As noted in this post, both Senator Sanders and Mr. Trump share a belief that China should be declared a currency manipulator, so that heavy tariffs can be imposed (Secretary Clinton’s position here). Not that it matters to either individuals’ beliefs, but — based on ongoing research I am conducting with Yin-Wong Cheung (CUHK) and Xin Nong (UW) — the evidence that China is currently manipulating its currency to keep it undervalued is not particularly persuasive.

As I’ve discussed in several previous posts [1] [2] [3], there are various means of assessing currency misalignment, corresponding to different theoretical concepts.

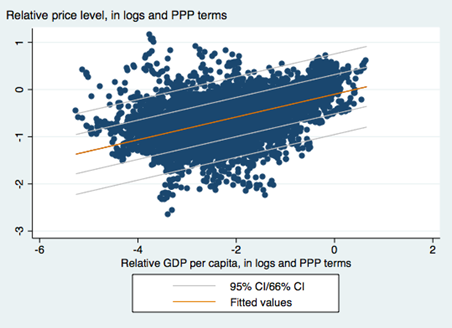

One key approach — central to earlier assertions of massive undervaluation — is to use the Penn effect. The Penn effect is the observation that price levels are higher in higher income countries than in lower income countries. This phenomenon is shown in Figure 1 (regression line and 1 and 2 standard error bands).

Figure 1: Scatterplot of price level against per capita income in PPP terms for full sample, 1970-2011, from Penn World Tables 8.1. OLS regression line (orange), +/- 1,2 standard error bands. Source: Cheung, Chinn, and Nong.

The elasticity of price level with respect to per capita income in PPP terms is 0.242.

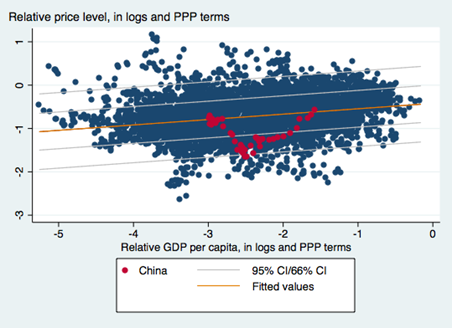

One can use the relationship for non-advanced economies to infer the equilibrium price level for China. This is shown in Figure 2, along with the path China has followed (in red). The last observation in 2011.

Figure 2: Scatterplot of price level against per capita income in PPP terms for non-advanced country sample, 1970-2011, from Penn World Tables 8.1. OLS regression line (orange), +/- 1,2 standard error bands. China observations in red. Source: Cheung, Chinn, and Nong.

The estimated regression equation is:

pi,t = -0.421 + 0.124yi,t + ui,t

bold figures denote statistically significant coefficients at 5% MSL. Adj.-R2 = 0.062, NObs = 4934, Sample 1970-2011.

Where p is the log price level relative to the US, and y is the per capita income relative to the US level, in logs.

As one can see, the estimated degree of misalignment is 2.81% in 2011.

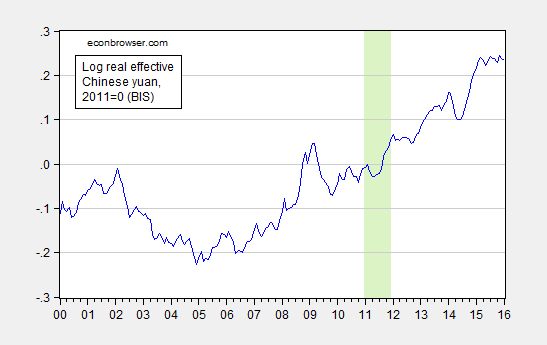

Obviously, it’s not undervalued in 2011. (There is some degree of imprecision in these estimates; however, using the World Bank’s World Development Indicators data set, and a similar specification, yields estimates of substantial overvaluation, so my guess is undervaluation in 2011 is a tough case to make.) Moreover, in the succeeding years, the yuan has appreciated on a real, trade weighted basis, nearly 25% (in log terms).

Figure 3: Log real trade weighted Chinese yuan, broad index, 2011=0. Green shading pertains to 2011. Source: Bank for International Settlements, author’s calculations.

The above series is CPI deflated. The degree of appreciation would be decreased if using a PPI to deflate.

Nonetheless, given these data (combined with the fact that Chinese fx reserves have been trending downward), it is not clear that Mr. Trump’s assertion is plausible:

Economists estimate the Chinese yuan is undervalued by anywhere from 15% to 40%. This grossly undervalued yuan gives Chinese exporters a huge advantage while imposing the equivalent of a heavy tariff on U.S. exports to China. Such currency manipulation, in concert with China’s other unfair practices, has resulted in chronic U.S. trade deficits, a severe weakening of the U.S. manufacturing base and the loss of tens of millions of American jobs.

Hence, the promise to “On day one of the Trump administration the U.S. Treasury Department will designate China as a currency manipulator”, thence validating imposition of tariffs on China, would require ignoring data (and installing instantaneously a very pliant SecTreas, I’d guess getting confirmation of the new SecTreas before being sworn in himself). (For detailed discussion of the challenges even if there were a lot of measured CNY undervaluation, see this CRS report).

Trump comment was arguably right….in 2005. so he is fighting the last war.

i’dd add that on a swan diagram basis, china has gone from high inflation/ high current account to low inflation/reasonable current account (arguably lower thant it really is due to fake invoicing).

furthermore, exchange market pressures are clearly down (fx rates + reserves decline) as everyone knows.

so the case for an undervalued yuan is a joke

Trump is a manipulator himself, a hothead and a dangerous man for our country.

But he is even then a better choice than Hillary, this disgusting lying snake.

I heard an interview with a British oddsmaker yesterday. He gave Hillary a 60% chance of becoming president, The Donald, 20%, and everyone else, less than 20%.

Seems like a reasonable estimate to me at this point, barring possible surprises, such as the email investigation resulting in indictments.

It seems, over the past 10 years, Chinese investment, and demand for dollars, in the U.S. accelerated, while American investment, and demand for yuans, in China has slowed.

Sanders and Trump should be blaming U.S. regulations and taxes, not an undervalued yuan.

Just out of curiosity, why did you use Stata for the first two graphs and Eviews for the third?

A nonymous: The panel data from PWT used in the regression analysis is in Stata. The monthly BIS data (not used in the analysis) is in an EViews file, so instead of importing the EViews data into Stata, I just plotted directly.

R2 = 0.06? Not too much to talk about. It’s not that I disagree with the thesis, but take away the lines on those graphs, and the trend is far from obvious.

Steve Kopits: Inclusion of additional covariates (capital account openness, corruption, oil exporter dummy) leads to an adjusted R2 for the same sample of 0.14. I don’t think in many pooled cross section time series regressions you’ll get much higher (note no time or country fixed effects in this regression).

Well, we try lots of methods to approximate relationships and trends. This is one, maybe not the worst one. But it’s still very noisy. If one were going to really work with that data set, I suspect one would want to pare it down to get more apples-to-apples numbers. In any event, I’ll grant the underlying thesis, that prices tend to be higher in wealthy countries, certainly for non-tradables and goods driven by local labor, eg, local fruits and vegetables.

I would note, however, that prices of tradable goods (adjusted for VAT and sales tax) are often lower in advanced countries. People have visited New York and Miami (from the south) for many years to buy electronics and clothing cheaper.

China is no longer labor’s “cheap kid on the block”. Other western Pacific and east/south Asian nations hold that title. The U.S. has narrowed the labor cost gap with productivity improvements (read that as adding robotics and other technologies to cut manpower requirements). There are whole automotive assembly lines with robotic “workers” while a few employees monitor the work. Now this doesn’t mean all industries in the U.S. are competitive, cost-wise, with China or other far East nations, but labor is becoming less of an issue.

Currency “manipulation” is probably overstated, too.

What hasn’t been addressed is home turf protectionism which occurs many ways from the overt in Korea and Japan to the covert in China and Taiwan. The covert aspect is the piracy that allows local manufacturers to copycat foreign products and thereby avoid massive development costs. U.S. manufacturers have lost trillions of dollars to this piracy and been shut out of protectionist countries preventing them from potentially selling billions of dollars worth of goods.

Perhaps these two aspects of protectionism should be the focus of Trump’s and Sanders’ ire.

Clearly, Trump is not current on Chinese developments. The talking heads are mostly calling for devaluation of 7-15%.

The issue is rather that Xi is not going to stop. We now have a track record to contemplate (and I have a very nice article on the matter if CNBC takes it). Xi’s natural impulse is aggression and exercise of power. And that’s going to continue, both internally and externally. The question, therefore, is when do matters escalate the to level that Trump or another candidate calls for sanctions? It’s pretty soon, I think, the summer if I were to guess. At that point, the issue is not currency manipulation, but rather explicit reaction to some incremental provocation, probably in the South China Sea. The call for sanctions would likely be almost as damaging as the sanctions themselves, for it would call into question China’s viability in the western supply chain. Will Apple still be able to assemble iPhones using Foxconn’s half million Chinese employees?

And of course, there’s the internal dimension. The government is seeing increasing push-back on its new censorship initiatives.

So, I agree with the Trump-is-clueless thesis, but there are serious emerging issues, and I think we need to start paying more attention to those.

http://blogs.wsj.com/chinarealtime/2016/03/15/chinas-censors-battle-mounting-defiance/

By the way, the WSJ’s China coverage is outstanding. Well-written and edited, insightful, courageous. Almost worth subscribing just for that.

Bruce Hall: “U.S. manufacturers have lost trillions of dollars to this piracy and been shut out of protectionist countries preventing them from potentially selling billions of dollars worth of goods.”

When you talk about piracy, you should be careful to distinguish between counterfeits and just cheaper copies. Counterfeits are products that use counterfeit company logos to pretend to be something they are not. Counterfeits are a way to cheat consumers. On the other hand, producing a product at a cheaper price that is similar to a branded product is a benefit to consumers. For example, Apple suing to prevent Samsung from making a cheaper phone with rounded corners is a loss to consumers and an economic rent for Apple. Consumers would be better off if more companies made similar, cheaper copies. That is not piracy.

Patent and copyright laws are government enforced monopolies. Curiously, economists claim to be opposed to monopolies as market distortions but apparently are okay with government enforced monopolies such as patents and copyrights that are even more distortionary.

Counterfeits may be indistinguishable from originals, especially hard part that carry no branding. Automobile manufacturers lost billions in sheet metal sales alone to Taiwanese garage operations that used original body parts to make sand-cast molds for dies to produce counterfeits. That’s design piracy. The Chevy Chery was another example of outright copying. You can attempt to distinguish between counterfeiting and copying, but I say that is six of one and one-half dozen of the other.

Some automobile manufacturers will not take their latest technology to China because they accept that to do business there, state-sanctioned piracy of their products will occur. Put protections against that in any treaty so that violators lose their favored status if they do not comply.

The fact that China’s currency is no longer is massively manipulated to support exports and disadvantage imports as it was in 2005 doesn’t mean that a lot of damage hasn’t already been been done or that such damage can be reversed as easily as one can change an exchange rate. Supply chains have been reworked and are now well embedded in China. How much of a “penalty” tariff would have to be imposed to get multinational companies to bring their operations back to the U.S.? I would guess it would have to be substantial and be kept in place for a while (maybe a decade?)

Plus manipulating the exchange rate is not the only way in which China has managed international trade to its benefit . There are many non-currency manipulation like local content rules that still appear to be in place. I would bet that many readers of this blog would be surprised at how un-free trade with China has been over the past 20 years of “free trade.”

William Meyer: So you are arguing there are sunk costs in investing in production chains? This sounds like the hysteresis arguments of the mid-1980s. I’m willing to entertain those concepts intellectually, but then again, what’s all this talk about the nimbleness of foreign direct investment in terms of outsourcing? — that seems counter to your point about deep and strong integration. If plants can move once to get to lower cost locales, they can certainly do it again.

If you are arguing that China violates trade rules at certain times, you would have no argument from me. But my point was that an assertion of currency manipulation to undervalue the RMB at this point in time would likely have a difficult time being accepted by those who believe in data. That’s all.

Dear Professor Chin,

I appreciate your response. As I am lazy, I will refer you to Justin Fox’s piece for Bloomberg, “About That U.S. Manufacturing Renaissance …”

I would suggest you read the whole thing at http://www.bloombergview.com/articles/2016-03-17/about-that-u-s-manufacturing-renaissance

Just to quote a part particularly apt to a discussion of sticky supply chains:

”

No renaissance here. Photographer: Daniel Acker/Bloomberg

Facebook

Twitter

LinkedIn

Google+

Email

U.S. Economy

About That U.S. Manufacturing Renaissance …

16 Mar 17, 2016 6:10 PM EDT

By Justin Fox

After a brutal period of downsizing and reorganizing, the U.S. manufacturing sector has become the most competitive in the world. Output per worker is higher than in any other major manufacturing country. Labor costs per unit of output are lower than in Brazil, Canada and Germany, and only slightly higher than in China. What’s more, writes Gregory Daco of Oxford Economics in the new report from which the above facts are taken, “the U.S. is ‘gifted’ with a stable regulatory framework, a flexible labor market, low energy costs and access to a large domestic market.”

So that’s great! Time for a manufacturing renaissance, right? Well, maybe, eventually. But — and Daco notes this in his report — there are few signs of it actually happening yet.

Yes, there are the almost 900,000 manufacturing jobs added in the U.S. since early 2010. But it’s important to see that for what it is — a modest rebound after a spectacular collapse:

189086-20160317195537000000000

There has also been a big decline in the trade deficit, from 5.6 percent of gross domestic product in 2006 to 3 percent in 2015. But that turns out to be a product of (1) an increase in the trade surplus in services and (2) the huge boom in domestic oil-production and accompanying fall in global oil prices. Strip out petroleum and petroleum products, in fact, and the trade deficit in goods is only down a little from its peak, and has grown markedly over the past two years.

189134-20160317155036000000000

This seems like a good spot to mention that running a trade deficit isn’t necessarily a bad thing. The growth in the deficit in 2014 and 2015 is due in part to the strength of the U.S. economy — faster growth than in other major economies and a strengthening dollar have led to more imports and fewer exports.

Still, you’d think that if there were a big return to manufacturing in the U.S. afoot — “reshoring” is the term of art — it would be making itself more apparent in the data. Consider, for example, trade in capital goods. While, the U.S. has been importing more cars and consumer goods than it exports for many decades, capital goods — airplanes, medical equipment, semiconductors and so on — have long been an area of comparative strength. Not so much anymore:

189216-20160317173038000000000

Again, one can find temporary factors increasing this deficit. The U.S. is usually a big net exporter of oil-drilling, mining and construction machinery, and recently demand for such equipment has plummeted (sorry, Caterpillar!). That demand will return someday, presumably.

There really aren’t many tangible signs, though, of a larger shift in manufacturing activity back to the U.S. The Boston Consulting Group, which has done as much as any organization to popularize the idea of reshoring manufacturing after years of offshoring to China and elsewhere, reported in December that a growing number of executives surveyed say they are moving production back to the U.S. from China or at least thinking about it. But rival consulting firm A.T. Kearney put out its own report in December asserting that “the reshoring phenomenon appears to have been more a one-off aberration than an inexorable trend.” Here’s the trajectory of A.T. Kearney’s reshoring index, which measures net reshoring or offshoring based on actual import and production data :

189274-20160317164334000000000

“Why isn’t reshoring taking off? Daco, of Oxford Economics, stressed that such shifts don’t happen overnight. “It takes quite a bit of time for a company to modify its supply chain,” he said in a phone conversation…”

“[I]n capital-goods manufacturing, labor costs matter less than technology and the existence of a local ecosystem of suppliers, consultants and skilled workers that can take a while to put together. In their rush to offshore, then, U.S. manufacturers may have permanently destroyed their ability to make certain products here. As Gary P. Pisano and Willy C. Shih wrote in a 2009 Harvard Business Review article:

In making their decisions to outsource, executives were heeding the advice du jour of business gurus and Wall Street: Focus on your core competencies, off-load your low-value-added activities, and redeploy the savings to innovation, the true source of your competitive advantage. But in reality, the outsourcing has not stopped with low-value tasks like simple assembly or circuit-board stuffing. Sophisticated engineering and manufacturing capabilities that underpin innovation in a wide range of products have been rapidly leaving too. As a result, the U.S. has lost or is in the process of losing the knowledge, skilled people, and supplier infrastructure needed to manufacture many of the cutting-edge products it invented.”

What’s kind of funny is that I recall reading a book about the semiconductor industry making this same point–that standard “free trade” theories don’t account for network effects and other forms of entanglement that often make “temporary” changes quite difficult or impossible to reverse. That book even went so far as to suggest that “strategic” policies targeting particular industries would make a lot of sense for the U.S.’s long term economic health. Of course, when it was published in the early 2000s, it was, ahem, roundly ignored.

William Meyer: Since I teach international economics, none of what you quote is particularly surprising. The relevant question is whether protection increases or decreases national welfare, both in a static or dynamic sense. If it increases national welfare, then the second question is whether the distribution of gains and losses is such that everybody is made better off — i.e., whether the losers are compensated by the gainers. I think that greater trade does generally increase welfare, but that in general the losers have not been sufficiently compensate to make greater trade openness a Pareto improvement.

In regard to strategic trade policy, I think that can make sense if the payoff matrix is such that subsidies can re-allocated surplus to the home country, and/or if there are externalities from learning by doing, or informational spillovers. The case has yet to be made, however.

By the way, even my intro international economics textbook includes discussion of strategic trade policy (that’s Rob Feenstra – Alan Taylor). 20 years ago, when I taught international trade, my textbook (then Krugman-Obstfeld) discussed strategic trade policy. I highly recommend you read one of those textbooks if you want to be conversant in international trade policy.

BTW, I did not intend to quote so much of Mr. Fox’s piece, my bad.

I didn’t suggest you weren’t aware of this, only that it appears that there are reasons for supply chains to be considered “sticky.” Hence, my original point: if supply chains are sticky, then exchange rate manipulation, if carried on at sufficient volume for a sufficient time, as in the case of China, can do damage that will not be automatically reversed even if the manipulation ends. Hence, saying that China is not longer manipulating its currency for advantage in trade doesn’t, in my mind, exactly end the discussion.

I will attempt to educate myself further on trade policy, per your suggestion.

Again, thanks for your work in promoting discussion of these important matters. I have read it daily for many years.

Now this is actually an interesting question: How sticky is the Chinese supply chain?

China exports about $2.5 trillion of goods annually, representing perhaps 23% of GDP. If we include export-related multipliers, then exports may support something like 1/3 of China’s GDP. It’s a big number. That ‘made in China’ thing is real, and not only from an import perspective. ‘Made in China’ is also critically important to the Chinese economy.

Now, the Xi regime has actively begun to impede the free flow of exports, or at least the financial flows associated with them. This seems to explain the horrific collapse of Chinese exports–down 25% in dollar terms–in February.

How sensitive is the Chinese economy to these sorts of interventions? If the Chinese supply change is hard to substitute, then making business harder to do will have little effect in the near term. On the other hand, if customers can easily source inputs from producers outside China, then in fact the Chinese supply chain might prove quite sensitive. It seems to me that Chinese exports still rely heavily on cost advantages: China still makes a lot of cheap goods, goods which could also be made in Vietnam or India. Let’s say 3/4 of China’s exports could be made elsewhere without that much difficulty.

Further, the domestic content of Chinese exports is estimated at 60%. (http://unstats.un.org/unsd/trade/events/2014/mexico/documents/session3/China_s_Exports_and_its_Distribution_MWZ.pdf)

Thus, were Xi’s policies to reduce China’s exports by 10%, this would represent 3% of GDP gross and 1.8% (60% of 3%) net. China’s economy is actually pretty highly sensitive to obstruction of trade flows, based on this back of the laptop estimate. Were the growth rate in China low, this might not matter that much. But given that the government is targeting 6-7% GDP growth, exports still have to advance at a pretty good clip. Thus, the primary effect of obstructing exports will be in reducing the rate of growth, and possibly quite materially. It’s not that trade will leave, it’s that further investments in export industries will be curtailed. Put another way, businessmen will become concerned about i) their ability to move money in and out of the country, ii) their ability to move goods in and out of the country in timely fashion, iii) the availability of information (now that the foreign press is shut down on the mainland); iv) the safety of their personnel, with businessmen being arrested and people abducted, and v) the risk of war in the South China Sea, with the possible loss of investment, or certainly access to plant and personnel.

Put another way, Xi’s new policy of obstructing trade flows is really risky from a GDP point of view. I regard it as the ‘third rail’. Devaluation would have been a far, far better option.

Well…I read the Hillary Clinton op-ed and I’m not convinced that there’s all that much difference between what she said and what Bernie & Trump are saying with respect to Chinese currency manipulation. For example, what’s the practical difference between saying that China’s yuan is undervalued versus saying:

“A stronger dollar, slowing Chinese economy and global economic turbulence mean that workers in industries from steel to auto parts are facing headwinds. At the same time, China and other countries are using underhanded and unfair trade practices to tilt the playing field against American workers and businesses.

When they dump cheap products in our markets, subsidize state-owned enterprises, manipulate currencies and discriminate against American companies, our middle class pays the price. That has to stop.

“Underhanded and unfair trade practices”??? Contrasting her view with Sanders & Trump sounds like a distinction without a difference to the average voter in the Rust Belt.

There’s no doubt in my mind that Clinton has a much subtler and more sophisticated understanding of trade issues than Bernie Sanders ever will. Or Trump for that matter. But Clinton’s problem is that all of that sophisticated understanding didn’t stop her (and a lot of economists) from overstating the benefits of trade bills like NAFTA and TPP. Too often those kinds of bills were sold as jobs bills, and then when the jobs didn’t materialize and the benefits went to the well-heeled, you can’t exactly blame voters for believing that just knowing the issues better isn’t enough. And what are statements like this if not outright obfuscation:

“First, we have to strongly enforce trade rules to ensure American workers aren’t being cheated. Too often, the federal government has put the burden of initiating trade cases on workers and unions, and failed to take action until after the damage is done and workers have been laid off.

That’s backwards; the government should be enforcing the law from the beginning, and workers should be able to focus on doing their jobs. To make sure it gets done, we should establish and empower a new chief trade prosecutor reporting directly to the president, triple the number of trade enforcement officers and build new early-warning systems so we can intervene before trade violations cost American jobs.”

Huh? Now I’m all for strengthening trade unions; but strengthening American trade unions is not exactly consistent with promoting global trade. Or how about this statement from Clinton’s op-ed:

“…we have to stand up to Chinese abuses. Right now, Washington is considering Beijing’s request for “market economy” status. That sounds pretty obscure. But here’s the rub —if it gets market economy status, it would defang our anti-dumping laws and let cheap products flood into our markets.”

Again, how is this materially different from what Sanders and Trump are saying? If candidates want to speak truth to power then they need to tell voters that trade brings benefits that (usually) outweigh the costs; but there are real costs and it’s usually the weakest and most vulnerable that end up paying those costs. So every trade bill should include a tax hike on those who are likely to benefit the most, with the proceeds from that tax bill going to those who lose out because of trade. Until politicians start speaking the truth about trade, we’re going to continue to see anti-trade messages coming from the likes of Sanders and Trump.

Bruce Hall: “Automobile manufacturers lost billions in sheet metal sales alone to Taiwanese garage operations that used original body parts to make sand-cast molds for dies to produce counterfeits. That’s design piracy.”

No it isn’t. It’s the consumer friendly option of buying generics. I can go to the grocery and buy generic corn flakes and generic “cheerios” that are almost indistinguishable from the branded products. As long as the copies are not marketed as branded there is no problem. But if the copies are sold in branded boxes, then they are counterfeits and that is a crime. Making cheaper generic copies is not a crime.

The auto parts industry is actually one of the more healthy and competitive. You can’t be required to go to a dealer to get repairs done. You can go to an independent repair shop. At the repair shop you have the choice of buying OEM (original equipment manufacturer) parts or generic aftermarket parts. That is consumer choice. If a Chinese company can sell me a fender for $200 that the OEM charges $2000 for, that is a consumer win, as long as the consumer is informed. In the auto industry, the distinction between OEM and aftermarket parts is generally clear to the consumer. Counterfeits are relatively rare.

@Joseph,

So, you don’t believe that the producers of designs and products that we benefit from should be protected from those who steal their ideas? Then what is their incentive to pour money and time into research and development when they can just steal it? Only problem I see is that everyone would just wait around for someone else to do the work and then steal from them. Of course, they would all just be waiting around. I guess that would be good for consumers… in the very short run.

Have you ever had an idea at work? Have you ever put in time and effort to make that idea usable? Do you welcome someone else taking your intellectual effort as their own?

International trade, over the past few decades, made the U.S. economy much stronger, raised our living standards, and the country has reached full employment with large trade deficits (moreover, we’ve had over a hundred years of technology and automation that made jobs less dangerous and difficult). The U.S. economy gains and loses jobs even without international trade.

“In 2010, the latest full year available, employers made over 47 million hires, and there were over 46 million job separations. Of the latter, there were 21.3 million voluntary departures (quits), and 21.2 million separations. This happened in a labor force of 154 million.”

What would you tell someone who lost their job, their pension, and who saw the value of their home plummet ?

A lot of fancy mumbo jumbo about confidence intervals ?

Why don’t you do something useful: explain to said person who they should be angry at; the National Rev Online view seems to be that said person has themselves to blame for being lazy and shiftless; the Sanders view is, i think, that we have a rigged system that cares only for the rich (ie, no re training for displaced workers, but tax rules that benefit the rich); not sure what the Trump view is (if in fact he has a coherent view)

PS: it is clear that there no longer are a lot of high paying manufacturing jobs; the robots actually, after decades of trying, are working.

So what would you tell said person about the future for his children

If you don’t have a plan, I think anger that sweeps away all the PhDs (many of whom have shamefully abetted things eg the bush dividend tax cut) is fully justified

and heck, I’m a phd myself, tho in bio science

There will always be winners and losers in a dynamic economy. Otherwise, most of us would still be farmers.

The tens of millions of dirt poor immigrants, and their children, over the past few decades, are winners. They live better in the U.S. than they would’ve in their home countries.

They don’t seem to mind working harder for lower wages and displacing domestic workers. And, eventually, after 20 years at a job, while learning and improving skills at work, they could be making $30 an hour in compensation and don’t mind business owners paying $10,000 a year per worker in regulations, along with high health care costs.

A lot of domestic workers aren’t willing to work that hard for low wages, or start low and spend 20 years on a job learning some skills at work. However, much of the domestic population obtained a valuable education and skills to earn high incomes.

Joseph argues that Chinese/Taiwanese theft of designs and technology is equivalent to generic drugs or generic cereals. The U.S. patent office would beg to differ.

http://www.drugs.com/availability/

When cheap Taiwan sheet metal first showed up in the U.S., automobile manufacturers stated getting sued because vehicles with those parts started failing to provide the crash protection designed into the originals. Turns out that the copycats were made out of inferior steel and the “crumple zone” elements were missing because of the extra cost to produce. Sometimes, you get what you pay for.

Apple sued Samsung for design infringement. http://money.cnn.com/2015/09/17/technology/apple-samsung/ What’s wrong with Samsung letting Apple do their R&D for free? Then Samsung can sell to consumers more cheaply. Win-win, right?

And pray tell, Joseph, what entitles the consumer to benefit from theft?

A fine piece of analysis.

However, with all respect, there seems to be a working assumption in the original article that American Foreign policy is fact-based in a meaningful sense. Those of us who recall the second War Against Iraq, complete with yellow cake, aluminum tubes, weapons of mass destruction-we know where they are, …find this assumption in need of a defense. Besides, trade sanctions can always be identified as retaliation for the American reconnaissance plane that was close to a decade ago rammed by a Chinese fighter aircraft and forced to crashland in Hainan not to mention the Chinese fortified reefs.

I think that the focus on “China” misses the larger issue. I do think that the strong dollar policy + free trade double whammy has been bad. We keep importing the world’s unemployment. In the 1980s and 1990s when the Fed was trying to tame inflation, that was a good thing. Now, it is results in perniciously low inflation.

I do think there is as feeling that we are no longer getting a good deal with free trade, because other countries are exploiting us and we are not getting as much as we are yielding. You can call it protectionism, nationalism, xenophobia, or whatever you want. It is that guttural feeling in your lizard brain caused by a persistent trade deficit, by low inflation, and by importing the world’s malaise with a strong dollar.