From Bloomberg:

President Donald Trump’s administration is considering a new tactic to discourage China from undervaluing its currency that falls short of a direct confrontation…

Under the plan, the commerce secretary would designate the practice of currency manipulation as an unfair subsidy when employed by any country, instead of singling out China, the newspaper reported. American companies would then be in a position to bring anti-subsidy actions to the U.S. Commerce Department against China or other countries, it said.

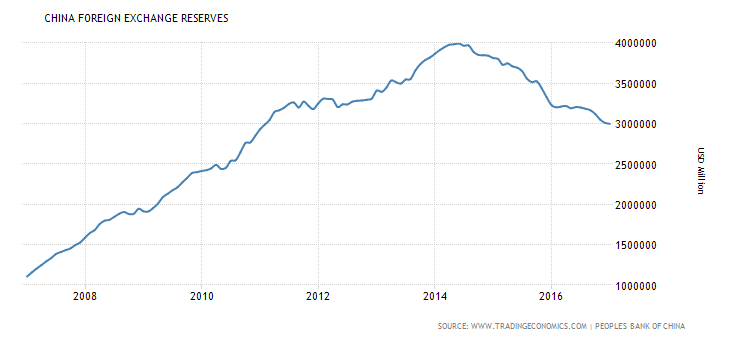

I don’t understand how this will apply to China at the moment. If Chinese reserves were rising because of PBoC intervention in the forex market, then one might be able to make the argument that — by buying dollar assets — the yuan is weaker than the value determined by supply and demand. But they’re not. Reserves have just dipped below $3 trillion.[1]

Source: TradingEconomics, accessed 2/13/17.

So whatever forex intervention China is implementing now — to some that’s manipulation — it’s pushing up the value of its currency. So I don’t know how this new plan is going to do anything to solve “the” problem (and in this case I’m not sure there is a real “problem” to be addressed).

I look forward to the plan to label the Bundesbank a currency manipulator (!).

Maybe the Trump administration should take heed of this man’s advice:

“I need to stop getting into situations where all my options are potentially bad.”

― Jack Campbell, Dauntless

How embarrassing, the Chinese have put tighter restrictions on out-flows of the yuan, and that has affected the supply in the Fx, and of course, less supply means higher value. So, somebody needs to send Trump a tweet and explain this (I don’t have a Twitter account).

Anyway, I’m doubtful that Twitter is the best format for what are some complex issues, but maybe with a few tweets, Trump could also be told that no nation on Earth restricts flows of its currency into the Fx like the USA does. Surplus dollars used for oil purchases would provide a simple example. And the next tweet should include at least a little something about ag subsidies and other “unfair subsidies”… like tax loopholes for MNCs based in the US, and if it will fit in a few words, something too about how much is written off for marketing costs and so on.

https://www.wsj.com/articles/currency-manipulation-is-a-real-problem-1487031395

U.S. Companies Are Stashing $2.1 Trillion Overseas to Avoid Taxes

by Richard Rubin

4 March 2015 6:00:02 pm SGT

Eight of the biggest U.S. technology companies added a combined $69 billion to their stockpiled offshore profits over the past year, even as some corporations in other industries felt pressure to bring cash back home.

Microsoft Corp., Apple Inc., Google Inc. and five other tech firms now account for more than a fifth of the $2.10 trillion in profits that U.S. companies are holding overseas, according to a Bloomberg News review of the securities filings of 304 corporations. The total amount held outside the U.S. by the companies was up 8 percent from the previous year, though 58 companies reported smaller stockpiles.

https://www.bloomberg.com/news/articles/2015-03-04/u-s-companies-are-stashing-2-1-trillion-overseas-to-avoid-taxes

Ben: i am sure the 2.1 thrillions usd cash stashed overseas distort trade balances of US.