The deterioration in Kansas state finances not only continues unabated — it is seemingly accelerating.

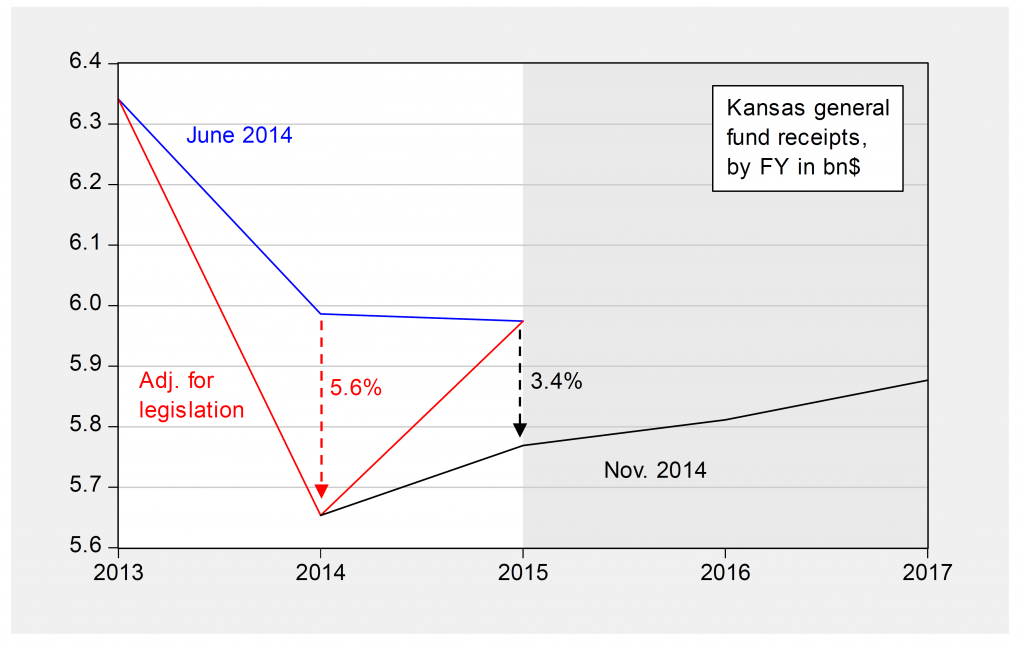

Figure 1 presents the evolution of estimates of Kansas state general fund receipts.

Figure 1: Kansas state general fund receipts, as estimated by Kansas Legislative Research Department and Kansas Division of the Budget June 16, 2014 (blue), adjusted for legislative changes during veto session Nov. 10, 2014 (red), and updated estimates as of Nov. 10, 2014 (black). Shaded area are forecasts as of November 2014. Source: Kansas Legislative Research Department and Kansas Division of the Budget (June 16, 2014) and Kansas Legislative Research Department and Kansas Division of the Budget (November 20, 2014).

As the Kansas budget blog observes, FY 2015 approved spending plus additional costs required to pay for Medicaid and school finance totals $6.427 billion. That means that even after completely draining the reserves in the state bank account, $279 million must still be cut from already approved spending just to keep the state solvent.

From the Wichita Eagle:

The state of Kansas will not have enough money to pay its bills through June unless it cuts $279 million in spending, according to updated revenue estimates.

Just a week after being re-elected, Gov. Sam Brownback is staring down a budget crisis, and nonpartisan analysts point to his signature policy as the cause.

Budget director Shawn Sullivan had the unenviable chore of presenting the state’s dire fiscal outlook at a news conference Monday evening at the Capitol. The state must cut $279 million for the current fiscal year, which ends in June, and another $436 million in the next fiscal year.

…

The shortfall is primarily being driven by the state’s income tax cuts, which Brownback signed into law in 2012, confirmed Raney Gilliland, director of the state’s nonpartisan Legislative Research Department. The state has lowered its expectation for individual income tax revenue by $239 million since April.

Sullivan said he had not discussed raising taxes or delaying scheduled tax cuts as possible solutions to righting the state’s financial ship.

Gilliland said the state’s current budget woes differed from the crisis it underwent during the recent recession, when the federal government came to the aid of Kansas and other states that saw revenue plummet.

“It’s not a national phenomenon, so I’m not expecting under these circumstances for the federal government to come to our rescue,” Gilliland said.

Gilliland said it was “yet to be determined” whether the income tax cuts were stimulating more economic activity than the state would see otherwise. The state is projected to see slower growth next year than the nation as a whole.

On the campaign trail, the governor repeatedly promised that economic growth would cover the state’s projected shortfall.

…

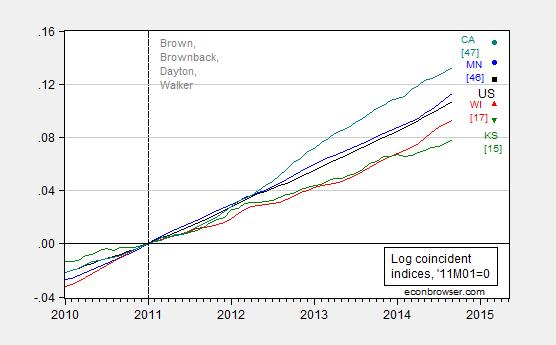

Below is a depiction of the Kansas economic outlook, based on the Philadelphia Fed’s leading indices.

Figure 2: Log coincident indices for Minnesota (blue), Wisconsin (red), Kansas (green), California (teal), and US (black), and forecasted levels for March 2015, all seasonally adjusted, normalized to 2011M01=0. Numbers in [square brackets] are ALEC-Laffer rankings from Rich States, Poor States 2014. Source: Philadelphia Fed leading indices, coincident indices, ALEC RSPS2014, and author’s calculations.

The outlook for the Kansas economy does indeed look rather lackluster for the next half year.

Update, 11/13, 9AM Pacific: From Barro, “Kansas Announces Big Budget Gap, but True Gap May Be Even Larger,” NYT today:

Kansas’ budget problems keep getting worse.

State officials said this week that the tax cuts championed by Gov. Sam Brownback would force them to start a new round of substantial budget cuts before the end of June.

They need to cut $279 million, $239 million of which is attributable to lower-than-expected personal income tax collections. Those aren’t small numbers in a state budget of approximately $6 billion and where revenues have already declined sharply. Kansas state revenues dropped 11 percent in the fiscal year 2014 (which ended in June) after the tax cuts took effect.

But that may not even be the whole picture. A close look at the state’s new revenue projections makes clear they are highly optimistic, even after this week’s cut in the forecast. Kansas says it expects to collect slightly more personal income tax this year than it did last year, even though, with four months of collections in, they are 11 percent behind last year’s pace.

If the last four months’ performance is similar to the next eight, the state won’t miss its original income tax estimate by $239 million.

It will miss it by $546 million.

And because the state was already scheduled to spend down nearly its entire rainy-day fund balance (which totaled over $700 million in 2013) by the end of this year, it will have to respond to any widening budget gap with some combination of further spending cuts and tax increases.

My favorite part is the way that delaying or reversing the tax cuts has “not been discussed.”

it is really hard to find anything positive to say about these developments in kansas. the tax cuts were expected to stimulate growth and produce increased revenue as a result. guess you need to be careful of relying on secondary effects. or is the real goal to starve the beast?

Looks like it’s bathtub drowning time Sam.

Apparently the people in Kansas are not clapping hard enough and Tinkerbell is going to die.

Tax cuts cannot fail to increase revenue. They can only be failed by insufficient belief in fairies.

The Reagan tax cuts generated strong GDP growth, while reducing government tax revenue.

Of course, if tax rates went to zero, government wouldn’t collect tax revenue.

PeakTrader: I think there was an expansion in Federal government expenditures (including defense), was there not?

I agree, there was a huge increase in defense spending and some cuts in other spending.

It is my understanding that Reagan’s combination of tax cuts and spending increases shifted the U.S. from being the world’s largest creditor before he took office into the world’s largest debtor by the time he left

What’s your point?

You don’t want foreign investment in the U.S.?

You don’t want the U.S. to consume more than produce in the global economy and in the long-run?

You don’t want the U.S. to shift limited resources quickly from old industries into new industries?

What about the U.S. investment surplus?

Perhaps you did not notice that it is the GOP the one that has been complaining about government deficits and the growing debt since 2009. Apparently, they were asleep at the wheel while the Bush administrator turned the budget surplus received from Clinton into a budget deficit and wrecking the financial sector (and the broader economy as a result).

You should be concerned about adding $5 trillion of federal debt for a deep depression over the past few years.

There was a mild recession in 2001, thanks to the Greenspan Fed and the Bush Administration, and the 1982-00 economic boom was extended when the structural bull market ended in 2000.

If Congress tightened mortgage lending standards, rather than easing them, when the Fed began tightening the money supply in 2004, the financial crisis and severe recession may have been averted.

It should be noted, the U.S. had a steeper rise in living standards in the mid-2000s, because the U.S. was at full employment and consumed about $800 billion more a year than it produced in the global economy.

Of course the massive rate-cutting at the fed had zippo to do with ’80s gdp growth: that’s your position?

Is it your position strong disinflationary growth was entirely caused by the Fed?

it is my position that to claim that the 1981 tax cut uniquely generated strong gdp growth is an untrue claim and must be evaluated in the context of highly favorable monetary policy providing a tailwind.

I guess, you believe the tail wags the dog.

How about taxing 100% with lots of liquidity from the Fed?

I’ve cited some of the factors that facilitated growth under Reagan and Clinton.

It should be noted, income inequality increased and the recovery has been weak with the QEs in recent years.

So, there are other important factors that can generate growth.

No, you’re simply not reading. I said monetary policy matters and to discuss ’80s gdp growth without discussing the monetary tailwinds is to misstate the basic facts.

“The Reagan tax cuts generated strong GDP growth, while reducing government tax revenue.”

And then Clinton increased taxes and GDP grew even faster as well as revenue for the first budget surplus in decades.

The GDP growth after Clinton’s tax increase exceeded Reagan’s after tax cuts. So there does not appear to be a simple correlation between tax cuts and growth. Other economic factors predominate.

On the other hand, there is no question that tax cuts increase deficits — every single time.

When Clinton raised taxes, the recovery was well underway, which is the best time to raise taxes (Reagan also raised taxes in a strong expansion).

Moreover, in 1995-00, the 80 million Baby-Boomers reached their peak productive years, oil fell to $10 a barrel, and we had a “peace dividend” after winning the Cold War.

I’ve explained it to you before.

No, the recovery was not well underway when the clinton tax hikes were passed. Whatever makes you say something that wrong?

“Whatever makes you say something that wrong?”

The Bush expansion began in 1991.

And, the expansion accelerated, in spite of the Clinton tax hikes.

It was inevitable, in part, for reasons I stated above.

sorry, i was occupied the last day or so and missed your response.

yes, the expansion formally started in 1991, but unemployment continued to increase through june, 1992, and the clinton tax hike was passed in may and june of 1993, so no, the recovery was not well underway and what you’re saying is incorrect.

The unemployment rate is a lagging indicator.

The 1990-91 recession was milder than the 1981-82 and 2007-09 recessions.

So, a milder recovery is expected, to move towards full employment.

Chart:

http://www.multpl.com/us-real-gdp-growth-rate

Real GDP growth accelerated in 1992:

http://www.multpl.com/us-real-gdp-growth-rate/table/by-quarter

So, “what you’re saying is incorrect,” except what you said that agreed with what I said.

The unemployment rate is a lagging indicator.

The 1990-91 recession was milder than the 1981-82 and 2007-09 recessions.

So, a milder recovery is expected, to move towards full employment.

Chart:

http://www.multpl.com/us-real-gdp-growth-rate

Real GDP growth accelerated in 1992:

http://www.multpl.com/us-real-gdp-growth-rate/table/by-quarter

So, “what you’re saying is incorrect,” except what you said that agreed with what I said.

It looks like the first posting went through under “Anonymous” with the name and email boxes empty.

When you can chart a well underway recovery, keep us posted. You haven’t, you’ve just shown an early stage recovery that ultimately ran, from the date of the tax hike, another 7+ years.

And, oil fell to $10 per barrel in ’86 because upon taking office in ’81 Reagan deregulated, one of the four planks of his program made clear to the American public ahead of time and followed through on. What neither Reagan nor all but one other cabinet member (Darman) grasped was what David Stockman at the OMB saw early on. That another of the four Reagan program prongs, that of supporting Volcker’s inflation fighting, was going to decimate nominal dollar GDP growth and thereby burgeon the deficit. Stockman’s warnings were to no avail. For all lurkers, Stockman’s The Great Deformation (2013) is heads and shoulders above any other macro book going back at least as far as Minsky’s and Rothbard’s and Hayek’s works. Stockman’s tome starts before the Great Depression, includes all the key characters along the way, is heavily data-based, and without parallel in its grasp of how the economy really works.

oil fell to $10 per barrel in ’86 because upon taking office in ’81 Reagan deregulated

It might also have something to do with oil from Alaska, the North Sea and KSA, combined with sharp reductions in consumption.

Nick G

If you really want to understand you must go back and examine history. Saudi Arabia was the swing producer. The Saudis’ attempted to keep price up by cutting back and cutting back on production. By late-1985 their quantity was falling dramatically putting their revenue on a fast track to zero. Recognizing this, they did an about face and started pumping again. Oil then dove precipitously in early-1986 to $10. By Occam’s razor, this and deregulation are the heart of the story. Of course, gasoline prices had soared during the second energy price shock. Price controls under Carter then put a lid on them, locking price between $1.25 and $1.27 from March through December 1980. Reagan took office in January and immediately deregulated. For the following 13 months price then ran well above this, even though the latter part of this period was 6 months into the ’81-82 recession. In fact, in final month of that severe recession price was $1.24! The market was righting itself from a prior wrong. Unleashing the market (in the context of OPEC in the background attempting to dictate a cartel price) caused the behavioral change you refer to, which did not happen overnight but gradually over a 5-year period. $10 per barrel oil for a time in ’86 was the visible consequence.

There was a great deal of additional supply from the N. Sea, Russia and elsewhere, in addition to KSA. Alaskan oil started flowing before 1981. http://en.wikipedia.org/wiki/Trans-Alaska_Pipeline_System#mediaviewer/File:Alaska_Crude_Oil_Production.PNG

Finally, US consumption fell by about 20% between 1978 and 1982 – that also helped drive down the price.

Deregulating the price of oil was a good idea, but it was not at the top of the list of factors in the 1980’s price crash.

“I’ve explained it to you before.”

What you explained to me was that this was the result of some golden era of bi-partisanship. That well-timed Clinton tax increase you toted did not get one Republican vote. And immediately after the welfare reform you toted, the “bi-partisan” Republicans unanimously impeached the President. Why do I get the idea that you are, like, 20 years old, and never experienced the things you bloviate about and rely on some dime-store revisionist history you picked up on a dubious internet site.

As to the Reagan expansion, it was accompanied by the biggest Fed interest rate cut, the biggest government expansion and the biggest deficit stimulus spending since WWII.

Joseph, why are your answers too simple?

For example, politicians often vote against things they’re for in a bill, because there’s no compromise.

And, why make a connection, e.g. voting for a bill, and impeachment, e.g. lying under oath, when there’s no connection?

Joseph,

Clinton increased taxes and lost both the House and Senate.

He then became one of the strongest supply side presidents in the history of our country. Clinton may be immoral but he certainly know how to turn after a “whuppin’.”

What strange definition of supply side are you using? Paygo is not supply side thinking, nor is running a surplus.

I see we have causation/correlation experts commenting in this thread.

What is the message of this post? That fiscal stimulus has failed in Kansas?

jeff, perhaps you need to target fiscal stimulus? if you put money into the hands of folks who need to spend it daily, it will work. if you put money into the hands of folks who do not need to spend it, they will simply save it. hence the need to separate tax cuts among the various income levels.

Wisconsin has gone down a similar path as Kansas and I can see on the graph that it’s only doing marginally better. Can you do a breakdown of Wisconsin’s finances?

To understand Kansas political economy,those closest are the best judge. Brownback won, Roberts won, the rest of the state wide offices continued republican. And perhaps most telling, the republicans gained 5 seats in the legislature. The people think the state is heading the right direction.

Wisconsin, Walker won, all other state wide offices went republican, except one, who in Wisconsin could not vote the La Follette name. The republicns gained seats in both houses of the legislature. Peoples decision, the state is heading the right direction.

Minnesota, Dayton won, Frankin won, all state wide offices went democrat. The republicans decisively won the legislature House, flipping it from the democrats. the people like the direction of the state, but insured against democrat overreach by dividing the power.

As an added note, although not in Menzies political sight, Colorado has a mixed result. Arguably, Colorado by statistic may have had the strongest recovery of the mentioned states. Hickenlooper, the democratic Governor won reelection, Gardner, the republican beat the democratic incumbent for the US Senate. All other state wide offices went republican. The democrats kept control of the state House but with a smaller majority, the state Senate flipped to the republican control, with a net pickup of 2 seats. The people decision was mixed, local races, retained a self described moderate governor, but flipped one house and reduced the majority democrats in the other house. Nationally, got rid of the incumbent democratic Senator.

Just a note. This is not where I would post a post-election wrap up, but it seems that Menzie, after months of blatant partisan electioneering, has not allowed us readers a reasonable place for such. Come on Menzie, the days of grief and mourning should be over, do a post election wrap up.

Ed

ANd no we can witness the post-election melt down in the Wisconsin budget for many of the same reasons I note below. Also, please explain why Wisconsin’s young people in the North and West seem to be voting with their feet and moving Westward in ever-increasing numbers.

Morb

If it is true, it is what the young should do. Please note I said the voters saw the direction of Wisconsin is right. But it is only the direction. The state remains a high tax, high regulation place. There are years ahead as more of the these disincentives that affect the young more are removed. I know this approach is counter to the “quick-fix” mentality of bigger government crowd, but it remains the only valid answer to the no-growth and slow-growth economy of the redistribution crowd. Maggie Thatcher had it right.

Ed

The fact that the Kansas tax revenue losses are accelerating is not at all shocking. The number of seminars and conferences being sponsored by tax professionals, Kansas CPA firms, and tax attorneys headlining how to “Turn Your Taxable Income Into Tax-Free Business Income” and how to “Become Tax-Free in Kansas”, that I saw (and I don’t even live in Kansas) should have tipped state revenue officials off early that a tidal change was happening–or maybe they didn’t want to see, or maybe they were actually happy about it. Speaking from 35 years of experience, throwing out the red meat of total tax exemption in front of tax professionals is begging, simply begging to see your state income tax revenues vanish–there is no other way to describe it. The techniques required to turn taxable salary income into exempt business income are inexpensive, easy-to-draft and, not surprising, fast to complete. And with the decimation of the Kansas Dept of Revenue through continual budget cuts means that even if you simply misrepresent taxable income as business income, there was no one to catch you. These losses will continue to accelerate after the 1st of the year when the last quarter estimated tax payments fall to nothing and the claims for refunds for the previous tax year begin to loom large. In response, Kansas GOP politicians stated “we don’t have a revenue problem, we have a spending problem”. I think the de-population of Kansas that we’ve seen in the last 10 years, is about to gain momentum.

Morb,

What is missing from your comment, is that businesses must submit the same tax form to the Federal government. Only legitimate business tax expenses are allowed. You have two powerful agencies state and IRS there to audit the forms.

So explain to me something, if a tax rate of just ~7% in taxation is the incentive for these businesses to claim missed legitimate tax expenses, why a tax rate up to 35% (Federal tax rate) did not give that incentive.

This law simply allows Kansas firms to accumulate funds within the company (~7% greater) for the use to strengthen and growth the company, but does not change their Federal tax bill.

BTW, would you link to some of these seminars and conferences, I could not find any with a quick search.

Now to your next point., the depopulation of the state. HUH? I will try to follow your logic. Living in Kansas as a productive entrepenuer who will pay less taxes if I designate money to remain within the company that I cannot spend on my personal consumption, rationally deciding to defer current consumption on the risk of greater wealth and consumption in the future. But because of this, I prefer to pay higher taxes and flee from the sate. Or if someone who prefers to be an employee, and because jobs are created because to private job makers are capable creating better jobs faster, I will flee the state because why? too much choice or opportunity. No, they do not flee.

Ed

Ed, you are incorrect on almost every statement, do you have any experience in filing business tax returns at all, or any tax experience other than your own personal tax filings? I have about 30 years of such experience as a CPA/attorney. The state tax forms are not submitted to the federal government. Whatever gave you that idea? Some states require the attachment of federal forms in their filings, others do not. But the presence of forms notwithstanding, Kansas EXEMPTS all business income that flows through to its owners—exempt—understand? I can (and have for the past 30 years) devised multi-state, multi-entity tax structures (totally legal) that can send “legitimate business expenses” wherever the owners so desire. As for those aggressive audits, let me assure you, they only skim the surface. Study after study shows that the greatest amounts of tax fraud occurs among closely-held and small businesses.

As for de-population I’d check the census department figures on population declines throughout rural Kansas over the past decade, as I have done, before talking. Did you know that Kansas actually has a program to pay, cash money payments, to young families who settle in decking rural areas?

Ed Hanson: Interestingly, Kansas population growth has fallen from 0.9% in 2010, to 0.3% in 2013, below the 110 year historical average of 0.6%.

Menzie,

Growth rate fallen still means population growing.

And as you know comparing to the historical average is meaningless

And the growth statistics fell off drastically between 2010 and 201, as like the growth rate of the US as a whole. Don’t know, but if I cared, I would investigate that severe drop as a statistical anomaly caused by some change in producing, which as you know does occur periodically in all long term data collections not a conspiracy. But the statistics show growth rate is growing from that year.

I know you l love to obsure data by use of percents and logs, that is, doing so by not putting anything in context, so I will.

This following was co.pied from “http://www.ipsr.ku.edu/ksdata/ksah/population/2pop1.pdf. I have made some formatting changes to attempt to make it clearer, but if it becomes unreadable I rewrote the most important numbers later.

first number – Year

second number – Kansas

third number – U.S.

fourth number – Rates of Growth(2)Kansas

fifth number – Rates of Growth(2)U.S.

sixth number – Kansas Population as a Percentage of U.S. Population

2010 2,853,118 308,745,538 6.1 9.7 0.92

2011r 2,869,548 311,582,564 0.6 0.9 0.92

2012r 2,885,398 313,873,685 1.1 1.7 0.92

2013 2,893,957 316,128,839 1.4 2.4 0.92

(1) Includes armed forces residing in the state.

(2) Rate of growth from the previous Decennial Census.

Single dash (-) indicates not applicable.

r – revised

Resident Population(1)

Rates of Growth(2)

Source: U.S. Bureau of the Census,

Statistical Abstract of the United States,

various issues; Population Division,

http://www.census.gov/

popest/index.html (accessed March 27, 2014)

So, to repeat the most important information derived from the U.S. Bureau of the Census, population continues to grow”

2010 2,853,118

2011 2,869,548

2012 2,885,398

2013 2,893,957

repeat, repeat, Population is growing and will grow some more.

Ed

rate of growth is the more important measure than absolute values. in particular, the rate of growth is low, and less than the US average. why?

Kansas population growth may have been lower than the national average during the Great Depression too, as people from Kansas packed-up and moved, e.g. to California.

Many young people in Kansas may want to move to a bigger metropolis, or megalopolis, rather than to Wichita.

Ed Hanson: “This law simply allows Kansas firms to accumulate funds within the company (~7% greater) for the use to strengthen and growth the company,”

Apparently you have never actually run a business. A business does not grow by accumulating funds. A business grows by spending money — on more workers, more equipment, more factories, more advertising, etc, — all of which is tax deductible.

You have the tax incentives exactly backwards. Low taxes on business income encourage hoarding of profits. High taxes encourage spending because spending in a business, unlike a household, is tax deductible. The higher the business tax rate, the greater the incentive to spend income on tax-free growth.

Anyone who has actually run a business knows this. You, who has never run a business, do not. You are thinking like a household, not like a business.

An example is the famous Bell Labs. At the time there was an effective corporate tax rate of 50% and similar rates on dividends. If the company accumulated their profits, as you suggest, they had to give at least half of it to the government, and have no spending for growth. On the other hand, if they invested it in blue sky research at Bell Labs, they got to keep all of their money, tax-free. High corporate tax rates encourage spending on research and growing a business because spending is tax deductible. Low tax rates do the opposite.

Ed Hanson: “This law simply allows Kansas firms to accumulate funds within the company.”

As I said before you simply don’t understand how businesses are taxed. For a pass-through business — S-corp, partnership, sole proprietorship — there is no concept of money retained in the business. There never was and there still isn’t. That is why it is called a pass-through business. All profits pass through to the owner. It makes no difference whether you leave the money in a business account or put it in your personal account. For accounting purposes all company income is counted as passing through to the owners. This has always been the case and is still the case in Kansas. So this idea of pass-through companies retaining funds is a red herring. It means nothing.

What has changed in Kansas is that the profits passed through the company are no longer taxed. It doesn’t matter whether you leave the money in the business or transfer it to your personal account. You can take all the profits from the company and buy a new pickup truck, a boat and a second home on the lake. It’s all tax free now in Kansas.

When pass-through income was taxed, the owner had an incentive to spend profits on expansion in order to get a tax deduction on business spending. So you can see that the elimination of the pass-through tax means there is no longer an incentive to invest in the business in order to get a tax deduction. Now the owner can simply strip all the profit out of the company and put it in their own pocket, tax-free.

Jo

As usual for your posts, it is full of misinformation, so much so, they are usually not worth responding to. But in this case I will.

It is you who has the Kansas law backward and wrong. Any funds passed through the company is still taxed at the Kansas rate. (And money will continue to be passed through. It is funds not passed through, which are not.

Not many companies are lucky enough to be so profitable that they can pay for large expansions out of current receipts. Most companies have to go to outside sources to raise the money. That being loans, personal injection of funds, or selling equity.

Ed

Any funds passed through the company is still taxed at the Kansas rate. (And money will continue to be passed through. It is funds not passed through, which are not.

Ed, Ed, Ed. Get thee to an accountant who can explain this to you.

All income passes through to the owner’s tax return. That is why they are called pass-through businesses. Even profits that stay in the business account are passed through to the owner’s tax return. There is no retained income. There just isn’t. Never has been and still isn’t. But in the Kansas case, that pass-through income is no longer taxed. So lots of S-corps are arranging things so that owner wages are reduced and instead profits passed through untaxed. That is why Kansas is generating huge deficits.

Obviously you have never run a business in your life, yet you pontificate on things you know nothing about. You are just making yourself look foolish.

Now I’m certain Ed has no understanding of business taxation. So here, go read this, it explains the concept to the layman.

http://www.kansascity.com/opinion/opn-columns-blogs/barbara-shelly/article3326556.html

The retention of cash in a business is an accounting concept. The pass-through of earnings to LLC members and other various owners is a tax concept. That is why you have GAAP books, and tax basis books in a business.

“Now I’m certain Ed has no understanding of business taxation.”

Yes, and this isn’t just a semantic difference. It goes to the heart of Ed Hanson’s argument about incentives to business owners. Ed’s mistaken belief is that pass-through owners — S-corps, partnerships and sole proprietorships, which includes LLCs — can avoid taxes by retaining earnings in the company. But this is a mistaken belief. Owners pay taxes on all business income, whether it is kept in the company or withdrawn by the owners. That is the essence of the definition of a pass-through business.

So what does this mean to business incentives? If all business income is taxed, as it is in pass-through businesses, then the way to reduce taxes is to spend the money in business expansion and get a tax deduction. Taxes encourage investment. But if all taxes are eliminated for pass-through income, as in Kansas, then there is no need for an investment deduction and the owner can just as well take the money out of the company and buy a boat. The elimination of taxes discourages investment in the company.

The chronic threat to the role of the states are governors, legislstors and electorates who run them to be run cheap and when recession comes, panicked. In 2007 the 50 states contributed $1.8 of GDP but cut that by $88 billion in supposedly heroic budget cutting, adding to heavy lifting by the Federal Government to get the national GDP up $837 billion. In 2007 the states on a net basis borrowed a “normal” $140 billion for capital improvements. In 2011, 2012, and 2013, the states rather than borrowing disinvedted by $145 billion. Lack of normal (let alone Keynsian) improvements created a $600 billion hole in construction. Governor Brownback created drag in Washington because of objections to federal power, but then he came back explicitly determined to “shrink” state government and do doing to leave the Federal Government the only significant player on the field. Decades ago, a Kansan named Dwight D. Eisenhower expressed disappointment at state governments’ unwillingness to be proactive, and he had great difficulty in getting the states to pay a 10% share of the Interstate Highway construction costs even though it was a huge loval wealth generator around every exit ramp. One would hope that people who run for governor would step out instead of retreat and retrench and undersell the potential of their respective states.