The April Employment release confirmed continued growth in total and private employment. My observations: some modest downward revisions, and some sectoral trends diverge.

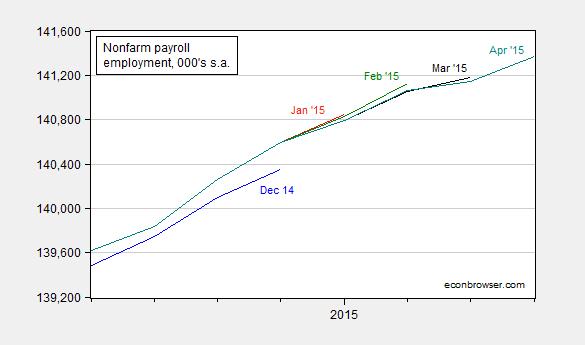

Figure 1 depicts the estimates by vintages for the past five releases. In general, the revisions are downward.

Figure 1: Nonfarm payroll employment, 000’s, seasonally adjusted, from December 2014 release (blue), January 2015 (red), February 2015 (green), March 2015 (black), and April 2015 (teal). Source: BLS various releases via FRED.

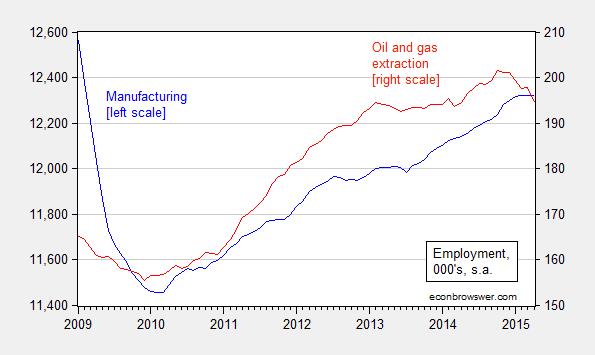

Next, it’s of interest to examine the trends in two sectors that have faced headwinds: oil and gas extraction and manufacturing. The former has definitely declined, but back to levels seen in March 2014. (Obviously, this series does not include effects on ancillary activities, including construction.). The latter has flattened out.

Figure 2: Employment in manufacturing (blue, left scale), and in oil and gas extraction (red, right scale). Source: BLS April release via FRED.

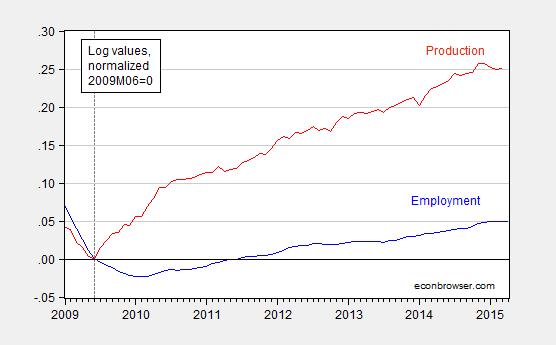

Since employment in manufacturing exhibits an overall downward trend over time due to above-economy-wide average productivity growth, it’s useful to compare to manufacturing production. Figure 3 confirms that output has also flattened out, likely due in important part to the effect of the dollar’s appreciation (see this post).

Figure 3: Log manufacturing employment (blue) and log manufacturing production (red), both seasonally adjusted, and normalized to 2009M06=0. Source: BLS April release and Federal Reserve, both via FRED, and author’s calculations.

Additional commentary from Calculated Risk, Davidson at Real Time Economics/WSJ, Stone/CBPP and Furman/CEA.

The 12-month average of the YoY rate of US Treasury payroll withholding receipts and reported wages and salaries imply that US employment peaked in Aug-Nov 2014 and is likely being overstated by as much as ~1% on a 12-month-average basis. (Then again, the labor force might be 1% smaller, resulting in a net wash for reported unemployment.)

Full-time employment has yet to exceed the 2007 high, whereas all net gains in employment since 2007 are attributable to part-time employment.

We’re still in “recovery” and in “full-time rehab”.

Sometimes the comments are more informative and interesting than the post. But not this time.

Since the economic bottom the trend growth of hours worked has been 0.2%,monthly.

In 2014 hours worked rose above that 0.2% trend, but it is now back to the old 0.2% trend.

I think, productivity in U.S. manufacturing has been somewhat overstated.

U.S. manufacturers use to do everything “in-house.” Then, they began outsourcing their work to other firms, boosting the service sector of the U.S. economy.

Also, the U.S. offshored low-end manufacturing, with declining prices, to other countries, and shifted into more high-end manufacturing with market power.