As I prepped for final lectures in my macro policy course, I generated these graphs.

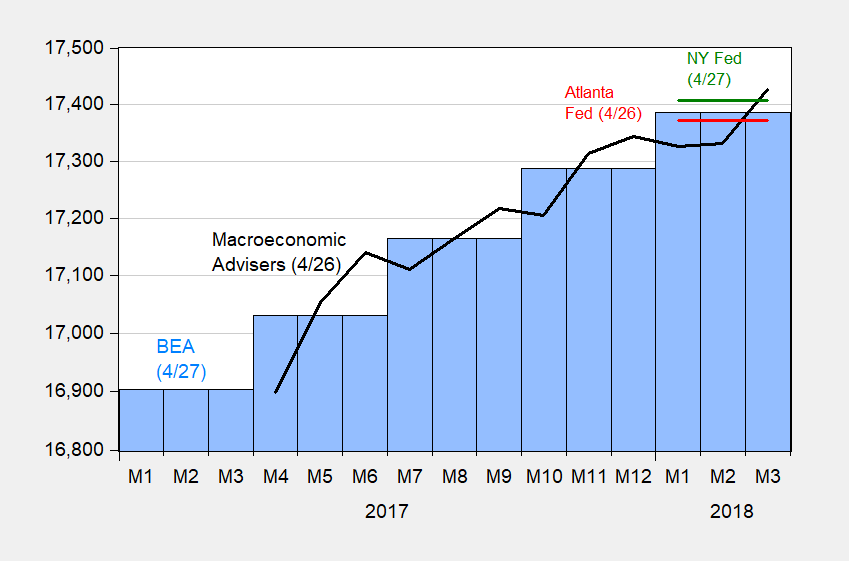

Nowcasting the US Economy:

Figure 1: Reported GDP (blue bars), Atlanta Fed GDPNow (red), NY Fed nowcast (green), and Macroeconomic Advisers (black), all in billions Ch.2009$ SAAR, on log scale. Source: BEA 2018Q1 advance; Atlanta Fed (4/26), NY Fed (4/27), Macroeconomic Advisers (4/26).

See Jim’s recent post on the advance release.

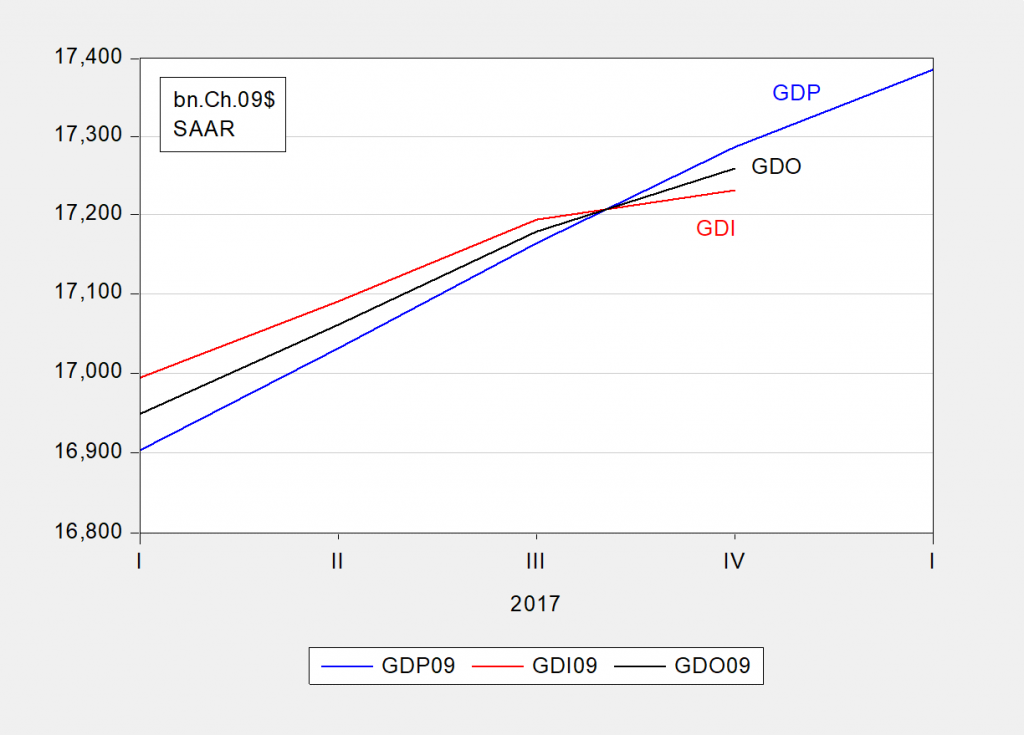

Tracking GDP using GDO:

Furman (2016) notes the fact that GDO better predicts GDP than lagged GDP.

Figure 2: GDP (blue), GDI (red), GDO (green), as average of GDP and GDI, all in billions Ch.2009$ SAAR, on log scale. Source: BEA 2018Q1 advance.

The fact that GDO growth is lower than that of GDP is suggestive for what 2018Q1 will be revised to.

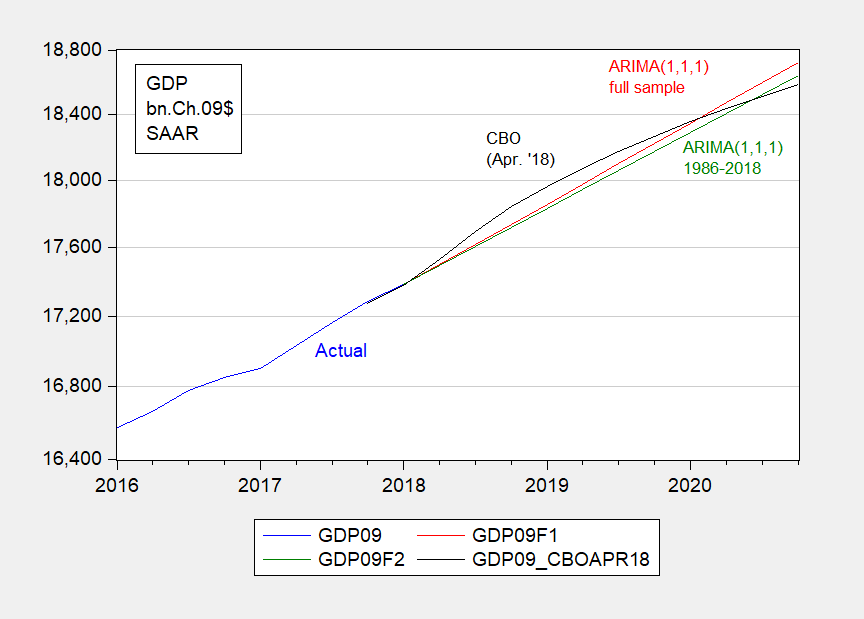

Conditional vs. Unconditional Forecasts:

Figure 3: GDP (blue), ARIMA(1,1,1) dynamic forecast over 1967-2018Q1 (red), ARIMA(1,1,1) dynamic forecast over 1986-2018Q1 (green), CBO projection (black), all in billions Ch.2009$ SAAR, on log scale. Source: BEA 2018Q1 advance, CBO Budget and Economic Outlook (April 2018), and author’s calculations.

CBO conditions on the Tax Cut and Jobs Act (TCJA) and new budget, so the trajectory of output is higher — for the most part — than dynamic forecasts from simple time series models that are unconditional. Obviously, with slower growth in era of the Great Moderation, the ARIMA model estimated from the post-1986 period implies a lower path.

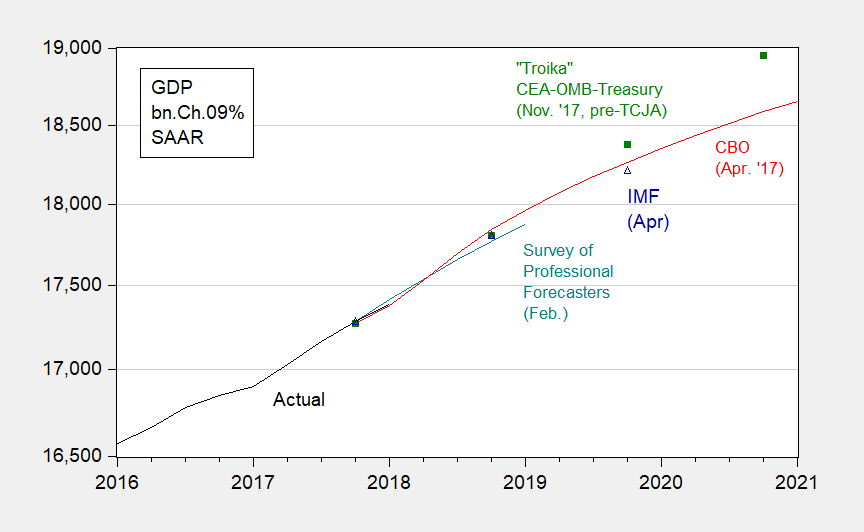

Which One of These Is Not Like the Others?

Figure 4: GDP (black), CBO projection (red), Survey of Professional Forecasters median from February (teal), CEA-OMB-Treasury (green squares), IMF World Economic Outlook (dark blue open triangle), all in billions Ch.2009$ SAAR, on log scale. Source: BEA 2018Q1 advance, CBO Budget and Economic Outlook (April 2018), Philadelphia Fed Survey of Professional Forecasters, IMF World Economic Oultook, and author’s calculations.

All the conditional forecasts match up over the short term. Starting by the end of 2019, the Administration estimate (by the Troika of CEA, OMB, and Treasury) starts to peel away from the others. Why this occurs can be traced back in part to differential assumptions regarding productivity growth. If you want to consider the plausibility of the Admninistration view, one might want to consider that the Troika forecast does not incorporate the massive tax cuts and relaxed spending constraints.

No Recession Right Now. Probably.

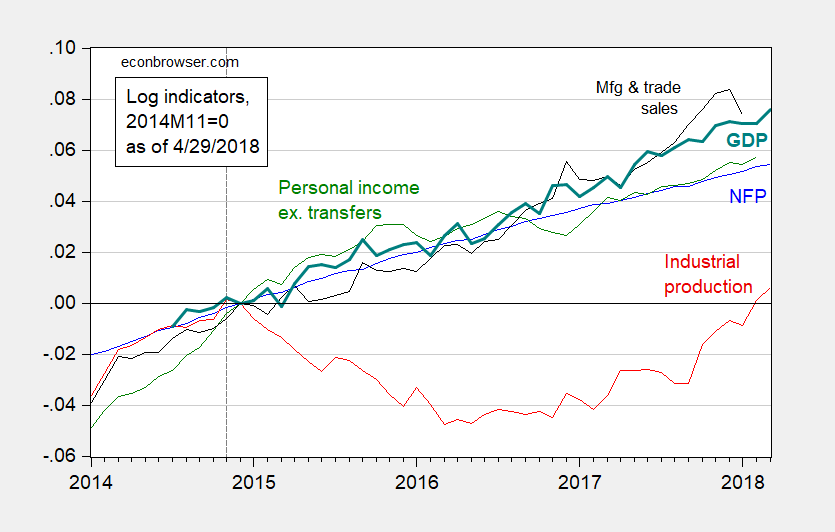

The NBER Business Cycle Dating Committee (BCDC) has in the past paid special attention to four key macro indicators, as well as the Macroeconomic Advisers’ monthly GDP series. Figure 5 displays these five variables, normalized on the recent peak in industrial production.

Figure 5: Log nonfarm payroll employment (blue), industrial production (red), real personal income excluding current transfers (green), real manufacturing and trade sales (black), real GDP (bold teal), all normalized to 2014M11=0. Source: FRED, Macroeconomic Advisers, and author’s calculations.

With most of the indicators rising (manufacturing and trade sales is the only declining at last report), an ongoing recession is unlikely. However, one should never “pull an Ed Lazear” and declare no recession.

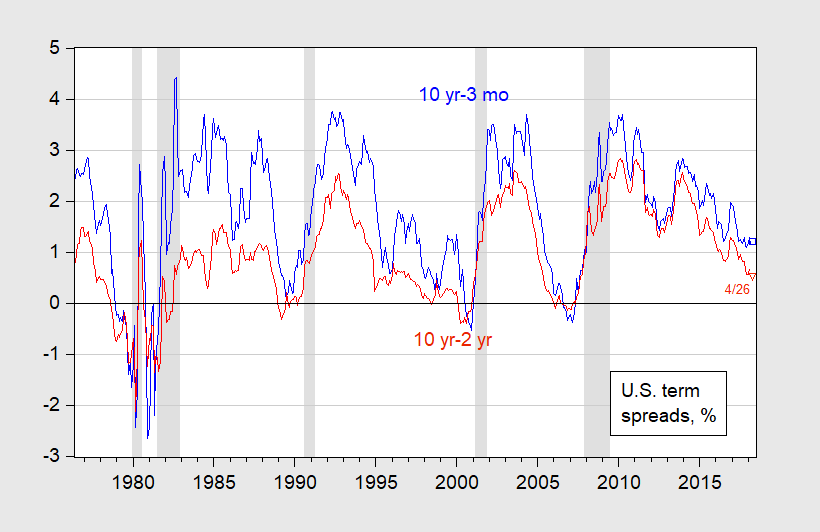

The Yield Curve Predicts…

Figure 6: Ten year constant maturity minus three month T-bills in secondary market spread (blue), Ten year minus two year constant maturity spread (red). April observations for 4/26. NBER defined recession dates shaded gray. Source: Federal Reserve via FRED, and author’s calculations.

A simple term spread regression implies roughly 15% probability of a recession in 6 months (see Chinn and Kucko, 2015). More on spread models in this March SF Fed Economic Letter, Econofact.

“With most of the indicators rising (manufacturing and trade sales is the only declining at last report), an ongoing recession is unlikely. However, one should never “pull and Ed Lazear” and declare no recession.”

There is no recession. No collusion. No collusion. I think this is what Trump wakes up every morning chatting!

“A simple term spread regression implies roughly 15% probability of a recession in 6 months.”

Another way to look at this is to check how far along the economy was in past expansions when the yield curve slope fell to its low in the current expansion. The past nine expansions were only 35% of the way through, on average, when the curve slope, defined as the month-average 10 yr. minus the month-average 1 yr., first fell to 0.70% (which is the low for the current cycle, reached in Dec. ’17, with April ’18 still higher at 0.72% at last check). At the median, past expansions were only 27% complete when the slope fell to 0.70%.

Although we don’t have as much data for 10s minus 2s, the results weren’t materially different (average was 34% of the way through an expansion with a median of 30%, checking those expansions against the April ’18 low which looks like it’ll come out to about 0.49%).

These results don’t contradict your 15% 6-month probability from a Probit, but they seem to make it clearer that there’s really no information yet in the current yield curve as far as predicting the next recession.

Here’s the analysis for anyone interested;

A Contrarian Look at the Great Yield Curve Scare

@ Nevins

It still fascinates me, how many folks (I tend to think of them as “the ZH crowd”, although there are other cult-like outfits taking this stance) expect the economy to magically turn around after arguably the 2nd worst recession this country has ever known. QE is not a “pro-growth” strategy. QE is not the way to get your GDP up to 3%+ per year. Certainly not when you have an obstructionist Republican congress who refuses to do any fiscal policy for a President, solely on the basis that that President has dark skin and their one goal is to make his job a living hell.

Bernanke has never presented QE as “a long-term growth strategy”. It was the one choice left over after a Republican congress decided they had no interest in performing their jobs. There are others such as Mario Draghi who have done the exact same thing as Bernanke. Draghi (a former member of Goldman Sachs) could hardly be presented as “a bleeding heart liberal”. But to save the Euro periphery countries from German and French banks hypocritically seeking “their pound of flesh” and to save a continent from neo-Nazi contagion, Draghi did what had to do.

Let’s please cut this conservative crap of blaming men who saved us from “W” Bush’s fecal matter that “W” left on the White House toilet seat for President Obama to clean up. No one would have done the QE or even asked for the QE, if the two wise monkeys “W” Bush and Henry Paulson hadn’t played the old Republican game as regards banks and financial “intermediaries”—see no evil, hear no evil, speak no evil.

Wow, this reply makes no sense in relation to anything I’ve written, nor are the words in quotes that the author purports to refute sourced from my work, nor do the political insinuations synch up with my voting record, and yet it’s addressed to me. Makes you wonder where people like this come from.

@ Nevins

Earth. Join us. The sane will have world domination….. someday.

Huh, quite a good comeback. Unexpected after the earlier b** s*** crazy comment.

Solid work! Particularly using the current yield spread as a benchmark to show how far away recessions were in prior expansions from the month when the spread was this benchmark number in those expansions. Caveat: not to be caught up in or rely upon this single indicator. Especially since the underpinnings of the consumer sector, due to debt and secondarily to anemic income, has never been weaker in the history of this country.

Menzie

Very nice overview, but not what those here want to hear; which is you.

What do you think first quarter GDP will be revised to?

What will 1018-2020 GDP and GDP Growth be?

Can unemployment get below 4% and sustain?

Will deficit 2018-2020 be as predicted or surprise larger or smaller?

For what my economic thinking is, far as it is from yours, good economic thinking is good economic thinking.. Different approaches well founded and thought out brings enlightenment to the subject. I have always been impress with your prognostication and outlook. But you are a cautious economist, and its like usually like pulling teeth to get you to make the big macro predictions.

Please.

Ed

Warning: off-topic

Occasionally I like to put links up or blabber about things I feel are crucially important to follow. I found this story about “CDS” over on Reddit. I have taken another step in my ongoing degeneracy. Roughly 6 weeks ago my account was suspended on Twitter for daring to criticize a female sportscaster in her own Twitter feed. And Twitter thinks (I typed Twitter thinks, not “I think”) that adult females are way too fragile, sensitive, and childlike to be able to take criticisms or even mild vulgarity. I was told I had to give them my phone to take the account out of being suspended. I won’t say what I told Twitter support, but involves a four letter word containing the letter F.

Anyway, Reddit is now taking the place of Twitter for my intravenous needle feed of nonconstructive time. And I found this link at Reddit which I thought was highly educational: https://www.bloomberg.com/news/articles/2018-04-30/hedge-fund-gambit-stirs-fresh-controversy-in-besieged-cds-market

It’s really fascinating Mercatus calls themselves an “Independent Institute” when everyone knows they all tap dance exactly how the Koch Brothers demand that they tap dance.

https://www.washingtonpost.com/local/education/george-mason-president-some-donations-fall-short-of-academic-standards/2018/04/28/bb927576-4af0-11e8-8b5a-3b1697adcc2a_story.html

You’re not going to work at Mercatus very long if you don’t make your prescribed policy conclusion first and work backwards to fabricate your supporting “data set” from there.

Members include:

Tyler Cowen

Russ Roberts

Arnold Kling

Scott Sumner

Alex Tabarrok

All of these guys portraying themselves in a “detached” fashion, when their paycheck seems to, uh, may I say “incentivize” a rather dogmatic policy medicine for all economic illnesses. Wait…. can you hear it??? Can you hear it…..??? It’s the sound of Charles Koch telling those Mercatus tap dancers “Dance boy!!! Come on dance boy!!! Dance for Mistah Koch!!!!”

https://youtu.be/CIKiey4VDWU?t=23s

I simply cannot see a recession on the horizon when fiscal policy is expansionary. Adam Posen showed way back in lieu of Japan in the 90s that fiscal policy is very potent.

Not Trampis In a ceteris paribus world I would agree; but there’s this other actor called the Fed, and I find it hard to believe that a sane Fed won’t act to take away the punch bowl just as the party gets rolling. Of course, a lot depends on how far out the horizon is. It takes a while for tax cuts to start having an effect on aggregate demand, so worrisome inflationary pressures are still several months away. But it’s entirely possible that the Fed will hike interest rates in June and then again in August if fiscal policy looks to be too expansionary. The risk is that the Fed overreacts and sets off a recession. And then there are higher oil prices along with that ongoing mess in Europe.

Reagan’s initial fiscal policy in 1981 involved more defense spending and a big tax cut for the rich. What we got was the FED’s overreaction leading to a massive recession in 1982. Yea the FED reversed course in 1983 and the recession was reversed as a result. Of course this gave the Usual Suspects (Kudlow, Moore, Laffer, etc.) license to misrepresent the data arguing that the 1981 tax cut led to massive economic growth. Cough, cough!

@ Not Trampis

Normally, I would agree with you, and if we were to put it in very general or very broad terms, I would 100% agree with you. But I think an important question arises, and it’s a question Krugman has asked, and I think had already dawned on me, if only barely in my subconscious (loosely paraphrasing Krugman here) “How well can we expect fiscal policy to be implemented when it is carried out by a bunch of nincompoops selected by Trump??” Personally, (although right now this is totally subjective on my part), my expectations are very low on what fiscal stimulus implemented by incompetent administration and staff can achieve.

I remember a semi-famous car ride taken together between Abe and Krugman, which was discussed at the time:

https://www.japantimes.co.jp/news/2014/11/21/business/economy-business/economist-krugmans-meeting-abe-may-swung-decision-postpone-tax-hike/

The above mentioned car ride must have happened around 2014?? Whereas the more formal meeting transcribed below was I guess in 2016:

https://www.gc.cuny.edu/CUNY_GC/media/LISCenter/pkrugman/Meeting-minutes-Krugman.pdf

Also, I’d like to say in a respectful tone Not Trampis, that one thing you are not accounting for in your statement is, this bill endorsed by Republicans and Trump, mis-aptly named “TCJA”, takes away many tax deductions that were priorly available to middle and low income families. How much of a “stimulus” package can you have that increases taxes on low and middle income people (the people more apt to spend any tax savings garnered) by yanking away deductions that were formerly available?? I would argue that’s not much of a “stimulus” plan when most of the “stimulus” goes to wealthy fat-cats who turn around and put it into the bank or in cash reserves.

This basically supports the theory I’ve carried for months now. That 98% of the fair international trade talk by Trump is “Told by an idiot, aimed at senile white people and southern rednecks watching FOX news, full of sound and fury, Signifying nothing.”

https://www.nytimes.com/2018/04/30/us/politics/white-house-delays-tariffs-eu-canada-mexico.html

I dare any of you “conservatives” who are regulars on Econbrowser (you know who you are, the functionally illiterate who rate about 4th grade elementary school in reading/writing) to set your DVR recorder for a full 24 hours starting midnight tonight and measure the time FOX spends on telling the alt-right assembled around their TV that Trump backed off (blinked first, like the true coward Trump is) on his big trade war.

BTW, I found some secret mobile phone video of Trump and Xi Jinping holding some intense trade talks. When State Chairman Xi arises from the stairway, Trump has to run to General Kelly for emotional support. If anyone wants to transcribe the conversation between the two, please feel free to put it in the comment feed:

https://youtu.be/Z8NSsLlrGrk?t=26s

Sluggsy ( I am autralalianisng you) it seems to me short term interest rates would have to rise considerably to entertain a recession. moreover in most instances fiscal policy is more potent then monetary policy.

Moses, one thing cannot be argued about ( well it probably will be here) is that the structural deficit has increased. That means no matter what foll is in power the economy will be stimulated by the public sector.

Not Trampis As to the relative potency of fiscal vs monetary policy, I’ve always thought the old school IS-LM approach was helpful. It all depends on the relative slopes of the IS and LM curves. But like I said, that’s really old school and probably not acceptable language in adult company these days. I suspect that one could make a good case for an asymmetric response with monetary policy, so a 25 basis point increase has a stronger effect than a 25 basis point cut, but that’s just a hunch.

We’re starting to see a consecutive upticks in core PCE. A lot will depend on whether the Fed views 2 percent as a target or a ceiling. I think a June rate hike is pretty much baked in the cake right now, but I wouldn’t rule out an additional 25 basis point hike in August if core PCE goes much above 2 percent.

https://www.bea.gov/newsreleases/national/pi/2018/pi0318.htm

tramp

The deep double recession of the early 80’s may qualify for your recession during fiscal expansion. The 70’s saw tax flows into government as inflation caused more earners to pay taxes in higher brackets (inflation caused bracket creep). The government spent the ill gotten gains and much more as it tried, for itself, to stay ahead of the inflation curve. Finally, sanity erupted from the American people and forced government and the FED to end the growing inflation. The cure was inevitable, a monetary policy recession. The good things that came from this episode were many, I will highlight a few. The Phillips Curve was proven wrong in the way Friedman and Phelps had shown theoretically earlier. The FED has since remained reasonably disciplined not to allow another inflation bout like it did in the 70’s. As it became clear that President Reagan’s administration was not going to pressure the FED into loosening until the inflation genie was bottled firmly, it demonstrated that seemingly counter forces of very tight monetary policy at the same time of expansionary fiscal policy can be the right prescription. And finally, even though the tax rate change was delayed implemented in slowly over a couple of years, it demonstrated the power of tax rate cuts, tax reform, and regulatory reform for revitalizing an economy.

Some here on each side of the politics remember those times directly, rather than trying to guess what it was like by looking at numbers and charts. The President Carter invention of the “Misery Index” may have been his longest lasting idea. It truly became a miserable time during his term. And we all paid the piper. Thank God that payment brought better times, there were at least as many doomsayers back then as there are now.

Dear Menzie,

Two things. One is just a general statement. GDO doesn’t seem to really be different than the idea that averaging forecasts gives you better predictors. Am I missing something here?

Also, there is a reasonable chance of a recession, despite expansionary policy, if there is trouble in the Middle East, which is quite likely.

Julian

Prospects for recession are two-fold. As soon as later this calendar year when the initial phase of 25K sealed indictments against the deep state and shadow government are unsealed. Shocking and traumatizing the country, and bursting the body-politic illusion 95% of the public (especially Democrats) are living under. Thus threatening an instantaneous shock to consumer spending, causing a mild consumer-led recession in contradistinction to the burst housing bubble recession of 2008. Secondly, a more-severe engineered recession getting underway in early-2020 to keep Trump from being reelected.

JBH: Thank goodness, the Illuminati will also be unmasked at the same time.

@ Menzie

Menzie, my father had a Masters degree in education, and although both my parents were from modest backgrounds (I would say “low middle class” at best), if my Dad succeeded in getting one thing into my thick skull before he died, it was the importance of education (both self-education and “institutional” education). I think you can understand this, as it is also engrained largely in Chinese culture (and somehow I feel certain by your own Mom, if I may be “so bold” to say). One thing that I have always found nearly endlessly fascinating/perplexing and mentally discombobulating, is the fact that people LOVE to make up and conger fictional tales of conspiracy and paranoia—-When REAL LIFE versions of conspiracy are often just as convoluted and compelling. And they choose to largely ignore the latter.

https://www.thedailybeast.com/exclusive-lone-dnc-hacker-guccifer-20-slipped-up-and-revealed-he-was-a-russian-intelligence-officer

Excuse my ignorant error in spelling, it obviously should read “conjure fictional tales” in my above comment.

The continuing education of Ed Hanson….

1. Bracket creep also had the beneficial effect of dampening inflation, something you forgot to mention.

2. You seem to have this crazy black helicopter view that the government is some voracious alien monster whose sole purpose in life is to steal from you and give money to “those people.” The government does spend money, but that money doesn’t just sit there in some Ft. Knox vault. Have you ever read Beowulf? Your views on the government running off with its ill gotten gains reminds me of the dragon who accumulates gold in his cave for no particular reason.

3. The Phillips Curve was not proven wrong. That’s a myth. What Friedman said was that the Phillips Curve did not hold in the LONG run, but it did hold in the SHORT run. That’s still the standard interpretation today. Just about every central bank uses both short run and long run Phillips Curves.

https://en.wikipedia.org/wiki/Phillips_curve

4. … it demonstrated that seemingly counter forces of very tight monetary policy at the same time of expansionary fiscal policy can be the right prescription.

This is pure fantasy. Reagan’s fiscal stimulus meant that the Fed had to increase interest rates higher than they otherwise would have had to. Reagan’s fiscal policies made the Fed’s job harder, and that made the recession worse than it had to be. You’ve really drunk the Kool Aid here.

5. Most of the important deregulation was done under Carter, not Reagan. By the time Reagan came along all of the low hanging fruit had already been plucked. What Reagan and Bush 41 gave us was a deregulated S&L that led to a government bailout of rich kids like Bush 41’s inept son.

6. The Reagan tax cuts were sold as a way to increase the personal savings rate, which would then increase investment. That was the essence of supply side economics. Guess what? That’s not what happened. When Reagan took office in Jan 1981 the personal savings rate was 10.5%. When Reagan left it had fallen to 8%. And that 8% figure was actually slightly higher than it had been during much of the Reagan era. What the Reagan tax cuts did accomplish was to give us high real interest rates, an appreciated currency, low personal savings rates and structural deficits.

I do remember the Carter and Reagan years. The Carter years were not great, but up until Nov 1979 most people were okay with the Carter economy. It was booming…probably too hot in fact. The only real problem was inflation. There’s a lot of misremembering out there, which is why you really need to look at data instead of fond (but false) remembrances of St. Ronnie.

BTW, the Fed’s big mistake during the 70s was to try and combat a supply side shock recession using monetary policy. The lesson from the 1970s is that monetary policy is good for demand shocks, but not supply side shocks.

slug.

My God you would fit perfectly in a Stalinist communist country. You can spiel the party line and I bet you even keep straight face. But government worker over there were party functionaries too.

Read slug carefully, boys and girls, you will find a true believer that everything you earn belongs to the government, and we should be darn thankful we have such wonderful people in government that they do think you should be able to keep some of it, with their permission of course. Now we slog through the blah.

1. Bracket creep solves inflation. Don’t laugh, this is how slug thinks that is true. Here is how it works. The sweat of your brow earns 10 units. By taxation, the government leaves in your care you 8 units to spend. Then, by the proverbial printing press, the government makes new units that can buy only 50% of what the old units were worth. But you know the beast and have negotiated the sweat of your brow and kept even by earning 20 new units. Did I say even? Lets check. 20 new units, 50% value, same purchasing power as 10 old units. But the government does not care you are earnings (as in purchasing power) the same, because the tax laws make no distinction between old units and new units, so they see your constant earnings as a higher wage and put you into a higher tax bracket. Now when the tax man cometh, he only allows you to keep 15 new units rather than the 16 if the bracket had not creeped. End result, for the same work and the same earnings, you now have less spending power – 15 new units after inflation rather than the 8 old units before inflation.

This slug calls inflation relief. All just because what was left you by the government of what you earned, you have the gall to spend. So because of bracket creep and the fact that the tax laws at the time conveniently said old units and new units were the same, you find that the tax man leaves you only 15 new units to spend. Ain’t it wonderful, at least to slug, you must spend less. And yes, slug is stupid to think so. But remember, the government worker has an invested interest to support government taking,

2. It is not black helicopters that allow the government to steal. The political appropriators loved inflation, the progressive tax structure combined with bracket creep allowed effective tax rate increases without a political risky vote for higher tax rates. A politician’s dream. Funny how it works out though. Money flooded into government coffer, but the budget remained unbalanced, unemployment rose, and inflation gained inertia (remember when I wrote don’t laugh, you can now). But surprise, surprise, the American taxpayer and voter is not the fool that the government elite believes they are. A true electoral landslide brought new thinking and new direction, staring with tax rate, and regulatory relief. Then a revitalization of the economy that lasted close to two decades, as well as renewal of government purpose of defense. The old USSR was failing, but it given a strong push when the adults were brought into power. And in case you did not notice, the President Reagan tax changes included reform to make ta bracket inflation adjusted.

One last warning, be vigilant watch how many tax changes offered or passed by the democrats do not contain the inflation-adjusted language.

Enough for now,

Ed

That’s funny. Of course, you wouldn’t know that what you’re actually peddling here is a version of the Marxist Labor Theory of Value. Not familiar with the Labor Theory of Value? Let me recommend Mark Blaug’s Economic Theory in Retrospect for a good discussion. He also has a nice chapter on Austrian economics and the Hayek/Kaldor debates.

https://www.amazon.com/Economic-Theory-Retrospect-Mark-Blaug/dp/0521577012

While there was plenty of ideology in your response, I didn’t see any actual economics. You might not like the idea that bracket creep has the effect of dampening inflation, but it does. You might not like inflation, but cutting taxes and ramping up defense spending when the economy is near full employment and the interest rate is well above the ZLB is tailor made to increase inflation. So apparently you hate inflation but love the policies that create inflation and hate policies that dampen inflation. Sounds incoherent to me.

Your history is pretty bad too. Money flooded into government coffer, but the budget remained unbalanced, unemployment rose,

Actually, go check the OMB Historical Tables. The budget deficit in 1979 was only 1.6% of GDP. It wouldn’t be that low again until 1997. The fact is that the budget deficit was shrinking under Carter until the 1980 recession. But even then it was only 2.6% of GDP. And the unemployment rate was generally falling, not rising. Unemployment didn’t spike until the 1982 recession. And Jimmy Carter was not the big spender. Government spending was never above 21.1% of GDP…and that was in 1980 (a recession year). In 1979 government spending was only 19.6% of GDP. Reagan was never below 20.6%. In fact, your whole theory that inflation is the bureaucrat’s friend because government spending increases with inflation is not supported by the data. In fact, government workers hated Carter because he froze pay for several years when inflation was very high. I suggest that you look at government spending as a percent of GDP and compare that to the inflation rate. You’ll see that during the Carter and Reagan years they moved in opposite directions. Government spending as a percent of GDP went down as inflation went up. And government spending went up as inflation went down. So your entire theory just doesn’t conform to the historical facts, although I’m quite sure that it conforms with your misremembering history.

the American taxpayer and voter is not the fool that the government elite believes they are

I agree. When it comes to economics they are much dumber than government elites believe.

Slug/Ed

Call me Walter….. it was Vietnam and the Salafists’ hissy fit over US not letting Israel go down (aka oil shock)…….. I was in US military airlift command then.

Carter was paying off the debt from Korea (Carter thought of ending the occupation, too), Nuke race and Vietnam, inflation was one part of the process. Reagan jumped in and decided more war injection despite the marginal effect on long run.

While today’s tax cuts look like Reagan’s cut low brow deductions and slash high brow rates.

slug

No I am not pedaling Labor theory, and I am familiar with it.

Slug, you know as well as I do that not only was money flooding into the government coffers, it take as a percent of GDP rose dramatically fast. What can I say about your perception, 1.6% deficit is not a balanced budget. That percent is 0% deficit. The budget deficit during the President Clinton times you so often proclaim was not 1.6% deficit, it was 0% and even negative % deficit. The democrats had complete control of the Executive and the Congress. If they truly wanted to balance a budget, without ant republicans control of Congress, this was their best opportunity. But of course the failed, and face it, they failed because despite their campaigning on the woes of debt, the priority of a balanced budget is negligible compared to programs they wish to spend on.

President Carters Presidency was a failure. It was rejected soundly in the Reagan landslide of 1980. It takes more than just being a good person to be successful as a president. Very few of our presidents were both good people and successful. President Reagan was the only such president in my lifetime although Eisenhower might fit the bill, but I was to young then to form an opinion.

Ed

Slug, continued from above,

3. we are in reasonable agreement, it was, except for your nitpicking, what I said.

4. You obviously in your narrow reading of economics did not recognize I was paraphrasing the ideas of Robert Mundell. He had great influence during this time. I take nothing back but you should try to understand your view of the world is not particularly right or accurate.

As for making the FED’s job harder, you are right. How much easier for the government to continue poor growth policy or policy that benefits government rather than the citizenry. The fact is President Reagan’s policy created a boom when many had given up on the promise of America and the empowerment it gave to the ordinary citizenwas so difficult for those who wish to command. But the fact is Volcker and the FED knew exactly what the president’s supply-side policy would be and could absolutely take that knowledge into their planning. And the fact is, many previous Presidents had made the FED job harder by bringing pressure to bear on policy demanding loosening, make the recession later than earlier, anything to help in elections. President Reagan would have none of that. He fully recognized that inflation was a huge problem which only would get worse if remedies were delayed. He supported the FED new anti-inflation policy. He recognized that this inflation truly fit “inflation is always and everywhere a monetary phenomenon.” If there was any pressure from the White House it came with recognition the FED caused the problem and the FED would fix it, or he would find new FED officers who would. Fortunately, Volcker, the democrat, was the right person. No, you don’t have to tell me, President Carter got him the job. Too late. Too bad it took him so long to learn the importance of the FED, remember William Miller.

5. The S&L crisis was cooked into the books long before President Reagan. Under your so called great regulation, the S&L’s had no ability to adapt to the inflationary period of the 70’s and it all unraveled. And by the way you give Neil Bush much to much credit. He was nothing more than a patsy, who others tried to use for exactly the purposes you described. It was quite a time, those decades, and don’t forget Billy Carter.

6. is important and belongs in a separate comment.

Ed

Ed Hanson

3. it was, except for your nitpicking, what I said.

No, that’s not what you said. Here’s what you said: The Phillips Curve was proven wrong in the way Friedman and Phelps had shown theoretically earlier.

That’s quite different and hardly nitpicking. The short run Phillips Curve is still the workhorse of most central banks.

4. In his youth Robert Mundell said a lot of interesting things. Some have held up better than others. In his middle age he kind of lost his bearings (and wandered out of his main field of study) and started drinking the supply side Kool Aid. As an old man he’s really been kind of pathetic. Hey Prof. Mundell, howz that euro currency working out? The suggestion that Reagan’s deficits were somehow a carefully measured goldilocks prescription working with Fed monetary policy is pure fantasy. Do you seriously believe that Volcker thought Reagan’s deficits were making the Fed’s job easier? This is just ad hoc rationalizing.

I agree that Miller was a bad choice. But unlike some presidents, Carter showed he was capable of admitting a mistake and he corrected it. And correcting that mistake probably cost him his re-election because the economy went into recession a few months after Volcker took over. As to Billy Carter, he was a harmless joke. His big crime was selling some rotgut novelty beer. And it was really bad stuff.

5. I agree that the germs of the S&L crisis pre-date Reagan; but Reagan’s policies turned a garden variety manageable problem into an unmanageable crisis. For example, Reagan’s fiscal stimulus was at war with the Fed’s monetary tightening. That meant the Fed had to increase interest rates all that much more. Those unnecessarily higher interest rates only made life harder for the solvent S&Ls. And Reagan’s policy of “forbearance” (i.e., see no evil, hear no evil) gave S&Ls tacit permission to make asymmetrically risky bets on highly speculative investments. And Reagan’s 1981 tax bill contained lots of perverse tax credit incentives that created downstream problems in real estate markets. Those policy choices all came home to roost in the late 1980s…long after Carter left office. Reagan inherited a nuisance problem. By the time Reagan left office he had turned that nuisance problem into a crisis that could no longer be smoothed over.

slug

Read this carefully, while I do not express supply-side economics as well as others, I believe I can straighten out some of your misconceptions. First, it is absolutely untrue that supply-side economics is designed to increase the saving rate. In fact, it is expected that savings will diminish as investment increases. But we need to back up a little to see where this came from’

One of the pillars of supply-side economics is reduction of the tax rates. While most taxpayers pay some percentage less than their bracketed tax rate, the next dollar they earn will be taxed at the that top rate. This is also true about the tax rate differences between tax brackets. The more progressive tax rates the more that next dollar of earnings is taxed and (READ CAREFULLY), at the margin, less incentive to take risk to earn that next dollar.

What is that next dollar I write of. It is what creates wealth for both the individual and society. It comes from many ways such as from working longer hours (less leisure), investing in a start up, or by creating a new business, just to name of few of the endless ways. One thing all these wealth building ways have in common is risk. And one of the important measure of the decision to take risk is the return from the investment of resources and time. A less top tax rate on that next dollar, will, at the margin, increase the willingness of risk taking, and result in higher growth and faster creation of wealth in an economic society.

,

Note one thing very important. It is called supply-side economics for a reason. By increasing at the margin, capital put at risk, both human and money resources, the great engine within free enterprise is allowed to flourish. And it flourishes by increasing the supply of goods and services. And it is this supply that must proceed demand. Polar opposite of the demand style Keynesian style economics.

I have only touch on one aspect of supply-side economics. There are many good primers on supply-side economics out in the net. I will look for some and bring here. I suppose it to much to hope for that either Menzie or Jim Hamilton knows Robert Mundell and could bring him on as a guest. He was quite dynamic in his time but seems to have quietly retired, in good health I hope, He is a Nobel winning economist that can bring great incite to the world.

Ed

I’m assuming “incite” was a typo and you really meant “insight” and that it wasn’t a Freudian slip.

Advocates of supply side econ made three principal claims. The first claim is that lower marginal tax rates would increase labor effort because the substitution effect would dominate the income effect. How did that turn out? Go check out the average hours worked data in FRED. I’d give you the link, but this website is acting kind of funny and won’t accept it. Spoiler alert. As you will see, average hours worked actually fell from what they were during the Carter years. Strike one.

The second claim was that a 1981 tax cut would increase the personal savings rate, which would then fuel investment. Go check the FRED data on the percent of savings. Oops. Looks like personal savings actually fell. Definitely not what the supply siders predicted. Strike two.

The third claim was that the 1981 supply side tax cuts would pay for themselves. Go visit FRED to see what happened to the public debt.

Uh-oh. Looks like the public debt rose dramatically after the 1981 tax cut. Strike three.

So let’s review. The 1981 tax cuts did not increase labor effort as measured by average hours worked. The tax cuts did not increase the personal savings rate. And the tax cuts did not pay for themselves as promised by the supply siders. It failed to deliver on all three principal claims. Does that sound like a successful policy?

Two other points worth noting. First, Reagan was responsible for a large FICA tax increase in 1983. Funny that Reagan idolaters seem to forget about that. The second fact worth noting is that in 1986 Reagan did a complete 180 and undid virtually every bad thing that was in the 1981 tax deform. People forget that the 1981 bill didn’t just lower rates, it also larded up all kinds of bizarre tax credits, tax expenditures and weird deductions…all stuff that the K-Street lobbyists wanted. All those things created distortions in the economy. Most economists understood this, which eventually led to Sen. Bradley introducing the 1986 tax reform bill. At first Reagan resisted it, but to his credit Reagan eventually came around and supported it. I’ve never understood why those who worship at the altar of St. Ronnie only praise the godawful 1981 tax bill and completely ignore the very good 1986 tax reform bill.

Slug

I hope you are right and it was not slippage of a Freudian nature, I think it was just typo.

1) No such claim was made. Reducing leisure is an independent decision. Such decision depends on what an individual decides what that next dollar is worth compared to risk. However, at the margin, more decisions to reduce leisure would be made that otherwise. And that did happen, as shown by the remarkable growth of the economy. It also proved to be quite long lasting as growth was many decades in achievement.

2) No such claim was made. And explained elsewhere in these post, such an idea is not part of supply-side economic theory. If you

as believe so, you are wrong. It is the dumb demand side thinking you hold that makes you think such savings has to be part of the theory.

3) Over the years the tax rate reductions did pay for themselves and today’s level of GDP is one of the shining stars of what Reagan, and I might add, a few very excellent democratic Senators brought about.

As for what you call strange tax treatments, some of that is absolutely true. But it was the democrat controlled House And Senate that added those provisions. However since they were quite small compared to the tax rate cuts themselves, the only logical thing to do was to accept them to get the bill passed. So it happened. You yourself demonstrated that Reagan did not want these provisions and bided his tome until he had the votes to get rid of them. One terrific President who understood he was only a president not a dictator, so his influence was used for the greater good.

Amazing that you should criticize the Social security change. Everyone knew the system was broken and would eventually run out of money to maintain full benefits. And President Reagan of all the Presidents and Congresses during my lifetime to had the courage and the political will to actually do something about it. He would have ended the system in an instant and privatized the whole retirement system, but again he was not dictator, only president; so he got what he could. The changes brought an extension of a functioning SS system for an additional 20 or thirty years. Again, he had the courage to touch the “third rail,” something we have not seen in any other of our leaders.

And about that ‘awful’ 1981 tax rate cut bill, as it was fully implemented in 1983, the country saw the fastest real growth of GDP in memory and which continued for years. If only President Obama had been a true student of history and passed such an ‘awful’ bill we all would be trillions ahead of where we are today. But as usual and necessary and better late than never, President Trump supported and pass an appropriate tax reform bill for today’s world. We will again all be beneficiaries of faster GDP growth.

Ed

Thank-you slug for bringing

your elitism, your command mentality, and your utter disregard and contempt to those who paid your salary and support your pension is out there for all to see.

Believe it or not, I have pity for you,. and am sorry if I am the one who upset you so much that you exposed your true self to our small world here.

Ed

I prefer to think of my contributions here as missionary work among savages.

2slugs, says arrogant: “I prefer to think of my contributions here as missionary work among savages.” I agree with Ed, you are: elitist, you apparently believe in command economic/society , and you do disregard/or have contempt for those “savages” who disagree with your views.

Well, I had something of an elitist upbringing. Lots of famous economists lived within easy walking distance: George Schultz, Beryl Sprinkel and George Stigler. The historian Michael Beschloss was a year behind me through middle school. The phrase “missionary work among savages” has a related history. The political scientist Charles V. Hamilton (co-author of Black Power) used to lecture at my high school back when he was at Roosevelt University. When asked why he was coming to an elite upscale lily white school his answer was “Missionary work among savages.” I always liked the turn of phrase. If you’re gonna steal a phrase, make it a good one.

I don’t believe in command economics. If you think textbook macro is somehow Stalinist, then you don’t know much about either Stalinist economics or textbook macro. And I don’t have contempt for people who disagree with me; my wife and I disagree about plenty. But I do have contempt for people who pride themselves in ignorance and won’t take the time or effort to actually learn a subject that they want to talk about. If you want to comment about socialist economics, then show me that you’ve actually read and studied socialist economics…Irving Howe’s “Essential Works of Socialism” would be a good start. If you want to talk about macroeconomics, then show me that you’ve gone beyond zerohedge.com. If you want to preach Hayek and Austrian economics, then show me that you’re familiar with the Hayek/Kaldor debates, or that you can explain why Hayek himself eventually agreed that he was wrong about the much of the welfare state.

2slugs, thanks for admitting to being elitist. Did you forgot your arrogance? Never mind, I see you showed it with your appeal to authority.

BTW, we’ve done this too long, so nothing personal. I’m just yanking your chain. 😉

I’m reminded, CoRev, that after losing the “Duck Season/Rabbit Season Debate”, Daffy Duck could only insist that his better was indeed “ Dethpicable!” You don’t need to end with “That’s all Folks.” You already did.

Well, Ed, That’s a good response after you’ve been intellectually spanked and have no other substantive reply.