Lost Decades

Here’s my 25 minute presentation of Lost Decades at the Rotary Club of Madison, on January 4th (as recorded by Wisconsin Eye) Powerpoint. One point I made was that the global financial crisis and ensuing recession have exacted a tremendous cost on the US economy. In the absence of more aggressive action, another 2.4 trillion Ch.2005$ loss will be incurred through 2013Q4. The blithe indifference with which opponents of extended payroll tax reductions, extended unemployment benefits, food stamp expenditures and infrastructure investment contemplate the damage continues to astound me.

Figure 1: from Chinn, January 4 presentation at Rotary Club of Madison. Data source: BEA, 2011Q3 2nd release, CBO (August, 2011), OECD (November 2011), and author’s calculations.

Wisconsin’s Lost Year

This presentation by Wells Fargo’s Scott Anderson (h/t WisBusiness 1/18/2012) highlights how the Wisconsin economy is going in reverse, contrary to Walker Administration assertions that we are moving in the right direction (see quote here [1]).

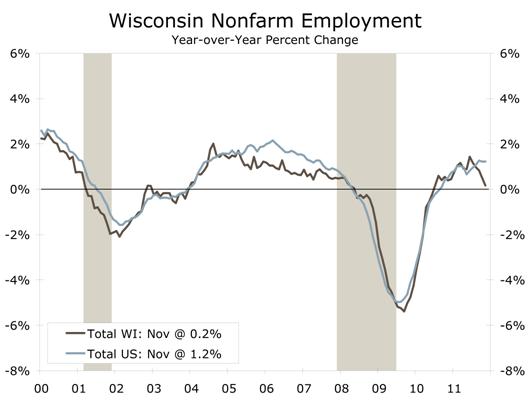

Figure from Scott Anderson, “The Road Ahead,” Wells Fargo Economics, January 17, 2012.

Not only is the 12 month change in nonfarm employment essentially zero through November — in contrast to overall United States employment — Wisconsin retains the dubious distinction of one of the few state economies going in the wrong direction, according to the Philadelphia Fed’s coincident index.

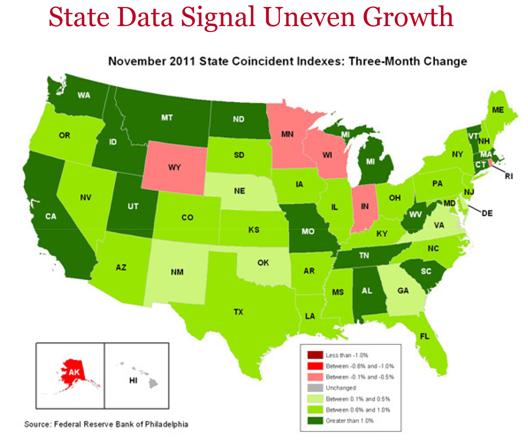

Figure from Scott Anderson, “The Road Ahead,” Wells Fargo Economics, January 17, 2012.

It is pretty easy to interpret this map; shades of red are bad. For more on the Wisconsin economy, see [2] [3]. Governor Walker’s proposal to increase the number of job fairs could conceivably reverse the trend in net job losses, although I have not seen any independent analyses quantifying that effect. For an analysis of the contractionary effects of Walker Administration policies already implemented, see here.

High Frequency Measures of GDP

Macroeconomic data for 2011Q4 has come in fairly strongly, although a bit below what was anticipated a few weeks ago. Here are two indicators, plus the January 2012 WSJ survey of forecasters.

Figure 2: GDP (blue bars), monthly GDP from e-forecasting (red line), and from Macroeconomic Advisers (green line), and forecasts from WSJ January survey (light blue line), all SAAR, in billions of Ch.2005$. NBER defined recession dates shaded gray. Dashed line at 2009M01. Source: BEA, 2011Q3 3rd release, e-forecasting, Macroeconomic Advisers, WSJ, and NBER.

The WSJ survey mean is for 3.1% growth (SAAR) in 2011Q4, while Macroeconomic Advisers is at 3.0. However, 2012 4q/4q growth is forecasted to be only 2.4%. These forecasts are conditioned upon the likelihood of a recession in the euro area.

The Euro Area

Why the pessimism regarding the euro area? From Hooper, Mayer, Spencer and Slok, “Economic adjustment in Euroland: where do we stand?” Global Economic Perspectives, January 18, 2012 (not online):

- We find that the domestic demand and cost adjustment needed to restore external balance has begun, but is far from concluded. In the meantime, the funding of continuing balance of payments imbalances by the euro area central banks is leading to a widening of the imbalances within the Target2 inter-bank payment system.

- It seems that exports (and by implication imports) of Greece, Ireland, Portugal and Spain are not sufficiently price sensitive to achieve external balance through relative price changes. From this follows that adjustment has to come mainly from changes in domestic demand.

Exports of Italy and Germany, on the other hand, seem to be more price sensitive, making external adjustment there easier.- Based on a simple illustrative exercise we find that GDP will probably have to drop by considerable further amounts in Greece, Portugal and Spain to achieve external balance. Hence, with the achievement of sustainable balance of payments positions still not in sight for most of

the problem countries, EMU seems to remain at risk for the foreseeable future.

The intra-euro area competitiveness problem is illustrated in Chart 3:

Chart 3 from Hooper, Mayer, Spencer and Slok, “Economic adjustment in Euroland: where do we stand?” Global Economic Perspectives, January 18, 2012.

Conditional Inflation Now!

It is because of the rigidity of wages and prices that adjustment will be excruciatingly slow, in both the United States and particularly the euro area (see the model in Schmitt-Grohe and Uribe). That is why Jeff Frieden and I have argued for conditional inflation targeting in Foreign Policy, along the lines laid out by the Chicago Fed’s Charles Evans. [4] [5]

Our proposal received coverage in Stephen Gandel/Time, and approving commentary by Matt Yglesias/Slate. With headline PPI declining, PPI components coming under expectations [6], CPI inflation muted [7] and inflation expectations quiescent, [8] we clearly have room for easing.

Figure 3: Implied inflation calculated as difference between constant maturity TIPS yields on five year Treasurys (blue), seven year (chartreuse), and ten year (red), in percentage points. Observations for January apply to January 13th observation. Source: St. Louis Fed FRED, and author’s calculations.

I just returned from Wisconsin. I am on the board of one maufacturing company and close to the owners of another. In the board meeting an economist who provides reports to the company indicated that the Wisconsin government is (my interpretation) doing nothing. It suffers its own form of gridlock. Apparently, Walker’s recall has stalled his efforts there. And, the legislators cannot agree on any path to the future. I would like your take on that political assessment.

Both companies are contemplating expansion. One has committed to buying several machines which will require skilled operators. The HR department reports that skilled operators do not repond to advertisements. A manufacturer of related goods just shut down a plant about 40 miles away, but the skilled workers who are losing those jobs have no interest in relocating even for an increased wage. [There was some interest if the company would adopt a defined benefits package instead of a defined contribution package, but management is afraid of that road]. So the company will hire unskilled workers and attempt to train them even though past experience indicates that this reduces productivity and usually results in higher labor turnover rates. So, as we try to increase jobs what we see is even if you build it, the labor force doesn’t come to the jobs. One cannot help but wonder why it is so hard to create jobs. Are there governmental policies which make the labor market sticky?

I know that this is merely anecdotal evidence, which you disparage constantly. Nonetheless, one must wonder whether the folks who yell on your blog about unemployment benefits interfeting with the market may have a point–at least on the margins. Are there studies regarding this issue?

On a related note, I spoke with another business owner from WI. Her business in the north is seasonal. She asserts that UI is a godsend for her business and that she could not operate without it. I say this to emphasize that I am not attacking unemployment benefits, but I am curious about there effects on different industries. It appears, circumstancially, that UI may hinder manufacturing efforts while supporting service industries.

I am a troll. Troll Troll Troll.

I live under a free market bridge in Galt’s Gulch – the only possible bridge and way to cross a crevasse in this place, and I own it. But I do not charge monopoly prices for crossing my bridge because market failures do not exist!

Why wouldn’t people move? Because they can’t sell their houses; they already own houses but are afraid of qualifying for a loan; they like where they live; their friends and relatives are nearby; the place where they would have to move sucks; etc. Lots of reasons to stay in one place. The expanding firm should have located in a more desirable living location.

Blithe indifference? I suppose that’s not unlike the Whitehouse’s elitist preference for statist action based on discarded Keynesian theories, and its general hamstringing of the private sector, as exemplified by the political move to ice Keystone XL with its contemplated 20k jobs and $13 Bil. capital investment. Wouldn’t robust support for private initiatives eliminate any need for a further $2.5 Trillion of stimulus which you seem to prefer, and in addition offer real productivity gains, unlike O’bama’s insolvent green initiatives?

So, the policy response is to “hold more job fairs”? What? That seems like pretty weak beer and this is a state that is known for its excellent craft beers. I guess the whole “take jobs from Illinois” scheme didn’t work out too well. Hey…what about we pay people a decent wage and provide good schools for their children?

Anyway, here’s hoping that the overall improvement in U.S. economy will also help out Wisconsin.

JLR: The HR department reports that skilled operators do not repond to advertisements.

Economics provides a very simple way to understand this. If there were a shortage of skilled workers then wages for skilled workers would go up. But there is no evidence of spiraling wages for skilled workers.

The answer to your question is simple. There are plenty of skilled workers but they simply prefer working for your competitors than working for you. In other words, they think you suck.

This may seem cruel, but there is no other explanation for employers that complain about inability to find workers when there is high unemployment and stagnant wages. Your company is an undesirable place to work. People vote with their feet and, as you admit, they are voting against you. Sorry.

JLR: Regarding UI and higher unemployment, see the discussion in this post. I don’t mind anecdotes, but I think they have to be augmented by data in order to validate an argument.

djt: I’m sympathetic to the housing/immobility view, but data suggests that this factor is minor in overall unemployment. See references here.

ddrandro: See CBS News:

Given that monthly net job creation in the United States is now averaging in excess of 130,000 over the past three months, the temporary 20,000 seems like rounding error.

JLR: I wouldn’t characterize Wisconsin government as “gridlocked,” which requires two parties (or more) in a stalemate (see Congress). The Republican party controls both houses of the state legislature, the Governor’s office, and the state Supreme Court. Nothing good has happened as a result of the tireless efforts of the ruling party to make nothing good happen. The last legislative session, for example, billed as “an emergency session on jobs” focused on social conservative issues, failing to pass a single bill that even had the word “jobs” in the title. So I wouldn’t call it “gridlock.” I’d call it “vaporlock.”

Joseph: The company pays wages that are higher than BLS median wages. It has a very stable workforce of veteran skilled workers. The people who work there are not voting with their feet. They say they like it there and their longevity at the company seems to bear that out. Therefore, this good company, which is a good employer, and pays well is trying to create new jobs (unlike most companies of which I am aware). Yet, this is actually a very difficult thing to do. Berating (without facts) those who are trying to be part of the solution is not helpful. But, if you have some ideas to make finding, hiring, and training people more efficient and effective, I would love hear your advice.

JLR, surly you know that there is a free market in labor. If you are unable to attract workers to your company, your company must be unattractive.

This reminds me of the bitter slouch in the bar who complains that there aren’t enough available women around because he just can’t get a date.

I’m quite astonished at the number of company managers who are willing to publicly humiliate themselves by proclaiming in the media that they just can’t find workers during the biggest labor glut since the Great Depression. Like that guy in the bar, they may as well be shouting to the world “I’m a pathetic loser.”

JLR Something in your story doesn’t quite add up. First you said:

“The HR department reports that skilled operators do not repond to advertisements.”

And then a few sentences later you said this:

“There was some interest if the company would adopt a defined benefits package instead of a defined contribution package, but management is afraid of that road.”

Sorry, but those two statements cannot both be true. If the HR report is correct and the company did not get any responses to its want ads, then how can they make the claim that there was some interest if the company made a better offer? Obviously potential workers did respond and said “No thanks.”

You also said that the company offered above BLS median wages for machinery operators. According to the BLS, the median wage for Occupation Code 51-4011 is $16.70/hr. Assuming 2080 hours per work year, that’s an annual salary of $34,736. Now you said “above” median, so let’s be generous and call it $36,000/year. But it’s also 40 miles away from the town that just lost similar jobs, so the average commute would be 80 miles/day. These folks aren’t rich, so we’ll assume their car gets 25 mpg. At ~$3.75/gal that works out to $12/day in gas costs, or $60/week, or ~$3,000/year. Not to mention the wear and tear on the car plus insurance. That’s money that has to come out of after tax income. And notice that you said the company is “contemplating” expansion and has “committed” to buying new machinery. That’s all in the future tense…and from the workers’ perspective it may well be in the subjunctive future tense. They need jobs now, not possible jobs in the future. And they need some assurance that they will keep a new job if it means turning down the possibility of another job. What the labor market is telling you is that you need to sweeten the deal. Besides, eventually the economy will recover and you will have to raise wages anyway. Or are you saying that the new investment project only makes sense in a generally depressed labor market? If that’s the case, then the workers are probably quite justified in being a bit leery of your company’s offer. In a normally functioning labor market the marginal value product of capital will equal the marginal value product of labor. And since this is presumably a long term investment, then wouldn’t you want to look at the long run value of marginal products? It smells like another one of these cases where the taxpayer is asked to subsidize capital investment for a project that otherwise makes no sense in a normally operating market. Then once labor costs begin to rise the company pulls up stakes, leaving the workers and the taxpayers holding the bag. We’ve seen this story played out all over the country. Heck, I’m paying high property taxes because my local politicians fell for this scheme not once, but twice. And that’s the kind of scheme your economist no doubt had in mind when he said Walker’s plans were stalled.

Two recommendations. First, if the board members want to earn their pay, they should do more than just fly into town for a quick luncheon and a meeting before flying off to another board meeting. Spend some time understanding the economics and the community. Second, fire that accountant posing as an economist.

Where I live 40 miles is a pretty common commute. I doubt many people here, if faced with a choice between subsisting on UI and driving 40 miles to make a paycheck would have to think too hard about it.