Here are my thoughts on options for handling Greece’s debt.

Let me begin with the following question: if someone makes a new loan to the Greek government, are they ever going to get paid back? Let’s start by being clear about what we mean by “paid back.” There’s nothing fundamentally unsound about the consols that the British government sometimes used historically to borrow. These bonds were intended to pay interest forever but never repay the principal. In practical terms it’s not really that different from a 30-year bond, nor for that matter from a one-year bond that creditors always roll over. As long as the interest payments always get made, the buyer can consider himself fully “paid back” in the present-value sense for the consol he purchased, even if the principal itself is never repaid.

But the question is, where will the Greek government get the funds with which to make future interest payments? If they always just borrow new sums with which to make interest payments as they come due, it’s obviously not a good deal for the creditors. The debt just grows over time, and creditors are only being paid back with their own money. If you followed the cash flow over time, you’d find it’s always a one-way street from creditors to borrowers, and amounts to an outright gift from creditors, not a loan that is ever paid back in any sense.

One way to keep track of this is by looking at the government’s primary budget surplus, which is calculated by taking the usual budget surplus and adding to it the government’s annual interest payments. If the interest payments are large, the normally calculated budget might be in deficit (defined here as a negative surplus). But when you add interest payments to that negative number, it could come out to be a positive number.

If the normal budget is in deficit but the primary budget is in surplus, it means that the debt is going to grow over time, but at least some of the interest payments are being made with real funds instead of with new borrowing. If you work through the math, it turns out that as long as the primary budget surplus is equal to annual interest expense, creditors are being fully repaid in present-value sense, even though the debt itself is never retired.

But if the primary surplus is less than the annual interest expense, the debt will be growing, and repaying in present value requires continual revenue increases or budget cuts. The question anyone lending new sums to Greece must contemplate is whether that’s a plausible scenario.

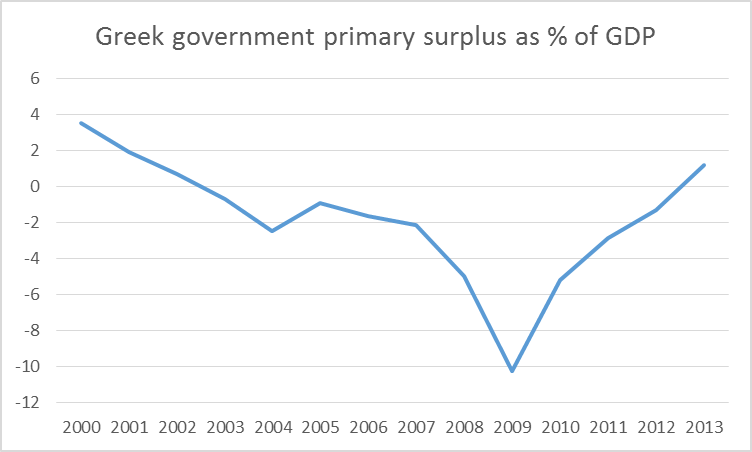

What are the numbers for Greece’s primary surplus? It turns out it’s harder to find a straight answer to that question than it should be. The graph below plots the figures from the IMF World Economic Outlook database. These claim that after years of big deficits, Greece finally ran a primary surplus of 1.2% of GDP in 2013.

But the ECB claims instead that Greece ran a primary deficit of 8.3% of GDP rather than a surplus in 2013. What’s the controversy? Based on this report from the Wall Street Journal, it appears that the IMF must be excluding one-time expenditures in support of the Greek banking system, which amounted to 10.8% of GDP. In terms of the calculus of whether external creditors on net were getting repaid anything in 2013, the ECB concept appears to be the correct one– Greece was still running a big primary deficit in 2013 in the sense that any interest payments they made that year, along with much of their spending, were paid for with newly borrowed money.

For 2015 the IMF is anticipating a primary surplus of 3% of GDP. But Daniel Gros attributes the surplus so far in 2015 to factors such as the government not having made cash payments yet for goods and services already ordered or provided– otherwise known as new government borrowing not recorded in the official measures of government debt.

This is why creditors are asking for more progress from Greece on the primary surplus before extending additional funds. But here’s the response of Greek finance minister Yanis Varoufakis:

Greece’s drama is often misunderstood in northern climes because past profligacy has overshadowed the exceptional adjustment of the past five years. Since 2009 the Greek state’s deficit has been reduced, in cyclically adjusted terms, by a whopping 20 per cent, turning a large deficit into a large structural primary surplus. Wages contracted by 37 per cent, pensions by up to 48 per cent, state employment by 30 per cent, consumer spending by 33 per cent and even the current account deficit by 16 per cent.

Alas, the adjustment was so drastic that economic activity was choked, total income fell by 27 per cent, unemployment skyrocketed to 27 per cent, undeclared labour scaled 34 per cent, public debt rose to 180 per cent of the nation’s rapidly dwindling GDP, investment and credit evaporated and young Greeks, just as their Irish counterparts, left for distant shores, taking with them huge quantities of human capital that the Greek state had invested in them.

What Greece needs now is not more cutbacks that push an impoverished populace into greater indignity, or higher tax rates and charges that crush what is left of economic activity. These “parametric” measures, as the institutions call them, have been excessive, the result now being a nation on its knees.

No, what Greece now needs desperately is serious, proper reforms. We need a new tax system that helps defeat evasion and curtail political or corporate interference, a corruption-free procurement system, business-friendly licensing procedures, judicial reforms, elimination of scandalous early retirement practices, proper regulation of the media and of political party finances, etc.

Suppose we granted the claim that further tax increases or spending cuts would be crippling and self-defeating. If true, doesn’t that make a pretty good case that Greece does not have the capability to make real interest payments on any new debt? And if it is as simple as implementing a few reasonable reforms, why were these not instituted earlier, and how effective can they be expected to be? Why wouldn’t they also depress demand in an already depressed economy?

Others argue that potential lenders would reap other benefits that compensate for the fact that the loans themselves cannot be expected to be repaid. Louka Katseli, chair of the National Bank of Greece, maintains that

the cost for the eurozone, which they are down-playing, is really serious…. If the markets decided the eurozone is not an irrevocable decision and a government can be declared insolvent, then the first thing that would happen is that there will be a speculative attack by the markets on the next weakest participant in the eurozone or the euro.

But that cuts two ways. If Greece is able simply to write off its debts without repercussions, what would become of political sentiment in Portugal, Spain, Italy, and Ireland? Perhaps Europe can successfully draw a sharp line, saying yes we’ll give you full support if you can achieve specific fiscal targets, but if not, you’re on your own, and in so doing provide a more credible defense for other vulnerable countries than is offered by the current status quo.

The bottom line for me is that Greece’s current debts and any new loans that get extended from here are not going to be repaid in the present-value sense defined above. The current debt load and its associated interest bill are simply too big. The only solution is default on a significant portion of outstanding Greek debt. Indeed, significant debt restructuring is a necessary step for Greece to move forward, whether within the euro or based on a new currency. My view is that any realistic negotiations at this point simply have to take those facts as given.

As far as why this wasn’t done before is because there was another government in place, the one that ran up most of it.

Of course Greece’s debt won’t be repaid. A debt-to-GDP ratio of 180% is patently unmanageable, and it was three years ago. That’s not what’s on the table.

What’s on the table is whether Greece is going to be a European country. And it can only achieve that by upgrading to European levels of governance. How do we achieve that?

The chosen method has been “push”, in which the Troika pushes the Greek government to undertake the necessary reforms to become a house-broken member of the European Union. But it is at the same time absolutely, positively, unambiguously clear that the objective function of Greek politicians is, let me repeat for the benefit of the tone-deaf economics community, not about sustainable economic growth. It is about buying political popularity with other people’s money. Any “push” strategy is therefore doomed to failure. And not only in Greece, but Italy, Spain, Portugal, Argentina and Hungary, to name just a few countries of interest.

If you want Greece to succeed, you must create a “pull” strategy, one in which there is demand for good governance. You do this by aligning incentives, by insuring that Greek politicians are rewarded–handsomely rewarded–for sustainable economic growth. This is plain vanilla, first year management consulting. I don’t know how to put this more simply.

Honestly, what the hell are all those economists doing over at the IMF? Is the institution really this useless? Is there not one economist over there with even the most rudimentary management consulting skills? You could dump the lot, hire two first year consultants from McKinsey, and you’d be on top of this problem in three months.

“Perhaps Europe can successfully draw a sharp line, saying yes we’ll give you full support if you can achieve specific fiscal targets, but if not, you’re on your own,”

Exactly, The EU policymakers would be assuming that the other countries don’t view this bailout as a favorable option and will only want it for themselves in an extremely dire situation. If this can be achieved somehow, that would be ideal and would avoid any financial market repercussions that would surely follow a default.

Greece is in particularly bad economic shape for a European country with unemployment over 25%, youth unemployment over 50%, the highest under-employment in Europe (75% of Greece’s part-time workers want more hours), and only a 53% labor force participation rate.

which is why any element of continued austerity on greece is ridiculous. if you notice, all the words coming from germany any similar minded governments it “punish the sins” and growth will miraculously appear. this concept of necessary punishment needs to be more thoroughly considered.

Greece has enormous capacity to expand the economy, raise living standards, and shrink government debt to GDP.

Here’s what a Greek economist says:

http://www.nytimes.com/2012/10/11/opinion/the-cost-of-protecting-greeces-public-sector.html

That’s the entire point, Peak. The issue is not ability to grow, it’s the incentive to grow. The New York Times article which you linked absolutely makes clear the that the problem is one of political incentives, no more, no less. If you want to fix Greece, you fix the incentives, and then pretty much get out of the way.

Baffs –

“The individual’s objective function: max rewards, minimize effort, and minimize risk. ”

This is not a view, it’s a stated objective function. This is really a classical rational man view. I’ve stated in terms in social, rather than monetary or economic, terms. I could have said “maximize utility”, but I think the way I’ve expressed it is clearer and amenable to analysis using a three ideology framework. Note that risk is highlighted separately, something which is not normally done in standard economics presentations. Nevertheless, risk minimization is very important in understanding the conservative mindset. (And if you’re in finance, you will eventually notice that you seem to be spending most your time managing risk.)

The allocation of risk, reward and effort within the group constitutes “culture”. And this involves both elements of who is allowed to allocated and what can be allocated. Thus, for example, the President can order a soldier to likely death on a foreign battlefield, but not to, say, shut down a runaway nuclear power plant in Pennsylvania. Some of these rules are formal and written down, others are by custom. In any event, the way I have put the objective function in these terms because it corresponds to the framework used in a three ideology model.

steven, my problem with your approach (or rather the current weakness, because you have valid points) is how you properly introduce the risk of failure and the resulting consequences. what is your penalty for poor performance? they simply do not get re-elected-not much of a penalty. better incentives are needed to make such a system work. and i don’t think society as a whole is ready to implement those incentives.

“This is really a classical rational man view.” its a fine model to use in theoretical constructs. makes the mathematics easier. but most of the problems of the world exist because the rational decision was not made. rational and politician only belong in the same sentence with the word irrational!

You raise the question of negative recourse, that is, some punishment for politicians not obtaining some goal.

The two goals in question would be failure to achieve economic growth, on the one hand, and failure to repay debt, on the other. The Greeks themselves don’t seem terribly worked up about a lack of growth, so I see no reason to throw politicians into jail when really, growth or lack of it is a Greek domestic matter.

Repaying debt is another issue. I suppose you could throw the politicians into debtors prison–it would certainly make my heart flutter with happiness. I don’t see it happening.

But let me turn to the question of an objective function. If you asked Greek politicians, growing the economy would not be high on their list of priorities. Many of them would not even recognize it as an objective function. Indeed, if I ever want to stump economists, I can always resort to, “What is the objective function of government?” It gets them every time.

Just the act of laying down an objective function has force. Above, I have stated that the objective function of government, first and foremost, should be the maximizing of sustainable economic growth. Almost anything Jim writes, for example, will have that assumption underpinning it. At the same time, many readers of Econbrowser would consider such a mission something they had not really realized or thought about, and not a few (Menzie) would find it at least in part objectionable. But that as it may, the very first step in achieving a goal is to articulate it. Anybody told Greek politicians what their most important task is? Let’s start there.

Now, as for the question of corruption. Why is there effectively no corruption in the private sector? Because voluntary employment ensures Pareto optimal relationships, such that the corruption wedge (the value you could arbitrage with a bribe) is bid out of the system. Let me illustrate with an example. Let’s assume there were price controls on gasoline, as there were after tropical storm Sandy. If your selling price is fixed below market, then there will be a surfeit of buyers to sellers, and these need to be rationed. They can be rationed by queuing, but obviously, a black market will emerge with the seller taking a kickback (a bribe) to sell the gasoline to some favored insider.

On the other hand, a free market insures that a price is the best deal either buyer or seller could get. For example, if a station could raise the price of gasoline and sell more, it would. And it will continue to raise the price until the price equals marginal cost. Similarly, the buyer will seek the offer with the lowest price. So the gas station attendant at Valero can’t say, “Well, sir, the list price of gasoline is $2.59, but I could sell it to you for $3.00.” The customer would laugh at him and go to the next station down the street. Thus, the station attendant has no opportunity for corruption, for taking a bribe. That value is fully captured by the station owner, and the attendant is forced to accept the role of agent. He’ll be paid for doing a good job pumping gasoline, not for selling gallons on the side. Thus, by letting the price go to market, corruption disappears from the transaction as a structural matter, not because we have enforced laws or regulations.

Therefore, I am asserting that i) politicians are grossly underpaid considering both their potential value added and their control over resources, on the one hand, and ii) are not motived to attain the prime objective of government, that is, sustainable growth. If we allow the price to rise to market and align compensation with performance, you’ll find that corruption disappears pretty fast. This is importantly why Singapore (where they do pay bonuses) is such a squeaky clean pace. And that’s why I don’t spend too much time on corruption as a problem. You can solve it–not perfectly, but adequately–as a by-product of addressing other issues.

I feel for the IMF. The Greek proposal is so patently bogus and ill-conceived. But the IMF has no cards to play. A Grexit is a mark-to-market event for the Trioka, including the IMF. The only method with a prayer of recovering the majority of the monies lent to date is the one I am suggesting.

peak, thanks for the article. nice link. an interesting quote to start the article

“To protect workers from being thrown out when a rival party came to power, virtually iron-clad job protections for government workers were enshrined in the Constitution.”

one would notice an irony in wisconsin. the ruling party staffed a government agency with its people (WEDC), while simultaneously looking to eliminate government workers in another agency (DNR) whose research conflicted with the ruling party world view.

so which comes first, the greedy workers demanding tenure, or the dirty politicians who hire and fire?

The individual’s objective function: max rewards, minimize effort, and minimize risk. That’s a universal objective function. Thus, there is no such thing as a ‘greedy’ worker per se. All workers are greedy, as a functional matter. The question is only the extent to which we can indulge our preferences.

If the median voter believes that the purpose government is to enjoy the perks of loyalty or to take money from others, then you have Greece, Argentina, or Philadelphia.

steven

“The individual’s objective function: max rewards, minimize effort, and minimize risk. ”

very pessimistic view of the world, and rather cold hearted and sterile. it is not a world we should necessarily encourage. these types of statements fall into the class of “greed is good” from the gordon gekko world view. perhaps true technically, but rather sad. plenty of people enjoy their work without maximizing the objective function. that said, the real problem begins when transient bosses, such as politically appointed government administrators, destroy the individuals objective function by simply firing them for no good cause. tenure was a response to irresponsible and politically motivated employment actions. tenure and worker protections are not needed when the individuals objective function is respected. at least in the private sector, when a person’s 20 year career is cut short by a myopic manager, a severance package is typically included. not so much in government work. your 20 year career is simply a waste of time.

but steven, you are correct about the situation in greece, argentina, etc. blame should not be made on the workers. blame should be made on the politicians who created that environment to begin with. but to punish workers today for the sins of government officials decades ago is not really fair. for instance, here in the usa, the baby boomer generation were politically advantaged and carved out too much of the social security benefits. now the solution is to take benefits away from future generations? why punish the groups who did no wrong, and reward (or at least not punish) the original rules breakers?

Agree. It’s clear that Greece simply cannot service it’s existing debt load. That would seem to mean, though, that the European powers-that-be insisting that this must happen are either clueless, or trying to (further) punish Greece for political reasons. Hopefully some adult supervision can be found before it’s too late.

mike, it almost appears as though some european countries are using the financial situation to conduct a proxy war on greece. the desired outcome is destruction. is this what future warfare will look like? cutting gdp in half?

Again, you work with wrong assumptions: Nobody expects that Greece will pay back the debt. However, nobody is willing to allow a write-down BEFORE there are changes in Greek governance.

My sense is that staying with the euro is not going to work for a long, long time and it will increase the misery of the Greek people all the while. If the idea is to get enough domestic devaluation for Greece to be competitive, then the Greeks are in for a long, long period of struggle. J.M. Keynes made that point back in the 1920s regarding German reparations when everyone was on the Gold standard. External devaluation came relatively quickly, internal devaluation almost not at all. Greece needs to cut the debt anchor from her neck. Install capital controls and a new drachma that is the exclusive currency for all domestic transactions. Put people to work building infrastructure assets and fund it from the Central Bank which will also peg the drachma to other currencies by fiat. Do not count this spending as deficit, it is investment building assets that will boost employment today and growth for generations. Stop paying private investors. Go it alone and build the nation’s assets. Create wealth and income, not poverty and even more debt.

The Greeks do not need to leave the Euro, at least not for reasons of competitiveness. Last I checked, the trade balance was positive there. Internal devaluation is complete, best I can tell.

However, returning to the drachma and putting people to work building infrastructure will not, let me underscore, not improve Greek governance. The Argentine example is absolutely clear on this. Such a policy, from the EU’s point of view, is properly considered a massive failure. It is tantamount to amputating Greece from the European body politic, not bringing it up to EU standards.

Success can be achieved by aligning the incentives and letting the Greeks figure out how to earn those bonuses themselves. That’s the path–and to my mind–the only viable path forward. Every other policy of which I am aware will constitute some sort of loss.

Steven,

How do you align incentives within a system that does not and will not allow that? You do not. You must think outside the box. Outside the box is outside the system. The system must be changed. I leave it to you and other readers to think about what this means.

JBH,

You align incentives by allowing people to earn and then protect their property so that they are incentivized to expand and hire more people. Get the government and the IMF out of the way and the people of Greece would heal the country.

it is interesting that the ECB continues to fund the greek banks. i almost think some in the Euro want the ECB to do the dirty work for them, cut the funding and force greece into bankruptcy. but the ECB seems to be saying, as long as greece is a Euro member, they will continue to provide backing to their banks. if the politicians want to bankrupt greece, they will need to do it with direct action. i think they had hoped to get their desired outcome through ECB inaction. i do hope the ECB maintains its independence from the politicking. otherwise, the Euro dream will be over.

JDH,

In practical terms it’s not really that different from a 30-year bond, nor for that matter from a one-year bond that creditors always roll over. As long as the interest payments always get made, the buyer can consider himself fully “paid back” in the present-value sense for the consol he purchased, even if the principal itself is never repaid.

Just to be clear, you’re assuming a stationary inflation rate, right? If inflation spiked in the out years but the interest rate was fixed, then the creditor would be worse off.

Is it the case that Greece’s original creditors are being asked to make additional loans, as your analogy suggests, or is it the case that the ECB and IMF are being asked to make additional loans so that Greece’s creditors won’t take a haircut? My understanding is that the bailout loans pass from the IMF to Greece for a nanosecond and then to the German banks. My admittedly cynical understanding is that the ECB and the IMF are really trying to bail out the reckless German banks that made those bad loans in the first place. When a loan goes bad it’s usually the fault of both the creditor and the debtor.

In any event, I think we arrive at the same place; viz., that German banks and the ECB & IMF need to accept the facts on the ground. Time to suck it up and prepare for a Marine Corps bootcamp style haircut. The banks, the ECB and the IMF are in denial. Greece cannot and never will be able to pay back either the principal or all of the interest. It’s time to negotiate a partial default.

Steven Kopits I don’t think anyone is opposed to a more responsible Greek government, but you didn’t offer any thoughts that deal with the present problem of not being able to meet interest payments. What you’re talking about is all fine and dandy, but it’s the kind of change that takes decades. Greece doesn’t have decades. And from what I’m hearing about the latest deal, it sounds like something that Greece will eventually have to renege on. Cutting pensions is great if your economic problem is strong demand and an inelastic aggregate supply curve. In that case you would want to expand the effective labor force. But that is definitely not Greece’s problem today. They are plagued with weak demand, excess capacity and an uncompetitive price level because of the euro, which is pegged to benefit German fears of Weimar and not Greece’s current problems. The latest proposals will only make Greece’s economy even weaker, thereby making it even harder to Greece to run a primary surplus.

2slugbaits: My point was that for example with a 3% interest rate on a 30-year bond, the present value of the repaid principal is only (0.97)^30 = 0.4. Getting repaid your principal is not your main consideration in a 30-year bond, instead it’s making sure you get each of those interest payments over the next 30 years.

I don’t think that adequately answers the point 2slugbaits made. What percentage of bond holders actually hold a bond for 30 years? 1 percent? Less? Your calculation is affected if you reduce the period of holding to the average period one holds that bond. According to this source, the average holding period of US Treasuries over 10 years in duration is 20 days(!):

http://seekingalpha.com/article/1310711-the-30-year-treasury-bond-makes-no-sense-compared-to-dividend-stocks

It makes more sense to me to use a realistic example for an average creditor.

The concern of bondholders is, certainly, to get their principal back. But, for the average bond holder, that means when the bond is sold, not when the 30 year term ends. A spike in inflation will mean getting less principal back because the expected interest payments and the principal payments compared with the inflation rate and default risk are inextricably bound. In addition to the inflation point 2slugbaits made, “getting one’s principal back” is also affected by the risk of default.

Professor,

This is the best analysis of the issue I have read.

Jude Wanniski used to say that it is not the bad economics that creates economic disasters but the stupid reactions of governments when their economic theories don’t work. Greece is a classic example. The EU seems to be throwing good money after bad. As you note, without a change in policy, Greece will simply fall deeper into the abyss until there is no option other than allowing them to crash.

Of course you can lend to Greece and expect to be paid back.

But you have to do it with protections broadly called seniority provisions. If your loan is to be paid first in line, you’ll be fine. Or if you have a dedicated cash flow stream like a mortgage.

But more broadly, in general you would expect to be paid back if the funds went into an NPV positive project. Greece has NPV positive projects everywhere you cast your eye now, and as a matter of fact so does USA.

It’s the existence of the other debt, and the potential ability of its lenders to avoid substantial haircuts and to command cash that should go to pay off the new debt, that should cause new lenders to seek additional protection.

Were there to be a real bankruptcy process for the country, current creditors would be crammed down, Greece would be assigned payments within its means, and new lending would flourish. But that is not what we now have.

I will provide you an indicative plan below, Slugs.

For now, here are the underlying principles:

1. Governance is more important than growth

2. Growth is more important than debt service

Of course, we believe ‘good governance’ (governance to our tastes) will produce growth, and growth will provide the source of funds to repay debt. But the prize were looking for, first and foremost, is good governance, by which we mean the establishment of primacy of the principle of maximizing sustainable economic growth.

Now, we take a Smithian view of the matter, that man acts in his own self-interest, and this does not change because he has been elected to public office. There is no ‘public servant’ carve-out regarding self-interest. The evident venality and corruption in Greece tell us that this presumption is true. Therefore, we have an opportunity to act on policy by motivating the principal (the politician) through bonus payments, rather than motivating the agent (the elected representative) through some presumed sense of duty. We are going to use venality and corruption as tools. They are a feature, not a bug.

We create harmony by aligning the principal and agent, equating ‘doing well’ with ‘doing good’ which is the entire essence of Smith’s invisible hand.

As a functional matter, we want to move from a “push” system in which reform is imposed externally on a resistant Greek political class, to a “pull” system in which there is demand for good governance, and external powers play a supporting role. Seems radical, right? Well, go hire the junior-most staff member at McKinsey, and they’ll tell you the same thing.

So those are the principles. Now we have to embody those principles in a specific program, for an investment banker, a transactions structure or term sheet. This is what you have requested from me.

The Source of Funds

How much debt can Greece service? Well, let’s look at our source of funds in principle. At its peak in 2008, Greek GDP was around $250 bn per year. Today it’s around $190 bn. Therefore, if we were able to get Greek GDP back to its earlier level, that would provide a source of funds of more than $60 bn per year, in which case, certainly $10 bn of annual repayments is not out of the question. That’s around 5% of GDP, so it’s a big number. I’m going to propose a gradual ramp to 3%, but that’s up to the Greeks. From our perspective, the trick is to build in debt repayment as the economy recovers–that’s why incentives matter.

Let me add a disclaimer here. There are many aspects of a Greek deal with which I am not familiar and which might materially alter the specific terms which I might suggest. For example, I am not accounting for any financing or liquidity support which may be necessary to support the Greek financial system. I am talking purely about fiscal issues here.

A “Pull” System

Essentially, a ‘pull’ system is passive. If the Greeks want to pay us back, that’s great. If not, we’ll wait. I am inclined to think that I would allow a very low interest rate, perhaps 0.5%. I think that’s close to the current rate they’re paying on at least some of their official debt. I would roll over all the debt for four years without condition. If the Greeks want to repay, that’s great. If not, well, that’s fine, too.

If the Greeks want to borrow more, they should feel free to do so on commercial markets on a subordinate basis, keeping in mind that increasing debt reduces the Bonus Pool and debt waived under the Proposed Program. The EU will also consider additional support, bearing in mind that it will reduce bonuses.

There is no other conditionality. There is no obligation to lay off anyone, reduce pensions, privatize assets–none of it. The Greeks can do whatever they like. The EU and IMF are there to help if requested.

However, once a year, there will be a Bonus Banquet, to which all the members of parliament and their spouses will be invited (and consider it mandatory). At this event, the IMF (yes, I think it’s the IMF) will review economic performance, debt repayment, targets for the bonus pool and bonuses achieved. Payment of bonuses will follow this event. That’s it.

The spreadsheet, as ever, is here: http://www.prienga.com/blog/2015/2/19/a-program-for-greece

steven, this does sound a little bit like paying a criminal to not act like a criminal. how long can you afford to do this?

No, Slugs, it is not about criminality. It is about recognizing that a value of an agent is directly proportional to the value they manage. It’s about treating politicians as valued employees, and not as your Mommy or Daddy. It’s democracy for grown-ups, not for children, Democracy 2.0 if you like, and it is the shape of the future.

As for how long one can keep it up, well, check the spreadsheet where I have of course calculated the number for you. As a matter of math, in 2020 in Greece the projected program cost is 0.05% of GDP. It’s an incidental expense.

“It is about recognizing that a value of an agent is directly proportional to the value they manage. ”

hogwash. steven, obviously you support the current notion in wealth management, where the agent takes a percentage cut of your wealth to manage it for you. as a consumer-or citizen with elected officials-i find this model completely beneficial to the agent and detrimental to the consumer. you should be paid for the work you do-investments mean making good trades. not on the volume of the asset you manage. i will concede, the larger the asset the more you will need to be paid. but the value is not directly proportional. tracking more assets is more work, so there should be a pay difference. but it is far from proportional. why is it ok for an educator to teach more students for the same pay, but a wealth manager or elected official to have his /her income tied directly to the proportional value of the size of the assets under management?

A teacher is not in a position to lose $2 bn in a couple of days. As you know, I advise hedge funds and equity holders in the oil space. The portfolio I have recommended (in the leveraged form I recommended it) is up 70% since December. On the other hand, one of my clients is up only 10% or so. He took a more conservative line (too conservative, given the position in the cycle). He also has a few billion dollars to manage, so it’s harder to take positions. I think under $1 bn, it’s pretty easy to move in and out of positions, at least in some markets. But once you’re over $1 bn, there are many securities you are moving with your trades. And there are liquidity concerns, etc. In any event, a fund manager is in a position to make or lose literally millions of times the salary of a teacher over a one month period.

By the way, I have no problem with success fees with fund managers (and the political bonus plan is exactly that). For the reasons I note above, I think bigger funds easily become about fees. It becomes too hard to beat the market easily. To date, investors have been willing to tolerate this fee structure, but maybe not forever.

In any event, politicians manage more wealth and income, by an order of magnitude, than do fund managers. No fund manager could reduce Greece’s GDP by 25%. Those 300 members of parliament there did manage the trick, though. How much is that worth to you? To me, it’s worth a great deal of money.

steven, a teacher can certainly derail a student’s career in the course of a semester. multiply that by 100 or 200 students in a semester, and a teacher has a fair influence over an asset class. while perhaps difficult to value directly, it is nevertheless quite valuable. income based on the value of the asset class you manage is probably not a great measure to use overall, in my opinion.

as i stated, i understand that as the size of the asset value increases, there should be an accommodation for the difference in work load. but it is not a directly proportional change (you did not say linearly proportional but that is what i assumed you implied in general. that is how the fund managers view the problem). this solution is promoted by the same folks who believe a 3% yearly pay raise across the board is fair. for example, only the top quintile of earners would think this to be a fair approach. but it is advocated across the country as a fair and equitable way to raise salaries in general.

two issues i see with your approach. one, risk-reward is skewed poorly. good performance gets rewarded, and bad performance? no bonus. but in the wealth management world, you still collect your cut of the overall asset. this leads to the second problem, which is to reward greater risk taking. failure has no penalty. now if you include incentives such as losing ones personal house, pension fund, etc as the price for failure (or poor governance), i am willing to listen to the proposition. but typically these incentive programs have positive rewards and no negative penalty. lack of a bonus is not a penalty. if we can somehow come up with an appropriate penalty for poor performance (or poor governance), you would perhaps make some headway. again, the inability to be re-elected is not a true penalty. cantor failed as a politician and was rewarded with a wall street job.

Tax increases on the consumer class are crippling but if you increase taxes on the rich the effects on economic growth is minimal. Increasing the age of retirement in a society where there is a 50% unemployment rate for young people is very destructive. If you have 100 jobs and 150 jobseekers evenly distributed from age 20 to 67 who would you want to pay a monthly subsistence check to stay out of the workforce; the young or the old?

I can’t believe no one commented yet on the egregious typo in the headline.

“Renegotiating Greek’s debt”

Seriously?

Sorry! Fixed now.

Steven Kopits: “If the Greeks want to pay us back, that’s great. If not, we’ll wait.”

Who is this “we” you speak of? Greece doesn’t owe a dime to you, me or most anyone else in the world.

The money is owed to greedy, incompetent, mostly German bankers who willingly lent money to Greece instead of buying nice safe German bonds because Greece paid a higher interest rate. Nobody put a gun to the bankers’ heads. They did it out of greed.

And now the German banks want to use all the power of government to beat the money out of Greek citizens that had nothing to do with the financial debacle. All of the taxpayer bailout money is not going to the Greece. It is going right back to the German bankers. German taxpayers should be very angry at the banks, not the Greeks.

With all the talk about morality and responsibility, why are bankers never held responsible for their failures? When you say “we” I can only assume that you sympathize with and include yourself in that category of irresponsibility.

So you think Germany should have let Greece sink sooner? I have no great affection for the bottomless debt which the EU has heaped upon Greece, but honestly, I would have done the same thing, particularly back in 2011 when things looked dicey indeed. Would you call me ‘greedy’ for trying to save Europe, the Euro and maybe the European financial system? I suppose I would have to live with that, but I doubt you would have found me opposing Mrs. Merkel if I’d been in the room. You don’t always follow a given line because it’s a great idea, but because all the other options seem worse.

In any event, the issue is not the past. The issue is what we want to do now. I think the Troika’s approach to Greece is wrong and it will fail, in some ways worse than the Argentine outcome. It will cost them much more money than what I am proposing (which recovers about 88 cents on the dollar, by the way). I have a better solution. It will work, and everyone at the end of the day will walk away reasonably satisfied.

“Greece doesn’t owe a dime to you, me or most anyone else in the world.”

Johnny, to take just one example, Greece owes $25 billion to the IMF and are likely to default on their payment due to the IMF on Tuesday. Take a few moments and check out who funds the IMF. The US is by far the largest source of funding, but there are many other countries “elsewhere in the world” that provide funding and stand to lose much more than a “dime”.

Agree with this post, default is the only option. but keep in mind:

the Euro is a political project. Austerity will not end, see tomorrow, Thursday.

Rich man,

You are correct that austerity will not end tomorrow. Austerity is a consequence not a policy. As long as the Greek government follows destructive policies austerity will get worse and worse.

Let me rephrase this:

As long as Greek politicians are rewarded for re-allocating and maximizing current resources (including foreign debt), they will continue to focus on maximizing current outcomes for specific favored groups rather than on long-term outcomes for the country as a whole. When they are rewarded for maximizing the long term benefit of the country as a whole, they will focus on that goal. No amount of Troika browbeating can change the long-term behavior of Greek politicians if the underlying incentives remain unchanged.

Period.

So the lawyer in me wants to look to Bankruptcy Law for guidance.

A court’s objective in bankruptcy is to permit the re-organization of the debtor. To accomplish this objective the court balances the competing demands of stakeholders (bond holders, employees, etc). The court has pretty broad power: it can order reduce payments to creditors and invalidate union contracts for example.

This is what Greece needs and it is what the EU needs. It needs an agreed set of criteria to apply in cases like Greece. It needs an agreed upon party to objectively apply the criteria. Because this will happen again.

The definition of the process is what is need to address the moral hazard worry.

I must say the short shortsightedness of the bondholders is stunning here. It is clearly in everyone’s interest to take the boot off of Greece’s throat.

But they need to answer this question in a broader context.

The Germans are right. The Greeks must be severely punished because they are not paying back their debts, effectively stealing other people’s money. Putting it in moral terms (with words like sin) makes it understandable for everybody. You economists can put it in terms of incentives and disincentives, although basically it is a teaching or training device. Greek debt will be rolled on to the future indefinite (as all sovereign debts are) and Greece will become a respectable member of the EU again.

I categorically disagree, J. With a bonus incentive, I have not taught the Greeks how to create growth, I’ve merely created demand for growth, ie for macro econ consulting services. (And even more micro econ services, actually. Deloitte and PwC would be so happy.) The plan does not show the Greeks “how”, only “what”. The “how” is pretty hard, but the point of a “pull” system is that we let the Greeks decide which steps to do in their own chosen sequence. And they have an incentive to seek help. (And that is how we professionalize the macroeconomics business.)

The way you solve this problem is that you

1. install the bonus plan

2. put a 4 year moratorium in debt repayments

3. let the Greeks ask for assistance

4. create growth

5. use the proceeds of growth to fund debt repayment

I would strongly emphasize that it is the bonus plan which protects the debt service program. So, just to give you some round numbers: each 1 pp of growth translates into a bonus of about Euro 50k per member of parliament. Further, each $1 bn of debt repayment translates into a Euro 20k bonus per member.

Thus, once you have established some growth–resulting in increased tax revenues and (ostensibly) declining outlays–you use some part of the increment to service debt. Now, without a bonus plan, the increment will go to increased spending. That’s plain as day.

With a bonus plan, however, that increment will go to debt service. So, if the Greeks are repaying, say, $6 bn per year (about 2% of GDP at the time), then members of parliament will receive a Euro 120k bonus every year for doing pretty much nothing. I doubt you could find a dozen members of parliament willing to endanger that bonus by withholding repayment. The is a principal reason why my proposed program is substantially superior to the dead-end track the IMF is currently taking. The difference is a solid $100 bn in recovered monies to the Troika.

This exercise is not about teaching. It’s about making clear which side of the bread is being buttered.

The way you solve this problem is that you

1. install the bonus plan

2. put a 4 year moratorium in debt repayments

3. let the Greeks ask for assistance

4. create growth

5. use the proceeds of growth to fund debt repayment

Step 4 reminds me strongly of the South Park Underpants Gnomes.

One wonders why Greek society did not think of step 4 in 2014? or 2013? 2012? 2011?

One also wonders why the IMF has changed its view during that time on the usefulness of front-ended structural reform measures in a depressed economy?

The notion of paying bonuses to elected politicians is deeply, deeply odious to the economics community. I had this very discussion with my uncle–a 26 year IMF veteran, seven years on Hungary’s monetary policy council (FOMC equivalent), and founder of Hungary’s fiscal council (as well as being a current member in Portugal and Peru)–and he was appalled. I could have suggested knocking over a liquor store and he would have taken it better.

I have suggested it to my brother–Fulbright scholar, Stanford Law grad and editor of the international law review there–and he is simply unable to process it. I will ask him, “Do you believe in Adam Smith, that men act in their own self-interest?” He will say, “Yes.” If I then say, “Do you believe that men stop acting in their own interest if elected to public office?”, he begins to splutter: “Well, you see, they get their rewards from power, so doing well for the public…” “So why then kickbacks and corruption, if they’re so interested in the common good? Why all the venality and partisanship?” And he freezes up. He can’t process it.

And I’ll tell you why. Because it inverts the relationship of governing to governed. I don’t pay my mom and dad, and they take care of me. Shouldn’t our politicians take care of us? Well, if you’re paying them a performance bonus, then they are nothing more than crass employees–important and expensive employees–but employees nevertheless.

Also, neither the IMF nor the Greeks use a three ideology model. So when you ask an economist, “What is the objective function of government?”, they freeze like deer in the headlights. The lack a framework to process the question. So when I suggest paying bonuses for economic performance, they’re concerned that they don’t fully understand the ramifications of such a system.

But the problem itself is straight-forward. If you have been an investment banker or venture capitalist and structured deals–and I have; if you have been a strategic management consultant and dealt with the likes of the Hungarian government and its state-owned companies–and I have; if you have structured debt deals–and I have; or you have chaired a public company where you had to set the goals of management and provide the rewards–and I have–then none of this is new or strange. It is part of your everyday tasks.

If you are a creditor and not being repaid, a consultant would ask three questions:

1. Can your client legally repay you (ie, can they sign a check)?

2. Do they have an incentive to repay you?

3. Do they have the funds to repay you?

In the case of Greece, the answers are clearly, yes, no and no. And that tells you exactly what your task is. First, you have to align incentives. Second, you have to create a source of repayment. This is not hard. In terms of analysis, it’s trivial.

That the IMF is not thinking this way is a failure of mindset, not analytics. It like the treatment of breast cancer. For decades, a radical mastectomy was considered optimal. But it was not “until 34 years after the first popular call for modifying the extensive surgery, by George (Barney) Crile, Jr., of the Cleveland Clinic in 1955, did surgeons at Columbia-Presbyterian Hospital in New York City, one of the last bastions of radical breast surgery, lay down their instruments and acknowledge that the Halsted [radical mastectomy] era had come to an end.” It’s all about mindset and what solutions can even enter discussion.

The issue is not the analytics or the prescribed solution. The analytics are straight-forward and solution will work. That’s not the issue. The issue is that it proposes a radically different view of governance. It is a new type of democracy, different from what we have known. In a sense, it undermines the notion of public service (although I would argue that “public service” is exactly what brought Greece to its knees). It makes governing just another form of business, and economists hate that, because they think they are above it all. I am taking not one, but two noble professions (governing being a noble profession), and making them grubby trades.

I get that. On the other hand, when the lives of millions of people are on the line, I have no patience for such niceties. For $100 bn and the future of Greece as a European nation, I can take some grubbiness.

So, it comes down to whether we want to try Democracy 2.0. If we do, where better to try it than in Greece, where they created the original version.

Steven, this may work in theory, but not with the current left-wing government and the corrupt and basar-style-oriental society, you find in Greece. 50 percent unemployment; & it would take too long to implement. It’s game over, default is the only option. Restart the system with Drachme. Ricardo, actually, I am rather poor, though it depends on the metric.

Nonsense, Johnny. I could get you a deal by Labor Day.

You’ll notice, by the way, that I did not single out the Tsipras government, which everyone can assume is well to the left of my tastes.

The incentive system depends heavily on the viability of corruption and venality. If Greek politicians were acting as true agents representing the prosperous future of Greece, my plan would not be viable, ie, an appeal to the principal would go unheeded.

So, how hard a sell is the proposed program?

Greeks, here are your options:

A. Default, capital controls, eviction from the Euro and exclusion from debt markets for the next generation

B. Service unserviceable debts forever with an economy perpetually ground down in servitude to the German Machine.

C. Enjoy a four year repayment moratorium and elimination of conditions as long as you accept a yearly performance bonus if you can get GDP growth up to some decent level and pay down some minimum amount of debt in four years.

I have to tell you, Option C doesn’t look that bad all things considered. I think I could sell that in Athens in the next few weeks.

The much harder sell of course is the IMF. OMG, pay politicians bonuses! The sky is falling!

And of course Merkel might not be that easy. But think about the alternative. I think there’s a pretty good chance that the Greeks will vote anti-austerity on July 5th. Not because they don’t want the bailout, but because it doesn’t solve the problem. In six months, we’re right back here. So what’s the benefit for avoiding the bullet now? Maybe it’s just better to get it over with.

If that’s the way the Greeks vote, then Mrs. Merkel is facing the most awful lose-lose-lose scenario. She loses Greece for the Euro, in an important way for Europe, and immediately faces a markdown of $200 bn. Nothing optimal about that.

She could do worse than let me try to put together a deal over the balance of the summer.

“The Greeks must be severely punished because they are not paying back their debts, effectively stealing other people’s money. ”

they are not effectively stealing other people’s money. the creditors made an investment, and should understand part of the risk of the investment is not being paid back. that is why they collect interest payments-to cover the risk. greece also owes worker’s paychecks and pensioner’s money-based on deals those people also had with the government. this is payment for work performed. should they not get paid as well? since there is not enough greek cash to go around, somebody is going to take a haircut. this “effectively stealing” morality play is simply hogwash.

by the way, i think greece has already been “severely punished”. how much more blood do you expect? perhaps the ill advised creditors, like the banks from germany, should pay a price for poor investment decisions? i would be angry if i were some other members of the EU who are bailing out some of the poor investment decisions of the german banks.

The Troika’s current 15.5 bn Euro offer to the Greeks is risible. It does nothing to solve anything, just throws good money after bad and plays for time.

Why do the Greeks not have a growth plan? Why are the Greeks not interested in creating a stable platform for growth and debt repayment? It is because they lack the proper incentives?

I’ve done a lot of government consulting in the US and Europe, and although I understand “Big Stick” tactics a la Merkel, it’s not the right approach to this problem. Not by a long shot. You cannot solve this problem by pushing on a string.

Let me further add that, if the Greeks reject the offer, then the Troika loans will be marked to market, as a practical matter, and that means a write-off on the order of $200 bn.

Second, should Greece accept terms, then the whole structure just creates on-going uncertainty, a perpetual waterboarding of the Greek economy. How can one invest with the prospect of a potential default and Grexit in December? Thus, the chosen EU tactics will fail to create a source of repayment. Instead, it means the Troika will face a mark to market event in December on the order of $215.5 bn Euro.

“Second, should Greece accept terms, then the whole structure just creates on-going uncertainty, a perpetual waterboarding of the Greek economy. ”

completely agree. i think the euro leaders (especially germany) do not like tsipras in power, and would be happy to try their hand with a new PM. they can do this by providing money for current bills and pushing this off a few more months, in exchange for even modest austerity. they will pursue modest austerity, arguing this should be a token taken by greece to show its seriousness. if tsipras takes this bailout money and agrees to any austerity, no matter how small, i think he loses his government seat. the germans probably feel another election, which they will happily pay for, will reintroduce politicians more willing to continue austerity policies. the big gamble in all of this is the assumption tsipras is not willing to leave the euro. he now has a choice, keep his position in a defaulted greece, or lose his position while greece continues to take a beating in the euro group. tough choice.

I agree with your analysis, Baffs.

That’s why an incentive system is so important. It’s not party-dependent, notably because we are appealing to the principal, not the agent, ie, we are appealing to their politicians’ pecuniary interests, not their political ideologies.

Tsipras could take the Incentive Plan as a total victory: debt repayment moratorium, lifting of all major conditions. Piece of cake.

On the other hand, he would have just brought the most classically liberal form of government since Lee Kew Yuan came to power in Singapore. (And for those of you who will argue that he was not a classical liberal, substitute “since the British colonized Hong Kong”.)

We have an unfolding tragedy in Greece and Europe. Easily prevented, and totally unnecessary.

steven, tsipras pulled a fast one with the referendum next week. now he has a chance to stay in power, no matter the outcome. the germans must be howling over this maneuver. i did hear one of them quoted as saying how undemocratic this move was. wow, a vote by the people is not democratic! hard to argue with people so out of touch with reality!

another flaw i see with your incentives approach, is it does not include the troika. can you provide an incentive approach to them as well? because as long as they continue to propose absurd policy ideas, greek leaders never have the opportunity to choose properly. greece can only react to the numbskulls with whom they negotiate!

baffling & Steven Kopits,

IMHO you give Tsipras political leaning too much credit. For Merkel it is only important not to loose more money and to avoid a situation, in which Greece gets money for doing nothing, i.e. Portugal et al. would request the same. Or from another POV: Merkel’s highest priority is to be Bundeskanzlerin, she would not endager this goal with political games like a replacement of Tsipras. Greec’s government is not important enough, there is no gain for her, only more minefields.

And again, nobody actually expects a repayment of the debt in Germany, therefore, a Grexit or a very long maturity of the debt is something that is not (longer) dangerous for Merkel, however, a continuation of payments without changes in Greece is.

BTW: I like Steven Kopits plan.

Thanks, Ulen!

ulenspiegel,

“And again, nobody actually expects a repayment of the debt in Germany,”

then why not negotiate along those lines, rather than negotiate as if greece must continue to fulfill debt payments everybody knows cannot be met? this is where i find the dishonesty with the troika and germany in their approach. if they know greece cannot pay off the full debt, but they continue to negotiate provisions without that debt relief, in my view at least, it is dishonest.

again i bring up the point, i believe the troika and other euro parties do not want to negotiate with tsipras, so they continue down this path until he is forced out of office. the mix of economics and politics leaves a wicked stench in this case.

but if greece does leave, the contagion-which i did not fully buy into at first-will become significant. spain, portugal and italy will then be in the crosshairs. if you interpret the fall and exit of greece as a political move by greece and the troika-and it was if they force tsipras out of office-those countries are going to feel as though they are also being manipulated economically for a political outcome as well. this will not be good for a euro outcome.

the euro fails because it has no real mechanism for internal fiscal transfers, and now it appears its monetary policy does not consider weaker players, only germany. as long as good german monetary policy is beneficial to a euro member, no problem. but when those needs diverge, who gets the benefit of monetary policy? greece gives you a real world experiment to this question.

baffling wrote: “then why not negotiate along those lines, rather than negotiate as if greece must continue to fulfill debt payments everybody knows cannot be met? this is where i find the dishonesty with the troika and germany in their approach. if they know greece cannot pay off the full debt, but they continue to negotiate provisions without that debt relief, in my view at least, it is dishonest.”

If you allow a write down before the Greek government has implemented changes you get nothing, Greece would be in the same position a few years later again, still in the Euro and expecting cash again, this would very likely a worse economic and politicla situation than a Grexit in 2015. A write down without conditions gives away the last bit of bargain power. And you would send the wrong signal to Spain, Italy and Portugal, i.e. only idiots implement reforms.

Germany could of course finance Greece, but not one of the others, so we have an important political issue to consider and to solve. It is not useful to argue with the economic issue in isolation when you (and Krugman) ignore the political aspect at the same time: Nobody in Europe believes a change of Greece without pressure/incentives. You have to bring a usefull package that covers both, the economic and political aspect. That is in my opinion the beauty of Steven Kopit’s proposal.

Schäuble’s “Greece must honor her debt” was only heard when the Greek government wanted a hair cut without own commitments, one politcal stunt as answer to another. Keep in mind, Schäuble is not as stupid as Krugman believes. At the same time Schäuble’s guys had no problems to make clear statements what would go with Germany. Hence, a useful program proposal by the Greek government which fixes some of the more pressing aspects, like better tax collection, retirement payments coupled to economic growth etc., would have been a good bargain for a write down or -better to sell in Germany- credit with very long maturity and very low fixed rate.

I fear the Greek government has missed a good opportunity for getting a good deal. (But I am only an amateur when it comes to game theory or, amybe, some Greek politicians may underestimate the importance of game practice when playing with political veterans. :-))

I expect a Grexit, which will produce a interesting situation, as a county can very likely only leave the Euro zone by leaving the EU, or a half cooked work around that prevents Greece from leaving the EU.

Ulenspiegel

“If you allow a write down before the Greek government has implemented changes you get nothing, Greece would be in the same position a few years later again,”

i guess this is where i see the dishonesty. the greeks did impose many austerity conditions. and the reward was an economy that depressed even more. it is rather unfair to continue to make the false accusation that greeks did not impose austerity-they absolutely did. they followed the advice of the troika-perhaps not to the letter, but to deny they implemented austerity is disregarding reality-and they paid an enormous economic price. why should they continue to take advice from the people who made the situation worse?

the germans are embracing the concept of a debtors prison, with the goal to beat the bad behavior out of the greeks. what about the bad behavior of the german banks making the loans in the first place? they received a reward-a european bailout. those banks were the enabler, the drug dealer if you will. why are they not considered for punishment as well? the asymmetry of the vindictiveness is baffling. german banks were actually bailed out, while the greeks simply has ownership of their debt changed.

“And you would send the wrong signal to Spain, Italy and Portugal, i.e. only idiots implement reforms.”

you could say the same thing about german banks.

Just a few observations.

Today (Friday), Reuters has been reporting that

“Confidential documents drawn up by Greece’s creditors and seen by Reuters showed that the country’s debt would remain sustainable, even under a worst-case scenario envisaged by the IMF, if the maturities on euro zone loans were extended and interest rates were cut, without the need for a write-down. The calculations are regarded as crucial to persuade German lawmakers to agree to the aid disbursement.”

This might help to understand why some of the creditors are acting the way that they are.

Reuters is also reporting that creditors appear to be ready to “restate a Nov. 2012 pledge by euro zone finance ministers to help make Greek public debt sustainable by extending loan maturities and a moratorium on interest payments and lowering interest rates.”

Finally, Reuters has also been reporting that the ECB has, for three days in a row now, refused to increase its level of emergency liquidity support to Greek banks in the face of continuing deposit outflows. Passionate objections from the Bundesbank to increasing the level of assistance seem to be part of the decision.

I think another important dimension of the decision facing creditors is that Greece is not the only (and far from the most important) creditor they deal with. They understand that the much larger debtor economies of Italy and Spain are closely watching the Greek case. Many argue that this gives the creditors an incentive to be unrealistically harsh with Greece to the extent that this provides useful “incentives” for Italy and Spain. (Note that I’m arguing about the beliefs of the creditors: whether such beliefs are correct is another issue.)

Some observers argue that there are precedents for creditors treating smaller countries seeking debt relief first and harshly; they point to the experiences of Bolivia in the 1980s and the recent experience of Cyprus (which was the first eurozone member forced to impose capital controls and confiscate some private sector deposits as a condition for a bailout. The latter does not appear to be on the table for Greece.)

Daily Mail: Shock vote on terms of bailout pushes Greek banks to the brink of meltdown as long queues form at country’s cashpoints

http://www.dailymail.co.uk/news/article-3141480/Hundreds-queue-outside-banks-fears-Grexit-grow-ahead-MPs-vote-bailout-referendum.html

The Greeks will vote for an exit on Saturday.

As readers will recall, five months ago, when Tsipras was elected, I commented that I thought that the government was serious about its intentions and that this was leading to a path to a Grexit. I asked several times for an Econbrowser post on the topic, which we saw only last week, when the exit was actually on the table.

I have spent a good bit of time over the weekend thinking about Saturday’s referendum. If I were a Greek, I would vote for exit, not because I wanted to exit, but rather because the situation seems so hopeless, and to be honest, the Troika seems so callous. A ‘yes’ vote to accept creditors’ terms solves nothing; it merely sets up this same vote at year end.

Therefore, I would vote to exit simply because I would see no other path before me. That’s what I think will happen.

The IMF, EU and in particular, Germany, have five days to contemplate alternatives..

steven, hind sight is 20-20, but i thought quite some time ago a grexit or default was the best path forward. greece had an opportunity to use its exit to improve its position with creditors several years ago. if you bluff, you need to make a move early, not late in the game. over time, greece’s hand got weaker and the creditors stronger. i fault the previous greek government for the weak hand now held. we have known for years greece could not exit this situation without significant compromises from its creditors. once this has been acknowledged, any delay only weakens your hand and allows the opposition to hedge its risks. that time was three plus years ago. greece is going to take the same beating for leaving the euro as it would have three plus years ago. but on top of that, it has also taken an additional three years of economic warfare from germany and the rest of the euro. very unfortunate for the greek people.

on a similar note, news coming out of puerto rico is slightly different. while they have suffered austerity, not nearly what the greeks have suffered. their leadership realizes they are in a hole too deep to escape. now they will take action, rather than wait an additional three years of pain before doing the same thing. now the interesting question: will the us government allow puerto rico to take action, or will they try and enforce austerity packages in a similar manner as europe on greece?

We have a pretty good idea what a Grexit might look like. Argentina is a reasonable template. Here’s the Wikipedia narrative:

“The [Argentine] economy shrank by 28 percent from 1998 to 2002. In terms of income, over 50 percent of Argentines were poor and 25 percent, indigent; seven out of ten Argentine children were poor at the depth of the crisis in 2002.

“By the first half of 2003, however, GDP growth had returned, surprising economists and the business media, and the economy grew by an average of 9% for five years.

“Argentina’s GDP exceeded pre-crisis levels by 2005, and Argentine debt restructuring that year were resumed payments on most of its defaulted bonds; a second debt restructuring in 2010 brought the percentage of bonds out of default to 93%, though holdout lawsuits led by vulture funds remained ongoing. Bondholders who participated in the restructuring have been paid punctually and have seen the value of their bonds rise. Argentina repaid its IMF loans in full in 2006, but as of 2014, the bond default had not been completely resolved.”

So, we would expect a sharp, but short, recession in Greece with a strong rebound subsequently, with growth rates approaching 10% for at least a few years. And all that’s fine.

But look at what comes next in Argentina–another [oil] shock in 2011 (also the story in Greece). The government decides to absorb increased oil costs onto the national budget, financing it with printed money, leading to high inflation, exchange rate controls, black market exchange rates, high interest rates, lack of foreign investment, etc. And we’re back in the traditional Argentine hyper-inflation cycle.

There was zero improvement in governance.

The prize in Greece, as I have said before, is first and foremost good governance, not economic growth or debt repayment. Thus, the window is open now to improve governance and bring Greece closer (indeed, ahead of) northern European standards. The struggle is bind Greece to Europe. That is the heart of the matter.

steven, as we have discussed before, even if you could get the greeks to commit, the troika and other european interests will never buy into your idea. this situation will go down in history as a major economic war fought between greece and a few other european countries. rather unfortunate-but i think this is the future of europe, and it is not very good. hope cooler heads prevail.