A large literature has examined the effects on employment of raising the minimum wage, with different researchers arriving at conflicting conclusions. The core reason that economists can’t answer questions like this better is that we usually can’t run controlled experiments. There is always some reason that the legislators chose to raise the minimum wage, often related to prevailing economic conditions. We can never be sure if changes in employment that followed the legislation were the result of those motivating conditions or the result of the legislation itself. For example, if Congress only raises the minimum wage when the economy is on the rebound and all wages are about to rise anyway, we’d usually observe a rise in employment following a hike in the minimum wage that is not caused by the legislation itself. UCSD Ph.D. candidate Michael Wither and his adviser Professor Jeffrey Clemens have some interesting new research that sheds some more light on this question.

Clemens and Wither study the effects of a series of hikes in the federal minimum wage signed into law in May 2007. The first of these raised the minimum rage from $5.15 to $5.85 effective July 2007, the second from $5.85 to $6.55 effective July 2008, and the third from $6.55 to $7.25 in July 2009. They note that such legislation would be expected to affect some states more than others, since many states already had a state-mandated minimum wage that was higher than the federal. They therefore chose to compare two groups of states, the first of which had a state-mandated minimum wage of $6.55 or higher as of January 2008, with all other states included in the second group. The hope is that this gives us a kind of controlled experient, with the federal legislation effectively raising the minimum wage for some states but not others.

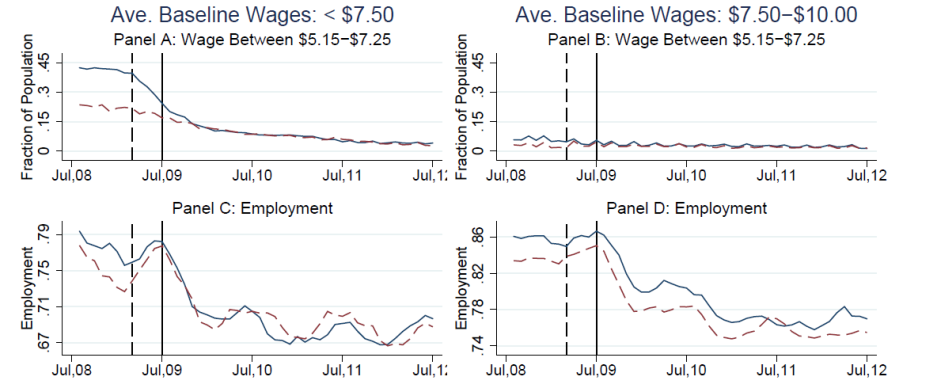

The hike in the federal minimum wage should also matter more for some workers than others. To allow for the latter possibility, Clemens and Wither considered two different groups of workers. The first group had an average wage in the 12 months leading up to July 2009 that was below $7.50, while the second group had an average wage over this period between $7.50 and $10.00. We would expect the legislation to matter more for the first group than for the second. The quasi-experiment is thus to compare the change in wages between low skill and slightly higher skill individuals between states that were affected by the federal legislation and those that were not.

The upper left panel of the figure below summarizes the experience for workers in the first group (an average wage over August 2008 to July 2009 that was below $7.50). The dashed line follows individuals in states that already had a state minimum wage above $6.55 as of January 2008, while the solid line tracks people in states where the raise in the federal minimum wage would have been predicted to have a binding effect. The heights of the lines indicate the fraction of individuals in this group who were employed and earned a wage during the indicated month that was between $5.15 and $7.25. Prior to the hike in the federal minimum wage, this fraction was about 20% in the first group of states and about 40% in the second. After the final hike in the minimum wage, the fraction was about the same for both groups of states. The legislation thus had its intended effects of significantly raising the wage for low-wage individuals in states that did not already have a higher minimum wage.

The upper right panel follows individuals whose average wage over August 2008 to July 2009 was between $7.50 and $10.00, reporting the fraction within that group that earned between $5.15 and $7.25 during the indicated month. These are individuals who at some time before the final minimum wage hike had a much better paying job, but nevertheless took a low-paying job during the particular indicated month. Of course these numbers are much smaller than for the upper left panel. But it was still a little more common for the slightly higher skilled individuals in the low-minimum-wage states to take a job paying below $7.50 prior to the final hike in the federal minimum wage, with this small difference between states again disappearing after the final federal hike.

Left column: individuals whose average wage between August 2008 and July 2009 was less than $7.50. Right column: individuals whose average wage was between $7.50 and $10.00. Dashed lines: states whose minimum wage as of January 2008 was $6.55 or higher. Solid lines: other states. Top row: fraction of individuals within the indicated category who earned a wage during the indicated month that was between $5.15 and $7.25. Bottom row: fraction of individuals within the indicated category who were employed in the indicated month. Source: Clemens and Wither (2014).

The second row of the figure summarizes the fraction of each group that were employed in each of the indicated months. Low-wage individuals were more likely to be employed in any given month in the low-minimum-wage states before the rise in the federal minimum wage, but this difference disappeared after the final hike in the federal minimum wage. By contrast, one doesn’t see much difference in the employment experience of slightly higher-wage individuals across the two groups of states as the federal minimum wage changes.

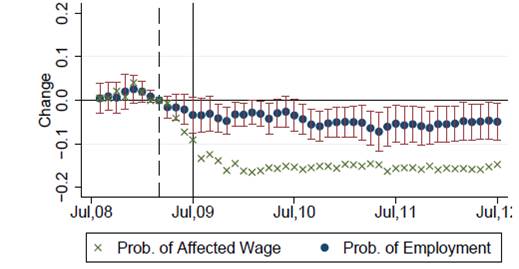

Clemens and Wither examined these differences using a number of statistical approaches. The figure below focuses on the group of low-wage individuals, that is, people whose average earnings over August 2008 to July 2009 was below $7.50. The green x’s come from a regression that tried to predict whether an individual in that group would have earned a wage between $5.15 and $7.25 in any given month. The regression includes state fixed effects (the average experience of people in each state may be different), time fixed effects (the average national experience might be different in each month), individual fixed effects (the average experience of individual i might be different), a measure of house prices in state s in month t, and the possibility of a different average experience for each month in states that had a lower state minimum wage in January 2008 compared to others. The green x’s plot the values for the last group of coefficients for each month, and again show the expected result– the hike in the federal minimum wage successfully lowered the fraction of low-skilled workers who earned a wage below $7.50, as measured by the observed difference between states affected by the federal minimum wage hike and those that were not.

Dynamic estimates of the effects of minimum wage on low-skilled workers. Green x’s denote difference in probability of having a low-wage job between states with low minimum wages and those with high minimum wages. Blue dots indicate difference in probability of being employed between states with low minimum wages and those with high minimum wages, with accompanying 95% confidence intervals. Source: Clemens and Wither (2014).

The blue dots represent the results from a comparable regression to predict whether one of these low-skill individuals had a job. Clemens and Wither found that the federal minimum wage hike resulted in about a 6% decrease in the probability that low-wage individuals would have a job based on this comparison of states in which the minimum wage hike would have been binding and those for which it would not.

The hike in the minimum wage thus appears to have raised the wage for low-skilled workers but made it harder for them to find jobs. Clemens and Wither conclude:

Over the late 2000s, the average effective minimum wage rose by 30 percent across the United States. We estimate that these minimum wage increases reduced the national employment-to-population ratio by 0.7 percentage point.

I think, raising the minimum wage to $15 an hour and eliminating tax credits would promote work.

Cost of Improper Earned-Income Tax Credits: $10 Billion

WSJ

Oct 22, 2013

“The payments paid out improperly for 2012 were at least 21-25% of all payments, according to the latest report from the IRS inspector general.

The report estimated that improper payments totaled between $11.6 billion and $13.6 billion for 2012, out of total EITC claims of $55.4 billion.”

http://blogs.wsj.com/washwire/2013/10/22/cost-of-improper-earned-income-tax-credits-10-billion/

“Over the late 2000s, the average effective minimum wage rose by 30 percent across the United States. We estimate that these minimum wage increases reduced the national employment-to-population ratio by 0.7 percentage point.”

I wonder what effect it had on productivity and GDP?

There are other factors that can raise employment.

“I think, raising the minimum wage to $15 an hour and eliminating tax credits would promote work.”

Yes, raising the minimum wage to $15 or even $10 alone would promote work. Millions of students, retirees, stay-at-home moms/dads and others not willing to work at $7.25 will enter the labor force at $10 or $15. Are there going to be jobs for millions of more workers at a higher wage? No, they will add to the ranks of the unemployed competing for the remaining minimum-wage jobs. And this is only the start of the problems.

For more see the book: Ten Unavoidable Problems with a “Living” Minimum Wage from 100% Waste of Your Money to Millions Unemployed

You can read the introduction and first few chapters for free with Amazon’s look inside feature:

http://www.amazon.com/dp/B00KYDDLP4

John to Steve,

Our Consumer Based Economy…….requires customers having money to spend.

70% of our GDP is Consumer Spending.

Raising wages increases customer spending……most people today….spend all or most of their wage into our economy.

Raising wages…and encouraging more people to take on a job…..means more customers will have money to spend in our markets.

Stagnation of wages may keep inflation low……but the price of poverty on our economy…..is too high.

Problem is, your idea is nonsense:

http://thenextrecession.files.wordpress.com/2014/08/us-consumer.jpg

John to E.Harding,

Thanks for your chart.

It shows…..over time…Consumer Spending makes up more of GDP than Government Spending and Business Spending.

It also shows wages declining as a percentage of GDP……That shows Consumers are spending their wealth in addition to their wage….and you can bet….they get that wealth from mortgaging their assets…..not by choice….but do to the lack of wage growth.

With Government Spending….and Business Spending declining as parts of the total GDP…..it makes wages even more important for GDP to continue to grow in our future.

Raising all “wages” may increase spending, but raising only the minimum wage will not. Raising all wages would absolutely increase inflation. Only a small percentage of people make minimum wage, so not only would an increase in the minimum wage alone fail to increase spending, it also wouldn’t have much if any effect on inflation.

The only effect of a minimum wage hike would be to price marginal workers out of the labor market.

Even though plenty of folks will pay $2-3 for one Mrs Fields’ cookie, they won’t pay $2-3 for a single Chips Ahoy cookie, tasty as they may be. Why would anybody hire a Chips Ahoy worker for a Mrs Fields’ price? Of course, in the cookie world, Chips Ahoy doesn’t throw a tantrum demanding $2-3 per cookie, they become more productive than Mrs Fields’ and make it up on volume.

John to Junk Science Skeptic,

Raising the Minimum Wage…..has an impact on wages above the MW.

Only 5% of workers make the MW of $7.25/hr….but….40% of all hourly paid workers…..make $10.00/hr or less.

The CBO study says at a MW of $10.10/hr….

16.5 million workers would get a raise.

900,000 workers would be lifted out of poverty.

500,000 workers may lose their job due to the wage increase.

One can’t just look at the benefit:

“Raising wages increases customer spending……most people today….spend all or most of their wage into our economy.”

without looking at the cost.

The money for increased wages will come largely from customers (often as poor as minimum wage workers or unemployed) and the rest from business owners. These people will have less to spend or invest offsetting the workers spending entirely or nearly entirely depending on marginal propensity to consume and crowding out.

Then when employment falls since some workers are not worth the higher minimum wage (all jobs not worth $10 or $15 will disappear), consumer spending will fall.

John to Steve,

When Obama asked for the Federal Minimum Wage be increased from $7.25/hr to $10.10/hr…..A study was made to see the increase in prices to accommodate the $10.10/hr wage…….Walmart was one of the companies in the study.

Walmart currently pays an average wage of $8.81/hr.

The conclusion of the study…..was Walmart would have to increase all their prices…an average of 1.4%.

A box of Macaroni & Cheese would have to increase from $0.68/box to $0.69/box.

I’m sure Walmart would take the advantage of a wage increase….to increase their prices more than1.4%……but wages will not be their only consideration.

This study was done over a period that saw the largest drop in economic activity we have seen in almost a century. To extrapolate that into a general rule for normal periods would seem to be ill advised. A real life experiment is described in a NYT article about cross border implications when Washington State increased minimum wage to 50% higher than neighboring Idaho.

The result for small business was significant. One Washington family restaurant owner was sure he would have to move to Idaho. After the wage hike was implemented the effect was the opposite of what he expected, “To tell you the truth, my business is fantastic,” he said in an interview. “I’ve never done as much business in my life.” Likewise another small business owner stated “We’re paying the highest wage we’ve ever had to pay, and our business is still up more than 11 percent over last year,” said Tom Singleton, who manages a Papa Murphy’s takeout pizza store here, with 13 employees.

The overall effect was so great that the state’s major business lobby, the Association of Washington Business, no longer fought the minimum-wage law, The other important effect was that neighboring Idaho had to increase wages.

See the article at: http://www.nytimes.com/2007/01/11/us/11minimum.html?pagewanted=all&_r=0

Steve to John,

I think you made my point. By taking on 1 cent to every 69 cents or $1 on every $69 retail Walmart order to pay higher wages, one is taking the same amount of money from customers – they have one dollar less to spend – and giving it to workers – who have one more dollar to spend, so there is no (or little) increase in spending.

Sadly, I agree with your point

“I’m sure Walmart would take the advantage of a wage increase….to increase their prices more than1.4%”

but for a different reason. Walmart does not need an excuse to raise prices; they could raise prices anytime they want.

A minimum wage increase will affect dollar stores and small local stores more than it affects Walmart. Walmart currently has competition that pays workers less than Walmart pays workers. Faced with less low-cost competition, any business will raise prices.

John to Steve’s REPLY on 12/11/14 at 7:32 PM,

You worry…raising the Minimum Wage would force workers above the MW to have less money to spend…and hurt low margin businesses like the 99-cent stories that would have to pay their employees more.

You miss some of my points….

The CBO reports 16.5 million workers would get a raise at a MW of $10.10/hr instead of $7.25/hr.

The increase to $10.10/hr takes years before it reaches $10.10/hr…..There’s no SHOCK to business of higher wages in the first year.

Those workers will spend that wage increase directly into our economy….they are so poor…they have to.

All business sales will be increased.

The inflation caused by this increase is not overwhelming.

Thanks for your COMMENT.

If that’s true, wouldn’t raising it to $100 per hour obviate the necessity of eliminating tax credits, plus promote even more work?

John to Danite,

There’s a reason……increasing the MW slowly, over time…..is critical to it’s success.

If you raise the Federal Minimum wage from $7.25?hr to $100.00/hr ……many businesses would simply close their doors.

I understand you were making your point.

I agree….raising the MW is a positive move for our economy.

>>> Over the late 2000s, the average effective minimum wage rose by 30 percent across the United States. We estimate that these minimum wage increases reduced the national employment-to-population ratio by 0.7 percentage point. <<<

I'm so glad that somebody in academia may have noticed that a tiny loss of employment is hardly of any concern to minimum wage earners who get a _relatively_ large increase — we are still talking way under LBJ's, 1968, minimum wage, DOUBLE the per capita income since here.

The kind of increase — usually a dollar or at most two — that academics typically discuss shift a fraction of one percent of income — too small for their effect on poverty to be measured; lost in the noise. (Ditto for the E.I.T.C.; $55 billion, a quarter of one percent.)

How about some real THOUGHT experiments:

If average Walmart nonsupervisory pay were raised to $100 an hour, the price of $10 items would only rise to $15. Walmart labor costs are 7%. Nonsupervisory workers average $12 an hour. $12 X 8 = almost $100. One of the $12s is there already. 7×7% = 49%.

Double current Walmart nonsupervisory pay to $24 hourly, throw on 25% for benefits to make it $30 and prices rise about 10%.

Somebody challenged me that raising Walmart prices 10% (at $30 — only 3.5% at $15 min wage) would charge low income consumers $26 billion more a year ($260 billion sales). I pointed out they could take it out of the $560 billion raise they would get from a $15 minimum wage.

A $15 minimum wage would shift about 3.5% of income from the 55 percent of the workforce who garner 90% of income to the 45% who scratch only 10%. $8,000 average raise X 70 million (45% of 140 million + 5% at minimum now) = $560 billion out of $16,000 billion GDP. BTW, 45% of workforce not going to be sent home over a 3 1/2 percent shift in income share.

100,000 out of (my estimate) 200,000 gang age, Chicago males are in street gangs – I say because they wont work for a minimum wage several dollars below LBJ’s 1968 minimum wage ($10.95) after per capita income about doubles. A $15 an hour minimum wage might actually put American born workers back to work at America’s McDonald’s.

* * * * * * * * * *

”Denmark has no minimum-wage law. But Mr. Elofsson’s $20 an hour is the lowest the fast-food industry can pay under an agreement between Denmark’s 3F union, the nation’s largest, and the Danish employers group Horesta, which includes Burger King, McDonald’s, Starbucks and other restaurant and hotel companies.” A.K.A., centralized bargaining.

http://www.nytimes.com/2014/10/28/business/international/living-wages-served-in-denmark-fast-food-restaurants.html?_r=0

$20 an hour + benefits: it’s the truly-free (one common contract) market!

Somebody better come up with something soon — or else:

If the top 1% income continues to receive all the economic growth, then, by the time the output per person expands 50% (25-30 years?) the top 1% income will “earn” half of a half-larger economy (25% + 50% = 75% of 150%). By the time output per person doubles (typically 40-50 years) the equation will read 25% + 100% out of 200% = 62.5% of a twice-as-large economy.

Why does it bother you so much what Justin Beiber earns?

I’m so glad that somebody in academia may have noticed that a tiny loss of employment is hardly of any concern to minimum wage earners who get a _relatively_ large increase

The number of people earning minimum wage is tiny who get a raise is tiny. 0.7% difference in unemployment is tiny. The number of people who used to earn a minimum wage and now are unemployed because of the legislation is tiny divided by tiny, which probably amounts to quite a high percentage.

The number of employees earning the federal $7.25 minimum is 5% of the workforce — 7 million. If you raise the min wage to $15 the number would grow to 45% immediately because $15 is the 45 percentile wage. As some employees got additional raises beyond $15 (some from $15 and some above) the percentage at min wage would go down — technically you might say.

The problem I have with this, other than the timing of this around the recession and county rather than state data being a better test, is that the real minimum wage declined for years before this without leading to an increase in employment to population ratio, so this would be an asymmetric effect. The Hungary paper where the increase was quite large but led to businesses largely passing along the costs is in many respects more interesting.

In free lunch economics, you only need to reason from a one sided perspective.

This is all part of a set of free lunch economic premises.

Workers are not consumers, consumers are not workers.

Consumption is driven by the wealth effect and tax cuts putting money in your pocket so you can spend, but not on higher wage income putting more money in your pocket to spend.

Welfare creates an incentive to not work because wages are lower than welfare benefits – but anyone can get a job if they look.

But higher minimum wages lead to higher unemployment because all the jobs that welfare slackers won’t take because the wages are too low instantly vanish.

Workers have no costs to work because they do not need housing, clothing, food, transportation, but businesses are sunk by the cost increase of a dollar in a fraction of its labor force which is a fraction of its total costs because businesses must pay for land, buildings, supplies, transport, energy, taxes, and labor or be creatively destructed. Remember, workers are not consumers, but businesses must consume to produce for consumers. Who are never workers.

John to mulp,

I fine it hard to agree with your logic…..

The U.S. GDP consists of:

70% Consumer Spending

18% Government Spending

12% Business Spending

How can you say….”Workers are not consumers, consumers are not workers”?

Our population of 316 million people require consumption to exist……

You say….” workers have no costs”……Where do you get such a thought?

One argument for raising the Minimum Wage…..put more money is pockets of workers (consumers)…..they will spend that money….the Economy will benefit.

I’m a lay person….not an economist……but raising the MW makes sense to me….We have seen what happens when wages do not go up……

He was being sarcastic. I know it is hard to tell because so many right wingers will say basically the same thing but be totally serious. On the internet it is really hard to tell the difference between actual right wing economics/theology and a parody.

John to efcdons,

Thanks for your clarification.

I jump….when a have a Reply…….

John to mulp,

You comment brings up an interesting subject…….today’s Government Welfare…..pays more to the worker……than the wage business will pay the worker…..therefore…the incentive to the worker…… is to avoid the penalty of working for a low wage.

However…..the Pride of the American Worker is more important to workers…than accepting the Welfare.

The obvious answer…it’s called the carrot vs the stick………is to raise wages to a level above Welfare, and provide a Living Wage……instead of lowering Welfare as a punishment for not having a job.

The opposition to a Living Wage…..is the profit to business…by forcing tax payers to supplement business low wages…by providing Welfare.

Business is supported by Republicans…..and their teaching of the Public…..increasing the Minimum Wage…..hurts low wage workers……

So an increase in minimum wage from $5.15 to $7.25, a 40% increase in wages, resulted in 6% less work. That’s an astounding increase in the welfare of low-wage earners. These results make a powerful case for more minimum wage increases.

John to Joseph.

I agree.

You do realize that you are arguing that receiving a 40% wage increase and a 6% drop in hours worked would make you worse off.

No wonder you buy the right wing propaganda hook line and sinker.

John to spencer,

I agree.

How does one come to a conclusion that the harm done to those who find themselves without work at all is outweighed by the benefits to others? Not to mention the morality of the issue.

John to Patrick R. Sullivan,

Look at history….

My Grandfather owned a Livery stable of horses….

You can imagine what the invention of the automobile did to his business….

Economics is a struggle……trying to do the most good….with the least harm….should be one of our major goals.

Capitalism puts a pretty high priority on profits.

Socialism may restrict opportunity….for entrepreneurs.

Trying to reach an optimum……in a mixture of economic approaches……is showing the difficulty in reaching that goal.

So far…..the recovery from the 2008/2009 Recession…..has been mostly one-sided.

A bit turgid.

It would have been better written inductively: “Many studies have been conducted on the minimum wage, with varying results. A new study by Clemens and Wither finds that the federal minimum wage hike of approximately 30% in the late 2000s resulted in about a 6% decrease in the probability that low-wage individuals would have a job based on this comparison of states in which the minimum wage hike would have been binding and those for which it would not.” Then oo on into detail.

I don’t understand why economists don’t go to McDonald’s or BurgerKing and ask them for actual store by store data. They have it all in their HR systems; all you have to do is cajole it out of them.

They have done this. See the famous Card & Krueger paper and some of its replications. The Card & Krueger paper got an unusual positive result on employment, but it may have been somewhat of a fluke given that its replications tend to find results like those above.

The upside of this approach is that you (maybe?) get better measurements of employment, and you can pinpoint the exact geographic location of employment, which isn’t always available in standard data sets. The big downside is that you limit yourself to a narrow slice of the minimum-wage jobs. You don’t get the maids, or the waiters at the regular restaurants, or the janitor at the school who’s the only minimum wage employee there. What if fast food is just fundamentally different somehow? It can give you a misleading estimate of the big-picture effect.

I wasn’t aware Card and Kruger was about fast food. That’s terrific. Fast food has by far the highest labor costs: 33% — compared to Walmart opposite end of spectrum 7%. A $15 an hour minimum wage would add 25% to fast food prices (lowest starting point, highest costs) — compared with 2+% price increase for Walmart assuming no other wages pushed up (just to get ball park — $12 average part and full time wage — 7% costs).

65% of McDonalds customers go through the drive through (hence, not broke); have to eat somewhere; 25% increase in prices at $15 min wage wont have them bringing peanut butter sandwiches. 5% of workforce getting $16,000/yr raise, 40% getting average $8,000 — 35% of custimers coming through door (me) wont be too broke either ($15 is appox median wage).

45% of workforce wont be laid off over 3.5$% overall price increase. $8,000 average raise X 70 million (45% of 140 million + 5% at minimum now) = $560 billion out of $16,000 billion GDP = 3.5%.

Nick –

Of course, you’re right. But what is really at stake in discussions of the minimum wage? It is not about ‘low wage’ workers. My daughter would be a ‘low wage’ worker, but not from a low income household. So the issue is really whether minimum wage laws help poor people, specifically those dependent on these wages for their livelihood, not spending money.

Therefore, as interested as we are in the aggregate employment effects, we are no less curious about the distributional implications. If I were going to be disparagingly Republican, I’d call the minimum wage law the ‘White Girl Law’, because I suspect it will do a good bit to favor white suburban girls at the expense of black and Latino boys, the latter being our most at risk population group (by a very large margin). We could see these sorts of demographic trends–if they exist–better in the store level data, which McDonald’s conveniently has store-by-store, day-by-day, and employee-by-employee in great detail in its HR files, ready to be downloaded.

Further, it would be similarly interesting to see the implications for selling prices, volumes, product mix, as well as for store profits and outlet density, since these are the flip side of minimum wage laws. These are the losses incurred for achieving higher wages.

So, company-level data doesn’t tell us everything, but it would shed light on certain key aspects of minimum wage policy, which, to the best of my knowledge, really haven’t been explored to date.

If we are talking $15 minimum wage, $15 is appox 45 percentile wage. Bottom 45 percentile currently take 10% of overall income share.

I was recently sadly surprised when looking up something called Glassdoor (I think) that most of these retail clerks I see every day in (unionized) supermarkets and drug stores top out at about $400 a week — maybe $500 at most. Seems the norm for most non-college America.

The official federal poverty line — appox $20,000 for a family of three — is based on three times the price of an emergency diet (dried beans only please; no expensive canned!) — a formula that worked 60 years ago. The MS Foundation book Raise the Floor provides the basis for a realistic minimum needs line based on a minimum basket of goods including taxes in table 3-2, on p. 44. After adjusting for inflation it works out to something like $50,000 a year for family of three that has to pay its own medical insurance ($1,000 a week!).

Half of Americans work for not much more than half that or (much) less! Assuming they can get 40 hours — the median wage is $16 an hour, but the median income is $26,000 a year ($13 an hour for 2000 hours); seemed to have slipped a gear somewhere.

100,000 out of (my estimate) 200,000 Chicago gang age males are in street gangs – I think because they wont work for a minimum wage SO LOW — several dollars below LBJ’s 1968 minimum wage ($10.95) after per capita income has since double (since 1968). A $15 an hour minimum wage might actually put (a lot?) more American born workers back to work at McDonald’s.

http://www.cbsnews.com/news/gang-wars-at-the-root-of-chicagos-high-murder-rate/

This would assume that there are hundreds of thousands of unfilled jobs at places like McDonald’s. Reality would suggest that actual market forces keep restaurants such as McDonalds fully staffed. A job opens up, McDonald’s advertises for the position. If nobody wants to work for minimum wage, they raise the wage price. Repeat until the job is filled.

John to Denis Drew,

Thanks for your COMMENT,

If workers had more wage to spend…….maybe McDonalds, and other businesses would have higher sales…and hire more employees.

John to Steven Kopits,

In our Supply/Demand economy……increasing wages should increase Demand….certainly…low paid workers spend there wage to survive.

Minimum Wage is a floor under wages…..not many businesses will willingly increase wages.

Currently….only 5% of workers are paid the Federal MW of $7.25/hr……but 40% of hourly paid workers make $10.00/hr or less.

Many businesses are reporting record profits……that does not support the argument….businesses cannot afford increased wages.

This article concludes……increasing the MW……does not create a greater economic problem….than the poverty created by low wages.

Really, do you think those Indians working at Dunkin Donuts are going to be in poverty? They are going to have low income, to be sure. You want to know what their kids are doing? Studying their asses off. They will be in the new elite in New Jersey. They are partly already there, but just wait twenty years.

Low wages do not create poverty.

A lack of discipline creates poverty. And a lack of accountability creates a lack of discipline.

Crime creates poverty. Have I mentioned that in Chicago 96% of murders are committed by young black and Latino men? This is the population that matters, because if they’re out committing crime on the street, then those neighborhoods are unsafe, and they will be in no small part creating poverty in those neighborhoods. Now do you think the White Girl Law is going to help them, because I have very serious doubts.

John to Steven Kopits,

When work does not produce a living wage……that creates poverty.

40% of all hourly paid workers make $10.00/hr or less……that creates poverty.

Many people are angry…that tax payers have to pay for Welfare…..but those same people are against raising wages….that would reduce Welfare…..

You think the kids of low paid workers….will make it thru college and end up with a good life-time incomeS…..you don’t know how hard it is to get a college degree. When I graduated from High School…..only 15% of my graduating class went on to college….On my first day as a freshman, the college president assembled the freshman class……he said…look to the person on your right…..look to the person on your left…..ONE OF YOU WILL GRADUATE.

And yet, and yet.

Millions of Mexicans gladly surge across our borders, risking their lives and deportation for illegal work that does not even pay minimum wage.

Let’s be clear. If we can intervene meaningfully with at risk populations, let’s do that. A minimum wage law is not that. You want charter schools; let’s do it. You want to decriminalize marijuana. Let’s do that to. But a minimum wage law will help suburban girls at the expense of inner city black and Latino boys. That’s terrible public policy.

It seems like it would be difficult to disentangle the disparate effects of the intervening (and largest) recession of the post-war period.

States that were more strongly affected by the recession disproportionately had lower minimum wages so they would have higher unemployment. There is potential for causality there (states with lower minimum wages got hit by the national shock coupled with a min wage hike), but I’m not sure this counts as a clean natural experiment.

In the paper they acknowledge the dual effect and try to figure out whether the bias means they’re understating the effect of the minimum wage, or overstating it. They seem to find that the bias is such that they are understating the effect (in their words, that the effect is “biased towards zero”)

Many studies showed raising the minimum wage had modest effects on employment.

http://www.raisetheminimumwage.com/pages/job-loss

Small effect for the price. As I read Section 3, I realized they relied heavily on a measure, meaning the FHFA housing price index, but my main issue was I couldn’t see a way this analysis doesn’t in the end rely on the internally generated differences in employment measures. Which makes me wonder about its sensitivity and thus whether the effect might fall in a range that begins even in the negative but which certainly could be smaller. Or larger, though I doubt that because I assume they’d report larger.

John to All,

It’s interesting that John Boehner and other Republicans call increasing the Minimum Wage….”A job killer”.

When Obama asked the Federal Minimum Wage be increased from $7.25/hr to $10.10/hr……the Congressional Budget Office did a study and issued a report on a $10.10/hr wage…..That report said:

16.5 million workers would get a raise.

900,000 workers would be lifted out of poverty.

500,000 to 1 million workers may lose their job due to the increased wage.

John Boehner……only mentions the 500,0000 workers losing their job.

Now….Clemens & Wither say…..for a 30% increase in the MW…..the employment loss would be 0.7%.

Many in the Public……. believe John Boehner.

With Republicans controlling Congress……there’s no hope of any increase in the Federal Minimum Wage…and little hope of higher wages going up.

0.7% of the entire working population- a much higher % of minimum wage workers. Losing a million jobs to give 16.5 million people modest raises (often teens and retirees) while their working conditions suffer and prices for poor consumers rise as a result, is not obviously a good deal.

There are a lot of canards in your short statement. Retirees are retired, and hence don’t work. Teens make up a small portion of minimum wage jobs; a little more than 10% of all minimum wage workers. One meta-analysis study conducted by Sara Lemos found that a 10% in minimum wage lead to a 0.4% increase in general prices. Or in other words, something that used to cost $100 would now cost $100.40. Albeit, Food prices were more sensitive to a minimum wage increase; a 10% increase led to a 4% in food prices. There is no reason why minimum would deteriorate working conditions. There are rules and regulations in place that provide a minimum standard of working conditions.

If opponents of the minimum wish to sway their audience, then I would recommend sticking to the facts rather than resort to hyperbole and unfounded talking points.

How about #5 on my list of solutions?

Allow Student Loans to be discharged during bankruptcy proceedings.

This is very nice research.

The estimates from the paper seem consistent with estimates made independently by Neumark and by Mulligan. Casey Mulligan, in his book, The Redistribution Recession: How Labor Market Distortions Contracted the Economy extrapolated Neumark’s 2009 estimate to imply an estimate of 1.2 million job losses from the minimum wage hikes between 2007 and 2009. Mulligan extrapolates the results of his own “Simple Analytics…” paper to get an estimate of 1.66 million. The estimate of Clemins and Wither of a decline of 0.7 percentage points in the employment to population ratio implies about 1.4 million in job losses.

James, congrats, your post is one of your best since a long time. BTW a late happy birthday to you …

What you never hear in the minimum wage debate is that the whole premise of minimum wage is general price increases as a consequence of inflation are normal. A constantly increasing price level is not the norm in most of the history of the industrial world. The purchasing power of the pound Sterling remained constant for 200 years and that of the dollar for over 100 years. Steadily declining purchasing power in the currencies of the world is a relatively new phenomenon.

So the minimum wage is a clear indicator of the failure of modern monetary policy (as have been cost of living raises). The real question is can one error be correct by a second compounded error? Rather than fixing the real problem reams of electrons are spent debating the level of destruction caused by bad policy.

Maybe it would be worth while to point out what actually happened to minimum wage employment during this period

EMPLOYMENT

(000)

………………..TOTAL………MIN WAGE…………SHARE

2007……. 129,767………..1,729…………………1.33%

2008………129,377………..2,226………………..1.72%

2009……….124,490……….3,572…………………2.87%

2010………..124073………..4,361…………………3.51%

From looking at all of the above discussions you would never guess that minimum wage employment actually increased in the face of a 40% rise in the minimum wage, while total employment actually fell.

John to spencer,

With the financial crash of 2008 & 2009….it’s hard to apply this data ……to any long term discussion.

Thanks for the data….anyway.

Efforts such as forcing a higher minimum wage is one of the tactics of liberalism/progressivism for their ultimate goal (and proven historically disastrous) of redistribution of wealth. This effort to throw a bunch of numbers around and using a mish-mash of statistics to justify getting more money from businesses (the rich) transferred to the lowest income population (the poor) is little different in effect to increased welfare and entitlement programs, Obamacare and the many other laws and executive actions that Democrats enact or have tried to enact to use the governmental power of taxation to take monies from those who work to GIVE (not have them earn) wealth to those that don’t. The key words here is the money provided in every case is “given” not earned; just like the increase in minimum wage, there is no corresponding obligation by the recipients to improve their education or even be a better worker; they just get more money for the same job while the rest of us do not. The result; there is no expectation (let alone any metrics specified to measure) that the expenditure results in achievement or even appreciation by the recipients, let alone acknowledgement that this additional boost should eliminate any other cries of haplessness, inequality or cries of “I want more free money” which is why the “Great Society” laws have been such an expensive disaster with no breakthrough lessening of poverty or minority dependency. Increasing the minimum wage will just be stopgap measure before once again we hear “we want more” from the exact same people. The answer should be clear; if you want more wealth then better yourself, work harder, work longer, save and control bad habits like drug and alcohol abuse. That is the secret of success, not depending on Democrats to make laws that take money from successful people.

John to Andre’

You obviously have missed the Greatest Redistribution of Wealth in the history of the U.S.A.

Ronald Reagan lowered the max Income Tax Rate from 70% to 28%…..today…that rate is 39.6%.

Even more damming for America,,, is his teaching the American Public……paying taxes is BAD…..we can borrow money to pay Government bills.

When Reagan took office….The U.S. National Debt was $970 billion….When he left office, that Debt was $2.7 trillion…….it’s now approaching $18 trillion…..and Republicans will stop any attempt to increase taxes to pay Government Bills.

You and others have been corrupted into believing……efforts to provide support to others….by taxing the richer….is in your mind….taking from workers…and giving to people that don’t work.

40% of Food Stamps go to CHILDREN…..another 15% goes to DISABLED and the ELDERLY…..the rest goes to WORKERS that sometimes work more than one job at a very low wage….to the benefit of the businesses they work for.

You pay no attention that……the top 20% own 84% of our nation’s wealth…..while the bottom 40% own 0.4% of that wealth.

Businesses have $2 trillion cash in overseas tax shelters….to prevent paying taxes that would help pay our Governments bills.

I understand….you and others have made up your mind……my hope is…others will read this posting….go read and learn their own facts…..rather than accept untruths without question….

See #8 on my list of Solutions…

8. Repatriate Overseas Corporate Profits and tax at the current rate

John to HomeGnome,

I agree…..

Rand Paul’s suggestion…to repatriate those off-shore business profits…..at a tax rate of 5%…is an insult to all tax payers.

The U.S. has what is often called a “worldwide” system of taxation that requires American businesses to pay the 35 percent federal corporate tax rate on their income no matter where it is earned—domestically or abroad.

http://taxfoundation.org/article/how-much-do-us-multinational-corporations-pay-foreign-income-taxes

http://www.huffingtonpost.com/2013/06/19/food-stamps-military_n_3462465.html

WASHINGTON — While the House of Representatives considers cutting more than $20 billion from the food stamps program this week, it may want to consider a startling statistic: military families are on a pace this year to redeem more than $100 million in food aid on military bases.

Andre,

A higher minimum wage would redistribute from the consumer — not the owner. The idea in a free market is to redistribute as much from the consumer as the market will bear — the same idea for both owner and labor. In de-unionized America labor has no way to extract the max the customer will bear — a reasonable minimum wage is one way to try to extract that.

[cut and paste]

”Denmark has no minimum-wage law. But Mr. Elofsson’s $20 an hour is the lowest the fast-food industry can pay under an agreement between Denmark’s 3F union, the nation’s largest, and the Danish employers group Horesta, which includes Burger King, McDonald’s, Starbucks and other restaurant and hotel companies.” A.K.A., CENTRALIZED BARGAINING.

http://www.nytimes.com/2014/10/28/business/international/living-wages-served-in-denmark-fast-food-restaurants.html?_r=0

$20 an hour + benefits: it’s the truly-free (ONE COMMON CONTRACT WITH ALL EMPLOYERS — PREVENTING THE RACE TO THE BOTTOM *) market!

* http://ontodayspage.blogspot.com/2014/05/the-american-amoeba-economy-literal.html

minimum wage is some bull shit I thank it should put up to 8.25 cause its hard out here

Spencer,

This is why we will be arguing about the economics for the rest of eternity. It doesn’t matter what those numbers show you just posted are if you ignore the context of the MASSIVE RECESSION that just happened to be going on at the time. Perhaps that had something to do with more people taking min wage jobs? Just a whacky idea I just had.

John to Anonymous,

I agree…..but raising the Minimum Wage will help many workers.

Maybe, but the claims about minimum wage workers is not based on the supply of workers willing to work at the minimum wage.

Rather, it is about the demand for minimum wage workers.

Interestingly, over the years teenage participation has fallen sharply.

Some blame this on the minimum wage.

But there have been a host of studies that found the minimum wage was below most teens reservation wage.

Their time was to valuable for them to work at the prevailing minimum wage.

They needed the time to do things that would look good on a college application.

In the years just before the last round of minimum wage hikes more than 90% of employed teens earned more than the minimum wage.

Spence,

Are you attempting to bring analysis to this topic or just throwing out flack? A link would help. Whichever, here are some questions to think about.

Shouldn’t the number employed be compared, not to minimum wage earners of 2007, to those who earned $7.25 or less in 2007?

The tipped worker minimum wage was not raised, how has the number of the employed within that category changed?

During recessions, is it normal for percent of minimum wage workers to increase? if so, has the increase been more or less than normal?

Has the full time to part time minimum wage worker ratio changed? Likewise, how many of these minimum wage jobs are second jobs?

These questions and many others need to be answered before the significance of your stated numbers can be determined.

Ed

John to All,

Many people are upset…..that tax payers have to pay for Welfare.

They accuse these people to being lazy and free loaders….

To qualify for Food Stamps…..a family of four cannot have a family income of more than $32,000/yr ($16.00/hr)

Walmart currently pays an average wage of $8.81/hr……Walmart workers are not lazy, and free loaders…..they are workers…trying to support their families.

What that means is….Walmart pays that worker $8.81/hr……you and I, tax payers, pay that worker $7.19/hr in the form of Food Stamps.

Walmart knows this….they train new employees how to signup for Welfare……We, tax payers, pay a portion of Walmart’s labor costs.

Many businesses benefit from this arrangement…..Increasing the Minimum Wage would attempt to correct this situation.

Obama asked to raise the Federal Minimum Wage from $7.25/hr to $10.10/hr.

At a MW of $10.10/hr…..the tax payer portion of Walmart’s labor costs would be reduced from $7.19/hr to $5.90/hr…..a little improvement.

Unfortunately…..Republicans will never increase the Minimum Wage……so, you and I, tax payers, will continue to support business profits…by paying a portion of their labor costs.

Actually, we have data on minimum wage employment back to 1979.

Interestingly, each and every time the minimum rate rose minimum wag employment rose.

In the other years when the minimum wage was flat, minimum wage employment fell.

I know, the increase is because the people who were making more that the old minimum wage but less than the new minimum wage are now

minimum wage workers.

Another beautiful theory to explain why the first theory was wrong. It is really a shame that no one has the data to test this, right..

Remember, Milton Friedman said the test of a theory was how well forecast based on it worked out.

Well, forecast based on the theory that raising the minimum wage leads to less employment has failed this test 100%.

I find it amazing that we see so many complicated claims about the minimum wage and virtually nobody looks at the actual data.

The data essentially contradicts the economic theory 100%.

All this data is freely available at the BLS.

Google characteristics of minimum wage workers.

If the minimum wage for tipped workers is unchanged an increase in the minimum wage should have no impact on employees working at the tipped workers wage.

Ed; you might find these comparisons interesting. 🙂

The early 2007 fed minimum wage actually underperformed, Malthus. US population was 200 mil in 1968 when fed min was $11 (today’s money). By early 2007 US population expanded to 300 mil and the fed min had shrunk to $5.90 — to just short of half. Under Malthusian — pre-industrial — theory, a 50% increase in population should have resulted in only a third off wages.

http://data.bls.gov/cgi-bin/cpicalc.pl?cost1=5.15&year1=2007&year2=2014

If we could have somehow foretold to Americans of 1968 that by early 2007 the min wage would drop almost in half what could they have guessed would happen: a comet strike, a limited nuclear exchange, multiple plagues? What was going to happen to the expected doubling of productivity — and of per capita income?

Here is what happened:

dbl-indexed is for both inflation and per capita income growth (2013 dollars):

yr..per capita…real…nominal…dbl-index…%-of

68…15,473….10.74..(1.60)………10.74……100%

69-70-71-72-73

74…18,284…..9.43…(2.00)………12.61

75…18,313…..9.08…(2.10)………12.61

76…18,945…..9.40…(2.30)………13.04……..72%

77

78…20,422…..9.45…(2.65)………14.11

79…20,696…..9.29…(2.90)………14.32

80…20,236…..8.75…(3.10)………14.00

81…20,112…..8.57…(3.35)………13.89……..62%

82-83-84-85-86-87-88-89

90…24,000…..6.76…(3.80)………16.56

91…23,540…..7.26…(4.25)………16.24……..44%

92-93-94-95

96…25,887…..7.04…(4.75)………17.85

97…26,884…..7.46…(5.15)………19.02……..39%

98-99-00-01-02-03-04-05-06

07…29,075…..6.56…(5.85)………20.09

08…28,166…..7.07…(6.55)………19.45

09…27,819…..7.86…(7.25)………19.42……..40%

10-11-12

13…29,209…..7.25…(7.25)………20.20?……36%?

So a tiny drop in unemployment versus a large increase in wages

Hmm, that 0.7% drop seems like a small price to pay

“Hmm, that 0.7% drop seems like a small price to pay”

Unless, of course, you are among the 0.7% – but who cares anyway? It’s a small price, and we do not know your face anyway.

There is an alternative solution – how about Congress passes a law that orders 0.7% low-skilled people to be fired from their jobs, and be unemployed indefinitely.

In this way, we restrict supply, and thus, minimum wage can increase.

Or better yet – let Congress pass a law so that 15% of the low skilled people are fired from their jobs, and be unemployed indefinitely.

That is even a more drastic supply restriction, and wages can increase for the rest of the 85% of low skilled people.

15% is small price to pay, for the greater good of the 85%. Surely, the 15% will understand, right?

“Hmm, that 0.7% drop seems like a small price to pay”

To be fair, that’s the drop across the whole population. Amongst the proportion actually affected by this change in law, the effect is significantly larger. Depending on how much of the decrease in demand is borne by this population, astonishingly larger, in fact. I would call this a shockingly large marginal effect, even relative to the wage gains.

When there’s a shift from quantity to quality, quantity falls.

Then, there’s more quantity available to expand the economy.

I suspect, states with lower minimum wages have more businesses that are less productive and can’t compete, unless wages are low.

If the minimum wage rises in those states, there’s greater unemployment and fewer hours worked.

However, productivity rises, as some of those laid-off workers are absorbed by more productive firms.

And, the opportunity cost of extended and overextended unemployment benefits, in a recession/depression, isn’t worth a “cheap” job, even when it becomes less cheap.

I only wish we could hold those liberals financially accountable who push us down a poor course based on good intentions, bad math and wishful thinking like I have seen here when their grandiose promises of better lives for the poor, higher employment and marvelous economic growth turn out to be false. Just like the disaster that Obamacare is shaping up to be, the ones who pushed so hard to get us here, who ignored the others who truthfully said IT WAS A BAD IDEA and put ideology ahead of common sense are nowhere to be found. So once again we have people here who cite fuzzy math and twenty year old unrelated economic trends to try to prove a point that raising the minimum wage is good for America; while (just like Obamacare) if you give away a lot more money IT HAS TO COME FROM PEOPLE WHO WORK. However, while there will be some people that will benefit that are deserving, hard working and very decent people who probably love their mothers and go to church regularly, the net effect is that Americans will simply pay more (a concept that liberals completely endorse) for EXACTLY the same goods or services without any benefit to society or economy. So once again we are at the nexus of the majority paying for an indifferent minority who are placed in a position of undeserved and unqualified taxpayer charity for what? Just so they don’t have to try harder, or so they don’t have to make the tough choices and sacrifice a little to start a career, or so they can stay unappreciative except to the Democrat politicians who keep filling their wallets and purses with others’ money? Yes, a higher minimum wage will help a few deserving people but the concept of paying people more than what the market drives what they are worth is wrong and simply is a liberal ploy to take money out of successful peoples’ pockets and giving it to selected recipients for the purpose of developing a targeted underclass. Welfare (and artificially high minimum wages) are the latest attempt of imposing economic slavery that so far has stagnated this country’s efforts to decrease poverty. John (and others) listen up; the country has spoken and we are tired of supporting an unappreciative and increasingly greedy entitlement seekers and unless you understand that the country has moved AWAY from your socialistic concepts and imperious president, and start moving back towards the center there will be even greater decimation of the Democrats. It is up to you guys to understand that you no longer had the voice you once had, the sixties are long gone, the “Great Society” has been a dismal failure and the trillions spent on the liberal “war on Poverty” has been a bloody waste of a huge chunk of America’s wealth for no good effect. You liberals have failed and the sooner you faced that fact and rejoined reality the sooner we can fix the mess you have made.

http://www.pewresearch.org/daily-number/was-tarp-passed-under-bush-or-obama/

“Only a third of Americans (34%) correctly say the Troubled Asset Relief Program (TARP) was enacted by the Bush administration. Nearly half (47%) incorrectly believe TARP was passed under President Obama.”

Is there one iota of measurable data in your tirade? Why come to this site if you provide no evidence to support your allegations?

Sure, let me recap the facts;

– The liberals who pushed so hard to get us here, who ignored the others who truthfully said IT WAS A BAD IDEA and put ideology ahead of common sense are nowhere to be found.

– If you give away a lot more money IT HAS TO COME FROM PEOPLE WHO WORK.

– while there will be some people that will benefit and who are deserving, hard working and very decent people the net effect is that Americans will simply pay more for EXACTLY the same goods or services without any benefit to society or economy.

– the majority pays for an indifferent minority who are placed in a position of undeserved and unqualified taxpayer charity

– a higher minimum wage will help a few deserving people but the concept of paying people more than what the market drives what they are worth is wrong and simply is a liberal ploy to take money out of successful peoples’ pockets and giving it to selected recipients for the purpose of developing a targeted underclass.

– Welfare (and artificially high minimum wages) are the latest attempt of imposing economic slavery that so far has stagnated this country’s efforts to decrease poverty

– the country has spoken and we are tired of supporting an unappreciative and increasingly greedy entitlement seekers

– the country has moved AWAY from your socialistic concepts and imperious presidentt

– the “Great Society” has been a dismal failure and the trillions spent on the liberal “war on Poverty” has been a bloody waste of a huge chunk of America’s wealth for no good effect

– liberals have failed and the sooner you face that fact and rejoined reality the sooner we can fix the mess you have made.

Those are the facts. I haven’t even mentioned how similar socialism has hollowed out England, reduced Spain, Portugal, Greece and many other countries to looking for co-signers to keep their countries solvent and how pathetically the remaining true Communist countries of North Korea and Cuba are faring. And don’t even get me started about how Peron took a thriving South America country that was vying for the kind of prosperity the US had in the fifties and with Evita reduced Argentina to a permanent third work (kinda like what Jerry Brown did to California.)

Yes, as with most liberals you want facts until they work against you, then you talk generalities until they fail and then (as you will do now) personally attack the opposition. I think I read that in one of Ayres’ or Piven’s books on “how to” crash America. Except America has turned on you which of all the truths, is the toughest for you to accept…

Andre,

>>> while there will be some people that will benefit and who are deserving, hard working and very decent people the net effect is that Americans will simply pay more for EXACTLY the same goods or services without any benefit to society or economy. <<<

When — and IF — Americans pay more for exactly the same goods — that is because Americans were paying less than they would have been willing to pay in the first place; probably (in this discussion) because labor had previously had no way to squeeze the market for all it would bear (via good minimum wage or labor union).

Americans then pay LESS for — actually buy less of — other goods since they have less money to buy the other goods with.

What happens to the DIVERTED money? It is spent by the employees — and employers — who raised their price to what the market would bear. Instead of being spent by the employees and employers who the money was diverted away from. For example, employees and employers of Target may have more money to spend — while employers and employees of Nordstrums have less to spend.

NO!NO! NO! the money does not come from those who work.

It comes from who have investable income to loan the government.

That is why it is commonly called UNEARNED income.

John to Andre’

The top 1%….have not felt your wrath…..

John to Andre”

I accept your strong opinions……but I try to back up my arguments with facts.

America has financial problems…..the dialog in this blog has tried to address the wage problem.

My position is……..the MW is a floor under wages…..by keeping wages low….it prevents expansion of our economy.

John Kennedy had a study done…..to determine what level of Welfare was required to provide a dignified life for the disadvantaged…….it was found that wages did not provide the minimum requirements established by that study…..we’ve now spent 50 years arguing about paid work vs Welfare…..and paid work is still losing that argument.

Spencer,

When full-time jobs are converted to part time jobs, are you really surprised that there is an increase in minimum wage employment. Most of these part-time jobs are minimum wage jobs. How many were once full time jobs?

John,

Some areas you need to study.

1. There is a difference between tax revenue and tax rates.

2. Deficits are caused by spending in excess of revenue. No amount of revenue increase can offset spending at double that rate.

3. The constitution give the control of spending to the House not the President.

4. Read “The Seven Fat Years” by the late Robert Bartley of the WSJ

When you finish this study come back and we will move forward.

John to Ricardo,

I Agree….There is a difference between tax rates and tax revenues…….but when you change the rate from 70% t0 28%….you can be sure…it’s a threat to any attempt to balance revenues with expenses,

The result of the Reagan Debt going from $970 billion to $2.7 trillion……is proof….lowering taxes too far…was a mistake.

The heritage left by Reagan was……we can borrow money to pay Government Bills…….and the Rich will benefit from low taxes….

In 2011……Mitt Romney had a taxable income of $21 million……he had to remove charitable deductions from his tax form to get his tax rate up to 14%..

In 2009….John Paulson….the Hedge Fund Manager had a taxable income of $5 billion…..he paid a tax of 15%……

You’ll have a difficult time……convincing me…..that those tax rates are beneficial to a U.S. Economy that has trillions of dollars in Debt.

Again….the major damage Reagan did…..was teaching the Public…..paying taxes is BAD.

The “wage problem” is not a problem nor is what I have stated an opinion; Employers pay more when the market dictates and based on the quality of work performed by an employee. An employee that provides consistent and increasing ability and skill becomes more valuable and is subject to raises in pay and advancement. The enforcement of minimum wages makes the reward of higher pay for a better worker very moot just like most companies’ job hiring and advancement have specific quotas and HR hurdles that sometimes disallows the best candidate the position or promotion (a product of “The Great Society” laws.) While I allow that I will not try to dissect stats down to a quarter of a percent like an engineer with a slide rule (oops just aged myself) the basic principle is that money flow is a zero-sum event where if someone is given unearned money (or is given an artificially high wage) that money is taken from someone else, and in business it is usually from the consumer so higher wages=higher prices. However this administration and Democrats in general seem to disagree with this and think that the pool of American dollars are infinite as seen by their increasing our national debt by 70% since 2008 and printing money like it was toilet paper (which it is rapidly becoming.) While increasing the minimum wage can be shown to be maybe helpful (depending on the mixed stats) to the economy, it does nothing to prompt businesses to hire more workers, expand or keep their doors open, which is much more important. If you want to haggle over stats stay here and make pie charts, lists and dredge up incoherent percentages of doldrums go ahead, but if you want to really help American workers, get Washington to stop stifling business and industry with oppressive and purposefully vague regulations and restrictions and promote the need for workers to walk into the door of a prospective employer willing and prepared to work hard, not as many companies have seen, with an attitude of self-absorbed entitlement where they expect high pay and easy days. The MW issue is just the tip of the iceberg with it masking a much deeper cultural schism of the haves being forced to pay out more and more by governmental decree while the have-nots, now fully embraced by a society that tells them they are accountable for nothing but deservingly expectant of others’ wealth, have little interest in properly preparing to enter the workforce, or while in it taking direction, guidance and discipline from their employers. You time may be better spent changing that paradigm verses making it even more difficult for businesses to grow and hire more Americans.

John to Andre’

For a business to proper……they need customers with money…..

If you keep wages low….and the worker only has money for necessities…..your constricting any expansion of our economy.

You keep talking about todays condition of lazy workers taking from the hard working people……a 20% Long Term Capital Gain Tax rate….is beneficial to only one side…some how you have convinced yourself…..becoming ultra rich is okay….because they earned it….but being a worker…you only deserve a low wage…

You treat Minimum Wage as a freebie to lazy workers……MW is a floor under wages……you think business should be the only one to determine wages…..

If you don’t raise the MW…..there is no pressure on business to raise wages…..and businesses are very agreeable to allow you and I, tax payers, to supplement their labor costs by paying Welfare for their low paid workers….It’s not taking from the rich…and giving to the poor…..it’s taking from the tax payer ….and giving to the rich……and the inequality between the rich…and the rest of us…proves that point.

“So once again we are at the nexus of the majority paying for an indifferent minority who are placed in a position of undeserved and unqualified taxpayer charity for what? Just so they don’t have to try harder, or so they don’t have to make the tough choices and sacrifice a little to start a career.”

Yo, Mitt! Is that you? If so, the Democrats would really, really appreciate it if you would run for President again.

If he runs, and said the same things about the “poor” he would find a much larger segment of the population in agreement as the last few years have proved beyond a shadow of doubt he was correct and a lot more people now know that there really is a segment of the population that will support liberalism because they have gotten a healthy taste of living off of others’ efforts and they have no intent to stop. However, if the Dems run Hillary, then THAT would be the best thing that could happen for the GOP and the country as she is actually unelectable and will spend the next eighteen months sorting through Bill’s baggage, Obama’s baggage, her poor performance as FLOTUS (remember Hillarycare 1.0?) and of course the botching of Benghazi as SecState and her support of ObamaCare. Really, she has nothing new to offer and while she will run as “eight more years of Bill” what we will see is “eight more years of Obama!” Please, please, please let her run.

Yes, businesses need customers with a disposable income and discretionary funds; the bulk of whom are career and professional (not minimum wage) workers, so saying that MW workers are essential market drivers is wrong. The biggest part of your defense that simply disintegrates your argument is that your opinion (shared by liberals as a keystone in their plank) that the MW workers are ethically deserving of obtaining additional monies while “the rich” simply are not. Hmmm…let’s look at this, the Americans who have made the right life choices, went and stayed in schools, started and supported businesses and were rewarded for their efforts by successful lives are the “bad guys” while the MW workers that by definition are unskilled are the “good guys?” So we should provide them with more monies ON THE THEORY that helping them (although damn noble) will not further stall the economy and kneecap businesses JUST SO the evil, nasty “bad guy” 1% are forced to part with some of their greedy profits? Is that it? Is that your basic premise that poor Americans are better and more deserving than rich Americans? Sounds like class warfare at its worst. Here’s a counter argument; let the successful rich keep their money but take away their governmental roadblocks so they can reinvest THEIR disposable and discretionary funds into more and better businesses to employ more Americans at wages that are driven by the desire to provide the best priced goods or services possible. How about that? We have pumped trillions of dollars into the bottomless pit of the “war on Poverty” and in 1980 the poverty rate was about 15% and here we are in 2014 and the unmassaged poverty rate is (surprise) about 15%. Maybe we should stop trying so hard to appease a segment of America who have done little with the huge wealth that has been bestowed on them and concentrate on the movers and shakers who turn ideas and dreams into businesses and companies and make money and jobs. If you want to bestow more money on some Americans, the biggest question is the one you never ask yourself; why do you select some but not others as recipients yet never see yourself as narrow-minded or worse?

JOHN TO ANDRE’

When 40% of hourly paid workers make $10.00/hr or less……you fail to understand the problems that creates in our society.

You and Reagan have proposed the Trickle Down economic process to solve our economic situation. We’ve tried that for 30 years…..40% of workers make $10.00/hr or less…..even you cannot deny the failure of that…..

Your description of Class Warfare……misses reality.

Stockton (can’t remember his first name) was Reagan’s budget director…..he has been critical of Reagan’s tax cuts.

He has reported that in 1985….the top 20% had a net worth of $8.5 trillion…..his report said…in 2009…that 20% had a net worth of $70 trillion.

THAT’S CLASS WARFARE……and the Middle Class is losing.

You and others some how feel…increasing wages benefits the worker….at the cost to business…..WRONG……increasing wages…and increasing worker consumption is a stimulus to business……keeping wages low is a drag on our economy

EXAMPLE OF CHANGES TO CUSTOMER BUYING POWER

In Nov. 2013….Republicans cut Food Stamps by $4 billion.

The week they did that……the executives at Walmart held a stock market analyst’s phone conference….they reported…..they were lowing their sales and profit targets…..because of loss of Food Stamp sales.

You are right…..slowly increasing the MW is not a major factor in our continuing economic struggle……but the positive direction on that change…sends a signal to the entire population…..we are aware of the problems of low wages…..and we are willing to do something about it…..

Ignoring the problem of low wages…also sends a signal……profits to the rich…is more important than addressing problems of poverty.

if a minimum wage worker still does not make enough money to remove oneself from poverty, then the taxpayer still must provide welfare to that individual. hence the common taxpayer is not subsidizing the individual, the taxpayer is subsidizing a business so that the business does not need to pay a living wage. this needs to change, unless you are happy providing corporate welfare as well. businesses will never up the minimum wage as long as the government continues to subsidize their employment model. fast food, walmart, etc are all recipients of this corporate welfare model. how can one defend this as a free market capitalist system?

John to baffling,

Thanks for your COMMENT.

To qualify for Food Stamps….a family of four cannot have a family income of more than $32,000/yr ($16.00/hr).

Walmart pays an average wage of $8.81/hr.

That means….Walmart pays that worker $8.81/hr…..you and I, tax payers, pay that worker $7.19/hr in the form of Food Stamps.

Walmart knows this….they train their new employees how to sign up for Welfare.

Increasing the Federal Minimum Wage to $10.10/hr……would reduce the tax payer burden to $5.90/hr…..that’s an improvement.

The last increase in the Minimum Wage was in 2009……But…..Republicans control the Congress…..so there’s no hope the Federal Minimum Wage will be increased in the next 2 years…….or even beyond.

The persistent liberal belief that WE MUST fund and nurture “the poor” in our society is the message that is interpreted by a large segment of the population as a permanent relationship where from now on they will rely on the government for their livelihood and they give up. While you believe that money is a message, it is just money and who does what with it is what YOU want to control. To make the argument that the 1% should have less (as they don’t deserves to have all that money) and want “the poor” to have more (since they are poor they deserve to have more), you make huge generalizations that the “rich” are bad and the “poor” are hard workers frustrated with a lack of employment. In fact with what you want, the “rich” cannot use their wealth to invest in our economy (as we have seen in the last half-decade) whereas the “poor” has been rendered totally dependent on free monies and instead of working to get education and employment, they learn to work the system using people like you to get more and more. Now, it would be nice if those people would read the same economic reports as you so they would know that their food stamp purchases at the Walmart carry such clout, but when half of American households use some sort of governmental assistance, we really ought to acknowledge that we have incorrectly sent a message of advocating well-funded dependency instead of the “message” you mentioned. Really, there is little actual success in using the MW to help grow this economy which should be our primary goal, not just fund another liberal “aww, let’s give the poor more money…” campaign. The message we need to send is what my father did when he hit the shores of America as did many, many immigrants who legally entered the workforce – work hard, save and make the right decisions so your kids can have it better, not blindly funding those who drive their Cadillac Escalade to pick up an EBT card while talking on a free phone. That message needs to be disconnected.

John to Andre’

Let me clear up one of your assumptions……..I have never called the Rich BAD…….we live in a Capitalistic System…..one of our great freedoms is to excel.

We show that to the rest of the world……..and many people hear that cry of freedom…and try to come here.

The facts I have presented…..show how a very low tax rate…..benefits the Rich…..far more than the poor…..income/wealth inequality.

You keep talking about giving free money to lazy people……this blog is about wages……you must work to receive a wage……You and others, can be critical of those that don’t work for a wage…..but your insults to workers crosses the line……to you and others…..the person that cleans your Hotel room….is unworthy of anything , but the lowest possible wage……..Shame on you…….America was built by workers of all types…..and not all were suited to be an executive…..but they work for their wage…..and deserve your respect.

The next time you buy a hamburger……thank the cashier…..instead of slapping him or her in the face……….

Income inequality is frequently thrown around but effort inequality or work ethic inequality or working your ass off inequality is seldom addressed. Yes, the successful people that you loathe usually got that way from hard, hard work, long hours, sacrifice of leisure and dedication to achievement; that is where the inequality is, the money is just the punchline, the well earned payoff. You and others like you simply want to take what those people have sacrificed and work so hard to get and when people for one reason or another, whether it was having a child out of wedlock, doing drugs, spending a decade “finding themselves” or simply came up out of their Mother’s basement looked around and said “dude, I want what he has…” WANT TO GIVE IT TO THEM! Hey, I don’t slap anyone in the face, or look down on people who do jobs that I don’t, but I sure don’t think that they are more deserving for access to public funds than others nor do they have a RIGHT to the money of others with more as you seem to indicate. Honestly if you provide a worker with a mandatory five to ten dollar an hour increase in pay, that is not a wage; it is a tax on people who had to fork over that money (like I said before it is a zero-sum game) so only in your dreams is a big bump in MW anything but taking money away from one to give to another because you prefer one and dislike the other. It is the worst bigotry, racism and discrimination possible; you want to pick winners and losers because the rich is bad and the poor are good. You think I slap and insult workers where you my friend make Archie Bunker look like a broad-minded renaissance man, so all things considered, I come out way ahead.

andre, not all people were born with a silver spoon in their mouths and endless opportunities. in fact, until civil rights legislation was passed it was perfectly legal to discriminate against minorities in many parts of the country. you don’t think that has left a legacy detrimental to many inner city residents to this day. maybe you need to reassess your view on inequality. did you attend a state university in your youth?

John to Andre’

This blog is about Minimum Wage…..and it’s impact on our economy…