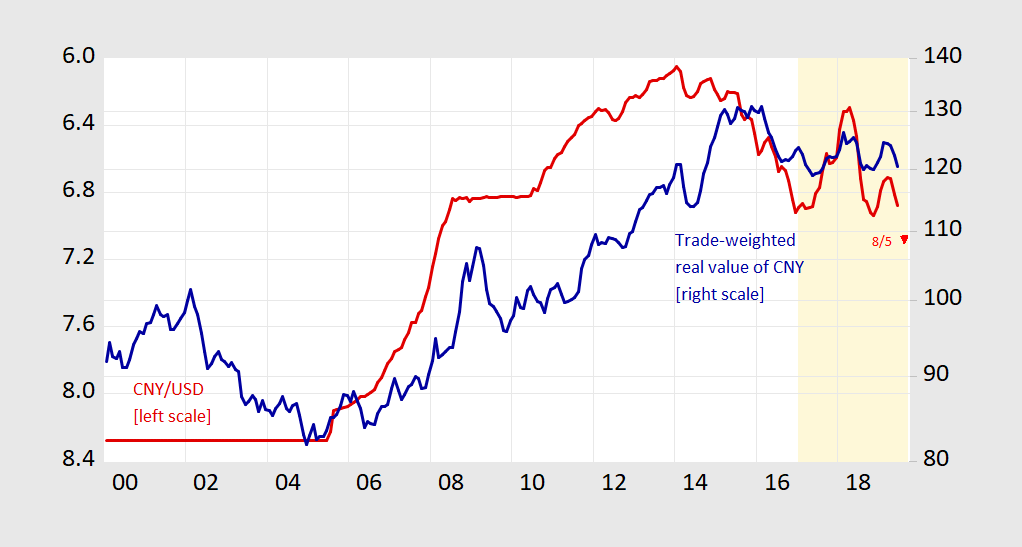

Figure 1: CNY/USD nominal exchange rate (red, left inverted scale), 8/5 value (red triangle, left inverted scale), trade weighted real value of CNY against broad basket of currencies (blue, right log scale). Up denotes appreciation. Light orange shading denotes Trump administration. Source: FRED, and BIS.

In a new (and extremely timely) EconoFact memo on Should the United States Try to Weaken the Dollar?, Michael Klein and Maury Obstfeld ask:

Direct intervention by the U.S. Treasury in the foreign exchange market offers one possibility, and several economists have advocated just such a move to counteract potential currency manipulation by foreign countries. In such operations, the Treasury would use dollars to buy foreign currency bonds, bidding up the relative prices of foreign currencies and weakening the dollar. The Treasury can intervene through its Exchange Stabilization Fund (which would give it just under $23 billion to sell, although the Fed could join the Treasury, as it has in the past, to sell U.S. bonds on its balance sheet for foreign bonds, without altering its interest-rate policy). Foreign exchange interventions might have to be big to move markets in a sustained way. For example, in the fiscal year 2019 through June, the Federal government issued $747 billion in dollar bonds to finance its deficit, or about $83 billion per month (and 23 percent higher than the same period a year earlier). All else being equal, these big increases in the supply of dollar-denominated bonds should weaken the dollar as investors diversify their increased U.S. bond holdings into foreign currencies, but although that was not the reason these bonds were issued, the dollar has not fallen. Given the size of international bond markets, would another few billions (the maximum size of past interventions) make a difference?

The answer is, I think, is no. Rather, the phrase “You’re gonna need a bigger boat” comes to mind, if we indeed want to engage in a currency war with China. The “if” condition is critical. A truce, and stand-down in the campaign as currently conducted is in order. Perhaps, trying to pressure China via multilateral pressure and activation of plurilateral trade organizations (e.g., TPP) on intellectual property and market access issues would be more productive.

This is so, despite today’s bombshell declaration by Secretary Mnuchin that China is a currency manipulator. As recently as May, the Treasury Department declined to designate China:

Based on the analysis in this Report, Treasury determines, pursuant to the 2015 Act, that China continues to warrant placement on the Monitoring List of economies that merit close attention to their currency practices. Treasury determines that while China does not meet the standards identified in Section 3004 of the 1988 Act at this time, Treasury will carefully monitor and review this determination over the following 6-month period in light of the exceptionally large and growing bilateral trade imbalance between China and the United States and China’s history of facilitating an undervalued currency. Treasury continues to have significant concerns about China’s currency practices, particularly in light of the misalignment and undervaluation of the RMB relative to the dollar.

The quick turnabout exposes the political expediency of this move — after all, none of the indicators highlighted in the Report have changed substantively since May.

(One operational question that comes to mind: if the US wants to counter Chinese currency “manipulation”, what are we gonna buy? Chinese government bonds? Can we?)

Read the EconoFact piece. A primer on misalignment. The implications of the June 2019 Big MacParity data.

Dear Folks,

Paul Krugman is right about this. While the Administration is arguing about China, anyone who is interested can see that the Euro has drastically weakened against the dollar over the last year, and the Administration has not yet called the Europeans currency manipulators. See

https://www.xe.com/currencycharts/?from=EUR&to=USD&view=1Y

J.

Good point. FRED provides a longer chart of how the Euro/$ has involved since 1999.

https://fred.stlouisfed.org/series/DEXUSEU

To make a broader and more reinforced argument Krugman’s point is important. However, as Menzie points out, it’s not necessary to prove the point when you look at the U.S. Treasury’s May statement and the fact nothing has changed in the meantime that wasn’t instigated by USA trade policy. It’s the logical equivalent of going to a friend’s house 4 weekends consecutive to eat egg based noodles and then telling them the 5th weekend you can’t eat noodles because you’re allergic to eggs.

P.S. Let me just add a brief word of defense of CoRev, who is likely to be a target in the responses to this. It is possible to agree or disagree with the Administration’s policies, and it is not possible to provide a complete model in which to test them out definitively. French opposition to the wave theory of light collapsed when a light source was placed in front of a large disk in a darkened room, and a spot of light was observed directly behind the center of the disk, and that’s an example of what economics lacks. In this case, the question is whether the Chinese are manipulating the currency, and the Administration has one position. It is possible to disagree with their position, and still want to see all the evidence, including arguments, that can be made to support it. If one doesn’t buy the arguments of Mick Mulvaney (who is unlikely to be CoRev), and one doesn’t believe shedding Federal workers is such a good idea (one of Mulvaney’s ongoing themes), at least CoRev is trying to make some additional argument for these policies that can be evaluated.

J.

“it is not possible to provide a complete model in which to test them out definitively”.

You are selling CoRev short. We have been begging him to provide a complete model of the soybean market but he has disappointed us so far. But maybe he has been busy working out some novel model of international macroeconomics. I hear the editors of the American Economic Review are eager to review it!

pgl: You’ll be waiting a long time. I don’t think CoRev can interpet through the lens of a multi-equation model.

The main topic of this post is an interesting question, and VERY worth exploring, so I don’t want my comment misconstrued as saying otherwise. But I think there is ZERO chance this happens (ZERO percentage chance the Treas or Fed purchases CNY). Why do I think there is ZERO chance?? Because, think about trump’s political base and their financial literacy level. Very very basic ad low financial literacy, with probably some contradictory views to reality. And donald trump is obsessed with his 41% base and how they view him. Do you think donald trump wants to see large headlines that the U.S. Treasury (for whatever reason) is purchasing Chinese currency in large amounts?? That one will NEVER fly with FOX viewers. Even FOX can’t heavy lift that one.

Figure 1 makes a point I have been trying to make. The yuan appreciated considerably both in nominal and in real terms after 2005. The recent devaluation only partly reverses this. Mnuchin’s claim that China is a currency manipulator only shows he is reading the evidence upside down. If he is not careful – those ugly glasses of his will fall off.

I was a lovely morning until 7:15 AM or so. Got up early and had a long run. Made breakfast and ate it watching CBS This Morning. I would have been better off turning on Fox & Friends. They wanted to talk about the trade war between us and China with Jill Schlesinger. OK – she might be able to help people out balancing their check books but why on earth does that make her qualified to talk about economics?

I was thinking “what utterly stupid comment will be this bimbo make today”. And then they had to ask her if China manipulates its currency to which she said “they’re bad”. Yes a bimbo who can balance her check book!

Julian Silk at least CoRev is trying to make some additional argument for these policies that can be evaluated.

I’m not trying to be snarky here, but I can’t think of any arguments, pro or con, that CoRev has made with respect to Chinese currency manipulation. Almost all of CoRev’s posts concern soybean prices, climate change or assault weapons. I find it hard to believe that CoRev has any interest at all in a topic as esoteric as currency manipulation. But I could be wrong and you might be able to summarize what you think his position is. Like I said, this isn’t a snarky comment. It’s just not a topic that would interest CoRev, so I don’t know what additional arguments he is trying to make WRT to currency manipulation.

2slug,

He has also at times had a lot to say about the US space program, especially his overwhelmingly important role in it and the many awards he received for his work that he somehow threw away, not to mention lots of later super duper important secret work for the DOD that makes him a climate scientist and expert on soybean markets, when he is not also being a “gentleman farmer.”

As it is, Julian, I do not know why you needed to bring him up here. Were you wishing to encourage him to come charging in and make a fool of himself? Nobody would have said boo about him, if you had kept your trap shut.

Barkley Rosser,

I THINK, Julian is trying to get CoRev to more explicitly state his “model”, which in terms of soybeans appears to me to be that harvest prices should approach what they used to be in the pre-tariff era. It is unclear WHY Julian is so interested in this exercise, and I am guilty of stifling this exercise in the past, primarily because I don’t think it is helpful to assume competence, or give the appearance of assuming competence, of someone (CoRev) who so clearly lacks such. Our more naive, and silent, readers may wrongly get the impression that CoRev has a point.

However, Julian, I will take your advice from now on and let CoRev speak for himself with his nonsense. Good luck in whatever you are trying to do here, assuming it’s in good faith.

I THINK, Julian is trying to get CoRev to more explicitly state his “model”

We all have been doing the same for well over a year. To date – nothing but the same old gibberish from CoRev. He does not have a model – just a lot of bluster.

CoRev did have a spreadsheet he gave Menzie didn’t he?? I’ll be damned if I can remember what the topic was, I just remember I about died when I realized I had DL’ed something authored by CoRev. I mean I know Menzie checked the safety of the file before he uploaded it but still, my Mac is hyperallergic to bloviated blathering. Green slime popped out of my USB docks right after I DL’ed that. This computer is worse than that high-maintenance girlfriend we’ve all seen who keeps whining about tree pollen to her BF like he’s been hiding the black magic cure from her the last 10 years, and I’m gonna DL a CoRev authored spreadsheet??

I still get the shudders over that moment.

P.S. That was a 100% meant to be snarky comment. And If I could spike the football in the field endzone directly off of CoRev’s shin muscle, I would do it.

Dear Dave,

I hope this is in good faith. I have to live with the Administration up close. A few weeks ago, there were Secret Service agents buying breakfast at a restaurant I frequent. So I am eager to get anything reasonable, as opposed to just harangues, for what they are doing. If CoRev can explicitly state models, that can be objectively examined, all to the good. If he can’t, he can’t.

J.

if the president is bullying the fed to cut rates, in part to assist in his economic war on china, would anybody here consider that to be currency manipulation if it impacted the strength of the dollar? ironic who appears to be actively manipulating one’s currency for political and economic purposes.

When white Americans currency manipulate, that is considered good, good. When Asian nations do the same – it is evil Communism.

Krugman noted that ECB is pushing low interest rates and a devalued Euro but not a word from Trump. But Germans are white people so all is good!

I would really like to know how the hacks like Bruce, corev, peakloser and dick stryker contort their arguments to insist the fed and ecb are not helping their governments manipulate their currency for competitive advantage. Interestingly, why would klown kudlow be against the Chinese weakening their currency, when his favorite catch phrase is king dollar?

Kudlow flip flops a lot. When his political masters wants to excuse dollar appreciation – he talks about King Dollar. But now Trump wants a weaker dollar – so Kudlow’s malleable opinion flips!

There is nothing “white” about Trump and his foreign lackeys. Like I said, they want to play games and transfer power. Nothing more or less.

Also worth noting that buying most foreign assets funded by Treasury debt is likely to yield negative returns, especially on a real basis, which could limit the effectiveness or sustainability of any such program. That and it increases the size of the unified CB-Treasury balance sheet, which might lead the Fed to be less inclined to reduce rates further than would otherwise be the case.

When white Americans currency manipulate, that is considered good, good. When Asian nations do the same – it is evil Communism.

Krugman noted that ECB is pushing low interest rates and a devalued Euro but not a word from Trump. But Germans are white people so all is good!

Kudlow the Klown was just on the TV talking about how the stock market has been “wonderful”. So I checked to see how the S&P 500 has performed over the past year:

https://finance.yahoo.com/quote/%5EGSPC/

Odd – this index today is at the same level as it was last year. Zero nominal growth is “wonderful” performance. Dumb even for Kudlow the Klown!

Ali Velshi of MSNBC is even more of a Klown than Kudlow. After airing the offensive Kudlow line – he endorsed it by saying the stock market has risen by 15%. Really Ali? Oh yea if you start at that post 2018 low. My apologies to CBS This Morning even though the check book balancing “economist” they had on this morning is still at utter bimbo but at least she is not as dumb as Ali Velshi.

Maybe I should start watching Fox & Friends. At least I will know in advance every discussion will be dumber than rocks.

“For example, in the fiscal year 2019 through June, the Federal government issued $747 billion in dollar bonds to finance its deficit, or about $83 billion per month (and 23 percent higher than the same period a year earlier). All else being equal, these big increases in the supply of dollar-denominated bonds should weaken the dollar as investors diversify their increased U.S. bond holdings into foreign currencies, but although that was not the reason these bonds were issued, the dollar has not fallen.”

I wonder how much of the recent dollar strength has come from Trump’s corporate tax changes, which reversed the incentives for corporations to keep foreign earnings abroad, including vast holdings that were built up in tax havens over a period of decades.

I also wonder how effective currency purchases would be in causing sustained moves in exchange rates when not accompanied with capital controls.

Finally, I wonder how much of Trump’s charges against China’s trade practices come from trying to close the barn door after all the cows have left (China’s huge holdings of foreign reserves, the ‘smoking gun’ for currency manipulation, have waned in recent years, falling from a high of about $4 trillion to about $3 trillion today) and how much of it is coming from U.S. corporations who now fear competition from China will cut deeply into their supernormal profits. Looking at equity valuations today, such profits appear to form the bulk of U.S. corporate valuations and earnings. Corporations might have lobbied against Treasury finding China to be a currency manipulator while China was building up its huge pile of foreign reserves, because they they were reaping the benefits of the arrangement (using undervalued Chinese wages to produce for the U.S. market). But now many of these same corporations might be casting about for excuses to keep dangerous competitors like Huawei out of U.S. markets.

I love this comment. Permit me to have fun with “I wonder how much of Trump’s charges against China’s trade practices come from trying to close the barn door after all the cows have left”.

Speaking of cows – Trump thinks he scored a big win by getting the Europeans to buy more American beef. Since they buy so little of our beef, the extra exports will be very modest even if the percentage increase is yuuuuge!

Considering the political impact.

This will play well with the base. The 41% who’ve written him off, will still write him off.

So, how do the folks in the middle react to this? I suspect, some will say, yep, if the U.S. government says so, it must be true, just goes to show that we got a problem with China. Others will say, in effect, how can doing nothing be currency manipulation? If all the Chinese have done is stop propping up their currency, weren’t they manipulating when they were intervening (and we didn’t label them manipulators) and now that they’ve stopped manipulating, haven’t they stopped manipulating (so what gives? why are we sticking the label on now?) For a non-economist, I think an articulated, non-faith based, answer to that will seem long winded and exceed the attention span of the questioner. But I wouldn’t underestimate the effectiveness of a faith based, short answer, either.

There is another constituency, as well. That’s the decision makers in the world economy and international financial system. I suspect that the European players are smirking at the Asian players and sniggering ‘better me thee than me’. But the Asians are snickering back, ‘yeah, but their aggressiveness with Iran is a bigger problem for you guys than for us.’ And then everybody agrees that something needs to be done about American policy unreliability, the outsized role of the dollar, America’s tendency to arrogate for itself the lead role in every global security issue, the centrality of U.S. regulated financial institutions to international finance, etc. etc.

and like clockwork, trump again attempts to manipulate the currency!

https://www.cnbc.com/2019/08/08/trump-rips-strong-dollar-says-the-fed-has-called-it-wrong-at-every-turn.html

where is larry “king dollar” kudlow? trump is trying to use the fed for political gain, no matter the long term consequences.