Californians who bought gasoline on Friday experienced an unpleasant shock.

|

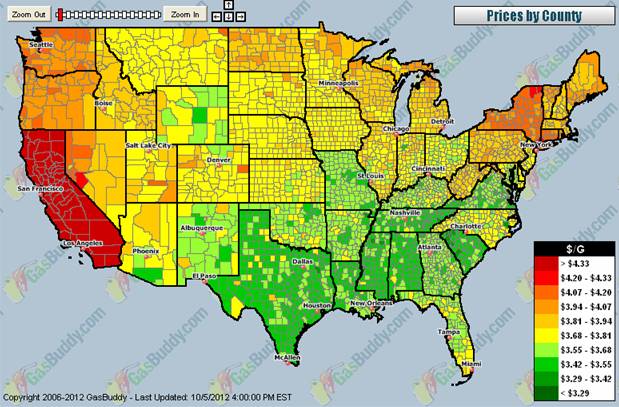

Gasoline prices in California are usually 30-40 cents a gallon higher than the rest of the country. About 20 cents of that is due to higher gasoline taxes in California and much of the rest from the fact that we use a higher quality of gasoline in order to reduce air pollution. But the average retail price of gasoline in California jumped 50 cents a gallon last week, even as the price elsewhere in the country was heading down. The average price in the Golden State on Friday was $4.64 a gallon. That compares with a California high of $4.38 reached this spring and $4.59 in June of 2008.

|

|

| New Jersey Historical Gas Price Charts Provided by GasBuddy.com |

California has experienced a series of disruptions to gasoline supplies. The Chevron refinery in Richmond (across the bay from San Francisco) has a normal capacity of 243,000 barrels per day, or 8.5% of the total petroleum products supplied to Petroleum Administration for Defense District 5, of which California is a part. But a fire at the Richmond refinery in August has significantly reduced its production. The Kettleman-Los Medanos pipeline, which carries 85,000 barrels per day of crude oil to the San Francisco Bay Area, has been closed since mid-September due to organic chloride contamination. And on Monday, a power outage shut down ExxonMobil’s 149,000-barrel-per-day Torrance refinery in L.A.

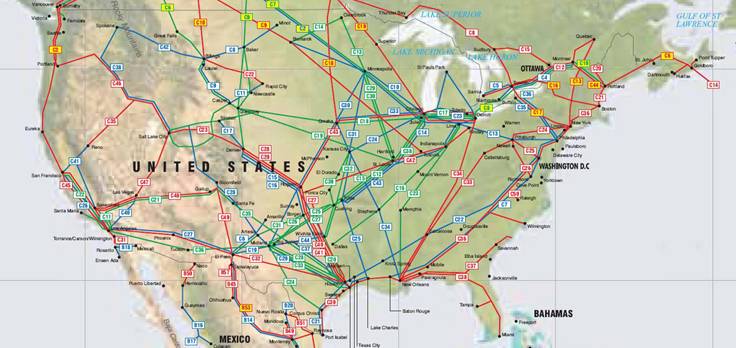

Two factors allow the price in California to spike much higher than the rest of the country. First, a different blend is required to meet California air quality standards. Second, there is little pipeline capacity (blue lines on graph below) to bring in refined product from elsewhere.

|

|

Earlier refinery disruptions, including BP’s Whiting refinery in Indiana, Holly’s Tulsa refinery in Oklahoma and ExxonMobil’s Beaumont refinery in Texas, had also contributed last month to modestly higher prices outside of California than they otherwise would be.

The good news is that these kinds of disruptions are by their nature temporary; in fact, the Torrance refinery was back to normal operations by Friday. Based on the current Brent price below $112/barrel, I would expect a long-run average national retail gasoline price of $3.64/gallon, about 15 cents below where it currently is, and an average price in California of $4.04/gallon, about 60 cents below Friday’s price.

On the other hand, sometimes people respond emotionally to this kind of situation. NBC San Diego reported “many rushed to fill up their tanks Friday night for fear of prices soaring again over the weekend.” If enough people do that, it would produce a temporary spike in demand to run up against the temporary drop in supply.

It would also provide an instructive illustration of the economic problems that are introduced if speculators (in this case, California consumers) somehow get the notion that what they should do is buy more when the price is highest.

Though if that happens, my guess is that the buyers of the gasoline would blame somebody other than themselves.

There is something else at work here which has been seen often in commodity markets over the last one hundred years. That is the response of buyers when one or more seller cuts off supply. In this case Valero and Exxon Mobile stopped selling to spot buyers. (Bloomberg, October 4.) These companies may not have any extra supplies of summer gasoline since they have now switched to making winter gasoline which can be sold after November 1. Buyers who rely on spot supplies such as Costco then rushed to the remaining sellers who were willing to make spot sales and bid up prices.

These buyers may have to wait until winter grade supplies are made available, probably in late October. Mean time Californians will need to pay up or park their cars.

We saw precisely such a response more than twenty years ago when the Exxon Valdez hit the rocks. We also saw a similar response in August 1990 when Iraq invaded Kuwait. Inventories were very high at the time so governments delayed release of strategic stocks despite commitments made by the IEA a month earlier to respond immediately. In response firms howling inventories chose to husband them(some might call it hoarding) causing buyers to bid up spot prices up more than 100 percent in two months., There are even academic articles on the episodes.

Such action is quite legal. When Midwest markets did this in 2000 the Federal Trade commission wrote “A decision to limit supply does not violate the antitrust laws, absent some agreement among firms. Firms that withheld or delayed shipping national supply in the face of a price spike did not violate the antitrust laws. In each instance, the firms chose strategies they thought would maximize their profits.”

Unfortunately, Californians may have to wait until November for lower prices without CARB action. The spot price for gasoline delivered in October (summer grade gasoline) was $3.85/gallon according to Argus. The same publication put November gasoline (winter grade) at $3.10. Any trader wanting to send gasoline to California from Singapore or Houston to take advantage of the tight market can only hope to capture the lower price due to shipping times.

Californians have done this to themselves. It couldn’t have happened to a nicer bunch of guys. Have fun.

This sort of nonsense occurs every summer in the midwest when something happens to “temporarily curtail production” at one of several refineries… a leak here, needed maintenance there….

The real issue is that the EPA has its 57 varieties of condiments, gasoline, that prevent balancing supplies for summer blends. Of course, one could ask why, in the age of sophisticated engine controls, that one blend of gasoline could not be used all year.

No, that would cause some bureaucrats to have to think up something else to gum up the marketplace engine.

What disruptions? Looks like gauging to me.

Of course, one could ask why, in the age of sophisticated engine controls, that one blend of gasoline could not be used all year.

Standardization of fuels would be the oil industry’s worst nightmare. Breaking the country into regional cartels adds to the profits of the oil refiners by preventing competitors from outside their region from smoothing out supply shocks.

Note that these excess profits don’t necessarily require explicit collusion between refiners. All refiners in aggregate benefit when there are frequent local shortages caused by any refinery event, planned or not.

Refiners have sufficient political power to broker a deal on standardization of fuels but have chosen not to because it would reduce their profits. So there is the answer to your original question.

Joseph,

Tell me, will the oil companies make more money by pricing gasoline 5% higher while forcing down demand by 10%?

Last night Governor Brown ordered the date for the switch to winter grade gasoline moved to today.

This morning Platts reports spot gasoline has dropped by 44 cents per gallon.

This is one of the few times where enviornmental rules have been suspended. Hopefully the companies will learn the lesson taught on Wall Street: Pigs get fat, Hogs get slaughtered.

Ricardo: “Tell me, will the oil companies make more money by pricing gasoline 5% higher while forcing down demand by 10%?”

Apparently you do not understand price elasticity. Studies have shown that for gasoline in the short term that demand elasticity is about -0.25. That means that a price increase of 10% results in a decrease in demand of 2.5%, quite contrary to your characterization. The other way of looking at it is that a very small decrease in supply results in a very large increase in price.

Let’s say there are two major refineries in a region. One shuts down for routine maintenance causing a shortage. The other goes into 100% production and collects a 10% price premium due to shortages. Six months later, the reverse occurs and the other refinery shuts down for routine maintenance.

Even if there is no explicit collusion in shutdowns, both refiners benefit from increased profits due to regional shortages. Neither refinery has any interest in eliminating their regional cartel enforced by requirements for specialty gasoline blends. Refineries like these specialty requirements because it eliminates competition from refineries outside their region.

Refiners have sufficient political power to broker a deal on standardization of fuels but have chosen not to because it would reduce their profits.

This is false. Obama prefers high fossil fuel prices to drive demand toward renewables. He has said so on more than one occasion. If Obama is re-elected, refiners will have 0 political power. EPA mandates will force coal off of the energy menu. EPA will slap enough fee and regs on natural gas to make new wells unprofitable. It’s the only way for Obama to reward his green cronies now that congress has refused to go along with his energy sector madness.

Joseph wrote:

Apparently you do not understand price elasticity. Studies have shown that for gasoline in the short term that demand elasticity is about -0.25. That means that a price increase of 10% results in a decrease in demand of 2.5%, quite contrary to your characterization. The other way of looking at it is that a very small decrease in supply results in a very large increase in price.

Oh, now that begs another question doesn’t it? Since that is the case why don’t they raise the price to $10.00/gal?

Before you answer, remember that elasticity is not a static number that is always the same. For elasticity to have any meaning you have to calculate it for every price level and supply level and then only for one point in time.

You can calculate in aggregates but life is lived at the discrete level.

This appears to have been a problem induced entirely by regulations. When the regulations were eased, so was the shortage. I hardly see what the lesson is for the companies involved, other than that California can be a wacky place to do business. Because the government there artificially reduces supply and has insufficient infrastructure to mitigate local shortages, California is prone to energy price spikes. This is, of course, not the first time this sort of thing has happened in California.

@tj – How then do you explain the lack of standardization before the Obama administration?

You really think that Obama, who is young to get re elected wants higher gas prices?

addicted

You are confusing the past with the present. Nobody said they didn’t have clout in the past.

Obama is on the record as saying that under his plan, electricity will sky-rocket. Step back and look at his general view – It is that fossil fuels need to be priced higher so that renewables can compete.

Do you think he will give a rip about high fossil based energy prices if he is re-elected? To add insult to injury, which income group will be hardest hit? (Hint: It won’t be the 1%’rs.)

Addicted,

Yes, President Obama wants higher gasoline prices. He just wants them slowly.

tj You need to refresh your talking points. Obama never said that energy prices would or should skyrocket. His Secretary of Energy said that energy prices would go up and that this was inevitable. In what universe does a politician want to see higher gas prices?

On the merits I think we should see higher gas prices. I’m not alone in this. Just a few days ago JDH suggesting that as a way to subsidize alternative energy sources (viz., natural gas) we should “…tax conventional gasoline vehicles, or gasoline itself, by an amount commensurate with their estimated external social costs.” One of those external social costs is air pollution. Perhaps you don’t remember those NFL games back in the 1960s when the Los Angeles Rams played in the old coliseum and the smog would be so bad that television viewers couldn’t see the field. Roman Gabriel might have thrown a 70 yard pass, but television viewers would never know. And the fans and announcers wouldn’t have known either.

And under Obama’s cap and trade proposal the net effect was to redistribute income towards those at the bottom. According to the CBO, Obama’s cap and trade was moderately progressive.

But none of this has much of anything to do with JDH‘s post, which was about inevitable supply shocks and how silly consumers like to buy high and sell low, and then wonder why they’re unhappy.

2slugs – Obama never said that energy prices would or should skyrocket.

“Under my cap and trade plan electricity rates will necessarily skyrocket.”

“if somebody wants to build a coal plant, they can — it’s just that it will bankrupt them, because they are going to be charged a huge sum for all that greenhouse gas that’s being emitted.”

http://www.youtube.com/watch?feature=player_detailpage&v=BqHL404zhcU

You cannot dispute the fact he wants dramatically higher fossil based energy prices. It doesn’t matter if it’s gasoline or electricity. I would argue that he cares more about his cronies than “those at the bottom”.

Ricardo, you are confusing two concepts: supply (firm behavior) and demand (consumer behavior). You made a statement (indirectly) about demand: firms raise the price by 5% and demand falls by 10%. That implies a demand elasticity of 2. No one believes the demand elasticity for gasoline is 2.

You then, in your rebuttal, made a statement about supply: if demand is so inelastic, why don’t firms charge $10. The answer to this is competition. Even if the demand elasticity is 0, competition will discipline price away from infinity. Indeed, in a perfectly competitive market, price would be marginal cost regardless of the elasticity.

This is not a perfectly competitive market, but competition still disciplines price.

tj Thanks for the youtube link. I only wish President Obama felt the same way as candidate Obama.

I’m still wondering who are those cronies. Under Obama’s now dead cap & trade plan the revenues were redistributed from Romney’s cronies to the bottom quintile. See the CBO report.

Anonymous, I am assuming you are Joseph who simply forgot to input your name. I have done the same.

That response is much better. Let’s go back to my question that was to illustrate absurdity by being absure.

Any business will maximize its profits or it will go out of business and that is – as you correctly note – because of competition. Others will. But this is important because it one of the miracles of the free market to optomize asset allocation.

The oil companies will compete based on the laws that the state subjects them to. Most existing businesses are very adept at using laws to limit competition.

So the problems in California were caused by the government not by the oil refiners. This is easily deduced when you note that the governor simply with the stroke of a pen increased the supply of gasoline by 10% by relaxing laws restricting the sale of certain blends of gasoline. There is little doubt that California has created their on hell on earth through their “Progressive” governments.

2slugs – I’m still wondering who are those cronies.

There are plenty of examples, but a quick google finds this:

Of the $20 billion of government grants and loan guarantees made to green-tech companies by the DOE since 2009, over $16 billion were allocated to “Obama-related companies,” Schweizer tells me in the accompanying video. “By that I mean either the chief executive or leading investor was a member of his campaign finance committee or was a bundler for his campaign.”

http://finance.yahoo.com/blogs/daily-ticker/peter-schweizer-solyndra-tip-iceberg-very-suspicious-govt-184151321.html

tj Check your timeline. The Solyndra loan was arranged by Bush 43 in 2007. In fact, on 19 Jan 2009 (i.e., one day before the inauguration), the Bush Administration tried to get the DOE to finalize the loan deal, but DOE refused because there were still some loose ends. The loan guarantee was approved in Mar 2009.

As to cronies. One of the venture capitalists did contribute to Obama’s campaign, but the major cronies were members of the Walton family (and I don’t mean John-Boy and ‘Lizbeth)…hardly Obama supporters.

In any event, the Solyndra loan was a reasonable risk given what was known about the technology at the time. The whole point of the loan was to accept risk that the private sector wouldn’t accept. And that’s rational given that the private sector must always be risk averse and the government must always be risk neutral.

An interesting article was posted in the WSJ today about this. Gas prices are expected to ease up in the next few days based on opening the idle plant and an early permission to produce winter-blend gas. It will be interesting to see the social impact of producing more winter-blend gas (which evaporates more easily and is worse for the environment) given the surplus in production to ease the financial situation.

The article goes on to discuss why the California demand curve is so different from other states and as a result of the different environmental regulations, we don’t all pool from the same supply, making us more vulnerable to our limited production.

In other news, the government is actually investigating the surge suspecting that it may have been market manipulation – I’ll be very interested to hear what kind of collaboration may have occurred.

The article is definitely worth a read…

http://online.wsj.com/article/SB10000872396390444897304578044542000498504.html?KEYWORDS=gas+prices

2slugs,

I didn’t say anything about Solyndra, just that

Of the $20 billion of government grants and loan guarantees made to green-tech companies by the DOE since 2009, over $16 billion were allocated to “Obama-related companies”.

tj I didn’t say anything about Solyndra

Right. Almost believable. That must be why your link is almost entirely about Solyndra. Check the title.

In California: On my commute to work I saw the most expensive station went from $4.99 to $4.93 for premium. I was hoping for a slight rise in order to shock motorists with $5 gasoline. No such luck.

2slugs

Right. Almost believable. That must be why your link is almost entirely about Solyndra. Check the title.

So you are saying that most of the $20 billion went to Solyndra?

I find it worth investigating why $16 billion out of $20 billion in green energy grants/loans went to companies and individuals with links to Obama.