Some argue that minimum wage hikes cause labor crises [1] or recessions [2] [3]. Is this true?

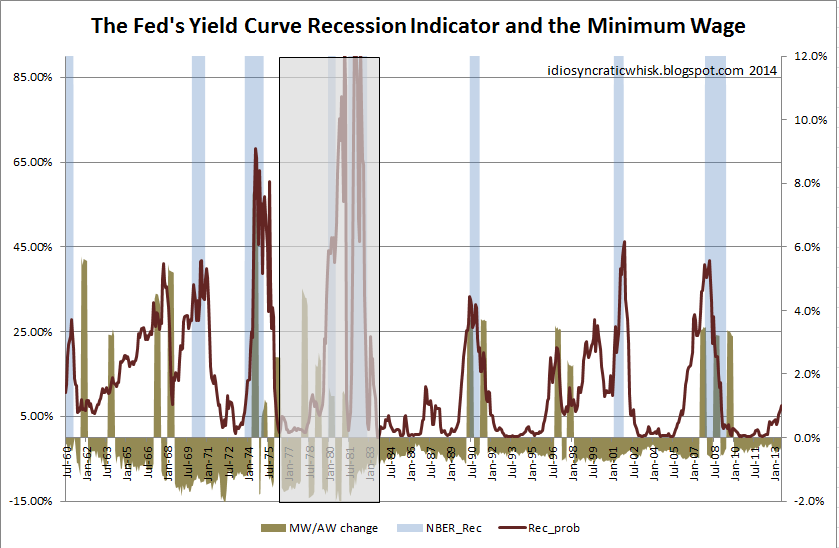

Source: Idiosyncratic Whisk.

This graph is at first glance highly persuasive. But then I realized the graph plots the minimum wage divided by the average level of compensation, so it’s tracking a ratio. Hence, average compensation (which declines during a recession) is also imparting some of the movement in the ratio. That prompted me to wonder what minimum wage increases look like in relation to recessions. Here is the relevant graph.

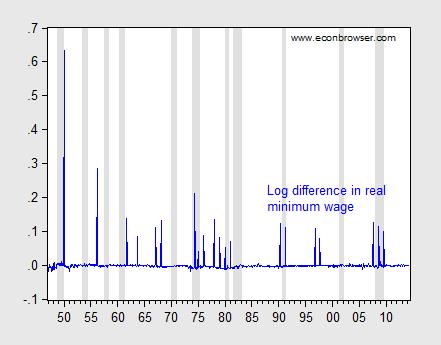

Figure 1: Log first difference of real minimum wage (blue), and NBER defined recession dates (shaded gray). Deflation uses CPI-all. Source: BLS, NBER, and author’s calculations.

It certainly seems like plenty of recessions don’t follow increases in the minimum wage. But to test formally, I undertake some Granger causality tests (remembering that Granger causality is merely temporal precedence). Using four leads and lags, I find that I can reject the null hypothesis that recessions do not cause minimum wage changes, at the 10% significance level. On the other hand, I cannot reject the null hypothesis that minimum wage increases do not cause recessions.

What about the weaker proposition that minimum wage increases induce noticeable decreases in employment? The Employment Policies Institute (not to be confused with the Economic Policy Institute) has been a vociferous advocate of this view. [4] A recent study by Professor Joseph Sabia [5] documents negative impacts of minimum wage increases. I have repeatedly asked for Professor Sabia’s data set in order to replicate his results, to no avail. Using the Meer and West dataset, I have found little evidence of the purported negative effects (see here). However, the Meer and West dataset is freely available, and anyone with the requisite skills can replicate my results.

(By the way, this is not a “spurious correlation” in the sense noted by Granger; for an instance of that, see this post.)

Menzie wrote:

Some argue that minimum wage hikes cause labor crises [1] or recessions [2] [3]. Is this true?

Menzie, could you give us links that actually support this claim. While the links you provide do say that increases in a minimum wage during a labor crisis or a recession make them worse, these links to not say that minimum wage hikes “cause” them.

Excerpt from first link: “The hikes in 1961 and 1963 were implemented as the US was coming out of a recession, and managed to avoid this odd series of misfortunes.” Oops, hikes did not cause recession.

Excerpt from second link: “Now, perhaps the minwage increases did stimulate the economy in each of those years, but the stimulus was not enough to overcome the problems that brought on the recessions.” Oops, they didn’t cause the recessions?

Excerpt from third link: “Could the minimum wage hike of 2007 have pushed the U.S. economy into recession? ”

“Let’s begin by saying that we believe that Jim Hamilton is right in that the fallout in the housing and financial sectors alone weren’t enough to produce the current recession and that it took the fallout from the oil shock to really sink the economy.”

What? You mean they claimed that Dr. Hamilton was right as to what caused the recession?

Can you spell “strawman?”

Ricardo,

The first reference is to “labor crises” so the statement is entirely correct, not recession. Do you even read things and think before going on auto-kamikaze? On 2 read the last line of the reference; the author wants it both ways. On 3, I suggest you reread the subtitle: “Could the minimum wage hike of 2007 have pushed the U.S. Economy into recession?” that suggests to me the thesis had there been no minimum wage increase, we would have avoided a recession. I am confident you have a different interpretation of English.

None of the three links claims what Menzie says; ‘Some argue that minimum wage hikes cause labor crises [1] or recessions [2] [3]. ‘

Ricardo is being overly kind by calling that a strawman.

Then there is what Meer and West actually, themselves, claim;

‘For both theoretical and econometric reasons, we argue that the effect of the minimum wage should be more apparent in new

employment growth than in employment levels. In addition, we conduct a simulation showing that the common practice of including state-specific time trends will attenuate the measured effects of the minimum wage on employment if the true effect is in fact on the rate of job growth. Using three separate state panels of administrative employment data, we find that the minimum wage reduces net job growth, primarily through its effect on job creation by expanding establishments. These effects are most pronounced for younger workers and in industries with a higher proportion of low-wage workers.’

There’s an easy way to evalue the intellectual integrity of a source (and therefore the likely value of investing your time in reading it): just look at the latest incarnation of group thinking, Climate Change (earlier examples include the world’s roundness, rotation around the sun, evolution, and the harm of smoking).

For example, we can look at the 2nd site, freemarketalternative. The first clue is that when searching for subject tags, they use “global warming” rather than the consensus term of climatologists, climate change. A quick look at the posts about “global warming” find that they’re all in denial.

We can see that this website is unlikely to give us fresh, thoughtful new information.

———————————————-

I know this suggest won’t make some people happy. Let me remind them that Climate Change really is the international and scientific consensus. For example, here’s the American Physical Society. The American Physical Society “strives to be the leading voice for physics and an authoritative source of physics information for the advancement of physics and the benefit of humanity”.

Their current statement about Climate Change is as follows:

“The evidence is incontrovertible: Global warming is occurring. If no mitigating actions are taken, significant disruptions in the Earth’s physical and ecological systems, social systems, security and human health are likely to occur. We must reduce emissions of greenhouse gases beginning now.”

That’s a strong statement.

See http://www.aps.org/policy/statements/07_1.cfm

Thanks for looking at this some more, Menzie.

I thought about the pros & cons of using the ratio. In the end I don’t think it’s a problem, because in my analysis I’m treating these series of MW hikes as events. The jump in the numerator is discrete and relatively large. Changes in the denominator of a couple percent are overwhelmed by these binary differences in the numerator. This is clear in the MW/AW series in the graph you copied here. For the purposes of that data, the scale of the nominal changes in the numerator are the overwhelming factor, and the denominator mostly acts as a trend leveler over time and as an estimate of real changes in MW, versus nominal, since real changes are more likely to be related to dislocations.

Since the Federal hikes tend to come in series, the other thing I have done is to treat the series as single events. I did this by using a set 2 year period, beginning with the first hike in a series. There is a shape of employment behavior through these events. Employment tends to drop in the months before the first hike, and tends to be recovering by the time we get past follow up hikes. Regressions of monthly time series aren’t going to catch this kind of data behavior. And I’ve seen analysts who say something like this: “There have been 20 MW hikes, and employment rose after 11 of them, so there isn’t any disemployment effect.” They really need to look more closely. I think they will find that the positive observations tend to be the last hikes in a series and the negative ones tend to be the first hikes in a series.

Also, along with my treatment of these hikes as grouped events, the identification of MW hike events as a sort of binary on/off issue breaks down between 1976 and 1981 because there are a number of hikes implemented at that time which are generally offset by high inflation. This is why I block out the 1970’s in the graph you posted. As above, any monthly data series that includes this period is probably going to get a little muddy.

As for the idea that recessions lead to MW hikes, you might be on to something. We had a MW hike in July 2008 and again in July 2009 when unemployment was at 9.5%. We had passed extended unemployment insurance in June 2008 because labor markets were considered dysfunctional at the time. Then, in September, after the Lehman Bros. collapse, the Fed decided to take a strong stand against inflation, and we experienced a deflationary shock. This is a shocking set of policy decisions, considering the place nominal wage rigidity has as a factor in labor crises. So, the idea that our government is conducting a heartless experiment on marginal laborers, under the direction of Kang and Kodos, is one of the more hopeful interpretations I can make of this. Maybe Congress has a secret policy of implementing MW hikes when they already expect a recession to come.

Here is the simple data set of the series of MW hikes. I created observations of the 2 year periods before, during, and after MW hike series, and regressed changes in the employment-population ratio against lagged RGDP and MW/AW. The most interesting outcome to me was that when I just used lagged RGDP, the errors were highly correlated to MW/AW. If MW/AW was bringing in some correlation with RGDP shocks or labor shocks, then I think we would expect to see RGDP drop during the MW periods so that it would tend to underestimate growth in the periods coming after the MW periods, as RGDP would be recovering by then. But, this isn’t what I find.

http://idiosyncraticwhisk.blogspot.com/2014/01/a-couple-more-minimum-wage-regressions.html

The teen employment-to-population ratio went from 45% in 1999 to 26% currently, and we think the answer is raising the minimum wage?

“Could the minimum wage hike of 2007 have pushed the U.S. Economy into recession?”

“Some argue that minimum wage hikes cause labor crises or recessions. Is this true?”

Which of the above quotes suggests the thesis that a minimum wage increase causes a recession?

Menzie, I wasn’t going to respond but when I read what you posted as claiming minimum wage caused a recession and compared it to your first sentence, I laughed right out loud.

Ricardo: As usual, I have no idea what you are trying to get at. But I expect nothing but incomprehensibility from you. Thank you again.

If the national minimum wage kept-up with inflation and low-wage productivity, since its peak in 1968, it would be around $13 an hour today. I stated before:

It’s highly unlikely a $10 minimum wage keeping up with inflation would result in millions of lost jobs. Many other variables would adjust to prevent those job losses. Whether the net effect, on the economy, is positive or negative is uncertain. However, the evidence suggests a market failure in low wage income. So, it’s likely, an increase in the minimum wage, up to some level, will have a positive effect on the economy.

There are many other factors that have a much more powerful effect on employment. It’s possible, low-wage workers have been underpaid for decades.

‘It’s possible, low-wage workers have been underpaid for decades.’

Boy, all those dopey businessmen who’ve missed out on this, and passed up profits that were staring them in the face!

Like my “dopey” former classmate at CU-Boulder, who started a firm about 15 years ago and has several hundred employees now?

He pays the highest possible wages for his workers, who all earn $30,000 to $60,000 a year, and buys equipment to make the work easier for them. He pays himself $150,000 a year. He could pay himself much more, if he wanted to, but limits his pay.

His philosophy has always been to pay his workers as much as possible and make their jobs easier. Attracting and retaining better workers was likely a major factor why he was able to take market share from his competitors.

****

And, what about these dopes?:

Worker wages: Wendy’s vs. Wal-Mart vs. Costco

August 6, 2013

“Hundreds of dissatisfied workers at major American companies like Wal-Mart (WMT), McDonald’s (MCD) and Wendy’s (WEN) have joined protests nationwide in the past year demanding higher wages and better benefits.

One company that hasn’t had to deal with such strikes is Costco (COST).

The no-frills warehouse chain pays its hourly workers an average of just over $20 an hour, compared to just under $13 at competitor Wal-Mart.

Sales at Costco have grown an average of 13% annually since 2009, while profits have risen 15%. Its stock price has more than doubled since 2009.

During the same period, discount retailer Wal-Mart’s sales grew an average of 4.5% each year, profits rose 7%, and its stock price increased 70%.

Costco seems to be investing some of those profits back into its employees.

Cesar Martinez, a 37-year-old fork lift operator, has worked at a Costco in North Carolina for 19 years. He makes $22.82 an hour, gets health benefits and a pension plan. He manages to save, and doesn’t worry about hospital bills for his daughter, who suffers from asthma.

“That’s the reason why I’ve been here for so long,” he said. “The company gives you a decent wage and treats you with respect and takes care of you. That’s why we all give 100%.”

Research shows that it pays to pay employees well, because satisfied workers are more productive and motivated, according to MIT Sloan School of Management professor Zeynep Ton, who focuses on operations management.

“How many times have you gone to a store, and the shelves are empty or the checkout line is too long, or employees are rude?,” she said. “At Costco, you see a huge line that disappears in minutes.”

The productivity translates into sales, she said.

According to Ton’s research, sales per employee at Costco were almost double those at Sam’s Club, its direct warehouse competitor owned by Wal-Mart.

The median pay for fast food workers nationwide is $9.05 an hour, or about $18,800 a year.

While the fast food and retail industry is making record profits, its workers are forced to rely on public assistance just to afford the basics.”

More curious correlations!

the theory behind the minimum wage thesis is that the demand for labor is downward sloping and a wage hike causes employment to fall.

So why don’t we try applying this theory to total employment.

As far back as we have data — 1947– labor compensation has risen each and every year.

If you apply the line of analysis or theory the opponents of minimum wage apply this

should lead to the conclusion that total employment should have fallen every year since 1947.

Of course this did not happen because the demand for total labor and minimum wage labor in particular\

is a function of many thing of which wages are just one. Essentially every model of total employment I know

of, has wages as a very minor element in the demand for labor. The same analysis applies to

minimum wage employment. Unless you have a methodology to hold all these other thing

constant — as the theory says you should — you can not predict what the impact of a minimum

wage hike will be on minimum wag employment.

It is a shame that so many economics teachers do not make sure their students understand that

their theory depends on the assumption of all other things being constant so you can not

just simply apply the theory to the real world.

‘the theory behind the minimum wage thesis is that the demand for labor is downward sloping ….’

Even Thomas Piketty admits that it is.

PeakTrader wrote:

He pays the highest possible wages for his workers, who all earn $30,000 to $60,000 a year, and buys equipment to make the work easier for them. He pays himself $150,000 a year. He could pay himself much more, if he wanted to, but limits his pay.

His philosophy has always been to pay his workers as much as possible and make their jobs easier. Attracting and retaining better workers was likely a major factor why he was able to take market share from his competitors.

Peak,

That is one of the best things written concerning free trade in labor I think I have read in a while. This is proof that the market sets the wage. Your friend’s business obviously has skilled workers who can demand a higher wage because he too these workers from his competitors with higher wages and still took market share.

If he were in competition with Walmart he would be out of business almost before he starts paying all his employees $30-60K per year. Walmart shoppers will not pay the prices to support those kinds of wages.

Comparing Costco to Walmart is apples and oranges. Costco must be compared to Sam’s Club, Walmart’s warehouse sales. First your $20/hour is bogus. A front end supervisor only makes $22/hr. The average for Costco is closer to $12/hr. Sam’s Club pays slightly less, around $11/hr. But then BJ’s pays about $10/hr. It is interesting that BJs charges the most for merchandise. Employeees at Costco and Sam’s will earn about the same. Customers at Costco and Sam’s pay about the same. Guess what? The market dictates wages and prices even at warehouse clubs.

Peak,

Just one other comment on Costco v Sam’s. Sam’s pays its managers more than Costco. This has been the technique of the Walton management style from the beginning. Sam Walton paid an entry level wage then those who were the best workers were moved into management and paid based on their sales success. Sam Walton created more low education millionaires than any one in history.

The market wage is too low. That’s why it’s a market failure, resulting in productivity and output that are too low.

‘He pays the highest possible wages for his workers, who all earn $30,000 to $60,000 a year, and buys equipment to make the work easier for them. ‘

In other words, he substitutes capital for low skill labor and only employs higher skill labor. Pretty much textbook economics.

All of which ignores the plight of low skill workers and those who work in non-capital intensive industry. Or for employers who simply don’t have the resources to provide their workforce with capital, to enhance productivity. I.e. the people who will be hurt by a minimum wage that is above the market clearing wage for low/un-skilled labor.

Why do you hate the poor?

Why do you want workers to work harder than they have to for less wages?

Why do you want less demand, to generate fewer jobs, which hurts the “poor?”

Why do you want to prevent production of capital equipment, to create jobs, including for “poor” workers?

Why do you hate the poor?

And, why do you assume poor people are too dumb to handle capital equipment?

Moreover, why do you want to keep firms that can’t even afford capital equipment?

And, prevent better firms from expanding?

Furthermore, why do you want to slow or stop freeing-up limited resources to expand the economy?

“I have repeatedly asked for Professor Sabia’s data set in order to replicate his results, to no avail. ” -MC

Good on ya man. Thanks for doing this. Thanks for attempting to rigorously test these various propositions.

I would have been tempted to simply dismiss the minimum wage hikes cause recessions hypothesis out of hand. I am not a fan of high minimum wages but that story makes no sense whatsoever.

Minimum wage hikes may increase structural unemployment. Slightly. I thought that was the stylized fact/received wisdom. But then I wouldn’t be surprised if that was difficult to empirically verify.