While eyes are on developments in Greece (and rightly so), I thought it would be useful to spend a moment on the uncertainty regarding the Chinese economy’s course (not that I’m the first to point out).

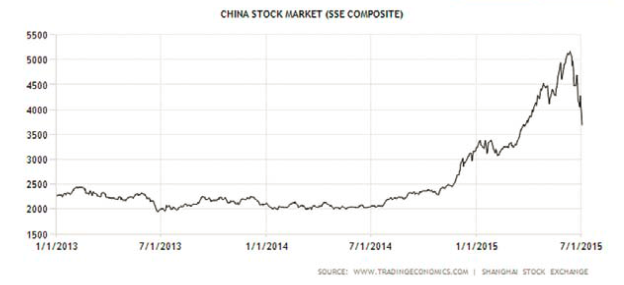

The wild gyrations in the Chinese stock market are displayed in Figure 1; the stock market has doubled over the past year.

Figure 1: Shanghai Stock Exchange. Source: Tradingeconomics.com

The plunge has spurred a flurry of large interventions by the government, with the government coordinating a fund to buy blue chip stocks, a halt to IPOs, and the move for the PBOC and one arm of the country’s sovereign wealth fund to backstop the stock market by lending to brokerage firms (see Bradsher, Buckley/NYT). This activity follows a series of measures implemented over the past few months.

Source: World Bank, China Economic Outlook June 2015 (July 3 update).

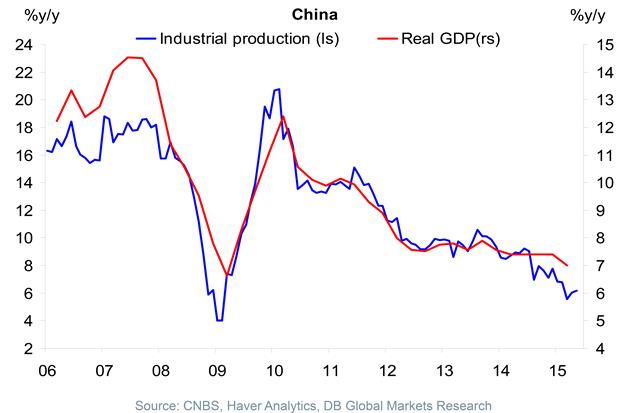

The anxiety over the stock market is heightened by the fact that output growth, measured in various ways, is decelerating. A shock to household wealth will surely put a damper on consumption; and a hit to confidence in the government’s economic management cannot help either.

Figure 2: Output measures for China. Source: Torsten Slok/Deutsche Bank (July 2015) [not online].

Some additional current statistics are reported in the World Bank, China Economic Outlook June 2015 (July 3 update). (The current version omits a section on longer term issues regarding the financial system; see here).

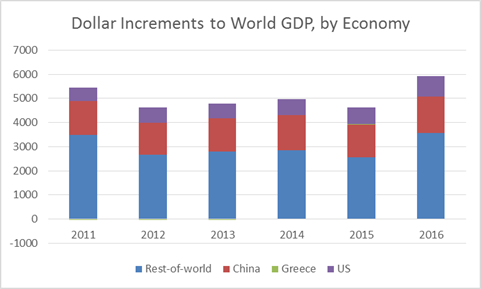

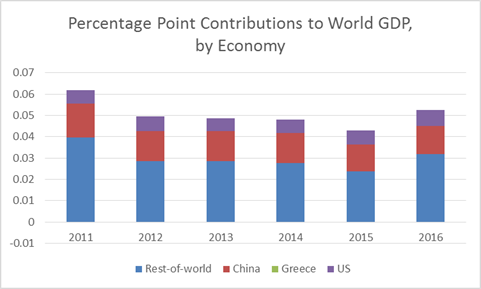

Finally, some context. Figure 3 presents the dollar increments to world GDP (in PPP terms, i.e., billions of current international dollars) for 2011-2016. Figure 4 presents the same, except expressed in contributions to world GDP growth.

Figure 3: Dollar contributions to world GDP increase, in billions of current international dollars, from US (purple), China (red), Greece (green) and Rest-of-world (US). 2015 and 2016 observations are IMF estimates from May. Source: IMF, World Economic Outlook May 2015 database, and author’s calculations.

Figure 4: Percentage point contributions to world GDP growth in PPP terms, in decimal form, from US (purple), China (red), Greece (green) and Rest-of-world (blue). 2015 and 2016 observations are IMF estimates from May. Source: IMF, World Economic Outlook May 2015 database, and author’s calculations.

Greece does not show up in either graph; of course, that doesn’t foreclose the possibility that the outcome of the Greek crisis will have outsized financial repercussions.

Latest reports on the Chinese markets as of 9pm Pacific, [1]

Dr. Chinn:

Great blog – I am glad I happened upon it.

The Chinese economy is complete driven by debt and the expectation that future growth will at least equal current investment. The government has the ability to keep this Ponzi scheme moving along a little further down the road, but at some point, it has to collapse. The current effort to stop the stock market crash will only make the collapse a little less dramatic, but in the end, there is nothing but air supporting their market. As the bicycle analogy goes, once the Chinese economy slows enough, it will simply fall.

Thanks,

James Thorall

http://www.jamesthorall.com

I think it’s silly to put Greece in figure 3 and 4.

But you are right, of course, about the possible outsized financial repercussions due to the Greek tragedy.

Interesting times ahead, a great investment opportunity.

And : Good bye Mr. Varoufakis, good bye Greece.

I think the point of showing Greece in the charts is to amplify how insignificant that nation’s troubles are in “the big picture” when compared to the almost invisible story of China’s slow-motion wreck. Lighten up.

Yes, I agree with this view. Greece, however emotional, is more of a sideshow. China is much more important in the big picture, and I dare say, we don’t understand it well.

I’ll be presenting on China and Global Oil Markets in Beijing in late October. I am happy to drop by elsewhere in the neighborhood to present on oil and the economy.

The Chinese market has had a strong runup and now a correction but is still well above its yearly lows. On the other hand the US DOW has been virtually flat and recently dropped to its lowest point since February. I am hearing a lot of chest beating about China but not much about the sluggish US. Judging by the 2015 stock markets alone China is stronger than the US.

So the Chinese government is trying to reflate a bubble after it is past the “blow-off” top. That is an interesting experiment – good thing they have a lot of money.

On fig 3 and fig 4 colors on graphs have labels that do not match your descriptions

Also, 2015 growth is lowest for years shown. Will this be enough to feel like a recession ?

John: sorry about that; have corrected.

It certainly will feel like a recession in some places– like China I suspect. Maybe commodity exporters with exposure to China as well.

Menzie : thanks.

timm0 : you say : ” …I think the point of showing Greece in the charts is to amplify how insignificant that nation’s troubles are in “the big picture …”. No, I do not agree that the Greek tragedy is insignificant compared to the China bubble, there is a real chance it could develop into a Lehman brothers 2.0. I am worried.

Peace.

In Prof. Chinn’s graphs during 2013-14 with real GDP growing at around 8% the “stock market” was flat; very few new illiterate investors. why was that? Then steady decline in real GDP (and every other economic indicator) and suddenly the new investor chart goes vertical and the “stock market” soars. Why was that? I certainly have my views; I would like to hear Prof. Chinn’s.

Dan Berg: With a repressed financial system (where deposits earn less than the rate of inflation), there are few options for saving that yields positive real returns. One is housing; but the authorities have engineered a retrenchment in that market, so that capital gains in that sector are unlikely. Then equities are one of the few alternatives. I think a positive feedback loop pushed up asset prices, until prices started reversing. Then the feedback loop magnifies the decline. See NYT.