From the Washington Post:

…”If this guy [Fed Chairman Bernanke] prints more money between now and the election, I don’t know what y’all would do to him in Iowa, but we would treat him pretty ugly down in Texas. Printing more money to play politics at this particular time in American history is almost treacherous, or treasonous, in my opinion.”

Perry continued by saying that printing more money would be “devaluing the dollar in your pocket, and we cannot afford that. …”

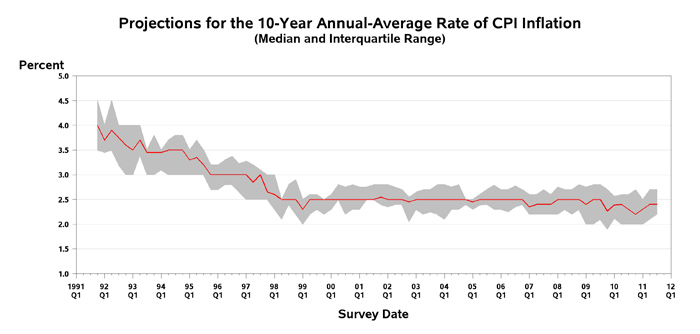

The Philadelphia Fed’s August Survey of Professional Forecasters was released on Friday. Ten year CPI inflation expectations are presented below.

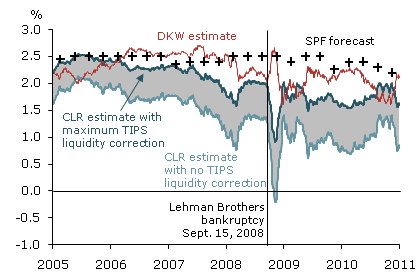

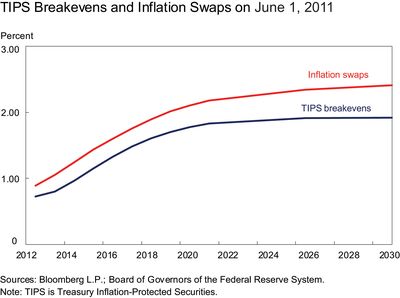

Update: 9:12AM Pacific 8/16: Some readers have questioned the reliance on survey based expectations (these are probably the same readers who take at face value surveys of purchasing managers, etc.). In any case, here are some market based indicators:

Figure 2 from Christensen and Gillan (June 2011).

Figure from Lucca and Schaumberg (August 2011).

Update 2: 11AM Pacific: Commentary by [RA/Free Exchange] and [Economists View], [Grunwald/Time], [Sargent/Plum Line]. In my view, heated rhetoric of this nature regarding monetary policy is not constructive. [0]

Well, he does have protect his monetary policy flank from competitor Ron Paul.

What is it with the GOP? They don’t want fiscal stimulus (rightly so in my mind), but they don’t want monetary stimulus either. Are they all Austrian now? I don’t buy GOP = anti-intellectualism, but this is really really getting my goat. Can’t wait to read what Sumner has to say about this. I’m sure it will be suitably vicious.

Money printing is treacherous in a sense that it spells the beginning of the end of the dominance of America in the world.

You seem to be trying to refute Perry’s claim by referring to current inflation levels.

There is little doubt that inflation would be lower, or that there would be deflation without QE. After all one of the Fed’s stated reasons for QE is prevention of deflation.

Therefore Perry is correct to say that QE devalues the dollar in your pocket, relative to its likely value in the absence of QE.

Maybe he was talking about printing Confederate script.

You’ve got to marvel at the chutzpah of someone who would accuse the Fed chair of treason when only a few months ago he was not only openly talking about secession, but actively pumping secessionist rallies in Austin…all in the name of winning a Republican primary.

FWIW, when is Bernanke going to print money? Unlike what Perry thinks, not a ounce has been printed to this date. Why, how dare I say that. We must force a overvalued currency at all costs……..to the day the overvaluement causes it to collapse. Then Perry will go to Morgan and ask for a bailout like his Democratic cross town rival and spiritual soulmate, Grover Cleveland.

I am so conflicted!

I had just written a post trashing Perry. The man is clearly a RINO, a crony capitalist, and not too bright.

But then he threatens to go medieval on Zimbabwe Ben! What am I to do?

the joke is, of course, that the professional forecasters are about 200 basis points above the fixed income markets… just look at the yield on the 2 year

The tough-guy facade works. I suppose if you are angling for the votes of an angry mod, an even tougher facade works even better. Sad, though, that he has decided (following the example of his predecessor in the governor’s office, perhaps) to sound like a tough-guy idiot.

One other thought that occurs to me is that he is doing exactly what he is accusing the Fed of doing. By making violent noises, he is trying to sway monetary policy for political ends. Just like Republicans in Congress, Perry thinks a bad economy is good for his prospects. How else is Bernanke “printing more money to play politics”? Perry is tacitly acknowledging that monetary stimulus might work, and so doesn’t want monetary stimulus.

He’s just the kind of traitor this country needs in the White House.

The great thing about economic forecasts is that they are always so accurate, especially the ones that cover the distant future.

Luckily our wise economic professoriate don’t do anything so tricky and so vulgar. Predictions based on models are so much more elegant and useful.

But look at the price of gold! Given the reference to the election and playing politics, it’s pretty clear that what he’s saying is that he doesn’t want Obama rescued by an upturn in aggregate demand. Mind you, Obama doesn’t seem to want that either, judging by his reluctance to make an issue of it.

Does Perry see Bernanke as Atticus Finch, thwarting the will of the people?

Few figures and charts may help as guidance for judgement.

Even though below figures are up and running they provide for the time of the foot print.The incumbent Fed chairman had no time to print so much money.

FEDERAL RESERVE statistical release

Flow of Funds Summary Statistics First Quarter 2011

At the end of the first quarter of 2011, the level of domestic non financial debt outstanding was $36.3 trillion; household debt was $13.3 trillion,non financial business debt was just under $11 trillion, and total government debt was $12 trillion.

If and when tempted to make a comparative analysis,the ECB is providing for the figures at comparative GDP.

ECB Statistical Data Warehouse

http://sdw.ecb.europa.eu/home.do?chart=t1.2

If and when tempted to make a weighing:

BIS Detailed tables on preliminary locational and consolidated banking statistics at end-March 2011

Table 2A: External positions of banks in all currencies vis-à-vis all sectors In individual reporting countries (in billions of usd)

Reporting countries Dec 2010 Mar 2011

United Kingdom 5,510.3 5,771.4

United States 3,582.1 3,690.7

At time of the official recognition of the financial crisis, a Pareto distribution as applied to incriminated assets was a guidance for the magnitude of the non performing loans.

Around one trillion usd for the mortgage loans in USA and more to assess on the other sub categories (MA,consumers loans and credit)The US CB is meeting with its obligation of lender of last resort to banks and treasury.One may wonder why banks are paying dividends,when they are not profitable.

Aware of the potential chisme and with all due respect to Professor Hamilton and Professor Chinn.

M3 as recorded by J Williams

http://www.shadowstats.com/alternate_data/money-supply-charts

M3 as recorde by the ECB

http://sdw.ecb.europa.eu/home.do?chart=t1.2

It may be opportune to leave the conclusion to more knowledgeable people, when it comes to the causes of this financial crisis.

http://www.bis.org/review/r050901c.pdf

“Alan, thank you for raising the respect which others give to our discipline of economics and our profession of central banking”

M.King Bank of England governor Jackson hole 2005.

RIP independent central bank.

1913-2012

The money printing has devalued the dollar..one need only look at the numbers. There are far too many on Wall Street and in economics who believe expansionary monetary policy solves all problems or even makes current problems bearable (with no consequences and in fact make matters worse). Some just like money illusion to hide the facts from the public.

Ever consider that the price changes easing is causing and spending decisions it allows create uncertainty and increase deflationary pressure as the broader population’s discretionry income and ability to save and invest erode?

And pay debts.

Um…..does he know the difference between “treacherous” and “treasonous”?

Right now, the Fed is flirting with 0 for 2 in forecasting if the economy goes back into recession.

Are you saying that you believe these 10-year inflation predictions are accurate?

I suspect that one of the reasons that CPI forecast accuracy falls during periods of high inflation is that predictions of future inflation lag actual inflation growth. If so, then we should expect these predictions to remain low until actual inflation rises and forces the forecasters to adjust their estimates….

http://www.clevelandfed.org/research/trends/2011/0111/01infpri.cfm

A dead simple chart; an logical point than cannot be refuted. However, most people have no clue what the chart says or what you mean to point out. Sometimes you also have to print the message in small, direct words, too.

In Harrisburg, Pa today. The contrast with Houston couldn’t be greater. The cars in the parking lot, the age and condition of the hotels and offices, the availability of a decent cup of coffee. Only the engineers look the same.

Texas has it’s problems and limitations, but today, the up-and-coming city in the country today has to be Houston.

Any effort to help the economy is “playing politics.”

Devaluing the dollar boosts oil prices which helps Texas economy. In 2008, the boost 130 oil gave Texas is very apparent. It softened the downturn in Texas. On this blog, I read $1 fall in dollar causes oil to rise $1.3. Think it was Prof Hamilton’s calculation but I’m not sure.

http://www.bea.gov/regional/index.htm

Only between now and the election. After the election and he wins, he will want him to do a lot. That won’t be political, just patriotic.

Another candidate offers a much different assessment of the economy and solutions:

http://www.nationalreview.com/articles/274699/great-deflation-thaddeus-g-mccotter?page=1

If you will vote for Obama, you want Perry or Bachmann as the candidate. Perry is on record opposing Social Security; it’s in his book. He cannot be elected with that kind of thing. He’s said that nearly everything Congress does is unconstitutional, again in writing in his own book. He says lots of things in public.

As for Bachmann, she’ll motivate huge numbers to turn out against her and her beliefs.

Most Americans by far don’t want a religious zealot as President.

So Perry is technically correct in arguing that Fed money creation is lowering the value of the dollar in your pocket, relative to what it would have been in the absence of QE2. Okay, stipulated.

And on the larger political question of calling that “treason”? – As opposed to promoting deflation in a moribund, heavily-indebted economy?

Really, why make excuses for these guys? The best you can say (and it’s apparently apt in Perry’s case) is that they’re morons, not scoundrels.

Having lived in Texas for almost a decade, I can tell you that Perry is “all hat, no cattle” as we say. He likes to talk a lot, but there’s really nothing spectacular about him. He very much believes in cronyism and the good old boys’ network. I sincerely hope he does not get the Republican nomination; Obama would probably get reelected if he does.

CarlC: If you prefer, you can look to market based indicators, such as the TIPS breakeven rates and the inflation swaps. They both tell you the same thing about inflation expectations. See this Liberty Street Economics post.

“So Perry is technically correct in arguing that Fed money creation is lowering the value of the dollar in your pocket, relative to what it would have been in the absence of QE2. Okay, stipulated.

And on the larger political question of calling that “treason”? – As opposed to promoting deflation in a moribund, heavily-indebted economy?”

I am referring to the post, which shows an inflation chart to try to make a point that I believe is incorrect.

I agree that Perry’s attitude is inappropriate, but agree with his statement about the dollar.

Well, ole Rick doesn’t have to worry about any dadgum money nonsense. He’s got the Bank of Narcoreserves lubricating the Texas Republic to the tune of 30 billion or so (give or take) a year, at least. Why, you go to El Paso or San ‘Tone, ain’t no such thing as a mortgage anymore. It’s all cash.

He’s a pathetic idiot, a hypocrite, and quite possibly, the unintended (?) beneficiary of the biggest black economy in the world. That’s why Texas is recession proof. Nose candy and la mota.

There is very little about which I feel a high degree of certainty. But one thing I am certain about is that the Professional Forecasters are seriously wrong in predicting 2.5% avg inflation for the next decade. We will be lucky if it isn’t double that.

Inflating away the value of our debts & unfunded liabilities is the path of least resistance & therefore the craven way politicians elected by voters [badly educated in govt schools] will choose. In the final analysis, the Bernanke is a politician, beholden to politicians.

Here’s my model, low interest rates shift consumption from the future to the present while decreasing productivity and increasing income inequality.

Low rates are not causing investiment in increased production or cost reducing capital.

People with access to cheap capital bid away future returns, allowing current holders to sell rather than wait. This also allows people with wealth and cheap credit to buy stock before the broader population is able to save money to invest.

Low interest rates only apply to new debt; they are only availible to a small, privlaged minority, so the broader population sees no benefit (propped up house prices aren’t helping them, they’re still trapped in their mortgages, and the propped up prices may be keeping them in mortgages that are ultimately bad).

Instead of investing in productive capital, investors are using borrowed money to buy commodities. Costs go up, decreasing most people’s discretionary income (leaving little room for new products and services) and reducing savings and investment for those without access to cheap credit, and making existing debt more difficult to pay down.

CPI is bunk.

Where is the $US v yen graph? The $US v euro graph? The $US v pound sterling graph? The $US v Canadian dollar graph? and the grandaddy of them all – THE $US V GOLD graph?

The US dollar is not devaluing. The US dollar was devalued by 47% during Bush’s reign of idiocy. The dollar is now bouncing along the bottom. It is currently the currency of choice to short in a “Carry Trade”. Short US Treasuries, Buy Euro Debt. Wager is Euro will stabilize.

Menzie, your commenters are plumbing new depths of stupidity. I hope you see the humor in it.

Anonymous (8:49AM)/David/Dave: Would you happen to have any more thoughtful analysis than that “CPI is bunk”? Do you prefer PCE, PPI, GDP deflator, Shadowstats’ massaged data, or your own personally-generated-but-unreplicatable series in your head?

I am not quite sure why, but as jonathan noted above, this site has deteriorated badly with respect to the quality of the comments. This used to be a place where people with some actual training in economics and finance and some historical perspective could comment on interesting observations and the occasional early stage model that sought to increase our understanding of the current environment. Now we have people telling us that the inflation rate isn’t the real inflation rate; asserting that looking at cherry picked foreign currency differentials means something and making statements that are trivial to demonstrate as historically inaccurate. For example, a trade weighted index of the dollar over the last 30 years shows that the dollar declined significantly in the last few years of the Reagan administration and early George W. admin, rallied a bit during the Clinton years and fell precipitously during the Bush years and has bounced in a trading range since then. Having noted that, I am not sure why it is viewed as a horrific negative that a freely floating currency actually floats according to market movements, or why it should not be obvious that in the long run as the US economy makes up a smaller part of the world economy it will most likely continue a secular decline, and that its value is to some degree currently distorted by the mercantilist policies of China creating a complex relationship for all other freely floating currencies relative to one another. And for all of you who are convinced that markets are perfect and government is evil, why are you so sure the market is wrong about its implied inflation forecast? If markets are so wonderful you should be pleased to know that inflation is under control. If you think the market is so easily misled then that sound you hear is the rest of your intellectual edifice crumbling around you. As Barry Ritholz would say some of you need to GYOFB.

I really think that Bachmann and Perry are in a contest to prove which one is the stupider. When one says something unbelievably idiotic, the other one rushes to top it. And on it goes, a real clown show.

That’s the problem Professor if there isn’t a nice, neat little model for everything the world just doesn’t make sense to you. My response to your post was just as lazy as your response to Rick Perry’s concerns, so i don’t think you should be so offended.

Menzie, surely it would not be difficult to show how good these projections are historically relative to actual measured inflation?

not a huge Bernanke fan

but which former texas gov appointed him?

anyone anyone?

so if he stays a while at former govs ranch, will Perry send a posse?

for history buffs. Down to zero rates and QE1 was done late 2008 by B under W.

East-coast, Wall-Street-connected Republican vs Southwest, crony-ist, religion-exploiting Republican. One will have the backing of the more traditional, business-oriented corporatist branch of the GOP. The other will have the backing of the social-issues GOP. How does Perry, fresh out of the gate, make clear who he is pandering to? Bash the Fed. That’s a gauntlet thrown down to the champion of the squishy, East-coast GOP. Romney has to choose to stand stand up for his class or be dragged all over the issues landscape by Perry. Neither is a pretty choice, and that’s just the way Perry likes it.

Moopheus: Reader CarlC provided a link to one assessment, for one-year-ahead inflation rates. I would say it’s difficult to do in a sensible fashion — and I think you would agree — once you consider how many non-overlapping ten year observations on CPI inflation one observes in the sample.

As of July the trade weighted dollar was 94.8

as compared to 95.4 in July 2008.

That means over the last three years the dollar has fallen less than 1%.

But during the Bush years the dollar fell from 129.0 in early 2002 to the July 2008 low,

or well over a third.

And exactly who is accusing who of devaluing the dollar.

Yeah. Let’s print more money. Rick seems to fear that Ben can save the economy (and thus, by extension, Obama.) I think his fears are misplaced. Maybe he should be hoping for the opposite. What good is inflation of food and energy prices if it does not help raise nominal wages? Maybe all Ben will accomplish by printing more money (or probably more accurately, by increasing excess reserves of banks) is to help overcome rigidities in the system and speed up a drop in real wages.

Ben’s policy will be even more likely to devalue the dollar internationally. Good idea? The main effect would likely be to increase the already overvalued euro even more (since Asian currencies will remain pegged) and hasten its collapse. If that happens, Rick can probably count on a result worse than the one we got from Lehman’s collapse.

I would strongly support Rick Perry over Barack Obama.

However, I disagree with the rhetoric here. QE3 is needed, and printing money will become a semi-permanent feature of the world economy. Eventually, QE will not even be given numbers.

@ Randy,

You hit the nail on the head. Well spoken. Thanks for your comments

I don’t prefer 10-yr expectations. 1,2,3,4 yr expecations for breakeven inflation are well under 2% (1.25% at 3 yrs, 1.75% at 5 yrs). (click link to bloomberg charts below, breakeven on TIPS)… suggesting poor growth or worse.

BTW, does anyone know which economist is advising perry? I know mankiw is advising romney.

http://www.bloomberg.com/apps/quote?ticker=USGGBE03:IND

http://www.bloomberg.com/apps/quote?ticker=USGGBE02:IND

ticker=USGGBE05:IND

Other than for the gross ineptitude of the economics profession itself, the Federal Reserve is the agent most responsible for the economic crisis we are in. Greenspan ginned the money supply each recession until the market famously named this policy the Greenspan put. This built the long credit cycle which well ahead of time Hyman Minsky warned would bust. Bernanke was present at the creation of the housing bubble. And after he had the reins at the Fed it was abundantly clear from his “contained” remark regarding subprime just weeks before the crisis erupted in 2007 that he was clueless. Certainly he deserves credit for championing the raft of creative support facilities in 2008, the massive injection of base money, somewhat belatedly taking the funds rate to zero, strongly supporting the TARP, initiating the QEs, and engineering the all-vital stress-testing of the big banks which (along with these other actions and fiscal stimulus) halted the plunging stock market and helped turn the economy up.

Yet after all this, in his keynote address to the American Economic Association in Atlanta last year he proffered a defense that the Fed was not culpable for the housing boom. His argument was logically flawless but for one thing – it was based on a false postulate, namely that the two-variable Taylor rule is the correct guide for monetary policy. Whether this was out of ignorance or duplicity I do not know. What I do know is it is high time that a real political leader come forth and raise to high visibility the bad road the Fed has been taking this country down. It has gone on for decades and enough is enough. However clumsily it came out, that is what Perry did with his remark. And though for right now monetary ease is the correct policy, until and unless the inept policies of the Obama administration are undone, all this monetary ease is moving the economy straight toward stagflation regardless what TIPS are saying.

JBH: the Federal Reserve is the agent most responsible for the economic crisis we are in

true, but not for the reason you specify. The Fed, OCC, HUD, and most other regulators were asleep at the wheel while a lot of people borrowed to buy houses they could not afford, primarily based on the assumption that “the housing market has never declined nationally” and housing appreciation would continue indefinitely. libertarian greenspan, i suppose, felt the banks would regulate themselves. Lending standards were not just lax, they were non-existent.

It was not the “taylor rule” per say – which is not actual policy and comes in many specifications – it was the de-facto printing of money via ever-looser lending standards as the housing boom wore on.

Of course, now we have gone to the exact opposite end of the pendulum on lending standards.

raise to high visibility the bad road the Fed has been taking this country down. It has gone on for decades and enough is enough.

*sigh* i wish actual evidence was informing the policies of the nutter right.

Dave aka Anonymous (8:49): I’m not offended. Although I don’t think it was so lazy; the time series plot provided information. I then added two additional plots, which incorporated in the background some theoretical and empirical work by respected economists, which augmented the debate. Your comment, in contrast, provided no information whatsoever, above and beyond demonstrating your inability to lay out a thesis, amass supporting information and data, and then interpret. But I thank you for serving as exhibit 1 for Randy‘s characterization

I agree with Jonathan and Randy – the vitriolic ignorance of many of the commenters here spoils the browsing experience for me, and, I suspect, many others lurking in the ether.

My suggestion: change the blog format so that the comments are separate from the main posting. Lots of blogs use this format.

QE3 would be a waste considering the results of QE2 which were:

over 50-1

That said, treason is an inappropriate word to use to describe Mr. Bernanke

Menzie, wouldn’t the PPI indicate that inflation has occurred in crude goods? http://www.bls.gov/news.release/ppi.nr0.htm

I just had a gander at Rick Perry’s college transcript. He earned a D in Principles of Economics. Sounds like a shoe-in for the Republican nomination to me.

http://www.scribd.com/doc/61684192/Rick-Perry-s-Texas-A-M-Transcript

P.S. His overall GPA was 2.22. Gives whole new meaning to a “Gentleman’s C”.