From a statement by the Joint Economic Committee Chairman, October 9th, 2013:

I fear that the Federal Reserve through current policies of Quantitative Easing and maintaining extraordinary low interest rates may be providing the fuel for igniting high

inflation.

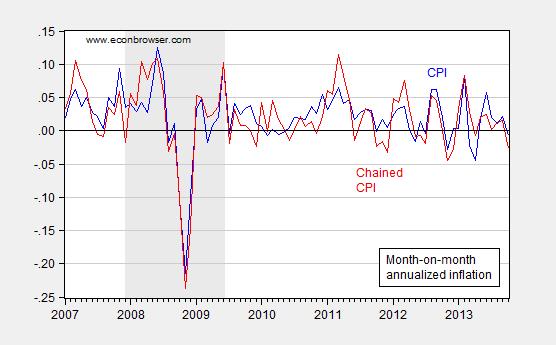

And here is a shapshot of CPI inflation from today’s October release.

Figure 1: Month-on-month annualized CPI inflation (blue) and chained CPI (red), calculated as log differences. NBER defined recession dates shaded gray. Source: BLS via FRED, and author’s calculations.

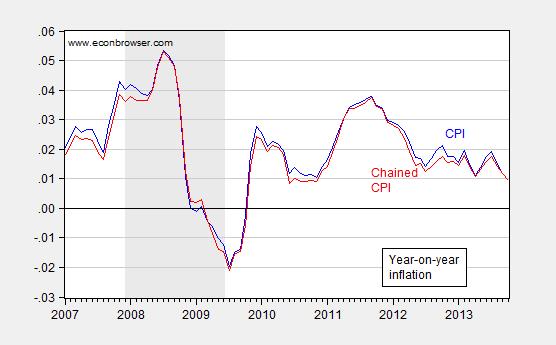

And to show the lower frequency change, I also graph the annual inflation rate.

Figure 2: Year-on-year CPI inflation (blue) and chained CPI (red), calculated as log differences. NBER defined recession dates shaded gray. Source: BLS via FRED, and author’s calculations.

For alternative estimates (based on data applying up to September), see Monday’s post.

Current inflation is too low. Inflation expectations over the next five years are too low. However, I think the probability of higher inflation 20 years out has increased. Inflation is the easiest solution to our intractable entitlement, pension and deficit problems particularly as the Fed becomes more politicized.

“This frustration spills over into debates over government funding and the debt ceiling.

Increases in the debt ceiling have traditionally been the vehicle used in divided government

to reach a bipartisan compromise on fiscal issues. The White House typically makes

concessions to the opposite party in Congress to win passage of an increase the debt

ceiling. In 1990, President George H. W. Bush agreed to tax increases in exchange for

sequestration relief and a debt ceiling increase from a Democratic Congress. And the

Budget Control Act of 2011 came about through negotiations between President Obama and

Republican House leaders.” — from the link.

I like how he skips over 20 years of history to gloss over his implied illusion that using a debt ceiling breach to negotiate a budget is the normal order of things. In 1990, default on the debt wasn’t on a negotiating table by any of the parties.

and yet there still exists a “respected” segment of economists and political leaders who have been warning of the dire inflation problems for nearly 5 years. how long must you be completely wrong before you become “disrespected”? it does take balls to be wrong for soooo long and spin the tale that you are correct-just wait a little longer!

The recent trend rates of M2+ less hoarded bank cash (contracting yoy, BTW), wages after tax and debt service (rentier tax), and PPI and import prices imply yoy CPI deflation again in 2014 (as in 2008-09).

Can a recession and debt/asset deflation be far behind . . . ?

If so, how long before the dreaded deflationary mass-social mindset takes hold . . . ?

Despite Fed and TBTE banks trying to make cash into trash, with assets so overvalued and price bubbles everywhere, cash flow and cash on hand will be dear hereafter during the emerging deflationary regime.

Let’s say corporations have profit room to raise wages, then inflation could rise. But then they would also have room to lower prices. In which case, inflation would go lower, due to businesses being more competitive.

It seems prices are going lower as profits rise.

Please not that GOP Rep Kevin Brady, the guy quoted, says we need to move toward the gold standard. He says that “Some advocate a return to the classical gold standard. I do not believe that objective is achievable in the near term. I advocate the concepts in my Sound Dollar Act, which would reform the Fed’s mandate to focus on the one thing it can actually achieve: price stability. The surest way to achieve maximum employment is for the Fed to return to a rules-based system, with a primary objective of price stability, and in achieving price stability, look at a broader category of assets, including gold.”

In other words, the gold standard. And I love the way he tosses out that price stability is the way to add jobs, as though that were a given and not some argument he’s stating without any proof. And of course he also ignores what the Fed currently does, which is that it currently works on a rule-based system but his argument depends on claiming they don’t so he can say his gold rule – and achieving price stability for gold! – is a “return” from some form of anarchistic ad hoc method.

Well, people vote for him so he gets to blather on the record.

Menzie,

I have only now had time to read the comments of Rep. Brady. I am curious. When did you only choose your quote above without reference to Rep. Brady’s qualification later in his piece.

“Though the Federal Open Market Committee still does not see inflation on the horizon, the question remains as to how quickly and effectively the Fed would respond if inflation were to take hold.”

How quickly and effectively do you believe the FED would respond to inflation?

ricardo,

if the fed does not see inflation on the horizon, then they do not need a plan-or to even state a proposed plan-today. that would impose a restraint on their future actions, which they do not want to do. the fed will not allow itself to be boxed into a corner-it wants to respond to a problem if/when it exists. hypotheticals put into public view get absorbed by some members of the pundincy as “fact” and then distorted views emerge. the fed will not play this game.

Ricardo: I don’t foresee the sun going supernova right now, but I think we should be prepared to respond quickly if indications are that that event is imminent.

According to oil market analysts PIRA, adjusted US oil demand is up 9.9% for the last four weeks compared to the same period a year ago. That’s 1.8 mbpd, a whopping number.

“Whopping” is the word of the day, clearly.

The contracting labor force growth and hit to growth of household spending from the higher payroll tax and ACA effects of cost shifting from firms to households will push the rate of CPI lower, if not negative in 2014, increasing real interest costs in a classic liquidity trap scenario with an economy burdened by unprecedented public and private debt to wages and GDP.

https://app.box.com/s/4kr0cpf9ovq6qejpemmg

https://app.box.com/s/hytem1fss5c8oi7084s3

https://app.box.com/s/zx60ukpszh5da3ioz852

http://research.stlouisfed.org/fredgraph.png?g=oIo

https://app.box.com/s/64sva05zmjfmhiczcd6p

What if the 5-year change rates of CPI and core CPI, US 10-year change or real GDP per capita, and labor force participation continue to track Japan’s experience since the 1990s as the Long Wave precedent implies will be the likely outcome?

The implication is ZIRP, QEternity, and real GDP per capita well below 1% or near zero for another decade, with the potential for the post-2007 trend rate of nominal GDP below 2% along the way.

Economists and policy makers are in persistent public denial that the US (and EU) has been turning Japanese since the early 2000s.

Now Summers issues his public pronouncement about an era of “stagnation” when it’s been happening for 13 years.

No amount of central bank reserve printing, Keynesian deficit spending, supply-side tax cuts, “revenue enhancements”, and talking up price and asset inflation has prevented the protracted drag effects from occurring in Japan as a result of too much debt to wages and GDP, overvalued asset prices, and post-peak demographics since 1998.

Neither will the US achieve any better results than Japan from Fed printing trillions to credit TBTE banks’ balance sheets, Fed “guidance” and encouraging unprecedented asset bubbles, sequestration, tax increases, and never-ending imperial wars.

Too much debt, extreme wealth and income concentration, debilitating health care and education costs, high energy costs, once-in-history Boomer demographic drag effects, and no gains in wages to GDP will restrain US economic activity and prevent acceleration of real GDP per capita indefinitely hereafter.

Few, if any, establishment economists will concede the fact and the proximate causes; therefore, no viable solutions will be forthcoming.

1. First a defense of Larry Summers in the sense that one should be congratulated on changing one’s mind when presented with new information. Professor Summers presentation has been misread to 1) stating that secular stagnation is a “new” development and 2) stating that the economy “needs a new bubble.” He was stating that the events of the last five years has given him a new perspective on U.S. economic performance since 1980 and he sees an underlying shortfall in aggregate demand (which Mr. Lambert has described in his model as a fall in “effective demand” as labor’s share of National income falls – a trend that started in 1966 and accelerated in the 70s and 80s). And that the bubbles that occurred during this period (S&L, Dot.com, and then Housing) obscured the increasing fall of aggregate demand and were a symptom of it.

2. Unlike John Taylor and many on the right such as Ricardo, with their model of 1. Return to Gold/Hard money 2.?????? 3. Investment boom!!!, Mr. Lambert at least has proffered a model (a model with a dismal message, but nevertheless a model) that can be discussed, challenged, and tested against reality. http://effectivedemand.typepad.com/ed/2013/05/monetary-policy-of-effective-demand-the-basics.html

3. I still think Zirp in combination with a real Keynesian Fiscal policy (as Charlie Pierce and Atrios would say, just start helicopter drops of money into ordinary people’s bank accounts and guaranteed WPA/CCC jobs to all whose unemployment expires after 12 weeks) and one would create boost effective demand pretty quickly.

http://effectivedemand.typepad.com/ed/2013/05/monetary-policy-of-effective-demand-the-basics.html

Kopits: Product supplied is higher over the past 4 weeks than for any 4 week period since August 2008! But look at the product mix. This is about propane/propylene and ‘other oils,’ as the increase in those two categories YOY is greater than the total increase in product supplied (this is masked somewhat by continuing substitution of DFO/Kerosene for RFO due to emissions issues). My guess is that a fairly big chunk of the increase in “supply” is refinery consumption for process heat to support increased product export, which isn’t a bad thing, but isn’t broad economic growth either.

Kopits: On the subject of product supplied, I forgot to mention record corn crops being dried with propane, which, along with reduced ethanol quota, will reduce the price of corn exports.