Today, we are fortunate to have a guest contribution by Ambrogio Cesa-Bianchi and Alessandro Rebucci. It is based upon Does Easing Monetary Policy Increase Financial Instability?. The views expressed in this column are the authors’ and not necessarily those of the institutions with which they are affiliated.

From a historical perspective, monetary policy worldwide has been systematically accommodative for most of the past decade. From the “BIS Quarterly Review,” September 2012:

“Policy rates have on aggregate been below the levels implied by the Taylor rule for most of the period since the early 2000s in both advanced and emerging market economies.”

According to many economists, such loose monetary policy stance played a central role in exacerbating the severity of the global financial crisis of 2007-09. From “How Government Created the Financial Crisis,” by John Taylor, WSJ, February 9, 2009:

“Monetary excesses were the main cause of the boom. The Fed held its target interest rate, especially in 2003-2005, well below known monetary guidelines that say what good policy should be based on historical experience.”

In a recent paper (Cesa-Bianchi and Rebucci, 2013), we develop a simple theoretical model that speaks to the interaction between macroeconomic and financial stability. Our results show that Taylor’s argument—i.e., that higher interest rates would have reduced both the probability and the severity of the crisis—is valid only with the auxiliary assumption that the policy authority had just one instrument at its disposal (the policy rate) to address both macroeconomic and financial distortions in the economy. However, in the United States, institutional responsibility for financial stability is shared among a multiplicity of agencies (i.e., Office of the Comptroller of the Currency, Federal Reserve, Office of Thrift Supervision, Federal Deposit Insurance Corporation). What did other regulators of the U.S. financial system do to contain the housing boom and mortgage lending excesses between 2002 and 2007?

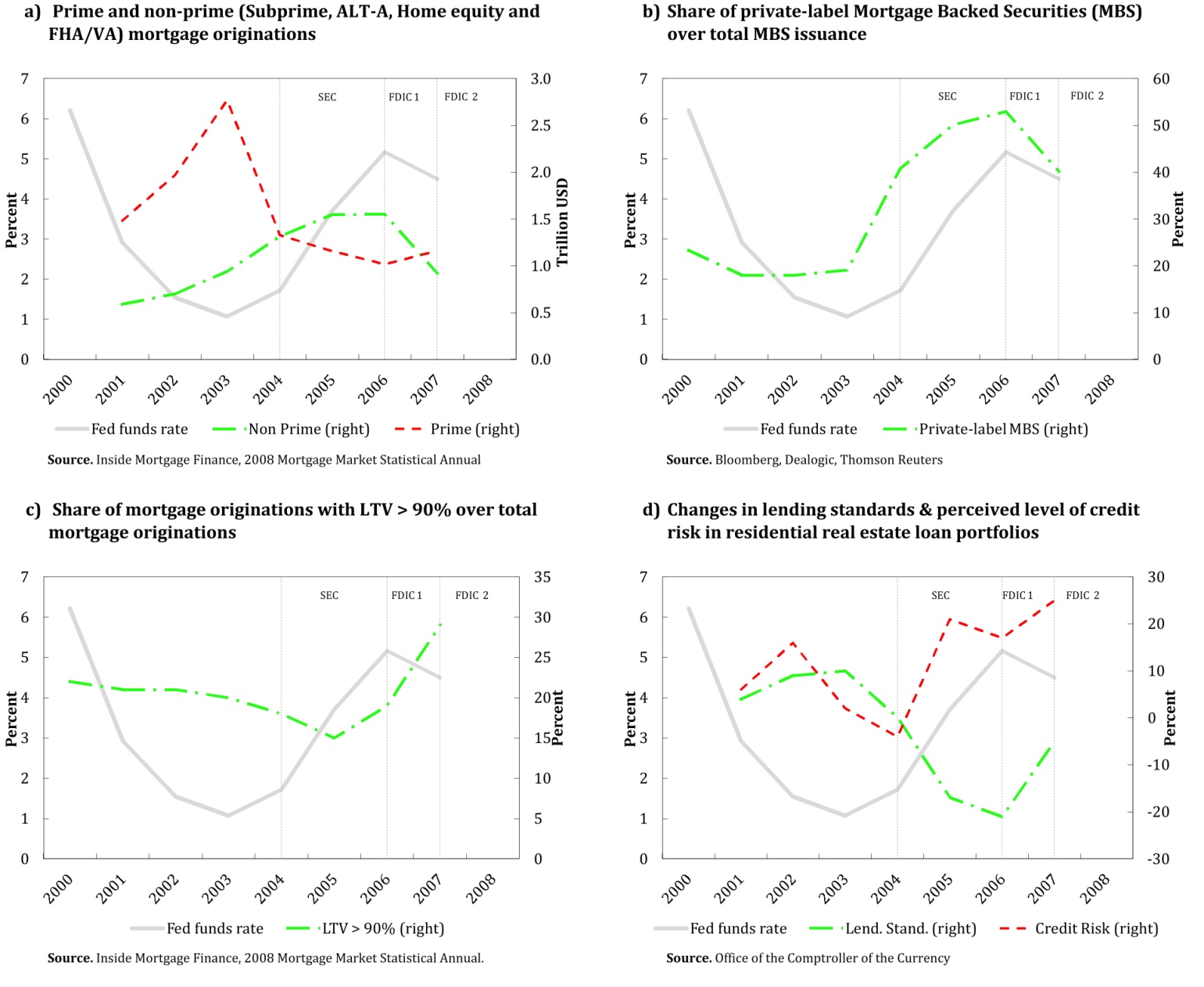

Figure 1 provides a picture of the evolution of the policy rate, the U.S. mortgage market, and regulatory policies on the mortgage market from 2000 to 2007. Broadly speaking, this evidence shows that, after the Fed started to tighten its monetary policy stance and the prime segment of the mortgage marketed promptly turned around, the subprime segment of the mortgage market continued to boom, with increased perceived risk of loans portfolios and declining lending standards. Despite this evidence, the first regulatory action to rein in those financial excesses was undertaken only in late 2006 (the vertical line labeled FDIC 1), after almost two years of steady increases in the federal funds rate.

In summary, in the context of our model and according to this evidence, regulatory rather than monetary policy failures are largely to blame for the occurrence and the severity of the Great Recession. Only by assuming that the Fed was the sole institutional guardian of financial stability, or at least the main one, is it possible to contend that monetary policy is to blame for the 2007-09 financial crisis and the ensuing Great Recession.

Figure 1. Monetary Policy, Regulatory Policy, and the Mortgage Market before the Global Financial Crisis

Are we heading for another financial crisis? The Fed is currently fighting an unemployment scare with extraordinary quantitative measures and a commitment to keep interest rates low for an extended period of time. Indeed, interest rates today are even lower than in the 2002-2005 period and have been low for a much longer period of time. However, and differently from the pre-crisis period, an important regulatory action has been undertaken in 2008 in order to address the subprime mortgage crisis (The Housing and Economic Recovery Act). So is monetary policy fuelling the next financial crisis, as some fear?

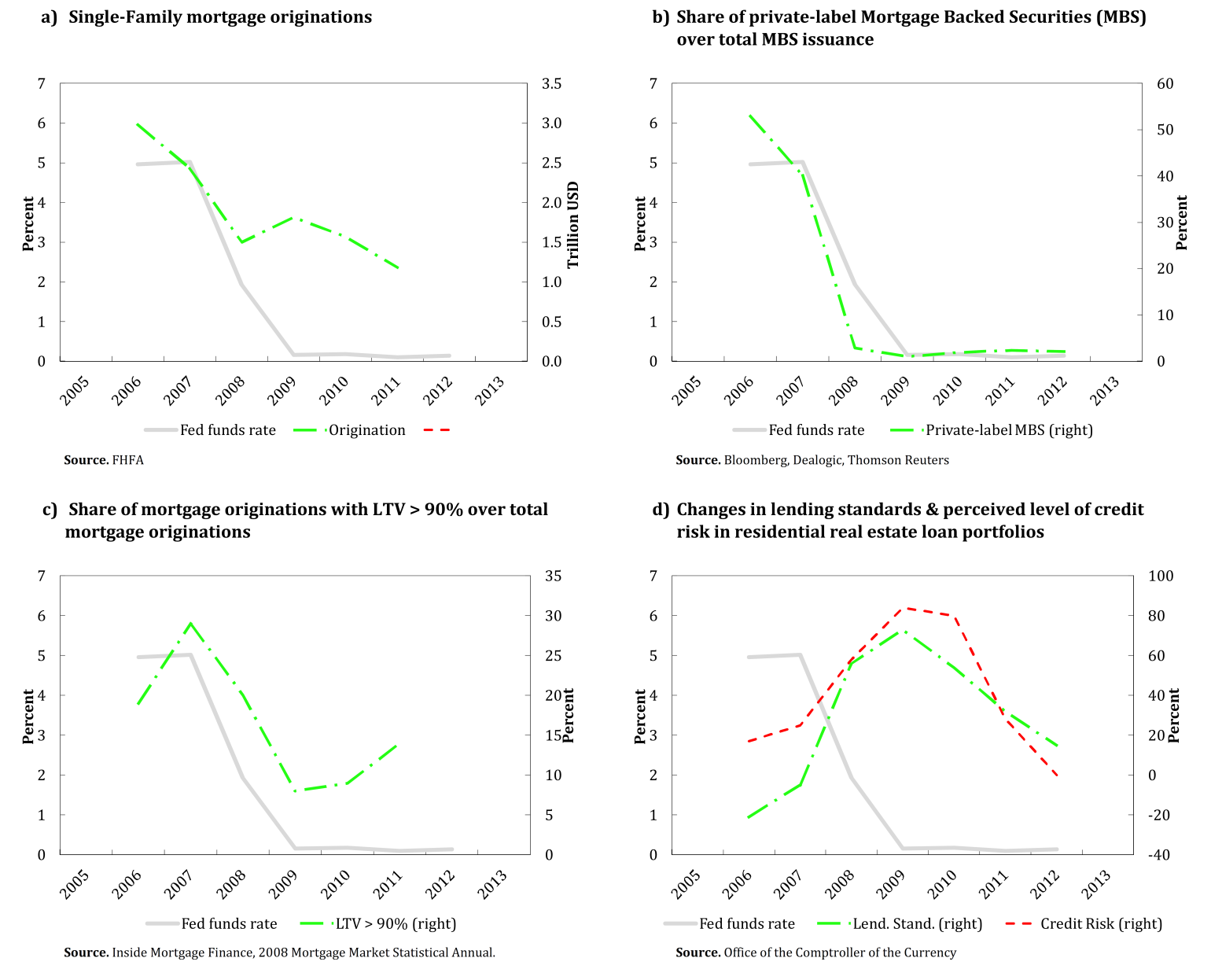

Figure 2 provides a picture of the behavior of monetary policy and the mortgage market as in Figure 1, but for the period after the financial crisis, from 2006 to 2012. Mortgage originations have steadily decreased since 2006 (Panel a). Moreover, and differently from the 2003-06 period, the share of private-label Mortgage Backed Securities (MBS) over total MBS issuance has decreased to almost zero (Panel b). The share of high-LTV ratio mortgages is slowly picking up from the very low levels achieved in 2009 (Panel c), but it is still well below the levels of 2007. Finally, the risk perceived by banks involved in residential lending is decreasing, while lending standards are easing from overly tight levels to more normal levels (Panel d). This evidence therefore shows that, despite historically low interest rates, current data are not sending alarming red signals regarding these markets.

Figure 2. Monetary Policy, Regulatory Policy, and the Mortgage Market after the Global Financial Crisis

Of course, the place where the last financial crisis occurred is a very poor predictor of where the next crisis will occur: financial imbalances might be growing in other parts of the U.S. economy (e.g., commercial real estate, corporate bonds, private equity) or outside the U.S. via exchange rate misalignments and excessive movements in commodities. Nonetheless, the lesson learned from the last crisis is one taught by many crises before: policymakers generally need as many instruments as objectives. It is not fair to blame the Great Recession only on the Fed’s monetary policy stance.

This post written by Ambrogio Cesa-Bianchi and Alessandro Rebucci.

No, the Fed is not breeding the next financial crisis; rather, the owners of the TBTE banks who also own the Fed are the ones creating the conditions for the largest and last financial crisis of rentier capitalism as we know it.

Look at the history of the past 40 years. Every decade or so the TBTE banksters blow up the US or international banking system by lending at 10%/year until they go broke and need a bailout, only to allow them to do it again.

All the rentier-oligarch banksters know how to do is increasingly lever up financial assets via all manner of complex digital financial shell games that eventually blow up their balance sheets, take down the economy, and necessitate massive gov’t borrowing and spending, pushing the gov’t ever closer to insolvency.

Not only are these state-sized, gov’t-sponsored hedge funds too big to exist, they are like virulent parasites who are too dangerous to exist (TDTE).

Shut them down = STD.

@Bruce Carman : Amen !

and the question remains : when the political elite, left or right, is hijacked by the TBTF (TBTE), what is the outcome ?

“when the political elite, left or right, is hijacked by the TBTF (TBTE), what is the outcome ?”

Johannes, further concentration of wealth, income, and political power to the top 0.01-0.1% rentier capitalist owners of the Anglo-American militarist-imperialist rentier corporate-state and “no representation without taxation (or wealth)” for the bottom 90%+ of society.

Historically, I don’t have to remind you that the kind of wealth and income inequality, no real GDP per capita growth, elite indifference and insensitivity to the masses, and increasing fiscal constraints and risk of insolvency are factors that preceeded revolutionary eras of the past, including the American, French, Russian, and Chinese revolutions of the past 100-240 years.

The Fed is an institution that runs political cover for the banksters and provides legitimacy for their license to steal. Putting faith in the Fed to print our way out of a once-in-a-lifetime debt-deflationary depression is like trusting Al Capone to safeguard your family jewels from a burgler.

Challenging the Fed is indirectly challenging the rentier criminal bankster syndicate and risks one losing more than one’s credibility, job, or livelihood. Therefore, I don’t expect eCONomists, politicians, and financial media influentials to take the risk to expose the criminal activity, even though Matt Taibbi has pushed his luck in recent years, and he’s still breathing.

The outcome is a bull market in tin foil hats.

Artifically raising interest rates like Taylor would want destroys investment. This is one of the problems with the 2004-6 tightening phase, it hurt other non-financial areas of the economy which were not going like the ones related to the RE sector.

Since GS had been abolished and that shoved alot of liquidity into the financial sector, the FED was going have to use “tools” that hit the financial sectors with RE alone. This is what Greenspan meant by “my world was blown away”. He never saw the financial sector overloading in one area.

Since we have had supply-side deflation since the 80’s, interest rates have been consistantly to high on the short side while regulatory constraints were repealed. This may be tough for some people to handle. It goes against their beliefs but something they need to understand in a general deflation environment.

Hence, monetary policy is to tight on investment and loose on finance. This has also lead toward nominal wages struggling to keep up with inflation as the number of jobs created has been cut down, outside the info boom/cheap oil years of the 90’s.

I continue to be frustrated that the Econobrowser has nothing to say about the financial derivative market, its privileged position in subordinating all other financial contracts via the “Financial Modernization Act” of 1999, and its ability to amplify “systemic risk”. I recommend that readers take a moment to read http://dealbook.nytimes.com/2009/10/07/dealbook-dialogue-lynn-stout/.

Bruce Carmen – “TBTE banksters blow up the US or international banking system by lending at 10%/year…”

Don’t you mean … by increasing their lending book by 10%/year…

Thanks for the comment, its right on track!

MarkS: Well, I don’t have anything to say right now, but here’s a paper to consider.

So, I like to think of this as three different problems (by analogy):

– the steam pressure wanting to enter the pipe

– the valve permitting entry into the pipe

– the strength of the pipe

Where did the money come from?

Clearly, large dollars balances were accumlating in China and in OPEC during this period. It’s Blame It on Beijing. That’s where the money came from. That’s the source of liquidity pressure.

How did it enter the US?

Liquidity infiltrated the US via low interest rates. This is where the Fed should have acted, but didn’t. Importantly, however, this liquidity would have found its way to other markets: the UK, Ireland, Iceland, Greece, etc. Even if the Fed sealed the US market, the problem would have migrated to other markets–which in fact it did anyway. Thus, the Fed is the gate valve to the economy, but not necessarily other economies.

What was the last line of defense?

Given that the Fed did not prevent low cost money from entering the economy, a blowup might yet have been prevented by stronger regulation and enforcement. For example, mortgage related regulations appeared stronger in Texas, in large part as a result of the S&L crisis there in the 1980s. The regulatory structure is then the pipe.

The problem with the regulatory structure is the same as that of the pipe: it’s only as good as its weakest point. To protect the system, the pipe must be strong almost universally. But let through a CDO, a derivative, a liar loan, and the system fails. In a complex economy like the US, it’s quite difficult to shut off all the points of failure, because these will appear, in part, as financial innovation.

In short, any analysis has to recognize a glut of liquidity looking for assets. The Fed did not cause this glut.

The Fed did, however, fail to close the gate valve; it did not protect the economy at the aggregate level. I would argue (indeed, have argued) this occurred because the Fed was not pyschologically prepared to counter asset bubbles in the absence of more generalized inflation. How would an (apparently) artificial recession in, say, 2006 have been received? Would the Fed Chairman have said, “Well, I know there’s no inflation, but I didn’t like the look of the Case-Shiller Index, so I thought we should engineer a pre-emptive recession.” Hard to do–but it would have been the right call.

However, given that the Fed failed to act, the expectation that regulation and enforcement would hold the line is naively optimistic. Demand will be hunting for yield (hence the willingness to purchase dodgy mortgages), the banks will be calling for lower reserve requirements, and financial innovation will be occuring at a rapid pace (SPACs, CDOs, CMOs, CLOs, CDSs, etc). The points of attack are too many to protect.

Thus, the Fed is ultimately the real line of defense. Once the money gets through that, the hope for universally air-tight regulation and enforcement across the board in a pro-cyclical environment is simply expecting too much. If the money makes its way through the central bank, it will find its way into the economy.

There is an old City of London joke. If you give bankers cheap money to play with, its like giving free beer to a drunkard.

You know the result; you just don’t know which piece of real estate will receive the outflow.

The answer to the title’s question is yes.

Unless and until the Federal Reserve takes its regulatory mandate seriously, which I think means until the people of this country demand that the government represent their interests again, the financiers will continue breeding crises. Financial trading can be distinguished from genuine investment activity, of which there is damned little nowadays. Financial trading is inherently zero sum, but the financiers demand a slice, so someone else must lose: they have to find victims. And they do that by persuading hordes of fools to follow them on financial follies, then privatizing the gains and socializing the losses.

For Mr. Rage, I respectfully disagree with your claim that “Artifically raising interest rates like Taylor would want destroys investment.”

Actually, higher interest rates would be beneficial for investment. Low rates, and especially low rates without meaningful financial regulation, enable scarce national resources to be wasted on low-return investments. Higher rates might lead to a reduction in overall apparent investment, but the investments being made would more likely be genuine investments with positive returns. Right now we’re just throwing away people’s lives with wasteful activities.

Unfortunately I think that to restore economic health we need to see a normalization of rates, a normalization of the regulatory environment, the end of fantasy financial accounting, a return to historically reasonable levels of corporate profits/GDP, deficits/GDP, total debt/GDP and labor wages/GDP, among other things… It’s a lot to fix, but until it gets fixed, we’re in a sick world.

I’m not heartened by the complete failure of our “elected” to address any of these in a meaningful way.

The Federal Reserve could do more to do its part.

“The Federal Reserve could do more to do its part.”

@Wisdom Seeker, what in bloody Hades is the Fed’s “part” other than to serve the owners of the private corporation known as the “Federal Reserve”, who in turn purchase “elected” officials to do their bidding?

By definition, you are seeking some “fix” to a “sick world” that has been created by the very banksters who buy the politicians and who direct the Fed to serve their interests, i.e., the banksters’ interests. How do you get the criminals to “fix” themselves to cure their “sickness”?

Can we PLEASE stop with the childish fantasy that the Fed is an agent of the greater social good and recognize once and for all that the Fed was created by the international criminal banking syndicate a century ago to run cover for the banksters’ license to steal?

When do those with with the intellectual capacity to discern, and institutional authority to do something about it, find the courage to call out the owners and operators of the criminal bankster syndicate and bring them to account?

Until the banksters are exiled, swing from the street lamp poles, and/or are summarily lined up against a wall and delivered a last meal of lead projectiles, nothing changes and they get a free pass to plunder mercilessly humanity.

Find a pair of male reproductive glands and bring it to the banksters where they will get the message, and I don’t mean the ballot box, blogs, academic Web sites, or the establishment media where the bankster-purchased gatekeepers sanitize and narrow the debate to marginalize substantive criticism and challenges to the legitimacy of the principals running the criminal bankster syndicate.

rEvolution is calling. Let’s get on with it already.

@BruceCarmen: Before calling for revolution, you should think carefully about the likely outcomes of violent political action. More often than not, revolution results in “reformers” swinging from the lamp posts, and a new set of oligarchs as bad as the last. “Meet the new boss … Same as the old boss.” Better to seek reform through nonviolent action. The alternative is too unpredictable.

Ho hum, the Fed’s not responsible. A half-dozen graphs to prove the point.. I think one chart is missing.

From July 2004 to July 2006 the Fed raised interest rates 13 times! The Fed took the Federal Funds rate from 1.25% to 5.25% in 24 months.

Folks, that is what killed the economy and set up the second depression.

Greenspan tried to play catch-up as he had over played his hand with cheap rates in his effort to “fix” the dot com bust.

Bernanke is doing the same thing today. He has stayed way to long at the QE party. The US will suffer again as he or (heaven help us) Janet Yellen attempts to unwind this mess..

I’ll wait five years for the authors to come back with why the Fed is not responsible for the disaster that is in the making.

I can’t understand how folks can look at what has happened, what is happening and what will surely follow, and conclude that the Fed is in no way responsible. Rubbish.

One may find comfort with the question itself « Is the Federal Reserve Breeding the Next Financial Crisis?”

Implicitly this question raises as an axiom, the contemporary crisis is solved. In all languages and countries a raging game, called the jeu de bonneteau, Kümmelblättchen Find the lady is prohibited. The Central banks ECB Federal own 6 Trillion USD assets that if redisplayed at the mercy of the private markets would trigger the existing underlying crisis. Are the Central Banks enough capitalised to meet with the potential losses.?

Is it monetary policy ?

When ruling Pr Taylor is confirming it is, through separate paper he will come to the same conclusion for the ECB monetary policy.

Economics one

More Monetary Policy Uncertainty

Is it regulatory ?

So many Banks in insolvency, so many rules, regulations constitutional agreements ,supervision bodies and an abnormal distribution of tails risks may lead to conclude that the operating financial world do not need those rules, those regulations.

A thorough examination may be needed before releasing to the employment market the all workforce populating these functions.

When chewing the ribs of a Tyrannosaur and before engraving the rocks of one’s cavern, consideration should be given to the above.

To my earlier point of whose funds are being confiscated in Cyprus:

http://www.zerohedge.com/news/2013-03-29/caught-cyprus-crossfire-small-businesses-suddenly-zero-cash

Bkrasting, that idea is called “ramping”. It is old but was tested in Japan, back when Michael Lewis et al were saying everyone in Tokyo is a millionaire. I could go through lots of details but the general idea is that all of society would work together to make everyone richer and that meant pushing problems aside and under the rug. The problem is the system is not complete, meaning it and its equations can’t be defined wholly within the boundaries and must be defined by reference to external context. What happened in Japan is external context screwed them so all the ramping – of stock prices, property prices, loan values, etc. – came to naught.

Same in true with the Fed. The cause in the US looks like the Fed but that is seen without reference to what was going in the rest of the world. We fit in that context.

Might be worth a Hamilton post:

http://www.zerohedge.com/news/2013-03-29/guest-post-why-mr-dijsselbloem-right-and-cyprus-template-eurozone

c.f. William M. Isaac and Richard M. Kovacevich at

http://www.americanbanker.com/bankthink/too-big-to-jail-symptomatic-of-whats-wrong-with-federal-oversight-1057879-1.html

Reiterating, the Fed is owned by the largest Fed member banks (TBTE) that in turn are owned by the top 0.01-0.1%, who are largely what one might describe as the Anglo-American, German, Dutch, Swiss, and Milanese Power Elite international banking cartel.

The Fed Chairman and fellow board members do virtually nothing without direction and approval of the TBTE banks and their owners, except perhaps decide what to have for lunch at the Fed cafeteria or the color of wallpaper in their offices.

FOMC policy “responds” to bankster requirements for reserves, not the converse.

The Fed has no ACTUAL mandate for full employment and “price stability” (LOL!!!), because they have no power to do so, and the evidence of the past 40-45 years proves in without a doubt. The equity, unreal estate, and commodities price booms and busts since the early 1970s is an open-and-shut indictment of the failure of the implied mandate for “price stability”, not to mention the inexorable decline in wages/GDP since the 1970s.

Then again, if the Fed’s mandate was for faciliating collapse in wages/GDP, unprecedented debt/GDP, Gilded Age-like wealth and income concentration to the top 1-10%, asset price bubbles, currency debasement, and periodic commodities booms and busts, gross public debt over 100% of GDP, then the Fedsters, i.e., banksters, have been a stunning success. You go, Fedsters!

The Fed’s ACTUAL mandate is the needs of its TBTE owners; all else is political cover and theater.

So, blaming the Fed or expecting the Fed’s bankster political hacks to perform some kind of economic miracle is akin to the belief in an itinerent rabbi returning from the dead after being executed by the Roman state as a subversive anti-establishment rabble-rouser dissident.

Place the responsibility and blame for the “Fed’s success” where it belongs: on the TBTE banks, their oligarchic bankster bosses, and, more importantly, the Anglo-American, German, Dutch, Swiss, and Milanese rentier owners of the supranational banks.

Otherwise, or irrespective, the oligarchic criminal bankster syndicate and their rentier masters will continue to exercise their state-sponsored license to steal from, and impose “austerity” on, the masses around the world, including directing politicians to confiscate depositors’ cash.

After all, the top 0.01-0.1% do in fact own everything via compounding interest claims or primary collaterlized claims against all debt-money in existence. The rest of us only borrow the debt-money at interest to circulate for subsistence, if we’re lucky.

So, in this sense, the banksters are not stealing, they’re just reclaiming what is their owners’ property before the borrowers of the debt-money abscond with the debt-money and squirrel it away in a coffee can, ouzo bottle, or mattress.

I query that China is to blame. China is the vehicle, but the multinationals are driving. They are the ones who sent manufacturing to China for the cheap labour, and dismantled the factories in the US and other nations.

Of course the Chinese got a cut, and now of course they have much more muscle after their cut has grown bigger and bigger.

But what about the obscene profits that the multis got as part of the outsourcing ? Where does that go ?

I’m waiting for the Protocols of the Elders of Zion to crop up.

Come on guys – what happened to just blaming George Bush?

Then there is the second Kennedy shooter. And genetically modified food. Microwave cancers. Expand your horizons.

It’s all about confiscation of wealth. There will be massive margin calls again, soon enough..

Recent events have shown that bank central planning of the economy does not work any better than past central planning experiments. Some day economic models may be advanced enough to centrally plan economies efficiently, but not yet.

For the nonce, we would be better off adopting Milton Friedman’s suggestion to run the central bank by computer. 2% per year, and let the free market set asset prices, interest rates, etc…

In a debt based monetary system you cannot solve a solvency crisis with liquidity. Therefore this monetary system ain’t go any further, it’s over. fiscal and monetary policy can postpone the inevitable, but cannot avoid it. Readers from the Netherlands are advised to visit:

http://www.economie-macht-maatschappij.com/index.html

Harvey

The multinationals park a healthy portion of their profits in offshore bank accounts. Eli Lilly, Facebook, Google, Microsoft, Oracle & Pfizer all use the same strategy. Check it out: http://en.wikipedia.org/wiki/Double_Irish_arrangement

The offshore cash can then be used to purchase assets – Stocks, Bonds, Property, Collectibles, and Politicians. The assets are not taxed until they are repatriated back into the USA. Be patient, the global elite will soon capture enough political power to get their repatriation tax holiday…. If, heaven forbid, the revolution comes, having the assets offshore can come in very handy. Besides, offshore cash can always be spent on your villa in Corfu, your apartment in Hong Kong or your travels outside the USA… Remember this: We’re in the age of the GLOBAL ELITE. The passport you use isn’t as important as where and how big your stash is.

I finally managed to look through the paper. The site wouldn’t respond for a while.

I was struck by how the discussion of these issue is made so much more difficult by the proliferation of “models”. I’m not even sure model is the best word for describing a regression analysis. Every paper has a model. A few, like this one, refer to other models but many don’t.

I wanted to like the paper because it fits my bias. If I had to assign a prior probability to liking, it would be high. I’m somewhat disappointed. Two reasons. First is I’m tired of reading model after model. I wish you could cite a few basic frameworks and then discuss how you build or alter those. It takes too much time to think through this stuff otherwise – and frankly, economics authors are as bad as any group at expressing themselves clearly. And they are particularly bad at something very important: they almost never discuss potential problems with their approach, just how they see problems in what others have done.

Second reason is I have trouble reading when the material becomes speculative. Whatever internal logic is in the model, economics authors, these included, do almost nothing to show why their model fits any other situation beyond what they modeled. This is a basic issue in statistics: are you modeling what you think you’re modeling and are you defining a set of circumstances which generate an internal logic that fits your regression? This really bothers me when a bunch of complex variables are used without doing more to unravel the causative relationships. There is a difference between math and meaning.

MarkS, Amen, brother.

Banks’ offshore non-transparent, unregulated (“self-regulated”) proprietary trading with capital levered 100:1 using global exchange-sponsored high-frequency trading (HFT) in overnight futures is the preferred method since ’09 to “manage” equity index futures, especially E-minis. The banks have created yet another MASSIVE leveraged financial bubble (like dot.com stocks, mortgage derivatives, and commodities futures) that will eventually blow up the global financial system and precipitate another crash; it’s what they do.

Harvey, regarding the Middle Kingdom and offshoring, note that the US and Japan have collectively invested $4 trillion in China since the early ’90s. China’s massive foreign exchange reserves are directly attributable to US FDI and the need for the PBoC to hold US$-denominated reserves against US supranational firms’ deposits in China that are not directly convertible. China’s economy is fatally dependent upon US FDI and its multiplier to fixed investment (~45% of GDP!!!), production, exports (25-30% of GDP!!!), and cumulatively about 70-75% of China’s GDP. Once US FDI begins to contract (any day now), there will be a “giant sucking sound” of capital out of China-Asia, including the Asian city-states and SE Asia, resulting in global trade plunging, US$ repatriation, as MarkS relates.

As little as a 1-1.5% decline in US FDI as a share of China’s GDP risks a Great Depression-like deflationary collapse in China, not coincidentally at the GDP per capita level of the “middle-income trap” and the similar level as the US before the onset of the deflationary Great Depression (the third one, in fact).

Westerners, Japanese, and Koreans should be exiting China . . . yesterday.

Breaking news! Bernanke comes clean:

charleshughsmith.blogspot.com/2013/03/bernanke-breaks-down-this-whole-thing.html

If only he (someone) would . . .

Bruce Carman: Not half as interesting as his “nonfiction” writing:

Who needs fiction when one can see this on the horizon imminently!

Seriously, this is what you read?

FED-policies like ZIRP and QE are the precursors of a final melt down. This debt based monetary system is at the end of it’s life cycle. The consolidated balance sheet of the banking sector has changed from a debt based money pump into a black hole absorbing all the outstanding credit. Fasten your seat belts. This will be a nasty deflationary mess. Mervyn King – governor of the Bank of England – was spot on when he said: “This is the most serious financial crisis since the nineteen thirties, if not ever”. They now the system is out of control, and it should be obvious to everybody with more than two brain cells. Keynesian crap will only delay the inevitable, causing the bounce of a dead cat against an enormous accelleration of public debt levels (US and the UK). This is a Minsky-moment, like the nineteen thirties. Debt levels are even higher as a % of GDP as they where back then. On top of that we have one quadrillion USD of derivatives, thanks to financial engineering. I love the euphemisms of our glorified financial sector.

http://www.economie-macht-maatschappij.com/index.html

Menzie, have you read David Hackett Fischer’s “The Great Wave”? Are you aware of Fischer’s “Price Equilibrium”, “Price Revolution”, and “Revolutionary Crisis”? If not, take a look.

Have you examined real GDP per capita and prices going back to the 16th and 17th centuries? Anything interesting to share?

Have you studied the constant-dollar price of oil since the 19th century and real GDP per capita? Any correlation?

Have you looked at US crude oil production per capita since the 1970s and industrial employment, private non-residential investment, and production per capita since then? Debt per capita since then? Real wages and after-tax purchasing power for the bottom 90% of households since? Financialization of the economy and society have anything to do with it? (Hint: The world now is where the US was in the mid- to late 1970s. Hint #2: Global industrialization, urbanization, and real GDP per capita growth are coming to an end.)

Have your looked at the 10-year change of US real GDP per capita? If so, do you see the similarity to the UK, Germany, and Holland in the 1830s-40s, 1880s-90s, 1930s-40s, and Japan since the ’90s? Any correlation with economic depressions, finanical panics, defaults, currency crises, wars, and revolutions and regime changes?

Have you looked at world food and energy prices since Peak Oil in ’05? Crude oil production per capita? Cereals production and supply rates per capita, especially wheat? Trend real GDP per capita? Anything to infer?

Have you looked at the ag production rates per capita versus net energy per capita and technological inputs over the past 40 years? Anything to share? What kind of progress are we making? Any cause for concern?

What are the differential rates of population and oil and food production and supply since ’05? Care to examine it? How long before population, consumption, and real GDP per capita (and gov’t receipts and spending) are inexorably constrainted by peak global crude oil production per capita, falling oil exports per capita, and contracting net oil exports per capita? (The price of cereals and fats/oils are growing at 12-13% and 9-10% per year since Peak Oil, or a compounding doubling time for prices of 5-8 years. Take a look at the share of the world’s population that spends 35-50% of income on food and cooking oil. Consider Chindia and SE Asia that spend 35% or more of income on food. With grain prices rising 12-13%/year and economies with consumer spending of 30-35% of GDP, incomes must rise a minimum of 4-5%/year, which implies a nominal GDP rate of 13%, i.e., a doubling time of 5-6 years!!! How likely is this with Peak Oil, unprecedented debt/GDP, fiscal constraints, and a population rate of 1.2% for 7 billion people?)

Ever look at what kind of growth rates occur subsequent to the levels of private and public debt we have today around the world? Keynesian prescriptions? Supply-side fixes? Monetarist remedies? Socialist solutions?

Any knowledge of the arguments for “The Limits to Growth” (LTG)? It’s been debunked, right? Wrong.

Do you acknowledge that there is a Long Wave for prices and real GDP per capita, including recurring sub-cycles and rhythms for births and population, interest rates, real estate and infrastructure, business investment and production, debt, and equity and real estate prices? If so, where are we in the Long Wave progression? What are the implications for the decade ahead? If not, oops! Time to do some homework.

You (or your grad students) could earn at least 2-3 more doctoral credentials given the material above.

emmrob, I could not have said it better. Debt has to be cleared. By definition, the top 1-10% of households hold/hoard 40-85% of the debt/assets/wealth as claims against virtually the entirety of wages, production, profits, and gov’t receipts in perpetuity. The top 1-10% have to take a 50% hit to financial wealth to clear the decks; they won’t, of course, choosing instead to direct the central bank to print bank profits and require the gov’t to impose “austerity” on the bottom 90% (as if they need another 40 years’ worth). The bottom 90% are the proverbial bloodless turnip, but the gov’t acting on behalf of the top 0.01-0.1% owners will mercilessly squeeze the turnip nonetheless.

@ Bruce Carman: Profs Chinn’s and Hamilton’s papers re the oil markets are probably a bit too technical for you, so here’s a non-technical summary of what’s been going on in the oil market.

http://openchannel.nbcnews.com/_news/2013/04/01/17519026-how-the-us-oil-gas-boom-could-shake-up-global-order?lite

We’ll wait while you catch up.

@markets.aurelius: Are you among the 99-99.9% who do not understand Peak Oil, net oil exports, EROI, and falling net energy per capita? Sorry, we’re 27-42 years too late to a US oil boom. Besides, total petroleum extraction and exports appear to be peaking for the cycle.

Crude oil (energy basis of modern civilization) extraction per capita in the US is down 45-55% since ’85 and ’70, coincident with the deindustrialization and hyper-financialization of the US economy, including an addition of more than $54 trillion in debt over the period, ~$175,000 per capita (5 times the average wage/salary) and 3 1/2 times GDP.

Adjust crude oil extraction for the level of debt-money (M2), and the per-capita value of oil extraction is down ~80% from the highs in the early ’80s and back to the level of the early ’70s and during the Great Depression. To return to the highs of crude extraction before the onset of inexorable deindustrialization, at the current rate of extraction since ’08 it would take 20-25 years and a discounted price of Brent in the $225-$275 range; it ain’t gonna happen, brother.

Moreover, the measure above is again contracting yoy, which historically is consistent with a recession and declining oil consumption and extraction.

Further, at $110 Brent and $95 Cushing, the US, EU, and Japan cannot abide profitable deep, tight, and tar oil extraction at these prices AND grow real GDP per capita AND service the MASSIVE debt/GDP. The lack of real GDP per capita growth will not permit continuing growth of oil sector investment, extraction, and profits hereafter; nor will it permit China to grow 13% nominal (doubling time of 5-6 years) and allegedly 7-8% real (probably more like 2-3%).

Finally, in terms of global crude oil extraction per capita, the world is now where the US was in the mid- to late ’70s, i.e., peak extraction and the onset of deindustrialization.

Sorry, it’s you who needs to catch up to the reality of the 42-year deindustrialization and financialization of the US and the resulting insufficient growth of real GDP per capita hereafter to sustain our material standard of living.

Now a similar process is 7-8 years along for the rest of the world, which most don’t see, or some cannot publicly admit. This precludes by definition China-Asia becoming an oil- and debt-based mass-consumer economy. China and India are 42-80+ years too late. China will grow old (demographically 6-7 years behind the US and 22-23 years behind Japan) before becoming rich.

Re: US & Global Crude Oil Production

US Oil Production

First, regarding US crude oil (actually crude + condensate, or C+C) production, an increase in production, to a level below a prior peak does not negate the prior peak; it is a reduction in the rate of decline, relative to the peak.

US C+C production hit a peak of 9.6 mbpd (million barrels per day) in 1970, and dropped to 8.1 mbpd in 1976 (EIA). Primarily because of Alaskan production coming on line, US C+C production rebounded, hitting 9.0 mbpd in 1985. Production then fell to 5.0 mbpd in 2008 (the decline was somewhat accelerated because of the 2005 Gulf Coast hurricanes). Production rebounded to 6.5 mbpd in 2012 (and to about 7.0 mbpd currently).

However, I suspect, and the EIA appears to concur, that the current rebound in US C+C production is likely to fall short of the 9.0 mbpd secondary peak that we saw in 1985, resulting in a tertiary peak in US C+C production. In other words, we are probably seeing a continuing “Undulatling Decline” in US C+C production.

Four Measurements of Oil Production

Second, There are four key definitions of “Oil Production.”

(1) Crude oil (less than 45 API gravity)

(2) Crude + Condensate (basically gasoline)

(3) Crude + Condensate + NGL’s (Natural Gas Liquids), AKA total petroleum liquids

(4) Crude + Condensate + NGL’s + Biofuels + Processing Gains, AKA total liquids

Unfortunately, it appears that no one tracks US and global crude oil production (defined as less than 45 API gravity crude). All we have is regional crude oil data, e.g., Texas Railroad Commission (RRC) and OPEC. But based on regional data, it appears quite likely that there was no material increase in global crude oil production from 2005 to 2012, despite a doubling in annual global crude oil prices. Even if we include condensate, I estimate that global Crude + Condensate production only increased from 73.8 mbpd in 2005 to about 75.5 mbpd in 2012 (a rate of increase of only 0.3%/year).

For purposes of this discussion, crude oil = oil with less than 45 Degrees API Gravity, and not crude + condensate (C+C).

Regarding crude oil volumes and prices versus total liquids volumes, it’s as if you ask your butcher what the price of beef is, and he gives you the price of steak. If you ask him how much beef he has sold today, he gives you the number of pounds of steak (crude oil), roast (condensate), ground beef (natural gas liquids) and pink slime* (biofuels) that he has sold.

*Pink slime is a highly processed ground beef product, made from beef scraps and treated with ammonia

Condensate and NGL’s (natural gas liquids, e.g., ethane, propane and butane) are byproducts of natural gas (NG) production, from both gas wells and from associated gas sources (NG produced along with oil). Condensate is basically natural gasoline, and it can easily be processed into finished gasoline, but it is not of much use in producing distillates, such as jet fuel and diesel.

Based on OPEC crude oil production data data and based on the high percentage of condensate production in many US shale plays, I suspect that virtually all of the post-2005 increase in global hydrocarbon liquids production (crude + condensate + NGL’s) comes from natural gas sources (as condensate + NGL’s).

As noted above, even if we count condensate, note that global C+C production was only up by about 2% in 2012, versus 2005, a rate of increase of about 0.3%/year.

Here is the question the Cornucopians don’t want to address: Why has a doubling in global crude oil prices, from $55 in 2005 to $111 or more in both 2011 and 2012, almost certainly not resulted in a material increase in global crude oil production?

I would argue that the post-2005 story has been one of higher prices causing (partial) substitution for crude oil (increased condensate, NGL’s and biofuels production), with probably no material increase in actual global crude oil production for seven straight years–even as the annual Brent price doubled from 2005 to 2011/2012.

Of course, there have been some efforts to substitute compressed and liquified natural gas for liquid fuels, but note that the EIA shows that US dry natural gas production has been virtually flat since April, 2011 Given the very high decline rates that we see in shale gas wells, there is a serious question as to whether the industry will be able to fully reverse a NG production decline and bring NG production back to prior levels, given that the underlying decline rates from existing wells are so much higher now than at the start of the shale gas boom.

Global Net Exports of oil

Third, we have seen a material post-2005 decline in Global Net Exports of oil (GNE), which I define as combined net oil exports from the (2005) top 33 net oil exporters (BP + EIA data, total petroleum liquids).

In my opinion, increased production of the liquid substitutes only made an incremental difference, and not a material difference, in the global net export market, as the developing countries, led by China, consumed an increasing share of a declining post-2005 volume of Global Net Exports of oil.

Summary

So, in summary Brent doubled from $55 in 2005 to $111 in 2011 and $112 in 2012. In response, globally, regarding liquids production, we saw:

(1) Increased condensate, NGL’s and biofuels production, all less than ideal substitutes for crude oil.

(2) Probably flat global crude oil production.

(3) Declining Global Net Exports (GNE), with developing countries consuming an increasing share of GNE.

For more information on the outlook for Global Net Exports, you can search for: Export Capacity Index, a very long and detailed analysis of the global export market.

Brilliant as usual, Jeffrey. If you adjust your figures per capita, the recent decline rates, global production levels, and cumulative decline from the peak indicate conditions that are even weaker.

http://www.fao.org/worldfoodsituation/wfs-home/en/

http://www.fao.org/worldfoodsituation/wfs-home/csdb/en/

The global per-capita Peak Oil conditions not coincidentally affect global food prices, production, and supplies, most importantly the rate and level of cereal/wheat production and supplies per capita that are on a precarious plateau.

Specifically, since ’08, global cereal production has fallen 4% per capita (supply up 0.5%). Wheat production is down 7-8% per capita (supply down 1.6%).

However, rice production is up 1.8% per capita (supply up 7-8%).

http://www.spiegel.de/international/world/limits-to-growth-author-dennis-meadows-says-that-crisis-is-approaching-a-871570.html

http://tinyurl.com/c5a88ue

Therefore, Peak Oil and decline per capita implies peak food production (as anticipated by the LTG projections) and decline per capita and the predictable outcomes, including peak and decline of population growth; economic decline; social unrest; attempts at mass population migration across borders; racial/ethnic/relgious conflict and violence; failed states; and increasing incidents of resource wars and a last-man-standing contest for the remaining vital resources of the finite planet.

Central banks have next to no power to mitigate the larger global structural effects of population/ecological overshoot and thermodynamics/exergetics. In fact, central banks serving primarily their bankster owners interests ensures maintaining increasing compounding interest claims to labor, production, profits, and gov’t receipts in addition to increasing costs of food, energy, and transport.

Here is a post I did on The Oil Drum on the disconnect between the booming economies in the oil and food producing areas in the US, versus the overall economy, especially in the non-food and/or fuel producing areas:

http://www.theoildrum.com/node/9921#comment-954944

@Jeffrey: “[T]he problem I foresee is that the food & fuel producers can’t support the entire economy, and I would expect to see increasing levels of resentment against the food & fuel producers, especially given high gasoline prices. But whatever happens, in my opinion it is better to be a net food and energy producer (or the indirect beneficiary of net food & energy producers), rather than a net food and energy consumer.”

Precisely. Not only can the food & fuel producers not support the entire economy, they are a net cost to US real GDP per capita, especially with the existing public and private debt and debt service costs to wages, profits, gov’t receipts, and GDP that were a fraction of today’s level the last time the two sectors boomed in the 1970s.

Note also that rising US petroleum exports are going primarily to support US supranational firms’ subsidiaries’ and contract production abroad, as well as to supply the imperial US military. So, rising energy prices are being driven by US firms’ investment in China-Asia, resulting in increasing demand for energy, food, and materials, the incremental costs of which hit the bottom 90% of US households without much, if any, net benefit in terms of wages, employment, or growth of purchasing power.