By David Papell

Today, we’re fortunate to have <a

href=”http://www.uh.edu/~dpapell/”>David Papell, Professor of Economics at

the University of Houston, as a Guest

Contributor.

The Fed recently <a

href=”http://www.federalreserve.gov/newsevents/press/monetary/20110427a.htm”>announced

that it would maintain short-term interest rates near zero for an extended

period” and complete its purchases of $600 billion of longer-term Treasury

securities, known as Quantitative Easing II or QEII, as scheduled by the end of

June. The rationale for both rounds of quantitative easing since 2009 is that,

given current and expected future economic conditions, the desired, or

prescribed, federal funds interest rate is negative. Since the Fed cannot lower

interest rates below zero, additional stimulus is warranted.

The

most common benchmark for the prescribed interest rate is the Taylor rule. In its original form, the Taylor rule states

that the federal funds rate should equal 1.0 + 1.5 times the inflation rate +

0.5 times the output gap, the percentage deviation of GDP from long-term

potential GDP. Using the measure of inflation favored by the Fed, the core

(excluding food and energy) personal consumption expenditure deflator, and the

output gap calculated by the Congressional Budget Office, the prescribed

federal funds rate has been zero or slightly negative since 2009:Q2, hardly

sufficient to justify over $2 trillion in mortgage-backed security and bond

purchases.

Taylor’s

original rule, however, is not what has been used to justify QE1 and QE2. The

most common change is to either double the size of the output gap coefficient

to 1.0 or, as in Glenn Rudebusch’s <a

href=”http://www.frbsf.org/publications/economics/letter/2009/el2009-17.html”>2009

and <a

href=”http://www.frbsf.org/publications/economics/letter/2010/el2010-18.html”>2010

San Francisco Fed Economic Letters, to use an unemployment gap coefficient

consistent with the higher output gap coefficient. John Taylor, in contrast, has

consistently <a

href=”http://johnbtaylorsblog.blogspot.com/2010/09/taylor-rule-does-not-say-minus-six.html”>argued

that his original rule should be used to calculate prescribed interest rates.

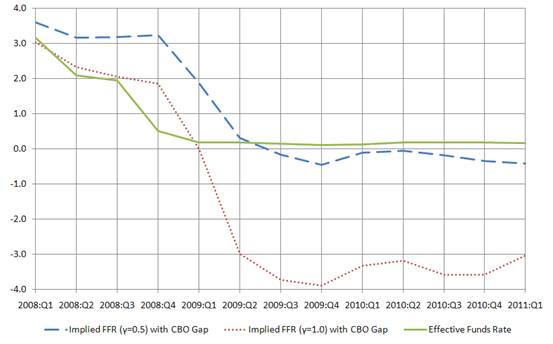

The effect of this change is shown in Figure 1. Raising the output gap

coefficient from 0.5 to 1.0 lowers the prescribed interest rate from about zero

to close to negative 4 percent for most of 2009 and 2010.

Figure 1: 2008.1-2011.1 with Core PCE Inflation & CBO Output Gap

The

debate continued in 2011. In testimony before the Senate Banking Committee, Ben

Bernanke justified QE2 by arguing that the prescribed interest rate is way

below zero. He stated that there are different versions of the Taylor rule,

there is no reason to pick the one that John Taylor picked in 1993, and the

version Taylor preferred in 1999 would give a much different answer. Taylor

countered that he did not propose or prefer an alternative rule in his <a

href=”http://www.stanford.edu/~johntayl/Onlinepaperscombinedbyyear/1999/An_Historical_Analysis_of_Monetary_Policy_Rules.pdf”>1999

paper than in his <a

href=”http://www.stanford.edu/~johntayl/Onlinepaperscombinedbyyear/1993/Discretion_versus_Policy_Rules_in_Practice.pdf”>1993

paper, and that the prescribed interest rate is close to 1 percent. The

exchange was reported in Taylor’s <a

href=”http://johnbtaylorsblog.blogspot.com/2011/03/lessons-learned-from-ben-bernankes.html”>blog.

Most recently, Roger Lowenstein in the <a

href=”http://www.nytimes.com/2011/05/01/weekinreview/01fed.html?scp=1&sq=Roger%20Lowenstein%20May%201%202011&st=cse”>New

York Times reported, without qualification, Alan Blinder’s assertion that

strict adherence to the Taylor rule during the financial crisis would have

mandated a negative 5 percent interest rate.

Which

version of the Taylor

rule should be used to assess current Fed policy, as well as to provide a

benchmark for when the Fed should start to raise interest rates? In a <a

href=”http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1826363″>paper

with Alex Nikolsko-Rzhevskyy

of the University of

Memphis, Taylor’s Rule versus Taylor Rules,” we analyze Fed policy

following the recessions of the 1970s and the 1990s and use the results to

evaluate Fed policy in the 2000s. The advantage of this approach is that, since

there is widespread agreement that Fed policy was too stimulative in the 1970s

and on target in the 1990s, we can analyze different variants of <st1:City

w:st=”on”>Taylor rules in relation

to a non-controversial benchmark.

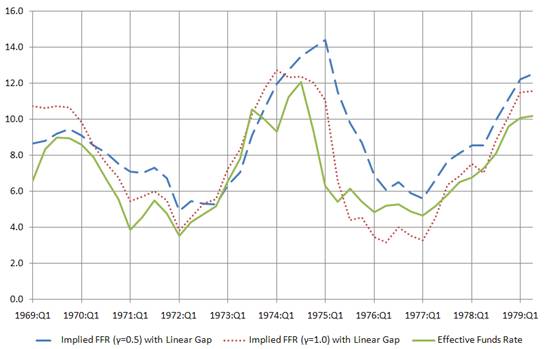

Our

results for the 1970s are shown in Figure 2. Following the recessions of 1970

and 1974-1975, Taylor’s original rule with an output gap coefficient of 0.5 prescribes

an interest rate that is considerably higher than the actual federal funds

rate, while a variant of Taylor’s rule with an output gap coefficient of 1.0

prescribes the same or lower rates than actual Fed policy. Since overly

expansionary Fed policy contributed to sharp increases in inflation following

both recessions, the historical experience of the 1970s favors Taylor’s

original rule.

Figure 2: 1969.1-1979.2 with GNP Deflator Inflation & Linear Output Gap

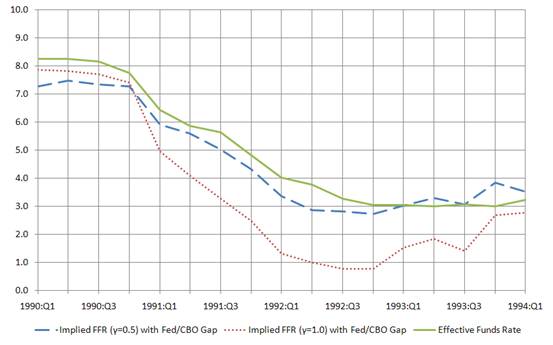

Figure

3 depicts our results for the 1990s. Following the recession of 1990-1991,

Taylor’s original rule tracks actual Fed policy very closely, while the variant

with a higher output gap coefficient produces a much lower prescribed interest

rate. Since Fed policy during the 1990s is widely credited to contributing to

low inflation and low GDP volatility, the historical experience of the 1990s

also favors Taylor’s original rule.

Figure 3: 1990.1-1994.1 with GDP Deflator Inflation & Fed Output Gap

In

a <a

href=”http://www.federalreserve.gov/newsevents/speech/bernanke20100103a.htm”>speech

to the 2010 American Economic Association Annual Meetings, Bernanke defended

Fed policy between 2002 and 2005 by arguing that forecasted, rather than

actual, inflation should be in the Taylor rule benchmark. I have discussed

Bernanke’s speech in a previous <a

href=”https://econbrowser.com/archives/2010/01/guest_contribut_6.html”>post.

In the paper, we show that using inflation forecasts lowers the prescribed

Taylor rule interest rate in both the 1970s and the 1990s. Combining inflation

forecasts with an output gap coefficient of 1.0, the prescribed federal funds

rate is clearly far too stimulative, hitting the zero lower bound in 1975 and

below 1 percent in 1992. Given that Fed policy was too stimulative in the 1970s

and on track in the 1990s, we find no justification

for replacing actual inflation with forecasted inflation in the Taylor rule.

Our results shed light on the exchange

between Bernanke and Taylor. While it is not correct to say that Taylor

advocated a different rule in 1999 than he proposed in 1993, he did not draw a

distinction between the Federal Funds Rates prescribed by the two rules, only

to the difference between the prescribed and the actual rates. In contrast, we

find substantial differences in the prescribed rates from the two rules. The

explanation is that, while we either use or construct real-time output gaps

that were available to policymakers, Taylor (1999) creates output gaps using

revised data with a Hodrick-Prescott filter. Taylor’s

revised output gaps are much smaller than our real-time gaps during and

following the recessions of the 1970s and the 1990s, minimizing the effect of

using rules with different output gap coefficients.

What are the implications of our research for

current policy? With Taylor’s original rule, the prescribed federal funds rate

for 2009 – 2010 is zero or slightly negative. With a variant of the Taylor rule

that doubles the size of the output gap coefficient, it is about negative four

percent. This is important because, with the constraint of a zero lower bound on

the federal funds rate, large negative prescribed interest rates provide a

rationale for the Fed’s

quantitative easing in 2009 (QE1) and 2010-2011 (QE2). Our paper does not say

whether or not QE1 and QE2 were good policies, a topic that is beyond the scope

of our research. It does say that, if you are going to use negative prescribed

interest rates to justify quantitative easing, you need to use a rule that can

be justified by historical experience. Taylor’s original rule, which can be

justified by historical experience, does not produce negative prescribed

interest rates for 2009-2011. Variants of Taylor rules with larger output gap

coefficients, which do produce negative interest rates, cannot be justified by

historical experience. The Taylor rule does not provide a rationale for

quantitative easing.

This post written by David Papell.

“The rationale for both rounds of quantitative easing since 2009 is that, given current and expected future economic conditions, the desired, or prescribed, federal funds interest rate is negative. Since the Fed cannot lower interest rates below zero, additional stimulus is warranted.”

So do you have any other possibilities besides more debt and/or more central bank reserves?

“The most common benchmark for the prescribed interest rate is the Taylor rule. In its original form, the Taylor rule states that the federal funds rate should equal 1.0 + 1.5 times the inflation rate + 0.5 times the output gap, the percentage deviation of GDP from long-term potential GDP.”

If I’m reading that correctly, I believe you are making the mistake that the economy should grow at whatever rate real aggregate supply grows. What if real aggregate demand is growing by the population rate (about 1%) and real aggregate supply is growing by about 2% to 3%?

Very basic question. “Since the Fed cannot lower interest rates below zero”

Why not? Because banks can not be forced to put their money in the Federal accounts? Why not? A negative interest rate equates to a tax on cash assets in the banks. It may be hard to implement this for every single bank, but surely it can be levied on the “too big to fail” kind of banks that dominate the financial sector.

Where am I wrong? Sure, the Fed cannot levy taxes, but it could impose fees justified as an extension of the interest rate policy to negative territory… So, why not?

“…with the constraint of a zero lower bound on the federal funds rate, large negative prescribed interest rates provide a rationale for the Fed’s quantitative easing…”

Pardon my ignorance, I’m just a lowly financial planner out here trying to understand this stuff the best I can, but…doesn’t the zero lower bound in itself justify the rationale for quantitative easing?

I know it isn’t much in comparison, but it looks to me like the original Taylor Rule does in fact suggest the need for a negative rate. So it would seem to me that the original Taylor Rule also suggests the need for some amount of quantitative easing, and the issue is how much.

Assuming that is right–do we know the amount of quantitative easing so far is inconsistent with the original Taylor Rule? Has it really been as effective as a negative 4 percent rate? I’m going to guess not, but that seems to me to be the question, even assuming you adopt the original Taylor Rule.

This whole post is misleading, to be polite. With the most commonly used Taylor rule, the fed funds rate responds to the inflation GAP, not inflation. All of the post assumes the inflation target is 0%, when it is really 2%. Taylor has been using this deception recently, and it is the source of the discrepancy with Blinder’s recommendation. Redo the graphs using the correct inflation target and see what a difference it makes. QE2 is quite sensible.

In 2008-09 the US economy experienced its greatest crisis since the Depression. The financial system nearly collapsed and God knows what would have happened if it had. The economics profession was derelict in not seeing it coming. Not one Nobel prizewinner did, which tells a tale. This is because adherence to the reigning paradigm occludes vision à la Thomas Kuhn’s structure of scientific revolutions. Mainstream economists did not pay attention to Minsky’s work or Roubini or Steve Keen in Australia nor to a dozen others who got it right for the right reasons. When you take it to first causes, the Great Recession was due to the failure of the profession. Next it was due to Greenspan and Bernanke keeping the funds rate far too low in the 2002-05 period. Notice that if the profession had gotten it right, Greenspan could not have bucked an entire profession in Congressional testimony all those years. The profession enables the Fed and that is what this paper is doing (though you will learn in a moment this enablement is in the wrong direction). Thirdly was all the deregulation which permitted the resecuritization from MBS to CDOs, which allowed Bear Stearns-type leverage to ramp up in the shadow banking system which brought the financial house of cards down once the housing bubble energized by the Greenspan-Bernanke liquidity finally burst. Bubbles always burst as anyone who studied Kindleberger knows.

In his 2010 keynote address to the AEA, Bernanke gave a logically brilliant defense of the Fed’s actions in 2002-05 via his Taylor rule analysis. The audience bought it hook, line, and sinker. Except he built his logic on a false initial premise, the Taylor rule as commonly understood. The bit about using forecast variables made the Fed’s historic actions look better, but begged the point. The point is the Taylor rule – a brilliant piece of work by the way – is misspecified. It is missing a third term on the right hand side, an asset price variable, in particular a housing price gap term. I call this an augmented Taylor rule. Research will find that commodity asset prices or stock market asset prices do not need to be included in the rule. But home prices do, which is face evident from the recent experience. The Fed must not aid and abet overpricing the largest wealth sector of our modern economy into a bubble as it manifestly did, and using an augmented Taylor rule is a way the Fed can keep from doing so.

When papers introducing the augmented concept eventually appear in the literature, here is what you will see. Not much difference in policy prescriptions per Taylor’s original rule throughout the post-war period with or without a housing asset price variable other than in 1977-79 and 2000-05 … and very importantly the present. The first two episodes are precisely when the funds rate should have been taken higher than per convention. Moreover, an augmented rule would have given the Fed political cover to act against the popular but illusory wealth generation via home prices that everyone “knew” could go only one way which is up.

Now to the conclusion of the paper: “… if you are going to use negative prescribed interest rates to justify quantitative easing, you need to use a rule that can be justified by historical experience. Taylor’s original rule, which can be justified by historical experience, does not produce negative prescribed interest rates for 2009-2011. Variants of Taylor rules with larger output gap coefficients, which do produce negative interest rates, cannot be justified by historical experience. The Taylor rule does not provide a rationale for quantitative easing.”

Absolutely a proper rule should be based on historic experience. The original Taylor rule works because there were no significant housing bubbles until now. But the analysis misconstrues the recent experience. The paper’s conclusion is based on a faulty premise – that it is unimportant to account for asset price bubbles – and hence its advice is as flawed on the downside of the credit bubble (right now) as it was on the upslope. In your mind’s eye insert into the Taylor rule a deviation of housing prices from norm, a housing price gap along with inflation and output gaps. With the Case-Schiller still falling, monetary policy needs to be far easier than the original rule specifies. Bernanke is instinctively doing the right thing with the QEs, all the while violating the very rule he so vociferously defended! Doesn’t the irony strike you? An augmented Taylor rule clears up a lot of the fog. Adhering to the original rule in the current environment where household deleveraging is inhibiting the recovery would be wrongheaded and counterproductive. An augmented rule, on the other hand, calls precisely for something like quantitative easing, just as it would have prescribed more tightening going into the double-digit inflation of 1980 and into the housing bubble.

There is another was to lower interest rates below zero. The government can stop deficit spending and return the savings to the productive economy in the form of a tax rebate or better a permanent tax cut.

Consider that today the Treasury borrows money to support government spending. Now that borrowed money can come from the productive economy as banks, individuals, foreign governments and others private investors buy Treasury securities or it can come from money creation as the FED buys Treasury securities.

Wouldn’t it make much more sense to borrow the money and give it to the productive economy where production would actually generate jobs and income that would actually increase tax revenue and decrease the need for borrowing?

The whole dynamic is built on a Keynesian notion that government “investment” can replace private investment, but this government investment is actually consumption while private investment is actually increasing productive capacity. Real government investment would be to facilitate the productive economy building productive assets.

If John Taylor or any other “Taylor” out there determines that a negative 4-5% interest rate is warranted why not “pay” people to borrow money, a negative interst rate, by giving tax cuts rather than having the government build another presidential library or another road to nowhere or another study of the sexual mating habits of some obscure animal?

I know Keynes likes digging holes and then filling them up but that has not worked. How about trying somthing else?

endorendl: If you taxed Federal Reserve deposits, banks would simply ask for $1 trillion in cash and hold it in their vaults. Among other things, this raises logistical issues of the Fed getting its hands on $1 trillion in currency that doesn’t exist and might take a year or so to print.

What if long-run aggregate supply has fallen permanently, investment levels are permanently depressed, and the NAIRU is permanently higher? Wouldn’t output gap estimates be biased in this case? This kind of analytical mistake is not even a new phenomenon, it happened e.g. during the 70s and it led *slowly* to a worldwide round of inflation that was very hard to vanquish once it caught on. I’ve seen this kind of mistake happening in different countries in different periods of their history, and there are political reasons for this misjudgment to repeat itself, mainly, refusal to acknowledge hard realities.

I’m betting on this hypothesis, and when I say that I’m betting, I mean that I’m putting real money on it.

Evaluation of the impact of QEII in both the paper being discussed and in the comments miss the most important facet of QEII: and that is what is done with the QEII money. A “balance sheet,” even the Fed’s, well “balances.” If you “print money” through QEII it does darn well matter a lot what you do with the money.

As JBH cogently notes, initially the QEI money was used to buy up MBS, and to “shore up” the banking system. Banks do not have to show losses under “mark to market” on MBS if they take such securities off their balance sheet and give them to the FED. This was in fact the initial use of the money in QEI.

But like Tom Cruise as Jerry Macquire we need to continue to “follow the money.” After the intial round of QEI into MBS, subsequently in QEII the Fed has used the money to buy treasuries. The Federal Government runs a $1.6 Trillion dollar deficit, and by the by, the Fed runs QE programs to buy up $1.6 Trillion in treasuries (OK the early QE programs didn’t buy treasuries, but the amounts matching may not be a complete coincidence, so just bear with me). Does anyone believe that this combined action (U.S. deficit $1.6 Trillion, Fed QE $1.6 Trillion used to buy treasuries) is cost free ? A free lunch ? Free money ? Is so then why not do the same thing, only do QEIII for $10 Trillion a year (or $100 Trillion) ?

Of course it isn’t cost free !! Now if the Federal Government had a balanced budget and the Fed engaged in QE, the expected result is that asset prices would be bid up (the Fed is adding QE money bidding for assets, as well as pumping cash into the system). But what happens when the QE money is put into treasuries, new treasuries based on a like amount of deficit spending in Washington ? Doesn’t it stand to reason that the net result is going to be a debasement of the currency, with attendant commodity price increases ? Silver prices recently rising parabolically towards $50 an ounce (with a recent pullback), what a surprise (NOT) !!!!

“Following the money” leads to several other questions/issues and facts that are striking: Bank reserves 4 years ago at only $9 Billion rising to $1.5 TRILLION now, the Fed paying interest on reserves (until a few years ago they didn’t), a consideration of whether Bernanke can really “unwind” these QE moves even if he wanted to do so, etc.

IMHO, all this discussion of the Taylor Rule and monetary policy in reference to the advisability of QEII or III or 33 ignores the real import of what the Fed is doing, the most important consideration, which is what they are doing with the money in QE. Inflationary effects are just as “transitory” as the financial crisis was “contained” to subprime. Bernanke can unwind these QE moves just as well as Greenspan was able to “contain” the financial crisis to subprime.

Anyone who thinks you can use interest rates as a monetary policy guide doesn’t deserve to be called an economist (Taylor et. al.). Keynes’s liquidity preference curve is a false doctine.

The other thing is the Taylor rule and its component variables are extremely ex-post.

Excellent article; similarly high quality comments.

“…if you are going to use negative prescribed interest rates to justify quantitative easing, you need to use a rule that can be justified by historical experience. Taylor’s original rule, which can be justified by historical experience, does not produce negative prescribed interest rates for 2009-2011.”

Agreed if you are talking about historical experience with the Taylor rule when we were up against the zero bound (hint: the great depression). To compare today with the 70s and the 90s when the FF rate was far from zero is at best a shakey historical comparison.

Taylor Rule? We don’t need no stinkin’ Taylor Rule.

Look around. Tens of millions of people are out of work. Inflation is below 2%. Wages are flat. Hours worked per week are flat. Labor participation rate is way down. With today’s rate of job growth, it will be many years before we return to full employment.

We have a dysfunctional Congress that refuses to apply fiscal stimulus — worse they propose contraction. We have a Federal Reserve that we supposedly gave political independence so they would not become gridlocked like Congress and always be free to do the right thing. Yet now we have arguments that the Fed should back off because of the “Taylor Rule”.

Economists are funny people. They will spend hours working out intricate calculations about the Taylor rule yet neglect to look outside their window at the neighborhood or maybe its just that their neighborhood is doing just fine.

With this Taylor Rule they strike me as Ptolemaic astronomers invoking ever more intricate epicycles within epicycles to explain the movement of the economy. Or perhaps they are more like day-trading chartists who are forever divining wonderful new relations like the January effect or the dogs of the Dow. Give them enough free parameters and they can back-test any random curve.

Meanwhile, it’s obvious to anyone with a lick of sense that a Taylor Rule that says everything is just fine as things are now must be useless. Arguing about decimal points for output gap coefficients seems pretty silly.

They are many intertwined variables in Professor Papell,that may not belong to the Taylor rule in its monetary principles.

QE (Europe,USA) is about funding the public debts,supporting the primary dealers, lowering the interest rates, bailing out the international banking community from the past commended and concerted manipulations of the interest rates,medium and long term yield curves (Please see Econbrowser posts among them ,The Fed’s new policy tools,The market moves ahead of the Fed,Progress report on QE2).

As laid out the Taylor rule deals with interest rates and not money supply,output gap,is explicitly anchoring a nominal level of inflation and does not dispute a given GDP deflator.It is aiming at providing for a monetary policy conditions for full employment and price stability.

On the current practice of the referred rule,few observations:

The real inflation targeted or anchored is not obvious (a mandate is set for the ECB inflation should not exceed 2 % but not for the USA Federal reserve)

The domain of definition of inflation is not comprehensively covered,and the GDP deflator may not be consistent with the Taylor monetary rule. As introduced,it is a supportive instrument of monetary policy not as a panacea for solving full employment target and filling up the output gap.

I find this post to be thoroughly unpersuasive.

Glenn Rudebusch’s equation is obtained by a statistical regression of the fed funds rate on the inflation rate and on the gap between the unemployment rate and the CBO’s estimate of the natural rate of unemployment. The resulting empirical policy rule of thumb recommends lowering the funds rate by 1.3 percentage points if core inflation falls by one percentage point and by almost two percentage points if the unemployment rate rises by one percentage point. This “Taylor Rule” captures policy over the past two decades, a period of time for which the Fed’s handling of policy recieved nearly universal praise (it has been termed “The Great Moderation”). This Taylor Rule also suggests that the fed funds rate should have been lowered to -5.5% by late 2009.

In the final analysis, any Taylor Rule that does not provide a rationale for QE2 when nominal GDP is still over 8% below trend over three years after the start of the recession is surely questionable.

QE is irrevelant. Nothing more than confidence schemes to force business to start spending their oversavings by giving the mirage of inflation. Nobody is buying it outside a small frock of schlocks. The FED is incapable in current form, to do anything with this trap we are in. The “financing” of public debts isn’t happening either. The debts are already financed. The so called ‘bailing out’ of finance was nothing more than a temporary stay of execution. They will eventually become like Lehman, unbailable. The monetarists that run the FED don’t have anything they can do. Which is why they are doing what they are doing(hoodwinks).

All inflation is global and that will end soon enough. Your feeling warm winds on a cold, frozen ground.

The actual situation of the formerly called “industriallised” economies (that is not the case now) is likelly to deteriorate for the main part of the people, and IMO there are only two way-out:

a) A re-orientation of the trade balances and in general the globalization process (f.e.real elimination of tax havens), in the sense that our economies are not sustainable without a big industrial base

b) A round of serious fiscal stimulus based on improvements of the infraestructures to act as a multiplier of the industrial competitiveness. This is not a matter of economist “receipt”, it is the people, when the problem scalate, who will force this interventions, as they did in the 1930’s in Germany choosing Hitler or in USA with FDR. So it is better to make in a way less “tragic”

Joseph Excellent Ptolemaic analogy to describe this paper and the profession in general. I believe the profession (incredibly bright people that they are) are mostly counting angels on the head of a pin. It is obvious you understand curve-fitting and have cast the net wide regarding all the ex post contrivations you have come across and recognized for what they are. Good for you. The augmented Taylor rule in my earlier post meets your “lick of sense”. The economy is in big trouble, and not doing QE2 would not have cut the mustard. Taking cognizance of below norm home prices (or more to the point changes therein) calls for easy money. The country is reeling from the shrinkage in housing wealth. Augmenting the Taylor rule is where the profession is going, and economists will someday grasp that the planetary orbital paths are in fact elliptic rather than circular once the gravitational effect of home prices is recognized and understood.

Mark S You also see through the veil. The Great Moderation was quite convincing as you looked at the reduction in the variance of real GDP growth during the Greenspan era. I was mesmerized by it for all too long. But Minsky saw it for what it was, a ratcheting up of the long-term credit cycle, a postponement of the necessary correction from one recession to the next until by 2006 the bubble could no longer be contained. We are now on the dark flip side of that. And in the spirit of opening our eyes to what is really going on, there is more to it than just the Taylor rule. There are a host of insidious redistributionist regulatory, tax, and other policies counterproductive to growth coming down on the economy’s head too.

Perhaps another analogy would be to the cargo cults of the South Pacific who believed that if they could just mimic the actions of the past, by clearing a strip in the jungle, putting coconut shells over their ears and speaking into a wooden box the planes would come again with their bounty. Of course they were oblivious to the World War going on around them that was the real cause.

Likewise, the Taylor cultists dream that if the Fed can just carefully retrace the curves of the 90s, the Great Moderation will come again. Like the cargo cultists, they seem oblivious to the war going on around them in which 50 little Hoovers around the country are cutting back spending and firing 100s of thousands of public workers. They are oblivious to the Republican clowns in Congress who have miraculously discovered fiscal prudence now that a Democrat is in the White House and are demanding austerity. It seems to make no difference to the Taylor cultists that everyone else in the boat is rowing backwards. The Fed must pretend these unprecedented countervailing forces do not exist in their ritualistic Taylor calculations or else the Great Moderation may not return.

1. I’ve always been skeptical of rules that use estimated output gaps, no matter what the coefficient. That seems like discretion in rule’s clothing, and it doesn’t surprise me that hypothetically allowing the Burns-Miller Feds to rationalize their actions in this manner doesn’t improve their performance. If the Fed is going to take this approach, then the rule should at least be self-correcting — that is, the impact of inflation should be cumulative.

2. If I’m not mistaken, the concept of the output gap still being developed during the 1970’s. (Wasn’t it the evidence of the 1970’s that finally convinced economists the the long-run Phillips curve was vertical? It’s hard to make sense of the “output gap” concept without assuming a vertical LRPC.) Is it really valid, therefore, to speak of “real-time output gaps that were available to policymakers” when talking about the 1970’s?

The FED pursues QE as a means to support continued Federal Government deficit spending at ridiculously low interest rates. It continues the addictive behavior that has hollowed out the productive economy in favor of subsidy to the crushing burden of accumulated debt. Total Credit Market Debt now equals more than 550% of civilian GDP.

The paradigm of continued expansion of leverage on the economy is pathological. The Taylor rule ignores leverage, and in doing so implicitly supports the imbalance that has caused the current crisis and continued Federal Reserve mismanagement.

One problem with the original Taylor rule is that the output gap term is cumulative (i.e., you don’t “reset” your estimate of potential output when actual output misses) but the inflation term is not (i.e., you do reset your target price level when the actual price level misses, because the inflation term only looks back 4 quarters, so the 4-quarters-ago price level is treated as the “base” for the new target). Correcting this problem, by making the inflation term cumulative, would be a much more effective fix for the 1970’s problem than simply reducing the output gap coefficient.

One could also make a case for using both cumulative and non-cumulative inflation terms, on the grounds that the real interest rate should be defined in terms of non-cumulative inflation. With Taylor’s original coefficients, that would give the following rule:

r = i + .5y +.5p + 2

where

i is the inflation rate,

y is the output gap, and

p is the price level gap

If we measure y and p relative to a fixed growth rate path from some base year and measure p using the GDP deflator, this equation gives us a nominal GDP targeting regime (using a crude estimate of the real interest rate, relative to Taylor’s arbitrary 2% neutral rate, as the policy instrument). It can be simplified to

r = i + .5n + 2

where n is the deviation of NGDP from target

Suppose we define the target as a 5% growth rate path starting in Q4 2007. (Q4 2007 is the last business cycle peak and represents roughly a point where output was at potential. 5% is an arbitrary target, but note that it represents a slight slowing from the trajectory of actual NGDP up to that point.) Then we get a target interest rate of -2.6%

Correction to my last comment. (There was a typo in my spreadsheet.) The target interest rate is -2.2%.

(The NGDP gap is a whopping 11.6%. Inflation rate is 1.6%. So neutral interest rate is 3.6%, and you get 3.6 – .5*11.6 = -2.2)

They are merits in modelisation as they offer benchmarks limiting the boarders of politicians gyration even though they are constitutional covenants.

Whilst Taylor rule is precise in its approach the data are not.The hereunder paper from ECB show the output gap to be unreliable and comparatively to supply better data resource on a longer trend in USA than in Europe.

http://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1157.pdf

Outstanding,are non philosophical questions,how real is an output gap where the reference GDP is sustained by an hypertrophy of the financial sectors,a debauchery of financial instruments leading to an overpricing of assets,a price distortion of the assets.

Should the Taylor rule be applied with long trend consistency in Europe

1 percent + 1.5 x inflation + .5 x (Real GDP – Potential GDP) /Potential GDP

The interest rates would defeat and would have defeated the “prophetic” inflation expectation

(please see P11 ECB monthly bulletin April 2011)

Couple points: 1) Q4, 2008 and Q1, 2009 are part of the historical experience. The Taylor rule this blog poster favors has a Fed Funds rate at 2% in Q1, 2009! As it was, we know that actual monetary policy — a 0 Fed Funds rate plus $1.6 trillion in QE and Fed govt stimulus — was not enough to prevent a severe, prolonged recession. That would seem to discredit the Taylor rule you’re proposing…

Basically, my feeling is that a more sophisticated Taylor Rule exercise (need inflation gap and not inflation, also probably need rate-of-change variables in there for sudden collapses) would be useful, and should be considered to guide, but not be policy.

Consistency needs to be looked in the data and applied in the rule.What if Taylor rule had been consistently in force since let us say 2000.

If we must have a “Taylor Rule”, then one that totally takes into account levels as opposed to rates would be a huge improvement.

I vote for the Andy Harless Rule as a definite improvement as it not only shifts the focus completely from rates to levels it also combines both the output gap and price level gap into an NGDP gap which would be more stabilizing in the face of aggregate supply shocks than a rule that treats output gaps and price level gaps separately.

P.S. On the other hand, perhaps it is just best that we declare the whole era of the Taylor Rule dead and move on to targeting NGDP (as Menzie Chinn once wrote about).

I’m afraid I don’t understand the argument but I appreciate the post and the analysis. My issue is that we’re arguing about the definition of a “rule” and that means it isn’t really a rule but maybe an approximation or rough rule of thumb. I thought the idea behind the original was mapping to historical data. I liked the graph in the post that relied on this point.

A rule, to me, is something like the candidates with the most votes wins. Or everything falls. I gather we’re talking in this case about an approximation of sorts – the Taylor Approximation might be a better title – but even then it isn’t actually an approximation but a rough rule of thumb (the Taylor Rough Rule of Thumb?). That gets at my real issue: so the Taylor RRoT has been relatively accurate, depending on definitions, but what if that’s as true as the correctness of a stock picking system. Those are often right, except when they’re not. In other words, I see no reason to believe the Tayler RRoT actually describes a fundamental relationship.

Has anyone here ever taken the time to examine the BOJ’s QEI (coincident with the Asian Crisis, Japan’s first debt-deflationary banking crisis in ’97-’98, the onset of persistent price deflation, and the 40-45% Nikkei crash into ’98) and QEII (’00-’03 episode of BOJ monetary base expansion coinciding with a 65% Nikkei crash)?

The US is now aligning with similar debt-deflationary cycle periods in 1838-39, 1892-93, 1939-40, and Japan in ’00. If we escape another 50%+ stock market crash and deflationary global recession and fiscal crisis by ’12-’16, it will be somehow “different this time” but perhaps not in the way we hope.

Look at the very long-term data of real GDP going back as far as we have reliable data. Advanced industrial economies grow at approximately population plus capital replacement/production, which in turn is correlated with per capita energy (oil) consumption.

The US grew domestic oil production at more than 4%/yr. from 1920 to 1970, at which point US domestic oil production peaked and has declined 44% since, and 62% in per capita terms.

Since 1970 and the secondary oil production peak in 1985, the US has added debt-money supply at a rate per capita of more than 5%/yr. to domestic oil production of -2.4% to -3.1%/yr. and industrial production of 2.3%/yr.

IOW, the US has added 4-5 more debt-money in terms of domestic oil production and value-add industrial production capacity.

Then, in ’05-’08, the US reached peak private debt and commenced a debt-deflationary regime, and the world reached peak crude oil production, implying that global peak oil production now precludes real per capita GDP growth hereafter.

To keep the nominal GDP from contracting, the US must now consume a sufficient share of accumulated equity and financial wealth at an approximate rate of the difference between nominal GDP and the difference between per capita oil depletion and production, an equivalent of 4.5-5%/yr. indefinitely.

At the trend rate of wealth consumption given the debt-money and debt service overhang on the US economy, the US will experience no sustained real per capita economic growth for 30-40 years.

Peak oil, and soon peak and decline of oil exports, means that global economic growth is over, including growth of “alternative energy” investment.

Most economists are missing this because (1) they mistake Keynesian aggregate consumption as growth in perpetuity, irrespective of the source of the growth and its rate, and the net energy returns to “growth”; and (2) they perceive the ecological system as a sub-set of “the economy”, when the obvious fact is the precise converse.

The Taylor Rule is constantly revisited and used to measure the effectiveness, & correctness, of PAST Federal Reserve monetary policies.

But the gDp figure (used in the Taylor rule), is only published quarterly (with one month’s delay, no I take that back, April 28 for 4th qtr 2010) & then its revised twice (in successive months).

By the time gDp is finalized, the equation is useless. For example, the flash crashes of Oct. 19, 1987, Feb. 27, 2007, & May 6, 2010, were all short-term monetary management mistakes.

The recent commodities collapse is just the net result of money flows collapsing (falling by over 50%). But don’t throw out the old wives tales yet, I’m getting rich.

all of this is a bit of nonsense since the Taylor rule, and Bernanke’s rule for that matter, ignore the impact of the dollar on domestic rates. As the trade deficit has accumulated since 1982 so too has the impact of foreign investors on domestic borrowing rates. One must recognize that domestic rates stayed too low in the past expansion because the trade deficit failed to weaken the dollar against China because of China’s FX policy. In a free trade world the dollar would have weakened and real domestic rates would have risen — and the housing bubble would not have grown to the extent it did. A too strong dollar in turn kept domestic inflation low relative to the unemployment rate. In sum, calculating the right funds rate must account for the fact that we are in an open economy where the dollar’s value is being manipulated by the nations with whom we have the largest trade imbalances. To ignore this and create a model wholly out of domestic variables and presume a free market in the dollar is to put one’s policy head in the sand and repeat the same mistake again.

When you net out the lengthening of maturities by the Treasury with the (attempted) reduction by QE2 you get close to 0 total effect – about what the original Taylor rule calls for.

Nemesis,

When lecturing on Japan’s Lost Decade last fall I basically made the following case to my students:

1) During 1993-2002 RGDP growth averaged 0.9%, unemployment rose almost consistently every year from 2.2% in 1992 to 5.4% in 2002. CPI fell from 2.5% in 1992 to -0.7% in 2002.

2) The Japanese announced their plan of ryōteki kin’yū kanwa (QE) on March 19, 2001 and maintained it through March 9, 2006.

3) RGDP growth averaged 2.1% during 2003-2007. Unemployment fell every year until it reached 3.9% in 2007. Deflation slowed down to -0.4% by 2007.

Now, I ask you, did QE work or was this merely a coincidence?

Mark, good question. Perhaps an equally relevant question is why it “worked”, or what was the coincident event or events that contributed to it appearing to “work”.

Not coincidentally, the English-speaking world, parts of Europe, and parts of Asia experienced cumulatively the largest residential investment bubbles in world history, providing export (for the North American and Asian markets) and FDI growth for Japanese export-oriented firms.

But it appears that what coincidentally “worked” was a MASSIVE pulling forward of investment, production, and consumption from the future to the present, which was enabled by MASSIVE amounts of debt/income and /GDP.

As an aside, from the Asian Crisis in ’97 to ’03 and to date, the BOJ doubled or more the monetary base (the Fed has tripled so far), bank loans fell 30%+, bank loans/monetary base fell to ~1.0, and the money multiplier and M2+ velocity collapsed with real estate prices continuing to fall and two 60%+ Nikkei bear markets occurring in ’00-’03 and ’08-’09.

Examining the larger effects of the slow-motion, debt-deflationary Japanese depression since the ’90s, it’s not easy to see how the BOJ’s QE and Japanese gov’t borrowing and spending at 5-6% of GDP “worked”.

That is, since ’90, Japan’s avg. trend real GDP has decelerated from 3.5% to well below 1%, reducing growth that otherwise would have occurred by a cumulative 40%+, which is worse than the net cumulative real GDP decline of the 1890s and 1930s-40s.

Similarly, the net cumulative loss of real US GDP since ’00 has been 10-11%, and ~15-16% for real per capita GDP.

So, with due respect, it depends upon what one’s definition of “worked” is, as to whether QE and outsized deficit spending/GDP “works”.

I would argue that, rather than a policy prescription, QE is a desperate policy reaction to having what is perceived as no other choice to financial ruin.

In my personal life, I try to avoid those kinds of situations, if at all possible. 😉

Steve:

Excellent points.

Nemesis and Mark:

In my opinion, the biggest effect of Japan’s interest rate policy was to spur the yen carry trade and boost Japan’s trade surplus. The policy did little for domestic investment, but probably helped blow housing bubbles abroad. Given China’s currency policies and the lack of global AD, for the U.S. to try the same now will prove disastrous to ROW, who will not be able to hold up against the loss in AD.

Nemesis,

You wrote:

“But it appears that what coincidentally “worked” was a MASSIVE pulling forward of investment, production, and consumption from the future to the present, which was enabled by MASSIVE amounts of debt/income and /GDP.”

Actually, that’s not at all true.

Gross central government debt as a percent of GDP rose from 68% in 1992 to 152% in 2002. Debt was growing at an average annual rate of 8.4% faster than GDP growth during 1993-2002. The rate of growth in gross central government debt slowed substantially under QE. It reached 167% of GDP in 2007, growing only 1.9% faster than GDP growth during 2003-2007.

don,

You wrote:

“In my opinion, the biggest effect of Japan’s interest rate policy was to spur the yen carry trade and boost Japan’s trade surplus.”

I’m talking about QE, not ZIRP. By the time Japan adopted ZIRP in 1999 it was too late to be effective.

Mark, I was referring to the private debt bubble worldwide that was an “exogenous” factor that, as don implies, assisted the Japanese export sector, and thus contributed to incremental Japanese growth that might not otherwise have occurred.

But even with the real estate and consumer credit bubbles in the US and elsewhere mitigating the worst effects of Japan’s slow-motion, debt-deflationary depression, Japan’s trend real GDP since ’90 (0.6-0.7%/yr. vs. 3.5-4%) is 40-45% less than otherwise would have occurred had Japanese Boomer demographics not turned down after the early ’90s, the long-term real GDP rate had continued, and the worst demographic drag effects occurred after the Asian Crisis to date.

By ’90, Japan’s avg. real GDP trend rate had decelerated from the long-term trend rate of 3.5-4% to 1.2%, whereas the US real GDP trend rate has decelerated from 3.1% in ’00 to 1.7% since ’00 to date.

From ’00 to ’10, Japan’s real GDP trend rate has slowed still further from 0.6-0.7% to 0.155%, with the avg. trend rate for real GDP since ’80 decelerating to 1.87%.

Of course, Japan did not have, as has the US, war spending/GDP of 5-6%+ and growing at 7-8%/yr. for 11 years. Less the sustained increase in the rate of growth of gov’t war spending since 9/11, post-’00 US trend real GDP would be 20-25% slower (all else equal).

The similar US Boomer demographic drag effects are now bearing down as in Japan in ’98-’00, with the additional unprecedented structural drag effects from peak global oil production and eventually peak oil exports coinciding with 10-yr. avg. US real private (real GDP less total gov’t spending, including private transfers) per capita GDP is now turning negative.

I expect that the US and EU will experience similar trend real GDP growth profiles hereafter as did Japan after ’98-’00, with trend US real GDP further decelerating from the ’00 peak of 3.1% and 1.7% today to 1% and below by decade’s end. US real private per capita GDP will decelerate even further into negative territory in the years ahead.

We will see ZIRP and additional QE with the ongoing decelerating rate of growth of post-’00 and post-’07 real trend GDP and GDP per capita.

“It” is happening here, just as in Japan in the ’90s to date. But ZIRP and QE are working no better in the US, unless the resulting real trend GDP and public debt/GDP were the desired outcomes in Japan, in which case ZIRP and QE will work just as well for the US as for Japan.

Nemesis,

You seem preoccupied with the slowdown in Japanese GDP growth. But there is no reason to believe it should continue at its previous breakneck speed with an aging population and a now relatively prosperous economy. Japan’s relative productivity level (GDP per hour worked) has been more or less 70% that of the US level since about 1990. There may be many factors that prevent it from going any higher.

My point is that as a macroeconomic stabilization strategy QE was very successful in Japan. Japan’s economy is only suffering now because it is afraid to debase its currency any further, and so deflating the value of debts and easing the consequent balance sheet effects. But this fear is (irrationally) quite widespread these days.

Mark,

Quote: “Japan’s relative productivity level (GDP per hour worked) has been more or less 70% that of the US level since about 1990. There may be many factors that prevent it from going any higher.”

Good point! And, mainly coming from fixed factors of production those factors may be telling the very reason why QE works better in Japan where many enterprises are still owned by those who undertook them or by their friends and associates, hence investment depends on a sufficient supply of individuals of sanguine temperament and constructive impulses who embark on business as a way of life, not really relying on a precise calculation of prospective profit. You will actually see numerous eateries, shops, ateliers, factories and other micro businesses all around you while you walk around in any large Japanese city in which both indirect finance and SMEs still remain vigorous after all the years of financial globalisation. As the interest rate on bank loans, in the shape of money which has negligible carrying costs, cannot go below a certain positive level patience along with QE must have been the option that the Japanese chose until depreciation expenses were sorted out to some extent.

Quote: “Japan’s economy is only suffering now because it is afraid to debase its currency any further, and so deflating the value of debts and easing the consequent balance sheet effects. But this fear is (irrationally) quite widespread these days.”

However, I don’t think the economy is afraid to debase its currency while it is suffering. Considering the average propensity to consume by household income class I suppose that its public debt has been ballooning because Japan has reduced the (effective) marginal tax rates for the last couple of decades while the general spending increased until recently and because it hastily deregulated the supply side during the same period so that its middle-class households, which are supposed to comprise the main chunk to feed the government, have been bipolarlised upwards and downwards.

Mark wrote: “My point is that as a macroeconomic stabilization strategy QE was very successful in Japan. Japan’s economy is only suffering now because it is afraid to debase its currency any further, and so deflating the value of debts and easing the consequent balance sheet effects. But this fear is (irrationally) quite widespread these days.”

This is the kind of thinking that will encourage in the years ahead economists and policy makers describing euphemistically the emerging debt-deflationary slow-motion depression in the US and EU as something like “slow, but sustainable, non-inflationary economic activity”. 😉

All the while, the post-’00 secular real GDP trend rate will continue to decelerate toward 0%, and the 10-yr. trend of real private per capita GDP will contract further into negative territory, and per capita net energy decline will continue, forcing an inexorable decline in the material standard of material consumption for the bottom 80-90% of US households.

And we will pat ourselves on the back congratulating ourselves for having achieved macroeconomic “stability” by printing hundreds of billions of dollars in debt-money reserves even as our oil reserves are depleted at 3% per capita and we have barely 15-20% value-add production capacity as a share of the mountain of debt-money and associated debt service accumulated over the past 25-40 years.

But don’t be surprised if the economic fatasyland’s walls come tumbling down and the foundation splinters in the months and years ahead.

Now Keynesian economics versus the economics of Keynes.

People tend to attach too much importance to ex ante trend and output gap, making light of analysing what is actually happening to the marginal efficiency of capital.

QE2 is a case of misplaced monetary policy. The better policy would have been to finance the budget deficit with the new money created for QE2’s interest rate reductions. This argument is presented in a short paper posted on the VOX economics website on 3rd March. (Use the search box on the website and insert the author’s name ‘Richard Wood’.