The preliminary results from the BIS triennial survey for 2013 are out. There are a lot of interesting results, but one I want to flag is that the Chinese yuan is increasingly used in forex transactions.

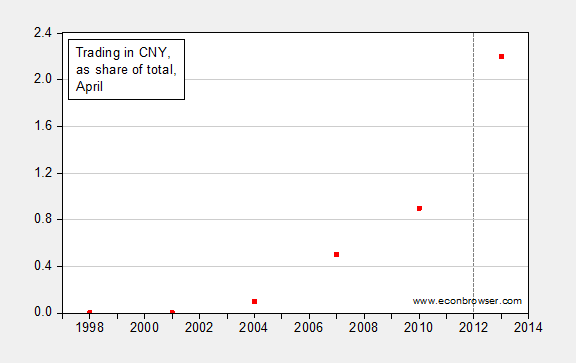

Figure 1: Share of total foreign exchange transactions accounted for by CNY, in percent, April 2013 (out of 200%). Source: BIS, Table 2. Dashed line indicates break in coverage of offshore centers between 2010 and 2013 (coverage is more complete in 2013).

The Chinese government has been quite aggressive in increasing the use of the Chinese currency, as noted in this post. It’s important to note the axis on the figure; the CNY has risen to 2% of total trading, so is still not a major player, despite big movements (it displaced the Swedish krona which was ranked 9th in 2010).

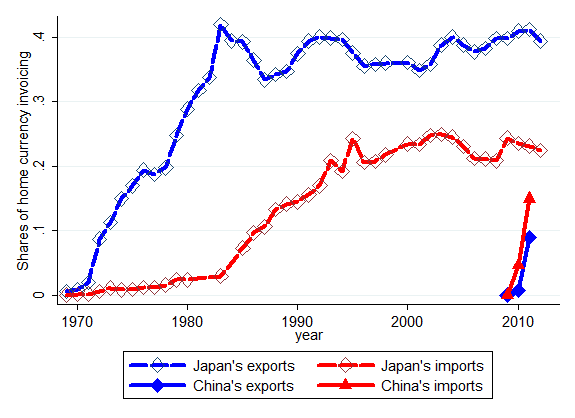

Hence, the yuan is far from becoming a reserve currency [1] [2], but there are other dimensions of an international currency that the CNY could fulfill. One of these is use as an invoicing currency, and here, the CNY has made rapid progress.

In a study conducted by myself and Hiro Ito (revision soon to be put online, current version here), we document the rise in CNY invoicing for Chinese exports and imports, and compare against JPY invoicing for Japanese exports and imports.

Figure 5 from Ito and Chinn, “The Rise of the “Redback” and China’s Capital Account Liberalization: An Empirical Analysis on the Determinants of Invoicing Currencies,” Paper prepared for ADBI workshop “Currency Internationalization: Lessons for the RMB,” Tokyo, August 8, 2013.

In the study, we employ a panel time series analysis to predict invoicing, and conclude that 2010 levels of CNY invoicing of exports are below model-predicted levels, suggesting further increases in home currency invoicing are plausible.

Congrats, Professor Chinn, as this thread has made it to Herr Thoma website!

http://economistsview.typepad.com/

Menzie wrote:

The Chinese government has been quite aggressive in increasing the use of the Chinese currency…

The use of the RMB in international trade has risen from 17th in 2010 to 9th in 2013. There is no country in the world that knows how to increase its currency use or most would. The use of a currency in international trade is dependent on its stability. Why was the Swiss franc the bench mark in the 1970s? It was the last currency to leave gold and its stability made it the currency against which all others were measured.

Granted the RMB is still only 2% of trades but it is increasing in use while the dollar is declining. Australia is now trading with China in RMB.

The Chinese are in no hurry to become the world’s reserve currency. They understand that the status must be deserved. This debate is very serious when we consider who might be our next FED Chair. Has any name been floated that would lead the world community to believe the dollar would become the most stable currency once again?

A reserve currency is not created over night, but as the UK discovered from 1920-1931, it can be destroyed in a very few years with bad monetary policy.

Some of the invoicing in RMB in external trade are those with related parties in Hong Kong. So, a Chinese exporter may sell merchandize to its Hong Kong subsidiary and invoice in RMB, but the subsidiary continues to sell to end customers in other currencies.

This has NOTHING to do with China hoarding gold over the last two years at the expense of US Treasuries.

-Lord Keynes.

Here is an article on the RMB-Aussie Dollar trade that began in April 2013.

With the rejection of the Progressives and the election of a liberal government in Australia the Asian trading block will become even stronger. The Aussies also elected their first libertarian Senator, David Leyonhjelm.

Menzie, I meant to thank you for this post earlier. This issue is more important than most understand.

To get the full impact of the increase in use of the Chinese RMB in international trade look at the graph in this WSJ article. Note that both the Australian and New Zealand dollars are also becoming significantly more popular with traders.

http://online.wsj.com/article/SB10001424127887323623304579056704113253902.html

The link to the WSJ article.

“With the rejection of the Progressives and the election of a liberal government”

wut?

“The Chinese are in no hurry to become the world’s reserve currency. They understand that the status must be deserved.”

wut