Back in late April, I participated in panel “Europe at the Crossroads: The Euro Crisis and the Future of European Integration” (video). There’re two graphs from my presentation I’d like to highlight, as they remain relevant even as the eurozone lurches into de facto recession [0].

The euro zone was not, and still is not, an optimal currency zone

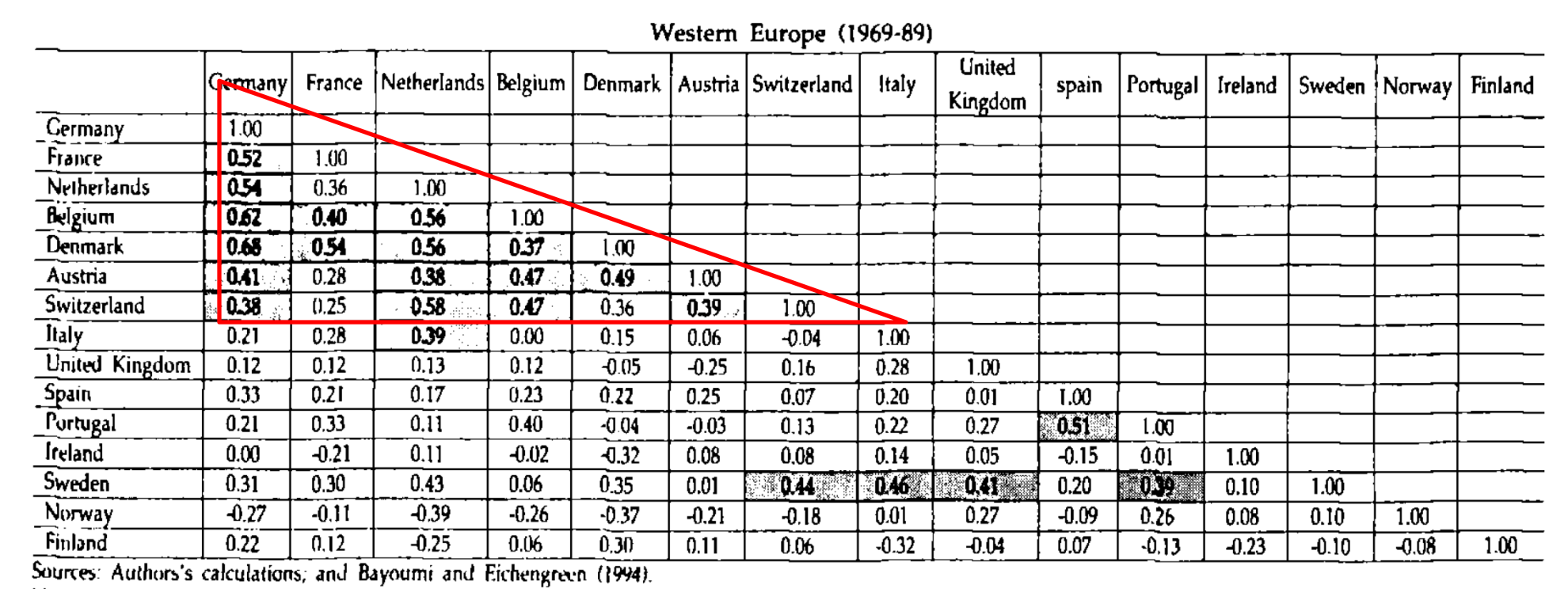

This was known as early as the early 1990’s, as highlighted by this table from a 1994 paper by Tamim Bayoumi and Barry Eichengreen:

The table is of correlations of estimated supply side shocks, obtained using a bivariate SVAR (demand side shocks are also relevant, but would change with the establishment of a euro zone wide central bank.)

Notice that the northern countries fit best into a common currency area, insofar as the correlations exceed 0.40. That is not the case for Italy, Spain, Portugal, and Ireland.

While there is a similar asymmetry of shocks in the US, fiscal transfers from the center are much more pronounced here. In addition, labor mobility is much greater.

By the way, none of the proposals that have thus far been forwarded addresses the issue that the EMU did not implement a fiscal union. The proposals that have been forwarded merely place greater restrictions on the deficits the member states can run.

Fiscal profligacy is not the source of all Eurozone problems

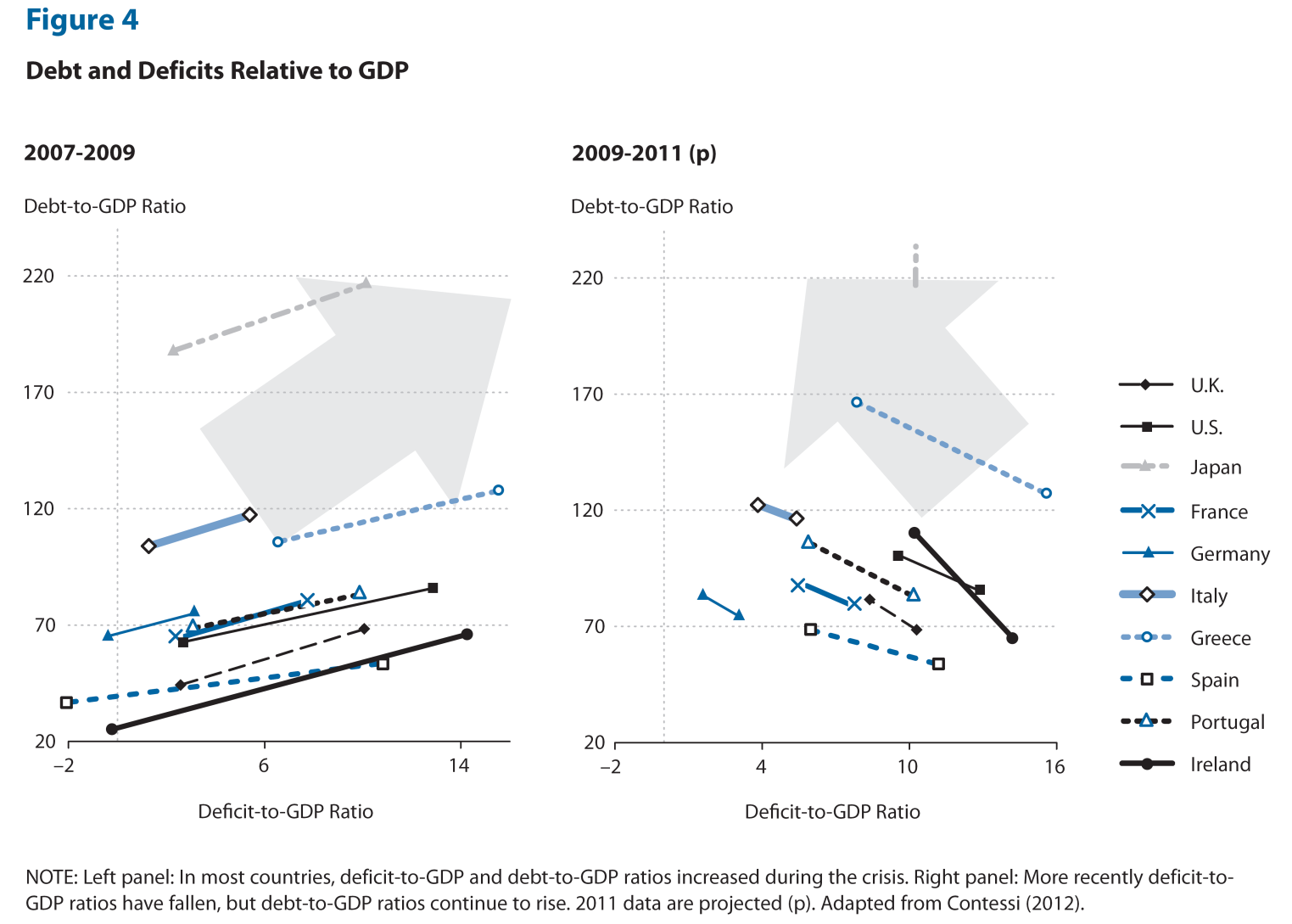

This graph, from St. Louis Fed President Bullard’s paper, highlights the fact that several problem countries — Ireland, Spain — were actually paragons of fiscal rectitude.

Figure from Bullard (2012).

What analysts failed to do is to fully account for the liabilities incurred by the private sector, in the form of the banking sector. Critics of any regulation of the financial sector fail to discern this point when they recount morality plays about the evils of government spending in leading to the Eurozone crisis.

Once one makes this realization, the resistance of finance and their captured legislators to further regulation here and abroad, even after the latest JP Morgan fiasco [1], seems even more dumbfounding. It’s as if some people want a replay of 2008.

More on the origins of the eurozone crisis, here.

By the way, how did the recall end up in Wisconsin?

But if you peel back the onion one layer, then you have a state backstop providing an incentive to take on excessive risk.

In general, most would agree that regulation is necessary in all markets, it’s the over-regulation that is the issue. e.g. no sugary drinks in cups larger than 16 oz’s.

Menzie,

What of Estonia. http://www.cnbc.com/id/47691090

What of Sweden. http://online.wsj.com/article/SB10001424052702303360504577412171533705392.html

Let’s recap this post. Menzie starts with some general facts on the correlation between EU economies. He then follows with general facts on EU budgets. He then concludes that more financial regulation is needed to prevent a reply of 2008. Huh? What ever happened to the time-honored tradition of facts supporting the conclusion?

Sweden is not in the Euro zone. During crisis its central bank cut interest rates & devalued the Krona. The resulting trade surplus allows them have increase private savings & government surplus. And universal health care &I cradle to grave welfare state. If Sweden is new model for conservatism, call me a conservative. Estonia has twice the unemployment as the U.S. A great model, not.

Ricardo Looks like you’ve fallen hook, line and sinker for the Estonia-as-a-Miracle-Economy story. Look, Estonia was hit harder than most countries in 2009, with a HUGE drop in GDP and unemployment spiking over 18%. There has been decent growth, but unemployment is still around 12% and to a large extent that’s because Estonia exported its unemployed to Finland. And except for Finland most of Estonia’s export market is with non-Euro countries. But look at the correlation chart at the top of Menzie’s post. Northern Europe makes for something like a decent currency zone. And while Estonia’s growth has been good, keep in mind that real GDP in Estonia is still 10% below where it was four years ago. At least real GDP in the US is above where we were four years. And you still don’t get why the Swedish experience is irrelevant. Sad.

tj First, the 16 oz soda ban is a local thing, not a federal regulation. Which makes this kind of a bizarre complaint coming from you because you’re the one who is always trumpeting the virtues of local and state government. But the bigger problem is that you need to wake up and realize this is 2012, not 1812. Should you change your moniker to Rip Van Winkle? The firms that took on excessive risks were precisely those firms that were lightly regulated if at all. Excessive regulation did not cause the finanacial meltdown; it was the lack of regulation that got shadow banks in trouble. You also seem to believe that threatening to not backstop “too big to fail” firms is somehow credible. This is laughable on its face. Trying to substitute regulation with tough talk about how the taxpayer isn’t going to come to the rescue again if the banks get in trouble a second time is an idle threat and bankers know it. If there were another huge Lehman type failure we would have to come to the rescue again for exactly the same reasons that we had to come to the rescue the last time. When you don’t have a choice it literally means you don’t have a choice. Remember, even though JP Morgan lost $3B their total exposure on that London Whale bet was over $150B.

The Eurozone problems are mostly unregulated capital flows coupled with the lack of a built in fiscal mechanism – like we have among the states – to rebalance accounts.

2slugs

The point is that over-regulation is as bad as under-regulation. There is plenty of regulatory over-reach at every level of government.

You are talking about the past, I am talking about the future. We need effective regulation but we do not need Progressives tyring to embed their big spending/big goverment social agenda into the legislation.

Regarding too big to fail – I agree, the under-regulated dervivaties market was a central cause of the financial crisis and remains a threat to the system. An effective first step to match risk with reward, something that could have been accomplished 4 years ago, would have been to require full disclosure/transparency of every derivatives trade including the amount/underlying/counterparties.

Any firm that chooses to pursue a business model that poses a systemic threat with a potential tax payer bailout, must be transparent to the public.

Slug,

It is common but it is still amazing to me that those who believe in monetary illusion are so wedded to their ideas that they spend hours coming up with rationales as to why supply side solutions work and demand side solution do not.

Estonia’s GDP is down in large part because the country is not printing money. What is common about the euro countries that are doing well? Germany – tax cuts; Estonia – tax cuts; Sweden – tax cuts. When Germany, Estonia, and Sweden were following your idea of increased central planning and monetary expansion they were failing. By moving toward freedom and liberty they are successful. The US because great because of liberty and freedom. Central planning is anathema to liberty.

It is Noticeable when reading the tables of correlation, few countries do not reflect a fundamental and homogeneous correlation to growth within the European zone and it would start at the 50 median.

More striking is the imperturbable negative correlation of UK to the change of term of trade and much more significant within the cross section of the European matrice P 24. When most of the European countries are exhibiting a correlated sensitivity to inflation, the UK is not (save exception with France and Switzerland). The independence of UK within the European zone, reaches its perigee with a total immunity to supply chocks and demand chocks within the same geographical zone. It must be due to a more horizontal specialization such as investment banking and banking. Tamim Bayoumi and Barry Eichengreen state in the same paper,” there is indifference in forsaking policy autonomy when two countries exhibit negligible or negative correlation in disturbances” that is the case of the UK.

This study should encourage deeper foray in the differences within the European zone. A considerable literature is attempting to compare the European economic union with the former Soviet Union.More thorough conclusion would need to be gathered around the figure 1 of the same paper,that is when supply remains constant and price decreases.

http://www.ioga.com/PDF_Files/oilpricechart.pdf

Yearly Average Crude Price 1977 to Present

Slug,

You spend a lot of time rationalizing away economic success. I have offered this challenge before but you always duck it. It is offered again. Where is the country that is the great central planning success story?

This article by Dan Mitchell does deeper into the Estonia example. http://danieljmitchell.wordpress.com/2012/06/07/estonia-and-austerity-another-exploding-cigar-for-paul-krugman/

It is dumbfounding that the bulk of the most recent Greek bailout went to shoring up Greek banks. Ditto Spain.

Nationalize the failing banks : fire current management; wipeout shareholders ; pay bondholder 5 cents to the dollar; reorganize assents and impose haircuts on creditors until equilibrium

is achieved ; overtime exit a downsized FIRE

( Finance, Insurance , Real Estate ) sector.

CThis will crush some local elites, but save the nation.

Ricardo Where is the country that is the great central planning success story?

Well, I suppose China would count as a country with central planning and strong economic growth, but your question is silly because no one is recommending central planning. What we’re talking about is propping up aggregate demand.

The Dan Mitchell post was a knee slapper. Poor Dan creates his own chart and then doesn’t even realize that it actually hurts his case and makes Krugman’s point even more forcefully. Look at Mitchell’s chart. Notice that it’s in levels, not rates. The drop off in GDP has the clear signature of a drop in aggregate demand. Trendline GDP shows that without an aggregate demand shock GDP would have been ~18B euros rather than the 12B it is today. This confirms Krugman’s point and actually refutes Mitchell’s own argument. Mitchell is so clueless that he doesn’t even understand the implications of his own graph!!! About what I would expect from someone educated at George Mason and working at Cato.

Estonia’s GDP is down in large part because the country is not printing money.

Hmmmm…see this:

http://macromattersblog.blogspot.com/2012/06/estonias-monetary-policy.html

Estonia no doubt has plenty of economic problems, but a constrained aggregate supply curve isn’t one of them. How in the world you come to the conclusion that supply side policies are the cure for an economy with almost 20 percent unemployment is beyond me. Your problem is that you’re stuck in 1979. Every problem looks like problems you remember from 1979. Move on. Disco is dead along with two-thirds of the Bee-Gees.

tj You say you want regulation, just not too much regulation. Do you think that’s what Mitch McConnell wants? Do you think Wall St. is opposed to Dodd-Frank and consumer protection provisions because they honestly think the regulations will hurt economic growth? Or do you think they oppose those rules because the regulations hurt their economic rents?

2slugs

I don’t give a rip what Mitch McConnell or Wall Street wants.

RINO’s are Progressives and the regulated will never choose the best regulatory mix.

Paul – I mean Slug, you once again ducked the question. I did not expect you to actually answer it because there is no answer. You say you are not advocating central planning then you advocate central planning (“propping up aggregate demand”) Your China example is absolutely amusing because it is actually true of China before the 1990s. Note the following from wikipedia:

…During the 1930s, China developed a modern industrial sector, which stimulated modest but significant economic growth. Before the collapse of international trade that followed the onset of the Great Depression, China’s share of world trade and its ratio of foreign trade to GDP achieved levels that were not regained for over sixty years.

The economy was heavily disrupted by the war against Japan and the Chinese Civil War from 1937 to 1949, after which the victorious Communists installed a planned economy. Afterwards, the economy largely stagnated…. Urban Chinese citizens experienced virtually no increase in living standards from 1957 onwards, and rural Chinese had no better living standards in the 1970s than the 1930s.

…Privatizations began to accelerate after 1992, and the private sector surpassed the state sector in share of GDP for the first time in the mid-1990s. China’s government slowly expanded recognition of the private economy, first as a “complement” to the state sector (1988) and then as an “important component” (1999) of the socialist market economy.

…Jiang Zemin and Zhu Rongji…were ardent reformers. In 1997 and 1998, large-scale privatization occurred, in which all state enterprises, except a few large monopolies, were liquidated and their assets sold to private investors. Between 2001 and 2004, the number of state-owned enterprises decreased by 48 percent. During the same period, Jiang and Zhu also reduced tariffs, trade barriers and regulations, reformed the banking system, dismantled much of the Mao-era social welfare system, forced the PLA to divest itself of military-run businesses.

…When China joined the WTO, it agreed to considerably harsher conditions than other developing countries. Trade has increased from under 10% of GDP to 64% of GDP over the same period. China is considered the most open large country; By 2005, China’s average statutory tariff on industrial products was 8.9 percent. For Argentina, Brazil, India, and Indonesia, the respective percentage figures are 30.9, 27.0, 32.4, and 36.9 percent.

…China’s trade surplus is considered by some in the United States as threatening American jobs. In the 2000s, the Bush administration pursued protectionist policies such as tariffs and quotas to limit the import of Chinese goods.

Slug, China tried your way and it did not work, Choosing China as your example was rather amusing. I am sure that it sticks in your craw that Robert Mundell is the only western academic honored with a professorship at the Chinese University of Hong Kong and given an honorary professorship to Hunan University China’s oldest and most elite University. After all, your theory is much closer to Chinese thought after WWII than Mundell. Yet modern China chose Mudnell over Keynes, supply theory over demand theory, and to add insult to injury had the nerve to actualy be successful, becoming the second largest economy in the world.

It must be frustrating when you spin your web to watch the world pass you by without even a wink or nod.

Ricardo: You’re claiming China is not particularly state-controlled? You really are detached from reality. 34% of industrial value added was due to State-owned enterprises; shares in the overall economy are even higher. [1] And the import of the state-owned sector probably rose in the wake of the response to the great recession of 2008. And of course, G (government spending) is large, and has risen as well since 2008.

OT:

An article on the economics of self-driving electric vehicles I wrote for Foreign Policy:

“How the Electric, Self-Driving Miracle Car Will Change Your Life”

http://www.foreignpolicy.com/articles/2012/06/08/self_driving_car?page=0,0

Ricardo You say you are not advocating central planning then you advocate central planning (“propping up aggregate demand”)

It’s a bit crude, but one way to distinguish between a centrally planned economy and a predominatly market based economy that needs temporary stimulusto ask yourself which curve are you talking about. In your world economics only has one curve…the aggregate supply curve. So naturally you see any government interference as tantamount to state central planning. But economic analysis with only one curve is a waste of time. If you had any real training in economics instead of just reciting BS from the WSJ op-ed page, then you’d recognize that there are two curves. And since you like to cite Mundell, let’s add a third curve to explain Mundell-Fleming. Central planning is all about controlling the aggregate supply curve. Keynesian economics takes the aggregate supply curve as pretty much a give and concentrates its energies on making sure aggregate demand matches potential output. I don’t live in a one curve world, which is why your “challenge” is meaningless. I’m recommending that the government stimulate aggregate demand; I am not advocating that the government tinker with the supply curve for purposes of closing the output gap.

As Menzie said, you’re detached from reality. You should not be allowed to vote until you get more grounded. Maybe states should start scrubbing voter registration rolls for people who are severely out of touch with reality.

Menzie,

I give it to you. You are definitely the master strawman creator. He who has eyes, let him see.

Slug wrote:

…one way to distinguish between a centrally planned economy and a predominatly market based economy that needs temporary stimulus [is] to ask yourself which curve are you talking about.

Actually there is only one way to distinguish between a centrally planned economy and a market based economy. Are you relying on the government to centrally plan to implement your policy or are you relying on the wisdom of free traders in a free market? The curve question should be reserved for those using the smoke screen of Sudoku to justify crony capitalism and rent-seeking. If the curve had any application to the real world I would think that you would have a multitude of real world examples, yet what we get is justification for why you have none. Hmmmmm?

Central Planners only love for Mundell is Mundell-Fleming (actually Mundell separates himself from Fleming). If you understood Mundell in totality you would be richer for it after all he gave us Reaganomics all the way back in the 1960s.

Your faux-economics had pushed all other economic debate out of academia for a long time and I can understand your discomfort answering questions that cannot be addressed in the aggregate. I also understand why having to face your theories in the real world are so discomforting. The sooner you face reality the better off you will be and also those you delude. Because of the reality of your errors you are no longer the only game in town.

I studied your theories in Grad School when they were the only game in town.

By the way, I think Robert Higgs has been reading our exchange because he is talking directly to you.

http://online.wsj.com/article/SB10001424052702303830204577448530666170076.html?mod=googlenews_wsj

tj I don’t give a rip what Mitch McConnell or Wall Street wants.

This is a pretty good example of what I mean when I say you’re naive. Voting is binary. What you personally give a rip about is neither here nor there. The choices on the table are the kinds of regulation that Team Obama wants or the kinds of regulations that Team GOP wants. Those are your choices. I don’t like either choice either, but that’s life. Voting against the kinds of regulations that many Democrats want does not mean you are voting for the kinds of regulation that you might want. It means you are voting for the kinds of non-regulation that McConnell wants. That’s just the hard calculus of elections. What makes it even worse is that at least the Democrats are open to compromise on most issues. The core of the Republican party equates political compromise with moral weakness bordering on treason. Given that we live in that kind of world you had better give a rip what Mitch McConnell thinks because McConnell and his big money backers sure don’t give a rip what you want. All they want is to put you in a frame of mind in which you vote against regulations.

As a consciousness raising exercise you might want to read the classic “And Economic Theory of Democracy,” by Anthony Downs. It’s an oldy but goody. The kind of bimodal political world that we live in today is not stable and does not converge towards equilibrium. And as the latest Pew Research numbers and the Ornstein-Mann book show, almost all of the drift to a second modal peak is coming from movement within the GOP. You really should give a rip what McConnell wants.

2slugs

Like I said before, you live in the past. You have decided to accept the staus quo. I haven’t.

Both sides know exactly what they need to put in a bill so that the other said will reject it. I am sure you are all for compromise, as long as the other side meets you more than half way to your your position.

There is a huge block of voters in the ‘middle’. Unortunately for you, the middle is much more conservative than you would like. So what you and your Progressive Utopians are really trying to pull off is a grand compromise that is to the far left of the majority of Americans.

No thanks, I will wait for the elections in November. We can talk compromise in January.

“Central Planning” is becoming the new “imperialism”. Overused and misunderstood.

China does not centrally plan in the sense market liberal intellectuals think. They “central plan” to what the global corporations want. The United States does as well and did 100-150 years ago.

TJ and Ricardo represent intellectualism gone awry. They spout success of “free markets” but don’t understand that “market success” was built on large quantity of open land and public innovation(outside eletricity) and then when that went away in the 20th century, wage inflation and increased federal debt to keep the capitalist system humming. Now it is all federal debt.

Without that, capitalism would have died already. Capitalism is a intellectual, humanistic ideology. It reality, it doesn’t work that well when placed with nature. When capital dries up, like after the recent computer revolution productivity gains ended, we have had massive problems. Corporations are looking for to high of a return and simply not getting them. So they eat away at labor trying to get those gains, which creates notable inequality and lack of demand. Stuff like “outsourcing” and “tax cuts” are just players in this game.

So what happens? Capital has a problem in finding investment returns inside the economy because of the lack of demand. They command the banks to extend huge piles of credit to people and reckless speculation to keep the party going. This boosts demand but at a cost. It implodes and now they are stuck trying to figure out the problem they have created for themselves.

The Rage wrote:

When capital dries up, like after the recent computer revolution productivity gains ended, we have had massive problems.

Goodbye Schumpeter. Welcome to the world of the Luddites.

The Rage wrote:

Capital has a problem in finding investment returns inside the economy because of the lack of demand.

Oh no. We have all stopped going to the grocery store because demand has disappeared. We are going to starve to death!

Rage

I agree that capitalism, in it’s pure form does not exist. Nor would we want it to. The tradeoff with capitalism and regulation is efficiency vs equality. In general, policy makes market outcomes less efficient. This is the central issue of the never-ending debate about the proper amount of regulation and proper type of regulation.

Progressives frame the debate in terms of equality, taking wealth from the ‘rich’ and redistributing it to the rest of society. They want more government regulation and higher tax rates to make economic outcomes more equitable, but at the expense of slower growth.

Conservatives frame the debate in terms of greater economic growth driven by less regulation relative to Progressives. More rapid economic growth drives increases in tax revenue instead and eliminates the need to increase marginal tax rates.

Of course, our policy makers on both sides of the aisle are coerced by a variety of special interests, so U.S. policy lurches from left to right rather than smoothly transitioning to some optimal mix associated with the needs of society.

Back on topic – How about the Spanish bailout? Spain has more of a private banking problem and less of a sovereign debt problem. So what is the regulator’s solution? Loan 100B euros to the Spanish government which in turn pushes the money into the banking system. This allows the private banks to use the 100B euros to buy the debt issued by the Spanish government.

The result is that the debt load of the Spanish government potentially rises by 100B euros and raises the probability that the Spanish government has a Greek-like sovereign debt crisis in the near future, on top of the current private sector banking crisis.

“Once one makes this realization, the resistance of finance and their captured legislators to further regulation here and abroad, even after the latest JP Morgan fiasco [1], seems even more dumbfounding. It’s as if some people want a replay of 2008.”

My understanding, although imperfect, is that Spain’s housing bubble was not a regulatory failure.

The real failure is preventing destabilizing and unsustainable international capital flows, of the type generated in the euro area by the combination of over-saving Germany and under-saving southern countries and in the U.S. by currency interventions in Asia.

@Don

The Central Banks regulatory failure in supervision,do not fall into one single reporting document but many.those hereunder are just very few of them:

Banks have to report on their outstanding and more particularly, those exceeding 25% of their capital and own funds per debtor.

Banks report on their assets by sectors of activity.To be read,concentration of risks assets by branch of activity.

Banks report on their liquidity ratios.To be read how do they fund their assets,long term medium term,short term liabilities.

Banks report on their prudential ratios,very often an assessment of their leverages.

Banks report on their contingent liabilities

Those documents published monthly,quaterly,semi annually, are deemed to enable the Central Banks to assess if the prudential ratios are fit and deemed to justify the banks perennity.Subsequently if a bank or many banks are not driving the payment system into jeopardy.