Maybe. Governor Romney has stated that he will declare China a currency manipulator on Day One, should he be elected President. In contrast to his other policy positions – from tax rates on the upper incomes, defense spending, coverage of pre-existing health conditions, the Blunt Amendment, Afghanistan timetable, first strike on Iran – he has exhibited remarkable (and pretty unique) constancy in his desire to call China a currency manipulator. In fact, one can find news reports from 2007 onward attesting to this long-standing stance [1], [2], [3]; so if there is any promise we should believe he will follow through on, it’s this one. And from Believe In America: Mitt Romney’s Plan for Jobs and Economic Growth (under “Day One”), it is:

An Order to Sanction China for Unfair Trade Practices

Directs the Department of the Treasury to list China as a currency manipulator in its biannual report and directs the Department of Commerce to assess countervailing duties on Chinese imports if China does not quickly move to float its currency.

In a recent post, I asserted that this is an odd time to undertake this type of action. That is because (1) the Chinese currency has appreciated considerably since 2005 to arguably near equilibrium levels, and (2) Chinese reserve accumulation has tailed off; in particular accumulation of USD has stabilized. (I leave aside the logistical constraints on implementing the declaration on January 21, 2012 [4]. Unless Congress confirms the Treasury Secretary on Day One, this will not literally occur.) I know facts are of little consequence to some, but I thought it useful nonetheless to document these assertions.

First, to the point of Chinese currency appreciation. Figure 1 shows the nominal bilateral USD/CNY exchange rate, with Deutsche Bank forecasts, and the trade weighted real CNY exchange rate.

Figure 1: Log trade weighted real (CPI deflated, broad basket, 2010=0) CNY index (blue, left scale), nominal USD/CNY exchange rate (dark red), as of 10/24 (dark red triangle), and forecasts from Deutsche Bank (Oct. 3) (red +). Sources: BIS, St. Louis Fed FRED, and Deutsche Bank, Exchange Rate Perspectives (October 3, 2012).

In general, the trade weighted real exchange rate (blue line) is the most relevant one for assessing China’s role in the world economy; it has appreciated substantially since the end of the Great Recession. The BIS (and IMF) trade weighted exchange rates are CPI-deflated. One might reasonably argue that this measure of competitiveness (see Chinn (2006) for definitions) is not the most appropriate. It turns out that using unit labor costs does not change the conclusion considerably. Figure 2 shows that the IMF CPI deflated measure and the unit labor cost deflated to do not differ substantially (and in fact has exhibited greater appreciation since 2009Q2).

Figure 2: Excerpt from Figure 4 of IMF, Staff Report for Article IV Consultation: People’s Report of China (July 2012).

A review of recent estimates of misalignment, using a variety of approaches, is shown in this paper by Yin-Wong Cheung. Slightly older estimates here. Since the real effective CNY has appreciated in the last couple years, the extent of measured misalignment is likely to have decreased. Furthermore, using the IMF’s new approach to evaluating the appropriate exchange rate and current account balances, the IMF finds relatively minor undervaluation – between 5-10% [1] (For more on the IMF’s EBA, see this post, and technical appendix).

Figure 3: Excerpt from “Figure 4: Estimated ESR Positions” from IMF (2012).

Governor Romney argues that China is keeping the exchange rate weak in order to gain competitive advantage, presumably by intervening in foreign exchange markets. However, the evidence for massive intervention is quite limited, insofar as we can infer from the data.

Figure 16 from Deutsche Bank, Exchange Rate Perspectives (October 3, 2012).

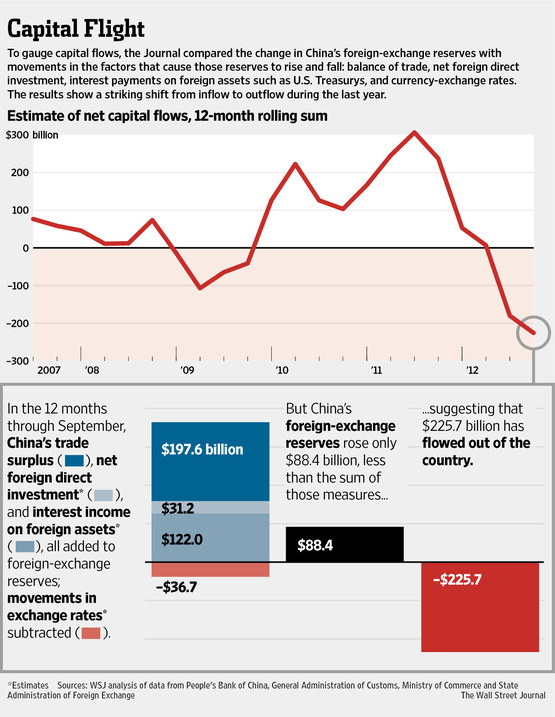

Total reserves are barely rising, while the share of reserves held in US dollar assets is estimated by DB to be declining over time. Moreover, it is not quite right to equate reserve accumulation with the trade surplus, as shown in the below figure from the Wall Street Journal Real Time Economics:

Figure 4. Source: “Capital Inflows Become Outflows in China, WSJ Analysis Shows,” WSJ Real Time Economics (October 16, 2012).

Would it be better for the U.S. and world economy if the Chinese allowed the currency to appreciate more rapidly? Most likely; as I’ve argued, this would help re-allocate aggregate demand away from China and to the rest-of-the-world. But declaring China a currency manipulator seems a particularly risky way to achieve something that is already occurring.

[When asked during the debate about the possibility that declaring China a currency manipulator might trigger a trade war, he answered no in the same way he assured Candy Crowley the tax measures “added up”, with a repeated/stressed “Of course…”. I must confess that does not make me overly sanguine.]

So, of all the campaign promises, the Governor seems to hold most steadfast to the Day One manipulator declaration. But, then, according various experts, he has become a bit malleable on even that promise.

What voters is Romney attempting to appeal to with his China bashing–or maybe he is attempting to appeal to to certain campaign contributors.

Or maybe it’s a bargaining chip. Recall how Reagan’s reputation helped him win the cold war and bring down the Berlin Wall.

Isn’t Romney just cheap talking for votes and money as Richard A. already stated?

Look, I am just a mouthy, opinionated and very annoying foreigner or alien if you wish.

I reckon that Romney disqualified himself from being the next president of the USA a long time ago. Far too many gaffes. He really went too far in this personalized conflict with Ben Bernanke. Romney comes across like a loose-cannon populist ranter. If undecided voters attempt to avoid the worst choice, Romney could lose though I’m impressed with his current standing in the polls despite his numerous gaffes.

Would guess that markets are expecting Mitt Romney to ditch the crazy ideas if elected. Attacking Iran would risk an oil-price catalyzed US recession.

Same with illegal immigration. Romney will be tough!!!!…….while business still imports cheap labor. The Reagan model demands it.

The dirty little secret of the Republican party. If you ever got a ‘Bryan Democrat’ to run again and a rejecter of post-war political liberalism, they could make hay. The liberals would still go along if grumpily.

China does manipulate its currency but that is the 21st century equivalent of a protective tariff. The US had a protective tariff from its infancy until Wilson fostered its repeal early in the 20th century. William McKinley made the tariff the centerpiece of his campaign in 1896 and garnered the support of many working folk by convincing them that he was protecting their jobs in emerging industries by keeping out foreign goods. So if candidate Romney read his history on this one he would not be so agitated on the topic.

I predict that this will be the first “promise” that the Mittster, if elected, will state that it will not be necessary to sanction China because of his personal “Awesomeness” and election has already solved the issue.

I think you can pretty much tell from past Republican administrations what policy promises will be kept and which will be deemed inoperative.

Tax cuts for rich people. Will be kept.

Savage cuts on programs for poor people. Will be kept.

Defense spending increases. Will be kept.

War with Iran. Will be kept.

Cuts in Government employees and their salaries. Will be kept.

Trade sanctions against China. Inoperative

Balance Budget. Inoperative (with tax cuts and war, the deficit will baloon. And proposed cuts in Medicare, Medicaid, and Social Security will not bite until well after the Mittster’s second term – but will project to show a balance budget in 2050!!)

Negotiations with Iran and withdrawal from Afgahanistan. Inoperative

Increases in employment and middle incomes. Inoperative.

Why don’t you show the exchange rate back to 1981? Here’s a graph:

http://www.economagic.com/em-cgi/charter.exe/fedstl/aexchus+1980+2012+0+0+0+290+545++0

JustMe: The reason is that there was a de facto multiple exchange rate regime prior to 1994; hence, the large devaluation you plot is one that pertains to the (only partially relevant) official rate. See Fernald, Edison and Loungani (1999), or Cheung, Chinn and Fujii (2010).

What bothers me is that Romeny has a record of keeping his campaign promises. Romney was not just making a campaign promise in 2007. He really meant it.

But Romney has lowered his rhetoric recently. While he did mention it in the third debate, Marco Rubio came out publically against Romney’s position and Paul Ryan also opposes Romney’s position.

Of all of Romney’s campaign promises I believe this one has the greatest chance of being walked back. Hopefully he will see the light before his inauguration in 2013. Perhaps he will make the announcement just to keep his promise, then he will drop it.

sherparick,

You forgot the 12 million jobs and economic recovery. But then all those Keynesians from 2000 who called for a housing bubble (Krugman) will say, “See, we told you stimulus would work.”It just took 13 years. (Before you nitpic I know Krugman made this statement in 2002 but it was the continuation of earlier demands for quantative easing.)

Interesting post.

I have a few questions. First, how much of the decline in the dollar’s share of total Chinese foreign reserves is simply the result of dollar depreciation (from Chair Bernanke’s QE policies)?

Secondly, in figure 4, increases in official foreign reserves are “flows out of the country,” so what point is being made by the last statement in bold?

Third, how are official reserves measured? Do they include accounts in London, where many official reserves are accumulated? Could part of the $225.7 billion ‘outflow’in figure 4 consist of such reserves?

Fourth, $84 billion in official reserve accumulations is not a negligible amount. The SOLE purpose for such accumulations is currency manipulation. What need is there to look at any other metric? If this accumulation is stopped, the currency is floating and currency manipulation is no longer occurring.

Finally, can you think of a bigger, more blatant lie than the Treasury’s position do date that China is not a currency manipulator?

don: The balance of payments accounting identity is CA + KA + ORT ≡ 0. If one does the accounting correctly, then yes, reserve accumulation includes purchases executed in London on behalf of PBoC. (TIC data as released doesn’t make the differentiation, but the benchmark surveys are supposed to correct; hence why one has to be careful interpreting the monthly TIC reports).

Also don’t understand points being made in figure 4. Current-account surplus should, other things equal, result in offsetting financial account outflows, which include reserve accumulation.

Also not clear if the FDI included on the left-hand side is FDI inocome or investment. Income is included in CA and investment in FA.

BenAround: The first bar is akin to the “basic balance”, rather than CA.