In his criticism of the Trans Pacific Partnership, Senator Schumer discussed at length the need to counter currency manipulation, with particular reference to China. (See developments here.)

This is an odd focus, given that China is not involved in the TPP. I’ll leave that point aside, and note that it’s not clear to me what constitutes currency manipulation. But we can revisit whether the Chinese currency, the RMB, is still undervalued.

Kessler and Subramanian (2014) use a methodology similar to Cheung, Chinn and Fujii [1] [2] for a 2011 cross-country cross-sectional sample, and conclude using a linear specification that the RMB was about 10% undervalued.

Source: Kessler and Subramanian (2014).

This approach builds on the Penn effect — the fact that the price level is higher (on a common numeraire basis) when per capita income is higher.

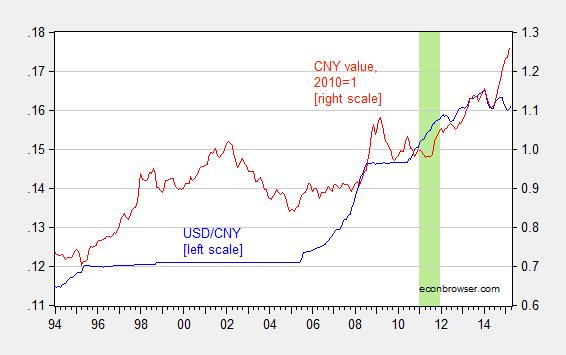

While the Chinese yuan against the US dollar is appreciated by about 4% through April 20 relative to 2011, on a trade weighted basis the March 2015 yuan is a full 23% stronger, in log terms.

Figure 1: USD/CNY exchange rate (blue, left scale), and CNY trade weighted (broad) exchange rate, 2010=1 (red, right scale). Green shaded area pertains to 2011. Source: Federal Reserve Board via FRED, and BIS.

Now, what is relevant is the inflation adjusted exchange rate. Figure 2 displays the nominal and real CNY (in logs).

Figure 2: Log CNY trade weighted (broad) nominal exchange rate (red) and real (dark blue), both 2010=0. Green shaded area pertains to 2011. Source: Federal Reserve Board via FRED, BIS, and author’s calculations.

As indicated in the figure, the real trade weighted exchange rate is now about 25% (log terms) above 2011 levels. Now it’s true that per capita income has risen relative to US in the intervening three years. Chinese per capita income in PPP terms has risen 22%, US by 4%, so the change is 18% (all calculations in log terms). Using the coefficients obtained in Cheung, Chinn and Fujii (2007), centered around 0.3, one finds the implied appreciation of about 5%, much less than the 25% observed.

Hence, I find the argument that the CNY is extremely undervalued somewhat questionable, at least on the price criterion. For discussion of alternative methods of estimating RMB equilibrium exchange rates, see this post.

Update: And here is the current account balance expressed as a share of GDP.

Figure 3: From TradingEconomics.

Update, 4/25 6PM Pacific: I should clarify one point: given the great degree of uncertainty surrounding Penn effect defined estimates of equilibrium exchange rates, I cannot rule out the possibility that the RMB remains undervalued.

In addition, informed sources tell me that the PPI deflated real value of the CNY exhibited much less appreciation. That would be relevant, if one were using a trade flow based measure of misalignment.

Reported Chinese money supply to GDP is ~200%, right up there with Japan and Switzerland. We know what happened to the Yen and Swissie recently.

Now with FDI waning and China’s GDP at ~0% after state-directed lending to sustain unprecedented overcapacity via growth of fixed investment at 45-50% of GDP, China has but one choice WRT to the Yuan, and it won’t be appreciation or floating the currency. Hint.

But because growth of global trade has decelerated to ~0% and regional GDP PPP and capital and credit flows between the three major trading blocs are effectively at par, there will be no more than a brief one-off effect to trade and GDP growth from currency devaluation hereafter, as we are likely to see in the EZ after the plunge in the euro and Swissie.

A similar situations occurred (1) during the debt-deflationary regime of the Victorian Depression in the 1890s and (2) during the Great Depression until the onset of WW II in Europe in the late 1930s to early 1940s.

As global GDP PPP and capital and trade flows settle at parity, the major fiat digital debt-money currencies will trend towards par with one another hereafter with the effects of the global debt-deflationary regime rendering cash/liquidity dear, prompting states to be compelled to raise regressive taxes further on labor and production, confiscate cash and proxies via bail ins and capital controls, and further constrain labor’s share of GDP in favor of unproductive unearned income and rentier speculative activities and net flows accruing primarily, if not exclusively, to the top 0.001-1%.

History (of the 1830s-40s, 1890s, and 1930s-40s) is rhyming yet again.

‘The yuan is not freely traded in FX markets, so there is no international market in which China could literally intervene, in the sense that some other nations have done with respect to their currency trading. The only source for Chinese exporters to exchange the dollars that they receive in international trade for RMB is through China’s central bank: The People’s Bank of China (PBOC or PBC) and its affiliate The State Administration of Foreign Exchange (SAFE). The exporters need to exchange the dollars, because there is nothing else they can do with them; they cannot deposit them, they cannot go to an international market. The exporters just go to their banks, which then go immediately to the PBOC to turn in the dollars in exchange for RMB that they can actually use. PBOC sets the rate at which it is prepared to exchange RMB for dollars….So, PBOC has set the rate; if anyone has dollars that they want to exchange into RMB, the rate is fixed….Either he accepts the rate set by the PBOC, or he cannot exchange.” ‘Six Myths that Hold Back America’ by banker Frank Newman, winner of the Alexander Hamilton Award for his work at Treasury.

“and note that it’s not clear to me what constitutes currency manipulation.”

The substantive answer seems clear – any official currency purchases or sales move the exchange rate from the market-determined rate. The stated reason for the intervention doesn’t matter.

don: Then we are all currency manipulators. Even the US occasionally intervenes.

This is possibly correct. It isn’t 2005 anymore.

If this data is correct: http://www.tradingeconomics.com/china/foreign-exchange-reserves, China has also reduced its reserve holdings in order to bolster the value of the RMB since last July. This doesn’t fit the image of China as foreign currency undervaluer any more. Of course, they still have nearly $4 trillion in official reserves, on top of fairly tight capital controls, so it’s not as though Schumer’s allegations came out of nowhere.

China’s Balassa-Samuelson residual did fall to become only slightly undervalued by 2011. But, that’s a crude measure. Another would be relative unit labor costs, which suggest the renmenbi was still quite undervalued in 2011. Enough so that this measure would still suggest the RMB is undervalued.

Lastly, Re: China’s current account. Aren’t CAs strongly procyclical? China’s been growing at over 7%, while Japan/US/Europe have still been relatively depressed. And still they are running surplusses. I think that points toward undervaluation, although point taken that there is substantial uncertainty, and the degree of undervaluation is nothing like it was from 1986-2007.

On balance though, I’d agree.

O.K. I will admit it is a matter of degree. But how would you explain these figures?

Foreign exchange reserves (in $ trillions):

China $3.9

Japan $1.2

Korea $0.4

Taiwan $0.4

U.S. $0.1

Ben offered the explanation that currency reserves in Asia were a result of the “Asian crisis,” and a resolve to remain free of IMF conditions. But China and Japan were not part of the crisis. IMHO the amassing of reserves in Asia is the direct result of mercantilism. I am open to reasonable alternatives if you have any to offer. There is a tendency among economists to confound notions of the gains from ‘free trade’ in the debate over whether currency manipulation should be allowed (who say it would be ‘protectionist’ to attempt counter measures). Ben cited estimates for the gains from international trade in testimony before Congress (probably in response to Congressional concern about leakage from U.S. AD caused by currency manipulation abroad), citing a deeply flawed study by Hufbauer that greatly overstated the gains. He lost a lot of my respect when he did that. I know some very competent international economists in the Fed who could have told him better. Dani Rodrick called him to account for the figures he cited, which were simply beyond the pale.

Chinese purchasing power may be overstated, because environmental regulations, labor standards, food & drug regulations, etc. are much less reflected in Chinese produced goods than American produced goods. Moreover, not much of a safety net is implied in the price of Chinese goods, which also results in a higher Chinese savings rate. Consequently, Chinese exports, to the U.S., are too cheap and American exports, to China, are too expensive.

Menzie wrote:

“Then we are all currency manipulators. Even the US occasionally intervenes.”

This may be the greatest understatement I have ever read. The US has been manipulating the dollar to generate windfall profits since WWII (even before is you look at Benjamin Strong’s manipulation, but it was not to benefit the US but to bail out the UK).

Menzie, I would be curious to see the results of your analysis if the euro is used as the base and the USdollar is the variable. For example, how much has the US dollar appreciated since 2011?