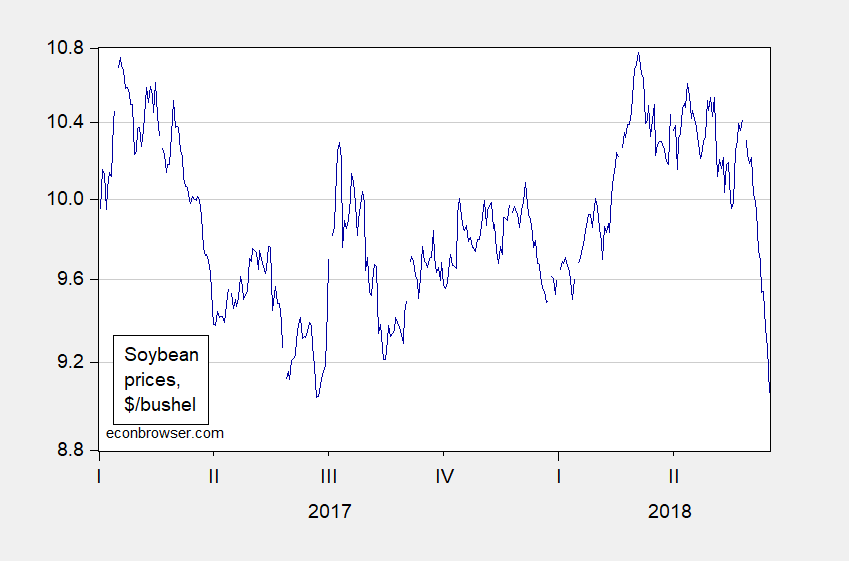

Figure 1: Soybean prices, daily, $/bushel (dark blue). Source: MacroTrends, accessed 6/16/2018.

In examining the free-fall in soybean prices, reader CoRev argues for ag conditions and the dollar:

Menzie, as a scientist you are failing. You have shown a clear bias as Trumps Tariff threats and implementations as the MAJOR cause and a tendency to select only data and periods for it that support that bias. A longer look at the data shows USDA harvest projections have a higher and quicker price impact than trade barrier impacts. Don’t get me wrong trade barriers do impact pricing in the long run, but quick drop like this in recent history are influenced more often by harvest projections. Steep price drops occurred in 2013 and again in 2015 after USDA projected increased harvests.

So what was the June 12 2018 USDA harvest projection: ” Price forecasts for 2018/19 are unchanged this month. The 2018/19 season-average price for soybeans is forecast at $8.75 to $11.25 per bushel; soybean meal and oil prices are projected at $330 to $370 per short ton and 29.5 to 33.5 cents per pound, respectively….

A higher trend yield for the 2018/19 Brazil soybean crop reflects harvest and yield results for the 2017/18 crop, which is increased 2 million tons to 119 million.With higher production, soybean exports for Brazil are revised up for both the 2017/18 and 2018/19 marketing years.” The buyers driving these price fluctuations obviously follow these data closely. The USDA projections: http://www.usda.gov/oce/commodity/wasde/latest.pdf

It is indeed true that USDA releases do have an impact on commodity prices. Lehecka (2014) notes that weekly USDA Crop Progress reports do have an impact, even after accounting for once-a-quarter

[now once a month – MDC 6/18] World Agriculture Supply and Demand Estimates (WASDE) reports (the most recent is here; Crop Progress reports).

Lehecka (2014) also observes:

…days. Additionally, market prices tend to react rapidly and rationally to new crop-condition information. Strongest reactions are found for July and August, when weather conditions are most critical for the crop, and reactions have increased over time. Overall, these results suggest that reports have substantial informational value.

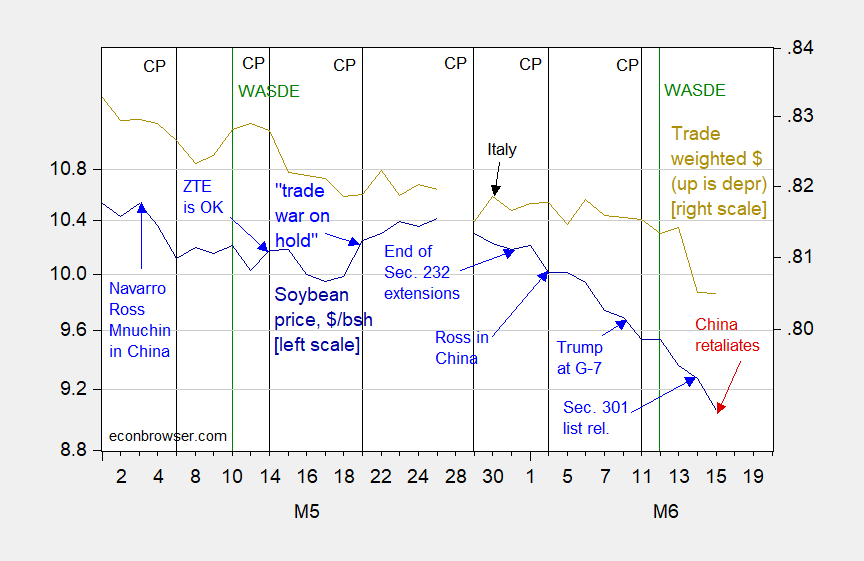

These points help one interpret the following graph:

Figure 2: Soybean prices, $/bushel (blue, left log scale), and trade weighted dollar (brown, right scale), Federal Reserve Board broad index to 6/8, dxy thereafter; up is a depreciation. Black vertical lines at release of USDA Crop Progress reports; green vertical line as WASDE report release. Source: MacroTrends, Federal Reserve Board via FRED, TradingEconomics. [updated 6/18 to include May 10 WASDE]

Two observations:

- The dollar appreciation in the last few weeks could be tagged as the culprit for the soybean price decline. But is it quantitatively sufficient? From 6/7 through 6/15, the soybean prices fell 7.3% (log terms), while the dollar gained 1.4%. Using historical correlations on changes of soybean prices and the dollar (from 1/1/2017 onward), soybean prices should’ve vallen 0.7%. Hence, the drop was about ten times larger than expected from dollar appreciation.

- Lohecke (2014) notes the very rapid assimilation of information from the Crop Progress reports. Soybean prices, however, continue their drop on 6/13, 6/14, and 6/15, after the information from the most recent Crop Progress and WASDE reports should’ve been impounded into soybean prices.

This suggests to me that the drop in soybean futures prices discussed in this post, as well as this post, as largely due to the revelation of new information regarding the likelihood of Chinese trade sanction on US exports to China, as retaliation for Mr. Trump’s actions, and not new information regarding world and domestic agricultural conditions. Journalistic accounts of traders’ views also place primacy on trade sanction fears.

Hence, why N.D. soybean farmers say ‘We feel like we’re a bargaining chip’.

Update, 6/18: Interesting article on relative importance of tariff vs. ag conditions, here.

It’s early in the morning here, was watching a movie called “It”. More geared for teenagers or immature guys like me that never grew up that like movies that have that ’80s vibe. I give it a 6 or maybe the redhead character “Beverly” nudges it up to a 7 on a 1 to 10 scale. If you’re into spook films Uncle Moses says check it out.

Great post by Menzie as per usual, I like how he uses the quantitative terms to explain how much the dollar rise has affected the soybean price drop (Obviously not even close to what CoRev thinks). Menzie reminds us log is important (log deserves to be stressed as a reminder and for new blog readers). I’m glad he put the Lohecke paper up, and it’s kind of at the bottom of my reading list, but I do hope to get around to reading the Lohecke. The USDA info etc seems to be…what was the phrase that was popular for awhile, seems I’m forgetting my pop lingo here “already baked into” (??) the prices—very fast—certainly inside 24hours yes??

Trying to find some more Ag based gunk online, and I may have walked backwards into a couple good ones. And by a couple “good ones” I mean those types CoRev says are “failing as scientists” and like to put pen and paper to things and even when they’re endeavoring to be grand failures as scientists may like to use formulas and spreadsheets or consult the academic literature. CoRev tells me that’s quite the current fad with “failing scientists”. Spreadsheets, formulas, statistical software, and empirical research are going viral with “failing scientists”. I’ll see if I can find some good numbers here just skimming…….

—The first thing they say is that Brazil’s Economic minister needs to send a “thank you” card to Donald Trump for all the free money. Brazilian leaders are very confused because they thought he only liked to give freebies to Russia and North Korea.

—They also say once you lose those export markets it’s hard to get them back, and that Brazil’s capacity and efficiency at growing soybeans is growing much faster than America’s.

—Only counting the soybean market (not other exports markets) America is losing about $2.2 billion in lost economic “well-being”

—China’s ability to produce more soybeans will increase 3–5% more because of Trump’s decision and how China utilizes the farmland.

Well, you know, those “failing scientists” tend to agree with one another, so we’ll see if Menzie takes issue with any of those latter points.

I can’t figure out how I stare at these posts for awhile before I hit “post comment” and still make errors in bold tags or spelling?? Oh well, maybe when my career is going down the toilet I can pull a Henry Winkler and claim I have dyslexia. These are the times of trump, we have to be creative people.

Menzie, let’s discuss you analytical conclusion: “This suggests to me that the drop in soybean futures prices …as largely due to the revelation of new information regarding the likelihood of Chinese trade sanction on US exports to China, as retaliation for Mr. Trump’s actions, and not new information regarding world and domestic agricultural conditions. ” Until several commenters noted the other ag harvest yield factors, your conclusion focused just on Trump policy as the price driver implying it was the only or primary price driving factor. Since, the commenter challenges you have added WASDE Reports as a price factor in this article.

I think we can agree that harvest yields and supply and demand estimates heavily impact ag. product pricing in both the futures and spot markets. The WASDE Reports’ concentrate primarily on the conditions effect harvest yield but also do include estimates on demand, especially export demand.

It was this singular focus on Trump’s policies that triggered my faulting your scientific analysis since recent yeas had also shown steep fluctuations in futures pricing. This article also has the same focus.

Two words you really need to understand: Event Study. It is all about the timing. Menzie has tried to make the point in many ways. But you refuse to listen.

The caption underneath the Youtube video gives it away quickly. But I ask the gentle reader to click on the link here, and after you click on the link and make the jump over to youtube—use all the self-disciplie you can muster and try not to look at the caption underneath. Focus on the man’s face, glasses, and his words. Then ask yourself “What does this make me think of??”

https://www.youtube.com/watch?v=FKe49zNXgls

We have been asking CoRev to read up on event studies. Quoting from this 2014 paper:

“Event studies are based on the idea that information is valuable to market participants in an efficient market if prices react to the announcement of information (“event”) (Campbell, Lo, and MacKinlay, 1997). New crop progress and condition information will change market participants’ supply perceptions, and these changed expectations will be reflected in movement in the market price. Since the direction in which the expectations are changed is a priori unknown, movements in market prices can either be positive or negative. While an average of market price movements is perhaps zero, the variabilities of price returns around the release of important new announcements should be greater than the “normal” variability on days without announcements (Sumner and Mueller, 1989; Isengildina-Massa et al., 2008).”

Pgl, from your quote: “New crop progress and condition information will change market participants’ supply perceptions, and these changed expectations will be reflected in movement in the market price. ” A duh explanation.

“Since the direction in which the expectations are changed is a priori unknown, movements in market prices can either be positive or negative.” True if we add “before the point occurrence” thereafter it becomes a posteriori. Experience will dominate the point analysis. ”

“While an average of market price movements is perhaps zero, the variabilities of price returns around the release of important new announcements should be greater than the “normal” variability on days without announcements” Its what Menzie and I talked about in how fast the market pricing reacts to release of the WASDE.

It goes back to my discussion of industry/market knowledge and lack there of. Of what value do you think is Menzie’s point analyses and to whom?

Lord – are you really this stupid? AFTER the report came out – prices went up.

C’mon CoRev, a 2 year old would get this by now.

Pgl, another deflection, Answer my questions if you can.

Pgl, that’s what i thought!

Of course the concept of event studies and the impact of news on agricultural prices was central to the movie Trading Places:

https://www.youtube.com/watch?v=hCKnB6R6U_k

Maybe CoRev should watch this classic!

WASDE Reports are monthly and in 2018 started with a May Report, released 11 May 2018. We have some soybean price reporting discussing that report’s impact here: https://farmlead.com/blog/insights/live-may-2018-wasde-recap/

In it we find this: “U.S. Soybean Numbers Look Bullish (12:15 EST)

U.S. Soybean prices ripped higher at 12 p.m.

Minutes after the release, July soybean prices added 13.25 cents to hit $10.29. The August contract was back above $10.33 after gaining 14.5 cents.

Here’s why…

Today’s report indicated higher exports and crush in 2018/19 than the same categories in 2017/18. In addition, the agency projected production at 4.28 billion bushels, which is about a 112 million bushel decline from the previous year.”

We also find this pre-release price reporting:

“Let’s also see how grain prices traded 20 minutes before the May WASDE report….

July Soybeans: Up 1 cent at $10.1675.”

We find the July prices climbed ~1.3% within minutes of the release. To forestall a claim of cherry picking the pre-release soybean price of $10.1675 is a more appropriate comparison starting point. Your ending price is $9.055, an ~10.9% drop in prices. We also have the impact of the June 2018 WASDE report to factor, and these

August Soybeans: Up 1 cent at $10.2025….”

From your chart above and the https://farmlead.com/blog/insights/instant-reaction-june-wasde-report/ the June pre-release price for soybeans was $9.54 and the report temporarily stabilized the September market pricing. Total drop between the two 2018 WASDE reports has been ~10.95%. A rough calculation of the price differences between the WASDE pre-release price differences and the total drop leaves a total of ~2.4% which could be assigned to the WASDE reporting of your ~13.35 total price drop.

Your assumptions: “… the information from the most recent Crop Progress and WASDE reports should’ve been impounded into soybean prices.” and “…that the drop in soybean futures prices discussed … as largely due to the revelation of new information regarding the likelihood of Chinese trade sanction on US exports to China,…” are largely true and verified with the nominal numbers.

But was that the actual argument?

CoRev: Thanks for pointing out the May 10 WASDE. I have added it to the graph. I see nothing in the revised graph that changes my assessment. Do you?

CoRev: The point is that the information from the WASDE reports — and indeed the CP reports — should’ve largely been impounded within the day, and should not have been responsible for the downward trend in the soybean prices during the two releases. That is the entire idea of event studies, which is what the Lohecke analysis was exploiting. What do you not understand about event analyses?

Menzie, I tried to make a 3 part comment for brevity, but the S/W didn’t allow it. To answer your question: “I see nothing in the revised graph that changes my assessment. Do you?” We are still in agreement. Policy changes can effect prices, as I/we have said all along.

Your 2nd question is not simple. We agree that the WASDE reports were impounded almost immediately upon release. I understand “event studies” but we have a different views of their values for farmers/the producers. Your uncertainty series shows this quite clearly by the durations and directional corrections of their influence, and I’ve made my views of their values for longer term use. My experience shows that they are prone to over interpretations and inadvertent cherry picking.

When asked you failed to answer the questions adding confusion regarding your intentions. Was it a simple statement of price changes or a slap at Trump. An earlier answer may have forestalled that confusion. Since you have now answered the point of this article to be: “he point is that the information from the WASDE reports — and indeed the CP reports — should’ve largely been impounded within the day, and should not have been responsible for the downward trend in the soybean prices during the two releases.” Your overall intent in the series of articles, including the Uncertainty series, is still unclear.

As for event studies, the answer is Ho Hum! No one said events have NO IMPACT, but their importance and duration, important event factors, have not been addressed by you and the other supporters, except by those questioning your conclusions. I guess it goes back to the arguments over static and dynamic analysis and their values for use.

I hope that helps explain my (and perhaps RTD’s) reactions to your articles. It’s hard to separate the obvious bias from the articles’ learning experiences. Again, thank you for the open discussion allowed here.

CoRev: If in fact trade measures are expected to only have a temporary impact, and ag conditions dominate at longer horizons, then why did the January 2019 futures exhibit a similar pattern to that of July 2018? And why does March 2020 also look similar? At that horizon, I would’ve thought current ag conditions would not matter.

Menzie, are you serious? Assuming you are not, I will play your game: why are current prices of $908.5 +3.00 (+0.33%) not the same as those at close of 06/15? “I would’ve thought current ag conditions would not matter.”

From that point analysis I can say: ”

June Soybean Futures as of Noon, Today

Thanks, Trump!”

CoRev: You miss my point. If current ag conditions regarding planting/weather impinge upon lets say front month futures, and maybe out to November 2018, why do futures for delivery in May 2020 exhibit a similar pattern of severe fall in the last two weeks, given the assumption that markets are weak-form efficient in the Fama sense?

I’m not sure how much more clear I can make it.

Menzie, i haven’t read Fama so I can not answer your question re: Fama’s weak-form efficiency. But that’s really not what you are asking, are you? Since you are referring to the past two week period, that is clarification of the event and event period you are considering. If that is not true, please elucidate. Since that period occurred and the Trump tariffs and Chinese retaliation also have been announced, I’m also assuming those are the event sot which you are referring. If not please elucidate.

Having set that as my frame work, I’ll repeat: Menzie, are you serious? Do you think the pattern would be removed from the prices trend? Or are you saying they did not occur?

Also, since you are referencing market efficiency and futures prices, each of your selected months goes up in your “Soybean Futures in Free Fall: Front and Back Months”. Why is that?

CoRev: Yikes! OK, if you can’t read Fama, read a finance textbook. Then come back. You’ll have your answers already.

Here is an ungated version of the paper. Read it, and join the 21 thousand plus people who have cited the paper, before trying to argue financial economics.

Menzie, focusing on my ignorance of the details in Fama’s papers instead of concentrating on my actual answer confirms RTD’s analysis of your writings/responses.

CoRev: None of your arguments have made sense to me. But when you told me you hadn’t read Fama, then all became clear, regarding your arguments about information, surprises, news, etc. That is all I’m saying.

corev continues to dance around, looking for a way to change the direction of the discussion rather than simply note his ignorance and end this commentary on his stupidity. with corev, it becomes simply rinse and repeat the idiocy.

Menzie, in continuing to respond to my actual answer to your question, instead or focusing on my ignorance of Fama’s paper’s has cause d me to lose confidence in your motives a la RTD. I answered your question about market efficiency in accepting/impounding new information quickly. I even provided examples.

You’ve danced around, failing to answer direct questions and not acknowledging answers for your questions. I’ve already claimed you were playing games, and this latest series of comment confirms that.

I hope RTD is noticing the continuance of this behaviour.

CoRev: Just read a textbook if Fama is too complicated. The point is you don’t understand basic financial theory and yet are trying to debate the implications of finance theory. Here are the steps toward understanding why I am not persuaded by your arguments – and I make no reference to any paper.

1. Commodity prices respond to supply, demand, and factors that impinge upon current and future values of those variables, because soybeans are a semi-storable commodity, so that prices thereof behave like an asset price. New information should then be the main driver of the nonsystematic component of soybean prices.

2. In the days after the releases of the Crop Progress report and the WASDEA report, soybean prices continued to decline, after information regarding agricultural conditions should have been incorporated into commodity prices at the front month.

3. It could have been additional information regarding agricultural conditions was revealed at the same time as the Section 301 list came out, and the Chinese retaliation was announced. However, if such news came out and pertained to the current planting cycles here and abroad, then at back months — say beginning of 2019 or May 2020 — we should not have seen a large concurrent decline in those futures prices. Yet we did, indicating that ag condition news likely did not drive the price moves.

Is that sufficiently reference free for you?

Ho hum to Event Studies? I guess you are going LALALALALALALA not listening.

Pgl, Troll! Add some value. Why did you not add the explantion.

Menzie provided a link to Fama’s 1970 seminal paper. Try reading that and actually learn something for a change.

Pgl, Menzie, provided the link after I had already answered. Why the continued desperate trolling?

Menzie I’m going to yell my answers to you because I am so annoyed at your willful refusal to understand what we have said in plain English.

1. Commodity prices respond to supply, demand, and factors that impinge upon current and future values of those variables, because soybeans are a semi-storable commodity, so that prices thereof behave like an asset price. New information should then be the main driver of the nonsystematic component of soybean prices. That’s exactly what we have said all along while giving real examples of those supply side factors. Except you have now caveated your previous conclusions with nonsystematic component. That is new.

If tariffs is your new information/point, and you believe it is impounded quickly, then what new information caused the continual drop in prices since late May? Your figure 2 has a series of possible factors, but in all your articles you have not made a case for multiple points. Which BTW some are unrelated and inconsistent. We do agree on the WASDE and China retaliation announcement.

2. In the days after the releases of the Crop Progress report and the WASDEA report, soybean prices continued to decline, after information regarding agricultural conditions should have been incorporated into commodity prices at the front month. Either you have forgotten what the June WASDE said about supply and demand or you’re ignoring their price impacts. Increased supply and potential reduced demand does not increase risk nor prices.

3. It could have been additional information regarding agricultural conditions was revealed at the same time as the Section 301 list came out, and the Chinese retaliation was announced. However, if such news came out and pertained to the current planting cycles here and abroad, then at back months — say beginning of 2019 or May 2020 — we should not have seen a large concurrent decline in those futures prices. What??? “we should not have seen a large concurrent decline in those futures prices.” What could have happened to remove the impact of your EVENT(S) from future prices once impounded? It’s an estimate! What changes in the future offsetting the already priced in impacts?

“Yet we did, indicating that ag condition news likely did not drive the price moves.” Here you are just wrong and reading more into the price estimates than is there. As I pointed out future prices go up for each of your selected months, indicating belief in reduced risk from your event(s).

Now that you’ve listed multiple events, which event did you study?

CoRev: (1) There is continuous revelation of trade news, as there is of ag news — but large bits of negative information seem correlated with drops in soybean prices. As you noted yourself, most of the ag news is revealed in the various reports. So the logical conclusion is that it’s trade news. The fact that 13-15 June was not associated with any noted ag news, but was associated with big trade news, seems relevant to making the inference that trade news was predominate.

(2) You haven’t answered the question of why planting/harvesting cycle news should affect futures prices a year or year and a half out. They shouldn’t. Yet they moved in synchronization. The back futures are slightly higher (nowhere near where they were pre-301) because perishable commodities exhibit contango due to cost of carry.

In any case, you’ve convinced me I have to write a longer exposition on how to interpret movements in commodity futures prices. You will have the honor of having your statements being used as the sample mistakes.

So this report caused soybean prices to rise but you interpret this is a factor that lowered soybean prices? Man – are you utterly confused!

Troll! Add some value. While you’re at it learn to write clearly: “So this report…blah, blah and more”

CoRev: On your basic thesis that WASDE release was important insofar as ag condition, see this article.

Menzie, OK I read your reference. What specific point were you trying to make?

Did you notice how it ended?

“It looks like global demand for grains is absorbing all that farmers can produce, even under the near perfect growing conditions of the past several years, which should get the attention of every investor around the globe because grain prices likely cannot remain inside of their current four year trading range when the balance sheet is tightening due to relentless demand. Farmers are incredibly efficient at producing grains, but it appears that their ability to produce all that the world demands will be put to the test in this and in future crop years.”

I realize this is for grains in general, but In general Supply & Demand economic terms can you describe for several here what that highlighted section means? Is it confirming the the future importance of Tariffs or the importance of other factors?

CoRev: That’s the quote from the author’s contact. See the author’s own views on page 2:

Menzie, I read that and didn’t think it added any detail to our discussions. That’s why I asked the question. You still have not clarified your point. How many more times do we all have to say tariffs effect prices?

CoRev: I’ve just posted a clear step-by-step for you. But you were asserting that most of the movement of soybean prices in recent weeks was due to market-moving ag condition news. I believe most is being driven by trade news, and I argue by way of comovement of front and back month futures. But you will only understand that if you understand (just a teensy weensy bit of) finance theory.

Menzie, you are wrong on our assertions. ” But you were asserting that most of the movement of soybean prices in recent weeks was due to market-moving ag condition news. I believe most is being driven by trade news, and I argue by way of comovement of front and back month futures.” From the beginning of the June 13th article I was talking about total price and from the farmer’s view point. It was you that was talking about the recent price Changes from a macro-econ viewpoint. You clarified your viewpoint with this: “The proper comparison is, if the administration hadn’t imposed sanctions on national security grounds that sparked retaliation on soybeans…”

I was have from the beginning including trade barriers, but said its impact only made up a part of the total price. You confirmed that difference with this: “…what would be the profits that could have been earned on soybeans,…”. You never have mentioned costs from which profits can be calculated, so profits for whom? Since you are using futures data it is profit for futures contract traders.

You have been all over the place with your comments.

CoRev: OK, I give up. If it makes you feel better, go ahead and convince yourself you’ve provided a coherent analysis. I think most economists would (1) not understand what you’ve written, and (2) understand what I have.

menzie, as i have stated before, if somebody is coherent but incorrect in their argument, one can correct that person. but when one is incoherent in their arguments, as almost always is, it is impossible to correct somebody with contradictory statements. it is simply whack-a-mole. it is tiring. but i have found, if we are to change the world for the better, we cannot let scoundrels like corev, peaky and rick stryker continue to promote false ideologies with no ramifications. we end up with trump when we let that happen.

Much of the issues were associated with the longer term (2018 harvest season) importance of these price drops. Steven Kopits asserted that these prices would largely be market adjusted by Fall harvest and I asserted that these price impacts, yes including the trade barriers, were largely transitory. All the while we agreed that the current policies effected day trading futures. My further assertions was that US harvest yield estimates and actuals have a larger long term effect on prices. I had a secondary point that farmers impact those decisions by not actually accepting those low futures contracts, and most of the market churn remains within the futures market and not into the producer/farmer side. And, finally implied in all these discussion is the assertion that these price changes are within the norms.

There is little doubt that the prices change with release of the WASDE Reports. The May Report caused your chart’s starting high prices. Longer term impacts of the Trump policies are still to be determined , as we are looking only at the current futures market and not the market as it will be during the Fall harvest.

So how impactful are these current future prices? Are they outside the long term estimates for soybean prices? No! The June WASDE Report provides this estimate:

“Price forecasts for 2018/19 are unchanged this month. The 2018/19 season-average price for soybeans is forecast at $8.75 to $11.25 per bushel; soybean meal and oil prices are projected at $330 to $370 per short ton and 29.5 to 33.5 cents per pound, respectively.”

The prices shown in your chart fluctuated for many reasons, including Trumps policy pronouncements, but they are not extraordinary remaining well within these latest estimates. Many future changes can be anticipated to effect prices, and I strongly believe they will be positive raising prices from this temporary low price.

Do you disagree?

Much of the issues were associated with the longer term (2018 harvest season) importance of these price drops. Steven Kopits asserted that these prices would largely be market adjusted by Fall harvest and I asserted that these price impacts, yes including the trade barriers, were largely transitory. All the while we agreed that the current policies effected day trading futures.

Oh my. This is a mess. I don’t even know where to begin.

i typically refer to his commentary as incoherent. it is usually contradictory, so that even when you address one area, another zombie from the opposite direction appears. when somebody is consistently wrong, it is easy to correct their misunderstanding. when somebody is inconsistently wrong, is implies a complete lack of understanding of the topic at hand. these are typically the students who fail their college classes rather than skate by with a gentleman’s c.

“i typically refer to his commentary as incoherent. it is usually contradictory”.

Yes CoRev is now explaining the decline in soybean prices with a May report that led to higher prices. Just incredible!

its like playing whack-a-mole with corevs commentary. the idiocy continually sprouts up in all corners. it never stops.

Troll! Add some value.

and i whack another mole! idiot.

CoRev calls you a troll as you have not added value? I guess CoRev thinks he is adding value by taking what should be an easy issue and creating mass confusion!

Is there a way we do this all in crayon for CoRev’s benefit?!

2slugs, I’ll wait for your in context review.

We are STILL waiting for your American Economic Review on this topic.

You just admitted above you have not read Fama’s seminal paper. Seriously CoRev – if you now admit you have never taken a course in financial economics, then stop pretending you know what any of these words mean. Get busy – start reading.

corev cannot read. that is why he needs to watch faux news to get his “knowledge”. then it is simply rinse and repeat.

Combine Princeton Steve and CoRev and you would expect anything other than a complete mess???

https://www.focus-economics.com/commodities/agricultural/soybeans

“Soybean prices fell in Chicago this month as the currencies of Brazil and Argentina, two of the world’s largest soybean producers and exporters, continued to weaken against the USD. Moreover, the global supply outlook remains encouraging for this year, despite recent harsh weather in Argentina. On 8 June, soybeans traded at USD 933 cents per bushel, which was 4.9% lower than on the same day last month. However, the price was up 1.5% on a year-to-date basis and was 2.3% higher than on the same day last year. The U.S. Department of Agriculture recently reported that more soybean crops had been planted by early June 2018 compared to the same time last year, and most of the crops examined were in excellent condition. Furthermore, due to uncertainty in the trade relationship between China and the U.S., the Chinese government has recently ordered farmers in the country’s Henan province to increase soybean production this year.”

Got that? The Chinese government has decided that Chinese farmers should increase soybean prices as a result of all the talk of trade wars.

Pgl, did you notice all those factors influencing prices in your reference? Furthermore, do you understand which country is impacted: “… the Chinese government has recently ordered farmers in the country’s Henan province toincrease soybean production this year.”

You clearly you misinterpreted the meaning: “The Chinese government has decided that Chinese farmers should increase soybean prices as a result of all the talk of trade wars.”

What other Chinese ag. products will be impacted by shifting to soybeans?

I get that market prices depend on various factors. But the key to comparative statics is to note which of these factors have changed and when. This kind of stuff is taught in the first month of any Principle of Economics class. And you still do not get this? Oh wait – you opine on what are clearly Event Studies but you have not read Fama’s seminal contribution or anything else on finance.

Until you do – your comments are clearly uninformed rants. Get busy with your remedial reading.

Of course lower soybean prices in the US are good for US consumers, if not US soybean farmers. But somebody has assured us that they are all patriots and fully willing and understanding of the need for this trade war, so will bear any losses associated with it with enthusiasm.

I’m heading to CostCo with soybeans on the top of my grocery list!

“Abstraction is often one floor above you. Two seats were vacant. She borrowed the book from him many years ago and hasn’t yet returned it.”

so i was in a jovial mood, and found a website that has a random sentence generator. i ran it for three sentences. as a little experiment, i am trying to gauge whether the random sentence generator creates a more or less incoherent commentary than corev. my gut feeling is the random sentence generator is a bit more coherent, but perhaps our statistics folks could do some analysis and confirm this? at least the sentences do not contradict one another!

CoRev clearly knows nothing about Finance. Heck he cannot even bother to read Fama. But he opines on economic modeling with his interpretation of what he sees as the term “Event Study”. And we thought the economists of Team Trump were lost!

he stayed in a holiday inn express last night with access to wikipedia. in his mind, he is now an expert.

Menzie,: ” (2) You haven’t answered the question of why planting/harvesting cycle news should affect futures prices a year or year and a half out. They shouldn’t. Yet they moved in synchronization. The back futures are slightly higher (nowhere near where they were pre-301) because perishable commodities exhibit contango due to cost of carry.”

There is nothing foreseen to reduce the risk factors for the traders. The suppressed price patterns will continue until something changes on the demand side. As reflected in the cash market in my area there have been no bids for soybeans this month.

Once prices and sales are depressed they can only be changed by demand side news changes, tariff news changed, or supply-side farmer/weather influences. Both demand and supply news cycles are long.