Politico Magazine asks “should we really be so optimistic about the year ahead?” Mohamed El-Arian (PIMCO), Jared Bernstein (CBPP), Laurence Kotlikoff (Boston U.), Robert Reich (Berkeley), Menzie Chinn (Wisconsin U.) and Jeffry Frieden (Harvard), Jeffrey Frankel (Harvard) and Dean Baker (CEPR) respond.

From the Chinn and Frieden entry:

Is the American economy finally going to grow rapidly? Our book, Lost Decades: The Making of America’s Debt Crisis and the Long Recovery, stressed that recovery would be long and slow, and could be hampered by such misguided policies as withdrawing fiscal stimulus too rapidly. Nonetheless, five years after the end of the Great Recession, there is finally some cause for optimism. GDP and employment growth are accelerating and manufacturing is rebounding, in large part due to growing exports. With corporate profits at record levels, business fixed investment is also going to surge—especially now that uncertainty created by congressional fiscal brinksmanship appears to have been resolved. Prospects for continued growth are good, especially because the economy is finally shaking off the aftereffects of accumulated household debt. Equity markets and home values have risen, bringing real household net worth back to its pre-recession peak. This has helped clear the debt overhang that held back consumer spending and bank lending for so long.

These points are discussed in this post, and illustrated in the following graphs.

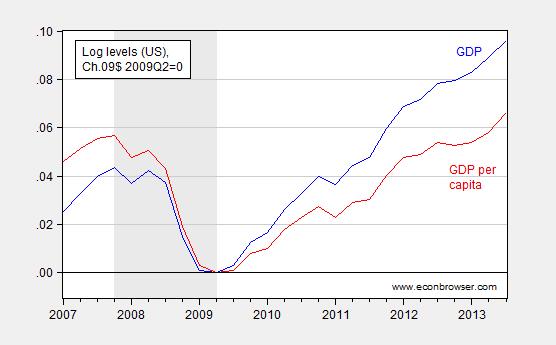

Figure 1: Log GDP (blue), and log per capita GDP (red), in Ch.09$, 2009Q2=0. NBER recession dates shaded gray. Source: BEA, 2013Q3 3rd release, and author’s calculations.

It is of interest that in Reinhart and Rogoff (2014), to be presented at the American Economics Association meetings, they write:

We examine the evolution of real per capita GDP around 100 systemic banking crises. Part of the costs of these crises owes to the protracted nature of recovery. On average, it takes about eight years to reach the pre-crisis level of income; the median is about 6.5 years. Five to six years after the onset of crisis, only Germany and the US (out of 12 systemic cases) have reached their 2007-2008 peak in real income. Forty three percent of the 100 episodes recorded double dips. Post-war business cycles are not the relevant comparator for the recent crises in advanced economies. [Emphasis added – MDC]

Pretty funny reading, when one remembers those folks who wrote (and defended the proposition) that the current recovery is “the worst economic recovery in history”.

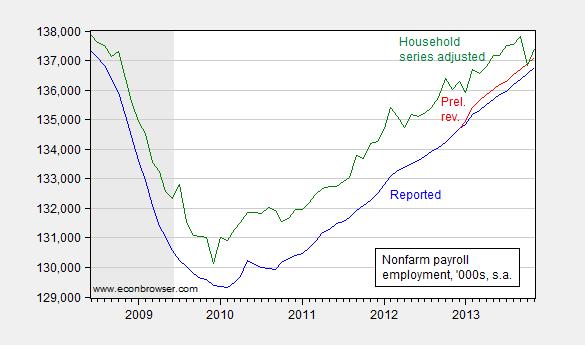

Figure 2: Nonfarm payroll employment as reported (blue), preliminary revision for March 2013 and extrapolation (red), and household employment series adjusted to conform to payroll concept (green). Source: BLS via FRED, BLS, BLS, NBER, and author’s calculations.

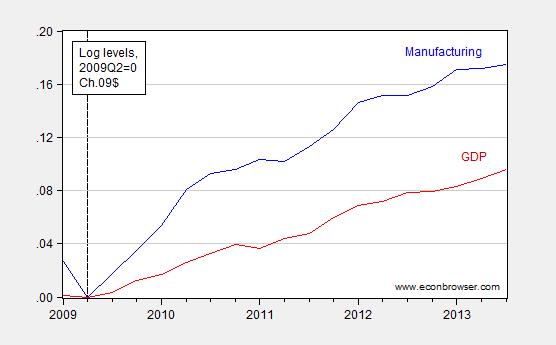

Figure 3: Log manufacturing output (blue) and GDP (red), in Ch.09$, rescaled to 2009Q2=0. Source: BEA, BLS via FRED, and author’s calculations.

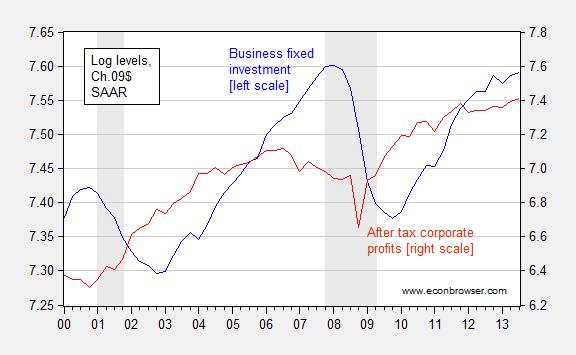

Figure 4:Log nonresidential investment (left scale, blue), and log corporate after tax profits, including inventory valuation and capital consumption (right scale, red), both in Ch.09$. Corporate profits deflated using nonresidential fixed investment deflator. NBER defined recession dates shaded gray. Source: BEA, 2013Q3 3rd release, NBER and author’s calculations.

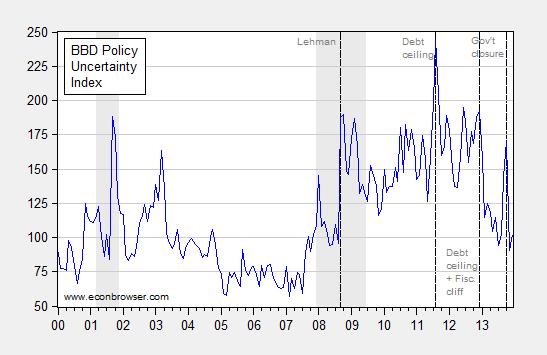

Figure 5: Baker, Bloom and Davis economic policy uncertainty index. Source: policyuncertainty.com, accessed 1/3/2013.

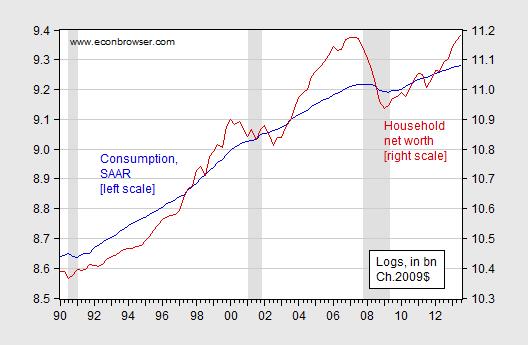

Figure 6: Log real consumption, bn Ch.09$, SAAR (blue, left scale), and log real household net worth, bn Ch.09$ (red, right scale). Net worth deflated by PCE deflator. NBER defined recession dates shaded gray. Source: BEA and Federal Reserve Board via FRED.

Of course, none of this means our longer term problems are solved:

Longer-term challenges to sustained American growth remain. One is the high, and increasing, degree of income inequality. The share of national income accruing to the wealthy has continued to rise, even as real median income has stagnated. This income disparity makes it unlikely for consumption to remain at levels necessary for sustained growth. …

The entire article is here.

I read John Taylor’s WSJ piece which begins by blaming Obama’s economic policies for the economy. It’s funny, isn’t it? The data shows the US has done better than the rest. I can’t believe Taylor, Lazear et al are ignorant of the state of the rest of the world.

Jonathan, record unemployment and folks on welfare is something you should not ignore.

Look at America’s declining economic growth rate – only the socshevik could be proud of…

America has clearly become a socialist state which will means slower and lower growth coupled with fewer booms and more busts…

” One is the high, and increasing, degree of income inequality.”

The Demcos’ talking points for 2014 elections which of course requires a governmental unit solution, lead by Barrocko himself and the New York Slim..

BTW, does anyone take Dean Baker and Robert Reich serious?

Hi Menzie, happy new year to you.

In case you are in NYC this weekend, like myself, we could go out for a walk in Central Park together and sing a song about global warming !

Mohamed El-Erian — I expect the U.S. economy to expand by a more robust 2 ¼ to 2 ¾ percent in 2014. Reasonable forecast, with my own forecast lapping into this range. The momentum of recent data, and key leading indicators on a high coming into this new year, make growth in excess of 2% an odds on likelihood though not by a lot.

Jared Bernstein — For many in the middle class, the growth in the macroeconomy will be something that they see on the news, not in their paychecks. And why is this? And what might the merchandise trade deficit have to do with it? And what might the obsession with free trade have to do the that selfsame trade deficit?

Laurence Kotlikoff — Our county is saving nothing, investing next to nothing, cooking its fiscal books beyond belief, printing money out the wazoo to pay the government’s bills, under-educating our children … Saving nothing goes right to the jugular. Alas, only Kotlikoff mentions this. The first thing we need to do to turn the country around is to correctly measure all of our future fiscal obligations. Not so the first thing. But Kotlikoff’s well-documented body of work that estimates fiscal obligations (he calls it the fiscal gap) on the order of $200 trillion – dwarfing the official debt of $17 trillion – is all the same a pressing order of business.

Robert Reich — When the buyout pump stops, as it must, expectations of further stock gains will end, and the bull market is likely to collapse of its own weight. Carrying this one step further, if the collapse happens by say mid-year, there is every reason to believe growth will be front loaded with risk of recession rising later in the year, especially into 2015.

Menzie Chinn and Jeffry Frieden — However, in the absence of policies to address inequality, the economic recovery will pass by too many Americans, and it will not guarantee a resumption of stable long-term growth. Inequality is the latest meme going around. As the memes of blame Bush and blame insufficient fiscal stimulus (directly contradicting Kotlikoff above) have worn themselves out. But where in the growth literature – and growth is the topic here – is inequality an important causal variable?

Jeffrey Frankel — Government employment has been declining since 2009, especially as a share of total employment. This is the No. 1 reason why the overall pace of the recovery has been frustratingly slow until now. Ratio of government to private: Dec 2007=19.3%, Nov 2013=19.0%. Now let’s just guess at the R-squared here.

Dean Baker The story on trade is hugely important since a reduction in the trade deficit will be the only way that the economy can return to full employment without large budget deficits. Baker does what Bernstein does not – gets to the core of it. But what beneath that? Exactly why is it that the merchandise trade deficit of the past couple decades, which is evidence of the ongoing hollowing out of American manufacturing and loss of high wage jobs and potential future know-how, has persisted? I mean when you scrape everything else away, what is the real reason?

Finally, what of the great white shark now swimming in the waters? That which already has begun shredding the disposable income of those losing their policies in the private health insurance market, leaving a froth of anger in its wake? And will be in full feeding frenzy by yearend, with a multiple of millions of still unaware swimmers scrambling out of the water, when finally they see the fin of the employer-mandate about to kick in heading straight toward them?

Well, with such an optimistic forecast from our resident Keynesian, I guess the President, whose policies have been largely responsible for the 5-year non recovery can abandon his talk of class warfare and the politics of envy. And the rapid increase in income inequality that has occurred under this President’s watch will, I’m sure, fade away so that Dems can get back to solving the REAL problems ….like protecting the K-12 teacher unions to ensure that inner-city kids keep getting that crappy education, like extending the welfare state (why work when you vote democrat?), like protecting public-sector unions so they can continue to live off the backs of taxpayers who earn less, and ensuring that EVERY American, except the very wealthy, has access to unaffordable and limited healthcare…

Hans Sometimes I wonder if you take yourself seriously, or if you just enjoy being a clownish troll. Not a single one of your comments makes any sense. First, by and large socialist economies, while they have many problems, unemployment isn’t usually one of them. Unproductive employment? Yes. Unemployment? No. The old Soviet Union and its old satellite countries had virtually zero unemployment. Almost everyone worked, albeit on useless projects that were poorly organized and shoddily produced. Now welfare states do have significant structural unemployment, but they also enjoy high productivity (e.g., hourly productivity in France is usually higher than US hourly productivity), high quality (think German or Swedish cars), and very high per capita GDP (think Norway). Second, you should explain how it is possible to have more busts than booms, as you seem to suggest when you said:

“lower growth coupled with fewer booms and more busts…”

It isn’t obvious to me what you mean here.

Finally, you need to read some of the more recent research on economic growth and income inequality. For a long time economists were largely agnostic on any connection between income inequality and slow economic growth. Income inequality could always be attacked from a Rawlsian “justice as fairness” position, but claiming that income inequality hurt economic growth was always considered a bridge too far. The empirical data didn’t seem to support such a claim. For example, even Paul Krugman was very reluctant to connect the two until quite recently. But lately economists are getting much more concerned about extreme income inequality and economic growth. There are several reasons why. First, the IMF found that political instability invariably follows once a country passes a critical inequality threshold. If you believe political instability hurts economic growth, then you ought to worry about income inequality. Second, extreme income inequality oftentimes masks a lot of unproductive rent-seeking that gets erroneously picked up in the NIPA tables as economic growth. Honestly, very few CEOs are really a thousand times smarter than the next best qualified person. A third connection between income inequality and weak economic growth gets to Larry Summers’ recent comments on secular stagnation, which is kinda, sort of what Menzie was getting at. Chronically weak aggregate demand due to income inequality keeps the economy below potential GDP and will eventually reduce potential GDP. It can also lead to frequent boom/bust cycles because savings may not follow a Harrod-Domar warranted growth rate…or if you prefer the updated version, then the Solow-Swan model.

jonathan I agree. I quit reading John Taylor a long time ago. He is just living in another galaxy. He’s become Greg Mankiw to the 10th power. He used to be a perfectly respectable (and respected) conservative mainstream economist. Today he’s just another nutjob with a website and an open invitation to write nonsense for the WSJ op-ed pages. A similar transformation befell Marty Feldstein. Feldstein is very conservative, but he is (or at least can be) a first rate economist when he wants to write serious stuff. But the crapola he regularly writes for the WSJ op-ed page makes me feel embarrassed for the man.

Speaking about the Reich Marshall, his “new” website now does not allow for comments, a clear sign that the web owners are concerned about debate and discussions of his threads.

Look at Reich’s video were he launches the classic class warfare argument. He states that the successful escape paying their “fair” share of taxes due to capital gains. The fact is, that the upper level income workers earn most of their wealth through labor and not capital gains.

Reich knowingly LIES. Reich knowingly misrepresents facts. And this man is a paid professor? Berkeley sinks to new lows.

http://robertreich.org/post/25010319397

More Reichism.

http://www.forbes.com/sites/paulroderickgregory/2013/09/10/robert-reichs-f-minus-in-economics-false-facts-false-theories/

RR comments of America’s top 400 riches people, also needs to be address, as it was by Michael Moore in Madison, Wisconsin.

http://blogs.wsj.com/wealth/2011/03/07/billionaires-own-as-much-as-the-bottom-half-of-americans/

Menzie: Here is what Lazear actually said: “Less publicized is that our current recovery pales in comparison with most other recoveries, including the one following the Great Depression.” The WSJ wrote the headline you quote, not Lazear. To date, average real GDP growth this recovery has been just 2.3%. No recovery in the past 100 years has been as slow. Lazear’s had that right. However his reference to the Depression muddied the picture. Zarnowitz’s observation that “the strength of the recovery is related to the depth of the recession” is apropos here. Seventeen quarters after the trough of the Great Depression, growth had averaged 10.9%. It ought to have had. Zarnowitz had it right. This recovery to date should not have been as strong as that of the Depression in growth terms. Nor for a different reason, should the current recovery have been as strong as the recoveries of ordinary recessions. This because of the systemic financial crisis nature of the current episode, which episodes as Reinhart Rogoff point out tend to have quite weak and protracted recoveries. Two important variables are in play: the unique nature of this recession compared to others and its relative depth.

That real per capita income has already reached its peak in the US as stated by Reinhart Rogoff is a different point than that this recovery is the poorest in the past 100 years as measured by average growth of real GDP 17 quarters into the recovery. Both statements are factually correct. The rebound effect from the deep V trough of the Great Depression drove growth at a pell mell pace. At the same time, the V was so deep in the 30s it took 10 years get back to the prior peak. That the V of this Recession was far smaller, no surprise then the “recovery” measured in units of time was faster.

Of far more interest is the ongoing trajectory. This story is not over yet. The ten years it took from peak to regain peak in the 30s is not up until 2017. Debt is far more pernicious today because of its record level. Systemic risk is still very high by objective measures. A second dip is quite possible in the next four years. Especially as record monetary and fiscal stimulus have merely postponed full adjustment of the imbalances that existed back in 2007. And, the full unintended consequences of the never-before-tried monetary experiment of the Fed are not yet known. To that add a wholesale wrenching of one-sixth of the economy by Obamacare which is only now getting underway.

2slugs,

What do you consider the most egregious examples of “rent” seeking?

JBH So you and Kotlikoff think our economic problems are due to inadequate saving??? Sounds like you’re one of those who is stuck with 1979 talking points. Go check the FRED site and look up growth rates for Gross Private Saving. There was massive saving in 2009 as people deleveraged. You have to go all the way back to 1951 to find a larger year-over-year increase in the gross private saving rate. Currently gross private saving is growing at about the same rate as GDP, so it’s not obvious to me why we should worry about too little private saving. As to public saving, perhaps you haven’t noticed, but the deficit both in nominal terms and as a percent of GDP is falling very fast…too fast for my tastes.

As to your comments on healthcare, let’s just call them uninformed. First, Obamacare does not wrench one-sixth of the economy. Obamacare expands the number of people who subscribe to private insurers and it increases the number of people getting government subsidies and Medicaid, but after all is said and done the basic private insurance market framework is retained. Second, Obamacare actually reduces Medicare payments (which are single-payer) and shifts the money to subsidize private health insurance subscribers. So you might want to explain to everyone here how it is possible expanding private insurance wrenches one-sixth of the economy towards more government control. Good luck making that argument. And since growth in healthcare costs has slowed dramatically, it’s a little hard to see how Obamacare is going to reduce incomes. Yes, it will reduce the economic rents collected by doctors, hospitals and labs. Yes, it will reduce the incomes of those who were previously freeloading, but since those folks will now have to pay their own way it will also increase the disposable incomes of those who already had insurance. In the aggregate Obamacare has reduced healthcare costs for both private individuals and the government (recall that CBO said repealing Obamacare would increase the outyear deficits).

As to your nonsense about Kotlikoff’s “fiscal gap” stuff, virtually all of that is a function of demographics. What matters is the total burden that retirees place on the working population, and that cost is approximately the same regardless of how it is financed. Kotlikoff and you both believe in the Doctrine of Immaculate Disappearance.

Does anyone think tech is frothy? Even Google execs are jumping ship…

http://www.insidertradingwire.com/insider-trading-at-google-inc-symbol-goog-alerted-on-122713-824pm/

JBH: To date, I have not yet found a disavowal of the title by Professor Lazear, despite searching extensively. Please provide the URL that states that he has, at your earliest convenience.

I also welcome information regarding his current views on his “no recession” call in May 2008.

Menzie: (1) Quarterly data on GDP exists back to 1913:Q1. Hard to state “all history” without using quarterly data for accurate historic comparison of the less than 3 year span between the trough in 2009 and the date of Lazear’s article (Apr 3, 2012). Annual would be too crude. (2) The quote I cited, as I’m sure you know, is verbatim from the first paragraph of the article. It would be incongruent to make an unsubstantiatable statement in the title and then immediately sharpen it for accuracy in the text. That simply doesn’t make sense. (3) As we know, copy editors take liberties with article titles. Especially, for visual effect across column space in newspapers. (4) I assumed this was the case because of the incongruity. Perhaps I was mistaken. (5) In any case, the statement taken from the article proper as quoted is factually correct. (6) If the WSJ can get the date wrong on the URL you link to — as they did — they can certainly take liberties with the title too. (7) More than likely, by the way, as this is the slowest recovery of the last 100 years, it very likely is the slowest in all US history as well. In such case the title would also be correct, though still in poor taste for whomever was responsible for it. (8) In any case, the point is a picayune one. Modify my comment to read: “I assume the WSJ op-ed editor was responsible for the incongruous title, that otherwise doesn’t jive with the obviously carefully worded line in the first paragraph.” (9) I assume you have Ed’s email address. Why don’t you contact him directly if this is such a pressing point with you?

2slugbaits: The relevant variable is net national saving, not gross and not personal. Kotlikoff said “country.” Net national saving averaged negative ½ percent 2009 through 2012. Negative! The flow of net plant and equipment spending was halved during this period from the average flow over the prior decade. The net is what adds to capital and increases productivity which translates into GDP growth which creates jobs which is what Americans most want for the purpose of making a living.

The word “wrench” was carefully chosen. I stand by it. Existing policies are being cancelled. Doctors are leaving their practice. Hospitals are struggling, with some planning to shut down. Headlines on all this abound. Stories come out daily. The public has yet to see the cancellations coming when the employer mandate kicks in. Premiums on new policies to replace cancelled policies will rise double-digit. Out-of-pocket costs are going up. Policy comparisons between old and new show a significant differential increase on annual deductibles to the disadvantage of policy holders. The risk pool is changing as youth leave the system choosing to pay the penalty instead. This already is cascading through to insurance companies, who must now raise premiums even more as a result of the swirl taking place in the risk pool being loaded with people who formerly couldn’t get insurance because of their health condition. Companies who choose to continue insuring their employees will in many cases see premiums rise. For the most part, premium increases will be passed on to the employees, who will see spendable income reduced as a result. Choice of doctor and medical facility is being curtailed. Per the CBO, the Physician Fee Schedule under Medicare will be a reduction of 23.7 percent for services furnished during calendar year 2014. How would you react if your income were cut this much? Something is going to give. There will be consequences. None of us can yet project the full first and second order impacts. But this domestic policy change cuts across the entire industry. Wrenching …

I’m not going to spend time debating Kotlikoff’s life work with you. Interested readers can visit his website (Boston University), replete with scores of articles and columns written, all pdf-able. And read The Clash of Generations (Kotlikoff and Burns, 2012). The reviews on Amazon are very informative. Kotlikoff engages in graceful extended discussion in some comment threads. I’m delighted to bring this subject to the attention of readers of this blog. You’ve done a public service raising the issue, 2slugs.

JBH Your predictions about Obamacare are simply hysteric and unfounded. The empirical data does not support your claims. CBO studies do not support your claims. In fact, the growth rate of healthcare costs have slowed…not entirely due to Obamacare, but somewhat. A lot of the scare stories have turned out to be false alarms. For example, the “real life” horror shows that Sean Hannity paraded turned out to be either wrong or completely faked. It is true that those with pretend health insurance saw their pretend policies cancelled, but in general I think it’s a good thing when fraudsters are put out of business. Now there will be some turbulence, but there would have been turbulence without Obamacare too. And aren’t you in the least bit uncomfortable defending doctors’ incomes? Do you think Medicare should be paying even more to doctors? Do you understand that the way doctor’s maintain high incomes is by restricting competition?

As to net national saving, obviously it was negative from 2009 thru 2012. Duh! Did you think the economy should have been running net surpluses? If you’re worried about national saving, then you should concentrate on the structural deficit, not the cyclical deficit. The structural deficit is what Bush #43 gave us and (to a large extent) Obama and the GOP House extended with the tax deal.

I happen to agree with you on the need to correctly distinguish between gross national saving and net national saving; but if you want to go down that route, then you should also recognize that correct accounting means we should include the depletion & spoilage of natural resources (including carbon effects) as depreciation in our NIPA tables.

I am very familiar with Kotlikoff’s work. Familiar enough to have noticed a definite decline in the quality of his work over the last 15 years. As I said, Kotlikoff has come to believe in the Doctrine of Immaculate Disappearance when it comes to generational issues. Costs are only worth counting when they appear on the public side of the ledger.

AS What do you consider the most egregious examples of “rent” seeking?

That’s a fair question. One would be the ridiculous expansion in what we would regard as intellectual property claims. The Constitution says that Congress should grant patents and copyrights in order “[t]o promote the Progress of Science and the useful Arts.” It does not say that copyrights and patents should be granted because there is some God-given natural right them. Copyrights and patents are only justifiable to the extent that granting them serves some larger social purpose. I’m not arguing against copyrights and patents; but I am arguing against the proliferation of specious claims that are clearly intended to restrict the “Progress of Science and the useful Arts.” Let me give you a small, realworld example from a couple of weeks ago. I work for the Dept of Army and we deal with all kinds of politically connected firms trying to sell us stuff. Back in the 1980s my office did a lot of research on a Markov bootstrapping model for predicting intermittent failures of certain kinds of parts. A few years ago a very prominent academic in the field picked up on the work and obtained a Defense Science Board grant for additional research. That famous academic then used the results of that government funded study to patent his solutions and integrated it with his commercial software. A few weeks ago his company tried to sell us the program that he created using a DoD grant. That strikes me as a lot of gall. In this case the granting of a patent only served to line the pockets of a few specific individuals without advancing society’s larger interests even though taxpayers subsidized the development of the patent. I see a lot of this kind of thing. BTW, it’s interesting to note that it wasn’t until 1897 that the US honored copyrights and patents established in other countries. In other words, until 1897 we did to Britain the very same thing that we today complain about China doing to us. It wasn’t until the US started making a lot of its own inventions that we started to worry about international reciprocity.

Another egregious example would be in the sports and entertainment fields. We all know and expect athletes and movies stars to make a lot of money, and that’s fine. There are good reasons why they should. But a good chunk of those salaries should be regarded as pure rent. For example, I’m a long suffering Chicago Bears fan, so when I heard that the Bears just signed Jay Cutler to a 7-year $120M deal with more guaranteed money than Aaron Rodgers, I had to scratch my head. The way to estimate rent is to first ask what is the lowest salary that a team could ask before Jay Cutler decided to pursue another line of work…not whether he decided to play for another team, but whether he would quit football. My guess is that it’s well south of $17M/yr. Let’s say he decides that the risk of injury isn’t worth it unless he gets at least $7M/yr, otherwise he moves to the television color analyst booth. The $10M/yr difference would represent rent. I am not saying that Cutler may not be worth $17M/yr, only that much of his salary is actually unproductive rent. Too much of this kind of thing raises ticket prices and eventually reduces productive output in other sectors of the economy. BTW, the same criticism applies to the owners of sports teams, not just the athletes.

A third example of egregious rent seeking would be in the financial sector. The financial sector does add value, but I don’t believe it adds anywhere near as much value as gets reported in the NIPA tables. Much of the financial sector’s income comes from arbitrary fees that don’t actually incentivize banks to provide services that they wouldn’t have provided without the fees. ATMs are a good example. Remember when ATMs were fee free and banks actively encouraged people to use them because they reduced labor costs at the banks? The basic labor saving nature of ATMs is still there. The only reason banks charge fees is because they can. If large fees were made illegal banks would still have strong economic reasons for promoting ATMs. Another financial sector example would be transaction churn. The arguments for a Tobin tax on churn is essentially an argument against rent seeking. Yes, churn makes some individuals better off, but it doesn’t make society better off.

2Slugs,

While it may be difficult for most responsible citizens to disagree that as a society we should reduce free riders on health care, it is possible that some of the hoped-for benefits from Obamacare may not appear. For example, emergency room visits may increase rather than decrease for a few reasons: one reason is that new insurance subscribers may not find doctors and thus use the emergency room as a primary care service, a second reason is that new subscribers may let health conditions continue past a prudent stage and be forced to make emergency room visits. A third reason is that new subscribers are issued cards (from at least one source that I have seen) with a written instruction on the card to go to the emergency room if needed and the subscriber will incur no charge. Visiting urgent care centers or physician offices may require co-pays.

Who will allow it to boom? FED? No way, it will taper harder than many think now.

Oil? No way, oil prices will move up around 50% after Israel attack on Iran and will start moving up as tensions in ME increase.

So I do not think USA economies boom is in anyones plans. Today the main importance is to reduce USD leverage over gold basis.

Like oil where reserves make people believe that Saudi can ramp up production if the wish so, Gold reserves in the West are key to ramping up production of debt money and making it acceptable.

Today , gold reserves of the West is too low and flowing East as well. Turkey is not cooperating , Saudi are not cooperating in releasing their gold stocks ( 8000+8000 tons) back to West and China.

India has reduced imports but has not started collecting gold from population.

As long as more gold is not coming to the West, its reserves are depleted and increasing money suppy or even maintaining the same will kill the USD as it will be called and rightly so a bluff.

So recession with inflation= stagflation- is the most likely outcome for the West in end of 2014- 2015.

Growth will obviously slow already in Q1, Q2, Q3 and turn negative in real terms in Q4 and beyond.

In the WSJ James Grant accurately discusses the actions that President Hoover took after the 1929 stock market crash.

“…stocks crashed in 1929, Hoover, as president, summoned the captains of industry to the White House. Profits should bear the brunt of the initial adjustment to the downturn, he said. Capital-spending plans should go forward, if not be accelerated. Wages must not be cut, as they had been in the bad old days of 1920-21. The executives shook hands on it.”

If you listen to what is being discussed today as policies going forward to revive our economy you hear Hoover all through it: prop up housing prices, hold down interest rates, pass a minimum wage to prevent wage corrections, just to name a few.

Grant goes on to quote Wesley Mitchell, father of the NBER on the Hoover experiment.

“While a business cycle is passing over from a phase of expansion to the phase of contraction, the president of the United States is organizing the economic forces of the country to check the threatened decline at the start, if possible. A more significant experiment in the technique of balance could not be devised than the one which is being performed before our very eyes.” [My emphasis]

Sadly, most economists still have not learned the lesson of Hoover’s disastrous policies now known as the Great Depression. Why would we expect the same Hoover policies to give us a different result?

The reality is that the economy is about to enter a deflationary bust, as the crack up boom in fiat wealth growth presents extreme systemic risk …………. The business cycle is now complete, and is now moving into Kondratieff Winter, as the Benchmark Interest Rate, $TNX, entered an Elliott Wave 3 Up on October 23, 2013; these are the most sweeping of all waves, they produce the greatest affect of all the waves; in this case, the destruction of economic prosperity, and introduce economic destructionism, as highlighted in Christopher Quigley’s Financial Sense article Kondratieff Waves and the Greater Depression of 2013-2020, and in David Knox Baxter Safehaven article Prepare for the Global Long Wave extinction event ………… Authoritarianism’s singular dynamo of regionalism in already establishing regional security, regional stability, and regional sustainability; this dynamo will be active in creating in addition to rising interest rates globally will fully develop economic destructionism; this as the world endures diktat money and poverty as Ambrose Evans Pritchard of the Telegraph writes IMF paper warns of savings tax as West’s debt hits 200-year high. Debt burdens in developed nations have become extreme by any historical measure and will require a wave of haircuts, warns IMF paper ………… Fiat money is now longer at work in the economy; it was a defining characteristic of the paradigm and age of liberalism. Now in the paradigm and age of authoritarianism, diktat money is at work; it incorporates new taxes, which work through public private partnerships, to produce totalitarian collectivism. Market Sanity posts details of this relating Ron Paul on ObamaCare: It’s all a tax; and Fox News reports ObamaCare brings new taxes, fees for 2014 ………… Diktat money does not and cannot support economic growth; it only serves to fuel economic deflation and economic recession; its purpose is to enforce the debt servitude of the debt serf, as the world is increasingly becomes centered around regional security, regional stability, and regional sustainability ………… Much more located here… http://tinyurl.com/m4xpge3

From the statistical point of view, those guys were right then and are right now. BEA has consistently revised their estiamtes on the US personal income upward every quuater for the past few years. I am not surprised at all if they found that the 2011 income were much lower last year this time than the number today.

However, the US wages were another story.

JBH is hands down the best commenter on this chatblog.

“So you and Kotlikoff think our economic problems are due to inadequate saving??? Sounds like you’re one of those who is stuck with 1979 talking points. Go check the FRED site and look up growth rates for Gross Private Saving. There was massive saving in 2009 as people deleveraged. You have to go all the way back to 1951 to find a larger year-over-year increase in the gross private saving rate.”

2slugbaits equates losing your leveraged house to foreclosure as “savings.” LOL you should probably start posting under a different moniker, 2slugbaits is finished here.

“CBO studies do not support your claims.”

HAHAHA the same CBO that correctly forecasted absolutely nothing ever.