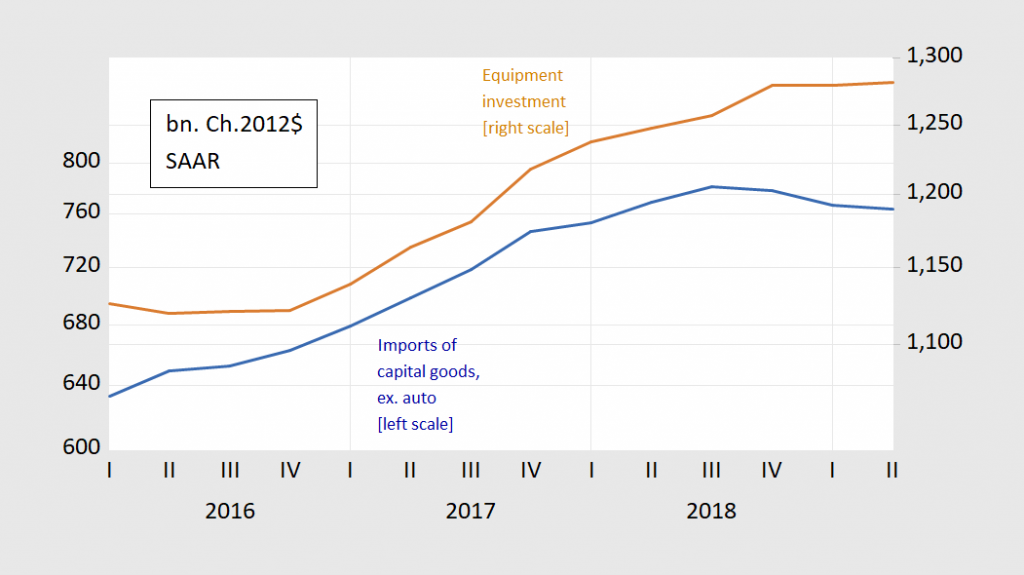

The last time we saw equipment investment declining was 08Q1; and capital goods imports in 08Q3

Figure 1: Imports of capital goods other than automobiles (blue, left scale), and equipment investment (brown, right scale), both in billions of Ch.2012$, SAAR. Source: BEA, 2012Q2 2nd release.

Given depreciation, net equipment investment is probably declining.

I like things that get to the crux of the matter. And Menzie does it in the above (as he so often does).

A “simple” post, but a great post.

We were told that the tax cut would lead to a yuuuuge increase in equipment investment. Yep – we were lied to again.

What is this lied to again? It is lies lies lies lies lies all the time. Are the speaking? Yes, and they are moving their lips in a lie.

Where are the Democrats hitting on this topic? (that the equipment investment was short-lived and artificial) ?? Yes impeachment is the main objective right now, but we have been told many times (correctly or incorrectly) Congressmen can walk and chew gum at the same time. Or was it take cash under the table and guzzle lobbyists’ gratis wine at the same time??

No need, and the average person wouldn’t get it. When work dries up, it is obvious. If that happens, then 2020 could be a blowout. If not, it will be closer. Saying the policy resulted in an ultimate fall in capital investment is meaningless to most Americans. It is a little pointing out the bass player or an offensive guard. Only those who pay more than casual attention even know what you are talking about.

Another reason is the level of uncertainty in the economy. Why say the sky is falling if it might not? The tune will change or not next summer. That is soon enough.

@ Willie

Your point is very valid and taken. Saying capital investment has gone down probably doesn’t resonate loudly in a political sense.

But we see guys like Kudlow and I am sure some Republicans hit on these numbers when a Democrat is in office. I’m just saying a little effort on CNBC, Bloomberg etc wouldn’t hurt. The odds on recession are quite high now—the question is when. I think it’s certainly apt to happen before July 31 of 2020, especially if trump doesn’t delay the tariffs in December. If “you” (Democrat politicians) start “setting the stage” or “setting the table” for connecting bad tax policy with both the economic downturn and the drastic increase in deficit, it gives it stronger trump branding (negative branding) and becomes a more viable talking point later. And if you’re a Democrat politician on a business talk show, it doesn’t take that much effort to tie in a decline in capital investment to lost JOBS. Even an AOC or a Tulsi Gabbard could discuss this on Bloomberg.

I remember years ago watching Henry B Gonzales on C-Span rant for multiple hours on the floor of the House of Representatives about the problems with the Federal Reserve (most of them legitimate problems). Gonzales managed to keep his Congressional seat over 35 years. What did the Federal Reserve mean to Gonzales’s typical constituent?? I don’t know, but the ranting didn’t seem to hurt his vote count.

Wow, Moses, you are right. If only Tulsi Gabbard would talk about this on Bloomberg, that would lead to Sean Hannity putting it at the top of his nightly monologue, confessing to all the assembled Trump followers the failure of the Trump tax law regarding capital investment. That will change everything.

The interesting thing about massive tax cuts that overwhelmingly favored the wealthy without yielding the advertised benefits is that, given the political will, you can claw them back (and then some) without taking back the bones tossed to the bottom four quintiles (or maybe bottom nine deciles).

But, let me repeat the qualification, Given the Political Will.

And, the interesting thing about that qualification is that the states that are the Republican backbone in the Senate are not states with a great deal of wealth in them. If anyone can ever get through to the local gentry of the Dakotas, etc. that, by national standards they aren’t part of the economic elite, you just might shatter that. Of course, that requires education people that, if their six figure income starts with a number less than five, and their net worth is in seven but not eight figures, they ain’t rich. Good luck with that one . . .

https://talkingpointsmemo.com/news/sondland-testify-trump-told-write-text-quid-quo

Gordon Sondland may be a Trump toadie but even his testimony is likely to note that this whole “no quid pro quo” is just another Trump lie. There was a quid pro quo from our Traitor-in-Chief.

I’m assuming Professor Hamilton has already seen this. Those are some “big players” withdrawing from Mr. Zuckerberg’s pansy scheme.

https://www.ft.com/content/a3e952dc-ec5c-11e9-85f4-d00e5018f061

Media outlets do this crap all the time. Examples—Chris Christie, Sean Spicer, Anthony Scaramucci, the list is near endless, those were just off the top of my head. I could give 30 easily before 10pm tonight with some slight help from Google. Do something incredibly immoral or unethical and the TV anchor job providing “commentary” on politics is waiting for you:

https://twitter.com/LeeCamp/status/1183057489258045440

Off-topic

My father, who passed away in 2012, complained about this for YEARS. And it may be worthy to note, my Dad had significant hearing loss all of the years I can actually remember. To the point I didn’t want to communicate with the man a large extent of the time out of extreme annoyance at having to repeat each and every sentence twice. What does it say about the cinema experience, when a man who has been half-deaf over 4 decades thinks that the sound in 98% of the theater movies he attends, is too loud?? BTW, I have gone to the theater many times since my Dad died. The most recent being “Rambo Last Blood” and “Crawl” and notice ZERO difference in theater volumes pre and post 2012.

https://www.theguardian.com/film/2019/oct/13/cinema-noise-levels-ruining-films-joker-hugh-grant

what?

For what it is worth, Trump’s tax law has never been popular, even in the immediate aftermath of its passage and when it id actually stimulate the economy somewhat for a while. It has always been understood to favor the rich over most of the population.

with your graphs at a different scale it’s hard to tell, but the combination almost looks like domestically sourced equipment investment could be accelerating…

A tip. Go to:

https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=2#reqid=19&step=2&isuri=1&1921=survey

Table 1.1.6. Real Gross Domestic Product, Chained Dollars

[Billions of chained (2012) dollars]

It provides data on real business investment by quarter.

Depreciation of private fixed investment has reached 70% of gross private investment as of 2019II. This series has been growing over time whereas real gross equipment investment has flat lined. I do not see sufficient detail in the BEA accounts to do this as an apple to apple comparison but this sounds about right:

‘Given depreciation, net equipment investment is probably declining.’