Today we are fortunate to have a guest contribution written by Timothy Bian (University of International Business and Economics, China) and Pedro Gete (Georgetown University).

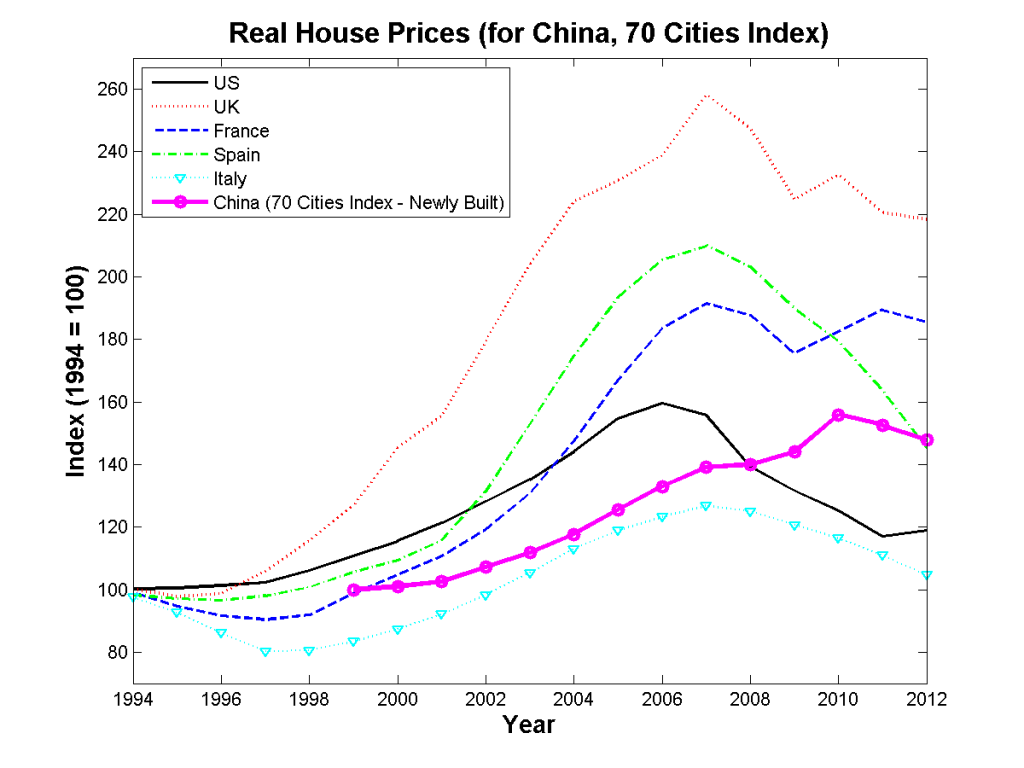

Housing prices in China have increased rapidly. The picture below compares their dynamics with those of the U.S. and other economies.

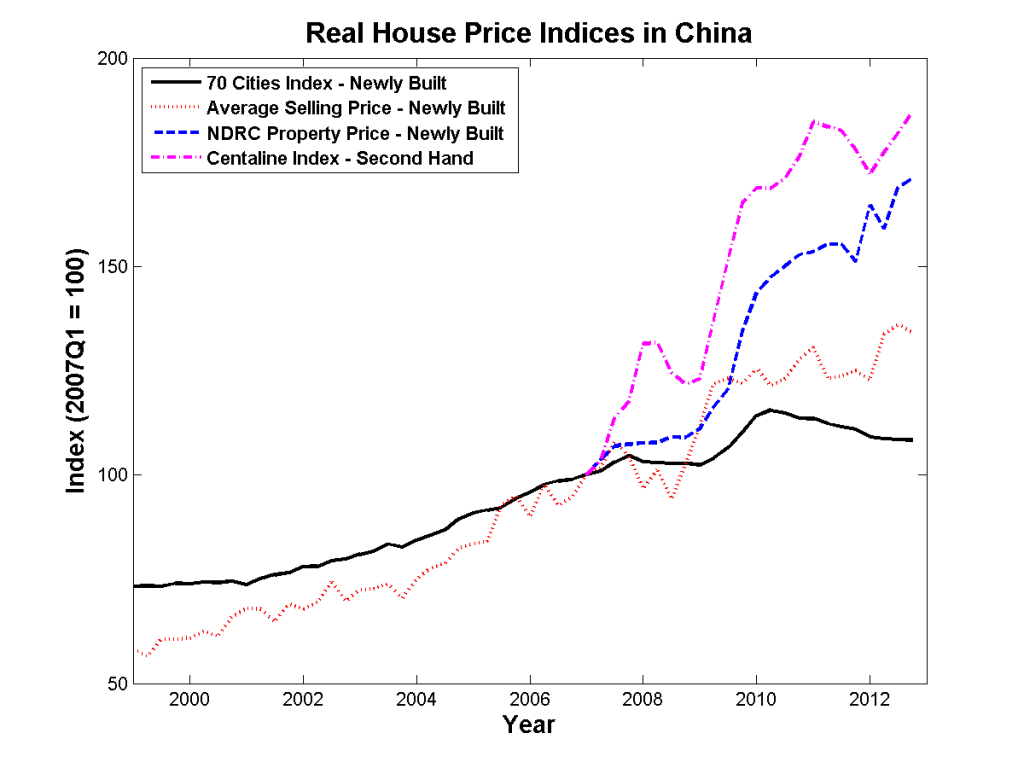

There is significant heterogeneity among the different indices of Chinese housing prices:

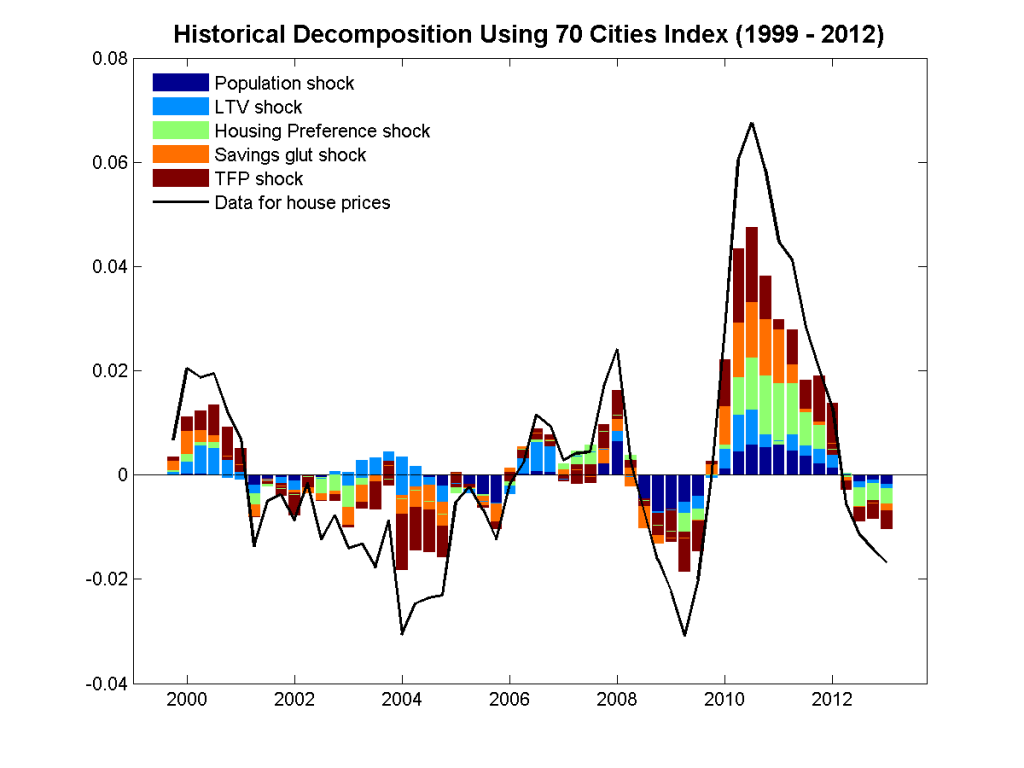

In this paper we analyze five potential drivers of Chinese housing prices:

1. Urbanization and Population Flows.

2. Relaxation of Credit Standards. For example, the shadow banking system. Or financial innovations, such as wealth management products, to circumvent banks’ lending quota.

3. Productivity and Income Growth.

4. Higher Demand for Savings. Real estate is among the few assets available to Chinese households given the capital controls that limit the ability to invest overseas and the non-competitive caps on banks’ deposit rates.

5. Preferences towards Housing. Housing bubbles, or a change in the status value of housing in marriage markets, are two factors that potentially could drive housing demand.

We use SVARs identified with sign restrictions consistent with a standard DSGE model of housing markets. We analyze different indices of housing prices.

Our main results are: 1) The five potential drivers play a non-trivial role in explaining housing prices in China. 2) Productivity growth has been the main driver since 1998. 3) However, when we restrict our data set to the 2007Q1 to 2012Q4 period, then housing preferences, which capture either a bubble or the status value of housing, are the dominant drivers. This result is robust across all price indices. It supports the recommendation from the IMF that China must act to prevent the risks associated with speculative demand in its real estate markets.

This post written by Timothy Bian and Pedro Gete.

Interesting data here. Thanks for the post.

I was quite surprised on a recent visit to Shanghai & Beijing at the condition of the real estate in both cities (but especially in Beijing). It seemed to me that even relatively new buildings were in fairly poor condition. This was true of both residential and commercial properties. An associate related that most of the condominium developers (and most urban Chinese live in what basically amount to condominiums) continue to own the buildings and collect condo fees after the units are purchased, but that unit owners have relatively little power to compel the developer/manager to perform maintenance or improve buildings. Developer/managers likewise have very little incentive to maintain or improve properties, as every dime reinvested is a dime that isn’t going into their profits.

It seems to me that there is actually a possibility that Chinese real estate prices could substantially rise over the medium term if this market inefficiency would be corrected. It is true, though, that the Chinese government does not have a great track record of standing up for individual citizens in the face of corporate (especially state owned enterprise) profits.

Well, some real data about a relevant topic. Well done, gentlemen.

I’ll be speaking on oil and the economy on March 17 at Georgetown, by the way.

So if I understand right the conclusion is that housing prices since 2009 look bubbly because they correlate with reduced consumption/GDP and reduced current account surplus / GDP. The former rule makes some sense to me but the latter not so much. Both those tests seem likely to be overwhelmed by policy changes in a country like China.

So which housing bubble will burst first — China or UK? Can you short them and remain solvent longer than they can remain irrational?

What am I missing? The first graph seems to show that China’s housing prices are much more rational than the other 5 countries listed. The increase in prices running up to 2008 were not nearly as rapid as the other countries and then in 2008 the Chinese did not see a market crash. While prices continued to increase in China they did not experience the real estate crash that sent western economies reeling. Now since 2010 prices in China have seemed to stabilized while other countries are still struggling with falling prices. As I asked, what am I missing?

From Andrew Klavan and Bill Whittle, an educational video :

https://www.youtube.com/watch?v=HzA7QomW4kY&feature=youtu.be

Why Nazi Germany was left-wing, not right-wing.

Menzie, to his credit, conceded the point long ago. But others need to be educated about history, sans the revisionism.

Darren –

All totalitarian regimes have features in common. Centralized control and dictatorship, terror, spies and informers, cults of personality, etc.

However, fascists and communists are traditionally the most bitter of enemies. Hitler was, of course, virulently anti-communist, and destroying Marxism in Germany, indeed, in Europe, was a primary goal for him. Interestingly, if you go to the terror museum in Budapest, you’ll see that a good number of the communist henchmen documented there earlier served the German Gestapo. They liked the line of work, apparently.

It is a good reason for a country like the US to be wary of using torture as an implement of policy. Sooner or later, those doing the torturing will be those who enjoy it.