At the last ASSA meetings in San Francisco, I participated in a Society for the Study of Emerging Markets panel entitled “Can the Chinese Renminbi Rule?: If So, How and When?”

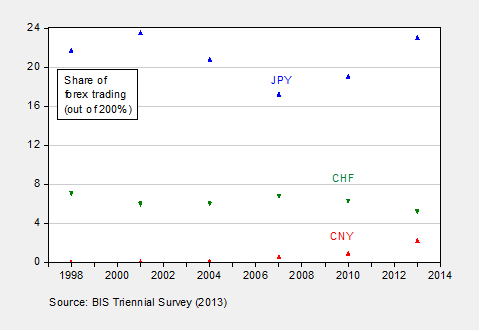

Figure 1: Share of currency in foreign exchange trading (out of 200%), in April. Source: BIS triennial survey.

Here’s the program.

Panel Moderator: ALI KUTAN (Southern Illinois University Edwardsville)

MENZIE D. CHINN (University of Wisconsin–Madison)

ESWAR S. PRASAD (Cornell University)

ROBERT MCCAULEY (Bank for International Settlements)

WING THYE WOO (University of California–Davis)

I began the discussion with a review of what is necessary for a currency to become an international currency, based upon my assessment of BRIC currencies as reserve currencies, and my analysis with Hiro Ito of invoicing currencies. In both cases I stressed the role of network effects and hence inertia, combined with the importance of financial development. I did argue that more East Asian currencies are anchoring to the CNY over time.

In his presentation, Eswar Prasad highlighted the progress that has been made in RMB usage in international markets, use as a reserve currency, but the doubts that the RMB could become a safe-haven currency, like the dollar. Some of these points are made in his June 2015 FT piece:

The renminbi is on a seemingly inexorable march towards becoming a global currency. It is already widely used in international trade and finance transactions. Now China wants the International Monetary Fund to label the renminbi an official reserve currency by including it in the exclusive group that make up its unit of account, the Special Drawing Rights. That group comprises the dollar, the euro, the yen and sterling.

There are good reasons to welcome the renminbi’s rise. Its trajectory is closely correlated with banking and other reforms that will make China’s economy more market friendly. These are necessary to establish a more balanced and less-risky growth path, one that is less dependent on investment, generates more employment and reduces environmental degradation.

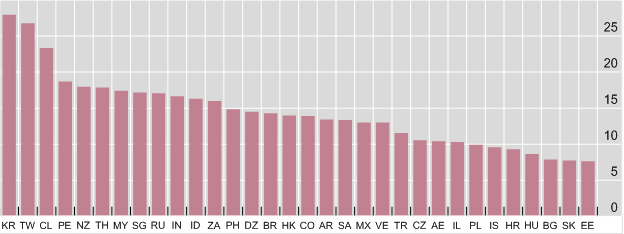

Bob McCauley argues that country-specific attributes are not the key to determining whether a currency becomes an international one; rather global factors are. So the dollar’s importance as an international currency is driven by the size of the dollar zone, the set of currencies being managed to the dollar. And the RMB zone is increasing in size as well, at least as measured by trade links (presumably basket weights will increase roughly in line).

Figure 2: RMB has substantial weight in trade-weighted baskets of emerging markets. Source: McCauley (2016).

His entire presentation is here.

Finally, Wing Thye Woo argues that time is of the essence. In his presentation [slides to come], he repeats these points:

In the first scenario, China becomes caught in a middle-income trap, with per capita GDP stuck at 30% of America’s – an outcome that has characterized Latin America’s five largest economies since at least 1960, and Malaysia since 1994. This would put China’s economic strength relative to the US at 1.1 – well below the necessary ratio.

In the second, more favorable scenario, China’s per capita GDP would reach 80% of America’s – higher than the 70% average rate for the five largest Western European countries since 1960 – and its economic strength relative to the US would amount to roughly 2.8. This would make the renminbi eligible for IVC status and enable Shanghai to choose whether to become a 1-IFC. But China’s economy still would not be strong enough relative to the US for natural market forces to ensure the renminbi’s international success.

Given this, the Chinese government would have to implement decisive measures to encourage international traders and creditors to price their transactions in renminbi. Specifically, China would have to use its market power to promote pricing in renminbi for relevant manufactured exports and raw-material imports, and encourage renminbi denomination of foreign financial assets that China purchases (which the country’s status as a net creditor should facilitate).

I think the real concerns about China are those expressed in the linked CNBC article (not mine, this time):

http://www.cnbc.com/2016/01/21/what-is-chinas-real-trouble-communicating.html

To me, this poses a series of questions:

– What level does the PBoC think is ‘right’ for the RMB? Why?

– What sorts of indicators does PBoC intend to track to confirm or refute its thesis?

– Does China still want to be a free market economy? If so, how does that gibe with the suppression of the flash PMI’s? Does the Chinese government believe this has added to stability, or caused greater instability? How does the government expect investors to react to this kind of step?

– What is the commitment of the government to greater transparency (for investors)? How will this be manifest specifically? What indicator, and when?

– Does the Chinese government appreciate that investors will tolerate fuzzy numbers when time are good, but may be unwilling to accept those same numbers when times are bad?

– Does the Chinese government believe that it is facing a global crisis of confidence in both the PBoC’s and the Xi government’s leadership competence?

– Clearly, recent events now show that China is a large economy, and arguably decisive for any number of markets. For example, PBoC devaluations were able to whip the DOW by 1,000 points, and oil prices by $10 / barrel, over the course of little more than a week. How does the PBoC feel about that? What kind of challenges does that represent? What kind of competencies must the PBoC develop to better cope? Or is the PBoC and Chinese leadership willing to see global markets whipsawed up and down chaotically?

Steven, forgive me, but you might be missing some elements of the reality of US-China (and US-intra-Asian) “trade”, including the disproportionate effect on China’s investment, production, and “exports” from US FDI China-Asia over 20-25 years from offshoring, “exports” of capital goods, tech transfer, trade credits, etc., to US subsidiaries in China-Asia, and intra-Asian, cross-border shipments (referred to as “exports”). The nature of China’s foreign exchange reserves are generally misunderstood, i.e, they are primarily held by the PBoC against foreign supranational firms’ holdings of non-convertible Yuan within China).

With US and Japanese FDI contracting in 2014-15, and with the FDI multiplier to China’s investment, production, and “exports” being so large, China’s industrial production and “exports” (55% of GDP) have predictably crashed and won’t be returning to significant growth hereafter with growth of global trade no longer growing.

Devaluing the Yuan is not going to assist China’s “exports” because “exports” are primarily from US and Japanese firms’ production in China (China-Asia).

Also, China’s money supply to GDP is nearing 200% and growing at a reported banana republic-like 13%/year, implying collapsing acceleration of velocity.

And with 55% of China’s economy contracting (but not indicated by falsified data reported by the CCP), China has to grow money supply by at least 10% to prevent nominal GDP from decelerating to 0%.

After contracting production and “exports”, China’s economy is growing no faster than 4% nominal (3.5% per capita), including gov’t spending contributing 4%, consumer spending at 3.6%, and production and exports subtracting 3.4%. (China’s treatment of exports, import prices, and depreciation is just made up in most cases.)

However, were gov’t spending to normalize to nominal GDP, China’s nominal GDP would decelerate from 4% to 2.6%. Were consumer spending to normalize along with gov’t spending to the implied trend of nominal GDP with no growth of production and exports, China’s nominal GDP would decelerate to ~2% and 1.5% per capita. (Who knows what the deflator should be to arrive at a real GDP figure.)

Moreover, China’s reported gov’t spending accelerated from ~10%/year to nearly 30% recently. That is the equivalent of the US increasing federal gov’t spending by $1.1 trillion/year or a deficit/GDP of something like 8%. But the bulk of China’s gov’t spending continues to flow to further build out of excess, unprofitable capacity (Potemkin Village-like effort), which is resulting in unprecedented debt to GDP and increasing signs of extreme risk of a debt-deflationary implosion at some point.

With money supply at 13-14%, wages at 10%, and gov’t spending at 25-30%, productivity and profits are in full collapse. With productivity declining and the labor force contracting for a third consecutive year, China’s potential real GDP per capita is 0% or negative, which is the case for Japan, the US, and the EZ since 2007-08.

So, arguably, China is collapsing and the CCP officials are keenly aware of what is happening, which is why they are reducing transparency; implementing capital controls; intervening in the equity market; arresting people who publicly counter the CCP officials’ narrative and challenge their credibility; redoubling their efforts to falsify data; directing lending for massive overinvestment; beginning to harass foreigners and foreign firms; and asserting their military activities within the Pacific.

China is looking like imperial Japan in the 1930s, which is not an unexpected development in the context of the Long Wave progression and the hegemonic cycle.

Speaking of the Long Wave progression, China has been in a similar situation four previous times (White Lotus Rebellion, Opium Wars, Boxer Rebellion, and Mao) historically going back to the late 18th century when China opened up to the West only to experience financial, economic, social, and political crises, becoming nationalistic/xenophobic, cracking down on domestic social unrest, and turning inward from the rest of the world.

Therefore, I expect increasing risk of financial and economic decline/collapse, social destablization and increasing unrest, further deterioration of US-China trade and diplomatic relations, and eventually the new generation of PLA generals in Beijing asserting increasing authority and violent reaction during the period of domestic crises.

So, the foregoing is a short list of the critical factors one should examine to understand China’s rise, current challenges, and implied outcomes hereafter.

FWIW.

Look, if you’re diagnosing a malady, then you treat the simple problem first and see where you are.

If a patient comes in with a headache, you give him an aspirin first and see if it goes away. You don’t start with brain surgery. If the aspirin doesn’t help, you move on in the treatment.

Now, as I have written several times before, the PBoC failed to devalue the yuan in line with the yen and won when oil prices crashed. So the very first thing you do, before turning to long waves and global apocalypses, is devalue the yuan to bring it back into line with the yen and won pre-oil price crash. The fx rate for that is 7.0 CNY/USD. Period. This is not deep or complex.

You try that fist, and see if it helps. If it doesn’t, then we can move on to more draconian interventions. But Step One–let me repeat, Step One–is to restore the relative exchange rate of the yuan to regional currencies as it existed in H1 2014.

Will China’s government survive a depression?

There are a billion rural poor and 200 million exploited factory workers.

What will they do if there’s a depression?

Will rich communist leaders fight or flee a massive rebellion?

http://cleantechnica.com/2016/01/19/china-electricity-demand-slows-coal-consumption-drops-hits-australia-hard/

http://www.enerdata.net/enerdatauk/press-and-publication/energy-news-001/chinas-power-generation-fell-2015-first-time-1968_35800.html

http://www.cnbc.com/2016/01/17/reuters-america-chinas-2015-power-consumption-up-05-pct-year-on-year.html

http://www.cnbc.com/2016/01/19/what-is-chinas-actual-gdp-experts-weigh-in.html