I attended a conference this weekend on lessons from the financial crisis for monetary policy. Among many interesting presentations, Federal Reserve Bank of San Francisco President John Williams provided updated estimates on the effectiveness of large-scale asset purchases and forward guidance.

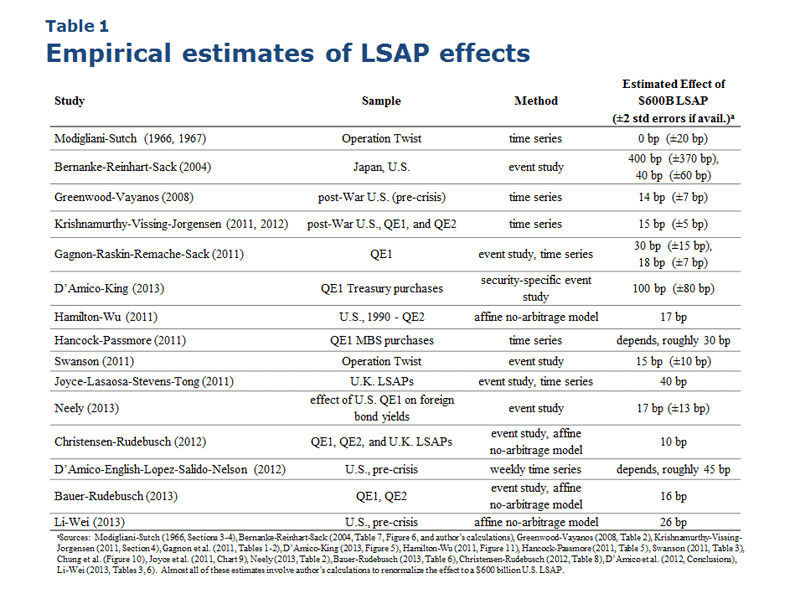

President Williams’s analysis included a survey of academic studies of what effects the Fed’s large-scale asset purchases seem to have had. The table below summarizes estimates that have been arrived at using a number of alternative data sets and methodologies for what we could expect to be the consequences for the 10-year Treasury rate of an additional $600 billion in Fed purchases. The estimates vary and are characterized by considerable uncertainty, but most studies would predict a 15- to 25-basis-point decline in the 10-year yield.

|

The hot debate among Fed watchers– when will the Fed announce a “tapering” of its large-scale purchases– concerns a change in the stock of Treasuries and mortgage-backed securities that the Fed ends up holding that comes to only a fraction of that $600 B reference point. For example, I noted earlier that if the Fed had (as some market observers once anticipated) announced at its September FOMC meeting that it would begin to reduce its net purchases of Treasury securities by $2.5 B per month beginning in October, the result as of the end of 2014 would be that the Fed would be holding about $100 B less in Treasury securities by the end of 2014 than if it waits to begin tapering until January. Using the above table as a guide, that suggests a difference of perhaps 2.5-5 basis points (that is, less than 0.05 percentage points difference in the annual yield) on a 10-year Treasury. Even if you double or triple that by adding in the consequences of MBS purchases, it’s hard to see this as the #1 news event with which financial markets should be gripped.

The real question is not when will the Fed begin to reduce the rate at which it purchases Treasury securities, but instead should be, when will the Fed first raise the interest rate paid on reserves? That, rather than a change in large-scale asset purchases, is the key date to be watching for.

The once-in-history Fed printing, i.e., QEternity, was directed by the TBTE banks to liquefy their balance sheets, not to “stimulate” the economy. Bernanke and Yellen should come clean about this ASAP.

However, the banks still have “reported” charge-offs and delinquencies equivalent to 5% of loans and 2.8% of bank assets, which is $375B or 2.2% of GDP and ~6.2% of private wages.

Add net interest on the US public debt to bank charge-offs and delinquencies, and the TBTE primary dealer banks will continue to direct the Fed to print at least the sum of same indefinitely.

http://research.stlouisfed.org/fredgraph.png?g=ny1

These charge-offs and delinquencies are historically quite high and no doubt the reason bank loans are no higher than in ’08 (as is real GDP per capita), whereas yoy growth of real bank loans per capita are at the recessionary tipping point of 0%.

http://research.stlouisfed.org/fredgraph.png?g=ny3

Moreover, total bank deposits less bank cash assets have been plunging yoy since Aug. and are at the same rate as the onset of the Lehman takedown and subsequent financial market wipeout.

http://research.stlouisfed.org/fredgraph.png?g=nya

Finally, the change from a year ago of banks’ net margin less charge-offs and delinquencies is again exceeding the change from a year ago of nominal GDP, which is historically a recessionary condition, implying that banks’ take of total output is occurring at the expense of the rest of the economy. No kidding.

“Somethin’s happenin’ here; what it is ain’t exactly clear.”

What is clear, however, is that growth of real after-tax wages for the bottom 90%+ of households after debt service is recessionary. $100-$110 oil, higher payroll taxes, and the net effects of Obamacare, i.e., medical insurers’ tax, will exacerbate the weak and deteriorating purchasing power of labor indefinitely hereafter.

Bruce,

“The once-in-history Fed printing, i.e., QEternity, was directed by the TBTE banks to liquefy their balance sheets, not to ‘stimulate’ the economy. Bernanke and Yellen should come clean about this ASAP.”

Rofl. Yes, because primary dealers love being obligated to provide Treasury securities to the Federal Reserve in return for… reserves. Which, by the way, cannot exit the banking system. If you want to argue that this increases government deposits at banking institutions, fine. But from that perspective it’s just an asset swap. Not really the big deal a lot of folks make it out to be.

http://www.voxeu.org/article/exit-path-implications-collateral-chains

Mr. Chan,

Imho, it’d be more interesting to see the impact, mechanics, and rates of the proposed RRP facility. I believe the trial of the program ends in January 2014.

Best Regards.

James,

The table presents results in terms of changes in interest rates. Do any of the studies actually try to estimate the effect of the LSAPs on actual economic activity such as employment or GDP? That is the more interesting question to me.

The interest rate estimates might be muddied up if the LSAP’s expected income effect offsets to some extent its liquidity effect. In other words, if the LSAPs improved the economic outlook that would raise expected short-term rates and put upward pressure on long-term yields. This would offset the downward pressure LSAPs created by lowering the term premium. If so, then the LSAP’s effect on the economy may not be fully apparent by looking their effect on yields.

Using a conditional VAR forecast, I made an preliminary attempt to see the effect of the LSAPs on economic measures other than interest rates. It would be fun to develop this more, but I figure someone has already done it:

http://macromarketmusings.blogspot.com/2013/10/what-george-bailey-can-teach-us-about-qe.html

David: Here are a couple of efforts: Chung, et. al. (2011) and Wu and Xia (2013).

David: “Rofl. Yes, because primary dealers love being obligated to provide Treasury securities to the Federal Reserve in return for… reserves. Which, by the way, cannot exit the banking system. If you want to argue that this increases government deposits at banking institutions, fine. But from that perspective it’s just an asset swap. Not really the big deal a lot of folks make it out to be.”

Yes, all the printing and swapping to liquefy the insolvent balance sheets of the TBTE banks is/was circulating between the Fed, primary dealers, and the Treasury at no velocity to net growth of bank loans, deposits, and flows to private economic activity.

Reserve inflation is not resulting in runaway price inflation the gold bugs have been predicting because bank lending is moribund (apart from lending to buy back stocks and derivatives to pump up equity index futures) because 90% of households’ real incomes after tax and debt service are not growing or are contracting; therefore, they have no capacity to assume increasing debt to income, despite Japan- and Great Depression-like interest rates.

Moreover, the flattening yield curve in real terms against the 5% bank charge-offs and delinquencies against bank loans is a further persistent constraint on growth of bank lending, deposits, M2+, wages, price inflation, and real GDP per capita.

The only game in town for the TBTE banks is to swap MBS and Treasuries with the no-cost Fed cash and use Treasury holdings to lever up equity index futures until the system implodes. Who is the counterparties netting bilaterally the derivatives? Hint: The four largest TBTE banks are “unilaterally” netting their collective leveraged positions against capital that now makes pre-’08 CDOs look like amateur hour. When the system implodes, which it mathematically must, the Almighty won’t have enough money, fiat digital debt-money book entry credits or no, to cover the wipeout.

Yet, economists and the financial media influentials will claim that no one saw it coming, or that no one could possibly know what the risks were. Well, they don’t want to know because they’re not being paid to know, which means that they are not the ones to be listening to now or after the once-in-history debt-deflationary wipeout occurs at some point hereafter.

JDH wrote:

The real question is not when will the Fed begin to reduce the rate at which it purchases Treasury securities, but instead should be, when will the Fed first raise the interest rate paid on reserves? That, rather than a change in large-scale asset purchases, is the key date to be watching for.

Professor,

Neither of these questions are important.

FED purchases of Treasury securities certainly expands the money supply and distorts monetary signals but businesses generally are pretty good at hedging against the distortions.

Paying interest on reserves makes no difference. Reserves are not growing because of the interest rate paid. Banks can make much more than dumping money into reserves. The money is in reserves because there is nowhere else for it to go.

A much better question is how much longer will traders buy Treasury debt at the current below market interest rates? As other producers continue to expand at double digit growth rates while the US is stuck in th 1% range soon the securities of other countries will begin to look better than the US securities.

China and Japan buy US Treasury debt because they have nowhere else to put their dollars. As they shift away from trading in dollars their dollar reserves will fall and they will reduce their US Treasury purchases.

The greatest danger is not the FED’s large-scale asset purchases but the interest rate on Treasury debt. Here we are playing with not just fire but an inferno.

ricardo

“A much better question is how much longer will traders buy Treasury debt at the current below market interest rates? ”

so what is the true market interest rate. if you are so sure we are below it, what is it and how did you calculate it? or did you pull it out of your behind?

you may not like the low rates, so you blame the fed. but the rates are basically a prediction of future economic growth. if growth is anticipated to be low, interest rates will also be low. is that not the world we have been living in the last few years? if the fed were not involved, what would the interest rates have been naturally over this period? would they have risen in light of the slow economic progress?

you can’t blame the fed when the rates would have been low otherwise. the fed simply solidified this expectation.

I suggest -if you have time for non-linear patterns in monetary events- take a brief look at this recent post:

http://www.tfmetalsreport.com/blog/5170/french-history-fascinating

Marvelous FASTFORWARD run-via history- till the end of the effects of devaluation of paper money in the republic. With actual pattern matching. And even historical pattern matching, including- war on terror.

Otherwise let the FED roll on in creating low rate “market” for USG borrowing – now once the floodgates are open, the speed of borrowing will increase so end of QE or tapering is in fact impossible. Due to the nature of superexponential process USG debt accumulation has reached matching log-periodic approximations and thus possibility to reach crash point in finite time – and not so far away – approximation with log-periodic function chart here:

http://www.tfmetalsreport.com/comment/359176#comment-359176

Pipelines are safer.

http://www.upstreamonline.com/live/article1340977.ece

Bruce,

“Yes, all the printing and swapping to liquefy the insolvent balance sheets of the TBTE banks is/was circulating between the Fed, primary dealers, and the Treasury at no velocity to net growth of bank loans, deposits, and flows to private economic activity.”

If by printing you’re referencing increasing reserve balances and not M1, this is correct. But I wouldn’t call increasing the amount of reserves an automatically positive thing for banking institutions because they cannot be used for anything outside of the Federal Reserve system. Basically, it’s a settlement vehicle although I am unsure how it fits into the capital requirements structure. On top of that it seems you’re implying that the Fed could be overpaying for securities or some such. For data on that, see:

http://www.newyorkfed.org/markets/OMO_transaction_data.html

“Reserve inflation is not resulting in runaway price inflation the gold bugs have been predicting because bank lending is moribund (apart from lending to buy back stocks and derivatives to pump up equity index futures)…”

Banks are not reserve constrained. Nor can they magically turn reserves into fungible money (M1) except by converting it into vault cash. Additionally, I agree that bank lending has been subdued because of deleveraging. But then again the relationship between raw credit growth and economic activity is not as straightforward as most people assume.

http://www.voxeu.org/article/myth-phoenix-miracle

“Moreover, the flattening yield curve in real terms against the 5% bank charge-offs and delinquencies against bank loans is a further persistent constraint on growth of bank lending, deposits, M2+, wages, price inflation, and real GDP per capita.”

Yes, net interest margins are low. But somebody can easily argue the benefits of low long-term interest rates and the impact on the demand side. Bank capital also factors into this. This is something that needs to be modeled.

“The only game in town for the TBTE banks is to swap MBS and Treasuries with the no-cost Fed cash and use Treasury holdings to lever up equity index futures until the system implodes. Who is the counterparties…”

Elaborate on the transmission mechanism please.

I get the sense that the Federal Reserve is aided in its efforts because people do not clearly understand the monetary system. When the culture believes that a CB is printing money that encourages activity. If you want an example of a community who has crafted a narrative around it all just look at the trading community.

baffled,

Great post!

You make it clear that the FED does not control interest rates and so all of their attempts at reducing long rates were futile. That is a great observation.

Then you state that the zero bound interest rates are predictions of future economic growth. In other words the zero bound interest rates prove that claims of recovery are a lie. Zero rate interest is predicting zero rate growth.

I am not sure I disagree with either of your points. You are right. Changes in policies to allow real growth are the only solution.

It seems that you are not totally baffled, though I think you stumbled onto the truth. But thanks just the same!

Ricardo.

I notice you did not answer his question

Robert,

baffaled’s question shows his ignorance of interest rates. They cannot and should not be predicted. That is Keynesian fantasy. He does stumble onto this truth, but indirectly, when he admits that the FED has no control over interest rates. As baffaled correctly observes, interest rates are determined by the market.

He and I do have a difference when it comes to the influence of the congress and the FED on interest rates, though. They do impact interest rates when they institute policies that inhibit production and growth. That doesn’t mean they control interest rates but they can distort them by hampering economic prosperity.

So if I assume correctly that you are talking about me telling you what interest rates should be, I do not believe anyone can. What I do know is that with all of the intervention by autocratic government and the monetary authorities, current interest rates while market rates, are not what Wicksell would call the natural rate, and since zero interest rates are absurd, it is not such a leap to say interest rates are currently too low for a growing economy. That creates a dangerous dilemma. If interest rates do increase, interest on the national debt will become unservicable.

Does that help?

ricardo please see robert hurley for the appropriate response-i won’t be so kind.

recovery will not occur in a vaccuum. when fiscal stimuls, which is needed, is not provided the recovery from this type of fiinancial crisis WILL be limited. that leaves monetary policy to help introduce a recovery. but most folks would agree it is not THE most effective solution-but A solution. and in the zero bound condition it is even more limited. but what other options are available?

do you truly think the economy would have recovered and prospered if the fed had left interest rates at 6%? you are probably the type that also believes tarp was not only unneccesary, but further damaged the economy. baffling.

David and Bruce,

I do not follow all of your points, but I have the following questions:

1) Why are equity futures prices higher than the spot prices? I know arbitrage with dividend-yielding stocks might cause this, but why isn’t arbitrage set by the cash alternative? Stocks have always paid dividends, but the futures prices were always lower than the spot prices before the fed’s extraordinary monetary easing…..

2) Are the big U.S. banks engaging in interest arbitrage with foreign sovereign debt (‘dollar carry trade’)? Are treatments of the foreign sovereign debt under current banking regulations as outdated as the CFTC’s (which abetted Corzine’s shenanigans)?

The benefit of low rates is supposed to be that consumers and businesses can borrow at lower costs – but will they? Businesses will only borrow if they need to expand, and that only happens if consumers purchase more of their services and products. But consumers have lost the will and ability to increase consumption based on credit (rather than income). So the model for increased GDP based on lower rates is rather shaky, at least for current conditions. That has to be weighed against negative effects of low interest rates on a substantial fraction of the consumer class – the small savers. People with savings, who cannot afford to lose that money, and also need an income from it to retain their lifestyle. The response of those people to low interest rates is usually to reduce their consumption (rather than moving their assets to something with more risk). So in that segment the low rates reduce GDP.

ricardo

on interest rates you said “They cannot and should not be predicted.” but you just said they were too low. how do you know this and not violate your rule?

“and since zero interest rates are absurd, it is not such a leap to say interest rates are currently too low for a growing economy. ” again how do you know this is too low? somehow i am supposed to believe you over the FOMC? and if we are in a deflationary environment, what should interest rates be?

when the private sector, ie business, consumers, savers, etc all retrench where do you get growth? or do you allow deflation and a depression to occur? by your logic business would simply boom if interest rates were higher. but you are in a demand slump, not a supply slump. different worlds.

Hi Don.

For your first point I’d read Wikipedia’s “cost of carry” article. It should explain the particular scenario you described. If you can get the data though I’d recommend looking at the differential between the risk-free interest rate (Treasury bills, etc.) and the dividend yield on the S&P 500.

For your second point, I do not know. My apologies.

Best Regards.

Correction to question 1):

1) Why are equity futures prices LOWER than the spot prices? I know arbitrage with dividend-yielding stocks might cause this, but why isn’t arbitrage set by the cash alternative? Stocks have always paid dividends, but the futures prices were always HIGHER than the spot prices before the fed’s extraordinary monetary easing…..

Apologies for any confusion

baffled kid

when fiscal stimuls, which is needed, is not provided the recovery from this type of fiinancial crisis WILL be limited. …in the zero bound condition it is even more limited. but what other options are available?

Does your mother know that you are sneaking on her computer? Really?

It should be obvious to you by now that the only option is employer-friendly fiscal policy. Give employers incentives to hire, rather than layer them with additional red tape and regulations.

How about some private-public partnerships to rejuvenate the inner cities? See East Lake in Atlanta.

Consider this – Without INCENTIVES for employers and real estate developers to help lift the inner city impoverished out of poverty, a transfer only exacerbates the situation. Perverse incentives of the Progressive agenda sentence those suffering in poverty to perpetual reliance on the state.

Your “Son of Menzie” mentality is insulting to rational people everywhere who envision more for the impoverished than redistributive handouts that do little to provide a hand-up rather than a hand-out.

Everyone needs help now and then, but you and your fellow Democrats have institutionalized reliance on government hand-outs. Democrats should be ashamed of the way Progressives have taken over their party and embarrassed that they are afraid to speak out against the radical left.

By the way, the world champion hide and seek champion was just crowned – the winner was global warming. It’s still hiding ! LOL!

Marc Faber argues that the Fed has no exit strategy (from QE):

http://finance.yahoo.com/news/faber-fed-could-qe-1-143500254.html

tj, boy, are you done with your rant?

apparently you fail to understand what a good fiscal stimulus entails. you have an enormous civil infrastructure in this country that needs upgrades, replacement and new construct. you have structurally deficient bridges, highways beyond design capacity, water and sewer systems not expanding with population increases. all of this would provide a fabulous platform for fiscal stimulus. and the work needs done, so you can’t really argue “government waste” unless you like having detours and unpotable water.

tj, your hatred against the poor receiving any benefits blinds you to the needs of this country. obamacare will help you, because now you can get health insurance and obtain the psychiatric therapy you so desperately need to deal with this anger.

baffeled wrote:

recovery will not occur in a vaccuum. when fiscal stimuls, which is needed, is not provided the recovery from this type of fiinancial crisis WILL be limited. that leaves monetary policy to help introduce a recovery.

Now when exactly has has this ever happened in history?

baffled kid

“government waste”

You just pulled that out of thin air, I never mentioned it.

your hatred against the poor receiving any benefits blinds you to the needs of this country.

Your baseless personal attacks are insulting. Show me where I said I hated the poor receiving any benefits. I offered an example of public/private partnership that offers the inner-city poor a chance to escape poverty–something that is impossible within the Progressive-Democrat simple wealth redistribution scheme.

ricardo, then you subscribe to raising interest rates to improve an ailing economy? take a position please, instead of being the party of NO!

tj, so you have no problem with fiscal stimuls targeting our civil infrastructure? i was simply anticipating a possible answer, correct me if i’m wrong boy.

i don’t imagine you have ever even set foot into a poor part of town. lost and driving through does not count.

The real question for ordinary people is when will the bank ever stop debasing the dollars in our wallets by printing? When will the bank ever stop slowly confiscating our pensions and IRAs by printing?

baffled,

You cannot see beyond your own nose. For you manipulating interest rates is a given. All your suggestions are pushing on a string.

As I said earlier, you are ignorant of what interst rates are. Interest rates are the price of borrowing money. When you attempt to manipulate interest rates the result is you distort the pricing signals of money, interest rates. It is your insistence on artificially raising or lowering interest rates to control the economy that expose your economic ignorance.

JDH is sort of right, except that taper news and consensus forecasts for the course of short rates are inextricably intertwined. Taper news obviously had a much bigger impact on 10-year yields than most of those studies suggest, partly because the news changed forecasts of short rates and partly because simplistic stocks models are no better at predicting the market than a dart throw.

Now taper is already priced in, so at this point the precise timing of it is unlikely to be very far from expectations. The only thing that could cause another equally big move would be news that taper is off indefinitely.

ricardo, not sure how i am manipulating interest rates. unless you are of the ilk that wants to abolish the fed and go back to the gold standard. the fed exists, and whether it raises, lowers or holds steady interest rates or bond purchases are all actions. not manipulation.

i have asked people like you here repeatedly, what should the interest rate be in a deflationary environment? we would have had that environment without fed action.

baffled-

what’s wrong with a deflationary environment? Please explain the deflationary spirals to zero where we had 100% unemployment prior to the fed, and where anyone could buy all goods in existence if they found a penny on the road because deflation had spiraled the price of everything to zero.

“what’s wrong with a deflationary environment?”

I too would like to hear more about deflationary spirals. I understand the standard theory of how households hoard money in mattresses in order to benefit from its expected gain in buying power and how this lowers demand which lowers production which lowers employment which lowers incomes which further lowers demand and the spiral goes on. But no spiral, especially one with a zero lower bound, goes on forever. Eventually the money comes out of the mattresses, spending resumes, etc., at some new equilibrium — which would presumably be stable, at least on the downside. You can’t fall off the floor. Could it be that our basic problem is that we are not in such an equilibrium and the problem of a deflationary spiral is in the transition, not the endpoint?

anonymous, why would you want 100% unemployment? stupid question!

David, thanks. Looks like it works empirically, too. I was too lazy to analyze fully, so now I pay the price by looking simple.

“The real question is not when will the Fed begin to reduce the rate at which it purchases Treasury securities, but instead should be, when will the Fed first raise the interest rate paid on reserves? That, rather than a change in large-scale asset purchases, is the key date to be watching for.”

— You are missing the point. The decision of the Fed not to taper in September had implications BOTH for the timetable of LSAP winddown AND the path of deposit rates.