Once upon a time, U.S. monetary policy was conducted with its primary target defined in terms of the fed funds rate, which is the interest rate on an overnight loan of Federal Reserve deposits between private banks or other institutions that hold accounts with the Fed. A bank that ended the day with more deposits in its account with the Fed than needed to meet its required balances could lend those funds to another bank that found itself short. The interest rate on these loans was very sensitive to the total level of excess reserves in the system. The Fed’s direct control of available reserves gave it near control of the interest rate on loans of fed funds, which was what made the fed funds rate a credible target for implementation of the FOMC’s policy directives.

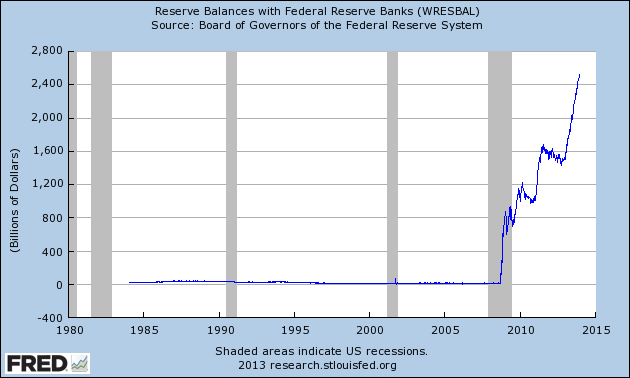

But that was back in the days when it only took about $10 billion in Federal Reserve deposits to satisfy all of the banking system’s needs. Today the Fed has created $2.5 trillion in deposits, and the number is still growing.

|

Nevertheless, overnight loans of fed funds continue to be made and the interest rate on those loans continues to be reported. Last week, for example, the fed funds rate averaged 0.08% (8 basis points). If you lent $1,000 every day all year long at that rate, you’d have earned about 80 cents in interest at the end of the year.

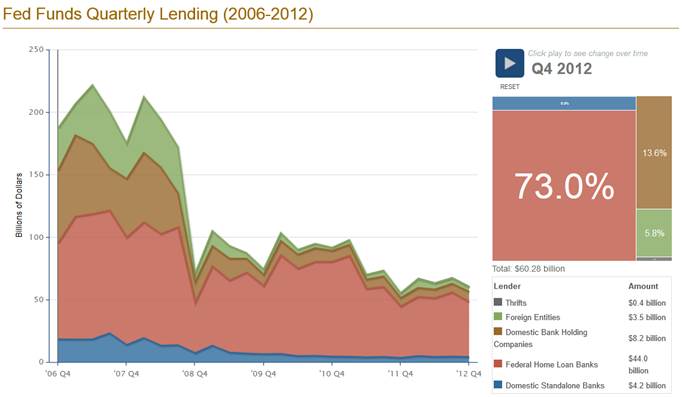

There are a couple of things that are surprising about a fed funds rate of only 0.08%. First, why in the world would an institution lend fed funds to another bank for 8 basis points when it could just hold those reserves overnight in its account with the Fed and earn 25 basis points in the form of the interest that the Fed pays on reserves? A recent analysis by Liberty Street Economics provides the answer. Most of current fed funds lending is being done by government-sponsored enterprises (GSEs) like the Federal Home Loan Banks, which have deposits in accounts with the Fed but, unlike private banks, don’t get credited with any interest if they hold those balances overnight. The GSEs thus have an incentive to lend out any extra reserves on the fed funds market, because 80 cents is better than nothing.

|

But that raises another question– why wouldn’t other regular banks jump at the chance to borrow fed funds from the GSE at 8 basis points and then just hold the funds overnight in their account with the Fed to earn 25 basis points? Sounds like a risk-free way to make money, no?

One reason more banks aren’t competing to borrow those funds may have to do with limits on who the GSE is willing to lend to. Even though the risk may be negligible, the potential returns are tiny as well, and some banks may not be approved to receive loans from the GSE. Another factor is that private banks face stiffer capital requirements and other regulatory costs if they try to expand their balance sheets. Liberty Street Economics notes that FDIC fees are a prime example of these costs. The FDIC imposes an insurance fee based on the bank’s total assets minus average tangible equity. If a bank puffs up its balance sheet by borrowing fed funds and holding them overnight, it can earn some profit from the interest differential (25 minus 8 basis points), but faces higher insurance fees that eat up much of that profit.

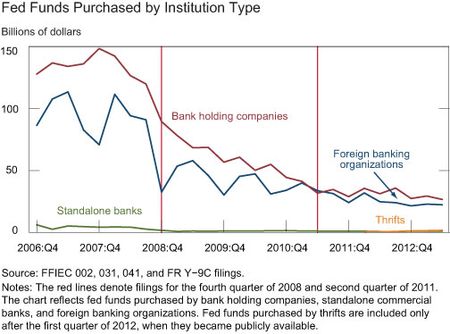

Given regulatory differences across different countries, it’s more advantageous for foreign banks to play the interest arbitrage between the fed funds rate and the interest rate the Fed pays on reserves. The foreign share in fed funds borrowing has increased significantly.

|

The fed funds rate has thus gone from one of the most closely watched indicators to one of the least relevant. The fed funds rate today is essentially determined by institutional details of little broader significance. Will we ever return to the previous system? It’s a long way to go from $2.5 trillion back to $10 billion. It seems to me there’s a good chance that the fed funds rate will never return as the key instrument of U.S. monetary policy.

A more natural policy tool for when the Fed gets back to worrying about the short-term interest rate would be the interest rate that the Fed pays on reserves, a magnitude that the Fed controls directly. When the Fed ultimately decides it wants to raise the overnight interest rate (and that decision, by the way, still appears to be quite far away), the natural way to do it would be by raising the interest rate it pays on reserves.

Another possible Fed policy tool for controlling short-term interest rates was recently described by Simon Potter, Executive Vice President of the Federal Reserve Bank of New York. A standard operation that has been used by the Fed for many decades is a repurchase agreement, or repo, in which the Fed acquires some high-quality asset from one of its primary dealers with a promise from the dealer to repurchase the asset at a fixed price a short period later. Essentially a repo was a collateralized short-term loan from the Fed to the counterparty. The Fed would make its initial payment by creating new Federal Reserve deposits, and these reserves would be removed from the system when the assets are returned. The Fed would traditionally implement these transactions in fixed quantities, specifying for example they would conduct $100 million in 3-day repos at a competitively determined market rate. The purpose of such an operation would be to add $100 million in new reserves to the banking system on a purely short-term basis. The reverse operation, designated by the Fed as a reverse repo, would call for the Fed to temporarily transfer some of its assets to the counterparty, and was a tool to temporarily drain $100 million in reserves from the banking system.

Temporarily adding or draining a small amount of reserves in the current environment would of course be completely inconsequential. But at its September meeting, the FOMC authorized the Federal Reserve Bank of New York to conduct a series of fixed-rate, overnight reverse repurchase agreements with a broad range of counterparties including primary dealers, banks, money market funds and GSEs. Although the initial implementation specified a cap on the total reverse repo volumes that would be transacted, the vision is that the ultimate system would be one in which the Fed temporarily absorbs whatever quantity of funds counterparties may choose to offer at the fixed rate specified by the Fed. In effect such a system would function like interest on reserves in that any approved counterparty with excess funds could always earn a specified return by lending overnight to the Fed through a fixed-rate reverse repo. The idea is that because a broader set of institutions would be allowed to participate than those that can earn interest on reserves, and because of the collateralized nature of the transaction, this would be a more effective way to control short-term interest rates than would result from simply changing the interest paid on reserves.

Potter described the results of this experiment as follows:

Although the current overnight, reverse repo exercise provides us with useful observations that allow us to improve the technical execution of policy, our knowledge is naturally limited by the exercise’s capped nature. Important questions will remain about the broader money market effects of a fully operational facility. Larger policy and implementation questions will also entail whether– and if so how– other tools would be used in conjunction with this facility and [interest on excess reserves], and how the facility might or might not fit into the Federal Reserve’s longer-run policy framework.

But while there’s still a lot to learn, the potential addition of an overnight, fixed-rate, full-allotment reverse repo facility offers a promising new technical advance in the Desk’s implementation of monetary policy.

It remains to be seen what will eventually become the primary policy tool of the Federal Reserve once short-term interest rates lift above the zero lower bound. But I think it is a good bet that it’s not going to be the fed funds rate.

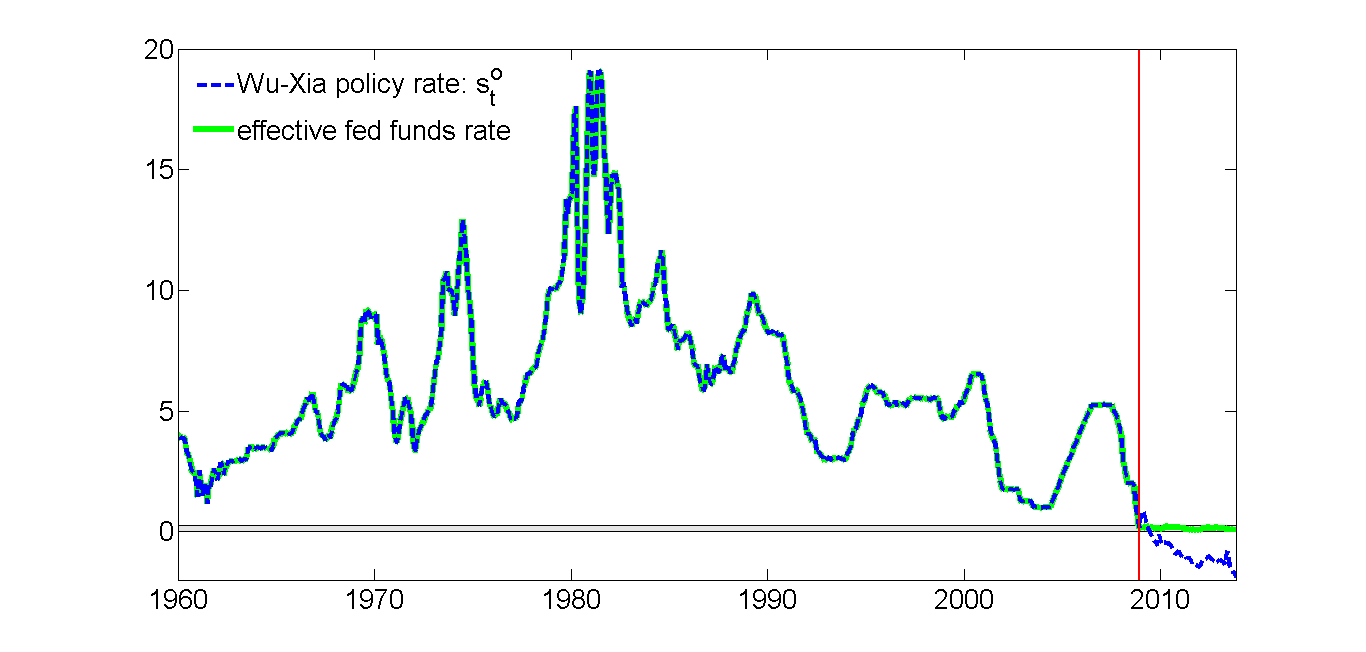

In any case, for some time it’s going to be helpful to have an alternative to the fed funds rate to summarize the stance of monetary policy, for which I recommend the Wu-Xia policy rate as a promising approach. Here’s the latest value for their series, which has turned more negative since their paper was first circulated.

|

In other words, the day when the Fed actually begins to use fixed-rate reverse repos, or any other new policy tool, to raise short-term interest rates is still quite a way down the road.

Fed bank reserves during the 1920s-49 (rose 10 times from 1933 and 30 times from 1917):

https://app.box.com/s/lyf7vkjyn1yzb8m1zzgg

US bank cash assets are up 9 times since 2007:

http://research.stlouisfed.org/fred2/series/CASACBW027SBOG

Japan’s reserves since 1990 have risen 17 times since the onset of Japan’s debt-deflationary regime in the late 1990s:

http://www.stat-search.boj.or.jp/ssi/cgi-bin/famecgi2?cgi=$graphwnd_en

There is no “exit strategy” because there will be no exit. Reserves will continue to expand indefinitely, perhaps until the Fed’s balance sheet/monetary base is ~1:1 with bank loans, if the history of debt-deflationary regimes is a guide. If so, at $85B/month reserve printing, ZIRP and QEternity will last into 2017.

The yoy change rate of NGDP after financial profits less charge-offs and delinquencies is below 2.5% (near 0% real per capita) and consistent with recession for real final sales per capita:

http://research.stlouisfed.org/fredgraph.png?g=q2a

Bank charge-offs and delinquencies are still at 5% of loans, which is still high by secular standards and a hard constraint on growth of bank lending, deposits and money supply (less bank cash assets), nominal GDP, wages, and price inflation.

The hyper-financialized US economy and banking system remains in a debt-deflationary regime of the Long Wave Downwave, only unprecedented deficit spending, central banks’ liquefying of US and foreign banks’ balance sheets, and massive financial market leverage as a share of GDP have prevented the implied debt-deflationary contraction and “adjustment” of private debt to GDP and wages.

The question remains how long central banks and TBTE banks can continue to print and lever financial assets to bubbly levels to postpone the debt-deflationary wipeout. Exponential mathematics and history suggest that there will be a blowout at some point at the weakest linkages in the levered superstructure.

Will the TBTE banks then print themselves $10 trillion+ to cover the equity market cap lost?

Will the TBTE banks print to overtly buy their own stocks and that of insurers, as well as buy equity index futures and options on futures?

Inevitable? I suspect so . . .

What are your thoughts on this:

http://www.standardandpoors.com/spf/upload/Ratings_US/Repeat_After_Me_8_14_13.pdf

Can’t they Fed just say to the banks “Thou shalt maintain reserve requirements of $2.5 trillion”? Do they have to pay interest?

Thank you professor. Excellent analysis.

I have always wondered when the FED would realize that trying to fix interest rates is just another price control that distort the market and lowers returns creating economic stagnation. But your analysis does give us insight into the actions the FEDs may take in the future. Bernanke’s “experiments” certainly went no where.

Ricardo, if bernanke’s “experiments” went nowhere, then where do you propose we would be right now if the fed had taken a hands off approach? What would the natural interest rate be? And would the economy grow in that environment? Unemployment drop? All within the context of a private sector over indebted and deleveraging?

Well baffling, we’d have the correction the economy actually needs.

HEY RTD!!! I have that article handing outside my cube! It is a must read!!

It would be far better to take Milton Friedman’s advice; stop using interest rates as the ‘stance’ of monetary policy.

Interest rates are prices. Prices that have numerous pressures pushing and pulling on them, besides Fed tinkering. One thing interest rates are not; the ‘price of money’.

anonymous,

“Well baffling, we’d have the correction the economy actually needs.”

and what is that correction exactly? some people are under the false impression that the economy is this creature that exists independent of the world, and if we just let it alone it will prosper. the economy simply operates within the confines of the powerbrokers who control it. in today’s world, it is the fed. in your world, it is simply the ceo’s and cfo’s of the most powerful corporations. who is to say they will make any better decisions, and that those decisions will benefit the spectrum of people involved in the economy?

anonymous, under your view I would imagine the world would be better if we had no fed or central bank at all? in that case, just let the ceo’s be the ones who tinker with the economy?

Anonymous,

Exactly! In the late 1800 when we had no Federal Reserve the economy was growing at 4-5% and on top of that the currency was actually gaining in value so that each dollar bought more every year. The Keynesians who look back see the deflation as a sign of economic distress but they are baffaled by 4% growth.

anonymous and ricardo,

have you ever looked at the number and frequency of recessions and depressions we had in the 1800’s as well, before a strong central bank was built?