Judy Shelton on currency manipulation.

In response to my post on a possible new approach to tackling currency manipulation, reader “Judy” comments by sending me a link:

https://www.wsj.com/articles/currency-manipulation-is-a-real-problem-1487031395

This is a WSJ op-ed, which is behind a paywall. Here is an ungated version:

Certainly the rules regarding international exchange-rate arrangements are not working. Monetary integrity was the key to making Bretton Woods institutions work when they were created after World War II to prevent future breakdowns in world order due to trade. The international monetary system, devised in 1944, was based on fixed exchange rates linked to a gold-convertible dollar.

No such system exists today. And no real leader can aspire to champion both the logic and the morality of free trade without confronting the practice that undermines both: currency manipulation.

When governments manipulate exchange rates to affect currency markets, they undermine the honest efforts of countries that wish to compete fairly in the global marketplace. Supply and demand are distorted by artificial prices conveyed through contrived exchange rates. Businesses fail as legitimately earned profits become currency losses.

…central banks provide useful cover for currency manipulation. Japan’s answer to the charge that it manipulates its currency for trade purposes is that movements in the exchange rate are driven by monetary policy aimed at domestic inflation and employment objectives. But there’s no denying that one of the primary “arrows” of Japan’s economic strategy under Prime Minister Shinzo Abe , starting in late 2012, was to use radical quantitative easing to boost the “competitiveness” of Japan’s exports. Over the next three years, the yen fell against the U.S. dollar by some 40%.

…

Whether China is propping up exchange rates or holding them down, manipulation is manipulation and should not be overlooked.

So…let me get this straight. If you lower interest rates and that depreciates a currency, that’s manipulation. If you embark on quantitative easing by purchasing domestic assets and the currency depreciates, well that’s currency manipulation. And if you intervene in the foreign exchange market to keep a currency weak by purchasing foreign currency, that is manipulation, as well as if you intervene to keep it strong by selling off foreign currency.

This expansive definition of “manipulation” means that pretty much every central bank in the world is manipulating their exchange rates — except for those that have their exchange rates at the “correct” levels, as determined by somebody.

That article made me wonder what criterion would result in exchange rates being at correct levels. According to this article, Dr. Shelton believes a fix to gold would do the trick.

“We’re talking about monetary integrity. And if we really do have a some kind of a global economy, it doesn’t make sense that people are using different units of account to measure value.”

Implicitly, this means she views the world as an optimal currency area (e.g., symmetric shocks, and/or free factor mobility and fiscal union). Hmmm.

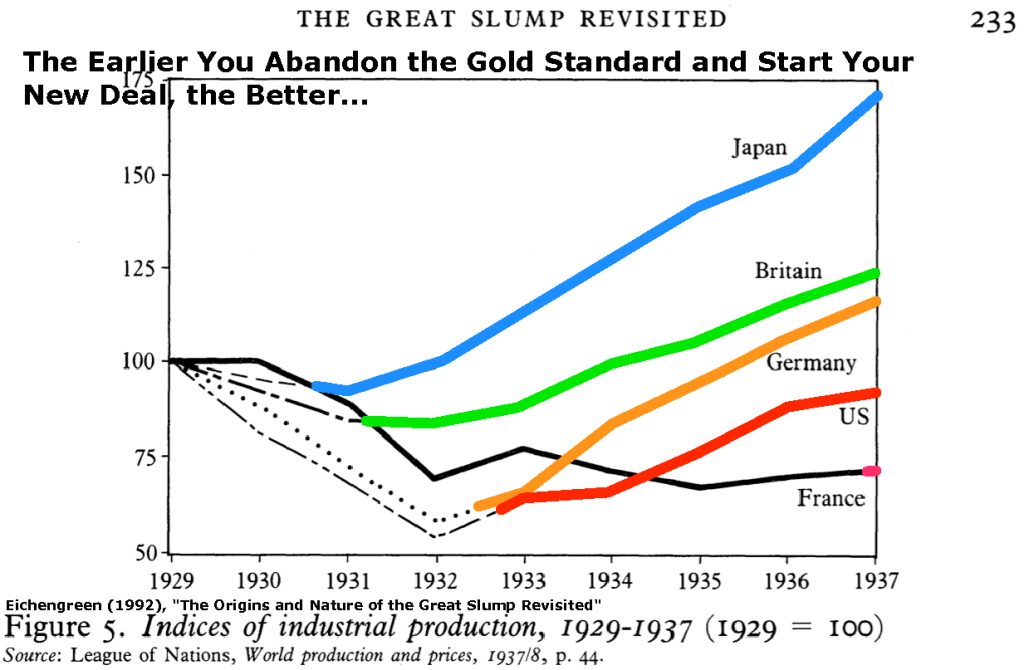

I’ll further observe that if you fix your exchange rate to gold at the “wrong” levels, you might have the real exchange rates less volatile, but still misaligned. Those who know economic history, know the consequences, summarized in this graph:

See also Jim’s post on the subject.

I have read that Dr. Shelton is an economic adviser to President Trump; if so, I think I will miss the days when Donald Trump called Lt. General Flynn for advice on the dollar.

David Glasner bags her unmercifully. you yanks have something else over there now. They have all been let out of the mad house

WRSF!!!

A gold nut in the White House. Who would have thunk it? Populists will rejoice.

A Ph.D. in economics willing to accuse China of currency manipulation. That I understand. People have to eat, including PhDs in economics. Special interest capture works for economists too.

The common denominator for the new administration appears to be an ability to quickly point fingers at others for perceived American shortcomings and failings. I am surprised that the new administration has not yet blamed technology and the decline in union power for the malaise of American blue collar workers.

I guess that mulatto Obama dude must have been a horrible president. Is that not what the strong US dollar is telling us? Investors park capital in the USA because the mulatto foreigner from Kenya did a horrible job. Horrible. Just horrible.

Oops. Shelton has Ph.D. in business administration not economics.

If Janet Yellen raises interest rates, thereby raising the value of the dollar and hurting exports, will US exporters be able to file a currency manipulation case against the Fed?

Re: Wall Street Journal

This link from the NYTimes may make some sense:

https://www.nytimes.com/2017/02/14/opinion/the-struggle-inside-the-wall-street-journal.html?ref=business&_r=0

Right, an important link.

The pewdiepie mud fight is even more disgusting. It seems the polarization is getting bigger, speed up of content due to the Internet vs. old media.

New York Times attacking Wall Street Journal is important?

Wall Street Journal seems to be moderate, while New York Times very liberal:

https://www.google.com/amp/s/amp.businessinsider.com/what-your-preferred-news-outlet-says-about-your-political-ideology-2014-10?client=safari

Essentially, there are 5 central banks in the world: Fed, PBOC, BoJ, ECB and BoE. They should just work together to set appropriate currency rates and help each other out with QE. No need for a gold standard. As Keynes said decades ago, “In truth, the gold standard is already a barbarous relic.” He was right, of course, but some people still don’t get it.

Paul,

What you are suggesting… is what was tried at the ‘Plaza Accords’ in 1985, (without the QE), and it is what triggered the ‘Lost Decade’ in Japan. But one nation’s “appropriate” might be another nation’s bubble. QE was also a matter of intense concern at the G-20 meeting in South Korea in 2009:

By Malcolm Moore in Gyeongju

2:40PM BST 23 Oct 2010

Comment

“In a final statement after two days of heated negotiation, the G20 said it would “move towards more market-determined exchange rate systems” and that the International Monetary Fund would “deepen” its supervision of exchange rates.”

“”This language calms everything down and gives us a route map forward,” said George Osborne, the Chancellor of the Exchequer. “Obviously this colourful language about currency wars has got everyone excited,” he added.”

“Mr Osborne clarified, however, that the statement was not a criticism of China for persistently undervaluing the yuan. “What people have been nervous about is that the current imbalance would get worse as countries other than China look at the route of competitive devaluation.” He also said that while currencies “tend to grab the headlines”, they are just one part of wider economic imbalances.”

“While several member countries of the G20 hailed the summit in South Korea as a success, Japan immediately broke ranks to declare that, contrary to the spirit of the communique, it would continue to devalue the yen if it saw fit. ”

——————————————————————————————————————————————–

I suspect that Governor Zhou of China has it correct:

“In the wake of the financial crisis of 2007–2008, the governor of the People’s Bank of China explicitly named the Triffin Dilemma as the root cause of the economic disorder, in a speech titled Reform the International Monetary System. Zhou Xiaochuan’s speech of 29 March 2009 proposed strengthening existing global currency controls, through the IMF.[1][2]

This would involve a gradual move away from the U.S. dollar as a reserve currency and towards the use of IMF special drawing rights (SDRs) as a global reserve currency.

Zhou argued that part of the reason for the original Bretton Woods system breaking down was the refusal to adopt Keynes’ bancor which would have been a special international reserve currency to be used instead of the dollar.” (Wiki)

Or…put in a somewhat different way:

“In the wake of the financial crisis of 2007–2008, the governor of the People’s Bank of China explicitly named the reserve currency status of the US dollar as a contributing factor to global savings and investment imbalances that led to the crisis. As such the Triffin Dilemma is related to the Global Savings Glut hypothesis because the dollar’s reserve currency role exacerbates the U.S. current account deficit due to heightened demand for dollars.”(Wiki)

(Wiki – under ‘Triffin Dilemma’)

The sad thing is the Dr. Shelton and her wingnut friends in the White House and in Congress like Ryan and Hensarling don’t even understand the Gold Standard and how it worked and how (as David Glasner points out) countries and Central Banks routinely manipulated it when it functioned. https://uneasymoney.com/2017/02/15/a-tutorial-for-dr-judy-shelton-on-the-abcs-of-currency-manipulation/

The stupidity, it burns, it burns.

Gooooooooollllllldddddddddd!

So many excuses. Obviously, some of our trading partners practice currency manipulation to boost exports, including Japan, which was running out of securities to buy, because its QE was so aggressive. China has lots of non-tariff trade barriers making it very difficult for countries to sell their products, when China isn’t pirating intellectual property, like music and movies. Chinese save a very high percentage of their income and consumption has declined to 35% of GDP. Include other factors, e.g. exploitation of labor and negative externalities, and it’s no wonder U.S. exports are too low and many foreigners sell their goods too cheaply in the U.S., resulting in large and persistent U.S. trade deficits. Of course, Obama did a “horrible” job on the economy, which made Americans poorer than otherwise, reducing consumption and trade deficits. Obviously, there are some problems that need to be corrected rather than ignored.

Peak Trader,

I’m a little confused by this: “Of course, Obama did a “horrible” job on the economy, which made Americans poorer than otherwise, reducing consumption and trade deficits.” First, you begin with “Of course”, and so that makes me feel that everyone else knows something that I don’t; and then, your use of the phrase “poorer than otherwise”…which further implies that I’m not privy to what I consider to be a counter-factual claim, but then you seem to know that Obama caused a “reducing of consumption and trade deficits”, and wow, I’m totally lost. How is it that you and everyone but me knows what would have happened “otherwise”? Am I misinformed because I don’t get Fox News, maybe?

These charts may shed some light:

https://www.advisorperspectives.com/dshort/updates/2017/01/27/q4-real-gdp-per-capita-1-03-versus-the-1-87-headline-real-gdp

The charts weren’t made by Fox News. The American people are so disappointed with the economy that someone like Trump got elected!, along with the GOP Congress.

so peak, you are arguing that growth after the financial crisis should be equal to or greater than growth prior to the financial crisis. you take this as a fact, not your opinion. please support this position with factual evidence.

That chart on real GDP per capita just shows that a great recession occurred and that a collapsing economy was put back on an upward trend.

The chart shows less than an L-shaped recovery after the severe recession.

The “recovery” is actually even worse, because trade deficits shrunk from 6% to 3% of GDP, which adds to GDP.

The demographic shift began in 2000 and takes place slowly. So, that doesn’t explain the sudden and sustained downshift in growth, since 2009.

Unfortunately, we had way too many idle and underemployed resources for too long, resulting in many trillions of dollars of lost output, since 2009.

real gap growth rate was dropping for several years before the financial crisis. it began dropping in bush administration.

Baffling, I’ve explained to you many times before, the 2001-07 expansion was on top of the 1982-00 economic boom and the mild 2001 recession. Moreover, trade deficits in the mid-2000s reached 6% of GDP, which subtracted from GDP.

The anemic Obama expansion from the severe recession is reflected in the charts. The “recovery” is not much better than population growth.

peak

“Moreover, trade deficits in the mid-2000s reached 6% of GDP, which subtracted from GDP.”

and as you argue, there was an artificial growth in the economy during the same period when too much housing activity occurred. so lets subtract that back out of the gdp growth as well. so again, during the bush years, growth was probably slower than obama.

if you want to argue for an anemic obama period, then those conservative economics polices from the oughts should be driving you absolutely insane. during that period, you were not fighting a financial crisis and the fallout. it was a more mundane recession period. and the results of the conservative economic polices were very anemic. you could not even outperform obama!

Baffling, the country was at full employment under Bush 43.

Under Obama, there were massive idle and underemployed resources, which is completely unnecessary for this long.

We should’ve had more tax cuts instead of a housing bubble to refund U.S. consumers, to allow the spending to go on, because trillions of dollars flowed to exporters in the 2000s, and they mostly bought U.S. Treasury bonds.

Unfortunately, Congress believed a housing bubble was needed instead.

peak, just to clear things up. we can adjust obama’s gdp performance down when it suits your narrative. but when the republican economy from the oughts also has circumstances which should also reduce the gdp for comparison, we ignore such an issue.

i guess we also ignore the continuously improving employment numbers under obama, which are pushing rather close to full employment as well.

peak, you have a narrative. bush good, obama bad. and you stick with that narrative, regardless of the data. it’s baffling!

Peak Trader:

“The chart shows less than an L-shaped recovery after the severe recession.

The “recovery” is actually even worse, because trade deficits shrunk from 6% to 3% of GDP, which adds to GDP”.

Yes, but far more is hidden from GDP in deferred capital gains than what the shrinkage from the trade deficit amounts to. And if we are comparing the true value of the recovery it seems at least some consideration needs to be given to how much was lost in asset values and then regained. There is now a far larger percentage of the population benefitting directly from investments than ever before, and so if we are concerned about regained prosperity, as opposed to the “shape” on a chart or graph, well… I doubt that a GDP comparison is very telling.

How does higher asset prices or more capital make up for the trillions of dollars of lost output, since 2009?

Paul,

The quote above from Malcolm Moore in Gyeongju doesn’t include any mention of QE but it was the hot issue of the meeting. But I can’t find anything germane about QE ‘spillover’ from that meeting but I did find the following:

by Peter WElls

“It was only a matter of time, really. Brazil’s outspoken finance minister, Guido Mantega, has taken a swing at the Fed’s QE3, labelling it “protectionist” and a move that will reignite the currency wars.”

“For the past week, we’ve been mentioning him in passing in a number of currency- and QE-related blog posts. He was, after all, the man who coined the phrase, ‘currency wars’ back in 2010 when the Fed unveiled its second round of quantitative easing.”

“It has to be understood that there are consequences,” Mantega told the Financial Times. QE3 would “only have a marginal benefit [in the US] as there is already no lack of liquidity . . . and that liquidity is not going into production.”

“Ultra-loose monetary policy, such as QE, increases the money supply (when the program isn’t sterilised) and depresses the value of a currency, which makes a country’s exports cheaper.”

“The Australian dollar has been pushed higher as the likes of the Fed, ECB, Bank of England and Bank of Japan ease monetary conditions, causing their currencies to weaken. The Aussie has also been caught in the crossfire (and pushed higher) as other central banks, particularly the Swiss National Bank, take action in response to their own currencies rising.”

“Brazil’s economy expanded just 0.4 per cent in the most recent June quarter from the previous three months. It grew 2.7 per cent in 2011, compared to 7.5 per cent in 2010.” ( Financial Review)

http://www.afr.com/markets/currencies/brazil-warns-on-renewed-currency-war-from-qe3-20120920-ixwg9

Read more: http://www.afr.com/markets/currencies/brazil-warns-on-renewed-currency-war-from-qe3-20120920-ixwg9#ixzz4Ysbha3g8

Follow us: @FinancialReview on Twitter | financialreview on Facebook