Today we are fortunate to have a guest contribution written by Luis Brandão-Marques, Senior Economist, Gaston Gelos, Chief of the Global Financial Stability Analysis Division, and Natalia Melgar, Economist, all at the IMF. The views expressed herein are those of the authors and should not be attributed to the IMF, its Executive Board, or its management.

Country transparency and capital flows

The ongoing debate on the normalization of U.S. monetary policy has renewed interest in understanding how financial shocks get transmitted from the financial centers to the rest of the world, in particular to emerging markets.

In this context, it is often asserted that more country-level transparency—the availability of information to properly assess risks and returns associated with investing in a country—can avoid excessive capital flow volatility by enhancing the orderly and efficient functioning of financial markets. Transparency can be expected to reduce the occurrence of phenomena such as herding, waves of sentiment-driven investment flows, and investor overreaction to news.

However, in principle, more transparency could result in higher volatility. For example, the excessive provision of public information can crowd out private information, reduce information efficiency, and increase volatility (Morris and Shin, 2002).

Although there is some evidence that supports the beneficial effects of country-level transparency (Johnson and others, 2002; and Gelos and Wei, 2005), the overall evidence is ambiguous. Moreover, existing empirical studies have largely focused on the transmission of shocks around crises.

Global financial conditions

We explored whether opacity at the country level amplifies the local impact of global market conditions by examining the behavior of bond and equity prices. The hypothesis is that when global financial conditions are benign, international investors become more prone to invest in markets whose underlying distribution of risks they understand less well, and then flee when global conditions deteriorate. This behavior could happen for several reasons. For example, investors might become more comfortable with opacity when their other investments have performed well. Alternatively, during difficult times fund managers may face more scrutiny and pressure to justify the asset composition of their portfolios. Lastly, opacity may make it harder for investors to separate fundamental shocks from pure noise shocks, inducing them to associate benign signals in the financial centers with good fundamentals in the less transparent markets.

Gauging the impact of transparency

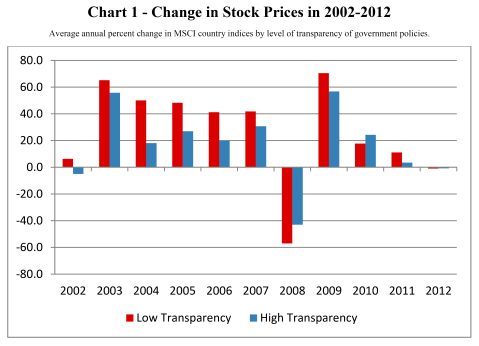

In the past, more opaque markets have experienced larger booms when financial market conditions are favorable, while the opposite is true during bad times (Chart 1). Although this suggests support for our hypothesis, we gathered more systematic evidence by quantifying the impact of shocks to the VIX—a proxy for risk aversion in financial centers—on equity returns and sovereign bond spreads, for different levels of country transparency. We used various measures of country opacity (ranging from the degree of corporate disclosure and transparency of government policies to broader measures of opacity such as corruption perceptions). We consistently found that emerging markets with worse opacity scores react more strongly to global market conditions than those that are more transparent.

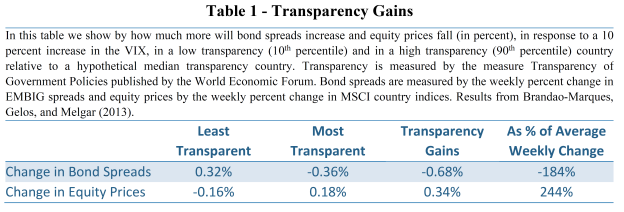

According to our estimations (see Brandão-Marques, Gelos, and Melgar, 2013), in response to a 10 percent increase in the VIX, the countries with the most transparent government policies experience an increase in sovereign bond spreads roughly 0.4 percentage points below that of the median country. By contrast, the least transparent country would see spreads increase 0.3 percentage points more than the median country. This amounts to “transparency gains” of roughly twice the average weekly change in spreads measured by JP Morgan’s Emerging Markets Bond Index Global. For equities, the gain is almost two and a half times the average weekly increase in the MSCI index (Table 1). This is roughly three times more than the increase in exposure that a country would get from doubling its international portfolio flows.

Policy challenge

Emerging markets are not helpless in the face of volatility in global markets. Countries that wish to benefit from financial globalization can reduce its unpleasant side effects by providing more and more timely data, improving corporate disclosure standards, increasing the predictability of policies, and more generally by improving governance. In other words, increasing transparency may be an effective instrument for countries to consider before resorting to other measures aimed at reducing the adverse consequences of capital flows.

References:

Brandão-Marques, Luís, Gaston Gelos, and Natalia Melgar, 2013, “Country Transparency and the Global Transmission of Financial Shocks.” IMF Working Paper No. 13-156. (International Monetary Fund: Washington).

Carrieri, Francesca, Ines Chaieb, and Vihang Errunza, 2013, “Do Implicit Barriers Matter for Globalization?” Review of Financial Studies Vol. 26, No. 7, pp. 1694-1739.

Gelos, Gaston and Shang-Jin Wei, 2005, “Transparency and International Portfolio Holdings.” The Journal of Finance, Vol. 60, No. 6, pp. 2987–3020.

Johnson, Simon, Peter Boone, Alasdair Breach, and Eric Friedman, 2000, “Corporate governance in the Asian financial crisis.” Journal of Financial Economics Vol. 58, No. 1, pp. 141-186.

Morris, Stephen and Hyun Song Shin, 2002, “Social Value of Public Information.” The American Economic Review Vol. 92, No. 5, pp. 1521–1534.

This post written by Luis Brandão-Marques, Gaston Gelos, and Natalia Melgar.

OK, I guess this is true. It’s like saying you can combine peanut butter with jelly to make a sandwich. Certainly true. But is it something we didn’t know?

I’d like to see more granularity. What specific measures of transparency are important? In what order? What are the specific benefits to specific reforms? How do these cascade? Which ones are hard, politically speaking? Which ones are easy low-hanging fruit? How does a country know which is the next sequential reform to implement?

This analysis seems removed for the day-to-day business of capital markets. One doesn’t get the sense that the authors have talked to people actually involved. It all seems to reflect generalities, in terms of economics advice, veritable platitudes. Show us some deeper expertise.

Why don’t the authors write on article on implementing a trial FAA? Something like: “Transparency is Great, But Don’t Expect It if Politicians Aren’t Paid for It”. Or if you want it in more academic terms: “IMF Policy Assumes Politicians Act as Proper Agents. Is it True? An Empirical Analysis.” Why don’t you do that, guys? It will make you famous.