From Reuters:

U.S. Treasury Secretary Steven Mnuchin said on Friday he believed the Republican tax cuts will ultimately become revenue neutral over 10 years due to higher growth, but the Treasury will likely ask Congress for more money to implement the plan.

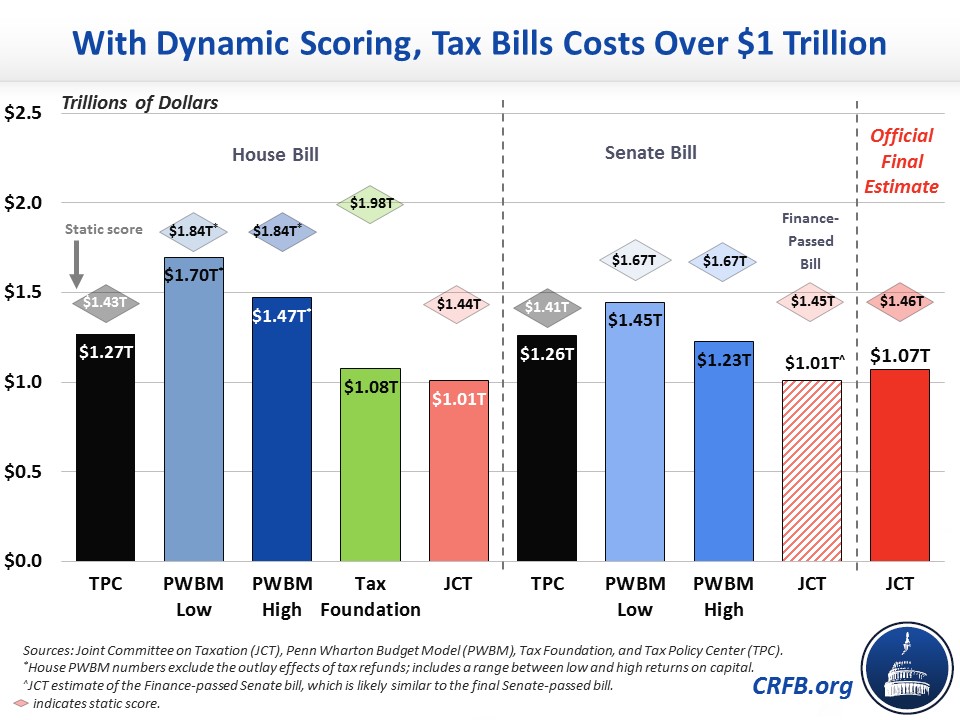

Just to remind readers, the Treasury’s own one-page “study” does not indicate revenue neutrality (insofar as I can understand it). Nor do any of the formal assessments surveyed by CRFB.

Source: CRFB (2018).

Of course, assuming a sufficiently high growth rate will make the numbers add up:

Mnuchin said that for modeling purposes, the plan assumes 2.9 percent annual U.S. growth, but “we do think we can get to three percent or higher.”

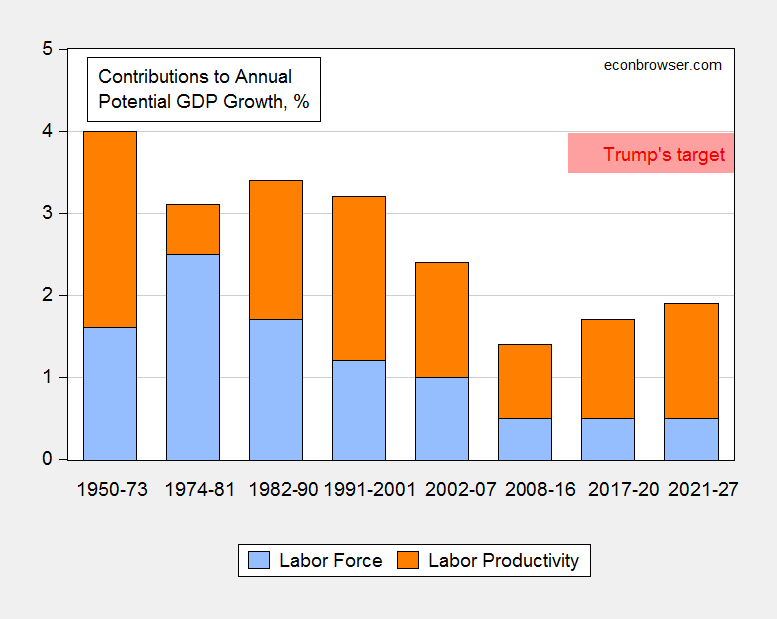

For perspective, here is a graph showing what needs to happen to potential GDP growth in order to get sustained faster growth.

Figure 1: Contributions to annual growth in potential GDP growth, from labor force augmentation (blue bar), and from labor productivity growth (orange bar). DJT’s target of 3.5-4% shown as pink range. Source: CBO, Budget and Economic Outlook, January 24, 2017, Table 2-3; and Trump-Pence website

This is just horrific writing:

”“We think there will be over $1 trillion in growth, so I do think this will pay for itself,” Mnuchin said at an event hosted by the Economic Club of Washington, dismissing estimates from the Joint Committee on Taxation that the tax cuts will increase U.S. deficits by $1.1 trillion to $1.5 trillion over 10 years.’

Is he saying we will see an additional $1 trillion of GDP over a decade? If so, then how does that raise $1 trillion in tax revenues over the same period unless he thinks the tax rate is 100%? Of course there is NO model that predicts an increase in annual GDP equal to $100 billion per year from this tax law change. Not only do we have a Treasury Sec. who lies to us but we have one who flunked basic English.

The corporate tax cut should expand and improve the capital stock, although the capacity utilization rate is too low for a big boost. The demographic shift may be better than expected, particularly with entitlement reform, to bring more people into the workforce.

the simplest solution is boost consumer spending, too bad the 1% have all the cash

Consuming without producing causes too much debt.

PeakTrader: “The demographic shift may be better than expected, particularly with entitlement reform, to bring more people into the workforce.”

So your plan is to cheat workers out of their promised benefits to impoverish them so that they have to work longer? Sounds just like a Republican.

Note that in order to have an effect over the next decade, you need to start cutting people’s earned benefits immediately.

I wouldn’t cheat anyone.

The government already cheated them – just like a Democrat.

PT’s reasoning: using borrowed money to finance a tax cut is a great idea as long as benefits can be reduced enough to offset the borrowing.

In other words, borrowing more money to take less of your money is a great idea as long as spending is reduced to offset the borrowing.

In still other words, borrowing from us to give to you.

PeakTrader I wouldn’t cheat anyone.

People paid FICA taxes that were converted to non-marketable Trustee bonds. Those bonds have been earning interest. The interest earned on those bonds is what is supposed to sustain Social Security recipients after FICA expenditures exceed FICA revenues. The GOP wants to cut the current rate of FICA expenditures. That is exactly equivalent to defaulting on a bond payment because you would be unilaterally pushing out the date of maturity. We know how Mr. Market would react if the federal government defaulted on a bond payment for a marketable security. How would Mr. Market react if the Treasury suddenly announced that 2 year bonds now have a 10 year maturity? Why should it be any different if the government defaults on a non-marketable bond payment? The truth of the matter is that rich GOP donors were only too happy to use the large FICA surpluses to soften the effects of large on-budget deficits resulting from GOP tax cuts. But those same rich GOP donors don’t like the idea of having their income taxes raised in order to pay the interest on those SS bonds. That’s Paul Ryan’s idea of “entitlement reform.” Some might call that cheating bondholders.

slug

I thought you were old enough to remember it was the democrats controlling House, Senate, and executive – President Johnson brought the huge SS surplus into the budget to soften the deficits caused by their democrat War in Vietnam.

Ed

“President Johnson brought the huge SS surplus into the budget to soften the deficits caused by their democrat War in Vietnam.”

Are you just making this up or what? The Social Security system back in the 1960’s was not the same thing as it was in the 1980’s. Data to back up this weird claim?

Ed Hanson Yes, I am (barely) old enough. And LBJ wasn’t wrong in doing so. There are very good macroeconomic reasons for a unitary budget…the deficit to the unitary budget represents the amount of debt that the Treasury has to issue. If the Treasury issued debt for the full on-budget deficit, then this would be extremely contractionary. Off-budget surpluses still count as national saving. For example, if the on-budget side is completely balanced, but the off-budget side runs a surplus, then the net fiscal position is contractionary. There are also good political management reasons for keeping an eye on the on-budget and off-budget accounts separately.

Wow! Another liberal does not know some basic SSA/budget history.

“”On-Budget”-

In early 1968 President Lyndon Johnson made a change in the budget presentation by including Social Security and all other trust funds in a”unified budget.” This is likewise sometimes described by saying that Social Security was placed “on-budget.” ”

https://www.ssa.gov/history/BudgetTreatment.html

Ed Hanson is obviously old enough to remember when Reagan promised to get the government off our backs. He did so by presiding over a 185% increase in the national debt and increasing the federal civilian work force.

The $2.8Trillion debt on the books in 1989 would be equivalent to about $5.8 Trillion today.

Reagan’s deficit spending topped any FY deficit ever dreamed of by “big spender” Jimmy Carter.

This was, of course, the era when real deal conservatives–aghast in 1981 at an approaching $1Trillion debt—decided to finance tax cuts with more borrowed money to prove, once and for all, that spending beyond your means would destroy the economy.

No surprise t see who now supports borrowing more to cut taxes so those who earn more can pay less.

2slugs, again you are wrong. “the deficit to the unitary budget represents the estimated amount of debt that the Treasury has to issue.” You forgot a key word. Monthly Treasury offerings may be significantly different for a variety of reasons too many to discuss here. Accordingly, annual Federal Deficits are often different than the estimated Budget Deficit.

Let’s put some numbers around this debate.

At present, SS + Medicare + Medicaid outlays, net of offsetting revenues, come out at $1.9 trillion for 2017. Total payrolls taxes (which also covers a few additional items) comes in at $1.2 trn. Thus, entitlement outlays are 64% higher than receipts, and that’s in 2017. By 2027, entitlement outlays reach $3.5 trillion, with total payroll taxes of $1.6 trillion, that is, outlays are 113% of receipts.

Now, when people say that they paid into SS and Medicare and therefore deserve the respective benefits, that’s almost true. It’s in fact about 2/3 true. If we reduced entitlements by a third, then beneficiary recipients could rightly claim that they deserved associated coverage.

As we move forward, the situation becomes increasingly problematic. By 2027, entitlement outlays will be almost $2 trn higher per year than corresponding receipts. The CBO finesses this problem 1) by simply posting large deficits (which is not really finessing, I suppose) and 2) by assuming that individual tax revenues achieve average levels seen only one year in the previous sixty. Specifically, the CBO assumes that individual taxes will range 9.5-9.7% of GDP from 2024-2027. Since 1967, individual taxes were at this level only one year — 2000 — in the middle of the dotcom boom. In the high marginal tax days before Reagan, individual tax collections averaged 8.0% of GDP (1967 – 1981). Since 1967 in aggregate, they have averaged 7.9% of GDP. Thus, the CBO’s expectation of 9.5%+ of GDP from 2024 looks unfoundedly optimistic–and keep in mind that was before the current tax cuts.

Instead, it seems far more likely that payroll taxes will be increased, and by a whopping amount. To fully close the gap, FICA contributions would have to be doubled from the mid-2020s. Thus, the current combined payroll tax rate of 15.3% would rise to around 30% of wages, if costs are fully passed through to beneficiaries.

Given political realities, a full pass-through is not likely. However, I think those who plan to be working in the 2020s should anticipate a combined payroll tax rate around 24%, barring any entitlement reform.

Steven Kopits Not quite. Let me help you out. Medicaid, Medicare and SS are three different programs with three very different funding streams. You can’t pretend that they’re all just one big entitlement program. Medicaid is funded out of general revenue. Parts of Medicare are funded through a payroll tax, other parts from general revenue. SS is funded entirely out of FICA taxes. For many, many years FICA receipts ran far in excess of FICA expenditures. The off-budget tables show very large surpluses. Those surpluses went into Trustee bonds, which earned interest. That’s what Reagan’s FICA tax increase was all about. The rationale was that eventually FICA revenues would not be sufficient to cover expenses, and that’s when the Trustees were supposed to cash in those bonds. Currently it is illegal to fund SS from anything other than FICA revenues or Trustee bonds. When conservatives talk about SS going broke, they often mean when FICA revenues are not sufficient to pay for SS expenditures. That’s what Bush #43 meant. They want to forget about those bonds held as SS assets because redeeming those bonds means the on-budget side has to make good on the interest. That’s what this argument is all about. PeakTrader wants to effectively default on those payments and pretend that the Trustee bonds don’t exist.

There may very well come a time (perhaps in the 2030s or 2040s) when the bonds will be exhausted and FICA revenues will not be sufficient to pay promised benefits. At that point Congress will have to either allow actual benefits to be less than promised or Congress will have to change the law to allow general revenues to supplement SS.

Let us not forget that Medicare Parts B&D are also partially paid for by means tested premiums from those who are receiving those benefits (as I am). Too many commenters who are not on Medicare tend to not understand the full funding stream for the program. Parts B&D also have co-pay and Part B a yearly deductible. Anyone who things that Medicare is free healthcare for the elderly is just wrong. Part A, hospitalization, is where one of the problems is as that is not covered by premiums.

I have already allowed for offsets that flow through the US government. (Table 2, line 61 of the CBO June 2017 ten year outlook)

Let’s first dismiss the nonsense of ‘Trustee Bonds’. There are no real assets in the Trustee Bonds, other than promises from one part of the government to pay another part of the government. Payroll taxes have always gone into the general fund.

https://www.heritage.org/social-security/report/misleading-the-public-how-the-social-security-trust-fund-really-works

As for calculations. We can take out Medicaid if you like, and include only SS, Medicare and the heath subsidies associated with Obamacare. In this case, 2017 payroll taxes are $1.16 trillion and outlays (net of offsets) are $1.58 trillion, for a deficit of $416 bn. Thus, payroll taxes cover 72% of outlays. To put it in the terms I used above: Those who think they are entitled to SS and Medicare at current rates, they are about 3/4’s right.

This number deteriorates to a 56% coverage ratio in 2027, with outlays of $2.94 trillion covered by payroll taxes of $1.65 trillion, for a deficit of $1.29 trillion for that year.

Now, if you want to make social insurance programs self-funding, then combined payroll taxes would have to be raised from 15.3% currently to 20.9% this year and on to 27.3% in 2027.

How do you want to pay for this?

The options:

1. More debt. Some may think we should borrow money forever to pay for current expenses. I think that’s outrageous.

2. Increase individual income taxes: Remember, CBO is already assuming effective steady state income taxes rates from 2024 achieved only once in the prior 60 years, even with very high marginal tax rates. That number is much likelier to be lower than forecast than currently anticipated.

3. Increase corporate taxes. Back to 35% we go, but remember, that still leaves your out-year deficits at 5% of GDP.

4. Raise other taxes. These are things like park fees and other miscellaneous income. These averaged 1.7% of GDP from 1967-2016, and are forecast at 1.3% over the horizon. So you have 0.4% of GDP to play with here, theoretically, at least by historical standards.

And that’s it. That’s all the sources of federal revenues, except payroll taxes. So where do you think our fine representatives in Congress are going to turn to fund Social Security and Medicare?

Steve, folks like 2slugs do not want to admit that those “Trustee Bonds” and their interest must be converted to spendable assets. The most common method for Treasury to do that conversion is to issue debt.

The various trust funds are accounting artifacts, and their balances change daily depending on received revenues and expenditures. Accordingly their calculated balance changes depending on whether they are in surplus or deficit.

For some reason some believe these trust funds do not adhere to regular accounting practices. These beliefs are reinforced by misunderstanding of terms like “on/off budget, dedicated revenue streams”, etc. In the end it is just AR/AP accounting.

Steven Kopits There are no real assets in the Trustee Bonds, other than promises from one part of the government to pay another part of the government.

Wrong. Hopelessly wrong. Trustee Bonds are just as real as the marketable bonds held by the public. The Trustees act as agents for retirees, so it’s only trivially true that the bonds represent a claim from one side of government to another side. Would you deny that savings bonds held by the public are assets? There is no difference except that savings bonds are marketable and Trustee Bonds are not. A corporate bond is also just a promise to pay, but no one would deny that corporate bonds are assets. Trustee Bonds represent a claim on on-budget revenues…that makes them an asset. An asset is an asset. And I’m pretty sure that if the Treasury defaulted on a Trustee Bond the reaction in the markets would be the same as if Treasury defaulted on a marketable bond. A default is a default.

I agree that at some point we may very well have to find new ways to fund SS; but that is irrelevant as to whether or not Trustee Bonds are real assets. Part of the problem is that Reagan replaced PAYGO with PAYFORWARD, and that changed created some long term imbalances. It got Reagan off the political hook, but it created long run problems.

Come now, Slugs, you’re smarter than that.

“Trustee Bonds are just as real as the marketable bonds held by the public. The Trustees act as agents for retirees, so it’s only trivially true that the bonds represent a claim from one side of government to another side. Would you deny that savings bonds held by the public are assets?”

Bonds issued by the Treasury are also marketable bonds. So what?

If the Trust held bonds from third parties, for example, corporate bonds or German government bonds, then, absolutely, these would be real assets. A promise from the US government to pay the US government holds both the liability and asset side of the equation. It is ultimately backed by the taxing power of the government. There is no call on third parties, only on the parties issuing the debt, that is, ultimately the US taxpayer.

That’s exactly why we speak of ‘debt held by the public’ as opposed to gross government debt. When the Trust sells its bonds, debt held by the public will go up pro rata. That simple, and you know that.

You know, name calling is all fine and good — and I am speaking to everyone here — but the numbers are out there on the CBO website. They are very nicely organized and easy to work with. They show the key assumptions, and provide easy access to the historical comps. Whatever ideology you may have, it all starts with the numbers.

In a political sense, I think Peak Trader is also a

peak xxxhole.

I’m only a reflection of the people I reply to.

Yep – the classic definition of a troll. Me? Time to just ignore your Trump tweets.

Peak, and they don’t realize they get what they sow. Living in a perpetual state of anger drives them to express themselves accordingly.

CoRev, they remind me of someone who can’t get more money out of the ATM machine. So, they bang on it hoping money will come out.

Then, they blame it on “the rich.” So, they go after them, but the rich have other ideas than being fleeced.

Or, when their line of credit is maxed out and no money comes out of the ATM, they’re ready to go into the bank and beat up the manager.

PeakTrader You’re the one who supported another $1T being added to the debt, remember? So just who is it that’s banging on the ATM machine? Look in the mirror. Democrats like to tax and spend. Republicans just like to spend.

Suggestion: You might want to change your moniker from PeakTrader to FreeLuncher.

Slug

Again I wonder if you are old enough to remember Obama’s Trillion dollar deficits but not over ten years but every year for 4 years.

Ed

Ed Hanson: Don’t think the full-employment or structural budget balances under Obama were the same as the projected full-employment budget balances under Trump/TCJA. But you can go to CBO website and download appropriate data to prove me wrong.

Menzie

Of course they were not the same. They were huge and highly ineffective for what was promised and expected. Eight years of government getting bigger and more intrusive. What did we get, eight years of pathetic GDP growth. Trump turned it around in one year despite being fought tooth and nail by the entrenched forces of government and those who live off it.

Ed

Ed Hanson writes this:

‘I thought you were old enough to remember it was the democrats controlling House, Senate, and executive – President Johnson brought the huge SS surplus into the budget to soften the deficits caused by their democrat War in Vietnam.’

I just checked the Federal finance tables from the Economic Report of the President. The Federal deficit did jump in 1968 due to the Vietnam War – which was continued by Republican President Richard Nixon (Johnson was trying to bring this war to a close in 1968 but certain Republicans in the State Department undermined his efforts to help Nixon win).

The off-budget surplus was less than $3 billion in 1968. Clearly Ed Hanson will tell any lie for partisan purposes. Check his spin each time.

PGL, instead of claiming others are spinning, look in a mirror. You claimed: “The off-budget surplus was less than $3 billion in 1968.” You appear to be deliberately misrepresenting (spinning) with that claim.

Ed was talking about the SS surplus. SS is only part of the “off budget” total. You just made the total/unified budget deficit worse.

BTW Johnson’s budget accounting change did not take effect until FY69. (Highlighted just to remind you Ed was correct.)

I am aware of the accounting. Not the point. The point was Ed claimed this was a huge offset. I noted it was less than $3 billion for 1968. That is not as large as Ed suggested. Either you do not know how to read or you are misrepresenting the discussion.

To be clear – I led with:

“President Johnson brought the huge SS surplus into the budget to soften the deficits caused by their democrat War in Vietnam.”

The SS surplus was not “huge”. I’m assuming CoRev realized that this was the point which means he is just spinning. But maybe I’m wrong and he cannot read past the first 4 words quoted.

PGL, tsk, tsk. You characterized the issue as: “The off-budget surplus was less than $3 billion in 1968. ” Apparently you consider a $3B deficit offset as not huge for 1968. Obviously you are so accustomed to $1T+ budget deficits under Obama that that cutting single digit $B deficits by $3B as insignificant (not huge).

You really should have read my SSA reference. Had you, you would have seen this: “As an illustration of the problem, the projected fiscal 1968 budget was either in deficit by $2.1 billion, $4.3 billion, or $8.1 billion, depending upon which measure one chose to use.”

You are still spinning!

CoRev thinks Ed’s claim that Social Security’s surpluses back in the day was correct with this line:

“BTW Johnson’s budget accounting change did not take effect until FY69. (Highlighted just to remind you Ed was correct.)”

Like Ed – CoRev provides no data so let me:

https://www.ssa.gov/oact/STATS/table4a3.html

The Social Security surplus varied and at times was negative between 1965 and 1980. As I noted, it was only 0.25% of GDP in 1968 but it did temporarily rise to 0.5% of GDP in 1969 before declining. For the entire period, its averaged only 0.2% of GDP. No CoRev – Ed’s claim is wrong. Try consulting with the real data next time.

My error. The average SS surplus over this period was only $0.33 billion per year which was only 0.02% of GDP. Now if Ed and CoRev wants to tell us 0.02% is “huge” – be my guest.

PGL, you are still spinning. Stop it! Why limit your comparison to just the US GDP, when world-wide numbers were available? Neither are related to the discussion re: the US Budget Deficit.

BTW, how does your comments re: GDP relate to anything Ed and I have said? Do you dispute the claim of implementation in 1969 that you quoted from me?

It looks like the Republicans plan is three basic stages to get the economy back on track.

Stage I: Business-friendly policies, including lower corporate taxes, to raise capital spending and make the U.S. more competitive internationally, and deregulation. Much of this has been implemented in 2017.

Stage II: Infrastructure spending and immigration reform, towards high skilled workers. This is expected to take place in 2018.

Stage III: Entitlement reform beginning after the 2018 election.

I stated before, regarding entitlement reform, I’d promote work through less entitlement spending. For example, Social Security benefits starting at 68 with a minimum $1,500 a month and freezing any cost of living increases for several years, if individuals are expected to receive over $2,000 a month. Require only catastrophic employer health care insurance and allow savings accounts for all other health care needs. So, consumers can shop around to reduce costs. Tighten eligibility for food stamps or limit it for two months (children living in parent’s basement are no longer eligible).

Infrastructure spending! If the plan is to encourage federal-state matching, it will be interesting.

The recently enacted 12cents/gallon gasoline tax here in California to rebuild transportation infrastructure is under fire from (you guessed it) Republicans who are currently conducting a statewide campaign to repeal the tax.

Among the repeal leaders are big Trump supporters.

So….if the administration provides all funding, great. If not, the Trump repealers–if successful– will be anti-Trumpers who will have to come up with another plan. Brilliant!

PT: do you honestly believe your entitlement reform proposals would be popular in the Midwestern Rust Belt states and in Kentucky and West Virginia, especially since Trump promised no change(s) to Social Security and Medicare? Even more so in areas throughout these regions where large numbers use Medicaid, SSI, and SNAP, where large numbers of retirees and near retirees have little in the way of pensions or retirement savings?

I think, poor people would be happy receiving a minimum $1,500 a month in Social Security at 68. And, they’d be happy with much lower health care prices for everyone, because that allows a stronger safety net. If people are able to work, they should – it would be good for them, the country, and their children. The explosion in entitlement spending is unsustainable. It crowds out other government spending, and it will crowd out economic growth, to make everyone poorer than otherwise.

I would’ve also like to see a higher minimum wage – a subsistence wage – for poor people 21 and older, including older poor people working beyond 65 to supplement their Social Security (studies suggest workers over 65, e.g. 65 to 74, are more productive than workers 16 to 24), I would’ve liked to see the Democrats involved to add a higher national minimum wage to the tax cut, but that’s the way politics go, on both sides.

Entitlement reform your style sounds like you want the people in the old folks home to have to go back to work. I guess Wal Mart can provide walkers for their cashiers.

PGL Good luck discussing anything the least bit mathy with CoRev. He struggles with logarithms, is befuddled by basic time series econometrics, doesn’t know that the derivative of a constant is zero and likes to think he understands the physics of climate but couldn’t solve a coupled differential equation if his life depended on it.

You are so right here. CoRev’s latest on my noting that Ed’s claim that the Soc. Sec. surpluses were huge was to question why I took the actual data (averaging a mere $330 million per year) as a ratio of GDP over the same period (that ratio being 0.02%). C’mon man – can the right wing trolls be more pathetic?

PGL & 2slugs, it obvious who won the argument when the dialog shifts to personal attacks.

the argument devolves into insults because you are too stupid to understand the math corev. in the past, he lost an argument and used an online complaint forum as evidence for his position! if a liberal stated the grass is green, corev would argue with him. Incessantly.

pgl

So you don’t like the use of the word huge. So be it. It could be defended but it makes no difference. The point was to respond to slug who implied that it was repubs who use that trick to use the “large FICA surpluses”. Use of SS surplus is now part of normal government budget and has since since Johnson and the democrat Congress in the 60’s.

Ed

Ed Hanson During the Bush 43 years the off-budget surpluses were huge…on the order of 1.5% of GDP.

Exactly my point. Thank you.

2slugs & pgl, making meaningless points to just hide your own ignorance? Pgl tried to show how small was the SS surplus, and 2slugs makes the opposite point. Both used the GDP for a meaningless baseline comparison when the subject was the Federal Budget. Pgl also was ignorant of which president made the change.

C’mon man – can the left wing trolls be more pathetic? It leaves one wondering, is it subject ignorance or deliberate obfuscation?

Ed Hanson Use of SS surplus is now part of normal government budget and has since since Johnson and the democrat Congress in the 60’s.

No, LBJ simply formalized what was a macroeconomic fact. Let’s go over this again for the slow learners. The unified budget deficit tells you how much public borrowing the Treasury has to do through auctions. From a macroeconomic perspective that is relevant because the size of the auctions can affect the interest rate. It does not matter whether LBJ formally recognized the unified budget or not; the fact is that the financial markets always operated using a unified budget deficit. Formally calling the facts on the ground by the name “unified budget” fooled no one who understood how financial markets operated, but apparently it fooled you because you seem to think it’s a big deal.

Let’s work through an example. Suppose it’s FY1967 and we don’t have something called a unified budget. The on-budget deficit is $100B and the off-budget surplus is $25B. How much does the Treasury have to borrow from the public? Answer: $75B. Suppose it’s FY1969 and LBJ just created something called a unified budget and the on-budget deficit was $100B and the off-budget surplus was $25B. How much would the Treasury have to borrow? Answer: $75B. See what’s going on here? You can wish away the phrase “unified budget” and it doesn’t make a damn bit of difference how much Treasury has to borrow. The only thing that the term “unified budget” accomplishes is that it fools people who don’t understand what’s going on. It was a P.R. job that hid the true costs of the Vietnam war from folks who were easily fooled; but it made no difference to the macroeconomics. Are you trying to tell us that you were easily fooled by LBJ?

Use of SS surplus is now part of normal government budget and has since since Johnson and the democrat Congress in the 60’s.

It always was. It didn’t just start in the late 60s. LBJ just gave it a name.

Please take a course in public finance.

2slugs, what a hypocrite! In your earlier response to Steven Kopits you claimed: “(SS) Trustee Bonds are just as real as the marketable bonds held by the public….) to his claim: “There are no real assets in the Trustee Bonds, other than promises from one part of the government to pay another part of the government.” You then went on to compare Federal assets held by the public while ignoring to whom the (SS) Trustee Bonds were booked, SS another part of the government intra-governmental assets.

You then go on to confuse terms: “Use of SS surplus is now part of normal government budget and has since since Johnson and the democrat Congress in the 60’s.

It always was. It didn’t just start in the late 60s. LBJ just gave it a name.”

Again you mix terms – (operational) with budgetary use. Johnson started use calculating the budget deficit for in the budget creation process, while you imply they this was not a unique/new use.

You have consistently confused budgeting (planning) with operations (expenditures).

slug

So you are saying that the statement “The truth of the matter is that rich GOP donors were only too happy to use the large FICA surpluses to soften the effects of large on-budget deficits resulting from GOP tax cut”

is completely irrelevant, and historically misleading. That was my point.

Edd