NBER WP by Wang, Wei, Yu, and Zhu:

The United States imports intermediate inputs from China, helping downstream US firms to expand employment. Using a cross-regional reduced-form specification but differing from the existing literature, this paper (a) incorporates a supply chain perspective, (b) uses intermediate input imports rather than total imports in computing the downstream exposure, and (c) uses exporter-specific information to allocate imported inputs across US sectors. We find robust evidence that the total impact of trading with China is a positive boost to local employment and real wages. The most important factor is employment stimulation outside the manufacturing sector through the downstream channel. This overturns the received wisdom from the reduced-form literature and provides statistical support for a key mechanism hypothesized in general equilibrium spatial models.

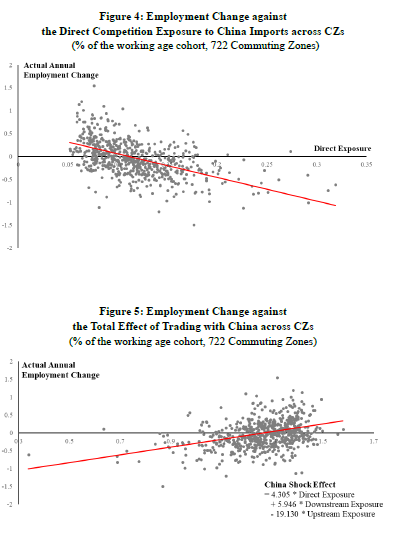

Here’s a graphical comparison between the correlation that Autor et al. found (discussed in this 2011 post) and that by Wang et al. (ungated version)

Taking into account downstream effects, the estimated impact of Chinese imports on local employment is positive.

This paper should be an interesting read. The first sentence will by itself have an interesting political effect:

“The United States imports intermediate inputs from China, helping downstream US firms to expand employment.”

Team Trump and the Bernie Bros are going to HATE this conclusion. Uniting the radical left and the racist right – just incredible!

@ pgl

Still butt hurt over Hillary?? Go call Debbie Wasserman Schultz and see if she can FIX, I say, see if Debbie can FIX your problem. Didn’t seem to work to well in 2016, but we gotta “fight” the glass ceiling for poor Debbie:

https://youtu.be/hiqApvxugXE?t=230

Gotta be “respectful” for Debbie. Gotta be, or…. or….. Debbie will bring up “a tragedy” she doesn’t give a flying crap about so people will stop booing her. Because….. because…. because…… Debbie is really “so sad” and wants to “fight” to FIX the problem.

Hillary likes Debbie a lot, and next time Hillary wants to skip the campaign bus to Wisconsin and skip the campaign bus to Michigan and skip the campaign bus to….well never mind, “Hillary will win those states whether she takes the bus or not”. And Pennsylvania really LOVED her husband’s passage of NAFTA so no “wasting time” canvassing Pennsylvania. “Women will vote for her in droves”. And uh, and uh, well next time Hillary wants to run another FAILED campaign, she’s going to phone Debbie first thing. Very first thing. No glass ceilings.

Bernie Sanders has a brain (unlike Hillary). Just because he supports labor and unions does not mean he’s going to shutdown intermediate input imports for important technology. WOW, you keep crying about the blue ribbon you lost back in 3rd grade and then wonder why Republicans keep dragging her name out again.

The type posts as the one above is the core reason why I cherish Menzie’s blog so much, so no disrespect by going off topic here, but come one, these are historic stories even if weighed over the last roughly 240 years of our nation. OK, this isn’t WaPo or Politico, but don’t we kinda share things here in our weird little off-kilter “community” here??

Rudolph Pinocchio Giuliani:

https://www.youtube.com/watch?v=ezdsiBMkCWo

https://www.apnews.com/Davos

World economy forecast to slow in 2019 amid trade tensions

DAVOS, Switzerland (AP) — The world economy absorbed more bad news Monday: The International Monetary Fund cut its growth forecast for 2019. And China, the world’s second-biggest economy, said it had slowed to its weakest pace since 1990. The IMF cut its estimate for global growth this year to 3.5 percent, from the 3.7 percent it had predicted in October and down from 2018′s 3.7 percent. The fund cited heightened trade tensions and rising interest rates. “After two years of solid expansion, the world economy is growing more slowly than expected and risks are rising,” said IMF Managing Director Christine Lagarde as she presented the forecasts at the World Economic Forum in Davos, Switzerland.

Dear Menzie,

Granted that is manufacturing employment, with the “Direct Exposure” axis. But this seems misleading as a measure of domestic sales. If we look at

https://www.ibisworld.com/industry-trends/market-research-reports/manufacturing/computer-electronic-product/computer-manufacturing.html

” Still, in 2018, imports are expected to satisfy 95.8% of domestic demand. High import competition and advances in substitute technology have driven fierce price competition in the industry. Nonetheless, the industry has performed well due to continued economic growth. Over the five years to 2018, industry revenue is expected to increase at an annualized rate of 3.5% to $10.7 billion, mainly due to a boom in 2015 that led to increased shipments. In 2018 alone, revenue is anticipated to grow 1.9%. The industry relies heavily on exports, which are estimated to generate 68.6% of industry revenue in 2018. ”

For the manufacturers who can’t export, the argument would seem to be misleading, and that is likely to be the case for American steel. We can look at

https://www.statista.com/statistics/271979/the-largest-steel-producers-worldwide-ranked-by-production-volume/

and see that Nucor is the only remotely competitive American company on the list. The tariffs are decreasing U.S. exports to Europe and elsewhere, even for what little there is, as in

https://www.trade.gov/steel/countries/pdfs/exports-us.pdf

But American steel production is up, as in

https://tradingeconomics.com/united-states/steel-production

Overall, the figure is right, since free trade allows some American companies to export more. But in terms of emotional impact, steel production (especially in the American Midwest) has it all over computer sales abroad.

Julian

Interesting chart of who produces steel. China produces a lot but they also consume a lot. Now the Koreans, Japanese, and Europeans likely lead the list on steel exports.

Canada exports more steel to the U.S. than any other steel exporter:

https://www.census.gov/foreign-trade/statistics/product/enduse/imports/c1220.html

Maybe this is what Trump is thinking – build that wall against Mexico with Canadian steel slats!

Maybe Trump should build a wall on the Canadian border with Chinese steel. He doesn’t seem to like Canada very much either, and Chinese imports are not going down. Just use up the excess by building a wall to keep Canadian steel out. Brilliant, eh?

Willie: Eine grosse Fest is unser Reich!

I’ve stated before that I don’t like ZH’s political agenda, but if you’re willing to sift through the weeds you can find some super good stuff there. This graph would be one of them. Notice that even with the drastic drops in exports going to the USA, China’s trade surplus hardly moves at all.

https://www.zerohedge.com/s3/files/inline-images/Screen%20Shot%202019-01-21%20at%201.37.14%20PM.png?itok=vfm-U_e2

@Menzie Chinn

It’s interesting, you know “MacroVoices” start this interview with this guy from Nomura securities, puffing up his ego like they always do with these guys (I could use some more vulgar metaphors there, but I’ll spare you and your readers). But it looks like some interesting stuff with some good graphs. I’m sure you can track it down on ZH blog if you care to. But he talks about something we have discussed on this blog. I believe certain of the more cerebral parties on this blog have discussed “tariff frontloading” with our resident “trade genius” CoRev. CoRev maybe was under the impression farmers shipped off and hid the soybeans and other crops under the Greenland permafrost until whatever decade arose when they could get a good price on the crops. But anyway…… what this Nomura guy thinks is that there’s little doubt that the Q1 and Q2 numbers will be worse because all of that “frontloading effect” will have been accounted for in the prior numbers. Menzie, I would be curious your thoughts on that, if that jives with your thinking [ on the Q1 and Q2 numbers looking worse ] or in what way you might differ on that??

Now Menzie, if you just answer that SINGLE question above, yours truly would be quite happy, as that is the main question I am asking here. But let me take my little inquisitive thought stroll a little farther to the end of the quiet residential lane here. Let’s take the wild idea that the donald trump shutdown of federal jobs goes, into, let’s say to February 14. Let’s also say no real progress is made in China talks, i.e not even a move to the prior status quo that donald trump then labels a “victory”. I’m wondering how many GDP % points that adds up to?? One or the other ALONE, maybe not much, but BOTH does what??

Moses Herzog: Would the frontloading affect 2019Q1/Q2 numbers? Possibly, if they are trying to beat the tariffs on China that were mooted for January 2019. But I don’t know if the numbers are big enough to hit GDP, particularly since lots was shipped in 2018Q2 to beat the first rounds of tariffs. Brad Setser probably has a better idea of likely impacts.