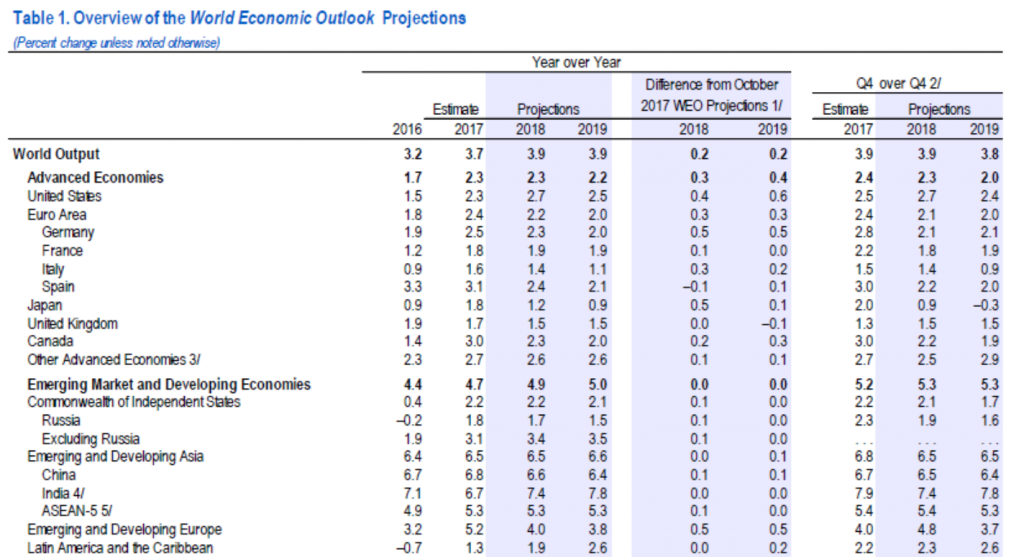

The IMF released an update to WEO today:

Source: IMF, WEO (January 2018).

From the report:

- Buildup of financial vulnerabilities. If financial conditions remain easy into the medium term, with a protracted period of very low interest rates and low expected volatility in asset prices, vulnerabilities could accumulate as yield-seeking investors increase exposure to lower-rated corporate and sovereign borrowers and less credit-worthy households. As noted in the October 2017 Global Financial Stability Report, the share of companies with low investment-grade ratings in advanced economy bond indices has increased significantly in recent years. Non-financial corporate debt has grown rapidly in some emerging markets, calling for a policy response. The Chinese authorities have made a welcome start by recently tightening the regulation of non-bank intermediation. Credit risks on these exposures may be hidden while near-term global growth momentum is maintained and refinancing needs remain low. The absence of near-term warning flags, in turn, may reinforce yield-seeking behavior and amplify the buildup of financial vulnerabilities that come to the fore over the medium term.

Interesting to me is this non-financial threat:

- Inward-looking policies. Important long‑standing commercial agreements, such as NAFTA and the economic arrangements between the United Kingdom and rest of the European Union, are under renegotiation. An increase in trade barriers and regulatory realignments, in the context of these negotiations or elsewhere, would weigh on global investment and reduce production efficiency, exerting a drag on potential growth in advanced, emerging market, and developing economies. A failure to make growth more inclusive and the widening of external imbalances in some countries, including the United States, could increase pressures for inward-looking policies.

This point takes on heightened relevance in light of this article from The Hill, Battered in 2017, trade may face Trump’s full wrath in 2018:

At the end of one year of President Trump, one could conclude that the trading system, while somewhat battered, remained intact.

However, risks of trade actions are higher this year for three reasons. First, various political considerations that stayed Trump’s hand on trade no longer exist, in particular the focus on repealing the Affordable Care Act and passing corporate tax cuts.

Second, the Section 232 process has been finalized, and the Section 301 process will conclude shortly, creating a legal basis for action. Third, there is a growing political imperative for Trump to show more aggressive trade action.

…

Chances of Trump pulling the U.S. out of NAFTA are higher. Trump sees leaving NAFTA as a clever negotiating tactic that could force Mexico and Canada to agree to U.S. demands. This could be bluster, as he did not mention NAFTA withdrawal in his January 2018 speech at the American Farm Bureau Federation’s convention.

Pursuing such a strategy could lead to the end of NAFTA. …

We could be too US centric here so let me note that they are saying China is expected to continue with real growth near 6.5% while India expects 7.5% growth. Not that this means Indian policy is even more amazing than Chinese policy. Last I checked, India’s income per person was really low compared to China’s income per person with the latter being lower than what we see for the “advanced” nations. So the implications of the 1957 Solow growth model – as simple as its assumptions are – still hold.

Now to the US and Trumpian nonsense. Let’s see – we have decided to give a huge tax cut to rich people who are likely to spend on a lot on Rodeo Drive in LA or the shops on 5th Avenue in Manhattan. Which means lower national savings – which per the Solow model means slower long-term growth. I guess Trump’s so called economic advisers have never heard of Solow’s seminal contributions.

@pgl

Chinese government officials are strong believers in truth-telling. https://twitter.com/doumenzi/status/955056940668760065

All jokes aside, Chinese province officials’ job is apparently to wave around pom-poms in a self-conscious fashion (“Is Xi ‘Winnie-the-Pooh’ Jinping looking at my pom-poms?!?!?!?”) https://d1u4oo4rb13yy8.cloudfront.net/article/63506-kybkgitrig-1500444937.jpg Out of sheer fear of being sacked by the politburo, and/or have other provinces’ leaders’ lies look more impressive than their own lies. The politburo’s job is to make the national numbers look semi-realistic so as not to make national expectations too high and then fall short.

I thought India might want to give China a TRUE (“true” here meaning objective and empirical numbers) “run for their money” (no pun intended) when they hired Raghuram Rajan as their central bank chief. But apparently Mr. Rajan was interested in keeping a VERY stable and consistent growth rate, and Indian officials were interested in self-adulation.

There are number of possibilities here as i read it. The IMF area tad more bullish then the Fed and if correct would mean interest rates rising further and quicker than expected.

However as you correctly point out there are a number of issues concerning trade that impede policy.

Thus far no policy advisor has pointed out to Trump how ban mercantilism actually is.

Also important ins the fact Trump has no idea on how to make a deal. He only knows how to break good ones.

This could mean heaps of volatility.

You people are much closer to the action than I so I am interested to inquire of how the mid terms would affect such policy measures. That is will it increase volatility or decrease it?

There are many things I find frightening about the VSG’s policy and the VSG’s judgement (or absence thereof). But his international trade policy isn’t one of them. There are too many vested interests, and there’s going to be too much pushback from farmers (conglomerate and small) for him to enact these trade policies. He’ll just give enough lip-service to it, to give joy to his illiterate political base.

The part I find worrying (exclusive to this IMF statement) is this part: “in the October 2017 Global Financial Stability Report, the share of companies with low investment-grade ratings in advanced economy bond indices has increased significantly in recent years. Non-financial corporate debt has grown rapidly in some emerging markets, calling for a policy response.”

We have seen how the Republican party has done it’s damnedest to destroy both the SEC and the CFPB, even though the CFPB has been shown to be OVERWHELMINGLY popular with financial consumers. https://www.nytimes.com/2017/08/31/business/consumer-financial-protection-bureau.html

The CFPB has given small household consumers (with otherwise very little power) an “inoculation” to make them safer from being royally F*cked over (sorry Menzie, there really is no alternate verb here) by banks and insurance companies. Of course Republicans don’t like the CFPB, popular with voters or NOT, as Republicans earnestly feel it’s their “God-given right” to F__K over the little guy.

Trade war! Trade war! Trade war! [Chanted with enthusiasm]

(Hey guys! Do ya think I would qualify for that stand-in part on a Trump-sponsored reality show?)

Canada is less wealthy, per capita GDP is much lower. That does not mean that Canada is more vulnerable.

I would guess that Canadian workers are politically more willing to take a hit when it comes to playing Chicken with NAFTA than American workers. Canadian negotiators know that American special economic interests — the ones that do well by NAFTA — can apply significant pressure to the President and the Republican party. And then some Canadians, well a few at least, want less protection for farmers and silly restrictions on foreign investment and control gone (e.g., Telecom). Wanna play ‘Chicken’? Come and get it.

Mexico is the only country in Latin America that has deep-seated anti-American sentiment of psychotic proportions. It is or certainly can be self-loathing. Any hint of humiliation and I would expect Mexico to become rather intransigent.

Our tribe? We all love real time economic experiments and a few of us are sympathetic to the notion of supplying thesis research material to econ grad students for the next decade or two. Our tribe first, n’est-ce pas?

This is going to be so darn exciting. In the interim, it is interesting to see a number of fund managers overweighting resource sectors and emerging markets.

@Erik Poole

You’ve got my vote for the stand-in part in a Trump show or political rally. Just bash out 4 or 5 of your own front teeth, get a quickie lobotomy, and bring a badly spelled cardboard sign that reads something like this: https://b- i.forbesimg.com/peterjreilly/files/2013/06/govoutofmedicare6.jpg or you can try this one, a personal favorite of Pat Buchanan’s http://silencedmajority.blogs.com/.a/6a00d834520b4b69e2017ee8b477c8970d-pi

This was a well written story in the January 22 hardcopy NYT, related to Canada and trade. America has this tendency to think we are the only ones suffering on trade issues (i confess to falling into that trap myself sometimes)

https://www.nytimes.com/2018/01/21/world/canada/peterborough-nafta-manufacturing.html

A long U-shaped depression and recovery is unnecessary. With appropriate fiscal policy and other economic policies out of Washington, most, if not all, of the output gap would’ve closed by 2011 and the economy would’ve settled at a lower real GDP growth rate around 2.5% annually, compared to average annual GDP growth of 3.37% over the long boom in 1982-07.

We needed a big tax cut, in 2009, rather than the small and slow tax cuts, to strengthen household balance sheets, which would’ve also strengthen the banking system. Moreover, the federal government spent and squandered too much money. Furthermore, we added too many regulations, including Obamacare and Dodd-Frank, which reduced discretionary income and made it harder to borrow, along with too many regulations in many other industries.

That is, 3.37% real GDP growth in 1982-07.

The U.S. could’ve reemerged as the powerful main engine of global growth, if the federal government refunded U.S. consumers to allow the spending to go on, rather than spend, squander, and strangulate.

“The U.S. could’ve reemerged as the powerful main engine of global growth”.

I’ll skip the rest of your latest as it is still ignoring the basic bang for the buck aspect of fiscal stimulus that you keep getting backwards. Let’s say the US took more of the lead in terms of expanding world aggregate demand. Our large current account deficit would have been even larger.

Lord – I do wish even the most basic aspects of macroeconomics would seep into Bottom Feeder’s comment but by now I must admit that I am asking the impossible.

bottom feeder provides the same cut and paste passage on every blog entry. the talking points are easy to follow for the weak minded, even if they are contradictory. peaktrader is an unhappy failed banker looking to find blame in somebody other than himself.

Negative name caller/complainer #2 jr, you’re the contradiction wanting to help people. Obviously, the weak minded didn’t learn anything. Look in the mirror to see who failed the entire banking system – you should be happy shifting blame.

peak, if you had completed a phd you probably would not resort to the copy and paste talking points, but actually provide legitimate solutions rather than contradictions. as a failed banker you helped to tank the us economy. you have done enough damage. please fade into the background.

We should have had more fiscal stimulus in 2009 indeed so welcome to the liberal side but this is just backwards:

“We needed a big tax cut, in 2009, rather than the small and slow tax cuts, to strengthen household balance sheets, which would’ve also strengthen the banking system. Moreover, the federal government spent and squandered too much money. ”

No – we should have had MORE federal purchases and we relied too much on low bang for the buck tax cuts. We have been over this before. And as usual – Bottom Feeder forgot to pay attention.

China is not an economy India should follow.

What the Chinese do best is corruption, crony capitalism, misallocate resources, cause negative externalities, prevent creativity, create inefficiency, and export much of its GDP.

GDP = Consumption + Investment + Government + Net Exports.

We know consumption is low (falling from 45% to 36% compared to about 70% in the U.S.) and malinvestment is high. Government doesn’t provide much of a safety net. However, it exports much of its GDP.

India has lower income per capita than China and yet its income inequality is more pronounced. I thought everyone knew this but not Bottom Feeder. Could you please learn even the most basic facts before writing any more of your usual nonsense?

Here’s what James Fallows said about China:

James Fallows studied American history and literature at Harvard, where he was the editor of the daily newspaper, the Harvard Crimson. From 1970 to 1972 Fallows studied economics at Oxford University as a Rhodes scholar.

January/February 2008

Through the quarter-century in which China has been opening to world trade, Chinese leaders have deliberately held down living standards for their own people and propped them up in the United States. This is the real meaning of the vast trade surplus—$1.4 trillion and counting, going up by about $1 billion per day—that the Chinese government has mostly parked in U.S. Treasury notes. In effect, every person in the (rich) United States has over the past 10 years or so borrowed about $4,000 from someone in the (poor) People’s Republic of China.

Any economist will say that Americans have been living better than they should—which is by definition the case when a nation’s total consumption is greater than its total production, as America’s now is. Economists will also point out that, despite the glitter of China’s big cities and the rise of its billionaire class, China’s people have been living far worse than they could. That’s what it means when a nation consumes only half of what it produces, as China does.

Neither government likes to draw attention to this arrangement, because it has been so convenient on both sides. For China, it has helped the regime guide development in the way it would like—and keep the domestic economy’s growth rate from crossing the thin line that separates “unbelievably fast” from “uncontrollably inflationary.” For America, it has meant cheaper iPods, lower interest rates, reduced mortgage payments, a lighter tax burden. The average cash income for workers in a big factory is about $160 per month. On the farm, it’s a small fraction of that. Most people in China feel they are moving up, but from a very low starting point.

This is the bargain China has made—rather, the one its leaders have imposed on its people. They’ll keep creating new factory jobs, and thus reduce China’s own social tensions and create opportunities for its rural poor. The Chinese will live better year by year, though not as well as they could. And they’ll be protected from the risk of potentially catastrophic hyperinflation, which might undo what the nation’s decades of growth have built. In exchange, the government will hold much of the nation’s wealth in paper assets in the United States, thereby preventing a run on the dollar, shoring up relations between China and America, and sluicing enough cash back into Americans’ hands to let the spending go

James Fallow is a journalist – sort of like Thomas Friedman. Journalists write a lot of uninformed nonsense. I’ll take the word of economists like Menzie Chinn over the bizarre writings of journalists any day. But do continue to find us more of your wonderful disinformation!

what is your point peak? stop the copy and paste without a point.

His point is simple. Stephen Moore is only in 2nd place re the dumbest person alive.

Damn, let’s try that link again https://b-i.forbesimg.com/peterjreilly/files/2013/06/govoutofmedicare6.jpg. I may be an honorary guest at the next Trump rally based on my typing skills.

Does the dude carrying that sign even know what Medicare is? That is almost as dumb as this line from Peak Trader as he continues his campaigning for tax cuts for the rich:

“average annual GDP growth of 3.37% over the long boom in 1982-07”.

I guess Peaky forgot we had a massive recession after Reagan got his tax cut. And it seems we got another tax cut 20 years later and it appears Peaky is not aware of the 2001 recession.

Why no comments on upwardly revised growth?

Negative name caller # 1 – pgl – obviously, likes to provide lots of tidbits of nonsense and irrelevance.

The U.S. had up to $800 billion a year trade deficits in the mid-2000s at full employment. U.S. consumers exchanged dollars for foreign goods and foreigners exchanged dollars for U.S. Treasury bonds. Thanks to the selfishness of the federal government pgl bows to, not enough dollars were refunded to U.S. consumers to allow the spending to go on.

More babbling from the bot? I get the sense that your mission in life is to make Stephen Moore look smart and honest by comparison. On that score – you are so an admirable job.

Obviously, your mission in life is to make things up and provide an endless supply of negative comments.

The country suddenly is underproducing by over $1 trillion a year, since 2009. Trade deficits shrunk partly from weaker U.S. growth and partly from importing less oil, thanks to the fracking boom. The U.S. has become a less powerful engine of global growth, pulling the rest of the world’s economies. Negative name caller #1 – pgl – and negative name caller/complainer # 2 jr – Baffling – seem to believe people should be poorer.

“The country suddenly is underproducing by over $1 trillion a year, since 2009.”

Yes – our failure to listen to Christina Romer was a mistake. Funny thing – she advocate a lot more fiscal stimulus via government purchases. YOU on the other hand want to CUT government spending. Stephen Moore is smiling as he is no longer the dumbest person alive!

For someone, who assumes others are dumb, you’ve shown no good reasons why you’re not. Robert Barro correctly predicted the result of the 2009-10 spending spree.

barro did no such thing.

Could be that the more the fake-news mob is increasing its Trump-bashing, the more economic activity will increase. Hey, I have found a new correlation Menzie !

Anyway, hats off for the first Trump year, achieved a lot and lots of persistence.