I see both dark clouds and rays of hope.

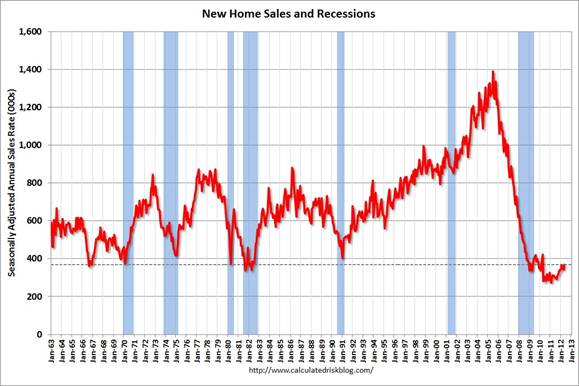

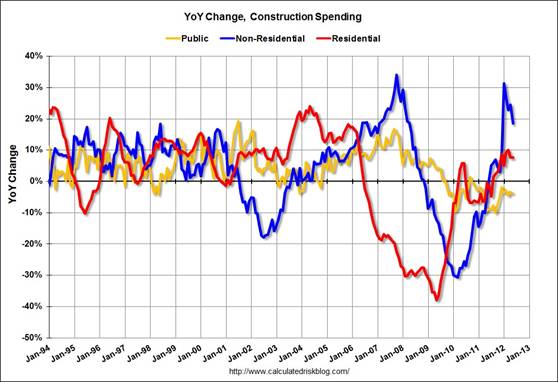

I’ll get to today’s seriously stinky employment report in a moment, but let me start with a bit of good news. Calculated Risk, who to my knowledge has never been wrong, called the bottom to the decline in both house construction and prices last February, and sees considerable confirmation of that prediction since then:

- housing starts are increasing

- residential construction spending is up 17% from its low

- new home sales are up 17% so far this year relative to the previous 18 months

- Case-Shiller and

Core Logic house price measures may have started to rise modestly. Moreover, a broader perception by home owners and buyers that prices have stopped falling would itself be a significant positive.

|

|

Autos are another bright spot for the economy. June sales of cars manufactured in North America were up 31% over the previous year, and up 24% so far for the first 6 months of 2012 compared to 2011:H1.

|

Year-over-year domestic light truck sales were up 18% for June and 11% for 2012:H1.

|

Tim Duy asks how a recovery in housing could make that much difference. Here’s my answer. The graph below plots the shares of total spending on final goods and services that are attributable to autos and residential construction. These sectors are indeed small relative to the whole economy, with autos and housing between them on average accounting for only about 8% of GDP. That means that if the economy were growing at a 3% annual rate, and housing and autos were doing the same, their contribution to the annual growth rate would only be 0.24 percentage points.

|

But the key point is that housing and autos hardly ever grow at the same rate as everything else. As housing dropped from about 6-1/4% of GDP at the top of the housing boom in 2005 to its value around 2-1/4% today, it took about 4% away from the level of real GDP. The table below summarizes the drop in real GDP during recent recessions. In an average recession since 1970, real GDP fell at a 1.34% annual rate, of which housing alone accounted for 0.74 percentage points, and autos another 0.27 percentage points. I’ve also argued that hits to the auto sector make an important contribution in the quarters just before a recession begins; see also Ana Herrera’s interesting paper on this last point.

| Recession | Average GDP growth | Autos contribution | Housing contribution | Combined contribution |

|---|---|---|---|---|

| 1969:Q4-1970:Q4 | -0.48 | -0.71 | 0.02 | -0.69 |

| 1973:Q4-1975:Q1 | -1.48 | -0.56 | -1.20 | -1.76 |

| 1980:Q1-1980:Q3 | -2.43 | -0.50 | -1.67 | -2.16 |

| 1981:Q3-1982:Q4 | -0.90 | 0.25 | -0.53 | -0.28 |

| 1990:Q3-1991:Q1 | -1.80 | -0.66 | -0.86 | -1.52 |

| 2000:Q1-2001:Q4 | 0.43 | 0.62 | 0.07 | 0.69 |

| 2007:Q4-2009:Q2 | -2.69 | -0.34 | -1.00 | -1.34 |

| Average | -1.34 | -0.27 | -0.74 | -1.01 |

|

And autos and housing can also make a key contribution to the economic recovery that we hope would follow after a recession. In the robust growth that came the year after the 1970, 1974, and 1982 recessions, these two sectors alone contributed 2 percentage points to the total real GDP annual growth rate. And in other recessions where there was a weak recovery, weakness in housing and autos was an important feature. For example, in the first year of the current recovery, autos and housing contributed a mere 0.17 percentage point to the 3.3% real GDP growth rate. In the 3 years since the recovery began, autos and housing contributed 0.24 percentage points to the meager 2.4% annual GDP growth rate.

| Date | Average GDP growth | Autos contribution | Housing contribution | Combined contribution |

|---|---|---|---|---|

| 1971:Q1-1971:Q4 | 4.53 | 1.45 | 1.13 | 2.57 |

| 1975:Q2-1976:Q1 | 6.18 | 0.86 | 0.93 | 1.78 |

| 1980:Q4-1981:Q3 | 4.48 | 0.25 | -0.13 | 0.12 |

| 1983:Q1-1983:Q4 | 7.75 | 0.73 | 1.64 | 2.37 |

| 1991:Q2-1992:Q1 | 2.63 | 0.23 | 0.47 | 0.70 |

| 2002:Q1-2002:Q4 | 1.93 | -0.27 | 0.34 | 0.07 |

| 2009:Q3-2010:Q2 | 3.30 | 0.07 | 0.10 | 0.17 |

| 2009:Q3-2012:Q1 | 2.40 | 0.20 | 0.04 | 0.24 |

But referring back to my first graph above, there is much more that we could still expect these sectors to do. For example, if autos were just to get back to 3% of GDP– a share exceeded in 94% of the quarters prior to 2005– and housing to 4%– a share exceeded 87% of the time prior to 2005– that could add another 2% to GDP right there. Note this makes no reliance at all on any kind of pent-up demand, and uses what seem like quite pessimistic assumptions about the size of the permanent hit absorbed by these sectors. Obviously if we instead did get something like a more typical post-recession boost, these sectors could make a much bigger contribution.

I was recently asked by a portfolio manager what a scenario that came out on the upside of everybody’s GDP forecast might look like, and this was my answer– a robust recovery in housing and autos could easily help produce a 4% real GDP growth rate.

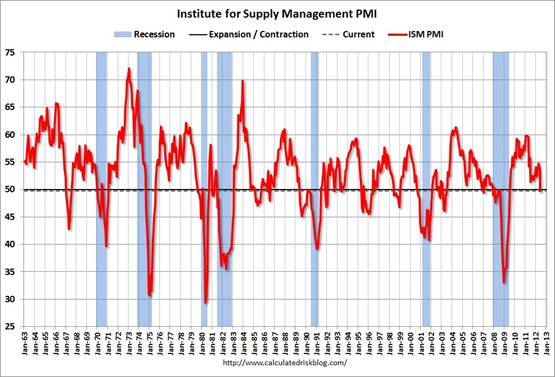

Unfortunately, the rest of the economy so far is not cooperating. On Monday we received the disturbing news that the ISM manufacturing index slipped below 50, meaning that more manufacturing facilities are reporting that conditions worsened in June than reported gains. One month by itself is not terrifying, but there are plenty of other disturbing developments.

|

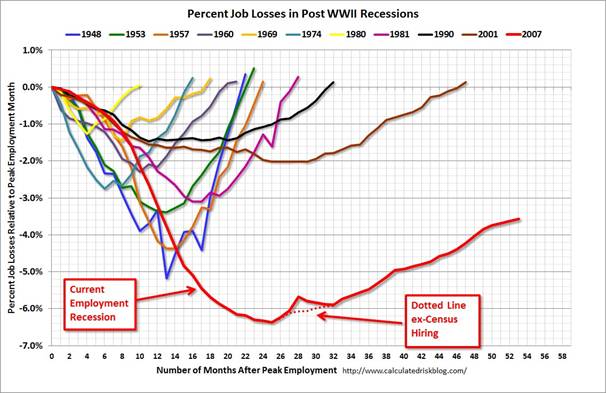

Chief among these was yet another disappointing report from the Bureau of Labor Statistics. The BLS estimated that nonfarm payroll employment grew by only 80,000 jobs on a seasonally adjusted basis in June. That’s not much help when there were 157,000 new Americans entering the labor force in June to add to the 12.7 million others who are still unemployed and actively trying to find a job.

|

Could housing and autos be enough to turn all that around? Before you answer yes, take a look across the Atlantic. Reports in the financial press on the European situation seem to have a boom-bust cycle all of their own. Last week we supposedly shifted back into the optimistic phase of the reporting cycle. But the long-run challenges facing Europe remain as daunting as ever. I have a hard time seeing how that story could be written so that it has a happy ending. And if we do see a dramatic turn for the worse in Europe, it becomes harder yet to get that upside surprise to work out for the U.S.

After all the economic analysis I read lately about the global economy, I would like to simplify the European economy problems and its solutions that exist, but need political courage to implement them.

The most significant problems are;

1. Youth unemployment mainly in Spain, Portugal and Greece, but also in other European countries;

Source; http://marginalrevolution.com/wp-content/uploads/2012/01/Youth-Unemployment-Europe_0.jpg

This structural unemployment is not only damaging to the unemployed youth but also to the economy, since the potentially most productive part of the labor force is excluded from employment. It is not accident that the biggest debtors have also the biggest problems with the youth employment.

The solution is to abolish all the legal and institutional obstacles that were created during the years of plenty. It needs to fight the unions? Yes that’s why it needs political courage.

2.Unsustainable current account deficit (the deficit that had to be covered by loans) created within years unbearable debt and is still creating them. If you look at the next chart;

Source; http://earlywarn.blogspot.cz/2012/05/one-way-us-is-like-piigs.html

You can see that the trends since 2008 are positive, yet still a lot has to be done to balance the current account between the borrowers and the debtors. Unfortunately there is no other way to solve the current account deficit, and the foreign debts, but by creating current account surplus, and it can be done only by reducing imports or by increasing exports (alternatively it can be solved by creating attractive investment opportunities, but it comes only with perspectively competitive economy).

Source; http://blog.securities.com/wp-content/uploads/2011/11/eu-consumption.jpg

In USA, the private consumption is about 71% of the GDP and because of the public consumption almost no positive savings in the last years. Interestingly even if not surprisingly the general consumption (Private and Public) is the highest in Greece and Portugal, while relatively low in Germany, reducing imports in the countries with high deficit can be done mainly by reducing the consumption there. But this means reduction of cumulative demand and with it comes necessarily the negative economic growth. This means the potential of creating economic growth with additional consumption can’t work, since the countries with big foreign debt and current account deficit like USA, Greece, Portugal are already consuming to much.

Conclusion? If we want to solve the big foreign debt and current account deficit without to create huge deflation and unemployment it has to be by increasing the export to countries with low foreign debts. So the solution is to create demand for consumers goods and investments in the countries with low debt which are the Asian and Oil exporting countries;

Source; http://static.seekingalpha.com/uploads/2009/9/23/saupload_current_account_balance_countries.png

Current Account Balance — G–20 Countries (USD)

Source; http://blogs.cfainstitute.org/investor/files/2012/06/Chart-1-Current-Account-Balance-G20-Countries.png

3. The obvious solution is to create demand in the Asian and the Oil exporting countries. It is again political issue, yet while the Chinese seem to do gradually their share in the demand creation, other Asian countries, namely Japan, S.Korea, etc. have to follow. As to Oil exporting countries, their relatively low population, prevents from them to create significant demand, but they could invest their financial resources in other Muslim countries without oil, with huge population and huge investment needs, like Egypt, Pakistan, Bangladesh, Indonesia, etc. It is also the interest of Saudi Arabia and other oil producing Arab countries, to support economic growth in the new democratic Arab countries, to prevent their political radicalization. Again it is up to the world leaders to explain to the Saudis, that if cleverly done, it could be the very best investment for them.

4. For years the developed countries propaganda was to help the under developed countries. Now the chance had come to turn the unused production capacities of the developed countries and use it for increasing investment and consumption in the less developed countries, that as it happened have also the lowest indebtedness. In principle what is needed is to transfer liabilities and subsequently assets from the rich but heavily indebted Europeans and USA to the poor but not indebted Asian countries.

5. The main problem to this scenario can come out of limited row materials and production capacity. Since in indebted European countries and USA the consumption will have to decrease, enough production capacity will be released, yet if economic growth has to excess the existing production capacities, row materials namely energy recourses will be needed for economic price. The latest new natural Gas field discoveries, seems came in the right moment.

6. The last but not the least, investments in scientific and technological research and in economic development has to focus on alternative solution for energy, and solving the environmental problems. This needs to channel the finances and the management effort of the most talented into the sciences and technology and not to finances, law or marketing. Direct involvement of governments in supporting this trend would be very welcomed.

Since the economic crisis is global, its solution has to be global, and again I have to speak about political leadership, who has to be committed to long run tasks and not only to the short term once.

Since so much attention is paid to CPI adjustments and measures, why not look at seasonal adjustments to hiring? Commenters here fixate on inflation, often claiming it’s understated. In this abnormal economy, if the seasonal adjustment is overstated, the jobs figure looks much lower than actual. This isnot a typical economy.

The Fed publishes statistics reflecting the state of industrial production and capacity utilization. As read, there is no deterioration in the manufacturing sector, capacity use or production.

http://www.federalreserve.gov/releases/G17.Everything

The state of the inventories is more troublesome in quantities, slopes,duration (no similar statistics are easily available for Europe).

USA Inventories:

Total Business (BUSINV)

http://alfred.stlouisfed.org/series?seid=BUSINV&cid=1

It is still nowadays, a better status for the manufacturing sector than during the great depression era 1930-1935 and precedent recessions. At that time, prices seem to factor the pile up in inventories.

F Mills “Aspects of manufacturing operations during recoveries”

“In no recent business recession have equal losses been suffered by manufacturing industries. The price decline of 1920-21 exceeded the drop of 1929-33, it is true, and in other respects the first post-War recession was of a magnitude roughly comparable to the most recent decline.”

Jonathon,

I had a similar thought. Did the warm Q1 pull some hiring from Q2? If it did, I would think that June should be the last month we see any significant effect.

The JOLTS data would probably provide a clearer picture because it contains a hiring series. Change in national employment is simply the net of job losses and job gains.

I also wonder how the part-time and temp numbers look. I have heard some anecdotal evidence that firms are holding off on adding permanent hires because they are unsure how much additional cost/regulatory burden Obamacare will add per worker.

tj firms are holding off on adding permanent hires because they are unsure how much additional cost/regulatory burden Obamacare will add per worker.

I wonder why employers would think that. The things about Obamacare that tend to increase healthcare costs (e.g., no pre-existing conditions, adding kids up to age 26, no lifetime limit, etc.) either don’t go into effect for a couple of years and/or apply irrespective of the number of workers employed at a firm. And the effect of expanding mandatory health insurance coverage should lower per worker costs for medium and large companies. Afterall, insurance premia from medium and large employer based programs subsidized free rider consumers and free rider small businesses that did not offer health insurance plans. And if you’re a small business owner and you are deciding not to add workers because Obamacare might put you over a threshold level, then in effect you are setting a permanent ceiling on the size of your business. Is that really smart? And even if you are a small business worried crossing an employee threshold, that threshold doesn’t kick in for awhile. Wouldn’t the rational response be to pull forward hiring today so that those workers can produce a carryover surplus and then let those workers go when Obamacare fully kicks in? I don’t doubt that many small business types are economically blinded by GOP talking points and may actually believe the junk they hear at Chamber of Commerce meetings; but most small businessmen are not economic geniuses. They may know their business, but that doesn’t mean they know the science of business or economics. Running a plumbing business usually means you know plumbing, not business. Running a restaurant usually means you know food service and cooking, not business.

2slugs

I guess this is what you get when the president has to bribe members of Congress with the “Lousiana Purchase” and the “Cornhusker Kickback” to get the last few votes for an entitlement program that a majority of voters did not favor.

I don’t doubt that many small business types are economically blinded by GOP talking points

Libs are talking about changes too.

Harry Reid – “No one thinks this law is perfect. But Democrats have proven we’re willing to work with Republicans to improve the Affordable Care Act.” http://www.kolotv.com/home/headlines/Nevada_Officials_Speak_Out_on_Obamacare_Ruling_160712265.html

Obamacare, with its potential to impact every business, is a policy-in-progress. Doesn’t really sound like the right time to make a significant increase to a workforce. Sure, a few ones and twosies here and there, but the mid-size to large firms who hire in quantity and provide jobs with longer tenure will be slow to move until the dust settles.

Its not a coincidence that we are nearing the end of the housing depression as the distressed sales (as a percent of existing home sales) start to decline. People *do* need places to live you know and eventually parents get tired of housing their children, whether its a rental, or owner occupied. maybe we built a few too many houses too early but that will eventually clear and eventually population growth and demographics take over.

I doubt that outside events will depress the housing rebound. its been in a depression for so long and is clawing without aid from monetary policy (some inflation to devalue those mortgages might have helped) or fiscal policy (principal writedowns and postponing fiscal consolidation might have helped). But its recovering despite the efforts of policy makers to ensure that there is no recovery.

If Congress and the Fed has not killed, then it must be pretty durable. As i said, eventually demographics and hormones take over and people need to live somewhere.

tj I guess this is what you get when the president has to bribe members of Congress with the “Lousiana Purchase” and the “Cornhusker Kickback” to get the last few votes for an entitlement program that a majority of voters did not favor.

First, those provisions would not have been necessary if it weren’t for the fact that sensible politicians have to play nice with brain dead conservatives like Landrieu and Nelson. Good riddance to both of them. Second, this is another consequence of what happens when political action is blocked by a minority that has more ambition than sense. Finally, the separate provisions in the bill were not unpopular. In fact, individually they are VERY popular. Eliminating pre-existing conditions is very popular. Allowing kids up to age 26 to piggyback onto their parents insurance is very popular. It’s also very necessary in the current economic environment. Creating exchanges and making insurance portable are all very popular. Eliminating lifetime caps is very popular. The two things that weren’t popular were both based on GOP lies; viz., (1) that bogus claims the tax/penalty applied to everyone rather than just those few who were able to buy insurance but didn’t, and (2) the $500B Medicare cut and death panel lies that were ginned up by Frank Luntz focus groups.

For the most part medium and large firms supported the bill because they knew that it would help lower their costs because those firms were paying for the free rider class.

Obamacare is not perfect and will need some tinkering. The same was true with Social Security when it was introduced. But overall it is a big improvement over the status quo ante and is at least a small step towards improving the structural deficit. And it will also improve the overall efficiency of the labor market because people will not be tied down to specific jobs based strictly on health insurance.

The economic case for Obamacare is overwhelming. You should try reading some of the serious stuff on health insurance. Try reading Finkelstein (recent winner of the John Bates Clark Medal), or Jonathan Gruber or Uwe Reinhardt. Try going beyond the silly Club for Growth pamphlets.

Since you seem to think that today’s unemployment is largely structural, then you should applaud Obamacare because it increases labor mobility.

Re: healthcare and hiring. The truth is perhaps found in Scott Brown’s latest radio ad. He says he’s talked to a number of businesses who aren’t hiring because of the law. He then says that we in MA found a solution that works for us. Problem: our law applies if you have 11 full time equivalent employees. That’s 11. The federal law applies if you have 50 FTE employees, meaning 30 hours/week minimum & not seasonal. So, how exactly does that work? Our unemployment rate is 6.5% and our economy is doing pretty well. Hiring has not been affected by the mandate applying if you have 11 employees. So how come it suddenly becomes an issue if you have more than 11, especially when you’re already paying either as a contribution to insurance or as a penalty tax? Answer: it isn’t a factor but it makes an ad. That’s the basic truth.

BTW, the ad also says that Obamacare cuts $500B from Medicare and that is a bad thing. It doesn’t say it cuts the growth in Medicare, which would be accurate. It doesn’t say the GOP plan would cut more or that the GOP would eliminate Medicare in exchange for vouchers whose entire point would be to reduce the program cost. But it makes an ad.

It would be nice if we could count on growth in the tradeable goods sectors rather than relying so much upon residential construction.

Most of the handful of people in the entire world who believe the calculated lie that Obamacare will save money are apparently on this site.

In the 2 years since Obamacare’s passage, my insurance has gone up 34%; I haven’t had a single claim in that time.

Obamacare is an added burden on society, making an already quite socialized system even more sclerotic with bureaucracy. I guess you guys love anything that adds 15,000 employees to the IRS.

Bryce – “In the 2 years since Obamacare’s passage, my insurance has gone up 34%” connects to what, exactly, since most of the provisions haven’t gone into effect yet? Furthermore why not try looking at MA stats, since this is a duplicate of the bill to see what will happen when they do instead of doing the “me me me” thing? Insurance isn’t a “me” thing, it’s a pool dependent on others contributing. And since you seem like the “bootstraps” kind of person by your posts, please explain to me why I should pay for people who freeload off the system in the form of higher premia? You can choose not to pay for insurance but at the same time you shouldn’t be able to foist that cost off to others. That’s the whole point of the tax/penalty. And I whole-heartedly agree with it.

So process the data on MA and then comment. Until then you do your cause no justice why writing what you just did.

Actually, we can call Progressives like 2slugs the “pass the buck” party. All they do is blame others for their problems.

Ultimately, in my opinion, the only way firms will pay less under Obamacare will be by dumping employees into the exchange.

I like the way Progressives don’t have a problem letting their side call conservative cuts to a growth rate “draconian”, but when conservatives call a growth rate cut, a “cut”, Progressives scream bloody murder.

At least we all seem to be in agreement with my earlier point, Obamacare is a work in progress. As such, firms will probably be more willing to use temporary and part-time workers rather than commit to a permanent hire. The result will be slower employment growth until the actual cost of adding an employee becomes more certain.

“Eliminating pre-existing conditions is very popular. Allowing kids up to age 26 to piggyback onto their parents insurance is very popular. It’s also very necessary in the current economic environment. Creating exchanges and making insurance portable are all very popular. Eliminating lifetime caps is very popular.”

What a strange talking point (one being peddled throughout the Democrat-talking-head-universe).

You know what is really popular? Godiva chocolate. Everybody loved Godiva chocolate.

So why don’t folks just live on Godiva chocolate, if it is so popular? Could it be that the COSTS of Godiva chocolate (both monetary and in terms of folks’ waistelines) balance out its popularity?

I have no doubt that there are aspects of Obamacare that poll well when the COSTS of Obamacare are not mentioned.

Anybody who thinks that 26 year olds are getting on their parents’ insurance for free is a fool. Anybody who doesn’t realize that lifetime caps are there for a reason is an idiot, or I guess a Democrat.

Anybody who doesn’t realize that panels of experts who are going to decide what procedures are “effective” and should be paid for is going to end up as a death panel is just not paying attention.

Bryce, I don’t like the mishmosh that is Obamacare. I agree with the doctors I know: get rid of the insurers. Obamacare is a vast compromise that provides vast employment for insurers, something the GOP would otherwise be pushing and whose main goal is bringing more people into the insurance system so cost can be contained over time. The current system leaks everywhere. In CA alone, the hospital association claims between $11-12B in unreimbursed expenses each year from uninsured patients. Even in MA, the hospitals along the NH & ME border say they’re losing ~$50M to uninsured patients from those states.

The idea is to improve insurance coverage so people aren’t penalized for the luck of the draw. Imagine you have a child that has a condition. Under the old law, you might never be able to get health insurance. At all. If you could, it might cost so much you could not afford it. Things like that are important.

As for premiums over the last few years, Obamacare has had no impact on that. In the future, Obamacare is an attempt to rein in the growth of health costs and of Medicare in particular. Since Medicaid will become a more important program, it will be squeezed as well.

“I agree with the doctors I know: get rid of the insurers.”

That’s funny, the only reason we have insurance financed health care in the first place is because doctors wanted third party payment. They felt that it made getting paid easier than the alternative (which was patients paying for their own care out of their own pocket).

Maybe we should stop looking to doctors to shape our health care system (after all, they have a lot more skin in the game than patients do).

tj: “Ultimately, in my opinion, the only way firms will pay less under Obamacare will be by dumping employees into the exchange.”

Obama care does do some good things (sometimes using very bad methods).

This is one of those goods things.

One of the key steps to getting healthcare in order is to get employers out of it. We should be scrapping the employer tax benefits for providing these products as well.

There are some really interesting adverse selection issues that could arise. It’s possible a battle could emerge over the younge and healthy between companies who offer a policy in the exchange and those who don’t. The reason is that the young will pay more in premiums than they draw in claims.

Let’s say I start an insurance company and do not offer a policy in the exchange. At the same time, I create a policy outside the exchange that appeals to the young and healthy but not to seniors, or those with pre-existing conditions. The price of an exchange policy will be higher than equivalent non-exchange policy because the pool of policy holders will consist of those who make the majority of the claims.

Unless Obamacare blocks this scenario, it seems like a natural equilibrium response. Policies are created by private health insurers with a combination of rates and restrictions that increase the probability the young and healthy apply, while decreasing the probability that seniors, or those with pre-existing conditions apply.

This seems possible because I don’t think Obamacare forces private insurers to charge the same rate to everyone.

This would create a huge problem for Obamacare which is relying on the young and healthy to subsidize those with pre-existing conditions and the old and infirm.

tj- maybe you should spend your time looking at the actual data rather than republican talking points.

If you did you would see that employment growth under Obama is actually stronger than it was under Bush.

Does anyone know of a US based insurance exchange that has worked for an extended period? There were several state sponsored exchanges when I was young. I do not believe any of those exist today (at least I cannot find them). Several companies that built on an exchange model (i.e. Farmers’ Exchange) shifted away from the exchange model–taking over the smaller participants. Long ago I helped develop risk retention pools that allowed physicians to obtain E&O on an “exchange” basis. All were subsequently pruchased by larger companies. Just look at E-surance. It started out as an electronic brokerage (exchange-like), now it is owned by Allstate. Lloyd’s, ILU, Zurich, and Bermuda have good insurance exchanges that have lasted a long time. I do not know why, but the exchange model does not seem to fair well in the US. Please tell me I am wrong and provide an example or two.

spencer Think about it for a minute before casting aspersions.

From Jan 2009 – Jun 2012 (~ the Obama years) the BLS says the number of people looking for full time work averaged 12,250,000 people.

From Jan 2000 to Dec 2008 (~ the Bush years) the BLS says the number of people looking for full time work averaged 6,265,000 people.

There were nearly twice as many workers in the pool of job seekers during the Obama years!!! It takes a much smaller fraction of the pool of job seekers to transition from ‘looking’ to ‘hired’ to increase employment by 80,000 workers.

http://research.stlouisfed.org/fredgraph.png?g=8AW

You folks really need to get over blaming Bush, comparing to Bush, etc, etc, etc. Or maybe you should refer to him as King George because you act as if he single-handedly, with no help from Congress, forced his agenda through Congress by bribing legislators with federal funds, or threatening to not enforce federal law, or threatening to take away federal funds.

True leaders don’t blame others for their problems, inherited or not. They take conditions as given, then identify problems and solve them, even if it means abandoning their social agenda.

It would be interesting to see those charts expressed as indices with 2000 = 100. Anyone knows that a 30 percent decline followed by a 30 percent increase does not get you back to your starting point.

Bruce Hall Try using logs.

tj Actually, we can call Progressives like 2slugs the “pass the buck” party.

Strange comment coming from the guy who is advocating for free riders.

Buzzcut Anybody who thinks that 26 year olds are getting on their parents’ insurance for free is a fool. Anybody who doesn’t realize that lifetime caps are there for a reason is an idiot,

Who said those things were free? Recheck my post. I specifically said that those things cost money, but they were still very popular. But you also have to keep in mind that many of those services were being provided anyway, albeit in a very inefficient way.

Anybody who doesn’t realize that panels of experts who are going to decide what procedures are “effective” and should be paid for is going to end up as a death panel is just not paying attention.

You’re confused. Sarah Palin’s “death panels” refrerred to the provision in the bill that provided funding for families that wanted to discuss end-of-life options. It did not mandate end-of-life consultations, it simply said that if a family wanted to explore those options with their doctor, then the billable hours for the doctor would be covered. That’s all it did.

What you’re talking about was a different provision in the bill. That provision said that Medicare would not pay for treatments that did not have any proven medical value. Of course, if your insurance company wanted to pay for useless procedures, that was fine and nothing in the bill prevented it. But good luck with that. No one has a right to wasteful and useless procedures. And that’s especially true when that $500B could be more productively spent on proven procedures for people without insurance. The GOP lied about what the bill said and appealed to geezer fears. My recommendation is that geezers who believed that lie should spend some time in a pediatric intensive care unit and talk to families struggling with ways to pay for medical care for 6 year olds with leukemia. Been there, done that. I’d rather spend $500B on proven treatments to address those kinds of medical issues rather than spending it on useless procedures that give some geezer patient the illusion that he’ll live another 30 days.

JLR Does anyone know of a US based insurance exchange that has worked for an extended period?

Yes. Federal government employees get health insurance through an exchange. The menu of available plans varies by state as well as a basic nationwide plan. For example:

http://www.opm.gov/insure/health/rates/nonpostalffs2011.pdf

“No one has a right to wasteful and useless procedures.”

Wasteful and useless to whom? And who gets to decide what is wasteful and useless?

That is really the crux of the issue. As we have seen recently with drug trials gone wrong, it is not easy to “prove” that a procedure is wasteful and useless.

Is there some light at the end of the tunnel? It seems that amidst the bad jobs report there are some encouraging signs — including a drop in new unemployment claims. Nonetheless it seems whether in the US, Europe or even in key emerging markets local central banks are not quite ready to pull the plug on monetary stimulus. At least this is what Oliver Adler at Credit Suisse says: http://www.thefinancialist.com/central-banks-to-continue-fighting-global-slowdown-ecb-credit-suisse-oliver-adler/

Is this a realistic analysis — Do you agree with it?

Buzzcut Wasteful and useless to whom?

If the taxpayers are being asked to pay for a procedure, then it’s fair that they have at least some say in what is considered wasteful and useless. Doctors providing the wasteful and useless service are not unbiased about the outcome. And patients obviously have strong biases.

And who gets to decide what is wasteful and useless? Today no one decides if the service is provided by Medicare. Today the insurance company decides if you’re not under Medicare. I think we can do better. How about a panel of doctors who don’t have an obvious financial interest in the outcome?

As we have seen recently with drug trials gone wrong, it is not easy to “prove” that a procedure is wasteful and useless. Except that we haven’t seen any cases in which useful drugs were categorized as useless. It’s all been the other direction. And bringing that up doesn’t exactly help your case.

A few points:

1. The housing market is based on speculation by lenders. When frustrated home sellers complain about interest rates or banks not lending, this is what they are really saying: “The only way I can sell my house for what I paid for it — with borrowed funds — is for somebody else to borrow funds to take it off my hands.” Needless to say, this is a tenuous arrangement, at best. Revival of the lending required under it requires either a loosening of lending requirements or a revival of household income, primarily through employment at high incomes. I do not see either occurring independently of a recovery in the housing or automobile markets.

2. The automobile industry in this country was suffering from foreign competition before and gasoline is still priced over $3 per gallon. Also, purchases of new automobiles are based on speculative lending, albeit from the automobile companies themselves. We are stuck in the same bind here: no lending to buy cars at inflated prices without an independent increase in employment income.

3. From my own perspective as an overqualified IT consultant, much of the work in the IT area has been outsourced to India. Despite the inferior software design by inexperienced Indian programmers, that work is not coming back to the United States under current exchange rates.

4. In other areas, as well, we are getting killed by the “strong” dollar. Therein lies the key to a domestic recovery. Our dollar is strong because we have been exporting debt, just like Greece. We like to blame this on the Chinese, but it is our own doing. By unnecessarily creating federal debt in order to pay our deficits — which were themselves unnecessary — by selling the debt on the open market, we have created an avenue for countries like China to be exporters of real goods and thus jobs, balancing that with imports of our debt.

The solution would be to bring the greenbacks out of mothballs. If we issued United States Notes to directly pay our daily deficits, including servicing and retiring our federal debt, the value of the dollar overseas would decline to the point necessary to bring jobs back to our country.

Can someone explain to me how on earth a two-income couple in California making $48,000 a year can possibly afford to buy the median-priced $375,000 houses there?

Anyone? Bueller? Anyone?

2 points: Obamacare arose as an attempt to deal with perhaps the greatest threat to U.S. businesses and the economy. This larger context is now lost amid the successful (?) Republican theme that Obama is anti-business and a “job killer.”

Second, as is well known, Obamacare was modeled on the Massachusetts Republican endorsed system, which in turn came from the Republican think tank the Heritage Foundation. Many clips are available with Romney, Gingrich and others endorsing this as the Republican’s plan to address the issue.

The fact that virtually all the Republicans have now lined up in opposition suggests to me that opposition to the Democrats in general and Obama in particular is the overriding issue – not Obamacare. Criticism is universal regardless of the issue.

If the Republican party is unwilling to even implement their own ideas if those ideas are blackened by support from the Democrats, what possible way is there for compromise and constructive solution to our country’s problems? We are so f__ked.