Today the Federal Reserve announced that it is increasing its target for the fed funds rate to a new range of 1 to 1.25%, a development that surprised no one. But something that was not heralded in advance was the announcement that the Fed intends to “begin implementing a balance sheet normalization program this year, provided that the economy evolves broadly as anticipated.” The Fed spelled out in detail exactly what that will entail. Sometime later this year, the Fed will begin limiting the amount of maturing Treasury securities and mortgage-backed securities that it reinvests, initially bringing its balance sheet down by $10 billion each month as its holdings are redeemed. Those amounts will gradually increase each month until after a year balance-sheet reduction reaches a pace of $50 billion per month. That compares with a net increase of $100B/month on the way up during QE1. Given current Fed security holdings of $4.2 trillion, this would reduce the Fed’s security holdings by about 14% per year once it gets into full swing.

So far, nothing has actually changed on the Fed’s balance sheet– the Fed just announced that it will likely do something later this year. However, much of the evidence for the effects of the Fed’s initial program of increasing the size of its balance sheet is based on how interest rates responded when various announcements were first made. We often saw that when the Fed announced a plan to buy more securities, the interest rate on 10-year Treasuries fell, consistent with the view that the large-scale asset purchases were succeeding in their goal of bringing interest rates down. Yesterday’s announcement gives us one more data point to add to that set of observations. So how much did interest rates go up when the Fed announced its plans to start selling?

Here’s what happened to the yield on 10-year Treasuries as measured by the TNX contract on the Chicago Board Options Exchange (divide by 10 to translate into the annual interest rate in percentage points). Rather than go up, the 10-year yield actually fell 6 basis points today.

Price of TNX contract, June 8 to June 14.

However, that drop all came on the market opening, before the Fed had announced anything. The Fed’s announcement wasn’t the only factor driving interest rates today. At 8:30 a.m. EDT this morning the Census reported that retail sales fell 0.3% in May, which presumably was the driving factor behind the day-over-day change in the 10-year rate. Typically researchers want to distinguish the effects of Fed policy from other influences. For this reason, the event-studies literature has increasingly looked at shorter time windows around the moment of the announcement, on the premise that within 15 or 30 minutes of the Fed’s announcement, monetary policy could reasonably be viewed as the most important factor. Here’s a look at what happened minute-by-minute today.

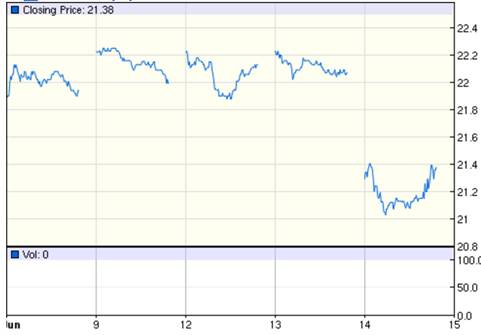

Price of TNX contract, June 14.

On that basis, after the announcement at 1:00 central time (the time used for CBOE quotes shown here), the 10-year yield either jumped up 1.5 basis points (if you used a 5-minute interval) or didn’t change at all (if you used a 10-minute interval) or maybe went up about 3 basis points, if you use just the right interval.

Which might be taken as a case study in the potential perils of the event-study methodology. But however you read it, today’s evidence seems to reinforce the conclusion that many of have drawn about the effects of the Fed’s large-scale asset purchases– whatever effects these may have had on long-term interest rates were likely less important than other fundamentals. That appeared to be the case on the way to building up the Fed’s balance sheet, and so far appears to be the case in the long process of bringing the balance sheet back down.

However, much of the evidence for the effects of the Fed’s initial program of increasing the size of its balance sheet is based on how interest rates responded when various announcements were first made.

I do not believe that the policy commitment made today is symmetric with the one for QE (1,2..N). Under QE, they made a firm commitment to buy securities at some pace. The economy was weak, so the market generally assigned a very high probability that the purchases would be made.

Today, the operative phrase is “provided that the economy evolves broadly as anticipated.” Well, that is a big “IF” given that the economy has *not* evolved as anticipated over the last few years, and the FOMC has repeatedly had to postpone rate hikes. Inflation is weak, at present. Yellen’s justification for weak inflation at today’s conference sounded contrived. If one looks at 30 data series, one can always label one an “outlier” than will mean-revert. The trimmed- mean CPI is well under 2%, which removes outliers in a way less subject to the kind of confirmation bias Yellen seemed to embrace today. Job growth has tapered in the last 3 months, retail sales, not great. Energy price inflation, nonexistent. Most importantly, wage growth is tepid at best.

Given the weak numbers, there is a significant chance that the FOMC postpones rate hikes, balance sheet reduction, or both. (One could also take the more cynical view that the commitment to policy tightening made it more likely that we would end up in a recession, driving yields lower, but I do not think that is consistent with equity markets or the 10-2 yr yield spread, neither of which are signalling recession).

Sorry. not seeing it. My business has had a good increase of cost pressures due to labor shortage. We are having to bid on labor and it is driving up cost.

I think the Census is drooling and using yry hedonics(aka, energy prices surged back last March-May) and making pricing errors with energy prices. I am not the only one complaining. They are distorting markets imo. They better correct their errors this June-August.

Local cost pressures may be different than national pressures.

I have no idea what “pricing errors with energy prices” you mean.

TLT, the iShares 20+ Year Treasury Bond ETF rose 1.54% today. Also presumably on weaker economic news.

It would be curious and most amusing if federal reserve shrinking of the balance sheet put it on a collision course with the Trump administration. I am sure that he has been told not to publicly attack or berate the board of governors but then this great man is known for not listening.

Personally, I will be most curious to see if higher borrowing costs slow the rush to explore and develop tight oil resources. You would think that massive losses would temper the enthusiasm of those who keep raising gobs of capital for the wealth destroying firms in the upstream sector.

The problem is, the weakness looks like crap to me. Pure Census driven noise. How about forcing them to raise inflation numbers and the BLS in response, nominal wage growth to what they really are.

Why doesn’t the fed just transfer their QE assets to the social security and Medicare trusts and push out the issues those trusts face.

How would that work exactly?

“funding” social security and medicare trusts by the Federal Reserve in a way that “pushes out issues,” is basically a massive tax cut, or like printing 4 trillion dollars and depositing it in an account at the Treasury.

It’s about as inflationary as they can be. It’s also the realm of fiscal (or social) policy -only Congress has the constitutional power to determine benefits and set revenues. And once they step into that morass, they will lose their independence within weeks.

GDPNow – June 14th:

“The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2017 is 3.2 percent on June 14, up from 3.0 percent on June 9. The forecast for second-quarter real consumer spending growth increased from 3.0 percent to 3.2 percent after this morning’s retail sales report from the U.S. Census Bureau and this morning’s Consumer Price Index release from the U.S. Bureau of Labor Statistics.”

The Fed hike was a foregone conclusion. Monetary policy remains highly accommodative, after eight years of economic expansion, since June 2009.

The market expects even more business-friendly policies later this year. Who knows how much of that is priced-into the market.

And, for those who believe Trump doesn’t listen. Why would Trump pay for advisors on his way to making billions of dollars, if he doesn’t listen? I think, some people just don’t like the decisions he makes, after listening to others.

“The consumer price index for May showed a 0.1 percent decline, versus expectations for a slight increase. Retail sales fell 0.3 percent last month, the most since January 2016.

Treasury yields fell after the reports and held near those lows after the Fed statement. “The big move [in yields] during the day was immediately after the twin reports,” said Larry Hatheway, group chief economist at GAM Holding.”

If the recent stock market rally was due to investors expecting Trump’s policies to boost future growth of GDP and profits it should have shown up in a higher market PE.

But it didn’t. In the months leading up to the election the S&P 500 P/E on trailing operating earnings was

trading just above 21. Since the election it has traded just below 21. Earnings bottomed just before the election and grew at double digit rates in the first quarter. This rebound in EPS accounted for over 100% of the post election stock market rally.

It is interesting how often the data strongly conflicts with the perceived wisdom.

For example, coal firms are profitable again thanks to deregulation.

and physicians can stay employed treating black lung disease. great economic plan.

Exactly what has been deregulated for coal?

One regulation about water run-off? There has not been time for this to be implemented.

What else?

We are seeing a cyclical rebound in coal output after a shock to the system a year or two ago. Coal output fell about 40% from January, 2015 to April 2016 — long before Trump became president. From April, 2016 to January, 2017 it rebounded some 44% before falling back about 16%. That is why their profits have improved. It has essentially nothing to do with deregulation.

The EIA blames the drop in coal demand in 2015-16 to a very warm winter and a collapse in foreign demand along with low natural gas prices continuing to cause utilities to switch from coal to gas.

But it was a problem with demand not supply where regulations supposedly hurt production.

By the way, did you know that Obama’s regulations caused coal mining employment to reach an all time peak in 1923.

Regulations not only put constraints on production, they waste time and slow production.

“Trump has made reversing the decades-long decline in coal mining the central tenet of his environmental policy, blaming federal regulations aimed at curbing planet-warming carbon emissions for job losses in the industry. Trump and Environmental Protection Agency Administrator Scott Pruitt have targeted laws that protected waterways from coal waste and required states to slash carbon emissions from power plants.”

peak, coal mine jobs have been lost due to automation. efficiency. increased productivity. coal mine jobs are not returning. no matter how much deregulation is imposed.

Baffling, I’m sure, some people said the same thing about jobs in the oil industry.

The U.S. has abundant coal reserves. Perhaps, clean coal technologies will revive coal production.

living in oil country now, i have never really heard any concern of lost oil jobs due to automation and efficiency. of course those have improved in the oil patch over the years, but most energy workers do not consider it a game changer at this time. other factors impact oil employment to a much greater degree. automation is not considered the enemy in the oil patch.

the country as a whole is really not interested in coal going forward. and this is a mentality spreading across the globe. only weird people seem to maintain their obsession with coal. even clean coal. it is an industry that will not be a great employer going forward no matter how you look at it. mostly because the coal mining businesses can automate what workers used to do by hand. robots work for free around the clock. this trend had been occurring for decades in coal.

Wrong. The only thing is profitable is the metallurgy coal that is used to make steel. The type of coal used to provide electricity is STILL in the downward shift and many power plants using this coal has been deactivated and that translate to loss of jobs.

The deregulation you cite is off because one of the regulation that Trump used to justify his policy allows coal mine to run off in the stream and that will kill tourism in states where river is the lifeblood of the tourism and fishing economy.

“after eight years of economic expansion, since June 2009”. What happened to the “Obama depression” you always make up?

You don’t believe this has been a very weak and expensive expansion from a severe recession?

It’s not really a recovery, since we haven’t closed the output gap, even with the destruction of many trillions of dollars of potential output, over the past eight years, from weak growth.

you mean the gap created by the fraudulent bankers?

You mean the gap created by Dodd-Frank and many other anti-growth policies.

no, i mean the gap that resulted from the financial crisis. which occurred before dodd-frank. the gap caused by fraudulent bankers.

No, you mean the gap that resulted from the financial crisis, which also involved Dodd and Frank, the gap caused by poor government policies, not of a massive conspiracy by bankers.

Peak Trader

It is fantasy to believe that Dodd- Frank was the cause of it. As a matter of fact, Congress will be passing the Financial Choice Act that will guarantee one thing, tax payer bail out of banks who put us in the same box in 2008. So spare me.

only an unemployed banker who was a contributor to the financial crisis, such as peak trader, would continue to deny the fraud that occurred by the banking sector. you do realize you are unemployed for a reason, and blaming the government is not the proper reason. the financial sector wants nothing more to do with people like you peak.

People like Baffling and Beeker are blissfully unaware of the extent of government influence in the housing market.

They want you to believe government had nothing to do with the financial crisis. Bankers just decided to approve home loans to marginal borrowers and forgot about the consequences, e.g. defaulting. And, bankers didn’t understand the consequences of homeowners using their homes as ATMs.

Baffling and Beeker don’t realize politician/lawyers like Dodd and Frank created a giant social program they believed Congress didn’t have to pay for. And, bankers were legally obligated to make those loans. Of course, bankers made the best of it, because that’s what they do.

“Bankers just decided to approve home loans to marginal borrowers and forgot about the consequences, e.g. defaulting. ”

yes peak, that is exactly what the financial types did. was it supid? what is irresponsible? of course. but they did it. they were not coerced. they were chasing yield and profits. you were probably one of those involved.

Gee, do I believe you Peak, or do I look at the fact that Countrywide, Wachovia, etc. made billions on the bubble, I don’t think the Government required them to do shit. I just refer everybody to look at Bill McBride’s archive at Calculated Risk and Tanta’s acidic comments on bankers like Peak Trader. I don’t recall any complaints about the Community Bank Reinvesting laws in 2003-05.

Also Peak, you really should understand that there is this thing called the Internet and we can look up current announcements from the Atlanta Fed on the GDP Now forecast. Its starting to trend down, and that is before any decisions Trump and Mulvaney make to screw up the economy.

” Latest forecast: 2.9 percent — June 16, 2017

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2017 is 2.9 percent on June 16, down from 3.2 percent on June 14. The forecast for second-quarter real residential investment growth decreased from 1.8 percent to 0.4 percent after this morning’s housing starts release from the U.S. Census Bureau. The forecast of the contribution of net exports to second-quarter growth declined from -0.23 percentage points to -0.34 percentage points after yesterday’s Import/Export Price Index release from the U.S. Bureau of Labor Statistics.”

I’ve shown plenty of evidence Congress promoted and facilitated high risk home loans. You and Baffling both seen the evidence before, e.g. “affordable housing requirements” – loans made to borrowers below median income being gradually raised and reaching 55% just before the economy collapsed. You’re two rigid ideologues, who refuse to believe Congress had anything to do with the financial crisis.

Lawmakers created the system. Banks operated within the rules and made the most of it. That was their best choice. At least, banks diversified the risks globally.

peak, you have not shown any evidence. “affordable housing requirements” were not the cause of the crisis, and all credible economists have come to this conclusion. poor loans were made, but that was not the result of government policies. it was because of banks looking for profit wherever they could find it. they failed to understand the risk. you live in a fantasy world where bankers will never be at fault for anything. crank and hack.

Here’s one of several credible economists I’ve posted before, you’ve seen, and completely ignored, along with all the other evidence, besides affordable housing requirements. You’re completely dishonest and totally in denial.

John B Taylor of the Taylor Rule:

“He finds that the crisis was primarily caused by flawed macroeconomic policies from the U.S. government and other governments. Particularly, he focuses on the Federal Reserve which, under Alan Greenspan, a personal friend of Taylor, created “monetary excesses” in which interest rates were kept too low for too long, which then directly led to the housing boom in his opinion. He also believes that Freddie Mac and Fannie Mae spurred on the boom and that the crisis was misdiagnosed as a liquidity rather than a credit risk problem. He wrote that, “government actions and interventions, not any inherent failure or instability of the private economy, caused, prolonged, and worsened the crisis.””

john taylor is biased by the promotion of his own rule. in particular, his argument is against the fed. now, it is fair to argue the fed kept rates too low, but this was not government policy or congress, per se. the private sector will always need to react to whatever rates the fed provides. the private sector reacted very poorly. as taylor notes, it was a credit risk problem. the banks misdiagnosed the risk and took a beating. further, taylor provides no evidence to back up his arguments. he simply argues from a position of authority.

baffling: FWIW, I agree with John Taylor.

The mass hysterical hyper-vigilant reaction to the Sept. 11th bombings affected not only foreign policy — the USA quickly re-asserted its status as the greatest terrorist nation state with kill ratios that easily surpassed those of the Israelis — it also affected US central bank policy where overnight rates remained too low for far too long.

There are problems with the American brand of socialism — subsidizing private home ownership strikes me as fraught with problems, just as heavily subsidizing grain exports also can cause serious problems.

A big problem from my perspective is the employment mandate of the US central bank. Perhaps that reflects a deeply ingrained lack of confidence in free market capitalism by American liberal economists. In that respect, liberal economists share much with the current president and his style of thuggish, partisan corporatism. Clearly President Trump does not trust free markets either.

“it also affected US central bank policy where overnight rates remained too low for far too long.”

erik, in hind sight, most people agree this was a contributor to the housing crisis. but one needs to separate the central bank policy with congress. congress did not mandate low rates. it is unfair, from folks like peak and even taylor, to lay blame on congress for actions taken by the fed. private banks reacted to the economic environment provided by the fed, and low rates allowed them to create low margin loans in volume-which was rather profitable. congress did not force this issue, like some want to blame. the problem is through the needed large volume of loans for profitability, the banks allowed (and encouraged) mortgage fraud to occur, which amplified the bubble in places like vegas and miami. the banks risk assessment was absolutely horrendous. the banks made a bet and lost. it is unfair to blame congress for the poor financial decisions of the bankers and other financial types. we socialized the blame and the resulting losses. we should have had more bankers in jail for fraud, and more punishments (lifetime bans from the financial sector) for the perpetrators. there are still too many bankers who were participants in the financial crisis, continuing to have careers in finance. that is wrong. let them wait tables instead.

Dear Prof Hamilton

FED was able to decrease interest rates with forward guidance (with not purchasing long term treasury securities or MBS..) It is my opinion.

Peak Trader, the recent data on coal output from the industrial production data.

dec jan feb mar apr may

73.7 78.4 83.4 71.7 76.2 74.8

Since Trump took office in Jan coal output is down 4.5% and 10.3% since the February peak.

Are you sure that coal production is profitable?

It sure looks like Trump’s policies are creating his usual results.

Maybe we are seeing the results from Trump’s anti-immigrant policies where the coal mine owners can not find cheap labor.

The mining industry had a profitable quarter this year:

http://www.cnsnews.com/news/article/terence-p-jeffrey/us-mining-industry-posts-first-profitable-quarter-2-years

How much does coal impact the entire mining industry?

Coal is dead.

http://www.foxbusiness.com/features/2016/03/09/last-gasp-for-coal-mining-industry.html

PeakTrader: “The mining industry had a profitable quarter this year.”

Apparently PeakTrader is unaware that the “mining” data from the Census is primarily oil and gas extraction. In fact, oil and gas constitutes 87% of the mining category. Of the remaining 13% of solid minerals, coal mining is a small percentage of the iron, copper, silver, lead, limestone, granite, sand and gravel mining. The rebound in mining is almost entirely oil and gas.

Your citation tells us absolutely nothing useful about the coal industry.

Joseph, here’s a better article:

http://rhg.com/notes/coal-quarterly-profits-rise-but-employment-falls

JDH wrote: “But however you read it, today’s evidence seems to reinforce the conclusion that many of have drawn about the effects of the Fed’s large-scale asset purchases– whatever effects these may have had on long-term interest rates were likely less important than other fundamentals.”

Agreed.

That conclusion does have me comparing OPEC to western central banks to the extent that the public, including the street, tend to exaggerate the power of OPEC to determine oil prices and rich country central banks to determine economic growth rates beyond avoiding stagnation or implosion.

It would be fascinating to run a Neo-Fisherian experiment and increase rates by another 50 to 100 basis points to see if inflation would follow higher. Higher inflation is not a good thing per se and one could argue that the western central banks should use the current context to edge inflation targets closer to 0%, except that the public and many economists appear to believe that positive, higher inflation is beneficial for growth. Presumably the more agents are confused by relative prices (within reason), the higher are expected growth rates.

Liberal economists have long been in favour of inflation deliberately confusing people for their own collective good. In theory these same economists should be ecstatic with the current Trump administration as conflicting signals and confusion abound.

Oil hit the 42s today. Has been about 50 for 3 years now. Shale seen as having a major impact.

http://www.cnbc.com/2017/06/20/oil-holds-near-multi-month-lows-as-glut-fears-persist.html