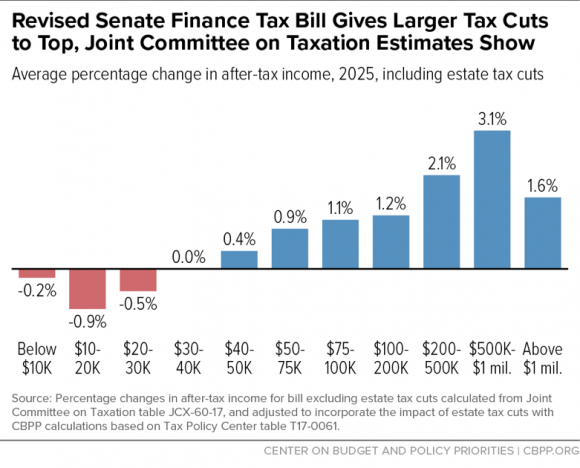

The Joint Committee on Taxation (JCT) has evaluated the distributional impact of the Senate’s plan. CBPP has graphically depicted the impact on households, adjusting the JCT figures to account for the provisions regarding estate taxes:

Source: CBPP.

In other words, by 2025, households with income less $30,000 experience a net decrease in after-tax income. Households with income greater than that experience net increases. The category of $500,000-$1,000,0000 experience a 3.1% gain(!).

CBPP summarizes the causes for this regressivity concisely:

The bill’s large tax cuts for high-income households reflect a series of provisions that provide large benefits to the wealthy but little or nothing to everyone else. These include: corporate rate cuts, the benefits of which flow overwhelmingly to wealthy investors and CEOs; the large estate tax cut; a tax cut for “pass-through” income, or income that owners of such businesses as partnerships, S corporations, and sole proprietorships claim on their individual tax returns and that is taxed at the same rates as wages and salaries; repeal of the Alternative Minimum Tax, which is designed to ensure that the wealthiest households pay at least some minimum level of tax; and a cut in the top individual income tax rate.

The CBPP calculations do not take into the expenditure-side implications of implementing the tax plan and budget bill. As noted in this post, spending cuts may be necessary in order to conform to the Senata budget bill, which limits deficit increases relative to baseline to $1.5 trillion over ten years. Nor do they take into account the higher premiums that would likely occur with the elimination of the ACA individual mandate.

Let me just say, I am unsurprised by the sheer brutality of the Senate GOP leadership. This tax plan perfectly epitomizes the Hobbesian view of these people:

“At this festive season of the year, Mr Scrooge, … it is more than usually desirable that we should make some slight provision for the Poor and destitute, who suffer greatly at the present time. Many thousands are in want of common necessaries; hundreds of thousands are in want of common comforts, sir.”

“Are there no prisons?”

“Plenty of prisons…”

“And the Union workhouses.” demanded Scrooge. “Are they still in operation?”

“Both very busy, sir…”

“Those who are badly off must go there.”

“Many can’t go there; and many would rather die.”

“If they would rather die,” said Scrooge, “they had better do it, and decrease the surplus population.”

A Christmas Carol by Charles Dickens:

https://ebooks.adelaide.edu.au/d/dickens/charles/d54cc/chapter1.html

From Marketwatch:

Third quarter GDP growth revised higher to 3.3%

“Big picture: Very bright. The U.S. has topped 3% growth for two quarters in a row and the economy is poised to make it three for the first time since 2004-2005.”

Anticipation of tax cuts boosted consumer and business confidence, along with rolling back regulation.

Except for the fact that the percentage change in consumer spending was only 2.3% and the percentage change in fixed investment spending was only 2.4% – both less than the percentage increase in real GDP. So part of this was a rise in net exports and part was inventory accumulation. But please don’t let the actual facts in the BEA release get in the way of your incessant worship of the DONALD.

Not to mention that Trump has achieved no major policy goals, so to the extent that policy matters to economic performance, it is Obama’s policies we are measuring in this year’s growth.

Peaky relies on “anticipation” to attribute the growth to Trump, but I don’t see “anticipation” anywhere in the GDP tables. Maybe “anticipation” is inventories by another name.

I’m curious as to how one adjusts “after tax income” for the effect of the estate tax provisions in the bill. Any ideas? The deceased no longer has income after death. One would have to be fairly prescient to predict who the beneficiaries of the deceased person will be and what income category they will fall into in the future, how they will invest that inheritance, etc.

Also, there seems to be a lot of dispute about the incidence of the corporate income tax. What does “overwhelmingly to the wealthy” mean? Does CBPP’s calculation represent a median consensus?

Lots of guesswork in this estimate (as in most of this nature), and I’m pretty sure I know which way the CBPP is guessing.

Vivian Darkbloom: If you think the plan is a lot more progressive if you don’t account of estate taxes, well then look at the JCT analysis (link in post). In other words, your point is non-dispositive. I am pretty sure nobody except maybe Heritage and Mercatus and Mnuchin (the couple) think the plan is progressive.

Menzie,

You didn’t address my questions.

Interesting question and I’m not entirely sure. But recall it is not the income of the deceased that matters but the income of the heirs. I wonder if these analysts have access to the wills of the very old rich people.

pgl It’s been a long time since I took a public finance course, but my recollection is that an estate tax is levied on the estate (not income) of the decedent and the income of the heirs is irrelevant. There are upfront and large exemptions or deductions that are applied before coming up with the portion of the estate that is subject to the estate tax. Very, very, very few estates actually reach this threshold. The estate tax is paid by the estate, not the heirs so it doesn’t matter whether the heir is a billionaire or a homeless person. Note that an estate tax is different from an inheritance tax. And inheritance is windfall income to the heir. Some states have inheritance taxes.

The estate tax is probably the oldest tax around and was a primary source of income for the crown during the Middle Ages. It is also one of the most efficient taxes because it’s difficult to avoid death and the incidence of the tax falls on the dead rather than the living (because death is the ultimate in an inelastic result!). My experience has been that the dead usually don’t complain about taxes. Eliminating the estate tax is economically equivalent to raising taxes on the living. I suspect that both of us would prefer taxing the dead to taxing the living, but there are some weird right wingers who seem to believe they can take it with them.

The usual argument against the estate tax is that it discourages highly productive persons from working and adding value to society. There might be a grain of truth in that, but probably no more than a grain. What’s clearly true is that whatever positive work incentive a reduction in the estate tax might have on the person while still alive, that positive work incentive is more than offset by the negative work incentives a large inheritance creates among the heirs. On balance, eliminating the estate tax will make society less productive over the long run.

The estate tax is levied on the value of the estate—not income. If the estate is not settled within a year, the estate is subject to income tax on its income for the year. This doesn’t allow one to predict with any degree of accuracy the incidence of the tax on beneficiaries. Current law generally exempts gifts and estates from tax on gifts and bequests to “charitable” organisations (similar exemption under individual income tax). This is a much bigger deal, tax-wise, than the doubling of the estate tax exemption. Hard to tell who among the potential beneficiaries of this “loophole” (I’m just having fun playing the rhetoric game here) would benefit the most, but it’s not built into any of CBPP’s models, as prescient as they are, for some strange reason.

CBPP chose to use the JCT model rather than the left-leaning TPC model, presumably because the latter shows more income gains to the lowest quintile than the former. But, TPC’s model was good enough for tacking on the estate tax estimate. Of course, Mercatus and Heritage (who don’t do tax modelling, as far as I know) aren’t the only cherry pickers in the political spectrum, despite Menzie’s implicit assurance to the contrary.

Also, the left-leaning TPC has the following macro-economic estimate regarding the effect of the bill on economic output (based on the House version):

“We find the legislation would boost US economic output by 0.6 percent of gross domestic product (GDP) in 2018, 0.3 percent of GDP in 2027, and 0.2 percent of GDP in 2037.”

That’s ain’t noth’in, especially from the TPC. Of course, the bill increases the deficit and the debt (which naturally will be re-paid, if at all, on the backs of the poor). And, naturally, I suppose, too, all of those gains go to the top 0.1 percent, so that the bottom income groups are still “in the red” (per the above graphic) as a result of this bill.

it is probably not unreasonable to expect, on average, the heirs will behave in a similar manner to the deceased when it comes to money and spending. usually one learns financial habits from ones parents.