Tabulating Inequality Trends

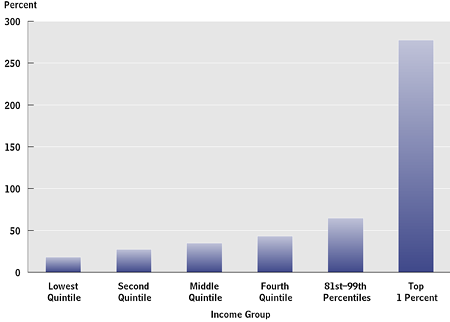

The CBO released a report on income inequality earlier this week. This means that the “inequality deniers” are having a more difficult time arguing that widening spreads an wages, compensation, or overall income are merely statistical artifacts dreamt up by liberals (see e.g. here). What is of most interest is (i) real after-tax income of the top 1 percentile has risen about 275%, and (ii) the pre-transfers/pre-tax income share of the top 1% has increased most profoundly.

Summary Figure 1, Growth in Real After-Tax Income from 1979 to 2007, from “Trends in Income Distribution,” CBO Director’s Blog, 25 October 2011.

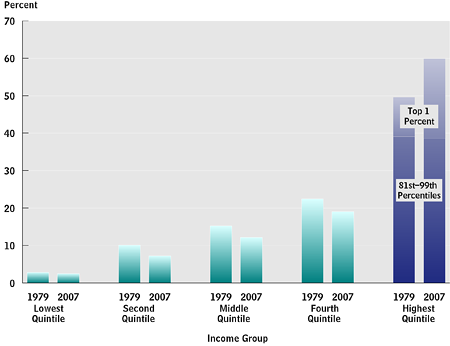

Summary Figure 2, Shares of Market Income, 1979 and 2007, from “Trends in Income Distribution,” CBO Director’s Blog, 25 October 2011.

The CBO Director’s Blog observes:

The rapid growth in average real household market income for the 1 percent of the population with the highest income was a major factor contributing to the growing dispersion of income. Average real household market income for the highest income group tripled over the period, whereas such income increased by about 19 percent for a household at the midpoint of the income distribution. As a result, the share of total market income received by the top 1 percent of the population more than doubled between 1979 and 2007, growing from about 10 percent to more than 20 percent.

The foregoing is completely consistent with the views laid out in Lost Decades (by me and Jeffry Frieden), Add-Figure 6-1 highlighted in this post, as well as this post.

Interpreting the OWS Protests

Against this backdrop, powerful forces have been deployed against raising tax rates at all on the top one percentile (and instead want to raise taxes on the lower quintiles).[1] [2]. The OWS protests can be interpreted in ths context. From TPM:

…Harvard Government Professor Jeffry Frieden said…

“Every debt crisis leads to major political conflicts over who will pay the price of dealing with the debt burden,” Frieden wrote. “One way or another, the accumulated debts will have to be addressed — either by writing some of them off, or by paying them off. Will the burden be borne by taxpayers? Government employees? Financial institutions? … I think that, in the context of our financial difficulties, OWS may reflect the fact that many Americans feel that too much sacrifice has been demanded of working people and the middle class, and too little of the financial community and the wealthy.”

Diane Lim Rogers, Chief Economist at the fiscally hawkish Concord Coalition, made similar points about the more reckless economic policies of the past decade: Much of the distaste with both Washington and Wall Street comes back to fact that DC is simply unwilling to change course.

“The difference is that during the Clinton years the rising tide was lifting all boats,” Lim Rogers said in an interview with TPM. “Low-income households were still doing better. Even then, the rich did really well, despite their taxes being raised.”

But what’s different now is that income inequality isn’t a political tenet of the left: it’s truly hurting people. Lim Rogers said the poverty rate is actually of more concern than the rich doing better given the circumstances.

“The outrage is not that the rich are richer,” she said. “It’s that the poor have gotten poorer — the inequality has become bipolar.”

Interestingly, Lost Decades, which makes many of these points, has been cited approvingly in at least one OWS document.

This is of course in contrast to views such as that of Econbrowser reader Brian who commented:

I honestly fail to see why some on the left are so concerned about how much money those at the top of the income distribution earn. Why not focus instead on why poor people are poor? And please, blaming that on the rich is a non-starter. People make bad choices in life. They get pregnant before they finish school and have a career started. They use drugs. They get tattoos and body piercings all over themselves and then wonder why no one will hire them for an entry-level job. They do not take school seriously. They have parents who never should have bred in the first place. I really, honestly and truly feel for the poor people and hope they can lift themselves out of poverty. But throwing more money at the problem, and taking it from the “rich”, is not the solution.

This worldview is apparently not rare; see this quote:

I don’t have facts to back this up, but I happen to believe that these demonstrations (Occupy Together) are planned and orchestrated to distract from the failed policies of the Obama administration. Don’t blame Wall Street. Don’t blame the big banks. If you don’t have a job and you’re not rich, blame yourself! …

I think the defenders of the interests of the top income percentile will continue to harp on these arguments: The unemployed are deservedly unemployed; the poor are deservedly poor. This will help distract the electorate from the issue of whom will bear the burden of adjustment to the aftermath of the financial crisis(including stabilizing the debt-to-GDP ratio), and the response to secular trends in income inequality.See more on tax policy here.

It’s actually a little worse than the CBO study suggests. The CBO analysis appears to be looking at wage and transfer money income rather than total compensation. Total wage compensation would include pensions, vacation and employer sponsored health insurance. All of those things are diminishing for those at the lower end. Meanwhile Wall St. executives continue to get golden parachute pension plans, Cadillac health insurance plans that drive up healthcare costs for everyone else, company cars, etc.

People wouldn’t be quite so upset about the rich getting richer if the rich had actually contributed to GDP growth in a proportional way. But they didn’t. It’s clear that a lot of the GDP growth over the last decade was an accounting illusion. As Krugman likes to point out, other than ATMs in the 1970s, what exactly did high flying finance types contribute to economic growth? Rent skimming is not economic growth, and as the French Physiocrats knew, pure rent should be heavily taxed.

i’ve seen a lot of stats for income and wealth inequality. what about consumption inequality?

Menzie: I think one has to be careful about thinking up a legitimate reason why the OWS protestors might be protesting, and what the protestors actually think.

For example, the protests had already been going for awhile before this young woman appeared holding the now famous sign:

http://cache.gawkerassets.com/assets/images/7/2011/10/1028_occupynewfront.jpg

Given that Conor Friedersdorf wrote what was on the sign, it begs the question of what the young woman was upset about the day before she held up the sign.

I with love the argument that Russ Roberts is having with Tyler Cowen.

Cowen came out with a paper that blamed the great stagnation on the absence of new technological and scientific breakthroughs that impacted our standard of living.

Roberts does not realize that Cowen is trying to deflect the argument away from income inequality or other factors that could be influenced by public policy and argue that both Cowen and what Cowen calls the great stagnation or wrong.

The U.S. Census surveys the data for total money income, which gets around the wage an transfer money income limitation of the CBO study, and even goes so far to publish the Gini coefficient data, the most widely accepted measure of income inequality, for all individuals, families and households in the United States, Age 15 and older.

Going by the data covering 1994 through 2010 (the period for which the Census Bureau makes all this data easily accessible in digital format – before that, you have to mine through scanned paper documents to extract the data), there has been no meaningful change in the income inequality of individuals, while there has been an increase in the level of income inequality as measured by the Gini ratio for both families and households.

That’s significant because income, whether derived from wages and salaries, transfer payments, dividends, capital gains, etc., is issued to individuals. (Check your paycheck – it’s not made out to your spouse. Or to your child! Or to any other member of your household!)

Now, because families and households combine the income earned by individuals into discrete groupings, which the Census has also documented, the lack of change in the level of income inequality of individuals but rising levels for families and households can only be explained by the changes in family and household composition that have taken place over time.

The observed increase is because people who have been successful in earning higher incomes have formed families and households together. It is also because people who earn low incomes have not been as successful in forming families and households (either not forming a family or household or by splitting existing families and households apart into multiple lower income earning ones), or perhaps have done so only with others who earn low or no incomes.

There are other non-economic factors at play that contribute to these observed effects for families and households, however the absence of an increasing level of income inequality among individuals over time at all means that there is no legitimate basis for outrage over growing income inequality among families and households – the last we checked, people were free to form those kind of groupings, or not, by their own choice.

I believe there’s even something about that in the First Amendment to the U.S. Constitution (that whole “right of the people peaceably to assemble” thing.) How unfortunate for the champions in the fight against rising income inequality, because that’s what they must attack to achieve their goal. And how unfortunate for families and households, because that’s who will be the most hurt if they succeed.

I am not going to argue that there is not a difference in the growth rate in wealth across income groups. But, the topic leads to a few questions:

*As a society, what is an acceptable growth rate for the lowest income group?

*Should we include the long term unemployed in the lowest income group? (I don’t know if we do, or don’t.)

*If the lowest income group had an income growth rate that was acceptable, would it still be possible for income growth rate of the top 1% to be too high?

*Is there survivor bias in the comparison? The top 1% will only include the successful entrepreneurs because those who failed will fall into a lower income group. I would expect (and hope) that successful entrepreneurs will have an income growth rate that exceeds that of the low wage workers. To argue otherwise is to argue that workers income should grow at the same rate as those who take risks.

* Do we need to control for the risk associated with the income?

I think the last question is interesting because it’s analogous to comparing an investment in APPLE to an investment in a treasury security. The return on APPLE is risky while the return on the T-bill is safe. It doesn’t make sense for the T-Bill holder to complain about earning a low return compared to the years when APPLE has a high return. I am not saying that difference in risk explains the difference in income inequality, but I would expect the incomes of successful entrepreneurs to grow at a faster rate. When I look at the definition of income, the bulk of the top 1% is based on risky returns,(business income, capital gains, capital income, and other income) and income measured before government transfers and taxes.

The the debate is often side tracked to one just over inequality in and of itself.

But that is probably the wrong issue.

There is what could be called an optimal level of income inequality and the debate probably should center on the point that inequality in the US has clearly passed that point.

How has the massive increase in inequality in the US over the last 30 years made the US better off as compared to where we would have been if inequality had remained at about the same level as in 1980? The main argument in favor of inequality is that it increases savings and investment in the economy and that makes the economy wealthier. But that has not happened in the US over the last 30 years. I would take that as obvious evidence that the US was closer to the optimal level of inequality in 1980 than it is now.

Readers like Brian slay me. So what he’s saying is that 99% of people make the wrong choices? What percentage is he talking about? 50%? 30? 10? Of course there will always be people making the wrong choices, but when such income disparity hits the MAJORITY of the population…well either they’re all making the wrong choices or perhaps Brian just have a cogent thought to put forward. I would love to see him argue this with a friend of mine who is heavily tattooed and also has pierced ears and is solid member of the 1%. That would be a hilarious conversation.

The issue here, frankly, is that people are an optimistic sort and they’ve been voting in people who policies favored the top percentages because they think that they will be in that top percentage one day. They’d be wrong, of course, because if you look at the corresponding mobility statistics, you’d see that people don’t move much from the circumstances to which they started life. And now, of course, what this all suggests is that for the first time in a while, current young people will struggle to land in the same circumstances as their parents.

So the deep question here is not just how did this happen, but how do we convince people they don’t belong to the class whose policies they are voting for? If the Democrats could figure this out, the Republican party would be decimated for at least a generation.

In reply to Brian: “I honestly fail to see why some on the left are so concerned about how much money those at the top of the income distribution earn. Why not focus instead on why poor people are poor? And please, blaming that on the rich is a non-starter. People make bad choices in life. They get pregnant before they finish school and have a career started. They use drugs. They get tattoos and body piercings all over themselves and then wonder why no one will hire them for an entry-level job. They do not take school seriously. They have parents who never should have bred in the first place. I really, honestly and truly feel for the poor people and hope they can lift themselves out of poverty. But throwing more money at the problem, and taking it from the “rich”, is not the solution.”

I’m not concerned about how much the top 1% earn, I’m concerned about how much they take without earning. I do worry and study what factors contribute to making the bottow 10% so poor, but I don’t let it distract me from the 1% making the rest of the 99% poor by taking our earnings as rents. 99% of the population is not drugged, illiterate, pregnant, and tattooed. The majority of the 99% is ‘poor’ relative to historical norms of labor share of income, not because of any bad choice they have made (unless, as you, we decide to count choosing who they were born to), but because the labor share of income growth due to productivity is being kept by the 1%. Preventing the 1% from taking from the 99% worked pretty well in this country from the 30’s to the 70’s, and growth was better than it has been since. That tide lifted all boats, rather than elevating those who place their booted heel on the neck of the rest of us.

The unspoken flip side of the “the poor deserve to be poor” meme is that “the rich deserve to be rich”. It seems to be part and parcel with the new nobility. Like nobles of old, they are obviously superior to others and their station in life is therefore rightly, and obviously, justified.

In a couple hundred years, our social systems seem to be going back to where they once were. What goes around, comes around. This may or may not be comforting to those who know their history circa 1789, depending on your particular point of view.

Ironman You might be misunderstanding the issue. The issue is about the top 1%, the top 0.1% and the top 0.01%. In other words, it’s not about quintiles…it’s about a very, very, very small number of very, very, very high income individuals grabbing almost all of the economic growth over the last decade. The Census data that you linked to does not address that issue; it’s about quintiles, not the very, very, very top. Take a closer look at Figure 2 in Menzie’s post. There is almost no difference when you compare the 81st-99th income group. The shocking disparity is in the top 1%. And if you’ve ever looked at the Saez & Piketty data it becomes very clear that we’re not even just talking about the top 1%, but the top 1% of the top 1%.

Another point about income inequality: while the US was comparable to other countries in the 1950, it has since become an outlier

http://www.verisi.com/resources/us-income-inequality.htm#s2

So being poor now means “…’poor’ relative to historical norms of labor share of income..”

So the earnings from the on-going accumulation of capital, which has lifted uncounted millions out of true destitution is in fact a means of exploitation. I think you’d have to go the last Chapter of Keynes to get anything nearly as nutty.

D.F. Linton What’s this “on-going accumulation of capital” of which you speak? Thanks to the masters of the universe on Wall St. wealth has vanished, 401k plans are a joke, physical capital is idle (checked out the capacity utilization over the last couple of years?), and human capital is wasting away. Far from “uncounted millions” being lifted out of poverty, we have well counted millions unemployed and falling into poverty. I think you’d have to go the the Heritage Foundation’s website to find anything as nutty as your comment.

The people at the very high end “earned” their income the old-fashioned way…they stole it. They engaged in fraudulent behavior, lied about risks, and betrayed fiduciary trusts. Is that your kind of capitalism?

Dear Mr. Linton: If you want some ideas that are really nutty, they are right before you in Cain’s 9-9-9 plan and Perry’s flat tax plan. Keynes is sanity itself in comparison. (Why Keynes has become the new face of evil bewilders me. Did it start with Friedman and the U. of Chicago people?)

i’ve seen a lot of stats for income and wealth inequality. what about consumption inequality?

You never see anything about consumption inequality because it is is not anything like income inequality, either by scale or trend, so it simply isn’t usable to whip up the outrage.

But since you asked, here’s the difference. The BLS Consumer expenditure survey for 2008 puts the top-to-bottom quintile ratios as:

Income: 15.4 to 1 ($158,652 to $10,263)

Expenditures: 4.3 to 1 ($97,003 to $22,304)

Of course all the income inequality warriors rhetorically *presume* that income inequality = welfare inequality. Yet in reality consumption is a far superior measure of welfare. And as the above numbers show, income inequality does not very much translate into consumption inequality(.pdf). (Measured by cohort on a lifetime basis consumption is even less unequal than shown above. Year-to-year numbers always exaggerate inequality due to temporary short-term highs and lows).

When informed commentators go on and on about income inequalty as a societal ill, without making even a single mention of consumption inequality to provide a more accurate perspective on things — even though they know full well that consumption is a much superior measure of welfare — well, it’s hard for me to believe there isn’t more than a bit of disingenuousness in it all.

BTW, as to the income side of things, here is Robert Gordon (noted right-wing partisan via CBO, NBER, the Boskin Commission, the popular textbook, etc.) on the subject…

“The rise in American inequality has been exaggerated both in magnitude and timing … This paper shows that a conceptually consistent measure of this growth gap over 1979 to 2007 is only one-tenth of the conventional measure….”

Damn right-wing denialists! 🙂

The issue is about the top 1%, the top 0.1% and the top 0.01%. In other words, it’s not about quintiles… we’re not even just talking about the top 1%, but the top 1% of the top 1%.

“According to the most recent IRS data, between 2007 and 2009 … 99.9th percentile income fell from $2,155,365 to $1,432,890.” [Mankiw]

That’s down more than 33%. Is this worth a mention in your analysis?

The top 0.1% don’t get their income by siphoning off earnings from everyone else. They get it by taking risk.

One more data point for interpreting OWS:

Here in NYC the chefs of OWS are revolting against the “freeloading” poor, “professional homeless” and criminal elements who are being attracted to their gourmet meals. They are going on strike until the freeloaders are purged from their community. “No vichyssoise for you!”

Everything is relative.

The question is not if it is happening, but why?

The debate over increasing taxes is really a red herring. The question is what forces are causing the gap to widen ON A PRETAX basis.

Of course the reasons are globalization and technology. But free trade is so ingrained in academia that we are simply not allowed to ask if it is really working to benefit most Americans.

So we have a debate about taxes and ignore what appears to be a systemic crisis.

“The outrage is not that the rich are richer,” she said. “It’s that the poor have gotten poorer — the inequality has become bipolar.”

Outrage? What outrage?

I’ll believe that outrage about income inequality and the income of the top 0.1% is an issue in American politics when people point me to the popular protests against the $15 million a year Katie Couric got paid for being a newsreader nobody watched … pickets are marching in Beverly Hills in front of the mansions of actors paid millions of dollars for one embarassing flop after another … and the fans in the stands turn on the semi-illiterates earning an average $5 million a year in the NBA, and near $4 million in baseball (versus the top $100k earned by Ted Williams and Mickey Mantle) on their last place teams.

These are real-life top 0.1% all. It seems that in theory there is “outrage” about the top 0.1% making so much … but in reality the fans are all peeved that the owner of the local pro team won’t open his wallet to spend more on free agents, and TV can’t put on enough celebrity news shows for all the adoring of Jennifer Anniston and Lindsay Lohan. Actual real-life top 0.1%-ers.

For some reason the masses don’t get the outrage. Is it because they don’t know something, or because they do?

Either way, don’d kid yourself, the Revolution remains a long way off.

Jim Glass: I guess this topic hit a nerve. You should quote the first sentence of Gordon’s working paper:

And about that “measure”, would’ve been nice for you to note what it is:

That is an interesting measure, but not necessarily the most interesting or relevant measure. Your selective quoting aimed to dismiss other studies which focus on absolute level measures of income inequality.

I fear you have been reading the AEI talking points too avidly. [1] Try thinking for yourself.

Regarding the allegations that I omitted the decline in income of the top one percentile, well mea culpa, I did not include every conceivable statistic in this particular post. Oh, but I did include data up to 2008 for the top one percentile in this post, and top 0.1 percentile in this post. Just ignore those preceding 30 years of worsening income inequality…

Well, I expect nothing more insightful from somebody who commented on Dec. 4, 2009:

That was quite the howler.

Jim Glass The top 0.1% don’t get their income by siphoning off earnings from everyone else. They get it by taking risk.

What a crock. What risk? They take “risks” with other people’s money, not their own. Even when they lost a bet, their ending position was usually no worse than it would have been had they not taken the “risk” at all. Even Rajat Gupta walked away with a pretty good deal. He gets an 11 year sentence (maybe he’ll serve 4 years) in a minimum security federal prison, but he still gets to keep a fair chunk of his winnings. Compare his “risk” and the magnitude of his crime with the rate-of-return on risk that some poor down-and-out black teenager faces for robbing a 7-11 of $500. The only investment crook that got what he deserved is Bernie Madoff, and his major crime was in fleecing fellow one-percenters. Madoff should have focused on the bottom 99% and he would have been okay. Hey, even Ken Lay found a way to use his death as a way to reverse his conviction. (Recall that his high-priced lawyers found a loophole that allowed a reversal of judgment if the defendant dies while waiting for an appeal, allowing his estate to keep some of his loot. How many criminals from the bottom quintile get that privelege.)

What puzzles me is why you want to defend these clowns on Wall St. Do you imagine yourself as someday being a high-flying member of the 0.01% club? Reminds me of a low income friend who opposed estate taxes because he didn’t want the government taking away a big chunk of what he would leave his family after winning the Lotto. Your post shows the same kind of detachment from reality. If you oppose higher taxes on the top 1%, then you are implicitly supporting higher taxes on the bottom 99%. And I don’t know about you, but if there have to be taxes, I think it makes a lot more sense to tax the incomes of pirates than taxing productive workers.

Marx pointed out in Das Kapital that wages and profits were inversely related. Right again!

I have a couple of questions that I haven’t seen asked elsewhere…

Everyone immediately assumes that the Top 1% is only populated by CEOs (at least that is my take). I wonder..how has the explosion of professional sports salaries (players, coaches, etc) impacted the growth rate of salaries of the Top 1%? I believe the top 1% starts around $350,000 or so, this is well below the avgs of the major sports. What is the actual number of taxpayers are in the Top 1% and what is the impact on the income growth numbers if the sports folks are taken out of the equation (like gas and food from inflation).

Secondly, how has the retirement of baby boomers affected the growth of income? Has the impact been negative on averages for the lowest income levels?

@rob and at @2slugs,

Good point Rob.

We could take all the wealth of the top 1% and redistribute it to the bottom 50%. However, in a few years, entrepreneurs would would climb back into the top 1% and progressives would be complaining again.

~150 million US workforce, 1% of that is 1.5 million people. For the most part, we are talking about entrepreneurs who run their own business, professional athletes, actors, and yes, even some money managers, speculators, etc. However, the story doesn’t sound as good if the left runs around yelling ‘TAX ACTORS! TAX ATHLETES! TAX BUSINESS OWNERS!’.

If we are going to base income tax on contribution to society, as 2slugs seems to suggest, then we can easily justify taking way more than half of actors’ and athletes’ income, but would that solve the problem? No way!

Transferring wealth is a short sighted solution. It is like giving your kids money every time they run out. It helps them pay the bills this month, but it doesn’t help them pay the bills for the rest of their lives.

Free healthcare, free education, free housing, free anything is fine for people that are truely in need. However, these programs would create the incentive to drop out of the workforce for marginal workers who are not truely in need. The government solution would be to increase taxes on the rest of the workforce, which would create an incentive for the next set of marginal workers to drop out and accept government freebies. Maybe this is the left’s solution to unemployment 😉

IMO, there is no plan on the table, including Obama Care, that can deliver those freebies without creating huge disincentives that nobody seems capable of adressing.

tj The problem isn’t with those at the very top getting rich. The problem is that many of them are getting rich by making everyone else poorer. Some of them, like athletes and movie stars do add value to the economy. No one begrudges the talented doing well. But Wall St. bankers want to be rewarded for lying and cheating their way to wealth. Bill Gates and Steve Jobs earned their wealth. The crooks at Goldman-Sachs and Lehman Brothers and Citigroup and AIG and all the rest added zilch in value but took billions in loot. You want to reward piracy. I think that Obama had the right policy with respect to pirates.

And what’s with the stupid strawman argument about free healthcare, free education, free housing, blah, blah, blah. That’s not what the OWS movement is about. The OWS folks are looking for opportunities to contribute; they aren’t looking for handouts. They want jobs.

As to increasing taxes on the rest of the workforce, did it ever occur to you that taxing the top 1% is a pretty good way to provide tax relief for the other 99%? Honestly, do the math. Learn a little class consciousness. If you’re in the bottom 99% and you’re pleading the case for the top 1%, then you’ve been duped. False consciousness.

2slugsbaits/ Menzie: “The problem isn’t with those at the very top getting rich. The problem is that many of them are getting rich by making everyone else poorer. ”

This is where I think your argument breaks down. Prove that causality.

The income stats you cite are pre-tax. So how is tax policy driving the inequality?

I’m willing to consider that Wall Street is driving inequality, that it is the top 0.01%, and even that the financialization of the US economy is not a good thing. But just highlighting the income statistics and making pronouncements like the above is not convincing.

Re: the world view that the under- or unemployed can only blame themselves, or my parents should not have had me as a child:

I am 55yrs old. I have a Bachelors in Chemistry. I worked for 7yrs in a very successful biotech company in the 90’s, leaving that field to become a successful commercial photographer/retoucher as the transition from film to digital took hold in my city. My wife’s income and mine at times has been nearly 100k, with both contributing about equally. She works in science editing for a successful medical advice web site. We held little debt, paid our taxes, played by the rules.

In this contraction, my photography partner and I have seen our working days diminish by half or more, my income diminishing commensurately. Our major client has severely cut their ad budget although their industry, groceries, has slowed, not due to people buying less food, but due to competition. Their ad budgets are shrinking due to belt tightening and finding ways to get more out of their budgets. They continue to hire entry level designers, but these employees work under supervisors that have been instructed to squeeze vendors – people like us – for lower rates…and they squeeze. Other advertising clients cut costs by using cheaper artwork, or demanding rock bottom rates from vendors such as ourselves. Second and third tier photographers offer lower rates (and lower quality) that seasoned photographers cannot meet.

For a lot of reasons related to both the contraction and structural changes in the commercial photography business, I find myself underemployed. Using my chemistry background I have written content for websites, one such site a successful medical practice in NYC. This work too has dried up largely due to the contraction and belt tightening. My last writing gig was writing a blog for a credit union, which recently stopped publishing their blog.

All of this has contributed to my pending divorce and my scramble to find new ways to bring in some income… I’m not complaining so much as pointing out the hollow ring that such worldviews mentioned above have when the problem is looked at more honestly. As a sign said that I saw the other day held by an elderly woman at a OWS rally in Portland, Maine: “There is NO advantage to having a HUGE underclass.” Inequality breeds instability and this is beginning to be acted out.

The forces that so greatly contributed to causing this contraction have little to do with what I did with my education and time, but are significantly affecting my quality of life. Having even marginal employment I consider myself lucky. Our mortgage is not underwater, I still have some work, I have so far protected my meager savings…

The problem is not about wealth, it is about inequality.

2slugs,

I agree, anyone that obtains their income illegally should be imprisoned and forced to pay restitution.

This is where you are misguided –

According to Table 2 above, the top 1% receive ~ 20% of market income. According to Figure 18 in the first link at the top of the post, the top 1% pay 30% of their income to the federal government.

According to the IRS, the top 1% had adjustable gross income of $1.3T in 2009. That means if the government took ALL the taxable income of the top 1% we would be lucky to balance the federal budget this year!

Obviously, if you take ALL the taxable income of the top 1%, they will leave the U.S !!! Incentives my man. What if the FEDS only want to take 70%? (They have to leave a few scraps for state and local government to pick over.) The result is that we still can’t balance the federal budget for even 1 year !!!

The moral of the story? You can raise taxes on the top 1% if you want to, but it doesn’t even eliminate our budget deficit, let alone solve the problem of income inequality.

reply to benamery21

I don’t know what others on the left think, but I can give you one reason.

In general, margins are better for luxury products, ie you can make more money serving a few wealthy people as a personal trainer then many people as a store selling, say, low cost clothes.

This means that our whole economy tends to shift to services to the rich; my home town, Newton MA, an affluent suburb of Boston; all the shops that serve middle and low income customers are disapearing, being replaced by shops that serve high income customers (eg, the brighams (a chain sort of like friendlys, family resturant/icecream parlour) replaced by “lumiere” a hoity toity resturant (sort of, if you ahve to ask, you can’t afford to eat there..)

You also saw this in the US auto industry; ford and chevy got hammered cause they put all their eggs in teh large SUV basket, cause the margin on large SUVs is much higher then on small cars

We have data on the top 1%. We don’t need to speculate.

They are not business owners or athletes/entertainers. Some are, but the majority are exactely what you’d think they are:

C-level at major companies

Finance guys

BIGLAW

That’s it, that’s the majority. The the share of finance guys has been growing and growing.

tj This is nonsense. Who ever said that raising taxes on the top 1% would in-and-of-itself balanace the budget? You’re inventing strawman argumenst. Raising taxes rates on the top 1% would not balance the budget, but returning to the tax rates of the 90s would go a long way towards fixing our fiscal position. A very long way. There’s no question that eventually taxes on the middle quintiles will have to go up; but that’s the sort of thing that should be put off until the economy is back on its feet. So if you’re worried about the current deficit, the single best way to reduce that deficit is by raising taxes on the top 1%. It would have minimal effect on aggregate demand and would help out that confidence fairy conservatives seem to believe in.

And where did you get this 70% tax rate nonsense? No one is talking about 70%. We’re talking about raising it to the high 30% range. There has been plenty of research on the revenue maximizing tax rate, and currently we are nowhere near that point. Not even close. But for those one-percenters who do want to leave the country, I say fare-thee-well and good riddance. I can’t imagine why any decent society would want to welcome criminal elements from Goldman-Sachs, so perhaps they will have to spend their days as the guests of some reactionary tinhorn dictator.

Buzzcut A little bit of investment banking is good for the economy. Too much of it is a bad thing and hurts growth. That’s how it makes the 99% poorer. You asked for evidence, try this:

http://www.voxeu.org/index.php?q=node/6328

And one way that tax policy is driving inequality is by not taxing estates. Inherited wealth is very bad for equality, and it’s also bad for economic growth. For example, the expectation of inheritances causes people to retire earlier than they otherwise would have. How is this good for economic growth.

http://www.nber.org/papers/w12386

2slugs,

I don’t have a problem with raising taxes on the top 1%, but it doesn’t fix anything. You say you want to raise the average tax rate on the top 1% to the high 30% range. It’s currently at 30%. So if you raise it to 40% you end up with another ~$135 Billion in tax revenue according to the figures I cited above.

You and the left are trying to frame the debate around the top 1% who you label as criminals, but the goal is to increase taxes on the top 50%, since the bottom 50% pays little or no federal income tax. However, you can’t get your people elected on that platform.

tj Let me turn the microphone over to Bruce Bartlett.

http://economix.blogs.nytimes.com/2011/08/23/what-the-rich-can-afford-in-income-tax/

According to the IRS the effective income tax rate in 2008 was 23.3%. The ~30% figure you see on table 18 is all federal taxes, not just income taxes. According to the IRS, raising the effective tax rate to 33.1% on the top 1% would have generated an additional $214.4B in 2007 and and additional $166.3 in 2008. Not enough to balance the budget, but a pretty good chunk of the long run structural primary deficit.

The top 1%, which is overwhelmingly made up of overpaid executives and high flying Wall Street finance types, simply did not value to the economy equal to their pay. In fact, they clearly destroyed more wealth than they created. But yet they want us to believe they are indispensable. They aren’t. They engaged in criminal activity throughout the 2000s, watched in horror as the financial world started to meltdown, begged for a government bailout (I remember being down in lower Manhattan the night the govt announced the TARP bailout…there were literally hundreds of (very drunk) brokers singing in front of the NYSE. You could hear them from blocks away). And then after the financial world got bailed out by the taxpayer, the same clowns are whining about regulation and threatening to hold their breath and turn blue if they aren’t given the chance to screw things up again. And then when those who gained the most from the bailout and are chiefly responsible for the fiscal condition we find ourself in today, those same people are whining about having to pay higher taxes on their ill-gotten gains. That kind of misbehavior is what’s fueling the outrage in the OWS movement. That’s the central issue. Meanwhile the WSJ op-ed page is trying to peddle this story about how it’s all the 47% who don’t pay income taxes wanting the 53% to pay even more. That’s typical WSJ B.S. The OWS movement is all about demanding that those who caused the most damage also pay their fair share of cleaning up the mess. From each according to his mideeds, to each according to his needs. That 47% who don’t pay income taxes would have been a lot smaller were it not for the reckless behavior of the top 1% who are not pay enough.

TJ,

I guess I should have posed my questions differently. I didn’t mean to infer that we should tax the wealthy to the point of poverty.

All I seem to see is propaganda and it is damn hard to wade thru. If we know who the Top 1% are, as is presented by some posters, then disect the numbers.

What professions are most impactful on the income increase in the Top 1% and where does that income come from?

What professions had the least impact on the income increase?

Might answers to these questions help better frame the debate?

I did a quick Google search and came up with a 1600% (!!) rise in NBA avg salary from 1984 to 2008. The increase went from $330,000 to $5.2 million. That sure sounds like top 1% to me. I don’t think it takes a Herulean jump to assume the rest of the big leagues have seen similar salary increases. It would seem that has some impact on the overall percentage rise of the whole.

As for the retiree part…folks entering retirement make a lot less than they did while working. How much impact has this had on “median income” or income gains of the middle class. I read somewhere that the number of retirees has increased about 160% since the late 70s while the number of workers has only increased by about 80%. I only saw percentages and not raw numbers…so maybe there is an impact there, maybe not.

If the general numbers are significantly skewed by some of the subsets, are we all asking the wrong questions or applying the wrong policy decisions?

How do you feel about the top 1% now?

http://www.parapundit.com/archives/008350.html

2slugs, both of your arguments are very weak.

Now, I 100% agree that excessive financialization is bad (I’m a follower of Arnold Kling on the subject). But the link from public policy to investment banking is not what you think it is (regulation is not the issue necessarily, it is more of a situation that things that are too complex to be regulated, like CDOs, need to be outright banned), and tax policy has nothing to do with it either.

Tax policy is a very blunt instrument, and you could easily throw the baby out with the bathwater. You could destroy growing sectors of the economy, which would certainly improve inequality, but at what cost?

Regarding estates, you are really off your rocker on that one. What percentage of the 0.01% are legacies? A trivial amount, certainly not the headline names (Buffet, Gates, Jobs, etc., I supposed I could do an analysis of the Forbes 500 to be more quantitative).

The problem is that the left is simply trying to brainwash the public into believing that ‘Wall Street Fat Cats’ are solely responsible for the financial crisis. That is simply not true.

They certainly share the blame, but we can throw in auditors, regualtors and congress as well. The point is that the crisis could have been avoided had any of those groups done their job or acted responsibly.

Now we have ideologues on both sides ‘crafting’ policy to fit social agendas rather than policy that solves problems. As we watch Greece and the EU unravel, we are reminded that our policy makers have dropped the ball when it comes to minimizing systemic risk.

I hear the arguments and am willing to accept as a postulate that large income inequality is bad for the economy. That may or may not translate into “income inequality is bad for society.” People dream of being rich even though they may not be able to achieve that dream. It incentivizes them to try. The pursuit of happines (even wealth) is a social good (maybe even an inalieanble right).

My problem is “What is the solution?” I know that increases the marginal tax rates on the very wealthy does not work. If you have $2 million in liquid assets, then I can create an international bank and/or insurance company for you. The tax code does not tax banks and insurance companies on all income from whatever source derived, as it does the rest of us. We could change that law, but the likely result is that US banks/insurers would be acquired by foreign banks/insurers. When they uphill (export) the profits through generally accepted accounting methods, the US will lose tax revenue.

No country (not even those led by tyrants) has successfully restrained the flow of money out of its borders when they target the wealthy. As long as the country wants international trade and investment, there are legal ways to structure transactions to export wealth. Even those countries that have taken draconian measures to prevent wealth transfer have learned that there is a significant black market for exporting wealth (i.e. money launderers). Tax havens exist because there is a demand for their services.

So, what is the cure? Do we cap incomes? If so, who sets the rates? What damage will this haggling over other people’s money do to the liberties I hold so dear that I put on my country’s uniform to stand in harm’s way so that others could enjoy them? Is economic efficiency sufficient justification to restrict liberty? There are those who speak of reducing income inequality for the purpose of social justice. I have read Aristotle, Plato, Cicero, Hobbes, Locke, Mills, Hegel, Marx, Engels, Kant, Dworkin, Rawls and dozens of other political philosophers who are not at famous. Great minds do not agree upon what justice is. The worst despots in history believed (at least claimed) that they were advancing social justice.

So let us get practical. Can a government regulate “social justice?” Do you want to live in a country that has such power?

Unless one can prove that a person made his/her money illegally, how is it just for the government to take that property by its coercive powers to give it to another?

tj Wall Street fatcats may not be solely responsible for the financial mess we’re in, but they still have a lot to answer for. And they don’t want to answer for any of it. That’s what has people upset. They screwed the pooch, refused to accept responsibility, are frantic about paying higher taxes to help clean it up, and are now bribing GOP politicians to gut financial reform so that they can go back to their bad old ways once again.

If you want to add to the list of evildoers responsible for this mess, then I suggest you start with Bush #43 and the GOP Congress that passed those tax cuts. The tax cuts helped increase the current account problem, which led to an inflow of hot money. That may have been a sine quo non factor in the crisis. And it certainly put us in a much more difficult position after the recession hit home.

You talk about wanting to minimize systemic risk, but doesn’t that mean raising taxes on the top 1% if we’re to have any hope of getting the long run structural deficit under control? Doesn’t minimizing systemic risk means a strengthening of financial regulation? Why do you support the crowd of usual GOP suspects who want to gut Dodd-Frank and go back to the wild west environment?

As to dropping the ball….I didn’t vote for the guys that dropped the ball. Did you?

Buzzcut If estate taxes aren’t a big deal, then why was it such a big issue for the very rich? They sure made a point of telling us how onerous the estate tax was. Were they lying? In any event, the empirical evidence says that the estate tax hurts productivity.

“Wall Street fatcats may not be solely responsible for the financial mess we’re in, but they still have a lot to answer for. And they don’t want to answer for any of it.”

How is that any different from any other party involved in this mess?

None of the politicians want to own up to their responsibilities for gutting the laws/regulations. It isn’t their fault they repealed Glass Stegal and ignored the shadow banking industry.

Alan Greenspan has spent the past 4 years telling anyone who will listen how he bears no blame in the matter.

Homeowners say the bankers forced them to take negative amoritizing interest only ARMs..or draw out all the equity on their nearly paid off home so they could buy a property to flip in Las Vegas.

The SEC spent years making sure Bernie Madoff crossed the Ts and dotted the Is on his forms, but ignored his raping of client accounts…not their fault of course.

Anyone who believes this mess was created entirely or mostly by one group is just insane and taking revisionist history to a whole new level.

Funny how some are fast to lay blame for the cyclical decline on corporate executives and bankers, and say these people only cause damage. But not give them any credit for the boom that preceded the bust. Yet the same people and same actions contributed to the good times boom, and to the bust. And it was not just a small group.

Our binge economy of the late 1990s and early 2000s was not sustainable, and it finally ended.