Today, we are pleased to present a guest contribution written by Vincent Grossmann-Wirth and Clément Marsilli (Banque de France) summarizing their chapter in the book International Macroeconomics in the wake of the Global Financial Crisis edited by L. Ferrara, I. Hernando and D. Marconi. The views expressed here are those solely of the authors and do not reflect those of their respective institutions.

The US economy has experienced an unprecedented leveraging-deleveraging cycle over the last fifteen years. The ratio of household debt to disposable personal income rose continuously in the 2000’s, reaching a peak of 133% by the end of 2007, before a sharp decline. While consumer credit picked up rapidly after the Global Financial Crisis, housing debt dynamics remain far from pre-crisis growth levels and private consumption still cannot rely on debt flows as much as before the crisis. Using an empirical stock-flow approach, we find that about two-thirds of the cumulative difference in private consumption from the pre- to the post-crisis period can be explained by a change in household debt flows.

An illusion of household balance sheet sustainability

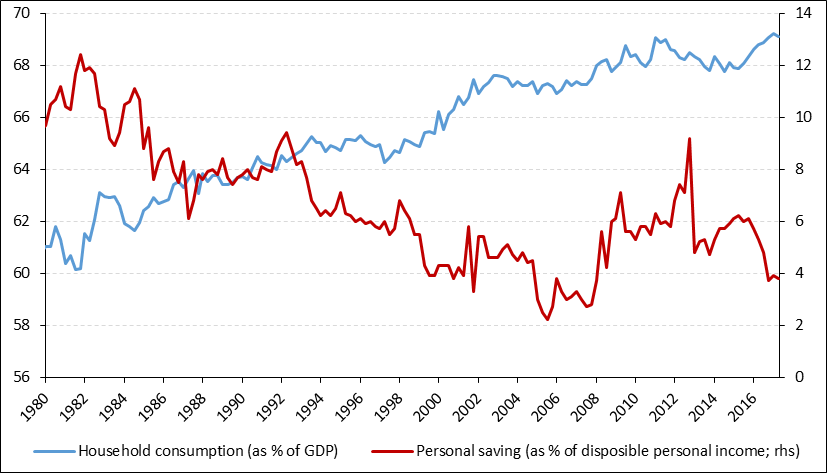

The sharp increase in household debt before the Great Recession, from around 90% of household disposable income in the 1990s to 130% in 2007, came with an even sharper increase in housing and financial wealth (both real housing prices and the SP500 index nearly doubled over the same period). The strength of US consumption in 2000s was then seen as the result of the increase in net wealth which, at that time, was not considered problematic by most observers of the US economy. The household balance sheet significantly changed over this period. From 1995 to 2006, both house prices and financial asset prices increased by more than 100 percentage points of disposable personal income. While this simultaneous increase in housing and financial wealth started to attract some attention in the mid-2000s, many economists downplayed the risk posed by the increase in household debt (on the liability side), as well as by the decrease in the savings rate (see Fig. 1).

Figure 1: Household consumption and savings. Source: BEA.

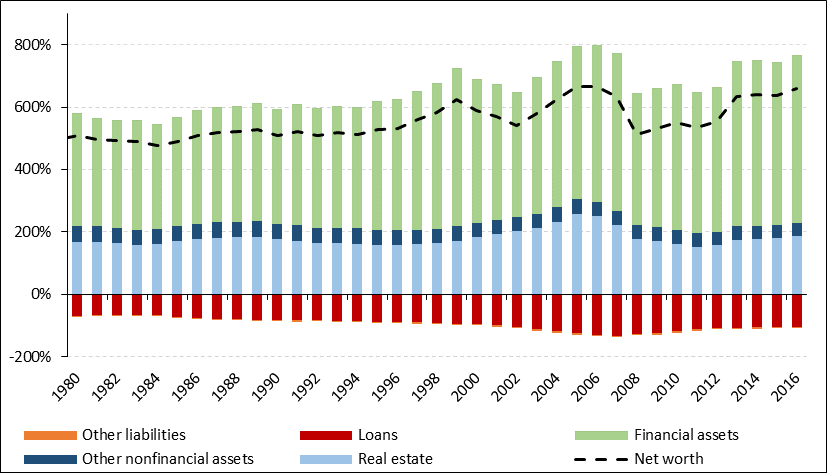

By using a “net wealth” concept (assets minus liabilities), these approaches implicitly suppose a symmetric effect of household assets and liabilities on consumption. Yet, looking at the Fig. 2, it is clear that household assets, especially financial assets, are more volatile than liabilities. The value of financial assets mostly depends on their market price, while the change in price is much slower on the liability side. Because of the higher share of financial assets as a percentage of household income and its higher volatility, the change in net wealth is very much in line with the change in financial assets, dwarfing changes in debt. The unprecedented losses and gains in wealth over the recent period were mostly driven by financial asset price movements. Hence, by reasoning in terms of net wealth, the increase in household debt (negative red bars in Fig. 2), and related weakening of the household balance sheet, was masked by the parallel increase in housing and financial assets.

Figure 2: Household balance sheet (% of DPI). Source: Financial accounts of the United States, Federal Reserve.

As housing prices started to fall and more and more households defaulted on their debt, it was soon clear that the consequences would not be neutral for private consumption and GDP. Indeed, also impacted by the decrease in stock prices, the fall in private consumption and in GDP was one of the most severe in US history.

The macroeconomic consequences of such deleveraging processes, and its consequences on growth, have been widely discussed in the economic literature. While Reinhart and Rogoff (2009) and Lo and Rogoff (2015), among others, argued that a high debt ratio generally should set off alarms, Justiniano et al. (2015) estimated that the macroeconomic impact of the leveraging and deleveraging processes in the US remained relatively minor. Most standard macroeconomic models do not grant a large role for debt dynamics and were not very useful to make predictions. As recognized by Eggertsson and Krugman (2011), “one might have expected debt to be at the heart of most mainstream macroeconomic models – (…) however, it is quite common to abstract altogether from this feature of the economy”. Sufi (2012) also recalled that “household debt played a relatively minor role in mainstream macroeconomic models prior to the recession of 2007 to 2009”, while Mian and Sufi (2010) suggest that a growth in household leverage indeed explains a large fraction of the overall consumer default rates during the recession. As the standard approaches do not seem to capture properly the boom and bust cycle, we use another approach, in the tradition of Godley/Lavoie-type stock flow analysis, for looking at household wealth, by considering separately the asset and liability sides of household balance sheets within a consistent framework.

A consistent stock-flow approach for debt dynamics

In order to identify the role of debt dynamics, we focus on the composition of household balance sheet flows. Rather than considering the saving rate as the share of income that is not spent, our approach uses financial flows. In this respect, in order to balance household assets and liabilities, it is also necessary to include the net purchase of financial assets as well as the net increase in household debt. Using US national accounts data (NIPA, BEA) and financial accounts data (Federal Reserve) we can write the following macroeconomic accounting identity:

DI – C – I = ΔFi asset – ΔDebt

where DI is the disposable income of households, C is the consumption, I stands for the household investment, ΔFi asset is the net purchase of financial assets and ΔDebt is the net indebtedness.

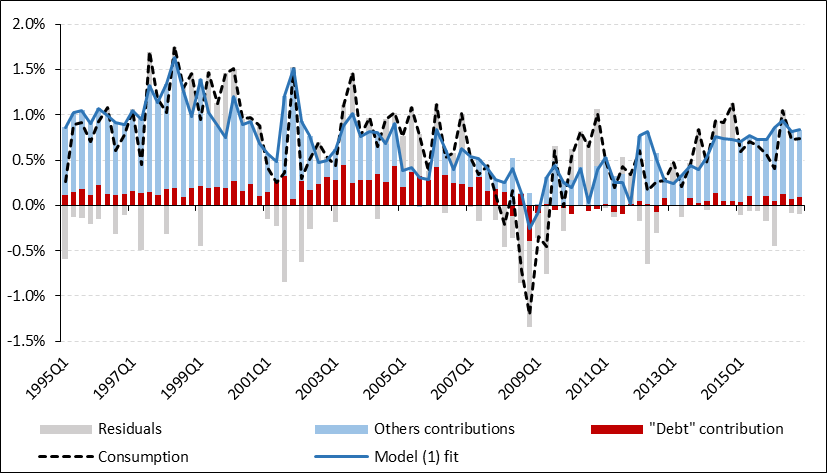

Then we isolate from the previous equation the source of funds, on the one hand, and the use of funds, on the other hand:

DI + ΔDebt = C + I + ΔFi asset

Source of funds Use of funds

This decomposition aims at identifying the role of debt flows as a complementary source of financing for households. We hence propose an empirical approach to model US household consumption in which debt flows represent an additional source of revenue. More specifically, our model is based on an error-correction model in which the long-run co-integrated equation incorporates three additional sources of revenue: labor income, debt flows and financial income, from 1995q1 to 2016q4. Fig. 3 exhibits this decomposition and highlights the role of debt dynamics in private consumption fluctuations. While the increasing contribution of debt flow over the period from 1995 to 2006 highlights a clear support for consumption, it diminished after the Global Financial Crisis. Regarding the other contributions, labor income and financial gains supported consumption growth while both unemployment and debt flows were a drag over the post-crisis period. In particular, these results indicate that household sector debt flows affected significantly the growth rate of consumption. According to our model, about two thirds of the private consumption slowdown from the pre- to the post-crisis period can be explained by the change in household debt flows.

Figure 3: Contribution of debt flow to consumption growth modelling. Source: Authors computations.

Take away messages

Contrary to the analysis in terms of net wealth, a decomposition of household’s assets and liabilities shows how the pre-crisis period was characterized by an excess in household indebtedness. High and increasing debt flows enabled private consumption expenditures to grow faster than disposable income. Then, After the Global Financial Crisis, households have been forced to deleverage in order to repair their balance sheet and to rebuild some of their lost wealth, thus putting a strong drag on consumption during the economic recovery. While consumer credit picked up, housing debt growth still remains far from pre-crisis dynamics and private consumption still cannot rely on debt flows as much as before the crisis. Going forward, the future behavior of both financial assets and house prices is likely to significantly influence the dynamics of debt and private consumption. Similar approaches based on debt flows could be developed to assess other sources of vulnerabilities with the US economy, in particular for the corporate sector.

This post written by Vincent Grossmann-Wirth and Clément Marsilli.

Wealth accounting seldom mentions the unpleasant fact that “Everybody’s gotta live somewhere.” I call this fact the original sin liability of housing. Point is when house prices go up so does the value of the implicit liability that you’ve gotta live someplace. Of course the asset/liability accounting does not exactly cancel for life-cycle reasons and others.

Similar approaches based on debt flows could be developed to assess other sources of vulnerabilities with the US economy, in particular for the corporate sector.

All the while I was reading this post I kept wondering why the same approach shouldn’t be applied to corporate debt. And then I read the last sentence. So was that last sentence just a teaser for another article they’ve already got in the works? Or is it yet another one of those open ended invitations for “future research” that never quite get done? I hope the former because this was interesting.

Every cycle the various debt/income and debt/assets ratios would get worse and worse and .regularly surpass previous peaks.

Yet,it was virtually possible to use these ratios in economic analysis or forecasting because we did not know what was the critical level that would trigger a change in consumer behavior.

I think one of the things that is very important in this article, is the fact that increased debt causes increased consumption (sometimes large increases).

……. and when we (as a society or as professional economic analysts) assume that increased debt (household or corporate) to be “disposable income” or assume the increased debt to be “signs of economic health”, then we are in fact making assumptions that are not only wrong—but are reverse or inverse to reality.

Getting a wrong number is one thing. Getting numbers (quoted by “experts” and “professionals”) that create a perception that is the inverse of reality is how you end up with situations like 2008. Which is what Greenspan and many others who had the financial education to “know better” did to the middle class on a regular basis before 2008—and onward, clear to this day.

makes you wonder why we still permit the very liberal use of heloc’s.

BTW, synthetic derivatives are part of this problem.

https://www.zerohedge.com/news/2017-11-02/theyre-ba-ack-citi-says-synthetic-cdos-may-reach-100-billion-2017-5x-increase-2-year

And Jia Chen can make all the rationalizations she wants for what she does. My question to her is, does she want to be the next Blythe Masters?? Knowing the amorality of most of these people (on a level to rival trump’s amorality), maybe Jia Chen would be “proud” to be the next Blythe Masters.

for those who resent fractional reserve banking, because it creates money from nothing, you should probably have a similar feeling about synthetic derivative products. they seem to be able to use the same underlying asset over and over again, creating a nearly inexhaustible supply of product for which investors can gamble on the performance. but since they are offered up not as gambles and bets, but as steady sources of income-they clearly misrepresent their risk to many in the financial bubblesphere. even the stock market has tried to eliminate the naked short. why we continue to allow products that can essentially create unbounded amounts of liability is crazy.