The “fiscal cliff” refers to a broad set of tax increases and spending cuts that under current U.S. law will take effect in January. A recent assessment by Bank of America Merrill Lynch estimates the tax increases in 2012 could come to $470 B and spending cuts another $250 B, for a combined fiscal shock of $720 B, or 4.6% of GDP.

|

A fiscal contraction of this size in an economy as weak as the United States would likely be enough to send the country back into a recession. Since that’s not an outcome either party wants to see, my assumption has been that somehow Congress and the President will find a way to avoid it.

Some respected analysts have suggested to me that there is one political reason that our leaders might prefer to go over the cliff and then try to back our way up. The advantage is one of framing– once we’ve gone over the cliff, their position can be described relative to the new status quo, namely, every politician can claim to be in favor of tax cuts, but with the Democrats opposing “new tax cuts for the wealthy.”

If we were to drive over the cliff before trying to back up, one of the logistically cumbersome changes to undo involves the alternative minimum tax, since the changes here concern taxes owed on income earned in calendar year 2012. Business Week explains:

the number of households facing the alternative tax would increase to 32.9 million from 4.4 million, according to the Internal Revenue Service. That’s an average unanticipated tax increase of about $2,800.

The effect from the AMT, as the parallel tax is known, would be immediate in early 2013 because Congress hasn’t addressed the change for tax year 2012, and taxpayers start filing returns in January. A retroactive AMT change is much more cumbersome than retroactive changes in the 2013 income tax rates, which can be handled through paycheck-withholding adjustments, said Kenneth Kies, a Republican tax lobbyist in Washington.

Although discussions treat the “fiscal cliff” as a monolithic event, surely the outcome will be to break it up in pieces, with a likely consensus reached for another one-year extension of what Reuters describes as the “perennial patch” that exempts most Americans from the AMT. Indeed, Reuters reports:

the folks at Intuit Inc’s TurboTax unit are so sure the feds will eventually do that AMT patch, they are already programming their software as if it’s a done deal.

It should also be straightforward politically to reach a consensus on a one-year extension of the payroll tax cut. More complicated are the Bush tax cuts. Here’s a summary of what’s involved given by the Tax Foundation:

- The two “marriage penalty elimination” provisions will expire, so that:

- The standard deduction for married couples will fall, no longer double what it is for single filers; and

- The ceiling of the 15% bracket for married couples will fall, no longer double what it is for single filers

- The 10% tax bracket will expire, reverting to 15%

- The child tax credit will fall from $1,000 to $500

- The tax rate on long-term capital gains earned by middle- and upper-income people would rise from 15% to 20%

- The tax rate on qualified dividends earned by middle- and upper-income people would rise from 15% to ordinary wage tax rates

- The 25% tax rate would rise to 28%

- The 28% rate would rise to 31%

- The 33% rate would rise to 36%

- The 35% rate would rise to 39.6%

- The PEP and Pease provisions would be restored, rescinding from high-income people the value of some exemptions and deductions

The plan outlined in the Obama administration’s budget is to allow only one of those 12 provisions to revert exactly to what it was in early 2001:

- The top tax rate will revert from 35% to 39.6%

Then there are the automatic spending cuts set to take effect in January as a result of the Budget Control Act of 2012, which calls for a 9.4% cut in defense spending, 8.2% cuts in spending outside of defense and entitlements, and a 2% reduction in the amount health-care providers receive from Medicare– see the Center on Budget Policies and Priorities for details. In the third presidential debate, President Obama made the mysterious statement that

the sequester is not something that I’ve proposed. It is something that Congress has proposed. It will not happen.

What the President meant by that statement is unclear to many of us. But I would note that the “political framing” argument given above is a reason not to go over the cliff as far as the automatic spending cuts are concerned. Politicians on both sides will want to be on the record as voting for spending cuts, not increases, so finding a way to avoid the sequester, and later implement more modest versions of the cuts, might have some political advantages.

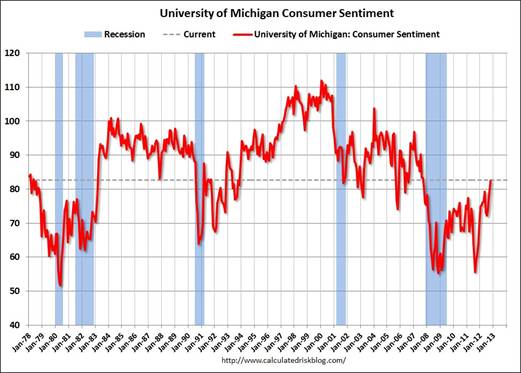

The most likely eventual outcome seems to me to be much more modest tax increases and spending cuts than implied by the full “fiscal cliff” scenario. A key question is then whether political brinksmanship, particularly the strategy of first going off the cliff before trying to find a way back up, could in and of itself exert significant costs. In my view the debt ceiling debacle last year did have a measurable effect on consumer sentiment and spending, though I don’t see any evidence of a replay of that so far in the most recent sentiment readings.

|

On the other hand, businesses, particularly those with a tie to defense spending, may be more anxious, and it is possible that recent weakness in business fixed investment is related to concerns about what’s going to happen to federal spending and taxes. Moreover, the anticipated wrangling may have already locked in a decline in defense spending between 2012:Q3 and 2013:Q1.

It also is worth commenting on the dividend cliff.

At the moment, the maximum tax rate on income from dividends is 15%. But under current law, in January we will see: (1) dividend earnings of high-income tax payers would come to be taxed at the regular income rate instead of the favored capital-gains rate, (2) the regular tax rate for upper-income households will rise from the current 35% to a new 39.6%; and (3) a 3.8% surtax will be added to dividend income of high-income investors. The combined effect of all three is that the maximum tax rate on dividends rises from a current value of 15% to a new value of 43.4%. That’s a sufficiently big change that I would not want to rule out the possibility of a significant effect on equity valuations or corporate governance.

I wouldn’t be so sure about extending the payroll tax cut.

It is significantly accelerating the bankruptcy of Social Security, and I think both sides see that the madness has to stop sooner rather than later.

It is quite amusing to hear conservatives who have spent the last four years saying that government spending doesn’t create jobs now saying that government spending cuts will destroy jobs.

Really, conservatives have demonstrated that they have nothing – zip, nada – to contribute to the conversation about the economy. They should be ignored.

I am a conservative with a money savings idea. What cha say about the US Congress only meeting for sixty days a year. No retirement benefits, no medical benefits, no cars, nothing for them. Then we will see who really wants to represent their constituents. All they receive is a small stipend, and a small per diem Amount for living expenses. We start with them, then we expand the cuts to all of government.

@Joseph – just because you can spot some idiots on one side of the aisle, doesn’t mean everyone on that side is an idiot. Also, it is worth noting that there are idiots on both sides of the aisle. And that they were all elected by what must be a much larger group of idiot constituents…

A couple months ago this plan to allow the country to go over the fiscal cliff for a few days and then rush through a “fix” in early January was one of the worst kept secrets around. But that was when Romney was given up for dead. Once his chances improved the GOP started to think that they might hold all of the cards come January 20th and talks kind of subsided. But now that it looks like Obama will win re-election and the Democrats will retain a slim majority in the Senate, this means Republicans will have to swallow hard on the top tax rate. So we’re back to where we were about 6 weeks ago. And of course there will be yet another debt crisis early next year unless a debt ceiling extension is part of the “fiscal cliff” negotiations.

The wisdom search of Jim is applicable to Europe where many government domestic bodies are duplicated within the European operating budget.

Many of the expenses are redundancies, the non elected parliament is the first one to be scrutinized,as clones of national domestic political families.

More tax and less spending. What’s the problem? This is exactly what’s needed … but I’m sure it won’t actually happen.

More on the dividend cliff – if past history is any guide, the effects upon the stock market and economy will see huge distortions.

Interestingly, the fiscal cliff is $2 tax increases for $1 of spending cuts. The Republicans should have taken the Democrats’ 10-to-1 offer.

With the fiscal cliff, we would certainly be back in recession. But we would be coming out of it on a sustainable basis. We might not have a present, but we’d be closer to having a future. We’d be pulling an Estonia. How have they been doing recently?

Joseph – Conservatives argue that government spending does not tend to create permanent jobs (just ask Big Bird, who would have been canceled decades ago if he’d had to compete in the marketplace).

However, spending does create GDP–it does create economic activity, which conservatives do not dispute. They dispute that it’s a good idea, because the expenditure tends to leave only debt in the long run. And, of course, GDP bizzarely does not account for debt accumulation (a good measure of the bankruptcy of economics, I might argue). A macroeconomist relying on traditional GDP accounting would think that Chesapeake Energy, which raised equity and borrowed tons of money to subsidize unprofitable gas drilling, was acting prudently.

And Jim – I agree that governance should not be confused with activity, which it usually is. The executive and legislature are much closer to a board of directors than CEO. Government is best at managing the framework of society, rather than being a player on the field. Assuming laws were well-structured and the economy static (ie, circumstances not changing), then ideally the executive and legislature would do best by not introducing any new legislation. But this is a hard concept to get across.

I very much, however, reject the notion that amateur, part time legislators are the best solution. Would you want a part time, amateur doctor or dentist? Then why would you want amateurs managing a $2 trillion budget. You objections are better directed at the matter of incentives than at tenure or expertise.

Professor,

You ignored the elephant in the room, tax increases on 90% of small to medium businesses in the form of increases on flow-through businesses. This will be devastating to employment a crash that will ripple through the entire economy.

Based on what President Obama has stated as his theory of growth and deficit reduction there is no reason to expect that if he is reelected tomorrow that he will not allow the us to drive head-long over the fiscal cliff and in all probabliity he will step on the accelerator.

Too much of the analysis is based on outdated political reasoning. President Obama has changed all of that by refusing to move his policies to the center even against overwhelming public disgust. High taxes, cuts in government spending on defense, increased regulation on businesses, with greater croney capitalism is his modus operandi.

Batten down the hatches, boys. We are in for a rough ride.

What I hear liberal politicians, think tanks and other officials talking about in relation to this is actually some kind of larger tax reform bill after the fiscal cliff that broadens the base while making the tax code more progressive, reducing loopholes and dropping the corporate rate down to 25%.

Obama hinted at some of this in the last debate.

RICARDO-

The only people that might not lose employment are personal trainers… I fail to understand how an increase in personal taxes on net distributed pre-tax profits from an S-corporation will affect employment at the business….

Ricardo, perhaps two elephants in the room:

http://online.wsj.com/article/SB10000872396390444772404577587310951310628.html

Scrolling through the recent Econbrowser post headlines is interesting. Passive aggressive political battle?

Bruce,

I agree! Especially with the recent revelations about the EPA plans if Obama wins a second term.

MarkS,

Do you know how taxes are reported for S-Corps? Do you understand how expansion and maintenance is funded in sn S-Corp?

Take a look at this paper that I posted earlier. It will help you understand what too many politicians just don’t get.

Here is an excerpt:

There is no fiscal cliff. A pure fantasy. The Bush tax cuts would be gone, who cares, they were contractionary and have helped boost commodity prices needlessly.

The “cuts” aren’t even that impressive on the DoD side. If the Democrats use the savings to fuel capital spending projects, what cuts?

Obama’s EPA rules are a non-factor.

Ricardo/Fred, you live the dreams a international society ruled by capital owners, my advice for you is to move away from that idea. It does not work.

“Increases in the cost of capital resulting from higher individual income tax rates was found to reduce the investment spending of entrepreneurs and the probability that they invested at all.”

That statement is so stupid that I have to wonder if an organization that calls itself S-corp.org is just running a con hoping no one will question their self-serving conclusions or if the “entrepreneurs” who respond to their polls are too dumb to actually run an S-corp because they don’t understand how their taxes are calculated.

S-corps are one of the greatest tax dodges ever invented. First, they are frequently used to convert earned income to dividends to avoid paying FICA taxes. Sort of the poor man’s version of the carried interest loophole.

Second, an S-corp can be used to reduce your income taxes to zero by simply choosing to invest in your company, either through capital equipment or hiring more employees.

So personal income taxes, quite contrary to the claim, increase the incentive to invest and expand the company. Investment and expansion of the business is the most effective way to reduce personal taxes for the owner of an S-corp. Higher taxes encourage higher investment.

I don’t think ending the Bush tax cuts should count as a negative. Most of the $180B would have gone to the wealthy and been saved, removed from the economy. With the cuts ended, that money would be spent instead. I’d consider it a stimulus and a major counterbalance to the other effects of the “fiscal cliff”.

Discussion about the negative impact of higher marginal indvidual rates on the incentive for unincorpated businesses to hire new employees gets a lot of attention because of the claims that “small business” accounts for most job growth.

However, I thought those results were largely discredited about 5-10 years ago when research demonstrated that the job growth was largely in the small establishments of large enterprises rather than small enterprises per se.

“since that’s not an outcome either party wants to see, my assumption has been that somehow Congress and the President will find a way to avoid it.”

Republicans: well, if the economy goes gangbusters now, we stand no chance in 2014 and 2016.

Democrats: well, republicans are never going to agree to this many tax increases at once, and spending on popular programs is easy to restore.

Wheeeeeeeeee

Going over the cliff might be necessary to enact defense spending cuts in any effect and meaningful way (a whole lot of legislative involvement would probably end in more poor cronyism based allocations).

With such high domestic private savings, what are we doing with such a huge trade deficit? The leakage through the foreign sector is very big. Before we fill that bucket, at a minimum, we should try to stop hundreds of $billions in currency purchases abroad annually.