It’s elevated. Hard to say exactly why. Hard to say why it isn’t higher.

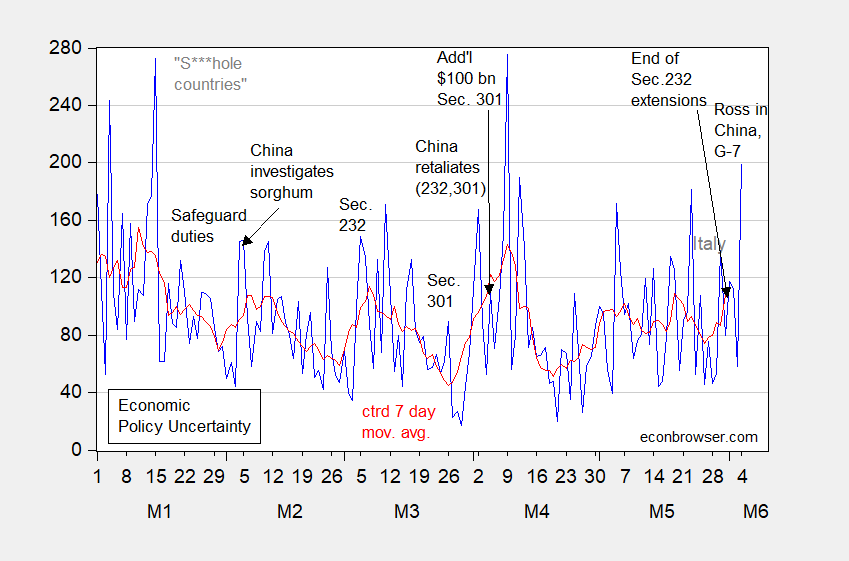

Figure 1: US Economic Policy Uncertainty index (blue) and centered 7-day moving average (bold red). Source: policyuncertainty.com accessed 4 June 2018, and author’s calculations.

“Measured Economic Policy” as opposed to the measurement of “Economic Policy Uncertainty”? I trust you are not saying Trump and his advisers know how to measure actual policy as all the evidence to date shows they do not.

pgl: Oops, fixed now.

Is the standard cliche response here “good catch”?? (rhetorical)

https://www.youtube.com/watch?v=nSUy2JIvUOI

Is a 7-day moving average too short? The monthly numbers at policyuncertainty.com are much smoother and, except for the period immediately following Trump’s election, on the low end of the Obama era. Perhaps its just a matter of people becoming inured to speculation or perhaps the constant stream of good news is drowning out the speculation in the media.

Bruce Hall Is a 7-day moving average too short?

The Bayesian Information Criterion is quite happy with a simple ARIMA (0 1 1) model w/o constant. That model has a well known equivalent in the simple exponential smoothing model. It’s easy to convert the ARIMA theta (i.e., moving average parameter) to the familiar exponential smoothing “alpha” parameter. In this case it converts to an “alpha” of 0.11. An exponential smoothing model with an “alpha” value of 0.11 has the same information content as a 17 day moving average. So a 7 day centered moving average might be a little short, but a 30 day moving average is definitely too long. But since the data shows very little autocorrelation persistence, a 7 day centered moving average is probably good enough and a lot simpler than playing around with various ARIMA models. A 30 day moving average probably over smooths the data, and you’re also sacrificing a lot of recent information.

2slug, you point that a monthly look at the data does sacrifice a lot of the recent information, but the flip side is that a lot of recent information seems to be more noise than signal.

Bruce Hall But only including 7 of the 17 days of the “optimal” information content still gets you 64% of that weighted information content. So you’re still getting a lot of signal. Adding another 10 days improves things, but not all that much. I’d rather use a 7 day moving average than a 30 day moving average.

I’ll take a shot. The news items measured are abuzz with the terrific economic news of job and wage growth. And certainly the tariff news creates its own measure.

What seems to be forgotten, what is measured is words within newspaper, uncertainty is a result of an algorism.

Ed

Ed Hanson The jobs numbers came out Friday morning…except for members of the Trump family, who got them Thursday night. The spike at the end of the graph occurs a couple days later, so the timing doesn’t work. The big news that tracks with the spike was Wilbur Ross’ Saturday arrival in China.

Kudlow excuses the Trump tweet on the premise that if he did not announce the precise number, all is cool. What an idiot. Remember The String and the whole thing about post partum betting? All one needed to know is which horse won. Whether it was by 1 second or 10 seconds, it would not matter. Kudlow is not only stooopid – he has zero principles. Like his boss!

cnbc produced a couple of hacks that turned me off to their live show quite a bit-kudlow and santelli. both present business news through their political ideology lens. it is not insightful, and frequently money losing (or at least not money winning). i do agree, the kudlow excuse was poor. under his explanation, if somebody from labor leaked the same message, they should not be investigated. and i do not believe that would be the reality-they would be investigated and crucified. why is the president held to a different standard?

Not certain slug but most these uncertainty graphs are a 7-ay moving average which is the preferable chart. Red on Menzies? It shows little volatility of uncertainty.

Ed

Someday I’m gonna create a small book containing Ed Hanson’s original lexicon. It seems like a horrid amalgam of a brain fart and William Burroughs’ Cut-Up Method. That prior sentence maybe the worst thing anyone has ever said about William Burroughs.

Ed, I assume you meant algorithm.

Not Trampis Ed Hanson is a die hard Republican. He may have meant “Al Gore-ism”.

This should make all the MAGA doormats happy. Never let it be said that Uncle Bleeding Heart Liberal never did anything nice for you. 4.8% seems a little too “rosy” to me, but hey, if you’re going to be delusional, at least be delusional with respected sources.

https://www.frbatlanta.org/cqer/research/gdpnow

Amongst the administrations available, it’s interesting Trump has the 2nd lowest average behind Clinton and lowest standard deviation. Although given that the current administration hasn’t experienced a recession, or other *major* disturbance, maybe it’s not too surprising.

This is also a little interesting. Take the squared residuals from the mean during Obama’s time (20 Jan 2009 thru 19 Jan 2017) and run them through a simple correlogram. Do the same for the squared residuals during Trump’s time beginning 20 Jan 2017. Notice anything different?

Biggest thing this cycle is the boomer withdrawal. Much larger than I or the Federal Reserve ever thought in the early 2010’s. Unlike the previous expansions, businesses have had to hire this cycle much more from turnover due to the withdrawal. Say in the 90’s the economy created 2.5 million jobs. About 2.3 million of those jobs, were sound on business expansion. In the 10’s, you can contract 700,000 thousand of that off without no business expansion. That means it only created 1.8 million jobs on business expansion. This my friends, is the problem. Employers are hiring more this decade just on replacement rather than business expansion. That also wrecks productivity as all the new bodies need training and the labor market tightens/shrinks without growth in the business.

This is a mess for the BLS, who lowers the unemployment rate just based on the withdrawal. It also explains why wage growth hasn’t accelerated at this level of U-6. It isn’t based on business expansion. So you get left with poorly shaped labor market. Maybe another 3 years of .5% growth above trend will finally close the output gap and finally boost business expansion into the “boom phase”, but I doubt it. This expansion is 5 years into a fairly healthy debt expansion in corporate and personal debt………and corporate bonds are showing the strain.