One of the things that mystifies me is a branch of the asset pricing literature which models exchange rates as a function of a “factor” or “factors”. It’s not that I don’t think they make sense, statistically; it’s that my mind wants to know what those “factors” are.

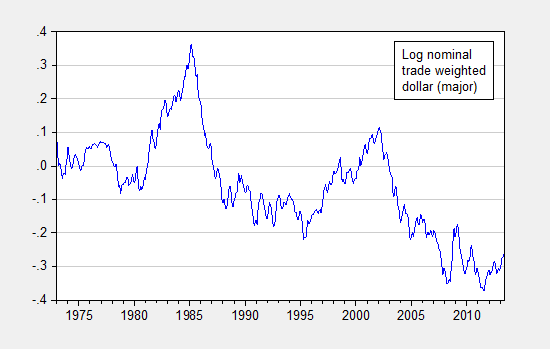

Figure 1: Log nominal trade weighted value of the dollar against basket of major currencies. Source: Federal Reserve Board.

In an interesting paper by Adrian Verdelhan (MIT) entitled The Share of Systematic Variation in Bilateral Exchange Rates, he writes:

Regressions of changes in individual exchange rates on lagged or contemporaneous interest rate

differences or other contemporaneous changes in macroeconomic variables at monthly, quarterly,

and annual frequencies deliver very low R2s. Contemporaneous industrial production growth and

inflation rates, for example, lead to essentially zero adjusted R2s on monthly series over the 1983-2010

period for developed countries. As a result, each individual exchange rate movement seems

mostly idiosyncratic.

In this paper, to the contrary, I report that two variables — the carry and the dollar factors —

account for a substantial share of individual exchange rate time-series in developed countries, as

well as in emerging and developing countries with

floating exchange rates. All exchange rates are

defined with respect to the U.S. dollar, and the carry and the dollar factors are constructed from

portfolios of currencies. The carry factor corresponds to the change in exchange rates between

baskets of high and low interest rate currencies, while the dollar factor corresponds to the average

change in the exchange rate between the U.S. dollar and all other currencies. I regress changes in

exchange rates on the carry factor, the same carry factor multiplied by the country-specific interest

rate difference (the latter is referred to as “conditional carry”), and the dollar factor. The change

in bilateral exchange rate on the left-hand side of these regressions is measured between t and

t+1; on the right-hand side, the carry and dollar factors correspond to changes between t and t+1

too, while the domestic and foreign interest rates are known at date t. Importantly, the carry and

dollar factors do not include the bilateral exchange rate that is the dependent variable.

The factor regressions offer a novel picture of bilateral exchange rate movements. Each factor

raises the adjusted R2s of the usual macroeconomic regressions by an order of magnitude. With the

carry factors, the adjusted R2s range from 0% to 23%. With the addition of the dollar factor, R2s

increase further: as an example, the factor regression for the U.S. dollar / U.K. pound exchange

rate has an R2 of 51%. Crucially, the factor regressions uncover large differences in the shares of

systematic variation: R2s range from 19% to 91% in developed countries and from 10% to 75%

among developing countries with

floating currencies.

Greater description of the two factors follows:

The risk-based interpretation of the carry factor is well known. Previous research on currency

portfolios shows that the carry factor accounts for the cross-section of currency excess returns

sorted by interest rates: covariances of the carry factor with currency returns align with the cross-

section of average excess returns (cf. Lustig, Roussanov, and Verdelhan, 2011). A consistent result

appears here on individual currencies: the higher the interest rate, the larger the loading on the

carry risk factor. This is the risk-based explanation of the classic currency carry trade.

This paper shows that, similarly, the dollar factor has a risk-based interpretation. Portfolios

of countries sorted by interest rates do not allow for a signi

cant estimation of the dollar risk

because all portfolios load in the same way on this factor. Instead, I build portfolios of countries

sorted by their time-varying exposures to the dollar factor (i.e., dollar betas). The low dollar-beta

portfolio offers an average log excess return of just 0.4% per year for investors who go long foreign

currencies when the average forward discount (average foreign minus U.S. interest rates) is positive

and short otherwise. The high dollar-beta portfolio o

ers an average log excess return of 7.6% for

similar investments. After transaction costs, the high dollar-beta portfolio still returns 6.3% on

average, implying a large Sharpe ratio of almost 0.6 over the last 30 years. Conditioning on the

average forward discount, covariances of the dollar factor with portfolio returns account for this

new cross-section of average excess returns, while covariances with the carry factor do not. As a

result, the carry and dollar factors are two, largely independent, risk factors.

There are quite interesting findings. The fact that two factors can explain so much of the variation in bilateral rates is fascinating.

The findings that a dollar factor is important highlights the fact that the dollar is (and remains) special.

(It does raise the question whether non-US-dollar based bilateral rates might be similarly well-explained; the pattern that shows up in the dollar in Figure 1 is quite unique).

Morever, I don’t doubt that the results are robust to a variety of alterations to specifications

(as suggested by the various robustness checks in the paper).

The question I have is how to interpret the factors in the context of those things old-fashioned macro types like obsess about —

incomes, monetary policy, and so forth.

The discussant, Nelson Mark (Notre Dame), observed that it is possible to interpret the “factors” as third country effects that arise from asymmetries in either monetary policy or in the degree of price stickiness.

Greater detail on this argument is in his presentation. A bit more detail in his paper with Berg, “Third-Country Effects on the Exchange Rate” (2012).

From the conclusion:

The low explanatory power of empirical exchange rate models has long been an awkward presence for

many elegant macro-based theories. This empirical work typically takes its guidance from exchange

rate theory, which itself is usually written down in a two-country setting. Hence, the empirical research

has mostly been conducted on a bilateral basis. That is, macroeconomic variables from a specific pair

of countries are investigated to explain their bilateral exchange rate. However, the data are generated

in a multi-country environment, and it is possible that innovations arising from some other country,

beyond the pair under consideration, will have effects on their exchange rate. If this is the case, then

there is an omitted variables problem in exchange rate regressions that condition only on bilateral

country variables, and incorporating third-country variables into empirical specifications should result

in improved explanatory power.

In this paper, we characterize the exchange rate disconnect puzzle by the low adjusted R2 in short horizon

exchange rate prediction regressions that are popular in the literature. We find merit, both

theoretically and empirically, in the idea that third-country omitted variables are at least partly responsible

for the puzzle. In the theoretical work, using a three-country DSGE exchange rate model,

third country shocks are shown to have relatively large effects on bilateral exchange rates. Additionally,

including third-country variables raise adjusted R2 in these regressions. The model also provides (at

least) one theory for recent econometric findings that common factors explain a large proportion of bilateral

exchange rate variation. In the empirical work, using data for twelve countries, we find empirical

support for the model’s predictions.

Our analysis makes measurable progress towards resolving the disconnect puzzle, but is not a complete solution (we do not obtain adjusted R2 values near 1).

…

Another paper at the NBER Summer Institute include The US Dollar Safety Premium,

by Matteo Maggiori (NYU). From the abstract:

I show that the US dollar earns a safety premium versus a basket of foreign currencies

and that this premium is particularly high in times of global financial stress. These

findings support the view that the dollar acts as the reserve currency for the

international monetary system and that it is a natural safe haven in times of crisis,

when a global

flight to quality toward the reserve currency takes place. During such

episodes, investors are willing to earn negative expected returns as compensation

for holding safe dollars. I estimate the time varying dollar safety premium by using

instrumental variable techniques to condition information down.

An earlier examination of the dollar risk premium by Adrian, Etula and Groen (NY Fed, Goldman Sachs, NY Fed) is discussed here. In this case, the premium is linked to balance sheet variables as well as macro fundamentals.

This chapter lays out how I think about exchange rates. Here is Charles Engel’s discussion of what a risk premium needs to look like in order to explain the forward rate bias and the tendency for high interest rate currencies to appreciate.

So, the ratio in the price of Earl Grey tea and Folgers coffee can be decomposed into the carry factor (the price ratio of tea to coffee), and the the Earl Grey Factor is idiosyncratic movements of the price of Earl Grey relative to everything else (or just tea). I’d imagine the Folger’s factor could help a brother out in this situation.

Mildly interesting, although the suprise, if anything, should be how little the R-squared’s rise, and the author might tamp down on the comparison to regressing fundamentals on exchange rates.