Chairman Bernanke says it all

From a speech today by Fed Chair Ben Bernanke, at the LSE:

…modern research on the Depression, beginning with the seminal 1985 paper by Barry Eichengreen and Jeffrey Sachs, has changed our view of the effects of the abandonment of the gold standard.6 Although it is true that leaving the gold standard and the resulting currency depreciation conferred a temporary competitive advantage in some cases, modern research shows that the primary benefit of leaving gold was that it freed countries to use appropriately expansionary monetary policies. By 1935 or 1936, when essentially all major countries had left the gold standard and exchange rates were market-determined, the net trade effects of the changes in currency values were certainly small. Yet the global economy as a whole was much stronger than it had been in 1931. The reason was that, in shedding the strait jacket of the gold standard, each country became free to use monetary policy in a way that was more commensurate with achieving full employment at home. Moreover, and critically, countries also benefited from stronger growth in trading partners that purchased their exports. In sharp contrast to the tariff wars, monetary reflation in the 1930s was a positive-sum exercise, whose benefits came mainly from higher domestic demand in all countries, not from trade diversion arising from changes in exchange rates.

The lessons for the present are clear. Today most advanced industrial economies remain, to varying extents, in the grip of slow recoveries from the Great Recession. With inflation generally contained, central banks in these countries are providing accommodative monetary policies to support growth. Do these policies constitute competitive devaluations? To the contrary, because monetary policy is accommodative in the great majority of advanced industrial economies, one would not expect large and persistent changes in the configuration of exchange rates among these countries. The benefits of monetary accommodation in the advanced economies are not created in any significant way by changes in exchange rates; they come instead from the support for domestic aggregate demand in each country or region. Moreover, because stronger growth in each economy confers beneficial spillovers to trading partners, these policies are not “beggar-thy-neighbor” but rather are positive-sum, “enrich-thy-neighbor” actions.

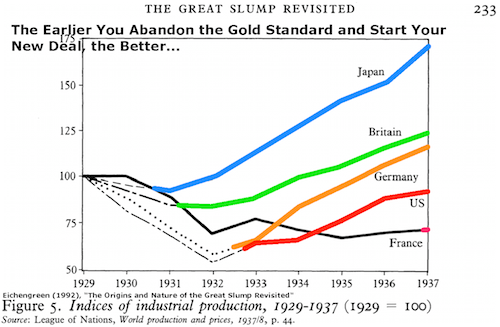

Just to remind people how poorly fixed exchange rates served the world economy in the Great Depression, I reprise Eichengreen’s famous depiction of comparative economic performance:

Figure 5 from Eichengreen (1992).

I agree with Bernanke’s view that these unconventional monetary policy actions are likely to be positive sum, although I might place a little more emphasis on expenditure switching effects. In my view, even if central banks are happy to see their currencies depreciate, this might end up leading to a positive outcome. This is despite the fact that the net outcome will be more or less unchanged exchange rates (against at least a set of countries) [1]. Reflation would imply a higher price level, and as I have pointed out (with Jeffry Frieden, and with Joshua Aizenman), this will have a salutary effect on economies currently experiencing persistent and large output gaps — namely a lessening of real debt loads, and a relaxation of credit constraints. In fact, expectations of inflation are now heightened slightly (i.e., although not to Paul Ryan levels!). From Deutsche Bank:

Source: Hooper, Mayer, and Spencer, “Staying the Course on a Sea of Central Bank Liquidity,” World Outlook (Deutsche Bank, 22 March 2013) [not online].

As I’ve noted before, we don’t need an acceleration of inflation in all countries. Exactly because the world economy has been experiencing a two speed recovery (fast in emerging markets, slow or none in advanced), the benefits of inflation vary by region. So more rapid inflation is necessary in the US, Euro area, and particularly Japan. Moreover, my point about exchange rates does not apply to all countries: for the same reasons, we would want emerging market economy rates to appreciate, while those of the advanced economies to depreciation. To some extent, this is happening (although the Euro area rate is going the wrong direction right now).

Figure 1: Log real trade weighted value of US (blue), UK (red), Euro area (green), Japan (purple), and China (orange), all normalized to 2010=0. Broad indices. Source: BIS.

Japan’s exchange rate has fallen substantially, as discussed here. The UK’s has decreased recently, which is good, given the complete and utter absence of the promised expansionary fiscal contraction effect. In contrast, China’s currency has gained substantial value. Nonetheless, much more adjustment of exchange rates is necessary, primarily against the emerging market economy currencies.

Summing Up

As indicated at the beginning, I can’t improve on Bernanke’s conclusion to his speech:

In sum, the advanced industrial economies are currently pursuing appropriately expansionary policies to help support recovery and price stability in their own countries. As the modern literature on the Great Depression demonstrates, these policies confer net benefits on the world economy as a whole and should not be confused with zero- or negative-sum policies of trade diversion. In fact, the simultaneous use by several countries of accommodative policy can be mutually reinforcing to the benefit of all.

My only remark would be that in the advanced economies, but in the Euro area in particular, such expansionary measures should be pursued with even greater aggressiveness.

Some thoughts:

– From the perspective of the southern tier, is not the Euro a begger-thy-neighbor policy. Greece, a poorly run country and a Euro zone member, has a 26% unemployment rate. Hungary, a poorly run EU, but not Euro zone, member, has an unemployment rate of 11%. Thus, Euro zone membership is costing the weaker countries something like an incremental 10-12% unemployment rate. Would it not be rational to leave this system, if we believe Bernanke?

– The Euro zone finance ministers have now stared into the abyss. We’ll have to see how the depositors respond. Very few people have more than $100,000 in cash, and can easily spread a greater sum over a number of other banks. But for businesses, $100,000 is a small amount. If you have half a dozen employees, you’ll need more working capital than that. How will they respond to insured limits?

– If depositors now start moving their accounts around to stay under the insurance limit, how can they be ‘bailed in’ in the future? Does then a depositor ‘bail in’ in, say Spain, then require an abrogation of insurance limits? Or is this policy option then effectively off the table?

– If bailing in is off the table, then what are your policy options? Do we continue the fiction that a country can reach debt of 140% or more of GDP and still be considered solvent? Isn’t this merely a means of pushing the problem forward?

– Alternatively, have we reached the point where we should more actively consider monetizing the debt? Is this not where the story is heading? Monetizing with conditionality would be a way of spreading the pain across the Euro zone. Is it pretty? No. Is it the most feasible option? It would increasingly appear so.

– How then do we enforce conditionality? As you know, I remain dismayed that the economics profession is entirely unwilling, mentally incapable, of discussing performance-based compensation. But where we have seen it implemented, it has worked. And both theory and private sector practice make clear that it would work in the public sphere as well. So enforcing conditionality is not a problem for lack of tools, but for the narrow mindset of the economics profession.

To my previous comment, from Upstream Online:

Oslo-listed rig contractor Prospector Offshore Drilling could be facing a seven-figure loss on its deposit at a Cyprus bank as a result of the international bailout deal agreed with the crisis-hit Mediterranean island state.

Prospector currently has around $8.1 million (€6.3 million) in an account at Laiki Bank that is set to be wound up under the eleventh hour deal reached on Monday whereby Cyprus will receive a €10 billion ($12.8 billion) rescue package from the EU and International Monetary Fund.

Cyprus has agreed to a restructuring of its stricken banking sector, as well as other measures such as tax rises and privatisations, as a condition of the bailout.

Let us recall few of Econbrowser posts on

Competitive currencies devaluation

Econbrowser Back of the Envelope Estimates of Chinese Trade Elasticities

« I was unable to obtain a reasonable estimate of a price elasticity for Chinese imports. This result might be in part due to inappropriate aggregation of ordinary and processing imports, but I think that is only part of the story, since in Cheung et al. (2010), we are unable to obtain sensible price elasticities even after disaggregation«

« In words, holding all else constant, a 10% appreciation of the trade weighted real value of the yuan will induce a 7.5% reduction in Chinese exports. To get a feeling for the quantities involved, Chinese nominal exports in the 2009Q3-10Q4 period were $1.385 trillion. A 7.5% reduction of this amount is $104 billion »

Worth adding

« Estimates in Cheung et al. suggest that the impact of a CNY revaluation on the US-China trade deficit will be larger if the other currencies remain fixed «

On reflation

Nothing against the rentier class, nothing against good deserved capital gains on papers holdings such as sovereign bonds, but for the sake of economic productivity it is worth taking note.

Econbrowser “Wealth Inequality: A Time Series Plot”

Evidence from the Forbes 400 richest Americans suggests that only the super–rich have experienced significant gains relative to the average over the last decade. Our results are consistent with the decreased importance of capital incomes at the top of the income distribution documented by Piketty and Saez (2003), and suggest that the rentier class of the early century is not yet reconstituted. The paper proposes several tentative explanations to account for the facts.

As long as one has the right vocabulary, the economies may « leap forward » in a two speed world and discard productivity,effisciency and strustural issues

Here we go again, via Zero Hedge:

Full Reuters article:

The European Parliament will demand that big savers take losses if their banks run into trouble, a senior lawmaker told Reuters, adding momentum to a policy unveiled as part of a Cypriot bailout.

Although some policymakers have sought to portray Cyprus and the losses suffered by depositors at two of its banks as a one-off, many experts believe it marks a dramatic change in tack in how Europe deals with troubled banks, to spare taxpayers who have been on the hook for previous bailouts.

Jeroen Dijsselbloem, head of the Eurogroup of euro zone finance ministers, said on Monday that in future, the currency bloc should first ask banks to recapitalise themselves, then look to shareholders and bondholders and then “if necessary” to uninsured deposit holders.

Now the likelihood is rising that tough treatment of big depositors will be written into a new EU law, making losses for large savers a permanent feature of future banking crises.

“You need to be able to do the bail-in as well with deposits,” said Gunnar Hokmark, an influential member of the European Parliament, who is leading negotiations with EU countries to finalise a law for winding up problem banks.

The European Parliament has an equal say alongside EU countries when deciding who must bear the brunt of future bank failures such as those now being seen on Cyprus.

“Deposits below 100,000 euros are protected … deposits above 100,000 euros are not protected and shall be treated as part of the capital that can be bailed in,” Hokmark told Reuters, adding that he was confident a majority of his peers in the parliament backed this line.

The law, which will also introduce means to impose losses on bondholders, is due to take effect at the start of 2015. Germany wants provisions for bailing in bondholders and others in the same year, though that may be delayed.

The European Commission wrote the first draft of the law but left it to member countries and the parliament to decide whether and when savers should face losses, when a failing bank is being salvaged or shuttered. Earlier on Tuesday, it said only that such a step was possible.

Hokmark urged savers to check their banks’ health before taking the risk of depositing money.

“If you put your money in Royal Bank of Scotland … or Deutsche Bank, depending on how that bank is working you are taking a risk,” he said. “You need to be aware that you are taking a risk.

“I want us to legislate in a way that makes investors aware of the risk,” said Hokmark, adding that savers should be asking whether their bank is solvent. “The bail-in instrument is creating thousands and thousands of supervisory authorities.”

Cypriot President Nicos Anastasiades agreed in a last-ditch deal to close down the second-largest bank, Cyprus Popular, and inflict heavy losses on big depositors, many of them Russian, after Cyprus’s financial sector ran into trouble when investments in Greece went sour.

“The markets may be shocked but some principles have to be laid down,” said one EU official, speaking on condition of anonymity, adding that it would be “unfair” for the new EU law to take a different approach to that used in Cyprus.

*****

To add some of my own commentary:

The EU goal here is to make bank deposits “information sensitive”, to use Gorton’s terminology. Or to put it another way, the European Parliament has announced open season on bank runs.

Steven

Not such an outraging outcome, add the inter Banks loans and the central banks loans and one may see the rebirth of a true capitalist system A bank failure will expose the all system to its level of incompetence public, private and corporate.

John Law after the demise of the compagnie des Indes, was searched everywhere in Paris when he found a shelter in Italy.

Towards an accountability of incompetence

I’m all for capitalism, and I do understand the need to recognize losses.

However, I did read Gorton, and I do find him compelling. Having “information insensitive” securities like demand deposits is a huge achievement for a society. Without them, life is much harder. Do you know how solvent or liquid your bank is? I don’t–and I bank with BoA.

Bank runs can be hugely destructive events, just as the collapse of Lehman showed (that being a shadow bank run). The EU has now created the climate for uncontrolled bank runs in Europe by enshring the principle that uninsured savers may be expropriated.

And there’s more. How do insured depositors react to confiscation of uninsured deposits? If you take away, say, 30% of the banks deposits which are uninsured, is the rest of the bank viable? Or does such a move imply a wholesale run on the bank? Do depositors differentiate between insured and uninsured deposits for purposes of a bank run? Our dinner table survey suggested they do not. Thus, the notion that only uninsured savings will be seized does not necessarily preclude a full scale bank run which includes insured depositors.

Finally, seizing uninsured deposits may disproportionately affect businesses. For example, in Spain, what percent of bank deposits over $100,000 are business accounts? 40%? 60%? 80%? So if you seize uninsured accounts, you may be defacto bankrupting your business sector. Has anyone checked the composition of those uninsured accounts? We know in Cyprus that seizing uninsured deposits have taken down the Greek Orthodox church and a couple of offshore drilling companies. What other damage is this causing? Has anyone actually checked?

Indeed, do the EU finance ministers know what they’re doing at all? Apparently, the Dutch finance minister does not.

Isn’t it odd to see the Fed Chair reacting to public commentary. I assume he’s doing that because there has been so much talk-talk about currency wars and the like. From my perspective, being uninterested in the nattering of economists to each other – no offense intended; we all natter – we worry publicly now about everything we can imagine. Did you know the Large Hadron Collider would great a black hole that will suck up the earth? Lots of trees died to talk about that idiotic idea. (That is, unless it happened and we don’t know it yet.) But to get on point, not long ago, the Fed was more Delphic: you had to approach with an offering and you might get a cryptic utterance in return. And now Ben is saying go, Japan, go. Weird.

I type this sitting in a coffee bar where the tables are decorated with old newspapers. The one I’m at is 12/3/1963 and the headline is FBI Assassination Report Finds Oswald Acted Alone. To the kids on either side, that is as near to them as Edison and the light bulb. That has relevance to my point: we worried a lot about what would happen if the Fed said more. And now? And if they stop talking? We’ll worry about that and life will go on. That is unless the Large Hadron Collider creates a black hole that sucks us into oblivion. Which might not be a bad thing.

“Oslo-listed rig contractor Prospector Offshore Drilling could be facing a seven-figure loss on its deposit at a Cyprus bank as a result of the international bailout deal agreed with the crisis-hit Mediterranean island state.

Why is an Oslo company, not even a member of the eurozone, keeping its money in a Cyprus bank? Two possibilities are tax avoidance and higher interest rates.

Higher rates imply higher risk. If they hadn’t gotten greedy and kept their money in a Norwegian bank or even a German bank, they would have been fine. Companies that make poor investment decisions should go out of business. Isn’t that what free marketers preach?

Bernanke wrote:

Moreover, because stronger growth in eadch economy confers beneficial spillovers to tradin gpartners, these policies are not “begger-thy-neighbor” but rather are positive-sum “enrich-thy-neighbor.”

Since the whole theory behind weakening currencies creating prosperity is to increase exports and decrease imports, by definition then the country with the stronger currency must experience a decrease in its exports and an increase in its imports. That being the case, could someone give me the mechinism Bernanke is referring to?

Menzie,

You demonstrate your unwillingness to believe reality when you persist in posting Eichengreen’s 1992 assertion “The earlier you abandon the gold standard and start your new deal, the better…” Even Eichengreen has modified his views on this.

Now it makes sense that if a country scams other countries by exchanging their currency for gold and then refuses to honor their currency, that the theft would for a period of time enrich the country that steals while empoverishing the country scammed. It would be the same as if I stole your identity and took all the money you have in the bank. I would be richer and you would be poorer. So those countries who bought into the gold-exchange standard and were holding pound-sterling when the UK refused to honor their currency were made poorer.

But Eichengreen’s analysis is weak concerning countries that were not scammed because they did not have massive pound holdings. For example Germany went off of gold in July-August 1931 but the UK did not go off until September 1931. Look at the chart for Germany v UK. Then Japan went off of the gold standard in December 1931 after the UK. Once again refer to the chart. Japan had a booming economy (probably because they dodged the UK scam).

The actual order of leaving the gold standard is Germany, Britain, Japan, the United States, and France. So only the United States and France are actually in the right order.

Why is the focus on the time after countries left the gold standard? Look at the graph. France and Japan were the last countries to enter the Great Depression. France did not begin to experience its industrial decline until after the UK stripped almost 40% of the wealth out of its pound holdings through devaluation. Who would deny that if France had followed through on forcing the UK into honoring its commitments in the mid-1920s to exchange its gold for the pound holdings of France that the UK would have had a massive decline in its industrial production.

The whole argument is based on fiction.

“Reflation would imply a higher price level, and as I have pointed out (with Jeffry Frieden, and with Joshua Aizenman), this will have a salutary effect on economies currently experiencing persistent and large output gaps — namely a lessening of real debt loads, and a relaxation of credit constraints.”

If (in no particular order), the US depreciates, then Europe depreciates, then Japan deprcies, at first glance they seem to be back where they began with no one gaining on the export/import front. But remember these are depression-like conditions with interest rates at the ZLB. When currencies depreciate debt loads shrink and there’s a transfer from creditors to debtors. As debts are paid down, demand will be added to the global economy as a whole. This won’t be inflationary because of the output gap and slow growth in the global economy.

As Bernanke says of the 30s and Eichengreen/Sachs ” The reason was that, in shedding the strait jacket of the gold standard, each country became free to use monetary policy in a way that was more commensurate with achieving full employment at home. Moreover, and critically, countries also benefited from stronger growth in trading partners that purchased their exports. In sharp contrast to the tariff wars, monetary reflation in the 1930s was a positive-sum exercise, whose benefits came mainly from higher domestic demand in all countries, not from trade diversion arising from changes in exchange rates.”

One final question, if abandoning the gold standard brought prosperity what happend to Germany when it abandoned the gold standard in 1914?

I’m not an expert in this, Joseph, but as I understand it, Cyprus had dual tax treaties with many countries. A drilling company will do work in many jurisdictions, so Cyprus may have been a convenient place to be as a tax domicile.

As for companies being unable to judge the creditworthiness of their banks, that’s exactly the point. You should be able to put money in any bank without worry that you can later withdraw it. That’s Gorton’s entire point about information insensitive securities. Read “Slapped by the Invisible Hand” or “Misunderstanding Financial Crises”. These were seminal in my understanding of banking crises.

Well there you go Steven. Too many investors let the tax avoidance tail wag the dog, making poor investment decisions.

Anyone dumb enough to put all their money in Iceland or Cyprus because interest rates were too low in the UK or Germany deserves what they get. Everyone knows that higher returns require higher risk — there shouldn’t be any mystery about creditworthiness. People who think they can get higher returns without risk, because of an implied bailout, create moral hazard. They invest irresponsibly because they expect corporate welfare from the government.

If you are advocating unlimited bailouts of depositors, then you are going to have to require very, very, very strict regulation of bank activities. Meanwhile, banks are spending over a billion dollars a year on lobbying to eviscerate even the mild reforms of Dodd-Frank and Basel.

“it freed countries to use appropriately expansionary monetary policies.”

To say nothing of the moral fiber provided by honest weights and measures.

Well, Joseph, a Cyprus-like scenario could easily happen in Spain or Italy. Are you suggesting then, that business people should pack up and leave these countries? Is that your proposed solution? Do you know which of the banks in these countries will fail?

As for regulation. Let’s see now. Ah, yes, the wild, crazy Cypriots invested in…in Greek government bonds. The same bonds of which we were assured that “the EU would never let a member state default.” You recall all sorts of pundits telling us that? How the EU, the Euro zone, were rock solid?

So what is it that you want to regulate? To make sure that banks never again have a free hand to invest in sovereign debt? You think maybe US banks should be prohibited from lending to the US government? Is that your solution? Or do you think everyone should stop lending to Italy and Spain?

Kopits:”The same bonds of which we were assured that “the EU would never let a member state default.” You recall all sorts of pundits telling us that?”

You conservatives crack me up. You rely on pundits for investment advice! Seriously? Pundits? You put your money in a risky investment because some pundit told you it was okay? You are like small children whose excuse is that everyone else was doing it. Whatever happened to personal responsibility which conservatives are forever lecturing everyone about.

It’s hilarious to hear conservatives beg for corporate welfare while at the same time saying there’s no money for social security. Conservatives seem to have an enormous sense of entitlement. When you talk about entitlement reform, there’s a good place to start. Lack of personal responsibility and a sense of entitlement to taxpayer handouts. This is Mitt Romney world turned on its head.

Alright, Joseph. You’ve convinced me. Bank deposits and government debt are risky investments.

Steven Kopits: Under Basel III, a nonzero risk weight will sometimes be attributed to government debt. In traditional money and banking textbooks, bank deposits are incredibly risky in the absence of deposit insurance (and deposits in the euro area in excess of 100,000 are not insured). I find reading a money and banking textbook very useful in thinking these matters through. I recommend Mishkin, or Hubbard-O’Brien, or Cecchetti-Schoenholtz.

There are two considerations regarding uninsured deposits worth keeping in mind:

1. If uninsured depositors run on a bank, do we know that insured depositors won’t? Might not insured depositors also assume that the bank will fail and therefore hurry to get their money out? Personally, I am not convinced that depositors differentiate between the seizure of insured versus uninsured deposits with respect to a bank run.

2. Exactly whose deposits are uninsured? Let’s take Baltimore, a city of 2 million that I know pretty well. How many people there have liquid deposits of more than $100,000 that they couldn’t split up between a few banks, ie, how many have, say, more than $500,000 in cash? Maybe a few hundred to a few thousand people.

Now, how many businesses in Baltimore have more than $100,000 in cash? Well, pretty much all the strip and shopping mall stores, the churches, the schools, the police, the fire department, municipal services, auto dealers, the phone company, the electric company, most law offices, most doctors offices, most dentists offices, most landlords, most convenience stores, most gas stations, most auto dealers, the newspaper, and thousands of other small businesses. So if you swept the cash balances in banks over $100,000, the ratio of businesses to individuals affected would be on the order to 90:10 to 99:1. In other words, seizing uninsured deposits would be the functional equivalent of a cash sweep of the business sector. You think that would go well?

So I think we should aggressively disabuse overselves of the notion that seizing uninsured deposits is cost-free to the economy or that it mostly affects “those rich people”. Mostly, it’s the working capital and retained earnings of your business community.

Menzie –

Yes, I used to teach corporate lending in Hungary. So I’ve sat in on credit committees and listened to senior bank management discuss the risks associated with making residential loans in Hungary in Swiss francs, for example. I led the privatization of the Post Bank in Hungary and had the opportunity to witness the run on that bank in real time. So I know something about the matter.

I am well aware of the riskiness of deposits. The point I have been making is that terminating deposit insurance at any level is very risky: depositors may not distinguish between insured and uninsured deposits for purposes of a bank run.

To me, Gorton is the last word on the matter.

Menzie,

“Under Basel III, a nonzero risk weight will sometimes be attributed to government debt.”

Basel III will NEVER be implemented. Europe can’t afford to recapitalize its banks to that level.

Steven Kopits: One can’t insure everything. And what we do insure, one has to mitigate the moral hazard problems that arise as a consequence of the guarantees, either explicit or implicit. So there should have been much greater regulation of the Cypriot banking system.

Anonymous (7:16AM): There’s a difference between what will be, and what should be.

Even The Economist is backing away from ‘Global Warming’ alarmism :

http://www.economist.com/news/science-and-technology/21574461-climate-may-be-heating-up-less-response-greenhouse-gas-emissions

Wow – they have lost even The Economist.

Very few bitter clingers still remain. For these holdouts, Prof. Mark J. Perry (an Economics professor) correctly points out that Global Warming is a religious doctrine, rather than a scientifically backed observation.

I mean, most things ‘environmentalists’ do actually harm the environment, rather than help it (blocking the Keystone pipeline to ensure that the oil is instead exported to Asia, among others).