Americans are living longer and retiring earlier. But how, as an individual or as a country, can you finance a 30-year retirement with a 40-year career? Stanford Professor John Shoven recently visited UCSD and presented some interesting policy suggestions.

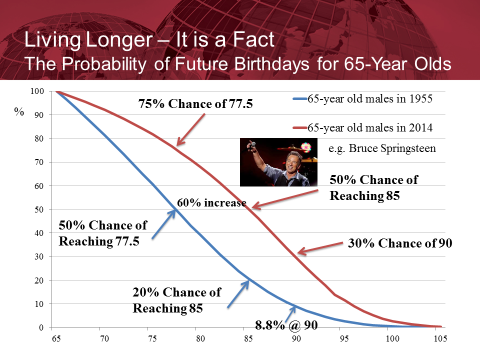

Probability that a 65-year-old male will live to the age indicated on the horizontal axis as of 1955 (in blue) and 2014 (in red), along with one example of a 65-year-old male in 2014. Source: Shoven (2014).

Professor Shoven noted that the current structure of Social Security in some cases amounts to a pure tax on those who work for more than 35 years in order to transfer those funds to individuals who retire early. He suggested that one change we should consider would be to recognize the status of “paid-up workers.” The idea is that if you’ve already put in 40 or more years of paying into Social Security, at that point your personal Social Security bill would be declared to be paid in full, and neither you nor your employer would be asked to make any more Social Security contributions for as long as you continue working. This would create more incentive for older citizens to keep on working and for employers to want to hire them.

I am deeply skeptical of claims that any cut in tax rates could actually produce an increase in tax revenue. But there is at least some offset in this case. If some people work longer than they otherwise would as a result of Shoven’s proposed change, while there would be less Social Security taxes collected from those individuals and their employers, the IRS would collect future income tax from those people that they otherwise would not get. And a number of academic studies (e.g., [1], [2], [3], [4], [5]) have concluded that the decisions of individuals to keep working in their later years can be quite sensitive to their take-home wage, meaning that the income-tax offset could be significant. Moreover, in research with Goda and Slavov Shoven proposed a combination of the “paid-up” exemption along with a number of other changes to benefits and contribution formulas that would be revenue neutral and on net encourage people to use some of the extra years that improving medicine has given us to keep on contributing.

These strike me as policy proposals that we ought to be taking seriously.

Also, older Americans rather than just consuming in retirement will produce and consume.

Right now we have more of a problem with older people not retiring early enough. Young people cannot get those jobs and get to pay income taxes, because the old folks don’t retire. Now if we had a lack of workers then that would do wonders with respect to increasing salaries and boasting consumption. If and when we get to the point where there is a lack of labor and wages have gotten a good natural increase as a result – then we can talk about ways to retain the old people rather than ways to kick them and and make space for the young.

It’s not a “problem” older workers aren’t retiring early enough.

The problem is the economy isn’t expanding fast enough to absorb everyone who wants to work.

Believing older workers should make room for younger workers is ridiculous.

To many workers for the amount of available work can be solved in many different ways. Having failed to solve it by expanding the amount of jobs the next question is who should be left without a job. Its a lot better long term to have the old folks retire than to have the young ones not getting started.

Why?

Older workers typically have more experience, training, and education.

Only their health can hold them back, and people are living longer.

Why not promote economic growth, and therefore jobs, instead?

I have nothing against economic growth. But in the current situation with a lack thereof we have to look at who would be less harmed by not being given the opportunity to contribute to society with paid work. A lot more harm is done by leaving young people out of the workforce than by letting older folks retire early.

‘Young people cannot get those jobs and get to pay income taxes, because the old folks don’t retire.’

DeLumpofLabor!

JDH: “Professor Shoven noted that the current structure of Social Security in some cases amounts to a pure tax on those who work for more than 35 years in order to transfer those funds to individuals who retire early.”

This is simply false for the great majority of Social Security workers. Your primary insurance amount is based on your indexed monthly earnings for your best 35 years. Most middle and lower class wage earners do not start making substantial earnings increases until well into their working careers. Their first 10 years may be little more than minimum wage, so tacking on higher earning years at the end can substantially increase their benefits. Most of these people can’t afford to retire early anyway. So Professor Shoven is going to have to define what he means by “fully paid up.”

The statement above might be true only for the top 5% who earn near or above the Social Security cap for the majority of their careers. It is much simpler to raise the salary cap for social security benefits and these “unfortunate” few at the top won’t have to worry about maxing out after a mere 35 years.

The idea that we can’t afford social security is false. The word “afford” is not a mathematical conclusion. It is simply a value judgement by some people who don’t want to pay for it.

The embedded assumption seems to be that a person’s benefit would be calculated from the 35 years when they are paying SS taxes. Currently most people will increase there 35 year average by working (and paying taxes) in the additional years beyond the 1st 35 – so there seems to at least a partial offset in inventives

Cut Medicaid benefits and use the freed up debt to pay for more SS. Or cut Defense spending…or more taxes.

Shoven is right that the peculiar formulas that social security system uses to calculate benefits implies net taxes typically on people who are at retirement age and who are deciding whether to work for one more year. These taxes discourage longer careers.

Social Security benefit calculations start with the average indexed monthly earnings (AIME), which is the sum of the largest 35 years of earnings, divided by 420. From that amount, the primary insurance amount (PIA) formula determines the monthly benefit. If you work one more year, you replace the current salary with the lowest annual salary in the 35 year average. That means that the change in the AIME is (current salary – lowest)/420. For example, if you work one more year at 65K and your lowest salary in the average is 25K, then the change in AIME is (65K – 25K)/420 = 95$. In 2015, the PIA formula says that you get 32% of AIME in benefits if it’s greater than $826 and less than $4980. Assuming that’s a typical case, that means the benefit goes up by about $30 per month (32% of $95), plus 8% for delaying retirement 1 year, so that’s $32 per month, which you might receive for perhaps the next 17 years if you are lucky. Even without correcting for present value, that’s 17*12*32 = $6528. And yet the worker plus employer will pay 12.4% in social security taxes on the 65K salary, or $8060, so that he pays $8060 – $6528 = $1532 to Social Security to work one more year. The tax disincentive to continue working gets more pronounced as income rises, since the PIA formula specifies that the worker gets 15% of AIME over $4980.

At the same time, if you are a high income worker who works for fewer than the 35 years, then you are taxed less and may even get a benefit. For example, suppose you are a high income worker who has worked for only 15 years (maybe you were a struggling actor before you went to law school), you are 67, and you want to decide whether to work for 1 more year at a 117K salary. If you work one more year, you replace a zero in the 35 year formula with 117K/420 = $279 change in AIME and if you get 32% of that in benefits that amounts to an extra $89 per month plus 8% for delaying retirement 1 year, or $96. So, ignoring present value, that’s 96 x 17 X 12 = $19,584. But you will pay 12.4% X 117K = $14,508 in social security taxes, a net benefit.

The implicit taxes in social security discourage people from working longer if they have already worked a long career. But given the increases in longevity, people really do need to work longer to finance retirement. Shoven’s proposals seem a very sensible and politically implementable correction to Social Security’s perverse incentives.

haha, you just said that something was “politically feasible”. the only way that anything will be politically feasible is if obama comes out in support of breathing, and in response, the tea party decides to stop breathing.

I have no illusions that something like this proposal could happen now, given that the most aggressive and partisan Administration in the post-war period will be in the Whitehouse for another 2 years.

you don’t think the GOP controlled House over the past few years has been aggressive and partisan? don’t be a political hack rick.

Baffles,

The behavior of the House since 2010 was a reaction by the voting public and the Republicans to the unprecedented partisanship and aggression of the Democrats in Congress and the White House over 2009 and 2010 in which they passed three major, unpopular acts with essentially no Republican support. True bipartisanship does not mean that you tell the other party that they must accept the essential features of your proposals and that you are only willing to negotiate with them over minor details. True bipartisanship does not mean that you push over the line the most liberal policy you can, subject to being barely able to get it past members of your own party, with many, many of them losing their seats in the process. True bipartisanship means that you only get half of what you want and that you accept serious philosophical compromises that you wish you didn’t have to accept in order to get something done. This Administration has been the most aggressive and partisan in the post war period, and Democrats in the House and Senate have suffered the political consequences.

rick,

midterm elections which result in congress switching power is not an uncommon result, you are very much overstating this situation to try and enhance your argument. in addition, republican’s refused to negotiate with obama on the health care plan, for they were afraid to be seen as compromising with obama-a four letter word in the conservative world.

you have two different definitions of bipartisanship, depending upon which party is in power. how many votes to repeal obamacare have occurred in the republican led House over the past few years? where is the compromise and bipartisanship you speak of? like i said, don’t be a political hack rick.

You claim people are living longer, then why is it you hear about most Americans being obese and that obese people don’t live as long? Something sounds deceptive here, maybe people are not living longer and this claim is just a scam to raise the age at which someone can draw Social Security. What makes the older generation more entitled than the younger generation? They sure didn’t leave a better environment for their children.

The median age at death is unambiguously higher now than in 1955 and higher than in 1975. The evidence is overwhelming. No room for conspiracy theories. The obligation to the elderly arises from law which compelled them to make contributions to the Social Security Trust Funds throughout their working lives. Are you suggesting that we, as a society, should simply ignore our pledges, and the law, to satisfy your distributional preferences?

jim, people are living longer because we have reduced considerably infant mortality over the years. That has increased the average and median quite a bit. If you examine a person’s remaining years after say reaching 65 (ignoring the effects of early year deaths), which is around the retirement age, you find the life remaining on average has not increased tremendously for most folks. you really need to be aware of how the statistics of life expectancy are calculated or you end up with a misunderstanding of the situation. many politicians and pundits have deliberately been capitalizing on this issue when pushing for their social security agenda. basically the peak of the distribution has been shifted, but the part of the curve describing 65+years is affected much less.

In my own case, I started watching my SS computation when I turned 55. At first, I was worried that I wasn’t going to get 35 years of full time income. Then when I was 58, I was worried that I wouldn’t be able to continue working to replace my my first 3 years of lower income earnings. Finally when I turned 61, I realized that my payments into SS were a personal waste and I wanted to retire.

Well, I had wanted to retire for decades actually, but wasting my income by continuing to pay into SS when it had almost no effect on benefits drove me to look for ways to retire as soon as possible. I guess that helped my employer to decide on pushing me into early retirement.

And I’m living happily ever after. The “paid-up worker” theory worked in my case, only the incentives drove me out of the workforce.

The graph seems irrelevant for policy – those who were 65 in 1955 are long since dead and were likely irrelevant when the system was revamped in the 1980s – it is meant more to create an emotional response. More interesting would be a graph of the 1980’s assumptions for a 65 yo in 2014 vs the current estimates – my bet is there has been little divergence.

I agree with Shoven: Only economists could cast living longer as a problem.

The effect of the Hartz IV reforms in Germany clearly indicate that workforce participation is a decision variable. (http://www.prienga.com/blog/2014/10/6/employment-to-population-ratios) You manage such variables by increasing the returns to working and decreasing the returns to leisure. Pretty basic. Shoven lists some possible policies.

Fortunately, we have quite a bit of money to negotiate with. If we assume that a 65 year old could earn $30,000 or require $20,000 of public support in various forms, then we have, in effect, a $50,000 annual pot we can split with the older worker.

I am personally intrigued by the concept of vesting some portion of Social Security. Currently, you receive about $100 per month for every year you defer retirement until the age of 70. Benefits do not increase after that. The current SS/MC tax rate is 15.3% if I read it correctly. So if one made, say, $50,000, then the SS payment would be around $7,500, in trade for $100 / month for the rest of his life. Not that appealing.

I agree with Shoven. Either waive the SS payments, rebate it at the end of the year, or vest it. The real prize here is not the SS payment, but the extra year of labor.

And have I mentioned, we appear to have a hot labor market: http://www.prienga.com/blog/2014/11/14/oil-and-labor

The fact that a consultant to the oil industry sees that labor market through the lens of oil doesn’t really add up to evidence about the labor market. Even that consultant is not arguing that the labor market is “hot”, as you have. The consultant is only pointing to indications that look positive for future hiring, except in the case of the quits rate.

Let’s not even get into the consultant’s utterly unsupported conclusion that secular stagnation isn’t in effect because oil prices explain everything. There is no reason to think the two effects cannot both be at work.

Wages are stagnant. There are more job seekers in every broad job category that there are job opening. How do those facts add up to a hot labor market?

Prof. Hamilton

I take a different tack at this Social Security fix as interesting as it is. The very fact that it would take 40 years to be considered to become “paid up” demonstrates the systems is extremely flawed and needs to be completely changed and not just fixed. I will attempt to demonstrate with a back of an envelope calculation. For this I use some statistics gathered from the net. The average monthly salary in the US is assumed to be $3,769 per month (Chron.com for 2011). The average monthly benefit from Social Security for retired workers is just over $1300 per month A simple average / average calculation shows the SS benefit at 35% (0.35 rounded up) of average monthly salary. Additional information came from Charles Schwab where I found their estimate of real long term returns for large-cap stocks at 7.4 %, mid/small-cap stocks at 8.2%, international stocks at 7.2%, and bonds at 4.8%. All compounded annually, and all percentages below historic average.

On the envelope:

Worker earns the same monthly wage throughout the calculated period. Called W. (very simplified assumption)

Worker contributes 12.4% of earnings to SS. Called savings S, which is 0.124W (actual)

Worker Standard of Living called StL = W – 0.124W = 0.876W

Assumed real return rate an savings I = 5% (conservative assumption)

Total contribution to retirement fund if privatized called C. (use of calculator found at

http://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php)

Simple annual interest payment at end of accumulation period to match SS benefit W * .35 = C * I/12

Simple monthly interest payment at end of accumulation period to maintain StL = C * I/12 (not an annuity, accumulated savings remain with worker)

Find the years it takes to match SSB.

Accumulation C to match SSB (Social Security benefit)

.35W = C * I/12 –> 84W = C

From calculator it takes 28 years of work to reach “paid up”.

Conclusion. It should only take 28 years of work, not 40 years, for annual return to match Social Security benefit.(I am not advocating retirement after 28 years) Because of some redistribution parts of SS, it will take very low wage workers to more years to reach SSB. In addition, the savings accumulated remains untouched with the worker to achieve this return. I submit that very quickly, survivor benefits are better if death strikes during the accumulation period. And, of course, the accumulated saving become ever greater, ever faster for more years of work.

First last note.

If you are young, it is imperative that you demand an end to the current SS system. Warning, I have been demanding for 40 years to no avail. Now after all those years of paying SS taxes I have no accumulated savings from that money and shortly will be sucking at the teat of your earnings.

Second last note.

I had not realized how bad the Social Security system had become. I actually hope that someone can show that my calculations of significantly wrong. It can not claim that I have been perfect in the past. Just recently Joseph correctly refuted my analysis of the Kansas new treatment of s-type businesses.

Ed

ed, it is probably important to realize that social security is meant to be an insurance program, not a retirement fund. granted, we have distorted it in use and media so that many people think it truly is a retirement fund, and unfortunately the only one they rely on. but when you consider it as an insurance program of sorts, then you really need to be careful about calculating your return on investment and other such parameters. i say this because it has a risk factor completely different from any other type of investment you may make. its risk and solvency concerns, in real terms compared to stocks and bonds, are very different.

Baff,

Call it an insurance program, a supplementary retirement program or just a retirement program, a bad deal remains a bad deal, a bad program, no matter its high ideals, remains a bad program.

I stop at a calculation of the years to attain current benefits with the addition of retaining the accumulation of assets, but it is easy to use the calculator to determine the years to achieve a true retirement income, It follows:

Worker Standard of Living = StL = W – .124W = .876W

StS = .876W = C * I/12 = C * .05/12 –> C = ~ 210W

From the calculator it would take 43 years to achieve the same Standard of Living with a huge accumulated asset untouched by retirement earnings. Of course, if you choose spend the years to accumulate this nest egg, many years earlier you would reach the point that purchasing an annuity to pay the StL monthly payment.

Note that approximately the same number of working years many have before retirement can gain a real retirement plan plus a huge accumulated asset.

Finally about risk. The risk of long term investing is very, very small compared to the actual risk of the current SS system which within 20 years by law will reduce its distribution to each recipient to 75% of benefit. That is lousy insurance. As it was when I was young and beginning my lifetime of work, I would take the market risk in a heartbeat. And any of you who are young today, I’ll give you 2 guesses if the crisis of benefit reduction will happen, and who will pay the piper as the politician play CYA to keep the reduction from happening. Advice, find your political power and change the system now.

Ed

ed,

“Finally about risk. The risk of long term investing is very, very small compared to the actual risk of the current SS system which within 20 years by law will reduce its distribution to each recipient to 75% of benefit.”

this is not correct. long term investing poses a serious risk based upon timing. if you needed to retire and cash out your retirement account in 2009 you would sing a different tune. social security is an “investment” if you want to call it that, which is basically immune to market timing. fundamentally different from your stock market investments and even bonds, it’s a completely different risk profile. this is why your return on investment is lower, if you want to measure it that way. social security is your “conservative” portfolio allocation-something everybody needs but most feel they don’t since they are great market timers!

now you can argue about the reduction in ss benefits in 20 years, but i would disagree with you that there will be such a reduction in benefits. of course you could start by capping ss payout limits today if you are so concerned about the future.

Point #1: There isn’t a lot of convincing evidence that people just entering the workforce today will live longer than those currently near retirement. The bigger concern is that today’s young generation will not live as long as their parents.

Point #2: We have two very different workforces. On the one hand we have high earners who drive desks all day. Their biggest impediment to working longer is fighting off the temptation of those donuts in the conference room. On the other hand, we have a lot of people who do hard, physically demanding work. For those people work isn’t just a simple labor/leisure trade-off at the margin that is likely to be influenced by trivial changes in tax rates on the marginal dollar. They retire in order to avoid the physical pain they experience everyday on the job. It’s one thing to encourage bankers to work longer; it’s quite another thing to design policies that discourage roofers and iron workers from retiring at 65.

Point #3: People working longer means the economy produces more. But it also means those same people increase their consumption. It is not at all obvious that on balance the increased output offsets the increased consumption that comes with higher income. There’s a reason why pay raises typically come fast during a worker’s first 20 years, and barely at all during the last 20 years. No one seriously believes that a 70 year old earns his or her marginal product beyond the 20th workweek hour. That’s why companies want to dump them. That’s why companies typically offer job sharing for older workers rather than full-time employment.

Point #4: If tax policies change to encourage workers to work longer, then why shouldn’t we expect workers to save less during their working years? You can’t take it with you, unless you think it’s important to be the richest man in the cemetery.

Big Picture: The main problem is inequality. There are two very different worlds out there. For one group of people, work is a rewarding experience. For those people the trade-off is between higher incomes or more leisure. In other words, they have to decide which good option they prefer. For the rest of the world work is a degrading and physically punishing experience. Their goal is to avoid the pain and misery of working 12 hour days doing back breaking work, only to find at the end of the week that they’re victims of wage theft. For this group the choice is between which bad choice they want to avoid more. That’s a reality for a lot of workers. So when Prof. Shoven writes about Social Security, he needs to remember that his work experience is very privileged.

2slugbaits, you’re making a lot of assumptions.

If half of workers are able to work well at 70, because they’re in good health (e.g. avoided serious injury at a more physical job, which a more physical job can be healthy, or worked-out at a gym, while working in an office, which is also healthy, etc.), then why discourage them from working?

Wouldn’t the economy be better off if those 70 year olds worked rather than not worked?

Why make everyone poorer just to reduce income inequality?

I’m 72 and my wife is 70 and we both started collecting social security (SS) at age 69 while continuing to work, although at reduced hours.

Just last week we were notified that each of us was receiving very small SS increases based on our individual earnings last year.

The increase was considerably less than the social security taxes we paid last year, so we would have been better off under the paid in full concept.

But if the SS system is facing a large deficit the last thing we need to do is cut SS revenues as this proposal does.

SS is a form of insurance and I know of no insurance policies that do not shift income from some participants to others.

This type of transfer is a deliberate feature of SS but the transfer from affluent to poor SS recipients is much larger than the transfers the good professor is concerned about.

So why should SS be different?

It is probably worth noting that nothing Ed has presented is new. He has offered a standard anti-Social Security argument. When offered rebuttals that he very easily could already have been aware of, he recycled some other long-ago answered stuff which, while couched in financial talk, do not represent sound financial advice. Why we should be convinced by arguments long known to be wrong is not clear.

And, oh by the way, that 75% figure is 75% of a much higher future benefit. It amounts to more than the current benefit, not nearly as frightening as it’s meant to sound. Again, Ed could easily have known that. If he didn’t know, then he really isn’t familiar with the facts, so cannot offer a reliable argument. If he was aware, but chose not to mention that the 75% figure is expected to be higher, in real terms, than today’s payout, then he is unreliable for an entirely different reason. We should have no faith at all in his assertion that a future reduction in benefits is a greater risk than the risk inherent in private financial instruments. He has no evidence for that claim. It’s mere opinion from someone who’s opinion is demonstrably unreliable.

Oops, technical difficulties led to posting the wrong comment here.

What I should have posted is that Spencer has spotted a real problem with Shoven’s piece. He is calling for a reduction in premium payments without identifying a reliable offset. In addition, his argument is based on an inappropriate notion of fairness. In insurance schemes, non-claimants support claimants. The only difference here is that some claimants support other claimants. That’s the plan. It is not a bug at all. Since we do not know, before the fact, who will support whom, Shoven’s claim of unfairness doesn’t really wash. The luck of the draw is a big part of relative benefit, as is intended in an insurance scheme.

Simply encouraging longer employment changes nothing regarding Social Security solvency. The Social Security formula for the age at which you first claim your benefits is close to actuarially neutral. In other words, the person who starts their benefits at age 62 at a reduced rate gets the same lifetime benefit as someone who starts at age 70 at a higher rate, on average.

From what I can see, he recommends simply changing the terminology, calling 70 instead of 66 the full retirement age, but he doesn’t change the benefit formula. So it makes absolutely no difference to solvency whether someone retires at 62 or at 70 if they no longer make contributions. They get the same benefits either way.

On the other hand, cutting off all increases to AIME after 40 years is a perverse benefit cut for lower income people who work longer. That is the only way I see this scheme changing Social Security finances. And eliminating all contributions after 40 years gives top earners a huge tax break that makes solvency worse.

So I don’t get it. How does encouraging longer employment improve Social Security solvency in this scheme other than potentially cutting benefits for low wage earners who work longer than 40 years. Maybe there is some secret sauce that isn’t evident in the Powerpoint, but the math simply doesn’t make sense. Working longer without making contributions doesn’t change benefits paid out.

Google search Professor John Shoven the Charles R. Schwab Professor of Economics at Stanford University and the many different schemes he has proposed for Social Security over the years. I think it’s called poisoning the well.

Professor Shoven noted that the current structure of Social Security in some cases amounts to a pure tax on those who work for more than 35 years in order to transfer those funds to individuals who retire early.

And why is that a bad thing? One reason people retire with fewer years of employment is that they find themselves in long periods of involuntary unemployment. It’s kind of hard to contribute to Social Security if you’re chronically unemployed. Another reason people chose to retire early is that they work physically demanding jobs. People like Prof Shoven tend to forget that being able to work a long time is largely a matter of good luck. Any why shouldn’t we tax good luck? If there have to be taxes, then let’s tax good luck before we tax effort.

As to his “fact” that people are living longer, I seem to recall a Krugman chart that showed the conditional life expectancy broken out by income group. Almost all of the life expectancy gains were associated with those in the upper income brackets.

Joseph I think a lot of these proposals are just ruses for getting the camel’s nose under the tent. The idea is to deliberately push Social Security into an even more difficult fiscal position in order to unveil yet another privatization scheme as the remedy.

I did find amusing Slide 12 in which a rational expectations economist suggests that workers can be irrationally tricked into working longer, even though there is no change in benefits, merely by changing the definition of the words “full retirement age.”

This particular plan seems like a devoted tax cutter appealing to us on the basis of tax rationalization, but the general idea of reducing the incentive to retire is good. I certainly agree we need to consider formula changes to better encourage working past 65. My main reason is simply that in my experience people who work longer are happier and healthier longer, though I admit that’s not always the case. Slug’s point about physical laborers is fair but I think there are almost always ways they can continue contributing without overstraining.

Social security is not meant to be the sole support of a retiree. If you do not have additional savings, or another defined benefit plan, you are foolish to rely on SS alone. Professor Shoven seems to assume that you should be able to do so.

I don’t understand the suggestion’s rationale that this will encourage older people to continue to be in the work force. Already, the over 65 demographic has the highest rate of growth in work force participation. The inadequacy of the current pension/SSN/personal savings strategy of retirement funding has forced many individuals to work well past their intended retirement dates, and setting up a system where younger workers get to compete with older workers who are statutorily cheaper to hire will increase the work force participation of younger workers.

Sorru that should be “decrease” not “increase” in the last sentence.

Glad we have repealed age discrimination so people can work long enough to be “paid up”

Peak Trader Wouldn’t the economy be better off if those 70 year olds worked rather than not worked?

Except that’s not what the Prof. Shoven’s proposal would do. The effect would be to reduce revenues going to Social Security, which would ultimately force people to work who really should not be working past today’s retirement age. Remember, we have two very different workforces. If bankers want to work longer, then fine. But giving them a tax break only means less revenue coming into the system and ultimately that means everyone has to work longer whether they want to or not.

Also, I’m actually not convinced that the economy is better off if old geezers continue to work. Yes, working longer means that they produce more, but it also means that they have more claims against consumption. There is no particular reason to believe that geezers actually earn their pay. My experience has been that they resist salary cuts even though they are not nearly as productive as they were when they were in their mid-50s.

Ed Hanson You’re forgetting that Social Security increases returns on equities and bonds. If you privatized Social Security, then those bond and equity prices would be bid up, which would lower their return on investment. Even Martin Feldstein, who is a big supporter of privatizing Social Security, concedes that you cannot use past equity and bond returns as an expectation of what you would get under a privatized system.

When it comes to Social Security benefits it seems that conservatives are all over the ballpark. On the one hand they scream about how rotten the returns are and how people could do much better under a privatized system. And then in the very next breath they will scream bloody murder that those SS Trustee bonds are earning a risk free return of ~5% when you can’t get that kind of return anywhere else. The complaint is that Social Security is too generous. Well, which is it?

Older workers, health permitting, have more experience and should be relatively productive. There could very well be significant spillovers from encouraging older folks to keep working.

Slug

I appreciate your comment, it is the only one which looked at my simplified calculations for errors. And you are right, it would seem that with all that private money bidding for a finite resource such as a bond the yield would go down. But that gives the impression that the resource would remain so finite. I do not expect you to agree, but as more money remains in the more efficient private sector, the growth of the overall economy would be much higher. This would increase the number of available bonds, the number would grow correspondingly. As would another investment category, stocks, which would increase in number and price as the economy grows faster. I am sorry, but worst thing that would happen is we and the world would all be richer, with the problems that come with wealth. One final note. Chile, the example of a country that did privatize, has gone through the same financial upheavals as the rest of the world. There is no popular sentiment to return to a public SS system. Even the socialist who are increasing in political power there, know not to touch the privatize system.

Baff,

And what would be the case of person whose retirement was to happen at the bottom of the market. Assuming that the person had not been prudent and changed his investment mix when approching retirement to be less affected by the stock market. Assuming that he retiree did not simply keep working, or just take a lower income stream as his accumulation dictated, until now when all his investments completely recovered. Assuming that the retiree who insisted on the same previously expected retirement income but did not buy an annuity which the lesser accumulation could easily have bought. The point is even if the retiree did not make any of the the adjustment above, his income from that now lesser accumulation would still be greater than he would get under the current system. Understandingly a shock to expectations, but better result in actuality. Or finally, the retiree simply could have died. After all, that is the best thing that can happen for the today’s SS system.

Other commenters;

I have read most several times. And have a few thoughts. Do not just take my back of the envelope calculation as anything but a guide to what could have been better. You have a better information available to each of your particular circumstance. Retrieve a copy of your yearly SS contribution. Assume you kept that money in an accumulating personal retirement account. Determine how you would have invested that money each year. Data on historical yearly returns of large-cap stocks, mid/small-cap stocks, or even 10 year government treasuries are easily available. See what you could have had, it came from your earnings, it should be your right to have.

And a final note.

The worse thing I read is about shifting of income from one group to another is okay and perhaps normal. I read that it is right that the young should send their income to the old, not just their parents, but any old one they do not even know. It is not right. This is the current system. The SS system has always been a transfer system from men to women. Perhaps not bad, good societies always provided special protection for its women, but is that philosophically the same today as women have gained full rights. I leave that question to academia. The current system is also a transfer system from the illegal immigrant to the citizen. You each can determine how you feel about that situation. So young to old, men to women, illegal to legal, I am certain many can justify this in their minds. BUT.

The most unjust transfer has always been and still is. That is black to white. Only recently have black people as group have achieve life expectancy beyond SS retirement benefits. (most true for black men). But still get much less benefit from the system. Go ahead and justify that in your mind. A privatize system may not solve the life expectancy problem, but it sure as heck allow the accumulated resources from the 12.4% earnings to stay with their families.

Ed

You have heard enough from me, but I will still make one more effort to the young especially. Start by reading the latest Social Security report about the SS trust funds. The summary can be found here:

“A SUMMARY OF THE 2014 ANNUAL REPORTS”

A few highlights:

You think that Social Security is an insurance system, just look at the most insurance type part of it. I quote, from the part about the Social Security’s Disability Insurance (DI) program,

“Trustees project trust fund depletion late in 2016, the same year projected in the last Trustees Report…Lawmakers need to act soon to avoid automatic reductions in payments to DI beneficiaries in late 2016.

That happens in less than 2 years and I will tell you The Lawmakers will not pay for the fix, you will. A bad system is what caused this and it is your bad system.

You can read about the other programs yourself. Read that the Medicare Hospital Insurance benefits will be severely reduced by 2030, unless fixed. And the major part of the system, what people think as SS benefits will be severely reduced in 2033, unless fixed. That is less than 20 years. And I will repeat, the Lawmakers will fix it, but they do not pay for the fix you will.

Just to put some numbers to the fixes, no longer will you just have 12.4% (SS) and 2.9% (Medicare) taken from you, the amounts will go up and up. Think 17% for SS and 6% for medicare. So instead of a whopping 15.3% today, a huge 23% soon.

When the government takes that much, forget about being able to supplement your retirement with IRA’s or 401K’s or other such vehicles. Your excess earnings to fund those will be already eaten. All that lifetime earnings will be dedicated to the same bad program with terrible return on investment. Wake-up and capture back your earnings. Chile could do it, Australia could do it, You can do it here. It will be better for you, as a consequence, it will be better for America and better for the whole world. Just remember one thing, the government, the takers, are counting on you being unconcern about the problem, ununified about a solution. And if fear is a problem, scary words like privatize just means that you keep what you earn the good and the bad, you have the responsibility, you keep the freedom.

Off the soapbox for now.

Ed

15.3 % to 23% buh-hu. We have to pay for having a civilized society – and if we don’t harvest the money from rich people, we have to harvest it from the average Joe. Our taxes will still be way lower than other civilized countries even if we increased them to cover the promises we gave people when they planned their lives and retirements. The social safety net in this the richest country in the world is already an embarrassment – stop the whining about having to fund it with taxes.

DeDu

What a magnificent citizen you make. If the government demands more of your earnings or your property, don’t look at the poor return of the program, don’t look that the program is something you could provide for yourself better, don’t look that when you provide for all provide for themselves with savings and investment, the country as a whole grows faster meaning more wealth for all.

I had a flash of a past life of yours, DeDu. Your Lord from the castle was coming, the government you have. You know the Lord will demand comfort for the night from your wife. Ah, the greatness of civilized society that government brings. And just think, the Lord may throw you a copper if your wife is good to the government.

Dedu, don’t evaluate, don’t be critical, just don’t care, it is an easier life. You remain a serf.

Ed

Ed,

If you divert FICA withholding to an investment program, how do you fund current SS payments to retirees?

I would be more than happy to look at those items – but that is not what you are doing – you are just whining and throwing unsubstantiated postulates. The idea of comparing social security to a private sector pension plan show that you have totally missed that it is not a retirement plan – it is poverty insurance for you and your loved ones. What you should look at is administrative and profit cost for the programs and nothing in the private sector comes even close to the low costs of these public programs.

Beg to differ. Ed is doing worse than making unsubstantiated claims. For instance, he directed readers’ attention to the disability fund as if it represents a sort of guide to what will happen with the old age pension fund. That’s a huge stretch. Ed’s entire effort seems aimed at people who don’t know enough to catch the inaptness of his arguments.

Ed also added the worker and employer tax rates together without mentioning that he did so. Even if you believe the claim that the employer contribution ultimately comes out of wages, it’s duplicitous to sneek the combined figure in without admitting to havedone so. In fact, in an era of stagnant wages, the claim that the employer share comes straight out of wages is pretty questionable.

So when Ed warns us not to be sheep-like, that can reasonably be read as a warning against taking Ed seriously.

Ed Hanson, you don’t have to guess. The Social Security Administration does a calculation of internal rate of return each year.

http://ssa.gov/OACT/NOTES/ran5/index.html

As expected low income people receive a better return than high income people because Social Security is designed as a redistributive program. Younger people get a lower return than older people because older people paid in at lower rates. Couples with one earner get better returns than singles or two-earners because of the spousal benefit.

Nothing particularly surprising with this.

It also amounts to a tax on those who go to work after high school to transfer those funds to individuals who go on to graduate school or otherwise have a shorter working career (with higher income while in it). (The bend points act as a marginal tax to decrease this effect somewhat.)

Ed,

Of course you are right that Social Security is a bad deal for current and especially future retirees. That’s the nature of the pay-as-you-go system in which early retirees received much better than market rates of return because of demographic factors that produced an increasing tax base, coupled with increases in taxes over the years. But now demographic factors imply that rates of return will continue to fall and there will have to be substantial tax increases or benefit cuts in the future. Thus, I agree that SS needs to be substantially reformed, with a new private investment component. But politically, I don’t think we’ll ever get to a full privatization. Reform will have to be a mixed system that retains features of the current system and that includes a component in which current and future workers can invest a component of their social security savings in market instruments such as stocks and bonds.

The political tension in reform is produced by the question of whether current or future workers will pay to address the medium- and long term solvency issues with social security. I think the only politically acceptable solution is to split the cost and to attempt to do it in a way that avoids the large increase in taxes or reduction in benefits that must surely come if we continue on the present course. That means for future retirees we need to gradually slow the rate of increase of benefits. And current workers will have to save more. One way to get them to save more is to require that part of the current social security revenue be diverted to a private account held by individuals which could be invested in a portfolio of stocks and bonds. And current workers could be required or incentivized to save an additional portion of their income in the private portfolio.

Doing something like this seems to me to be the most feasible political path to avoiding large tax increases or benefit cuts in the future. And the economics makes sense. The increase in national saving will yield increases in real growth, which will help to compensate for and may replace slowing of future benefits growth. On top of that, future retirees will not face a world with much higher taxes and will enjoy reduced labor market distortions from social security. And current and future retirees will very likely get higher returns from their investment in the market portfolio than they would from social security.

I don’t buy the argument that his often made that people can’t get higher returns investing some of their savings in a market portfolio rather than in social security. While it is true that a greater aggregate demand given a constant risk profile could reduce the expected return necessary to hold a risky asset, there are countervailing forces. First, the argument typically assumes that people have already optimized their portfolios, so that increased returns just represent compensation for bearing increased risk. But a substantial part of the population does not own stocks or other investments and participation in these markets could well be beneficial on a risk-adjusted basis. Moreover, the government taxes away a substantial portion of returns to risky investments and distributes them to people who didn’t bear the risk. So, after-tax returns could be too low given the risk and a substantial increase in public participation in risky assets, if it is done pre-tax, might imply higher returns in equilibrium.

People also criticize the proposal to transfer at least some of social security to an investment in a market portfolio on the grounds that it is too risky. But I think this is mistaken too. The mistake is a common one: rather than compare two options realistically, they compare an idealized version of one option to a realistic version of the other. The most common example of this occurs when people point out market imperfections and then advocate that the government come in a fix them. But this argument compares the market to a government that is depicted as a disinterested umpire rather than an institution that has its own serious imperfections that might well be worse than the market failures. Similarly, people point to the uncertainty of market returns, and worry about the chance that the returns will be lower in a recession when people need them, but then they portray a pay-as-you-go social security system as somehow risk free. But the risk to future returns of the current social security system is also substantial. Future taxpayers and congresses cannot be bound by today’s promises. Benefits and therefore rates of return can and have been cut in pay-as-you go systems all around the world. Unfortunately, you can’t quantify this political risk and you can’t hedge it, since it’s not traded.

However, market risk can be quantified and it can be hedged. People who are much more dependent on social security and their market portfolio for their retirement income can transfer the risk that return on the market component might be reduced in a recession to someone who is better able to bear that risk. But there is nothing you can do about the political risk of your returns dropping in the current pay-as-you-go system other than voting and hoping that the laws of arithmetic don’t apply. Besides, even if market returns do turn out to be lower than what we’ve observed historically, it doesn’t mean that people won’t be better off by investing partly in a market portfolio. We know that returns to social security will be substantially lower going forward and so the market portfolio would have to seriously under perform to ultimately be worse.

At the same time, we need to reduce any other labor market distortions produced by social security. Professor Shoven has pointed out one such distortion that JDH has highlighted in this post. There are many others to deal with as well. But, ultimately, we do also need fundamental reform, as you suggest.

rick,

you fall into the same trap most people do, as you misunderstand the purpose of social security. it is not a retirement account, it is insurance against poverty in old age, beyond the age at which you can work your way out of poverty. this is why it is nonsense to try and compare social security to an investment portfolio. you want to change social security to a privatized system. then why not simply abolish the system altogether and let people put there money wherever they desire? but before you answer that question, you need to ask yourself why social security was created in the first place. once you understand why social security was created, then you understand why a privatized system-or simply abolishing the system-is not an option in a civilized society.

of course, if you are concerned about revamping both social security and medicare, to preserve our fiscal future, you would have no problem enforcing these changes on everybody, including those currently collecting benefits? we should all share the pain, current and future beneficiaries, shouldn’t we?

Rick,

I have seen the previous plans and attempts to partially privatize Social Security by allowing workers to keep a small portion of SS taxes to invest, and I supported them as the best I could get. But in the past, these type plans had no chance of gaining the momentum to pass. The reason was twofold. From the taxpayer side, the amounts were to little to generate much enthusiasm and from the government side, the appropriators just got too much value out of the excess funds coming from the SS system. But it is important to note, that since 2010, every single cent from SS taxes has been going out in benefits, the appropriators are getting nothing, zippo, nada, zilch. By paying all legacy benefits by debt, all pressure to their precious budget is off. The real danger now is the selling of a fix within the current system for some decades in the future, That will mean a drastic rise in SS taxes now, and again give the appropriators “free” money in the budget and the continue writing of IOU’s to themselves. As you perfectly realize, this additional tax on employment will have bad effects on workers as both their take-home pay is reduced and the scope of job opportunities becomes more limited.

As for SS taxpayer, fear of the market can be greatly enhanced and exaggerated by politicians. I do not know how to stop this. But fear is fear, it is not easily quantified. For example, fear of falling 20 feet can be as great as falling into the Grand Canyon, even if a safe path can be found away from the fall. So the best counter I have to the fear mongering is enhanced reward for navigating the system. If I have fear of the market and only get a pittance of private return from a bit of my SS taxes, than the reward is simply not big enough to bother countering the fear. But if the reward is great enough then the effort to educate myself, to look at the historical record of return on saving and investment , to look at the few other countries who have instituted similar private savings and note the satisfaction found in the populous. is worth doing.

Go for the whole enchilada.

Ed

NickG, you asked

“If you divert FICA withholding to an investment program, how do you fund current SS payments to retirees?”

My first thought is to hire a highly regarded MIT Economics Professor, lets say, hypothetically, a Professor G, to write the enacting legislation, guaranteeing that all my promises of how wonderful the program would be shouted over and over, while no one could possibly read and understand the actual bill. I would simply tell you, NickG, you will have to pass the bill in order to find out what is in it. If that satisfied you before, than I ask you to stop reading my post now.

Now for the hard lesson, there ain’t no such thing as a free lunch.

The current program is costly, any fix to the program will be costly. Given that, the matter remains the difference between the current bad program with negligible returns causing poor benefits for the cost of the worker, or a program that will that will return higher benefits, and the control to the worker of accumulated savings and investments. I choose the latter. And before the costs stagger you, I remind you it had been done in the past, and because of it, the United States exists today. As anyone who knows US history will realize, I am referring to the Hamilton program that converted debt that had very bad return and outlook to a viable financial product. He did it with dedicated taxes, in that case tariffs, which caused gold to flow into the US treasury and almost instantly caused the war bonds to attain a greater than 100% value. And after this,and from then on, the world willingly invested in this country, leading to the growth we all today benefit.

I am back to the envelope to further describe the details of converting the SS system to real retirement savings program with real returns. First, all current recipients of SS continue to receive current benefits. It is too late for them to get a decent return on all that money they had the government taken from them. Those very close to receiving could either be forced to remain with the current system, or receive a warrant guaranteeing their benefits under current law. It makes very little difference in costs, so that detail remains for the political caste.

Before describing the change in situation for those workers not close to retirement, I will explain the warrant. The warrant guarantees the worker current vested benefits at retirement age. Thus a worker who has 1 year in the system will get a warrant that if held to retirement will pay benefits at that time of 1 year of paid SS taxes and the rest of the years to vested as 0. Some one with 20 years in the system will get a warrant guaranteeing benefits at retirement based on 20 years of taxes paid and the rest of the years until vested, 0’s. The benefit guaranteed would be based and frozen on current law. I imagine that the warrant to be convertible to a bond of actuarial value determined by the benefit guaranteed and the expected lifetime of the worker. The bond would be held in, or sold with the with the proceeds put in, the private retirement account. For how long the warrant remains convertible is a detail I leave to others. As do I leave detail if the warrant to those close to retirement should be convertible.

This obviously entails a large cost. This cost would be paid through new Federal debt or combination of debt and taxes. I promote new debt. This would extend the payment of cost close to the period of complete transition to the new program. The world will be eager to buy that new debt. Why this expectation, it is based on the experience of Australia and its superannuation. Its economy, since it began, has shown excellent growth and stabilization due to its growing savings rate. The world would see the same potential in the US. So I submit, the long term, cost will be much smaller compared to cost of continuing the current system

I have not the knowledge nor education nor care to put the time in now to put a number on the new debt. But know it can be readily estimated and it will be high but not impossible. I welcome any here to put a number on it. But I am absolutely certain that the conversion of tax to savings will cause the growth in this country to make this investment a great thing.

So although there is no free lunch, it can be a great lunch. I ask again that people show the courage to control their lives and wealth. It used to be the normal thing.

Ed

So, the proposal is that the US borrow at low rates, due to people’s faith in the US government, and then invest the borrowed money in the stock market at higher returns.

This has been tried: a number of local governments in the US were convinced by investment bankers that they could borrow at low rates, and put that money in their pension funds to earn higher returns. It was a disaster: the market returns have been lower than the rates paid, and those pension funds are now in bad shape. I have personally discussed this with pension fund managers, who were aghast at trying the idea again.

ed,

“First, all current recipients of SS continue to receive current benefits. It is too late for them to get a decent return on all that money they had the government taken from them. ”

no. if you want to make changes, then everybody needs skin in the game and needs to contribute. it is completely unacceptable to let baby boomers skew the system to their benefit in retirement, and then make others sacrifice to cover their cost. if boomers want to continue to collect their higher benefit, then they need to take on risk that could ultimately deplete their higher benefit during retirement. you want a private system, or you want a system where risk is pushed off onto the public sector? if you change social security it is unacceptable to have a portion of people in the system operate risk free. in addition, current retirees should have saved additional money in the private market for retirement. they should have gotten a decent return on that money if they were responsible. social security did not eat up that much of their savings-the rates were not that high.

“This obviously entails a large cost. This cost would be paid through new Federal debt or combination of debt and taxes. ”

who is paying for this debt and taxes? the younger workers. so how does this appreciably change the predicament of younger workers currently?

“I have not the knowledge nor education nor care to put the time in now to put a number on the new debt. But know it can be readily estimated and it will be high but not impossible. I welcome any here to put a number on it. But I am absolutely certain that the conversion of tax to savings will cause the growth in this country to make this investment a great thing.”

ed, you need to understand what you just stated. you said i do not know how to do this calculation, nor what the result would be, but i am certain the result is exactly what i need to reinforce my beliefs. trust me. ed, i certainly do appreciate your interest in the topic. but you must understand, you need more than faith based arguments here. refer back to the belief that tax cuts increase revenue through growth-not much evidence this is true.

I don’t get what the big deal is. Social Security isn’t luxurious, and the projected discrepancy is not that big, and fairly far off.

Sure, lower income recipients don’t live as long after age 65, but on the other hand they’re not dying before age 65 nearly as often, so the discrepancy between the income tiers isn’t as big as you might think. And, the increase in benefits due to lower mortality is much larger than most people (like Krugman) estimate.

Let me say that again: Social Security benefits aren’t luxurious, but due to longer lifespans they’re substantially larger than originally promised.

So, the easy solution is just to push back the retirement age a couple of years: increase the revenue base, reduce the payout. Easy.

Nick,

Below is a post about what I consider a lack of logic of some comments. This comment of your definitely does not fall into that category. However, there some of it I disagree and some of it I agree.

“I don’t get what the big deal is. Social Security isn’t luxurious, and the projected discrepancy is not that big, and fairly far off.”

Less than two years for disability insurance failure is not fairly far off. And I do not consider Medicare failure – 16 years away and the retirement, survivor,and spousal benefits 19 years away as fairly far off either.

“Sure, lower income recipients don’t live as long after age 65, but on the other hand they’re not dying before age 65 nearly as often”

That is particularly harsh. I do not now if you are a registered democrat, but you would certainly fit right in. Despite a long, long history of blatant discrimination the party has enforced against them, that party has captured the black vote and it continues such practices today. In the case of SS, the black population as a group, still contributes greatly more to the system than it ever receives back. If nothing else, my recommended retirement system ends this practice.

“And, the increase in benefits due to lower mortality is much larger than most people (like Krugman) estimate.

Let me say that again: Social Security benefits aren’t luxurious, but due to longer lifespans they’re substantially larger than originally promised. ”

Privatized retirement as I described ends the problem of increase benefits due to lower mortality.

“So, the easy solution is just to push back the retirement age a couple of years: increase the revenue base, reduce the payout. Easy.”

I might quibble with the descriptive “easy,” but I agree with your solution, if taken deep enough, would solve the SS crisis.

I have to ask you why? Why such a solution which magnifies and emphasizes the very nature of the current systems bad return. The dollars it costs, reducing further the bad returns on those dollar, and increasing the number of those who never see a cent from their years of earning.

These are my words not yours, but I will answer part of the question why. You have a blind faith to this major pillar of the Socialist movement. No matter how bad the system, how marginal in its attempt (especially currently) to eliminate poverty and how unfair to a substantial portion of people so historically abused and currently so in matters of quality education, safe living environment, of course, Social Security; it makes no difference. No enemies on the left.

Ed

This is wildly misleading stuff. Ed routinely mentions the disability trust first when much of the focus is on “reforming” the old age trust. They are different programs with very different money flow dynamics. Ed also uses the word “fail” to describe what may happen in a couple of decades’ time, without mentioning what “failure” would look like. If the current surplus is spent, then absent any action at all, beneficiaries would receive a higher real beebefit than they do today. Retired workers would be better off under what Ed calls a “failed system” than under any “reform” being proposed by the Pete Peterson crowd. The only way that most recipients would be better off with so-called reform than with so-called failure is in the case that that annual cap on contributions is lifted and the benefit schedule is left unchanged.

And oh,by the way, Ed has been talking down Social Security long enough to know all of this. So has Rick Striker. The fact that they carry on as if they are unaware of these facts makes them utterly unreliable in discussions of Social Security.

Some of the statements I read about removing the government from being a retirement service are bereft of logic, some just the normal crud others quite stunning, it is impossible to respond to it all. But here is a beginning.

Baff: “rick, you fall into the same trap most people do, as you misunderstand the purpose of social security. it is not a retirement account, it is insurance against poverty in old age, beyond the age at which you can work your way out of poverty.”

There is no trap here. You can call the current system an insurance program, a retirement program, or a tax program if you

like. What does not change through semantics is it is a bad program which produces poor results compared given the high cost to each working person.

Baff” “you want to change social security to a privatized system. then why not simply abolish the system altogether and let people put there money wherever they desire?”

In a better world where the political class has rejected the socialist method of attaining control over the masses by generalizing fear, poverty, and high taxation, then not mandating where a people put there own private property would be a good thing. But we don’t live in that worlds. and you, Baff, greatly fear such a world. The fact is and Baff knows this, the greatest restraint to the socialist world is general prosperity. The privatized system described would quickly result in general prosperity, breaking down the class struggle created and used by the political class.

baff: “then everybody needs skin in the game and needs to contribute. it is completely unacceptable to let baby boomers skew the system to their benefit in retirement, and then make others sacrifice to cover their cost.

Of course, benefits have not risen. They remain about 34% the average wage of the country. This constant is because of the long used formula by SS to calculate wages. What has changed is the cost to each contributor to the system, past, present and future due to changing age distribution in the modern world. It is obvious that Baff is advocating making a a bad system even worse by reducing benefits.

Nick: “So, the proposal is that the US borrow at low rates, due to people’s faith in the US government, and then invest the borrowed money in the stock market at higher returns.”

No, the US needs to borrow at the rate the market demands. And no, the US does not invest in the stock market, but any individual might with their own money. Two things about this comment, Nick writes of low rate on bonds, this could imply the Fed attempts to manipulate the market to keep rates artificially low. Absolutely not. And. Treasuries need to be on choice of investment for anyone, inside a retirement account or outside.

Final comment. As I said before, There is no such thing as a free lunch. The change to a completely privatized retirement system comes with costs. In my proposal, the cost comes in the form of national debt. It would at the end of 40 years it would be a lot but when added to current debt would still be less than 200% GDP. Less than Japans debt today. However, the accumulated savings from the program would be greater than the total national debt. People would have a meaningful retirement income. And I can not emphasize enough, retain the accumulated savings for their own purposes. The benefits of the program so greatly outweigh the costs, no politician would possibly advocate it.

Ed

Here, too, Ed is using standard duplicitous talking points. Most particularly is his dismissal of the financial logic of Social Security as part of a retirement plan. Notice that he just keeps repeating that Social Security is “bad” without addressing the logic of including a fixed benefit in a retirement scheme. He doesn’t address the logic of having a fixed benefit program because the virtuesofa fixed benefit component are quite strong. He started with some tired old math about how, in an unrealistic hypothetical, stocks outperform Social Security, and just clinks to that without ever addressing the portfolio benefits of a fixed benefit. This is like those high school investment contests in which the lucky kid who buys just one stock and it turns in a big gain wins, while the kids who built portfolios like a grow-up would necessarily lose.

Ed’s rhetoric is well-practiced, but that’s a big part of what’s wrong here. He just keep repeating the same carefully crafted deceptive stuff, rather than answering the objections put to him.

Duck

Here is a serious deal I present you.

You pay me $444.00 a month for forty years.

At the end of the 40 years, I will pay you $1069 per month for the rest of your life (the current benefit calculated at http://www.bankrate.com/calculators/retirement/social-security-benefits-calculator.aspx).

If such an arrangement is legal ( I will, at my own cost, consult a lawyer once you make a serious commitment to the above payments), a contract can be made.

Understand the following, unlike a financial adviser, but exactly like the government, I make no commitment to acting your best interest, but only commitment to your determination of fair payout derived from a monthly payment for 40 years.

Take this conditional offer to all your like minded friends, I will be glad to create the same deal over and over.

Please note. I never thought I would be a rich man, but will deals like this, you give me hope.

If anyone thinks I would not make piles of money from such a deal, please speak up, but I advise you to first research existing resources such as whole life insurance or annuities which you accumulate money within for 40 years before taking a monthly payout.

Ed

ed,

“There is no trap here. You can call the current system an insurance program, a retirement program, or a tax program if you like.”

you need to define what the program is if you want to properly evaluate the outcomes. and it was not developed as a retirement fund. until you understand this basic idea, discussion with you is pointless.

ed, you continue to complain about making a bad system worse. unfortunately, you do not understand what the system is. you have a belief, an ideology, of what the system should be in your world-but that is not the reality. you fall into the trap of many conservatives, who want to impose their solution onto a problem that does not really exist-because their solution sounds good to the conservative mind. but you need to deal with reality, and not your warped view of reality.

Possible Solutions:

1. Reintroduce Glass-Steagall Act

2. RICO charges for AIG, Goldman Sachs, JP Morgan, Citigroup and Bank of America for massive and on going mortgage and securities fraud.

3. Fully Audit the Federal Reserve.

4. Clawback of Banker Bonuses that were funded with taxpayer dollars

5. Allow Student Loans to be discharged during bankruptcy proceedings.

6. Overturn Citizens United vs. FEC

7. Repeal Commodity Futures Modernization Act of 2000

8. Repatriate Overseas Corporate Profits and tax at the current rate

9. Treat all Capital Gains as income for tax purposes

10. Ban High Frequency Trading and Quote Stuffing

11. Remove FICA tax cap

12. Reinstate FASB 157

Ed,

I think your investment proposal modeled on social security is a great idea. But since it sounds like we’ve got some live ones here, I going to engage in good old healthy competition and offer a program that is closer to the social security system, called “The Plan.” Here’s how it would work:

First, people who need “poverty insurance in old age” will pay to The Plan a monthly stipend for 40 years. In return, The Plan will promise on retirement the following:

1) The Plan will guarantee to pay a monthly retirement benefit that is consistent with investing the investors’ funds in an investment whose real return is substantially below market rates, if The Plan decides to pay in full at all that is, since …

2) Unlike an ordinary insurance plan, The Plan doesn’t need to sign a contract guaranteeing the payment that was promised. The Supreme Court has ruled that no one is entitled to the social security retirement payment he was promised. Similarly, The Plan will be set up so that if for some reason it can’t or won’t pay–it overpaid early investors to stimulate interest in the program for example–it will simply levy a new personal “retirement fee” which it will collect and then return to the investors to pay their expected retirement benefits. Alternatively, The Plan can just cut the promised payments at its discretion.

3) Early on in the program, The Plan will levy some additional, surprise “retirement fees” in order to shore up the investment pool. Of course, The Plan will immediately spend the proceeds on stuff its proprietor really wants (such as donations to The Cato Institute). But every time it spends the retirement fees on other stuff, The Plan will write IOUs to itself and put them into a “Trust Fund” so that The Plan’s investors can feel comfortable about the program’s long-term solvency. The Plan will not have to worry about paying off the IOUs to itself, since it can always levy additional “retirement fees” or cut the expected monthly benefits to pay them off. (See point 2)

4) I’ve saved the best part for last. During the course of the program, there will be those who will try to tell The Plan’s investors that they are getting a raw deal. They’ll try to tell them that The Plan can’t pay the benefits that were promised without substantial hikes in “retirement fees” or cuts in the expected payments. They’ll encourage The Plan’s investors to get out of the program to earn higher returns. But The Plan’s investors will be its strongest advocates. The Plan’s investors will tell those nay-sayers that they are spouting standard duplicitous talking points. They’ll say that The Plan’s critics are saying wildly misleading stuff and are falling into the trap of misunderstanding the program: it’s not a retirement fund but rather poverty insurance in old age, after all.

You can’t build a really great business without this kind of customer loyalty!

Baffles, Joseph, DeDude, 2slugs, and Macroduck, don’t listen to Ed. I can offer you a program closer to what you seem to be looking for. Please make out your monthly checks to The Plan, c/o Prof: Rick Stryker, Dept of Free Market Economics, Wassamotta University, Frostbite Falls, Moosylvania

rick, you seem to have plenty of time on your hands. it would be nice if you could spend it on something good and beneficial, instead of writing stuff that is just plain stupid. and before you get your panties in a bunch, you need to recognize what you wrote is just plain stupid.

Baffles,

I laid out the basic principles for how social security operates and presented those principles to you in very simple terms. Your reaction was to call it “stupid.” Yes, you are right. Perhaps you are beginning to see why so many people understand that the system needs to be reformed.

no rick, i call your remarks stupid because that is what you write. you create these vivid stories, like the stories about your “brother” and your “son” regarding obamacare, which are filled with hypotheticals and opinion which you try to pass off as fact. you write them in a disparaging and condescending way in order to get a reaction-i understand your motive. but it is still stupid. again, you try to pawn off social security as an investment retirement plan, and that is not what it is. but your argument cannot be made with reality, so you stick with your lie and proceed to make an argument against a program that only exists in your fantasy. that is why i call your comments stupid.