Posted today: Economic Report of the President, 2017:

Table of contents:

- CHAPTER 1 EIGHT YEARS OF RECOVERY AND REINVESTMENT

- CHAPTER 2 THE YEAR IN REVIEW AND THE YEARS AHEAD

- CHAPTER 3 PROGRESS REDUCING INEQUALITY

- CHAPTER 4 REFORMING THE HEALTH CARE SYSTEM

- CHAPTER 5 INVESTING IN HIGHER EDUCATION

- CHAPTER 6 STRENGTHENING THE FINANCIAL SYSTEM

- CHAPTER 7 ADDRESSING CLIMATE CHANGE

The weak “recovery,” after the severe recession, was the result of pro-growth policies with too many anti-growth policies, which also made the “recovery” very expensive.

It looks like we’ll get a substantial reduction in anti-growth policies, e.g. overhauling Dodd-Frank, replacing Obamacare, more student debt forgiveness, reducing some Cabinet budgets, deregulating, less litigation, and business tax cuts.

I suspect, there will be substantial savings in some Cabinet budgets to limit government intervention, create efficiencies, and raise effectiveness, which will allow more infrastructure spending and rebuild the military. Moreover, there may be a massive overhaul of the tax code towards simplification.

Along with optimism again, and the unleashing of the American spirit, we’ll get more growth more efficiently.

peak, you sound just like larry kudlow. here is a greatest hits of ol’ larry

http://www.huffingtonpost.com/entry/larry-kudlow-donald-trump_us_58530e9de4b08debb78832c1

i do like how we are no longer repealing obamacare, but instead replacing obamacare. we will just capitalize a couple of the letters in the document and rename it trump care. its gonna be HUUUUUGE! but still obamacare, or romneycare for you old timers.

The comments on the weak recovery are interesting.

While real GDP growth averaged 2.1% over the last 5 years, real output growth of the private non-farm business sector averaged 2.6%. The 0.5 percentage point difference is the direct impact of tight fiscal policy imposed on the US by the republican congress. So Trump will find it relatively easy to achieve some 3% to 4% growth. All he has to do is simply let government grow.

Of course we all know that democratic deficits are bad but republican deficits are good.

Spencer, after the severe recession, we had an L-shaped “recovery” at best. Real per capita GDP is now over 10% below a long-run trend.

Keynesian economics suggest we should have budget surpluses by now. Instead, we still have $600 billion annual budget deficits. What would happen to the economy if spending was reduced or taxes raised by $600 billion?

Perhaps, expansionary fiscal policy wasn’t strong enough to achieve “escape velocity” from the recession. Yet, Congress had “spending fatigue” in 2009. It’s more likely sustained new anti-growth policies slowed the economy too much, offsetting much of the pro-growth policies.

“Yet, Congress had “spending fatigue” in 2009.”

no. they wanted the economy to falter. they were more interested in making obama a one term president than actually governing in a responsible manner. the poor recovery was exactly what the republican party was after.

“The weak “recovery,” after the severe recession, was the result of pro-growth policies with too many anti-growth policies, which also made the “recovery” very expensive.” -Peaktrader.

PT, With all due respect, if your approach was a little more scientific, you wouldn’t write things like that.

Erick, I guess, you can’t imagine the result driving a car with one foot pressing on the accelerator and the other foot pressing on the brake.

Erik Poole Peak Trader’s interest in economics exceeds his abilities. And that’s a problem. You’ll find that he knows just enough to be dangerous. For example, he believes that certain “pro-growth” policies will push out he supply curve, but he doesn’t have any serious model in his head that quantifies or even understands the importance of convergence rates of positive supply shocks. Setting aside the dubiousness of some of those “pro-growth” policies and even assuming they really are “pro-growth”, the part that he doesn’t understand is just how slowly those “pro-growth” policies work their way through the economy. Bending the long run supply curve takes generations, not months. But he doesn’t get that because he doesn’t have a deep understanding of the math involved. As a result he always recommends useless bromides that are irrelevant to the problem at hand.

2slugbaits, making things up to discredit me shows you’re either dishonest or cannot comprehend economics. Below was my response to your statement in question:

“Yes, I read the article and agree it’s partly cyclical. Sounds like you’re mixing models (AD-AS and IS-LM) and making contradictions. For example, if the price of health care insurance doubles and demand for health care falls, because the deductibles are too high, that can cause a contractionary shift in demand. We saw health care inflation slow with less demand for health care. Also, since there’s less discretionary income for other goods & services, because you’re forced to pay too much in the health care industry, you get what we’ve been having – weak growth with low inflation. I’ve explained before how other structural problems reduced income and therefore spending. It would be much cheaper to correct the structural problems than spend even more to trying offset them.”

“We saw health care inflation slow with less demand for health care. Also, since there’s less discretionary income for other goods & services, because you’re forced to pay too much in the health care industry, you get what we’ve been having – weak growth with low inflation.”

just to be clear, those directly affected by obamacare are a small fraction of the population, and are not contributing much to your weak growth argument. you appear to have a gripe with health care costs. fine. what you really have a gripe with, is a failure of the free market system to operate a health care system efficiently for the benefit of the population as a whole. it appears the free market system does not produce a health care system to the satisfaction of peaktrader.

I’m not sure who has attempted to wade through the 500 pages of this report, but I read the first 50 or so and skimmed the rest pretty quickly, so I’m not claiming to be an expert on the thing. My general observation is that it is as much a political document as an economic one. The political aspect is certainly shown by placing a positive spin on nearly every action done by the administration over the last 8 years and avoiding too much mention of the negative aspects.

That’s okay. Reality is a series of biases that affect our perspectives, so I can understand the report in that light.

Where there should be general agreement is that when Barack Obama took over the office of the president, the U.S. and a large part of the world was suffering significant economic distress… and as he leaves office most of that distress has been diffused. Sure, there are problems and there will always be those who see themselves as victims and losers regardless of who is in office.

There should be general agreement that the President’s assertion that the stimulus moved the country back toward recovery. There will be disagreement about the distribution and duration of the stimulus being the correct course, but money did flow through sectors of the economy.

There should be general agreement that the President’s claim to have expanded health care insurance is factual. More people have policies now than in 2009 when he took office. There will be disagreement about the cost, fairness, and efficacy of this effort versus other possible approaches. Many promises made to convince the American people that the ACA was what they should want were broken and many people feel that they not only have higher insurance premiums, but that the coverage is not as good as they had in 2008.

There should be general agreement that during the President’s years in office, the U.S. has come much closer to energy independence than it was in 2008. There are some who will point out that the President is disingenuous to take credit for the growth of U.S. energy as he tried (unsuccessfully) to clamp down on “fracking” and has maintain an obstructionist stance toward new pipelines. They will say that the expansion of fracking has led to a surplus of natural gas which has replace coal in a significant portion of our country’s electrical production plants and that has been the major contributor to the lowering of CO2 emissions and pollution, not the mandate for so-called alternative energy (which has been the recipient of billions of dollars in government grants and subsidies and is still expensive and unreliable… requiring fossil fuel backups).

The President’s report states: “The legislation President Obama fought for and signed into law represents a historic accomplishment in reducing inequality. The Administration has achieved its most substantial and immediate success in this respect in three areas: restoring economic growth, expanding health insurance coverage, and enacting a fairer tax code.” The first two areas have been comment on above, the third represents a gray area of “fairness”. Given the percent of taxes paid by the top 10% before the President’s changes, one might debate the definition of “fair”. The major argument for increasing taxes on the top tier was that the middle class was shrinking and more wealth was accumulating in the top decile. That’s true. What is misleading about that argument is the fact that much of the change is a result of people moving upward economically from the middle class.

Climate change is covered as an issue and a success for the President based on spending many billions of dollars. The results, however, are dubious at best. Many feel this is a way to redistribute taxpayer money to cronies and other nations and has had little positive economic impact in the U.S. Biases will definitely be in play for this issue. There is no doubt that the U.S. now boast more solar panels and wind turbines than in 2008. The disagreement is whether or not this has been a good or foolish investment. Fuel economy standards for motor vehicles have increased since 2008, but real-world mileage has plateaued. The President’s push to double mileage standards is not based on either the marketplace nor feasible technology… feasible being the operative word.

Beyond that, the four areas of productivity growth, income inequality, labor force participation, and economic sustainability are left as TBD.

I’ll reiterate: the economy is better in 2016 than 2009 without question. The question is whether the policies and actions taken under this President were 1) the best available and 2) produced the best results. The country remains divided about that. As measured by average GDP growth over the past 8 years, the answer would seem to be “probably not”. But that’s purely speculation.

What we will find out now is whether President Trump will be able to match or beat that record especially in light of the Federal Reserve’s action/plans to ratchet up interest rates which will create a magnificent strain on the budget while making it harder to export U.S. goods. The Feds’ action was overdue and the delay was needed to make a wobbly economy look good. But now that the piper is leaving town, the rest of us may well be paying much more than we anticipated as the policies of the last 8 years come home to roost.

Bruce Hall Obama’s policies probably were the best available given the crazy opposition party he had to face. Sen. McConnell made it perfectly clear since Obama’s first day in office that the number one priority of the GOP should be and would be to ensure Obama was a failure. What was good for the country was not even considered; it was all about making life hell for Obama. A lot of what Obama settled upon were second best solutions….Obamacare being one of them. But we should also compare Obama’s performance with other political leaders across the developed world. And on that score the US economy has done a lot better. By a long shot.

Your last paragraph is unintelligible. You seem to be simultaneously claiming that the Fed was wrong in not raising rates and that now they are wrong in raising rates. Anyone who was even only half paying attention understood that the Fed was practically begging the GOP to go along with fiscal stimulus in the form of increased spending. The only reason the Fed had to keep interest rates low was because the Congress wouldn’t go along with fiscal stimulus. And if you’re worried about a strain on the budget, then you should be especially worried about the Siberian Candidate’s proposed tax cuts for the rich. Those tax cuts will create YUGE structural deficits (note…structural deficits, not cyclical deficits) that will have almost no positive effect on aggregate demand. The worst of all possible worlds. Trump is a business wheeler-dealer type, and businessmen are notoriously godawful at macroeconomics. And now we hear that Predator Trump is considering Larry Kudlow as his economic adviser. Larry Kudlow!!! Seriously…LARRY KUDLOW!!! Ugh.

2Slug,

As I said, it can only be speculation spun by biases in saying whether the policies and actions of the Obama administration was the best course or not. I take the position that it is obvious the economy has improved, but the results have been lukewarm, at best, which leads me to believe that a few monkey wrenches were tossed into the gears along with the grease.

As to the last point about the Fed, quite simply the Fed’s inaction about raising interest rates in order to make a … lukewarm … economy seem better has placed Trump in a position where the higher costs of servicing the debt (from four? planning interest rate hikes) will be spun as a failure on his part to control the debt. Whereas if the rates had been increased at least two years ago, there would have been greater budgetary pressure to control deficit spending leaving slightly less strain on future budgets as well as having the dollar adjust early. After all, wasn’t the economic “success” of Obama’s policies and actions so readily apparent 6 years into his administration? I’m not saying the Fed is wrong to raise interest rates; I’m saying it waited too long and allow the illusion that our economy was working properly.

Trump will be paying for Obama’s excesses and policies that have been, what I see, as an anchor on what should have been a faster and stronger recovery by having to deal with an abruptly stronger dollar (stifling exports and eating up more of the Federal budget). Look for Trump to respond by dismantling some of the Obama spending programs and, perhaps, massive streamlining of the large and often redundant Federal bureaucracy. Of course, there will be massive resistance by the Democratic Party and the entrenched bureaucracy that will do everything they can to ensure failure.

“which leads me to believe that a few monkey wrenches were tossed into the gears along with the grease.”

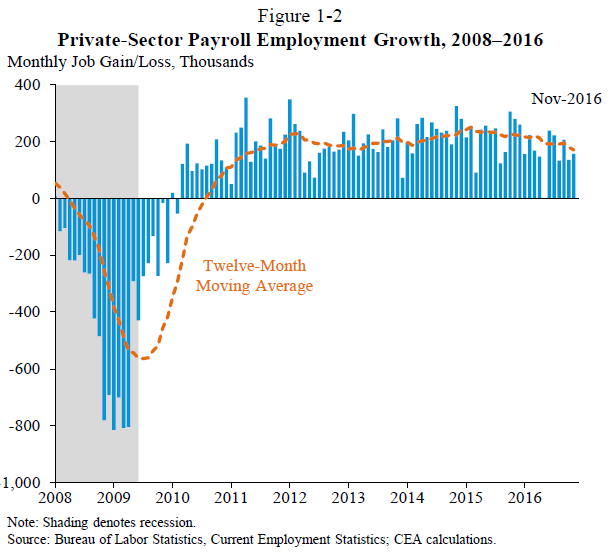

yes. the republican backed austerity policies of the past 8 years were more than a few monkey wrenches. we could have had a real recovery without such policies. ever look at calculated risk summary of employment over the duration of each president? obama has a quite impressive private sector growth. however, government employment was largely negative over his term. contrast that with the large expansion of government workers under the reagan term. interesting how obama is argued to be a grower of big government, and saint reagan the enemy of big government. when you look at the employment numbers, the truth is exactly the opposite.