Paul Krugman notes the disjuncture between what confidence is being expressed in the Trump economy as measured by surveys, and what the actual data indicate. Here are some additional observations on the disjuncture, based on yesterday’s consumption release.

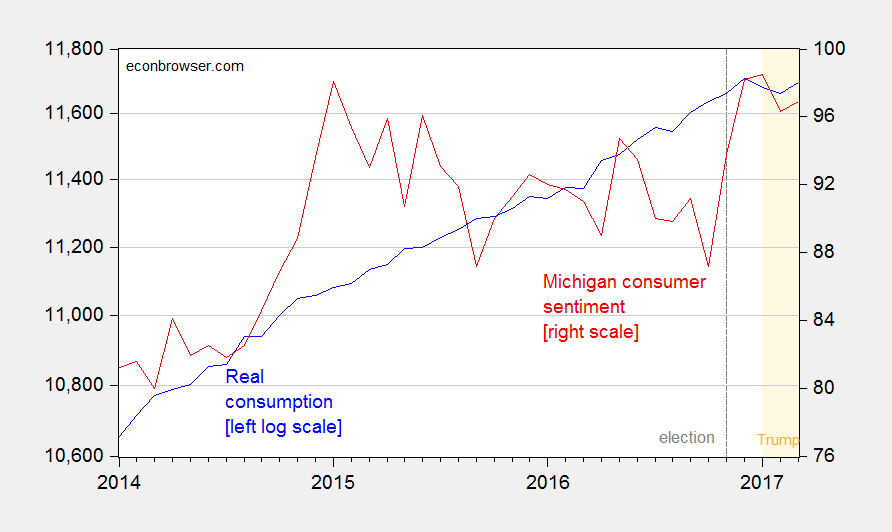

First, monthly consumption has been flat since December, despite elevated consumer sentiment in the wake Trump’s election.

Figure 1: Consumption in billion Ch.2009$ SAAR (blue, left log scale), and Michigan consumer sentiment index (red, right scale). Dashed line at election. Orange shading denotes Trump administration. Source: BEA, and FRED.

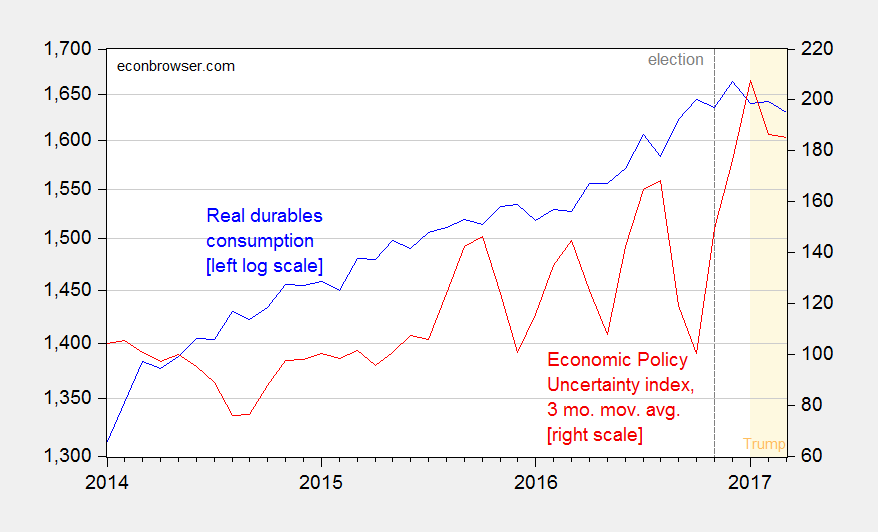

Second, durables consumption is down.

Figure 2: Consumption in billion Ch.2009$ SAAR (blue, left log scale), and three month trailing moving average of the Baker, Bloom and Davis Economic Policy Uncertainty news index (red, right scale). Dashed line at election. Orange shading denotes Trump administration. Source: BEA, and policyuncertainty.com.

While durables consumption is a relatively small share of overall consumption (most is services and nondurables), movements of durables can be informative regarding expectations of the longer term future and uncertainty. (Services consumption should be approximately a random walk, on the other hand.)

The downward move in durables consumption could be explained by appeal to economic policy uncertainty, which is also elevated. Aggregate consumption, dominated by services and nondurables consumption, should not be too affected by policy uncertainty. But durables consumption should be noticeably affected — and that appears to be the case.

Or, sentiment is mismeasured, and consumption is depressed because the actual level of confidence is actually low.

Sentiment is measured across the economy. What matters, however, is the sentiment of those making major purchase and investment decisions. In this latter group, particularly those making investments involving debt, confidence has collapsed.

I would curious as to what extent measured consumer confidence is being driven by fuel prices at the pump.

In passing, if Americans were more familiar with modern economics — theory and stylized facts — I would expect confidence to be much worse.

Steven Kopits: You seem to believe that the economy is about to roll over. Care to explain in the absence of the usual factors that typically precede recessions?

The saying goes that the stock market predicted the last 12 of 6 recessions. In this case, the stock market might be in for a near-term correction but otherwise broader financial markets are calling for continued economic growth. Yield curves suggest growth.

I am trying to figure how to financially bet on what I expect is the inevitable disappointment with Trumponomics. Hence the question.

Some institutions are already diverting assets to Europe and emerging markets.

Looks like corporate and industrial bank debt is rolling over. Always associated with a recession.

We have auto sales down four months is a row.

http://jalopnik.com/new-car-sales-are-in-the-longest-losing-streak-since-20-1794830763

Personally, I’ve seen enough. This has been a very long expansion, albeit a weak one. We are at full employment, and the President comes in and scares the pants off of everyone. Look at the Citi surprise index. It is literally Trump, personally. (Hence my admonition to Peak on another thread.)

Now, I don’t think it’s a deep recession, but I think it has a Japanese on-again-off-again feel to it. This is the first of the Retirement Recessions: weak productivity growth at full employment.

If you want to play it, you could put the S&P. I think we’ll see a pullback if the thesis holds up.

Atlanta Fed’s GDPNow is at 4.3% opening ‘bid’ on Q2 GDP; blue chip consensus is around 2 something. So I am well out of consensus, for what it’s worth.

For more, see my Platts presentation: http://www.platts.com/IM.Platts.Content/ProductsServices/ConferenceAndEvents/americas/north-american-crude-oil/presentations/Steve_Kopits.pdf

Sorry for the delay in getting back. Thanks for the post Steven! I hope you are wrong but then I suspect you might be right……

I skewed EM slightly to start the year, and have slowly been shifting international and EM… continued US strength (which itself has been underappreciated, and plays into the market behavior since the election, imho) will at some point lead investors to realize there is a lot of unappreciated growth potential overseas. Nobody can predict the markets, but if it does catch fire, it could be very rewarding. It’s doing well enough in any case.

The Trump rally is an unusual animal. Supposedly the rally was driven by expectations that stronger growth and tax cuts would lead to much stronger future earnings growth. That belief should have caused the S&P 500 P/E to rise. But it hasn’t. In the months prior to the election the PE on trailing operating earnings averaged slightly over 21. Since the election the PE has traded slightly below 21– just the opposite of what was the rally implied. Just before the election trailing earnings growth turned positive and was growing at double digit rates by the first quarter. Earnings have been growing faster than the stock market since the election and that is why the S&P P/E is lower than before the election.

Interesting, so what does this say about the Trump rally?

Interesting take here on the Confidence numbers: basically it’s the elderly and those without college degrees.

https://ftalphaville.ft.com/2017/05/02/2188069/americas-rising-consumer-confidence-mostly-due-to-the-elderly-and-less-educated/

“…a closer look at who exactly is excited about the future suggests there is less here than meets the eye.

Deutsche Bank’s Torsten Slok points out that the improvement in expectations is entirely due to Americans without a college degree, rather than those with greater spending power and higher earning potential. Americans with degrees have been getting steadily less optimistic since mid-2015…”

Fascinating. Maybe another case of “if you torture a dataset long enough, it will confess to anything.”

I’m about in the same place as Steven Kopits with this one. There are lot of headwinds ahead, including Brexit. The recovery is getting long in the tooth, and while there is no definite time length for a recovery, it seems that the quarterly recovery data just seems anemic. I’ve long believed (perhaps somewhat irrationally) that the economy would drift into recession around late summer or early fall regardless of who won the Presidential election. Consumer sentiment can’t sustain the economy indefinitely if labor productivity numbers are chronically weak. Two interest rate hikes could be just enough to push the economy over the edge.

Interesting. Thanks 2slugbaits.

I would disagree that another couple of interest rate hikes would be enough to push the US into recession.

My gut says no recession but slower growth.

Remember that the long form of “a con” is “confidence game.”

And a lot if this improved confidence is nothing more than Pom-Pom waving by weak-minded Republicans and greedheads on Wall Street. If good things don’t reach Main Street by July, watch things turn….fast

I have no sympathy for Trump’s policies. But he is getting exactly what he wants, and possibly what others do: private investment spending is up, with a very radical change in spending on structures (a 22% increase) and residential spending (a14% increase), and a drastic fall in government spending (led by a 4% decline in national defense spending). Perhaps the consumption decline in durables spending is an expectation that the investment spending will not lead to an increase in average (per-capita) income, as opposed to a shift in income from the average to the wealthy. It is possible this could be checked with preceding data to find out. So it may be more subtle.