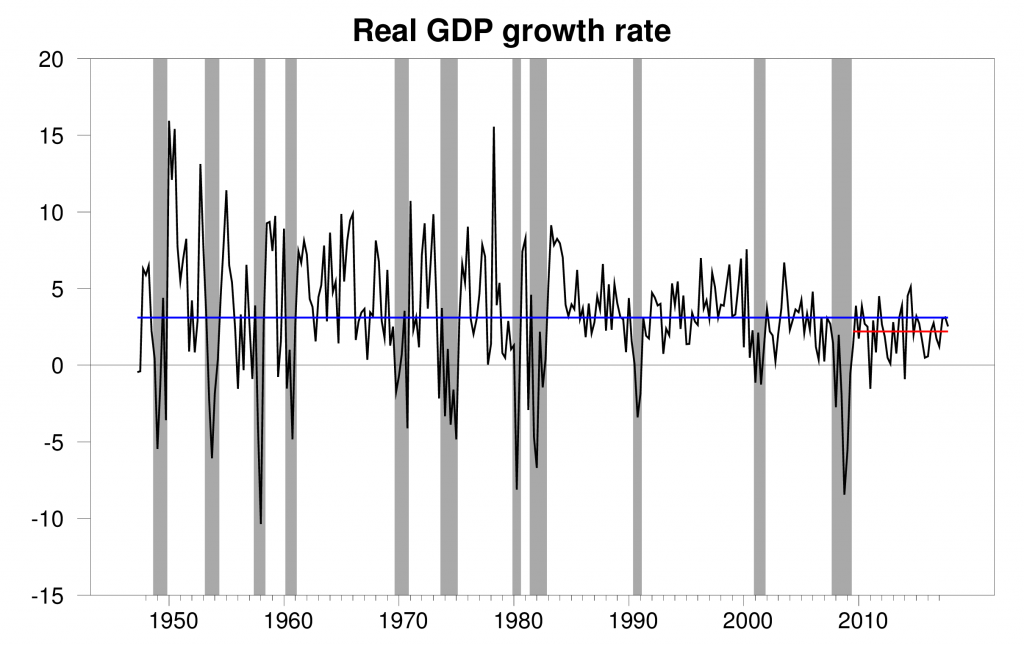

The Bureau of Economic Analysis announced today that U.S. real GDP grew at a 2.6% annual rate in the fourth quarter. That is better than the 2.2% we’ve seen on average since the Great Recession ended in 2009, though below the historical average growth rate for the U.S. economy of 3.1%.

Real GDP growth at an annual rate, 1947:Q2-2017:Q4, with the 1947-2017 historical average (3.1%) in blue and post-Great-Recession average (2.2%) in red.

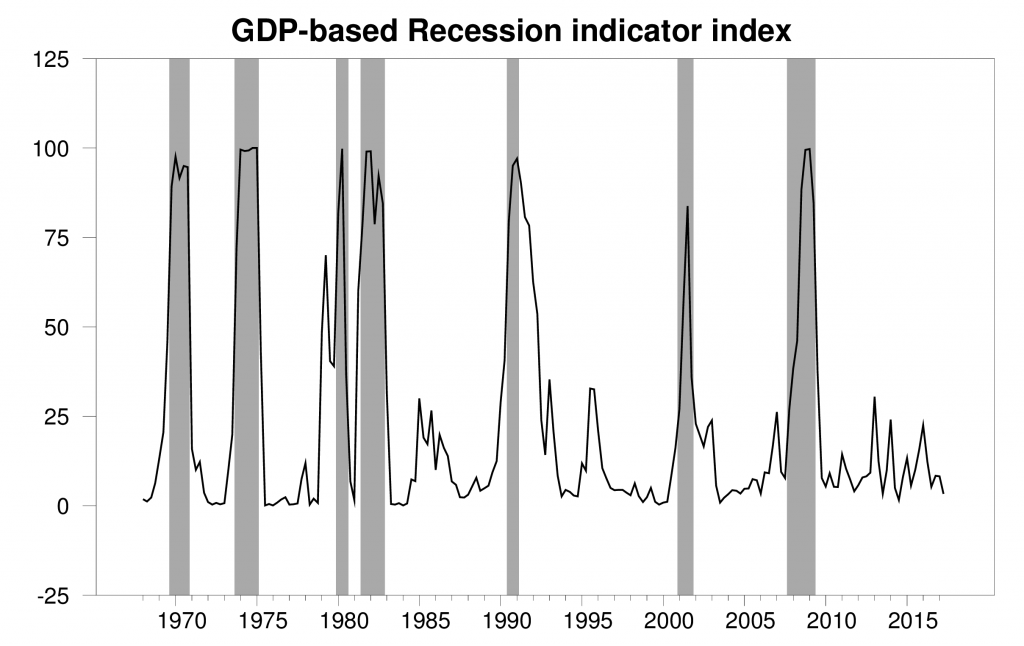

Solid growth over the last three quarters has brought our Econbrowser Recession Indicator Index down to 2.4%. The U.S. remains clearly in the expansion phase of the business cycle.

GDP-based recession indicator index. The plotted value for each date is based solely on information as it would have been publicly available and reported as of one quarter after the indicated date, with 2017:Q3 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index, and which were sometimes not reported until two years after the date.

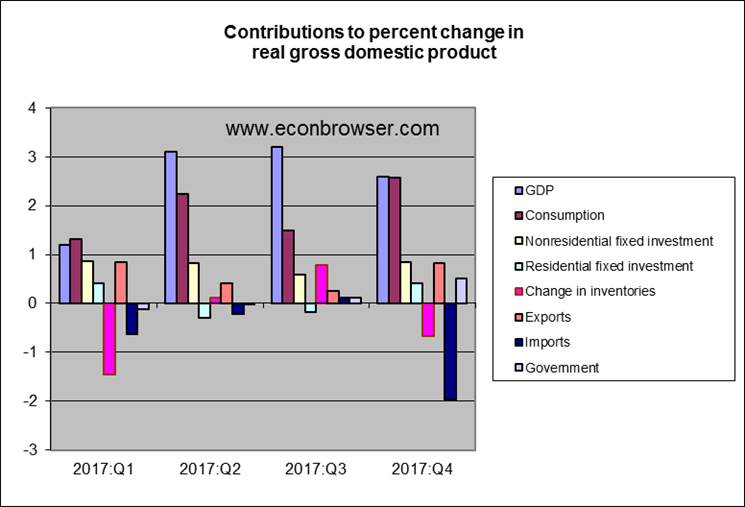

Consumption spending, residential and nonresidential fixed investment, and government purchases all grew strongly during the quarter. However, much of the new spending went to imports, whose growth ended up subtracting two percentage points from the annualized growth rate that would have resulted if all the new spending had been on domestically produced goods and services. Some of the spending also went on goods sold out of inventory (goods sold but not produced), which subtracted another 0.7% from the annualized growth rate.

Imports and inventories are the two most volatile components of GDP, often changing from one quarter to the next, and indeed estimates of these two numbers for the fourth quarter could change as we receive better data. Overall, I conclude that solid economic growth continues.

It looks like government spending added about half a point more than it did over the first three quarters.

Mainly from a rise in defense spending. We also had strong growth in fixed investment.

Indeed, more government spending, but the interesting number is imports which had a significant suppressing effect on GDP. What should be interesting over the next decade is any impact the corporate tax structure has on imports versus domestic production. Perhaps none; perhaps some.

Just a reminder. Since the Great Recession while real GDP growth averaged some 2.2%, real output of the non-farm business sector averaged 2.75%.

So it is really easy for the economy to realize 3% growth. All it needs is for government spending to grow rather than contract.

… or for businesses to take advantage of the new tax structure and begin investing in America. https://www.bizjournals.com/albuquerque/news/2018/01/30/energy-giant-plans-to-triple-production-in-permian.html?ana=yahoo&yptr=yahoo

Does Paul Krugman know this? He actually won a Nobel Prize in economics and informed us markets would never recover from Trump winning the Presidency.

He has updated this post – pay attention before launching such an assault.

A few days after the election Krugman stated “There’s a temptation to predict immediate economic or foreign-policy collapse; I gave in to that temptation Tuesday night, but quickly realized that I was making the same mistake as the opponents of Brexit (which I got right). So I am retracting that call, right now. It’s at least possible that bigger budget deficits will, if anything, strengthen the economy briefly.”

see: https://mobile.nytimes.com/blogs/krugman/2016/11/11/the-long-haul/?referer=

Additionally, Krugman is a Laureate due to his research on international trade.

see: https://www.nobelprize.org/nobel_prizes/economic-sciences/laureates/2008/press.html

He also replied he should not have said this in the heat of the moment. how come you forgot to mention this?

NT, but he did say it, and it was woefully wrong. Moreover, it is a demonstration of the error(s) prone due to the Trump Derangement Syndrome (TDS).

Yes, he did say it. And unlike “never admit a mistake” conservatives, he quickly corrected his mistake, apologized for it and offered it as a lesson learned for his readers. I’m still waiting to hear Barro et al. admit they were very, very wrong.

Curious as to why aggregate growth numbers are used (corrected for inflation of course), as opposed to per-capita.

And while on the number set – why is it that 1947 to current is preferred since we do have reliable data going back to at least the rise of the modern economy.

SecondLook We do have data going back to 1870, but it’s not terribly reliable. And it’s actually GNP rather than GDP. If you’re really interested in learning more, there are a few old papers by Christina Romer that discuss the history of national income accounting. One focuses on the really bad data covering the 1920s and how it has caused all kinds of bad research covering the 1920-1921 recession. http://www.nber.org/papers/w2187 Another paper looks at GNP data going back to 1869 through World War I. http://www.nber.org/papers/w1969

A solid report overall. Thanks, Jim.

Currently, GDPNOW shows 3.4% real growth in the quarter. Maybe, it’ll be revised upwards. Rising oil prices may help.

Perhaps, we’ll get strong growth in Q1 ‘18 with oil prices continuing to rise and the positive reaction to the Trump Christmas tax cuts, from repatriation, wages, bonuses, benefits, capital spending, and foreign investment.

“the positive reaction to the Trump Christmas tax cuts, from repatriation, wages, bonuses, benefits, capital spending, and foreign investment.”

The Trump machine never rests.

Pgl, another TDS sufferer, denies the obvious.

Peaky’s alleged cause and effect is obvious? Let’s see – I took my umbrella with me on Tuesday and it rained. I caused the rain. Had I left the umbrella at home – New York City would have had no rain. It’s obvious!

Patient Zero of TDS is Trump himself.

It should be noted, after the long-wave bust in 1973-82, where average annual real growth was 2.02%, we had 4.38% average annual real growth in 1983-89. Real GDP growth continues to move away from the long-run trend that began in 1947 – real GDP was $3 trillion below that long-run trend in 2017. Perhaps, we’re close to a turnaround.

In 2008-16, annual real growth averaged 1.51%.

There isn’t much of a business cycle, since 2009. It’s just slow and steady growth.

https://www.advisorperspectives.com/dshort/updates/2018/01/26/q4-gdp-advance-estimate-real-gdp-at-2-6

Ah, 1983-1989: years of then- record deficits, the decade when the national debt nearly tripled. Spring forward to 1993,and you complete a 12 year period when the national debt quadrupled.

Who can forget the conservative motto of the time : free trade, freer markets. Those were the days!

Noneconomist, I responded to your statement before. Reagan cut taxes and raised defense spending resulting in strong growth and winning the Cold War. Reagan did not get the promised spending cuts from the Democrats. After winning the Cold War, we got a peace dividend, in the ‘90s. Carter deserves credit for being a fiscal conservative. We didn’t max out borrowing, because debt to GDP was less than 40% under Reagan. The peace dividend reduced it. Chart:

https://fred.stlouisfed.org/series/FYGFGDQ188S

Also, the Information Revolution peaked, along with the Baby-Boomers, in the late ‘90s, when actual output exceeded potential output.

What makes you think we are not still in the information revolution? It is still peaking today. The amount of information we create, process, consume and transmit today is beyond what those in the 90’s ever imagined.

I didn’t say the Information Revolution is over – I said it hit a peak in the late-‘90s – it’s on its way to another peak.

The Information Age did not hit a peak in the late 90’s. that would mean there was a drop at some point, and then a new climb. That did not really occur. The Information Age has really been on a coninual climb with little/no pull back. The only thing you can say about the late 90’s is that it was higher than the early 90’s. don’t confuse the stock market dot com bubble with what has been happening with the world of data over the past few decades.

(1) Reagan cut income taxes. Reagan also raised FICA taxes. Reagan also undid his disastrous 1981 tax “reform” with a much better and revenue neutral (and true) tax reform in 1986.

(2) The debt held by the public as a percent of GDP almost doubled during Reagan’s 8 years. It would have increased more if it had not been for two important facts. Fact 1: the nominal debt held by the public actually tripled during the Reagan years despite higher FICA taxes offsetting much of the additional on-budget borrowing. Fact 2: debt held as a percent of GDP is partly a function of the inflation rate. Back in the 1980s we still had some pretty high inflation numbers, so a lot of the debt as a percent of GDP was inflated away.

(3) Reagan’s role in ending the Cold War was marginal at most. Most of the credit goes to the Pope, Solidarity, Gorby (although unwittingly), the Hungarian government, and a confused East German politician who made the (very Trumpian) mistake of speaking extemporaneously on live TV. Reagan’s main contribution came with the Iceland meeting and deploying Pershing II missiles. The rest is myth.

2slugbaits won’t give much credit to Reagan, including for the V-shaped recovery, strong sustained growth, and of course, the Pope won the Cold War.

With no increase in defense spending – we would have had a decade long recession? Even conservative Greg Mankiw disagrees with this bonkers statement. His first text book on macroeconomics noted how the Reagan fiscal stimulus dramatically increased real interest rates crowding out investment and lowering long-term growth. This is in fact the standard Solow model applied to the real world.

Peaky – you love to lecture others for not understanding economics but it is you that needs to learn the basics.

PeakTrader Mankiw also wrote a well known paper in which he introduced readers to the Debt Fairy. And don’t forget that even Martin Feldstein admitted years later that the Reagan deficits were indefensible.

You’re confusing diminishing marginal returns on capital investment with crowding-out, which typically happens when an expansion is well underway and when the output gap is closed. The Solow model supports everything I stated. Actually, real interest rates fell throughout most of the ‘80s, although they were at relatively high levels:

https://ycharts.com/indicators/us_real_interest_rate

Tax cuts and defense spending are expansionary fiscal policy, which helped create the V-shaped recovery. Stronger growth raises inflation and interest rates, and taxes should be raised to slow the expansion to a sustainable rate. I suggest, you learn more than one textbook in Macro 101.

winning the Cold War.

Saudi Arabia opened the spigots in late 1985 to retake control of OPEC. It worked(costly though 2-3T). Side effect, the USSR collapsed

That is an interesting observation. It is one I hadn’t heard before and is supported by Putin’s behavior after the increase in oil prices.

Peaky loves to cherry pick numbers this way. Let’s see – we were at the bottom of a deep recession at the end of 1982 and at full employment by the end of his short period of time. Now if he took the growth rate over the 12-year period where Reagan and Bush41 were in the White House, the growth rate would have been only 3%. As opposed to near 3.5% for the 30 years before and 3.6% for the Clinton years.

But will this reality ever show up in Peaky’s cherry picked statistics? I doubt it.

The desperation of pgl (and others) to dispute conservative comments strikes again. Peak shows a chart of deficits, and pgl shifts attention to “the (GDP) growth rate”. Pgl, can you be any more obvious?

I’m sorry but your latest is incoherent babbling.

Pgl has a oversimplified explanation for everything, by ignoring wars, higher defense spending as a percent of GDP, less U.S. competition, while Europe and Japan rebuilt, the poor U.S. economic performance in the ‘70s after the poor economic policies in the ‘60s, etc..

The Reagan Revolution facilitated growth. We had the longest peacetime expansion in history under Reagan, until the Bush 41 expansion from 1991-01. Clinton was moderate and pragmatic. With the GOP Congress, we had strong growth in the late ‘90s. Bush 43 added to the long boom with the mild 2001 recession and more growth on top of the 1982-00 boom. It should be noted, trade deficits began to increase under Reagan and reached 6% of GDP under Bush 43. The U.S. was consuming more than producing in the global economy, which subtracted from U.S. GDP. Interestingly, the Obama expansion, that began in 2009, may end up being the longest expansion. Unfortunately, it’s a very depressed expansion.

“Pgl has a oversimplified explanation for everything”.

Seriously? Pot calling the kettle black!

“The Reagan Revolution facilitated growth.”

Note my comment above to what Greg Mankiw wrote. Just the opposite and he clearly articulated the standard economics for this period. I know he charges $300 for his books but you really need it. My earlier offer to buy his text for you is still on the table.

No other country produces such a crappy first estimate of GDP. OUr first release down under is the same as your send estimate for good reason.

No other country uses annualised estimates. Clearly 3.4% is not 2.6% which Jim now reports.

Good to see JIm is now producing work that is comparable to other countries

I’m still wondering why JDH, whose hair was on fire warning about the dangers of $1 trillion in government spending in the depths of the recession, has not said a peep about $1.5 trillion in tax cuts for the rich at the top of the cycle. Is that what they call pro-cyclical fiscal policy?

Nothing left to burn?

Why do you disingenuously say the tax cuts for the rich? Online estimators suggest I’ll save $5K. I’m not rich.

Also, it’s 1.5T over ten years, not over 3 like the money Barry pissed away.

obama spent money to get out of a hole bush presided over, with high unemployment. donny is giving away trillions at full employment, which obama provided.

Sometimes hard to recall what candidate Ronald Reagan said in 1976 about relying on increasing deficits “The fact is, we’ll never build a lasting economic recovery by going deeper into debt than we very have before.”

He was talking about big spender Gerald Ford, whose 1976 budget called for borrowing $95 Billion, virtual chump change , of course, during Peak Trader’s chosen glory years from 1983-1989.

“He was talking about big spender Gerald Ford, whose 1976 budget called for borrowing $95 Billion, virtual chump change , of course, during Peak Trader’s chosen glory years from 1983-1989.”

During the 1975 recession Ford was not only running around with those stupid WIN buttons (tight money to Whip Inflation Now) but he also wanted to cut government purchases. I would say he was a goof ball but the supply-side crew that entered the White House in 1981 was even dumber.

The WIN button actually stood for “Wilbur Is Naughty”. He and Fanny Foxy ended up in the Tidal Lagoon in that era.

Could be that the more the fake-news mob is increasing its Trump-bashing, the more economic activity will increase and improve. Hey, I have found a new correlation Menzie !

Anyway, hats off for the first Trump year, achieved a lot and lots of persistence.

PeakTrader 2slugbaits won’t give much credit to Reagan, including for the V-shaped recovery, strong sustained growth, and of course, the Pope won the Cold War.

You need a history lesson as badly as you need an econ lesson. Let me suggest that the Fed’s policies might have just a wee bit to do with that V-shaped recovery. It was the Fed who raised interest rates to slow down the economy and it was the Fed who lowered interest rates after taming inflationary expectations. The “sustained” part of the Reagan years was okay, but not spectacular. The big increases in GDP occurred at the very beginning of the recovery…the right half of that “V” shape.

You also forgot that I did give Reagan credit for the 1986 tax reform. That was a well designed piece of legislation that made a lot of economic sense. It was also a 180 degree reversal of what guided the disastrous 1981 tax bill.

And yes, the Pope along with the Grim Reaper meeting aging, original Bolsheviks in the Politburo had a lot more to do with ending the Cold War than St. Ronnie.

“You need a history lesson as badly as you need an econ lesson. Let me suggest that the Fed’s policies might have just a wee bit to do with that V-shaped recovery. It was the Fed who raised interest rates to slow down the economy and it was the Fed who lowered interest rates after taming inflationary expectations.”

Finally an accurate statement of what drove the economy in the early 1980’s. Reagan’s CEA in 1982 were actually advising that the White House make a deal with the FED to reverse the fiscal stimulus that Peaky lauds. Alas, the staff at the CEA which included Paul Krugman and Lawrence Summers notes no one else in the Reagan White House had any clue about the role of monetary policy. Apparently Peaky still has no clue.

2slugbaits and Pgl, read my statement above why you need more than one Macro 101 textbook.

Dude – I have published articles on international macroeconomics in referred journals. Your publications are where? A comic book? I suggested you start with a Principles text. Maybe once you grasp the basics, you can move on to Intermediate texts. But one thing is clear – you have no clue what the Solow growth model is about. Which is OK as your leader (Trump) does not want real economists – just cheerleaders like you.

The Fed tightened the money supply to reverse high inflation, which caused a severe recession. Then, eased the money supply in the recession. Tax cuts, defense spending, and deregulation resulted in powerful growth. Consequently, the Fed tightened the money supply again and Reagan raised some taxes.

And, what 2slugbaits and pgl don’t understand is it’s easy for the Fed to tighten the money supply and cause a recession. What’s not easy is easing the money supply to get out of a recession – it’s like pushing on a string – people need a reason to borrow, even with low interest rates. Reagan provided reasons, including optimism.

“What’s not easy is easing the money supply to get out of a recession – it’s like pushing on a string”.

What a silly comment – yes this applies to an economy in a liquidity trap. I guess you have no clue what interest rates were during the Reagan years. Even in real terms, they were quite high. Which of course is what one would expect after a massive fiscal stimulus. What part of reality has failed to sink into your thick skull?

PeakTrader The Solow model supports everything I stated.

Have you ever actually read Solow’s paper??? It doesn’t sound like it. Key to understanding the Solow growth model is recognizing that the economy must follow the balanced growth path (BGP). Ever hear of the Inada condition? Go work out the phase diagram. In the Solow model each variable must grow at the growth rate of output per worker and changes in the growth rate are determined entirely by changes the rate of technological progress. An increase in savings can lead to temporary capital deepening and a level increase in output, but it cannot lead to an increase in the growth rate. But yet you are forever blathering on about how Trump’s “supply side” tax cuts are going to increase the growth rate through capital deepening, blah, blah, blah. Instead of the neoclassical BGP model in Solow, you seem to be advocating a deliberately unbalanced growth path. If you and El Presidente really want to increase the growth rate (as opposed to a one time level shift), they let me suggest raising taxes to better fund higher education.

2slugbaits, I responded to your assumptions many times before. GDP has been moving away from the post WWII trend – it’s now $3 trillion a year below that trend. We need to replace the aging capital stock and expand capital spending, which will boost productivity. Also, we need to attract more people into the workforce. A higher minimum wage, in itself, will also boost productivity. We don’t need more waiters with college degrees – we need above average growth, for several years, to reach potential output. GDP = Consumption + Saving. Trillions of dollars of output disappeared, since 2009, and it’s just “blah, blah, blah” to you.

“We need to replace the aging capital stock and expand capital spending, which will boost productivity.”

To the degree tax cuts for the rich will lead to the rich consuming more, this will mean less national savings and hence less investment. Which delays the replacing of the aging capital stock. What part of this simple reality does Peaky not get? It seems all of it.

“Also, we need to attract more people into the workforce. A higher minimum wage, in itself, will also boost productivity.”

Peaky is going to get in trouble with Bannon and Trump once they figure out what this entails.

Pgl, I can not find the reference now, but in the past hour I saw a headline December US capital investment up 2.9%. What’s the multiplier on this investment?

PeakTrader You’re the one who introduced the Solow growth model into this discussion, remember? I’m simply pointing out that you don’t understand it. The Solow model is about the long run steady state…you could think of it as modeling potential GDP over the long run. Over the short run the economy will deviate above and below potential; that’s why God created aggregate demand oriented macro alongside neoclassical models. Replacing an aging capital stock would be a good thing…indeed, maintaining breakeven capital stock is one side of the balanced growth equation in the Solow model. But that’s a level shift, not a change in the growth rate. It’s far from obvious that the Trump plan is a good way to accomplish the goal of increasing productivity. Killing NAFTA and TPP doesn’t help productivity. Slapping tariffs on washing machines doesn’t help productivity. Subsidizing coal at the expense of solar doesn’t help productivity. Scrapping net neutrality doesn’t help productivity. Praising businesses for handing out unconditional bonuses doesn’t help productivity and doesn’t lead to more capital deepening. Adding a trillion to the debt when the economy is already at or very near full employment doesn’t help productivity and doesn’t help national saving. Pissing away $25B for a “beautiful” wall to keep workers out doesn’t increase economic growth. Not everything in the Trump tax “reform” is bad (there are a few good things), but most of it is just godawful. It’s 1981 all over again.

The time to argue for larger deficits and increased government spending was when the economy was going off the cliff and interest rates were stuck at the ZLB. That time has long passed. At this point it’s time to focus on gradually shrinking the deficit and allowing the Fed to manage aggregate demand. And of course, if we still have an independent Fed that’s exactly what they will do. It’s pretty hard to imagine an independent Fed not reacting to Trump’s fiscal stimulus.

This is the type of analysis one produces when they complete a junior phd. They know just enough to be dangerous, but not enough to be competent.

And, if you believe those vectors now reflect balanced growth, you believe potential output steeply declined, since 2009, to where $3 trillion a year in output disappeared.

Peaky has reverted to bald faced lying:

“The Solow model supports everything I stated. Actually, real interest rates fell throughout most of the ‘80s”

Real rates before the 1980’s were 2% but then jumped to 7% during the Reagan-Volcker tug of war. OK by the end of this night mare they were 5%. So is Peaky telling us that 5 is less than 2?

I guess he has never learned the Solow growth model. The predominant effect after the 1981 tax cut was that the national savings rate fell from 10% of NNP to only 5% of NNP. If Peaky thinks a fall in the national savings rate leads to higher long-term growth, it is no wonder he flunked economics.

Seriously Peaky – please stop this intellectual garbage as it only embarrasses your mother.

2slugbaits,

Thanks for replying.

I was under the impression that BEA data on GDP was reasonably solid from 1929 on (and perhaps old-fashioned in assuming the more data the more robust the math). I assumed that using the 1947+ set was more based on the notion of focusing on the post-war era than anything else.

However, still puzzled by what I think is a bit misleading in not using per-capita GDP growth rates. It should be very obvious that changes in population growth rates have and will increasingly have an impact on overall economic conditions. And especially meaningful when comparing growth rate among countries.

It’s amusing to see liberals so angry at how incredible the Trump economy is.

“how incredible the Trump economy is”

Really? Let’s see, the average over the last 8 years (2010-2017) has been 2.2%. The 2017 number comes in at 2.3%. Economic growth for 2017 was about middle of the pack. Growing, but pretty much what it’s been doing since the end of the Great Recession. BTW, 2017 was the first year since 2010 that federal government spending actually increased year-over-year. The only thing I find “incredible” is the inability of some folks to look up basic BEA data.

slug

Generally your statistics are excellent, but the current 2017 annual GDP growth comes in at 2.5%. (1.2, 3.1, 3.2, 2.6 = 10.1 / 4 = 2.25%). I suspect you are using Federal fiscal year numbers, and if so you should make that clear. But that also puts approximately the first half and the greatly lower half squarely on the previous administration responsibility.

Ed

No, I am using the annual data from BEA, not the average of their four quarters. When you use BEA data you have the option of selecting quarterly data expressed as an annualized rate or the actual annual rate.

Whenever I see average I want to see if something (peaks/valleys) is being hidden. Yup! There it was: “2017Q1 3.3 1.2, a carry over from the Obama policies. Under Trump policies we have:

2017Q2 4.1 3.1

2017Q3 5.3 3.2

2017Q4 5.0 2.6

A 2.7% average for Trump policies. That’s 0.5% higher than Obama’s average. BTW, the President submitting the 2017 budget was Obama. Did Obama suggest the federal increase? Dunno, just wondering. Trump’s 1st preliminary budget was released in March 2017 and formally released in May.

Hmm! that must mean the economic carnage of the Obama years is ended.

DJIA 1/30/09: 8000

DJIA 1/20/17 20093

Unemployment 12/09 9.9%

Unemployment 12/16 4.7%

Unemployment 12/17 4.1%

Finally, with the emergence of Trump, our long national economic nightmare is over with unemployment down one half of one percent in a year’s time.

Yes, special mention of the strong market uptick. So far.

nonec

Lets do a little analysis of your dates you picked and the Dow. Lets assume the Dow is forward looking. It is. And when did the Dow see certain information to base the forward look on. That would be election day. So looking at election day dates:

2008-11-04 9625.28

2016-11-08 18332.74

inaugatation dates Dow difference —-12093

election dates Dow difference ———— 8707

That,s well over a 3000 point difference from the dates you chose. I submit the dates of election are a better choice when looking at the forward looking Dow.

So while not carnage, the Obama years were, in comparison, some what slow compared to the Dow response since Trump election day.

Ed

Well, Ed, at what point in 2008 did the Dow move up? Correct. It never did .

On 1/04/08, the Dow was a bit over12800. By Election Day, it had fallen 24% and, sadly, went lower still after Inauguration Day. You would have a point if there had been any correction and any upward movement in that year-long plus dive. Didn’t happen.

By the time Bush left office, the Dow had lost a third of its value from the preceding year. And it didn’t bottom out until months later.

If you wish to do so, feel free to calculate the percentage increase from that low to Election Day, 2016.

BTW, it’s normally rather difficult to compare eight years with one-plus.

Something else, Ed. You neglected the fall of the Dow, which began in October, 2007 when the it hit 14164. The plunge did not stop until March 2009 when it bottomed out at 6507. By the time Obama was elected, the Dow already lost a third of its value. Less than two months into his first term, the Dow had plummeted 52%!

Though I’m neither an economist nor even a semi-skilled mathematician, I’d say that the 170%+ rise in the Dow from March 2009 until election day, 2016 was not too shabby.

Speaking of carnage…the spike in interest rates isn’t doing much for the market.

There are those, slug, including the Trump apologists on this blog, who seem confident the market will continue to repeat its current gains over a four or an eight year period. While such would not disappoint investors–even minimal ones like me–I would be personally satisfied with that much discussed baseline 8%/year that would-be financial advisors are always yapping about achieving, if only you’ll allow them access to your investments.