a home.

My response: You have got to be kidding? The financial firms created all these instruments that are burning a hole in the FED balance sheet, and the government has let them get away with the biggest fraud and theft in our nation’s history while Democrats and Republicans have their hands out for financial payback.

How did mortgage-related losses lead to the failures of important financial firms?

Republican response: Runs are contagious. During a panic, fear of loss spreads quickly. When one firm is failing, investors will often lose confidence in firms with similar business models, or similar asset holdings. This is how the panic spread in the fall of 2008.

My response: Oh, right, now I get it. It is all the people trying to feed their families that are at fault. We were stupid and, in panic and fear, we brought down the pristine clean financial firms. The government tried to stop us (choke, choke) but we were dead set on panic and fear. Wow! And I actually thought these were huge investment banks that most Americans have never even heard of.

How did the panic start, and why did it end?

Republican response: Following the successive collapses of Bear Stearns, Fannie Mae, Freddie Mac, Lehman Brothers, and American International Group (AIG), what had begun in the second half of 2007 as a run on those firms that the market identified as having large mortgage exposures and acute liquidity risks exploded into a generalized market panic.

My response: Well, there was financial weakness due to a declining dollar and government interference in the market, but there was no panic until the Bush administration under the “brilliant” leadership of Henry Paulson, intimidated congress into passing almost a $trillion TARP bailout. Look at the date of TARP passing and then look at the date of the market crash. No, that is not a coincidence. And just for the record with unemployment at nearly 10% I am not ready to say the crisis has ended. Econometrics has never brought anyone to life

Why was the panic so painful for the economy?

Republican response: The historical record is rich with examples of the prolonged and devastating economic impact of financial crises.

My response: Oh, thanks. I was worried. I thought I was the only one who lost almost half of my life savings from my 401-K. It makes things a lot better to know that this has happened throughout history. So, when my family begins to starve all I will need to do is think of how bad it was in Weimar Germany and I will feel a lot better.

So Menzie thanks for the political lesson about contributions. All this time I thought this was an economics blog.

Steve Kopits” “So, as a practical problem, how do you remedy this?”

Ban campaign ads on radio and TV, same way as cigarettes and booze. Enact very low limits on campaign spending by making pols and their PACs hand out handbills on street corners just like the good ol’ days before Marconi invented radio. If that is too old fashioned for everyone, allow pols to have a website where they can get their campaign platform out to the Little Peoples.

Problem solved.

W.C. Varones: Geez, I gave the link — it’s two mouseclicks away! Are you that data averse? There was a momentous shift away from Republicans to Democrats in the 2008 cycle…to 50-50 (FIRE). I think that tells you a lot about the general tendency.

But recall, I was trying to highlight the influence during the rapid expansion of the housing market financing boom. Using your logic, I could’ve extended the sample all the way backwards too. In any case, I provided the link to the data — generate your own graphs and post ’em.

Ricardo/RicardoZ/DickF: One can waste electrons?

Does anyone here believe that the US is something other than a one-party, militarist-imperialist, rentier-financier corporate-state? But, apart from nothing, what is to be done?

The top 10% of US households by wealth and income pay 70% of federal income taxes, and the top 20% pay effectively 90%+ all of the federal income taxes whereas the bottom 50% pay no federal income taxes.

We have “no representation without taxation” at the federal level (and similarly at the state level, although to a lesser degree) for the bottom 80-90% of the US population.

By definition any federal income tax cuts benefit the top 1-10%. Any cuts to federal social services and transfers hurts disproportionately the bottom 80%, and especially the bottom 50-60%. “Privatizing” social security, for example, would only result in another labor product/wealth transfer to the top 1-10% who own 40-85% of US financial wealth.

How many readers realize that US spending for wars, sick care, household debt service/disposable income, oil consumption/private GDP, and personal transfer payments make up an equivalent of nearly 70% of private GDP?

Nearly 7 dollars out of 10 of so-called US private economic output reflects a warring, elderly, sick, unemployed, malnourished, foreign oil-dependent, and highly indebted society. And this is supposed to reflect the wealthiest nation in history? Good grief . . .

And, by our national income accounting scheme, the more wars we fight, the more ill, malnourished, elderly, indebted, and underemployed/unemployed we are, and the bigger gov’t gets, the more the US economy grows. Spending 20% to 35%+ of GDP on sick care in the next 5-7 to 10-20 years is said to reflect how rich we are!!! Are we not absolutely insane?!

And yet e-CON-omists sit around debating how to tweak taxes a bit here, subsidies there, and a deduction or credit for good measure.

Forgive me, but the overwhelming majority of e-CON-omists are worse than worthless to the vast majority of us; they are dangerous. And I have little doubt that the majority of them know it.

Cedric –

The problem is not solved. This problem is not the most acute in the US, but rather in the emerging economies: Argentina, Iraq, Gaza, Hungary, and of course, Greece and Italy. (Are any of these actually emerging?) In none of these places is campaign finance the central issue.

I worked for the government in Hungary, so I can speak from experience. The striking feature was the lack of a client. No one was interested in maximizing the benefit of spending. Rather, bureaucrats consistently sought to meet political expectations subject to a budget constraint. Put another way, they wanted to keep their jobs and it was other people’s money.

I have written about my uncle, the budget czar there, and his travails. I know a number of his team, and they are literally the best economists Hungary can muster. And does the government want them? Does leadership ask for policy advice? No, they seek to eliminate the entire economic oversight function. These economists have no client; they are pushing policy, not being pulled into it. And that is the same just about everywhere.

Except Singapore. GDP growth last quarter: 14.7%.

Would you pay $10 per year if Congress could muster 3% GDP growth with a budget deficit not more than 3% of GDP? I would. That comes out to a bonus of $2 million per member of Congress. From my perspective, money well spent.

There are now fewer financial industry safeguards, as well as fresh moral hazard precedents, to fuel other crises. But that’s only what’s out in the open. Expose’s will never reveal the true depth of perversion & conspiracy in the banking industry.

Menzie, it’s and expression. The writer believes the content is not even worth the costless electrons. They consider it noise.

tj I’ve always thought that wall street was simply copying the business model that Fan and Fred created

Isn’t it the other way around? Fannie and Freddie were rather late to the party. The reason they got into the subprime business was because they were losing market share to the shadow banks created by Wall Street titans. By the time Fannie and Freddie got into the game the inevitable collapse was already a foregone conclusion.

Jerome Turner Hotz-Eakin is the best example of this. Once upon a time he had some great papers on fiscal policy. But now, he’s just a hack that Fox News

Yep. A couple months ago I heard Holtz-Eakin on some NPR discussion and I was struck dumb by the idiocy coming out of his mouth. I remember that he referred to a study that I had also recently read. I had to wonder if we had read the same versions. I was stunned that someone with his reputation would so brazenly misrepresent the larger conclusions by ignoring the conditional nature of one of the findings.

While I understand the reflex to look for evidence that campaign contributions influences the outcomes of votes. is that really necessary?

There is of course a high level of circumstantial evidence of quids pro quo, and the occasional politician who actually gets caught stupidly making an overt link.

But to study how a politician might vote otherwise, were he not reacting to the inducements of a specific interest group (and therefore requiring also for your study a lack of any interest group as alternative lest you merely be study the process as a bidding war)… You might also study how life might have evolved on earth if there was no oxygen.

You might be better served to answer this question: why are companies contributing all that money, if they don’t believe it pays off as an investment in friendly legislation?

“Isn’t it the other way around? Fannie and Freddie were rather late to the party. The reason they got into the subprime business was because they were losing market share ”

Freddie and Fannie were just one of several vehicles that Wall Street used to sell grossly overpriced MBS etc to the tax payer and conservative investors. They were late to the game by design.

Is someone above actually claiming that the flood of PAC and lobby money into both parties election campaigns won’t influence policy decision? I suppose Id call that “The Disneyland Factor”.

if you remember the fall of 08, the right, looking for a villian, started the blame the CRA game, which I first saw in the op ed of the WSJ.

so I googled, and I’m to lazy to redo it, but what I read, CRA was ancient history by 2008; and after it passed, people were worried – were those mandated loans hurting the banks

so Fed Res Houston did a study, you can find a pdf on the web.

CRA loans, roughly, to 1st order, same as other loans

(this was before someone pointed out that CRA didn’t apply to mortgage companies, even the oped of WSJ couldn’t get by that one, they switched to bashing B Frank and Fannie/Freddie

All of your references to dispute the Republicans are just as biased the other way. I would have preferred a more objective reason why Fannie and Freddie were not worsen the bubble. As far as the Fed’s report, “While subprime lending existed before the 1990s, the flagrant and widespread abuses in this market did not occur until the late 1990s. ” This is not true at all there were major problems in subprime in the late 80s and early 90s. The subprime lending had always been a shady business with shady people. I thought the problem with CRA was the need to meet un-official quotas to avoid law-suits from Andrew Cuomo hence forcing the banks to reduce their underwriting standards across the board. Certainly, the banks reduced their underwriting standards. Plus, how did this crisis help the banks? Isn’t it the real estate speculators, real estate agents, and state governments, who raised property taxes, who really benefited at the expense of the baby boomers saving for retirement?